Reports Mailed to Shareholders (registered Investment Company) (n-30b-2)

27 Octobre 2021 - 7:32PM

Edgar (US Regulatory)

ADAMS

NATURAL RESOURCES

FUND

GET THE LATEST NEWS AND INFORMATION

Dear Fellow Shareholders,

Broadly positive data continued to support the robust, ongoing economic recovery in the third quarter. However, the market was challenged by persistent supply chain disruptions, signs that surging inflation appears less transitory than many believed, and uncertainty surrounding the fate of major U.S. infrastructure spending bills. The Federal Reserve added to the mix, signaling it could start to taper its $120 billion monthly asset buying program as soon as its November meeting.

The market’s performance showed increasing levels of concern about the impact of those headwinds on the recovery. The “reopening” trade, which drove strong equity returns in the first half of the year as investors

Energy was the best performing sector in the S&P 500 in the first nine months of 2021, outperforming by more than 27%.

pivoted from high-multiple technology names toward more cyclical companies, lost momentum during the quarter, especially in September. The S&P 500 declined 4.7% for the month. The market did, however, produce its sixth consecutive quarterly gain, finishing with a 0.6% advance. For the first nine months of 2021, the S&P 500 rose 15.9%.

The biggest questions relate to how long these issues will last. We believe inflationary pressures will be transitory, but we share the Federal Reserve’s uncertainty about how quickly they will ease. Likewise, we view the September downturn as more about investors taking some profits than a long-lasting crisis of confidence. Consumers appeared to pull back on spending as the Delta variant of COVID-19 spread during the summer, but they remain flush with record savings levels as the pandemic continues to wind down.

Energy was the best performing sector in the S&P 500 in the first nine months, outperforming the index by 27.3%. Our Fund rose 33.8%, outperforming its benchmark. WTI oil closed the third quarter near three-year highs, above $75 a barrel, up approximately 55% year-to-date and more than 100% in 12 months. Gas, coal, and power prices also rose sharply, driving inflationary pressures across the globe. Rising demand since the initial shock of the pandemic combined with supply disruptions to drive oil and other energy prices higher. Many analysts expect prices to rise further in the coming months. Within the sector, all industry groups advanced sharply year-to-date.

That said, the sector’s first-half rally slowed during the third quarter. Our Fund posted a modest decline of -1.8% but outperformed its benchmark. Our holdings

Letter to Shareholders (continued)

in the Exploration and Production (E&P) and Refining groups added the most relative value, while our Materials holdings lagged those in the benchmark.

Performance in the E&P group was led by our overweight position in ConocoPhillips. Conoco was an early adopter of the strategy to focus on returning excess cash flow to shareholders while keeping production levels stable. Late in the quarter, the company announced they were acquiring the Permian Basin assets of Royal Dutch. Importantly, the company is paying for the acquisition without adding debt to their balance sheet and intends to sell other assets so that average production costs will decline. We also moved to an overweight position in EOG Resources. We believe EOG is a best-in-class operator whose valuation is attractive.

While Refining declined during the third quarter as fears that the Delta variant of COVID-19 would lower demand for gasoline and other refined products, stock selection within the group added value. Our overweight position in Marathon Petroleum, which strongly outperformed its peer group, was a key relative contributor. Marathon completed their spin-off of the Speedway gas station network, and we believe the resulting cash infusion will enable the company to buy back a significant percentage of their stock over the next couple of years.

Investments in the Chemicals group within Materials adversely impacted the Fund’s relative performance. This was primarily due to our position in Air Products and Chemicals. The company is engaged in two large joint ventures in the Middle East that have run into cost issues and timing delays. We believe these projects will ultimately prove to be beneficial to the company and expect resolution of the issues in the coming months. The weakness in Air Products was partially offset by strength in Sherwin Williams. The company continues to see strong demand for their coating products from all their major customer bases.

For the nine months ended September 30, 2021, the total return on the Fund’s net asset value (“NAV”) per share (with dividends and capital gains reinvested) was 33.8%. This compares to a total return of 33.4% for the Fund’s benchmark, comprised of the S&P 500 Energy Sector (70% weight) and the S&P 500 Materials Sector (30% weight). The total return on the market price of the Fund’s shares for the period was 40.8%.

For the twelve months ended September 30, 2021, the Fund’s total return on NAV was 64.8%. Comparable return for the Fund’s benchmark was 64.5%. The Fund’s total return on market price for the period was 69.6%.

