false000113777400011377742024-10-302024-10-300001137774us-gaap:CommonClassAMember2024-10-302024-10-300001137774pru:A5950JuniorSubordinatedNotesMember2024-10-302024-10-300001137774pru:A5625JuniorSubordinatedNotesMember2024-10-302024-10-300001137774pru:A4125JuniorSubordinatedNotesMember2024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

___________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

___________________________

PRUDENTIAL FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

___________________________

| | | | | | | | |

| New Jersey | 001-16707 | 22-3703799 |

| (State or other jurisdiction | (Commission | (I.R.S. Employer |

| of incorporation) | File Number) | Identification Number) |

751 Broad Street

Newark, NJ 07102

(Address of principal executive offices and zip code)

(973) 802-6000

(Registrant’s telephone number, including area code)

___________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: |

| | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, Par Value $.01 | | PRU | | New York Stock Exchange |

| 5.950% Junior Subordinated Notes | | PRH | | New York Stock Exchange |

| 5.625% Junior Subordinated Notes | | PRS | | New York Stock Exchange |

| 4.125% Junior Subordinated Notes | | PFH | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Prudential Financial, Inc. (the "Company") furnishes herewith, as Exhibit 99.1, a news release announcing third quarter 2024 results.

Item 7.01 Regulation FD Disclosure.

| | | | | |

| A. | Quarterly Financial Supplement. The Company furnishes herewith, as Exhibit 99.2, the Quarterly Financial Supplement for third quarter 2024. |

| B. | Conference Call and Related Materials. Members of the Company's senior management will hold a conference call on Thursday, October 31, 2024 at 11:00 A.M. ET, to discuss the Company's third quarter 2024 results. Related materials are available on the Company's Investor Relations website at www.investor.prudential.com. |

Investors and others should note that the Company routinely uses its Investor Relations website to post presentations to investors and other important information, including information that may be deemed material to investors. Accordingly, the Company encourages investors and others interested in the Company to review the information that it shares at www.investor.prudential.com. Interested parties may register to receive automatic email alerts when presentations and other information are posted to the Investor Relations website by clicking on "Subscribe to Email Alerts" at www.investor.prudential.com and following the instructions provided.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 30, 2024

| | | | | |

| PRUDENTIAL FINANCIAL, INC. |

| |

| By: | /s/ Robert D. Axel |

| | Name: Robert D. Axel

Title: Senior Vice President and Principal Accounting Officer |

October 30, 2024

Prudential Financial, Inc. Announces

Third Quarter 2024 Results

•Net income attributable to Prudential Financial, Inc. of $448 million or $1.24 per Common share versus net loss of $802 million or $2.23 per share for the year-ago quarter.

•After-tax adjusted operating income of $1.260 billion or $3.48 per Common share versus $1.332 billion or $3.62 per share for the year-ago quarter.

•Book value per Common share of $84.47 versus $70.82 per share for the year-ago quarter; adjusted book value per Common share of $98.71 versus $94.19 per share for the year-ago quarter.

•Parent company highly liquid assets(1) of $4.3 billion, in-line with the year-ago quarter.

•Assets under management(2) of $1.558 trillion versus $1.361 trillion for the year-ago quarter.

•Capital returned to shareholders of $721 million in the third quarter, including $250 million of share repurchases and $471 million of dividends, versus $711 million in the year-ago quarter. Dividends paid in the third quarter were $1.30 per Common share, representing a 5% yield on adjusted book value.

Charlie Lowrey, Chairman & CEO, commented on results:

"Our third quarter performance reflects continued momentum in our global investment, insurance, and retirement businesses.

Prudential reported robust sales across our U.S. and international insurance and retirement businesses, as well as strong investment performance and private credit originations in PGIM.

We also continue to shift our business mix, through the recently announced $11 billion Guaranteed Universal Life reinsurance transaction, and by expanding our distribution capabilities and diversifying our products to grow our market-leading businesses.

We remain well positioned to deliver long-term value for our stakeholders and help our customers around the world live better lives, longer."

| | | | | | | | |

| Prudential Financial, Inc. Third Quarter 2024 Earnings Release | | Page 2 |

NEWARK, N.J. – Prudential Financial, Inc. (NYSE: PRU) today reported third quarter results. Net income attributable to Prudential Financial, Inc. was $448 million ($1.24 per Common share) for the third quarter of 2024, compared to a net loss of $802 million ($2.23 per Common share) for the third quarter of 2023. After-tax adjusted operating income was $1.260 billion ($3.48 per Common share) for the third quarter of 2024, compared to $1.332 billion ($3.62 per Common share) for the third quarter of 2023.

