Annaly Capital Management, Inc. Announces 3rd Quarter 2022 Common Stock Dividend and Reverse Stock Split

08 Septembre 2022 - 10:15PM

Business Wire

Annaly Capital Management, Inc. (NYSE: NLY) (the “Company” or

“Annaly”) announced today that its Board of Directors declared the

third quarter common stock dividend and has unanimously approved a

reverse stock split of the Company’s common stock at a ratio of

1-for-4.

3rd Quarter Common Stock Dividend

The Board of Directors of the Company declared the third quarter

2022 common stock cash dividend of $0.88 per share of the Company’s

common stock (maintaining the Company’s dividend of $0.22 per share

before the reverse stock split, adjusted for the 1-for-4 reverse

stock split). This dividend is payable October 31, 2022, to common

stockholders of record on September 30, 2022 (based on the number

of shares of common stock held by each stockholder on such date

after giving effect to the reverse stock split). The ex-dividend

date is September 29, 2022.

1-for-4 Reverse Stock Split

The reverse stock split is expected to take effect following the

close of business on September 23, 2022 (the “Effective Time”).

Accordingly, at the Effective Time, every four issued and

outstanding shares of the Company’s common stock will be converted

into one share of the Company’s common stock. The Company’s common

stock is expected to begin trading on the New York Stock Exchange

on a post-reverse stock split basis beginning on September 26,

2022, under a new CUSIP number: 035710839.

The Company is implementing the reverse stock split with the

objective of reducing Annaly’s number of shares of common stock

outstanding to more closely align with the number of common shares

outstanding for companies of a similar market capitalization. As a

result of the reverse stock split, the number of outstanding shares

of Annaly’s common stock will be reduced from approximately 1.8

billion to approximately 445 million. Furthermore, the Company

believes the reverse stock split will make the common stock more

attractive to a broader range of investors, which has the potential

to reduce share price volatility over time.

No fractional shares will be issued in connection with the

reverse stock split. Instead, each stockholder that would hold

fractional shares as a result of the reverse stock split will be

entitled to receive, in lieu of such fractional shares, cash in an

amount based on the closing price of the Company's common stock on

the New York Stock Exchange on September 23, 2022. The reverse

stock split will apply to all of the Company’s outstanding shares

of common stock and therefore will not affect any stockholder’s

ownership percentage of shares of the Company’s common stock,

except for de minimis changes resulting from the payment of cash in

lieu of fractional shares. Stockholders of record will be receiving

information from Computershare Trust Company, N.A., the Company’s

transfer agent (“Computershare”), regarding their stock ownership

following the reverse stock split and, if applicable, payments of

cash in lieu of fractional shares.

Stockholders with certificated shares of common stock will

receive a letter of transmittal from Computershare with

instructions on how to surrender certificates representing

pre-reverse stock split shares, which will become book-entry shares

post-reverse stock split. Stockholders should not send in their

pre-reverse stock split certificates until they receive a letter of

transmittal (which will also include a lost securities affidavit

with respect to any certificate that cannot be located) from

Computershare. In order to receive new shares of the Company’s

common stock, cash payments in lieu of fractional shares, and any

future dividends or distributions the Company may declare with a

record date after the Effective Time of the reverse stock split,

stockholders must return these certificated shares of common stock

or a lost securities affidavit. Stockholders with book-entry shares

or who hold their shares through a bank, broker, or other nominee

will not need to take any action.

About Annaly

Annaly is a leading diversified capital manager with investment

strategies across mortgage finance. Annaly’s principal business

objective is to generate net income for distribution to its

stockholders and to optimize its returns through prudent management

of its diversified investment strategies. Annaly is internally

managed and has elected to be taxed as a real estate investment

trust, or REIT, for federal income tax purposes.

Forward-Looking Statements

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as “may,” “will,” “should,” “estimate,”

“project,” “believe,” “expect,” “anticipate,” “continue,” or

similar terms or variations on those terms or the negative of those

terms. Actual results could differ materially from those set forth

in forward-looking statements due to a variety of factors,

including, but not limited to, risks and uncertainties related to

the COVID-19 pandemic, including as related to adverse economic

conditions on real estate-related assets and financing conditions

(and our outlook for our business in light of these conditions,

which is uncertain); changes in interest rates; changes in the

yield curve; changes in prepayment rates; the availability of

mortgage-backed securities and other securities for purchase; the

availability of financing and, if available, the terms of any

financing; changes in the market value of our assets; changes in

business conditions and the general economy; operational risks or

risk management failures by us or critical third parties, including

cybersecurity incidents; our ability to grow our residential credit

business; credit risks related to our investments in credit risk

transfer securities, residential mortgage-backed securities, and

related residential mortgage credit assets; risks related to

investments in mortgage servicing rights; our ability to consummate

any contemplated investment opportunities; changes in government

regulations or policy affecting our business; our ability to

maintain our qualification as a REIT for U.S. federal income tax

purposes; and our ability to maintain our exemption from

registration under the Investment Company Act. For a discussion of

the risks and uncertainties which could cause actual results to

differ from those contained in the forward-looking statements, see

“Risk Factors” in our most recent Annual Report on Form 10-K and

any subsequent Quarterly Reports on Form 10-Q. The Company does not

undertake, and specifically disclaims any obligation, to publicly

release the result of any revisions which may be made to any

forward-looking statements to reflect the occurrence of anticipated

or unanticipated events or circumstances after the date of such

statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220908005895/en/

Annaly Capital Management, Inc. Investor Relations 1-888-8Annaly

investor@annaly.com

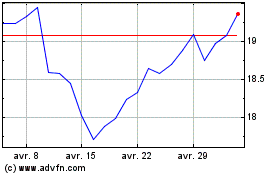

Annaly Capital Management (NYSE:NLY)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Annaly Capital Management (NYSE:NLY)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024