During the first three quarters of this year, the Fund paid distributions to shareholders in the amount of $7.2 million, or $.30 per share, consisting of $.03 net investment income and $.03 long-term capital gain, realized in 2020, and $.24

Letter to Shareholders (continued)

of net investment income realized in 2021, all taxable in 2021. These constitute the first three payments toward our annual 6% minimum distribution rate commitment.

Looking ahead, we remain positive on the market, despite our belief that supply chain disruptions and inflationary pressures seem likely to linger into 2022. Those issues, along with the unpredictability of COVID-19 threats, remain risk factors, as do the market’s above-average valuations and investor sensitivity to the Fed’s moves and statements. We could well see more short-term volatility in equity markets, especially as investors anxiously watch the U.S. stimulus bills. Still, the economic recovery from the pandemic continues, supported by record-high savings levels and the likely continuance of fiscal and monetary stimulus. The potential for short-term ups and downs only reinforces the importance of stock selection, and we believe our focus on that, along with our disciplined investment approach, will carry us through. As always, we appreciate the trust you place in us.

By order of the Board of Directors,

Mark E. Stoeckle

Chief Executive Officer

October 21, 2021

Disclaimers

This report contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. By their nature, all forward-looking statements involve risks and uncertainties, and actual results could differ materially from those contemplated by the forward-looking statements. Several factors that could materially affect the Fund’s actual results are the performance of the portfolio of stocks held by the Fund, the conditions in the U.S. and international financial markets, the price at which shares of the Fund will trade in the public markets, and other factors discussed in the Fund’s periodic filings with the Securities and Exchange Commission.

This report is transmitted to the shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in the report. The rates of return will vary and the principal value of an investment will fluctuate. Shares, if sold, may be worth more or less than their original cost. Past performance is no guarantee of future investment results.

Summary Financial Information

|

|

|

|

2021

|

|

|

2020

|

|

|

At September 30:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value per share

|

|

|

|

$

|

18.05

|

|

|

|

|

$

|

11.58

|

|

|

|

Market price per share

|

|

|

|

$

|

15.69

|

|

|

|

|

$

|

9.78

|

|

|

|

Shares outstanding

|

|

|

|

|

24,084,964

|

|

|

|

|

|

23,822,808

|

|

|

|

Total net assets

|

|

|

|

$

|

434,783,848

|

|

|

|

|

$

|

275,792,627

|

|

|

|

Average net assets

|

|

|

|

$

|

403,729,827

|

|

|

|

|

$

|

398,753,189

|

|

|

|

Unrealized appreciation on investments

|

|

|

|

$

|

(7,143,672)

|

|

|

|

|

$

|

(170,609,235)

|

|

|

|

|

|

|

For the nine months ended September 30:

|

|

|

Net investment income

|

|

|

|

$

|

9,213,888

|

|

|

|

|

$

|

9,955,527

|

|

|

|

Net realized gain (loss)

|

|

|

|

$

|

4,909,580

|

|

|

|

|

$

|

8,290,529

|

|

|

|

Cost of shares repurchased*

|

|

|

|

$

|

478,299

|

|

|

|

|

$

|

71,906,399

|

|

|

|

Shares repurchased*

|

|

|

|

|

37,000

|

|

|

|

|

|

6,053,018

|

|

|

|

Total return (based on market price)

|

|

|

|

|

40.8%

|

|

|

|

|

|

-39.1%

|

|

|

|

Total return (based on net asset value)

|

|

|

|

|

33.8%

|

|

|

|

|

|

-36.8%

|

|

|

|

|

|

|

Key ratios:

|

|

|

Expenses to average net assets**

|

|

|

|

|

0.91%

|

|

|

|

|

|

1.33%

|

|

|

|

Net investment income to average net assets**

|

|

|

|

|

3.05%

|

|

|

|

|

|

3.36%

|

|

|

|

Portfolio turnover**

|

|

|

|

|

24.4%

|

|

|

|

|

|

33.3%

|

|

|

|

Net cash & short-term investments to net assets

|

|

|

|

|

0.7%

|

|

|

|

|

|

0.5%

|

|

|

*

For 2020, includes 5,955,676 shares at a cost of $71,170,328 purchased in a tender offer.