Consolidated adjusted operating income and adjusted book value are non-GAAP measures. A discussion of these measures, including definitions thereof, how they are useful to investors, and certain limitations thereof, is included later in this press release under “Non-GAAP Measures” and reconciliations to the most comparable GAAP measures are provided in the tables that accompany this release.

RESULTS OF ONGOING OPERATIONS

The Company’s ongoing operations include PGIM, U.S. Businesses, International Businesses, and Corporate & Other. In the following business-level discussion, adjusted operating income refers to pre-tax results.

PGIM

PGIM, the Company’s global investment management business, reported adjusted operating income of $241 million for the third quarter of 2024, compared to $211 million in the year-ago quarter. This increase primarily reflects higher asset management fees, partially offset by higher expenses.

PGIM assets under management of $1.400 trillion were up 15% from the year-ago quarter, primarily resulting from equity market appreciation, lower interest rates, investment performance, and net inflows. Total net flows in the quarter of $3.2 billion reflect affiliated net inflows of $6.4 billion, partially offset by $3.2 billion of third-party net outflows. Third-party net outflows reflect institutional outflows of $4.5 billion and retail inflows of $1.3 billion, both primarily driven by fixed income. Total net flows on a year-to-date basis were $29.2 billion, including $15.3 billion of affiliated and $13.9 billion of third-party flows.

U.S. Businesses

U.S. Businesses reported adjusted operating income of $1.108 billion for the third quarter of 2024, compared to $1.088 billion in the year-ago quarter. This increase primarily reflects more favorable underwriting and higher net investment spread results, partially offset by lower net fee income and higher expenses.

Retirement Strategies, consisting of Institutional Retirement Strategies and Individual Retirement Strategies, reported adjusted operating income of $966 million for the third quarter of 2024, compared to $941 million in the year-ago quarter.

Institutional Retirement Strategies:

•Reported adjusted operating income of $438 million in the current quarter, compared to $439 million in the year-ago quarter as higher net investment spread results were offset by higher expenses.

•Net account values of $279 billion, a record high, increased 13% from the year-ago quarter, reflecting the benefits of business growth and market appreciation. Sales in the current quarter of $11 billion included funded pension risk transfer transactions of $6.3 billion and longevity risk transfer transactions of $2.8 billion. Year-to-date sales of $26 billion increased 84% from prior year-to-date.

Individual Retirement Strategies:

•Reported adjusted operating income of $528 million in the current quarter, compared to $502 million in the year-ago quarter. This increase primarily reflects higher net investment spread results, partially offset by lower fee income, net of distribution expenses and other associated costs.

•Net account values of $129 billion increased 17% from the year-ago quarter, driven by market appreciation. Sales of $3.6 billion in the current quarter increased 86% from the year-ago quarter, reflecting continued momentum of our registered index-linked annuity products and increased sales of fixed annuity products.

Group Insurance:

•Reported adjusted operating income of $82 million in the current quarter, compared to $89 million in the year-ago quarter. This decrease primarily reflects higher expenses.

| | | | | | | | |

| Prudential Financial, Inc. Third Quarter 2024 Earnings Release | | Page 3 |

•Year-to-date sales of $487 million increased 3% from prior year-to-date, driven by growth in group disability and supplemental health.

Individual Life:

•Reported adjusted operating income of $60 million in the current quarter, compared to $58 million in the year-ago quarter. This increase primarily reflects more favorable underwriting results offset by lower net investment spread results.

•Sales of $210 million in the current quarter increased 13% from the year-ago quarter, driven by variable life sales.

International Businesses

International Businesses, consisting of Life Planner and Gibraltar Life & Other, reported adjusted operating income of $766 million for the third quarter of 2024, compared to $811 million in the year-ago quarter. This decrease primarily reflects less favorable underwriting results and higher expenses, partially offset by higher joint venture earnings and higher net investment spread results.

Life Planner:

•Reported adjusted operating income of $464 million in the current quarter, compared to $527 million in the year-ago quarter. This decrease primarily reflects less favorable underwriting results, higher expenses, and a net unfavorable impact from foreign currency exchange rates.

•Constant dollar basis sales(3) of $269 million in the current quarter increased 13% from the year-ago quarter, driven by growth in Japan and record high sales in Brazil.

Gibraltar Life & Other:

•Reported adjusted operating income of $302 million in the current quarter, compared to $284 million in the year-ago quarter. This increase primarily reflects higher joint venture earnings and higher net investment spread results, partially offset by less favorable underwriting results.

