Form 8-K - Current report

27 Août 2024 - 10:31PM

Edgar (US Regulatory)

false

0000924822

0000924822

2024-08-27

2024-08-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United

States

Securities And Exchange Commission

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 27, 2024

MILLER INDUSTRIES, INC.

(Exact Name of Registrant as Specified in

Its Charter)

| Tennessee |

001-14124 |

62-1566286 |

(State or Other Jurisdiction of

Incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

8503 Hilltop Drive, Ooltewah, Tennessee

37363

(Address of Principal Executive Offices)

(Zip Code)

(423)

238-4171

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share |

MLR |

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 7.01 | REGULATION FD DISCLOSURE. |

On August 27, 2024, Miller Industries, Inc. (the

“Company”) posted an investor presentation (the “Investor Presentation”) to its website at https://www.millerind.com/investors.

A copy of the Investor Presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The Company expects to use the Investor Presentation, in whole or in part, and possibly with modifications, in connection with presentations

to investors, analysts and others on and after August 28, 2024.

The information contained in the Investor Presentation

is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”)

filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Investor Presentation

speaks only as of the date of this Current Report on Form 8-K. The Company undertakes no duty or obligation to publicly update or revise

the information contained in the Investor Presentation, although it may do so from time to time. Any such updating may be made through

the filing of other reports or documents with the SEC, through press releases or through other public disclosure. In addition, the exhibit

furnished herewith contains statements intended as “forward-looking statements” that are subject to the cautionary statements

about forward-looking statements set forth in such exhibit. By furnishing the information contained in the Investor Presentation, the

Company makes no admission as to the materiality of any information in the Investor Presentation that is required to be disclosed solely

by reason of Regulation FD.

This Current Report on Form 8-K and its contents

(including Exhibit 99.1) are furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2)

of the Securities Act of 1933, as amended (the “Securities Act”), nor shall it be deemed incorporated by reference in any

filing under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing, except as shall

be expressly set forth by specific reference in such filing.

| ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Miller Industries, Inc.

(Registrant) |

| |

|

| |

By: |

/s/ Frank Madonia |

| |

|

Frank Madonia |

| |

|

Executive Vice President, General Counsel and Secretary |

| |

|

|

| Dated: August 27, 2024 |

|

|

Exhibit 99.1

| INVESTOR 2024 PRESENTATION

THE WORLD LEADER IN TOWING AND

RECOVERY EQUIPMENT ® |

| SCAN TO WATCH A SHORT OVERVIEW

VIDEO ABOUT MILLER INDUSTRIES |

| FACT SHEET

The World Leader in Towing and Recovery Equipment ®

Miller Industries is the world’s largest manufacturer of

towing and recovery equipment and markets its towing

and recovery equipment under a number of well-recognized brands, including Century, Vulcan, Chevron,

Holmes, Jigé, and Boniface. There are approximately

76 distributor locations in North America, who serve all

50 states, Canada & Mexico, and approximately 30+

distributors that serve other foreign markets. Each of

the Company’s brands has a well-established, distinct

product image and corresponding customer loyalty.

Since 1990 Miller Industries has developed or acquired

several of the most well-recognized brands in the highly-fragmented towing and recovery industry. During this

period, management has strengthened the Company’s

distributor network, increased production capacity, and

improved manufacturing efficiencies and product design.

Miller Industries offers a broad range of products

that meet most customer design, capacity, and cost

requirements. The Company manufactures the bodies

of wreckers and car carriers, which are installed on

truck chassis manufactured by third parties. Wreckers

generally are used to recover and tow disabled vehicles

and other equipment, and range in type from the

conventional tow truck to large recovery vehicles with

rotating hydraulic booms and 100-ton lifting capacities.

Car carriers are specialized flatbed vehicles with hydraulic

tilt mechanisms that enable a towing operator to drive or

winch a vehicle onto the bed for transport. Car carriers

transport new or disabled vehicles and other equipment

and are particularly effective over long distances. The

company also manufactures a line of transport trailers.