**

Annualized

Ten Largest Equity Portfolio Holdings

September 30, 2021

(unaudited)

|

|

|

|

Market Value

|

|

|

Percent

of Net Assets

|

|

|

Exxon Mobil Corporation

|

|

|

|

$

|

74,914,917

|

|

|

|

|

|

17.2%

|

|

|

|

Chevron Corporation

|

|

|

|

|

56,932,827

|

|

|

|

|

|

13.1

|

|

|

|

ConocoPhillips

|

|

|

|

|

32,714,341

|

|

|

|

|

|

7.5

|

|

|

|

EOG Resources, Inc.

|

|

|

|

|

18,389,857

|

|

|

|

|

|

4.2

|

|

|

|

Linde plc

|

|

|

|

|

17,456,110

|

|

|

|

|

|

4.0

|

|

|

|

Schlumberger N.V.

|

|

|

|

|

16,776,240

|

|

|

|

|

|

3.9

|

|

|

|

Marathon Petroleum Corporation

|

|

|

|

|

16,564,153

|

|

|

|

|

|

3.8

|

|

|

|

Valero Energy Corporation

|

|

|

|

|

12,018,071

|

|

|

|

|

|

2.8

|

|

|

|

ONEOK, Inc.

|

|

|

|

|

10,791,939

|

|

|

|

|

|

2.5

|

|

|

|

Sherwin-Williams Company

|

|

|

|

|

10,461,902

|

|

|

|

|

|

2.4

|

|

|

|

|

|

|

|

$

|

267,020,357

|

|

|

|

|

|

61.4%

|

|

|

September 30, 2021

(unaudited)

|

|

|

|

Shares

|

|

|

Value (a)

|

|

|

Common Stocks — 99.3%

|

|

|

Energy — 74.7%

|

|

|

Equipment & Services — 5.7%

|

|

|

Baker Hughes Company

|

|

|

|

|

171,900

|

|

|

|

|

$

|

4,251,087

|

|

|

|

Halliburton Company

|

|

|

|

|

170,270

|

|

|

|

|

|

3,681,237

|

|

|

|

Schlumberger N.V.

|

|

|

|

|

566,000

|

|

|

|

|

|

16,776,240

|

|

|

|

|

|

|

|

|

24,708,564

|

|

|

|

Exploration & Production — 23.4%

|

|

|

APA Corporation

|

|

|

|

|

59,700

|

|

|

|

|

|

1,279,371

|

|

|

|

Cabot Oil & Gas Corporation

|

|

|

|

|

102,300

|

|

|

|

|

|

2,226,048

|

|

|

|

Canadian Natural Resources Limited

|

|

|

|

|

47,800

|

|

|

|

|

|

1,746,612

|

|

|

|

ConocoPhillips

|

|

|

|

|

482,726

|

|

|

|

|

|

32,714,341

|

|

|

|

Devon Energy Corporation

|

|

|

|

|

270,300

|

|

|

|

|

|

9,598,353

|

|

|

|

Diamondback Energy, Inc.

|

|

|

|

|

105,800

|

|

|

|

|

|

10,016,086

|

|

|

|

EOG Resources, Inc.

|

|

|

|

|

229,100

|

|

|

|

|

|

18,389,857

|

|

|

|

Hess Corporation

|

|

|

|

|

85,600

|

|

|

|

|

|

6,686,216

|

|

|

|

Marathon Oil Corporation

|

|

|

|

|

401,500

|

|

|

|

|

|

5,488,505

|

|

|

|

Occidental Petroleum Corporation

|

|

|

|

|

161,051

|

|

|

|

|

|

4,763,889

|

|

|

|

Pioneer Natural Resources Company

|

|

|

|

|

52,700

|

|

|

|

|

|

8,775,077

|

|

|

|

Whiting Petroleum Corporation (b)

|

|

|

|

|

476

|

|

|

|

|

|

27,803

|

|

|

|

Whiting Petroleum Corporation warrants,

strike price $73.44, expires 9/1/24 (b)

|

|

|

|

|

2,654

|

|

|

|

|

|

18,976

|

|

|

|

Whiting Petroleum Corporation warrants,

strike price $83.45, expires 9/1/25 (b)

|

|

|

|

|

1,327

|

|

|

|

|

|

9,581

|

|

|

|

|

|

|

|

|

101,740,715

|

|

|

|

Integrated Oil & Gas — 30.8%

|

|

|

Cenovus Energy Inc.

|

|

|

|

|

196,700

|

|

|

|

|

|

1,978,802

|

|

|

|

Chevron Corporation

|

|

|

|

|

561,191

|

|

|

|

|

|

56,932,827

|

|

|

|

Exxon Mobil Corporation

|

|

|

|

|

1,273,630

|

|

|

|

|

|

74,914,917

|

|

|

|

|

|

|

|

|

133,826,546

|

|

|

|

Refining & Marketing — 8.4%

|

|

|

Marathon Petroleum Corporation

|

|

|

|

|

267,985

|

|

|

|

|

|

16,564,153

|

|

|

|

Phillips 66

|

|

|

|

|

112,775

|

|

|

|

|

|

7,897,633

|

|

|

|

Valero Energy Corporation

|

|

|

|

|

170,300

|

|

|

|

|

|

12,018,071

|

|

|

|

|

|

|

|

|

36,479,857

|

|

|

|

Storage & Transportation — 6.4%

|

|

|

Kinder Morgan, Inc.