•Constant dollar basis sales(3) of $331 million in the current quarter increased 37% from the year-ago quarter, including growth across all channels.

Corporate & Other

Corporate & Other reported a loss, on an adjusted operating income basis, of $487 million for the third quarter of 2024, compared to a loss of $438 million in the year-ago quarter. Current quarter results primarily reflect higher expenses.

NET INCOME

Net income in the current quarter included $805 million of pre-tax net realized investment losses and related charges and adjustments, including $93 million of pre-tax net credit-related losses, $146 million of pre-tax losses related to net change in value of market risk benefits, $127 million of pre-tax losses related to market experience updates, and $49 million of pre-tax earnings from divested and run-off businesses.

Net loss for the year-ago quarter included $2.491 billion of pre-tax net realized investment losses and related charges and adjustments, largely driven by the impacts of rising interest rates, and also $97 million of pre-tax net credit-related losses, $251 million of pre-tax losses related to net change in value of market risk benefits, $111 million of pre-tax losses from divested and run-off businesses, and $143 million of pre-tax gains related to market experience updates.

EARNINGS CONFERENCE CALL

Members of Prudential’s senior management will host a conference call on Thursday, October 31, 2024, at 11:00 a.m. ET to discuss with the investment community the Company’s third quarter results. The conference call will be broadcast live over the Company’s Investor Relations website at investor.prudential.com. Please log on 15 minutes early in the event necessary software needs to be downloaded. Institutional investors, analysts, and other interested parties are invited to listen to the call by dialing one of the following numbers: (877) 407-8293 (domestic) or (201) 689-8349 (international). A replay will also be available on the Investor Relations website through November 14. To access a replay via phone starting at 3:00 p.m. ET

| | | | | | | | |

| Prudential Financial, Inc. Third Quarter 2024 Earnings Release | | Page 4 |

on October 31 through November 14, dial (877) 660-6853 (domestic) or (201) 612-7415 (international) and use replay code 13742770.

FORWARD-LOOKING STATEMENTS

Certain of the statements included in this release, including those regarding our recently announced planned reinsurance transaction and our strategy to deliver long-term value for our stakeholders, constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Prudential Financial, Inc. and its subsidiaries. Prudential Financial, Inc.’s actual results may differ, possibly materially, from expectations or estimates reflected in such forward-looking statements. Certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements can be found in the “Risk Factors” and “Forward-Looking Statements” sections included in Prudential Financial, Inc.’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. The forward-looking statements herein are subject to the risk, among others, that we will be unable to execute our strategy because of market or competitive conditions or other factors. Prudential Financial, Inc. does not undertake to update any particular forward-looking statement included in this document.

NON-GAAP MEASURES

Consolidated adjusted operating income and adjusted book value are non-GAAP measures. Reconciliations to the most directly comparable GAAP measures are included in this release.

We believe that our use of these non-GAAP measures helps investors understand and evaluate the Company’s performance and financial position. The presentation of adjusted operating income as we measure it for management purposes enhances the understanding of the results of operations by highlighting the results from ongoing operations and the underlying profitability of our businesses. Trends in the underlying profitability of our businesses can be more clearly identified without the fluctuating effects of the items described below. Adjusted book value augments the understanding of our financial position by providing a measure of net worth that is primarily attributable to our business operations separate from the portion that is affected by capital and currency market conditions, and by isolating the accounting impact associated with insurance liabilities that are generally not marked to market and the supporting investments that are marked to market through accumulated other comprehensive income under GAAP. However, these non-GAAP measures are not substitutes for income and equity determined in accordance with GAAP, and the adjustments made to derive these measures are important to an understanding of our overall results of operations and financial position. The schedules accompanying this release provide reconciliations of non-GAAP measures with the corresponding measures calculated using GAAP. Additional historic information relating to our financial performance is located on our website at investor.prudential.com.

Adjusted operating income is a non-GAAP measure used by the Company to evaluate segment performance and to allocate resources. Adjusted operating income excludes “Realized investment gains (losses), net, and related charges and adjustments”. A significant element of realized investment gains and losses are impairments and credit-related and interest rate-related gains and losses. Impairments and losses from sales of credit-impaired securities, the timing of which depends largely on market credit cycles, can vary considerably across periods. The timing of other sales that would result in gains or losses, such as interest rate-related gains or losses, is largely subject to our discretion and influenced by market opportunities as well as capital and other factors.