Our continued success in the future will rely heavily on

sensitivity to our customers’ needs and our quality in

construction and design of our products. With these

attributes, Miller Industries will continue to be the

acknowledged leader in the towing and recovery industry.

CORPORATE SUMMARY

MISSION STATEMENT

Miller Industries is the global leader in towing and

recovery equipment, manufacturing and servicing the

highest quality and most innovative products. Our

mission is to create superior value for our end-users,

distributors, suppliers, employees, and shareholders.

CORE VALUES

• Customer Satisfaction

• Innovation

• Integrity

• Quality

• Dedication

NYSE: MLR

FINANCIAL OVERVIEW

FY 2023

Revenue: $1.15B

Gross Margin: $151.9m

(13.2%)

Net Income: $58.3m (5.1%)

EPS (Diluted): $5.07

FACILITIES

Ooltewah, TN

Athens, TN

Greeneville, TN

Hermitage, PA

Lorraine, France

Thetford, England

millerind.com |

| EXECUTIVE BIO

The World Leader in Towing and Recovery Equipment ®

NYSE: MLR

William G. Miller, II has served as a director since May 2014, our

Chief Executive Officer since March 2022 and President since

March 2011, after serving as Co-Chief Executive Officer from

December 2013 to March 2022 and as a Regional Vice President of

Sales of Miller Industries Towing Equipment Inc. from November

2009 to February 2011. Mr. Miller II also served as Vice President

of Strategic Planning of the Company from October 2007 until

November 2009, as Light-Duty General Manager from November

2004 to October 2007, and as a Sales Representative of Miller

Industries Towing Equipment Inc. from 2002 to 2004.

Deborah L. Whitmire has served as a director since February

2020, our Executive Vice President, Chief Financial Officer and

Treasurer since January 2017, after serving as our Vice President

and Corporate Controller from January 2014 to December 2016

and Corporate Controller to Miller Industries Towing Equipment

Inc. from March 2005 to January 2014. From April 2000 to

March 2005, Mrs. Whitmire also served as Director of Finance

– Manufacturing to Miller Industries Towing Equipment Inc. In

addition, Mrs. Whitmire served as Controller to Miller Industries

Towing Equipment Inc. from October 1997 to April 2000 and

Accounting Manager to Miller Industries Towing Equipment Inc.

from October 1996 to October 1997.

millerind.com |

| PRODUCT SUMMARY

The World Leader in Towing and Recovery Equipment ®

NYSE: MLR

LIGHT-DUTY

Vulcan 812 Intruder II

Century 12-Series LCG™

CAR CARRIER

Miller Industries brings a whole new dimension

to transport with the 12 Series LCG™ (Low

Center of Gravity) carrier. The patented

design lowers the deck height 5" – 6" over

conventional carriers, which provides better

stability during transport. The lower height

allows for the transport of taller loads, such as

forklifts or man-lifts, that may be over-height

on a conventional carrier.

The Vulcan 812 and Century Express 300 have

been the most popular choices in the industry

over the past decade for private property

repossession and commercial towers. But in an

effort to improve upon an already great product,

Miller Industries’ engineers surveyed operators

on what features most important to them.

The result was increased rear visibility between the boom and tailboard for easier hook ups, a new

hose tracking system for longer life and easier maintenance, and your choice of several handheld

controllers to suit what the operator is most comfortable with. Other changes include a totally

redesigned low profile crossbar, claws that have a recessed area for better oil pan clearance, and

a new patent pending pivot system.