|

|

|

|

|

464,400

|

|

|

|

|

|

7,769,412

|

|

|

|

ONEOK, Inc.

|

|

|

|

|

186,100

|

|

|

|

|

|

10,791,939

|

|

|

|

Williams Companies, Inc.

|

|

|

|

|

362,100

|

|

|

|

|

|

9,392,874

|

|

|

|

|

|

|

|

|

27,954,225

|

|

|

Schedule of Investments (continued)

September 30, 2021

(unaudited)

|

|

|

|

Shares

|

|

|

Value (a)

|

|

|

Materials — 24.6%

|

|

|

Chemicals — 14.9%

|

|

|

Air Products and Chemicals, Inc.

|

|

|

|

|

34,300

|

|

|

|

|

$

|

8,784,573

|

|

|

|

Albemarle Corporation

|

|

|

|

|

9,000

|

|

|

|

|

|

1,970,730

|

|

|

|

Celanese Corporation

|

|

|

|

|

29,600

|

|

|

|

|

|

4,458,944

|

|

|

|

CF Industries Holdings, Inc.

|

|

|

|

|

44,300

|

|

|

|

|

|

2,472,826

|

|

|

|

Corteva Inc.

|

|

|

|

|

66,245

|

|

|

|

|

|

2,787,590

|

|

|

|

Dow, Inc.

|

|

|

|

|

65,745

|

|

|

|

|

|

3,784,282

|

|

|

|

DuPont de Nemours, Inc.

|

|

|

|

|

44,487

|

|

|

|

|

|

3,024,671

|

|

|

|

Eastman Chemical Company

|

|

|

|

|

8,900

|

|

|

|

|

|

896,586

|

|

|

|

Ecolab Inc.

|

|

|

|

|

31,600

|

|

|

|

|

|

6,592,392

|

|

|

|

FMC Corporation

|

|

|

|

|

10,500

|

|

|

|

|

|

961,380

|

|

|

|

International Flavors & Fragrances Inc.

|

|

|

|

|

21,006

|

|

|

|

|

|

2,808,922

|

|

|

|

Linde plc

|

|

|

|

|

59,500

|

|

|

|

|

|

17,456,110

|

|

|

|

LyondellBasell Industries N.V.

|

|

|

|

|

53,300

|

|

|

|

|

|

5,002,205

|

|

|

|

Mosaic Company

|

|

|

|

|

21,001

|

|

|

|

|

|

750,156

|

|

|

|

PPG Industries, Inc.

|

|

|

|

|

19,700

|

|

|

|

|

|

2,817,297

|

|

|

|

|

|

|

|

|

64,568,664

|

|

|

|

Construction Materials — 3.1%

|

|

|

Martin Marietta Materials, Inc.

|

|

|

|

|

4,500

|

|

|

|

|

|

1,537,560

|

|

|

|

Sherwin-Williams Company

|

|

|

|

|

37,400

|

|

|

|

|

|

10,461,902

|

|

|

|

Vulcan Materials Company

|

|

|

|

|

9,800

|

|

|

|

|

|

1,657,768

|

|

|

|

|

|

|

|

|

13,657,230

|

|

|

|

Containers & Packaging — 2.8%

|

|

|

Amcor plc

|

|

|

|

|

125,100

|

|

|

|

|

|

1,449,909

|

|

|

|

Avery Dennison Corporation

|

|

|

|

|

5,500

|

|

|

|

|

|

1,139,655

|

|

|

|

Ball Corporation

|

|

|

|

|

29,100

|

|

|

|

|

|

2,618,127

|

|

|

|

International Paper Company

|

|

|

|

|

28,200

|

|

|

|

|

|

1,576,944

|

|

|

|

Packaging Corporation of America

|

|

|

|

|

7,600

|

|

|

|

|

|

1,044,544

|

|

|

|

Sealed Air Corporation

|

|

|

|

|

59,200

|

|

|

|

|

|

3,243,568

|

|

|

|

WestRock Company

|

|

|

|

|

22,200

|

|

|

|

|

|

1,106,226

|

|

|

|

|

|

|

|

|

12,178,973

|

|

|

|

Metals & Mining — 3.8%

|

|

|

Freeport-McMoRan, Inc.