Realized investment gains (losses) within certain businesses for which such gains (losses) are a principal source of earnings, and those associated with terminating hedges of foreign currency earnings and current period yield adjustments, are included in adjusted operating income. Adjusted operating income generally excludes realized investment gains and losses from products that contain embedded derivatives, and from associated derivative portfolios that are part of an asset-liability management program related to the risk of those products. Adjusted operating income also excludes gains and losses from changes in value of certain assets and liabilities relating to foreign currency exchange movements that have been economically hedged or considered part of our capital funding strategies for our international subsidiaries, as well as gains and losses on certain investments that are designated as trading. Adjusted operating income also excludes investment gains and losses on assets supporting experience-rated contractholder liabilities and changes in experience-rated contractholder liabilities due to asset value changes, because these recorded changes in asset and liability values are

| | | | | | | | |

| Prudential Financial, Inc. Third Quarter 2024 Earnings Release | | Page 5 |

expected to ultimately accrue to contractholders. Adjusted operating income excludes the changes in fair value of equity securities that are recorded in net income. Additionally, adjusted operating income excludes impact of annual assumption updates and other refinements included in the above items.

Adjusted operating income excludes “Change in value of market risk benefits, net of related hedging gains (losses)”, which reflects the impact from changes in current market conditions, and market experience updates, reflecting the immediate impacts in current period results from changes in current market conditions on estimates of profitability, which we believe enhances the understanding of underlying performance trends. Adjusted operating income also excludes the results of Divested and Run-off Businesses, which are not relevant to our ongoing operations, and discontinued operations and earnings attributable to noncontrolling interests, each of which is presented as a separate component of net income under GAAP. Additionally, adjusted operating income excludes other items, such as certain components of the consideration for acquisitions, which are recognized as compensation expense over the requisite service periods, and goodwill impairments. Earnings attributable to noncontrolling interests is presented as a separate component of net income under GAAP and excluded from adjusted operating income. The tax effect associated with pre-tax adjusted operating income is based on applicable IRS and foreign tax regulations inclusive of pertinent adjustments.

Adjusted operating income does not equate to “Net income” as determined in accordance with U.S. GAAP. Adjusted operating income is not a substitute for income determined in accordance with U.S. GAAP, and our definition of adjusted operating income may differ from that used by other companies. The items above are important to an understanding of our overall results of operations. However, we believe that the presentation of adjusted operating income as we measure it for management purposes enhances the understanding of our results of operations by highlighting the results from ongoing operations and the underlying profitability of our businesses. Trends in the underlying profitability of our businesses can be more clearly identified without the fluctuating effects of the items described above.

Adjusted book value is calculated as total equity (GAAP book value) excluding accumulated other comprehensive income (loss), the cumulative change in fair value of funds withheld embedded derivatives, and the cumulative effect of foreign currency exchange rate remeasurements and currency translation adjustments corresponding to realized investment gains and losses. These items are excluded in order to highlight the book value attributable to our core business operations separate from the portion attributable to external and potentially volatile capital and currency market conditions.

FOOTNOTES

(1)Highly liquid assets predominantly include cash, short-term investments, U.S. Treasury securities, obligations of other U.S. government authorities and agencies, and/or foreign government bonds. For more information about highly liquid assets, see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” included in Prudential Financial, Inc.’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

(2)For more information about assets under management, see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations – Segment Measures” included in Prudential Financial, Inc.’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

(3)For more information about constant dollar basis sales, see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations by Segment – International Businesses” included in Prudential Financial, Inc.’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

Prudential Financial, Inc. (NYSE: PRU), a global financial services leader and premier active global investment manager with approximately $1.6 trillion in assets under management as of September 30, 2024, has operations in the United States, Asia, Europe, and Latin America. Prudential’s diverse and talented employees help make lives better and create financial opportunity for more people by expanding access to investing, insurance, and retirement security. Prudential’s iconic Rock symbol has stood for strength, stability, expertise, and innovation for nearly 150 years. For more information, please visit news.prudential.com.

MEDIA CONTACT: YeaJin Kim, Yeajin.Kim@prudential.com

| | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | |

| (in millions, unaudited) | | | | | | | |

| | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Adjusted operating income (loss) before income taxes (1): | | | | | | | |

| PGIM | $ | 241 | | | $ | 211 | | | $ | 616 | | | $ | 541 | |

| U.S. Businesses | 1,108 | | | 1,088 | | | 3,017 | | | 2,804 | |

| International Businesses | 766 | | | 811 | | | 2,364 | | | 2,435 | |

| Corporate and Other | (487) | | | (438) | | | (1,293) | | | (1,381) | |

| Total adjusted operating income before income taxes | $ | 1,628 | | | $ | 1,672 | | | $ | 4,704 | | | $ | 4,399 | |