The operator can easily secure loads or tie down vehicles while standing on the ground, thanks

to the lower height. When mounted on most air ride chassis, with the air dumped, the 12 Series

LCG™ has less than an 11-degree load angle, making it ideal for loading low-clearance vehicles

or equipment without using ramps or wood. Your new 12 Series LCG™ is available in 20.5' to 22'

deck lengths with a capacity of 12,000 lbs. and a wide variety of options to fit your specific needs.

millerind.com |

| PRODUCT SUMMARY

The World Leader in Towing and Recovery Equipment ®

NYSE: MLR

HEAVY-DUTY

Century 5130

Century 1150

ROTATOR

With the call for quick clearance on congested

roadways and to handle a variety of difficult

recovery and lifting jobs, Century is the number

one choice worldwide. As the only manufacturer

of recovery equipment that designs specifically

for towers’ needs and safety, we are proud to

offer the 1150, a 50-ton rotator ideal for heavy

recovery with a weight-saving design for your

daily towing.

The 5130 is Century’s best performing heavy-duty integrated unit with 128" of underlift

reach. The 5130 has the ability to tow most

vehicles without giving up maneuverability of

a single axle or tandem axle unit. The 5130

also provides a 25-ton recovery boom and

25,000 lbs. winches for your recovery and

lifting applications.

The Century 1150 features 360° of continuous boom rotation, a 3-stage recovery boom, optional

deck and turret mounted winches and a variety of underlift options. The 1150 technology is also

available in the Century 1150R, which features a unique patented roller system that allows the

boom to travel up to 60". The low-maintenance roller system has the ability to start and stop under

heavy loads, even while rotating.

millerind.com |

| The World’s Largest

Manufacturer of

Towing and

Recovery

Equipment

NYSE: MLR

1

Q2 2024 Investor Presentation

Safe Harbor Statement

The World’s Largest Manufacturer of Towing and Recovery Equipment®

NYSE: MLR

Certain statements in this Presentation released August 20, 2024 made with respect to future operating results,

expectations of future customer orders and the availability of resources necessary for our business are forward-looking

statements. Forward-looking statements can be identified by the use of words such as “may”, “will”, “should”, “could”,

“continue”, “future”, “potential”, “believe”, “project”, “plan”, “intend”, “seek”, “estimate”, “predict”, “expect”, “anticipate”

and similar expressions, other comparable terminology, or the negative of such terms. Forward-looking statements also

include the assumptions underlying or relating to any of the foregoing statements. Such forward-looking statements are

made based on our management’s beliefs as well as assumptions made by, and information currently available to, our

management. Our actual results may differ materially from the results anticipated in these forward-looking statements due

to, among other things, the risks set forth in Part I, Item 1A - “Risk Factors” in our most recent Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, in Part II, Item 1A – “Risk Factors” in our most recent Quarterly Report on

Form 10-Q filed on August 7, 2024, and in our other filings with the Securities and Exchange Commission. Given these

uncertainties, you should not place undue reliance on these forward-looking statements. You should read the Quarterly

Report and the documents that we reference in the Quarterly Report and documents we have filed as exhibits to the

Quarterly Report completely and with the understanding that our actual future results may be materially different from what

we expect. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of

this Presentation. Except as required by law, we assume no obligation to update these forward-looking statements publicly,

or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements,

even if new information becomes available in the future.

2 |

| Introduction to Miller Industries

The World’s Largest Manufacturer of Towing and Recovery Equipment®

Overview

Miller Industries, Inc., founded in 1990 by William G. Miller “Bill”, is the leading manufacturer of towing and recovery equipment in the world

Our goal is to deliver long-term value to all shareholders through continued innovation, growth, and profitability

Six world-class

facilities located in

three countries

manufacturing the

largest portfolio of

towing, recovery,

and transport

vehicles in the

world

Largest North

American

distribution

network in the

industry

Export to 60+

countries

Significant global

presence in the

military recovery

and transport

sector

Transport

equipment supplier

for the largest

Rental & Salvage

companies in

North America

(Herc, Sunbelt,

United,

Copart, IAA)

Industry leader in

innovation

45+ Engineers that

specialize in

mechanical,

hydraulic, and

electrical

engineering

4

The World’s Largest Manufacturer of Towing and Recovery Equipment® |

| Investment Highlights

• World Leader in Towing & Recovery Equipment

• Consistent Organic Growth

• Global Presence

• Industry Leader in Innovation

• Best-in-Class Products & Distribution

• Strong Customer Relationships

• Attractive Financial Metrics

• Experienced Management Team

5

The World’s Largest Manufacturer of Towing and Recovery Equipment®

Industry History

Holmes Tow Truck (1916 Chattanooga, TN)