|

|

|

|

|

225,300

|

|

|

|

|

|

7,329,009

|

|

|

|

Newmont Corporation

|

|

|

|

|

94,700

|

|

|

|

|

|

5,142,210

|

|

|

|

Nucor Corporation

|

|

|

|

|

21,100

|

|

|

|

|

|

2,078,139

|

|

|

|

Steel Dynamics, Inc.

|

|

|

|

|

36,000

|

|

|

|

|

|

2,105,280

|

|

|

|

|

|

|

|

|

16,654,638

|

|

|

|

|

Schedule of Investments (continued)

September 30, 2021

(unaudited)

|

|

|

|

Shares

|

|

|

Value (a)

|

|

|

Total Common Stocks

|

|

|

(Cost $438,913,084)

|

|

|

|

|

|

|

|

|

|

$

|

431,769,412

|

|

|

Short-Term Investments — 0.8%

|

|

|

Money Market Funds — 0.8%

|

|

|

Northern Institutional Treasury Portfolio, 0.01% (c)

|

|

|

|

|

3,555,412

|

|

|

|

|

|

3,555,412

|

|

|

(Cost $3,555,412)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total — 100.1% of Net Assets

|

|

|

(Cost $442,468,496)

|

|

|

|

|

|

|

|

|

|

|

435,324,824

|

|

|

Other Assets Less Liabilities — (0.1)%

|

|

|

|

|

|

|

|

|

|

|

(540,976

|

)

|

|

Net Assets — 100.0%

|

|

|

|

|

|

|

|

|

|

$

|

434,783,848

|

|

|

|

(a)

Common stocks and warrants are listed on the New York Stock Exchange or NASDAQ and are valued at the last reported sale price on the day of valuation.

(b)

Presently non-dividend paying.

(c)

Rate presented is as of period-end and represents the annualized yield earned over the previous seven days.

Information regarding transactions in equity securities during the quarter can be found on our website at: www.adamsfunds.com.

[This Page Intentionally Left Blank]

Adams Natural Resources Fund, Inc.

Board of Directors

|

|

Enrique R. Arzac (2)(4)

|

|

|

Roger W. Gale (2) (3)

|

|

|

Kathleen T. McGahran(1)(5)

|

|

|

|

Kenneth J. Dale(1)(2) (3)

|

|

|

Mary Chris Jammet (2) (4)

|

|

|

Mark E. Stoeckle (1)

|

|

|

|

Frederic A. Escherich (1) (3) (4)

|

|

|

Lauriann C. Kloppenburg(1)(3) (4)

|

|

|

|

|

(1)

Member of Executive Committee

(2)

Member of Audit Committee

(3)

Member of Compensation Committee

(4)

Member of Nominating and Governance Committee

(5)

Chair of the Board

Officers

|

|

Mark E. Stoeckle

|

|

|

Chief Executive Officer

|

|

|

|

James P. Haynie, CFA

|

|

|

President

|

|

|

|

Brian S. Hook, CFA, CPA

|

|

|

Vice President, Chief Financial Officer and Treasurer

|

|

|

|

Janis F. Kerns

|

|

|

Vice President, General Counsel, Secretary and Chief Compliance Officer

|

|

|

|

Gregory W. Buckley

|

|

|

Vice President—Research

|

|

|

|

Michael A. Kijesky, CFA

|

|

|

Vice President—Research

|

|

|

|

Michael E. Rega, CFA

|

|

|

Vice President—Research

|

|

|

|

Jeffrey R. Schollaert, CFA

|

|

|

Vice President—Research

|

|

|

|

Christine M. Sloan, CPA

|

|

|

Assistant Treasurer and Director of Human Resources

|

|

500 East Pratt Street, Suite 1300, Baltimore, MD 21202

410.752.5900 800.638.2479

Website: www.adamsfunds.com

Email: investorrelations@adamsfunds.com

Tickers: PEO (NYSE), XPEOX (NASDAQ)

Independent Registered Public Accounting Firm: PricewaterhouseCoopers LLP

Custodian of Securities: The Northern Trust Company

Transfer Agent & Registrar: American Stock Transfer & Trust Company, LLC

Stockholder Relations Department

6201 15th Avenue

Brooklyn, NY 11219

(866) 723-8330

Website: www.astfinancial.com

Email: info@astfinancial.com

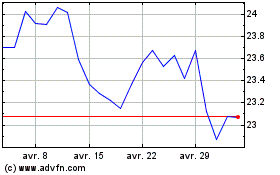

Adams Natural Resources (NYSE:PEO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Adams Natural Resources (NYSE:PEO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024