- The Netherlands retains top spot as world’s leading retirement

income system

Mercer, a business of Marsh McLennan (NYSE: MMC) and a global

leader in helping clients realize their investment objectives,

shape the future of work and enhance health and retirement outcomes

for their people, and CFA Institute today released the 16th annual

Mercer CFA Institute Global Pension Index (MCGPI).

The Netherlands’ retirement income system has retained the top

spot on the list, with Iceland and Denmark remaining in second and

third places, respectively.

“In a world where fertility rates are falling and life

expectancy is rising, retirement income systems are center stage,”

commented Pat Tomlinson, Mercer’s President and CEO. “Ensuring

strong alignment in private and public retirement income

arrangements, increasing employee coverage and encouraging higher

labor force participation for those who wish to work at older ages

are just a few ways to improve long-term outcomes for

retirees.”

Helping DC plan members get the best retirement

outcomes

Retirement systems around the world are increasingly moving away

from defined benefit (DB) plans and shifting to defined

contribution (DC) arrangements. The report explores the

opportunities and challenges associated with DC plans for both

pension plans and individuals.

“The ongoing shift to defined contribution pension plans

introduces many financial planning challenges, which are falling

squarely on the shoulders of tomorrow’s retirees,” said Margaret

Franklin, CFA and CFA Institute’s President and CEO. “DC plans

require individuals to make complex financial planning decisions

that may significantly impact their financial circumstances, and

yet many individuals are not well prepared to manage the required

decisions. The Index serves as an important reminder of the gaps

that remain in providing long-term financial security and advice

for individuals. The need for credentialed and ethical financial

advisors once again stands out, and that’s why we have launched new

initiatives in the private wealth space to meet this gap.”

Despite these challenges, as people live longer, the increased

flexibility and personalization offered by DC programs will be

critical. The concept of retirement is shifting, and many

individuals are transitioning gradually to retirement or rejoining

the workforce in a different capacity after their initial

retirement. DC plans also offer important benefits to gig and

contract workers, who have often been left out of traditional DB

schemes.

“Significant retirement income system reforms are needed to meet

the financial needs of retirees and their evolving work

expectations,” commented Dr. David Knox, lead author of the report

and a Senior Partner at Mercer. “There is no single solution to

getting retirement systems onto more solid ground. Now is the time

for governments, policymakers, the pension industry and employers

to work together to ensure that older populations are treated with

dignity and can maintain a lifestyle similar to what they

experienced through their working years.”

By the numbers

The Netherlands had the highest overall Index value (84.8),

closely followed by Iceland (83.4) and Denmark (81.6). The

Netherlands’ pension system has continued to be the best system, as

it moves from a DB structure to a more individual DC approach. The

system also features strong regulations and offers participants

guidance regarding their pensions.

The Index uses the weighted average of the sub-indices of

adequacy, sustainability and integrity. For each sub-index, the

systems with the highest values were the Netherlands for adequacy

(86.3), Iceland for sustainability (84.3) and Finland for integrity

(90.8).

Increasing longevity, high interest rates and rising costs of

care have put increased pressure on government budgets to support

pension programs, causing scores to be slightly lower this year

overall. Several systems, including China, Mexico, India and

France, have undertaken pension reforms in recent years. The most

recent pension reforms in China, announced in September, are not

reflected in its Index score.