Century M100 (100-ton Rotator)

6

The World’s Largest Manufacturer of Towing and Recovery Equipment® |

| Towing & Recovery Market • Multi-Billion Dollar Global Market

• Primary Market Segments

• Commercial Towing

• Transport Fleets (Rental, Salvage)

• Government and Municipal Sales

• Military

• Primary Product Types

• Light-Duty Recovery Vehicles

• Medium- & Heavy-Duty Recovery Vehicles

• Carrier Transport Vehicles

7

The World’s Largest Manufacturer of Towing and Recovery Equipment®

Industry Drivers • Miles Driven

• Aging Vehicle Fleet

• General Construction

• Infrastructure Construction

• Natural Disasters

• Global Conflict

• Future Emission Changes

• Military Recovery Vehicle

Upgrades

• Trade Cycle

Accelerators

8

The World’s Largest Manufacturer of Towing and Recovery Equipment® |

| Miller Strategy • Develop a world-class team from the top down by investing in our employees’ education

and career development to enhance the value of the Miller organization

• Locate, develop, and maintain a five-star distribution network that has industry leading

product sales, parts sales, and after-the-sale service

• Innovate, design, and produce the highest quality products with greater payload and

recovery capabilities than our competitors

• Grow commercial market share, explore new market potential, and develop innovative

products to create new opportunities

• Focus on core competencies and reinvest in our infrastructure to increase capacity,

capabilities, and improve quality

• Vertically integrate to control costs, reduce manufacturing disruption, and improve quality

control

9

The World’s Largest Manufacturer of Towing and Recovery Equipment®

Manufacturing Locations

Ooltewah, TN

Greeneville, TN

Hermitage, PA

Lorraine, France

Thetford, England

Athens, TN

Global Footprint: 1,154,000 sqft

11

The World’s Largest Manufacturer of Towing and Recovery Equipment® |

| Investment in Manufacturing

Century Wrecker 1990

Miller Industries Headquarters Present Day

16

The World’s Largest Manufacturer of Towing and Recovery Equipment®

Miller Industries Carrier Plant 1990

Carrier Plant Present Day

Investment in Manufacturing

17

The World’s Largest Manufacturer of Towing and Recovery Equipment® |

| Revenue Streams

• North American Distribution

• Export

• European Operations

• National Accounts

• Government

• Military

• After Market Parts

• Chassis

For 2023, no individual customer was responsible for more than 10% of revenue or accounts receivable

10

The World’s Largest Manufacturer of Towing and Recovery Equipment®

North American Distribution

• 54 Distributor Principals

• 76 Distributor Locations

• 300+ Retail Sales Personnel

13

The World’s Largest Manufacturer of Towing and Recovery Equipment®

• Commercial Towing Operators

• Entrepreneurs

• Average Fleet Size 10-15 Trucks

• Vehicle Life Cycle

• Warranty Offering / Cost of Ownership

• Depreciation

• Trade Cycle |

| • 30+ Foreign Distributors

• Direct Sales to Foreign Governments

and Militaries

• Export to 60+ Countries

Foreign Market Distribution

14

The World’s Largest Manufacturer of Towing and Recovery Equipment®

“We have the best people,

the best products,

and the best distribution network

in the Towing & Recovery Industry.”

