PGIM Multi-Asset Solutions marks continued expansion with key portfolio management and risk hires

10 Octobre 2024 - 3:00PM

Business Wire

PGIM Multi-Asset Solutions (PMA) has appointed Mao Dong as

co-head of Portfolio Management.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241009388611/en/

“Our insurance, reinsurance and pension

fund clients increasingly require complex multi-asset class

portfolio construction and management. Mao’s appointment is another

important milestone in building PGIM’s multi-asset solutions

business to meet the needs of those clients.” -- Phil Waldeck, CEO,

PGIM Multi-Asset Solutions (Photo: Business Wire)

Dong joins PGIM from Goldman Sachs Asset Management (GSAM),

where he spent over 14 years, most recently as co-head of OCIO

Portfolio Management and head of Portfolio Construction and Manager

Research.

At GSAM he led a team of portfolio managers in overseeing

strategic and dynamic asset allocation, manager selection,

portfolio implementation and risk management for OCIO portfolios

globally. Dong also served as senior portfolio manager for several

of GSAM’s multi-asset class funds across global equity, fixed

income and public real assets.

At PMA, Dong will be responsible for designing and managing

multi-asset portfolios for institutional clients, including

developing and applying relative value views across public and

private investment strategies.

PMA CEO Phil Waldeck comments: “Our insurance, reinsurance and

pension fund clients increasingly require complex multi-asset class

portfolio construction and management. Mao’s appointment is another

important milestone in building PGIM’s multi-asset solutions

business to meet the needs of those clients.”

The appointment comes amid a continued build-out of PMA, which

has grown AUM to $17 billion since it was formed in 2022.1 Among

recent hires was Eoin Elliffe as chief risk officer in June.

Elliffe’s role is to build and enhance PMA’s risk framework and

support the development of investment and risk management solutions

for clients. Waldeck continues: “Eoin’s expertise will help us

develop our capabilities and strengthen our value proposition for

each of our market segments: insurance and reinsurance companies,

and pension funds.”

Elliffe joined PMA from Midwest Holding, where he served as

chief risk officer. His career spans asset liability management,

trading and risk management roles across insurance, reinsurance

providers, and investment management firms.

Dong shares portfolio management responsibilities with co-head

Jonathan Holt and reports to PMA chief investment officer Alfred

Lerman. Holt joined PMA in 2022 from Prudential Financial, where he

served as head portfolio manager for Prudential’s Retirement and

Group Insurance portfolios.

Waldeck concludes: “With these appointments we have created a

team with a deep understanding of the solutions which insurers and

pension funds require. I look forward to seeing them contribute to

our continued success.”

PMA was recently appointed as the asset manager for the assets

supporting an $11 billion reinsurance transaction by Prudential

Financial to Wilton Re. This is the second reinsurance mandate for

the affiliate following its appointment as asset manager to Prismic

Life Re, a Bermuda-based life and annuity reinsurance company

announced by Prudential Financial and Warburg Pincus in September

2023.

ABOUT PGIM MULTI-ASSET SOLUTIONS

PGIM Multi-Asset Solutions (PMA) was launched in 2022 as a

business of PGIM, the global asset management business of

Prudential Financial, Inc. (NYSE: PRU). PMA combines

asset-liability management expertise with portfolio strategy and

asset allocation to develop integrated solutions for institutional

investors. Partnering with the wider PGIM businesses that manage

investments on behalf of 158 of the largest 300 global pension

funds,2 PMA brings together over 145 years of investment management

and risk management expertise. For more information visit

pgim.com/multi-asset-solutions.

ABOUT PGIM

PGIM is the global asset management business of Prudential

Financial, Inc. (NYSE: PRU). In 41 offices across 18 countries, our

more than 1,400 investment professionals serve both retail and

institutional clients around the world.

As a leading global asset manager with $1.33 trillion in assets

under management,3 PGIM is built on a foundation of strength,

stability and disciplined risk management. Our multi-affiliate

model allows us to deliver specialized expertise across key asset

classes with a focused investment approach. This gives our clients

a diversified suite of investment strategies and solutions with

global depth and scale across public and private asset classes,

including fixed income, equities, real estate, private credit, and

other alternatives. For more information, visit pgim.com.

Prudential Financial, Inc. (PFI) of the United States is not

affiliated in any manner with Prudential plc, incorporated in the

United Kingdom, or with Prudential Assurance Company, a subsidiary

of M&G plc, incorporated in the United Kingdom. For more

information please visit news.prudential.com.

1AUM estimated as of Sept. 30, 2024.

2 Based on PGIM client list as of June 30, 2024, compared to

P&I/Thinking Ahead Institute’s Top 300 Global Pension Funds

ranking, data as of Dec. 31, 2022, published September 2023. U.S.

funds data was sourced from the P&I 1000, while figures for

other regions were sourced from annual reports, websites, and

direct communications with pension fund organizations.

3As of June 30, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241009388611/en/

MEDIA CONTACT Guy Nicholls +1 973 204 1648

guy.nicholls@pgim.com

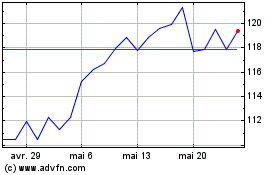

Prudential Financial (NYSE:PRU)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Prudential Financial (NYSE:PRU)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024