2024 Mercer CFA Institute Global Pension Index

System

Overall Grade

Total

Adequacy

Sustainability

Integrity

Netherlands

A

84.8

86.3

81.7

86.8

Iceland

A

83.4

82.0

84.3

84.4

Denmark

A

81.6

84.0

82.6

76.3

Israel

A

80.2

75.7

82.6

84.1

Singapore

B+

78.7

79.8

74.3

83.0

Australia

B+

76.7

68.4

79.5

86.1

Finland

B+

75.9

77.0

64.2

90.8

Norway

B+

75.2

77.2

63.6

88.3

Chile

B

74.9

71.2

70.9

86.5

Sweden

B

74.3

75.2

73.7

73.6

UK

B

71.6

75.7

61.5

79.3

Switzerland

B

71.5

66.0

71.4

80.4

Uruguay

B

68.9

84.0

46.6

76.1

New Zealand

B

68.7

64.8

64.9

80.2

Belgium

B

68.6

81.8

40.1

87.4

Mexico

B

68.5

73.8

63.4

67.1

Canada

B

68.4

67.0

63.8

77.1

Ireland

B

68.1

73.6

52.8

80.5

France

B

68.0

84.8

43.4

75.7

Germany

B

67.3

81.1

45.8

75.3

Croatia

B

67.2

66.8

57.4

81.7

Portugal

B

66.9

83.4

34.6

85.7

UAE

C+

64.8

77.1

43.3

75.3

Kazakhstan

C+

64.0

45.8

73.1

80.4

Hong Kong SAR

C+

63.9

51.5

61.1

87.5

Spain

C+

63.3

82.9

30.7

77.6

Colombia

C+

63.0

63.9

57.4

69.5

Saudi Arabia

C+

60.5

61.1

58.0

62.9

USA

C+

60.4

63.9

58.4

57.5

Poland

C

56.8

59.2

45.2

69.4

China

C

56.5

65.2

37.8

69.1

Malaysia

C

56.3

44.5

54.6

77.4

Brazil

C

55.8

70.4

31.0

67.3

Botswana

C

55.4

39.7

52.0

85.2

Italy

C

55.4

68.2

25.1

77.2

Japan

C

54.9

57.1

47.1

62.1

Peru

C

54.7

55.3

46.9

64.7

Vietnam

C

54.5

56.8

41.3

69.3

Taiwan

C

53.7

46.2

51.9

68.2

Austria

C

53.4

67.2

22.0

75.2

South Korea

C

52.2

40.5

52.4

70.5

Indonesia

C

50.2

38.1

50.4

69.3

Thailand

C

50.0

50.2

43.8

58.2

South Africa

D

49.6

34.7

48.0

75.7

Türkiye

D

48.3

48.3

32.2

70.8

Philippines

D

45.8

41.7

63.4

27.7

Argentina

D

45.5

61.5

29.4

42.3

India

D

44.0

34.2

44.9

58.4

About the Mercer CFA Institute Global Pension Index

(MCGPI)

The MCGPI benchmarks retirement income systems around the world

and suggests possible areas of reform that would provide more

adequate and sustainable retirement benefits. This year, it

compares 48 retirement income systems across the globe, including a

new entrant, Vietnam, and covers 65% of the world’s population.

The Global Pension Index is a collaborative research project

co-sponsored by CFA Institute and Mercer and is supported by the

Monash Centre for Financial Studies (MCFS). Find more information

about the Mercer CFA Institute Global Pension Index here.

About Mercer

Mercer, a business of Marsh McLennan (NYSE: MMC), is a global

leader in helping clients realize their investment objectives,

shape the future of work and enhance health and retirement outcomes

for their people. Marsh McLennan is a global leader in risk,

strategy and people, advising clients in 130 countries across four

businesses: Marsh, Guy Carpenter, Mercer and Oliver Wyman. With

annual revenue of $23 billion and more than 85,000 colleagues,

Marsh McLennan helps build the confidence to thrive through the

power of perspective. For more information, visit mercer.com, or

follow on LinkedIn and X.

About CFA Institute

As the global association of investment professionals, CFA

Institute sets the standard for professional excellence and

credentials. We champion ethical behavior in investment markets and

serve as the leading source of learning and research for the

investment industry. We believe in fostering an environment where

investors’ interests come first, markets function at their best,

and economies grow. With more than 200,000 charterholders worldwide

across 160 markets, CFA Institute has 10 offices and 160 local

societies. Find us at www.cfainstitute.org or follow us on LinkedIn

and X at @CFAInstitute.

About the Monash Centre for Financial Studies (MCFS)

A research centre based within Monash University's Monash

Business School, Australia, the MCFS aims to bring academic rigour

into researching issues of practical relevance to the financial

industry. Additionally, through its engagement programs, it

facilitates two-way exchange of knowledge between academics and

practitioners. The Centre’s developing research agenda is broad but

has a current concentration on issues relevant to the asset

management industry, including retirement savings, sustainable

finance and technological disruption.

Read our important notices here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241014402558/en/

Media Contact: Cassie Lenski Mercer +1 469 841 8999

USMediaRelations@mercer.com

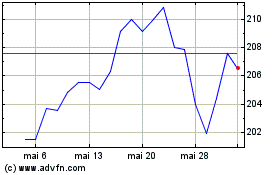

Marsh and McLennan Compa... (NYSE:MMC)

Graphique Historique de l'Action

De Oct 2024 à Déc 2024

Marsh and McLennan Compa... (NYSE:MMC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024