-Bill Miller

Year - 1990

15

The World’s Largest Manufacturer of Towing and Recovery Equipment® |

| Investment in Human Capital

Welders supplied with air-purifying respirators

Employee Health & Safety Employee Engagement Employee Development

Safety Systems

First Responders provided

with CPR/AED Training

Annual relevant safety

training for all employees

Bi-Monthly town hall

meetings with employees

Increased team leader to

employee ratio to improve

on-the-job training & quality

Six-week Team Leader

Bootcamp Training Program

Employee Family

Scholarship Fund

Cost-of-living adjustments for

all employees

Front-Line Leadership

Academy

Weld Academy

External training on as-needed basis with local

universities

Tuition Reimbursement

Program

18

The World’s Largest Manufacturer of Towing and Recovery Equipment®

Experienced Management Team

William G. Miller “Bill”

Founder and Chairman of the Board

William G. Miller II “Will”

President and CEO

Jeffrey I. Badgley

President of International and Military

Deborah L. Whitmire

Executive Vice President,

Chief Financial Officer and Treasurer

Frank Madonia

Executive Vice President, Secretary

and General Counsel

Josias W. Reyneke

Vice President and Chief Information Officer

Vince Tiano

Vice President and Chief Revenue Officer

30+ years

20+ years

30+ years

25+ years 25+ years

25+ years

30+ years

19

The World’s Largest Manufacturer of Towing and Recovery Equipment® |

| $151.9M

84.2% 286.5%

$58.3M

Hist. Gross Margin Hist. Net Income Hist. EPS

$1.15B $5.07

35.9%

Hist. Revenue

2020

$651.3m

2019

$818.2m

284.8%

2020

$78.4m

2019

$96.5m

2020

$29.8m

2019

$39.1m

2020

$1.42

2019

$3.43

2021

$717.5m

2021

$69.9m

2021

$16.3m

2021

13.2% 5.1%

Financial Overview - FY 2019 - 2023

2022

$848.5m

2022

$82.4m

2022

$20.3m

2022

$1.78

$2.62

20

$0

$325,000

$650,000

$975,000

$1,300,000

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Historical & Projected 2024 Revenue

21

The World’s Largest Manufacturer of Towing and Recovery Equipment® |

| $0

$300,000

$600,000

$900,000

$1,200,000

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

CAGR

CAGR: 13.6%

22

The World’s Largest Manufacturer of Towing and Recovery Equipment®

Q2 2024

Peer Group

Analysis

23 |

| -$2.00

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

ALG MLR FSS BLBD EPAC PKOH PLOW CVGI FSTR SRI SHYF ASTE NNBR MPAA

TTM

27

EPS

Q2 ‘24 TTM

ALG $2.35 $10.56

MLR $1.78 $6.22

FSS $0.99 $3.29

BLBD $0.85 $3.03

EPAC $0.47 $1.52

PKOH $0.92 $1.41

PLOW $1.02 $1.18

CVGI -$0.05 $0.96

FSTR $0.26 $0.67

SRI $0.10 $0.07

SHYF $0.06 -$0.08

ASTE -$0.61 -$0.10

NNBR -$0.12 -$1.14

MPAA -$0.92 -$3.36

Sorted by TTM

-50%

-25%

0%

25%

50%

75%

100%

BLBD MLR FSTR EPAC PKOH FSS NNBR ALG SRI PLOW MPAA ASTE SHYF CVGI

TTM

25

TSR (Total Shareholder Return)

Q2 Div. Q2 ‘24 TTM

BLBD $0.00 40.3% 139.5%

MLR $0.19 11.2% 57.3%

FSTR $0.00 -20.2% 50.7%

EPAC $0.01 7.6% 41.6%

PKOH $0.13 -1.7% 38.9%

FSS $0.12 -1.6% 31.4%

NNBR $0.00 -31.4% 25.5%

ALG $0.26 -19.0% -5.4%

SRI $0.00 -12.2% -15.3%

PLOW $0.30 -2.5% -17.7%

MPAA $0.00 -24.1% -20.3%

ASTE $0.13 -30.3% -33.6%

SHYF $0.05 -2.4% -45.3%

CVGI $0.00 -24.7% -55.9%

*MLR Increased Quarterly Dividend 5% in 2024 Sorted by TTM |

| 0.00%

5.00%

10.00%

15.00%

20.00%

CVGI MLR ALG BLBD PKOH PLOW EPAC FSS FSTR SRI ASTE SHYF NNBR MPAA

TTM

CVGI 19.59%

MLR 11.30%

ALG 6.10%

BLBD 5.63%

PKOH 5.45%

PLOW 5.04%

EPAC 3.98%

FSS 3.93%

FSTR 3.11%

SRI 0.44%

ASTE -0.34%

SHYF -0.67%

NNBR -38.00%

MPAA -54.46%

*EOQ2 ’24 Stock Price Used

Earnings Yield

TTM

0.0

0.5

1.0

1.5

2.0

2.5

MLR ASTE FSS ALG SHYF EPAC FSTR BLBD SRI MPAA CVGI NNBR PLOW PKOH

Q2 ‘24

MLR 0.19

ASTE 0.22

FSS 0.26

ALG 0.32

SHYF 0.52

EPAC 0.54

FSTR 0.66

BLBD 0.71

SRI 0.72

MPAA 0.97

CVGI 1.03

NNBR 1.05

PLOW 1.16

PKOH 2.41

Debt to Equity Ratio

Q2 ‘24 |

| 0x

5x

10x

15x

20x

25x

30x

CVGI MLR MPAA PKOH ASTE ALG SRI BLBD PLOW FSTR EPAC NNBR FSS SHYF

Q2 ‘24

CVGI 4.93

MLR 6.35

MPAA 7.16

PKOH 7.89

ASTE 8.45

ALG 9.59

SRI 10.04

BLBD 10.23

PLOW 11.85

FSTR 12.03

EPAC 15.02

NNBR 15.48

FSS 18.87

SHYF 34.54

EV / EBITDA

Q2 ‘24

Select Market Information

As of August 16, 2024

Ticker

Exchange

Stock Price

Market Capitalization

Book Value

Debt to Total Capitalization Ratio

MLR

NYSE

$59.47 per share

$681.2 million

$33.17 per share

15.68%

28

The World’s Largest Manufacturer of Towing and Recovery Equipment® |

| Q3 & Q4 IR Schedule

The World's Largest Manufacturer of Towing and Recovery Equipment®

• MW Ideas Conference, Chicago - August 28-29

• D.A. Davidson Conference, Nashville - September 18-20

• Raymond James Small Cap Conference, Sonoma - November 17-18

• SW Ideas Conference, Dallas - November 20-21

• Roadshows - California & New York

The World’s Largest

Manufacturer of

Towing and

Recovery

Equipment

NYSE: MLR

Thank You

30 |

| Exhibit 99.1

8503 Hilltop Drive, Ooltewah, TN 37363

Telephone (423) 238-4171

CONTACT:Miller Industries, Inc.

Debbie Whitmire, Chief Financial Officer

(423) 238-8464

FTI Consulting, Inc.

Mike Gaudreau

millerind@fticonsulting.com

MILLER INDUSTRIES REPORTS 2024 SECOND QUARTER RESULTS

CHATTANOOGA, Tenn., August 7, 2024/PRNewswire/ -- Miller Industries, Inc. (NYSE: MLR) (“Miller Industries” or the

“Company”) today announced financial results for the second quarter ended June 30, 2024.

For the second quarter of 2024, net sales were $371.5 million, an increase of 23.7%, compared to $300.3 million for the

second quarter of 2023. The year over year growth was predominantly due to consistent demand from customers, increased

production volume and continued elevated OEM chassis deliveries in the quarter. We anticipate that chassis deliveries will

normalize during the second half of the year.

Gross profit for the second quarter of 2024 was $51.1 million, or 13.8% of net sales, compared to $39.9 million, or 13.3% of

net sales, for the second quarter of 2023. The year over year increase in gross margin was largely driven by higher production

and delivery volumes.

Selling, general and administrative expenses were $22.8 million, or 6.1% of net sales, compared to $19.5 million, or 6.5% of

net sales, in the prior year period.

Net income in the second quarter of 2024 was $20.5 million, or $1.78 per diluted share, an increase of 37.5% and 37.7%

respectively compared to net income of $14.9 million, or $1.29 per diluted share, in the prior year period.

The Company also announced that its Board of Directors has declared a quarterly cash dividend of $0.19 per share, payable

September 16, 2024, to shareholders of record at the close of business on September 9, 2024, the fifty-fifth consecutive

quarter that the Company has paid a dividend.

“During the second quarter we continued to deliver strong operating results, capping off a record first half for Miller

Industries,” said William G. Miller, II, Chief Executive Officer of the Company. “Our continued strong topline performance

underscores the success of our strategic initiatives, and when coupled with our improved production and delivery levels, also

contributed to improved margins. We continue to maintain current production levels to decrease our backlog to more

historical levels. This will allow us to better accommodate our distributors with increased flexibility and to deliver finished

products to retail customers with a more acceptable lead time. Our steady order entry rate demonstrates the strength of our

salesforce and distribution network, and the competitive advantages our products provide to our customers. Moving into the

second half of the year, we are acutely focused on shifting product from our distributors to our end users, to ensure that the

revenue we are generating has a strong cash conversion rate. As our first half results have surpassed our initial expectations,

we now expect to achieve low double-digit revenue growth for the full year of 2024, in line with our historical annual growth

rate, as opposed to the high single-digit growth we anticipated two quarters ago.” |

| - MORE -

MILLER INDUSTRIES REPORTS 2024 SECOND QUARTER RESULTS PAGE 2

Mr. Miller, II, concluded, “As we look ahead, and as we mentioned last quarter, we continue to analyze the need for future

investments in our manufacturing capabilities, specifically our production capacity. As always, we will also prioritize

returning capital to our shareholders through our industry leading dividend and the $25 million share repurchase program we

announced in April.”

The Company will host a conference call, which will be simultaneously broadcast live over the Internet. The call is scheduled

for tomorrow, August 8, 2024, at 10:00 AM ET. Listeners can access the conference call live and archived over the Internet

through the following link:

https://app.webinar.net/B1LjNejVJ5M

Please allow 15 minutes prior to the call to visit the site, download, and install any necessary audio software. A replay of this

call will be available approximately one hour after the live call ends through Thursday, August 15, 2024. The replay number

is 1-844-512-2921, Passcode 13747773

About Miller Industries, Inc.

Miller Industries is The World's Largest Manufacturer of Towing and Recovery Equipment®, and markets its towing and

recovery equipment under a number of well-recognized brands, including Century®, Vulcan®, Chevron™, Holmes®,

Challenger®, Champion®, Jige™, Boniface™, Titan® and Eagle®.

- MORE - |

| MILLER INDUSTRIES REPORTS 2024 SECOND QUARTER RESULTS PAGE 3

Certain statements in this news release may be deemed to be forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of words such as “may”, “will”,

“should”, “could”, “continue”, “future”, “potential”, “believe”, “project”, “plan”, “intend”, “seek”, “estimate”, “predict”,

“expect”, “anticipate” and similar expressions, or the negative of such terms, or other comparable terminology and include

without limitation any statements relating to the Company’s 2024 revenues, profitability, backlog, customer demand, and capital

allocation plans. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing

statements. Such forward-looking statements are made based on our management’s beliefs as well as assumptions made by, and

information currently available to, our management. Our actual results may differ materially from the results anticipated in these

forward-looking statements due to, among other things the risks discussed in our filings with the Securities and Exchange

Commission, including the risks set forth in Part I, Item 1A, “Risk Factors” in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2023 as supplemented in Part II, Item 1A, “Risk Factors” in our subsequent Quarterly Reports on

Form 10-Q, which discussion is incorporated herein by this reference. Such factors are not exclusive. Except as required by

law, we expressly disclaim any obligation to update these forward-looking statements, or to update the reasons actual results

could differ materially from those anticipated in these forward-looking statements, even if new information becomes available

in the future.

- MORE - |

| MILLER INDUSTRIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share and per share data)

(Unaudited)

Three Months Ended Six Months Ended

June 30, June 30,

% %

2024 2023 Change 2024 2023 Change

NET SALES $ 371,451 $ 300,264 23.7% $ 721,322 $ 582,539 23.8%

COSTS OF OPERATIONS 320,373 260,335 23.1% 626,001 512,194 22.2%

GROSS PROFIT 51,078 39,929 27.9% 95,321 70,345 35.5%

OPERATING EXPENSES:

Selling, General and Administrative Expenses 22,773 19,480 16.9% 44,316 37,403 18.5%

NON-OPERATING (INCOME) EXPENSES:

Interest Expense, Net 2,048 1,700 20.5% 3,293 2,713 21.4%

Other (Income) Expense, Net 13 (229) 105.7% (20) (548) 96.4%

Total Expense, Net 24,834 20,951 18.5% 47,589 39,568 20.3%

INCOME BEFORE INCOME TAXES 26,244 18,978 38.3% 47,732 30,777 55.1%

INCOME TAX PROVISION 5,730 4,063 41.0% 10,195 6,642 53.5%

NET INCOME $ 20,514 $ 14,915 37.5% $ 37,537 $ 24,135 55.5%

BASIC INCOME PER SHARE OF

COMMON STOCK

$

1.79 $ 1.30 37.7% $ 3.28 $ 2.11 55.3%

DILUTED INCOME PER SHARE OF COMMON

STOCK

$

1.78 $ 1.29 37.7% $ 3.26 $ 2.10 55.0%

CASH DIVIDENDS DECLARED PER SHARE

OF COMMON STOCK $ 0.19 $ 0.18 5.6% $ 0.38 $ 0.36 5.6%

WEIGHTED AVERAGE SHARES

OUTSTANDING:

Basic 11,461 11,466 0.0% 11,457 11,425 0.3%

Diluted 11,550 11,526 0.2% 11,531 11,477 0.5%

- MORE - |

| MILLER INDUSTRIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

June 30,

2024 December 31,

(Unaudited) 2023

ASSETS

CURRENT ASSETS:

Cash and temporary investments $ 23,816 $ 29,909

Accounts receivable, net of allowance for credit losses of $1,633 and $1,527 at June 30, 2024 and

December 31, 2023, respectively

391,797 286,138

Inventories, net 187,286 189,807

Prepaid expenses 8,099 4,617

Total current assets 610,998 510,471

NON-CURRENT ASSETS:

Property, plant and equipment, net 115,768 115,072

Right-of-use assets - operating leases 659 826

Goodwill 19,998 20,022

Other assets 744 819

TOTAL ASSETS $ 748,167 $ 647,210

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES:

Accounts payable $ 243,146 $ 191,782

Accrued liabilities 49,546 40,793

Income taxes payable 771 1,819

Current portion of operating lease obligation 306 320

Total current liabilities 293,768 234,714

NON-CURRENT LIABILITIES:

Long-term obligations 70,000 60,000

Non-current portion of operating lease obligation 352 506

Deferred income tax liabilities 4,159 4,070

Total liabilities 368,279 299,290

SHAREHOLDERS' EQUITY:

Preferred shares, $0.01 par value; 5,000,000 shares authorized, none issued — —

Common shares, $0.01 par value: Authorized - 100,000 shares, Issued - 11,453,792 and 11,445,640 at

June 30, 2024 and December 31, 2023, respectively

115 114

Additional paid-in capital 153,014 153,574

Retained earnings 233,330 200,165

Accumulated other comprehensive loss (6,571) (5,933)

Total shareholders' equity 379,888 347,920

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 748,167 $ 647,210 |

| NYSE: MLR |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

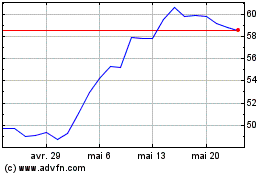

Miller Industries (NYSE:MLR)

Graphique Historique de l'Action

De Août 2024 à Sept 2024

Miller Industries (NYSE:MLR)

Graphique Historique de l'Action

De Sept 2023 à Sept 2024