| Reconciling Items: | | | | | | | |

| Realized investment gains (losses), net, and related charges and adjustments | $ | (805) | | | $ | (2,491) | | | $ | (774) | | | $ | (2,879) | |

| Change in value of market risk benefits, net of related hedging gains (losses) | (146) | | | (251) | | | (320) | | | (160) | |

| Market experience updates | (127) | | | 143 | | | (112) | | | 188 | |

| Divested and Run-off Businesses: | | | | | | | |

| Closed Block division | 2 | | | 2 | | | (61) | | | (50) | |

| Other Divested and Run-off Businesses | 47 | | | (113) | | | 50 | | | (22) | |

| Equity in earnings of joint ventures and other operating entities and earnings attributable to noncontrolling interests | (43) | | | (11) | | | (113) | | | (42) | |

| Other adjustments (2) | (3) | | | (9) | | | (16) | | | (24) | |

| Total reconciling items, before income taxes | (1,075) | | | (2,730) | | | (1,346) | | | (2,989) | |

| Income (loss) before income taxes and equity in earnings of joint ventures and other operating entities | $ | 553 | | | $ | (1,058) | | | $ | 3,358 | | | $ | 1,410 | |

| Income Statement Data: | | | | | | | |

| Net income (loss) attributable to Prudential Financial, Inc. | $ | 448 | | | $ | (802) | | | $ | 2,784 | | | $ | 1,171 | |

| Income (loss) attributable to noncontrolling interests | 3 | | | 11 | | | (11) | | | 11 | |

| Net income (loss) | 451 | | | (791) | | | 2,773 | | | 1,182 | |

| Less: Earnings attributable to noncontrolling interests | 3 | | | 11 | | | (11) | | | 11 | |

| Income (loss) attributable to Prudential Financial, Inc. | 448 | | | (802) | | | 2,784 | | | 1,171 | |

| Less: Equity in earnings of joint ventures and other operating entities, net of taxes and earnings attributable to noncontrolling interests | 35 | | | 5 | | | 119 | | | 15 | |

| Income (loss) (after-tax) before equity in earnings of joint ventures and other operating entities | 413 | | | (807) | | | 2,665 | | | 1,156 | |

| Less: Total reconciling items, before income taxes | (1,075) | | | (2,730) | | | (1,346) | | | (2,989) | |

| Less: Income taxes, not applicable to adjusted operating income | (228) | | | (591) | | | (376) | | | (667) | |

| Total reconciling items, after income taxes | (847) | | | (2,139) | | | (970) | | | (2,322) | |

| After-tax adjusted operating income (1) | 1,260 | | | 1,332 | | | 3,635 | | | 3,478 | |

| Income taxes, applicable to adjusted operating income | 368 | | | 340 | | | 1,069 | | | 921 | |

| Adjusted operating income before income taxes (1) | $ | 1,628 | | | $ | 1,672 | | | $ | 4,704 | | | $ | 4,399 | |

| | | | | | | |

| See footnotes on last page. | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | |

| (in millions, except per share data, unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Earnings per share of Common Stock: | | | | | | | |

| Net income (loss) attributable to Prudential Financial, Inc. | $ | 1.24 | | | $ | (2.23) | | | $ | 7.64 | | | $ | 3.15 | |

| Less: Reconciling Items: | | | | | | | |

| Realized investment gains (losses), net, and related charges and adjustments | (2.24) | | | (6.85) | | | (2.15) | | | (7.87) | |

| Change in value of market risk benefits, net of related hedging gains (losses) | (0.41) | | | (0.69) | | | (0.89) | | | (0.44) | |

| Market experience updates | (0.35) | | | 0.39 | | | (0.31) | | | 0.51 | |

| Divested and Run-off Businesses: | | | | | | | |

| Closed Block division | 0.01 | | | 0.01 | | | (0.17) | | | (0.14) | |

| Other Divested and Run-off Businesses | 0.13 | | | (0.31) | | | 0.14 | | | (0.06) | |

| Difference in earnings allocated to participating unvested share-based payment awards | 0.02 | | | 0.03 | | | 0.03 | | | 0.06 | |

| Other adjustments (2) | (0.01) | | | (0.02) | | | (0.04) | | | (0.07) | |

| Total reconciling items, before income taxes | (2.85) | | | (7.44) | | | (3.39) | | | (8.01) | |

| Less: Income taxes, not applicable to adjusted operating income | (0.61) | | | (1.59) | | | (1.05) | | | (1.76) | |

| Total reconciling items, after income taxes | (2.24) | | | (5.85) | | | (2.34) | | | (6.25) | |

| After-tax adjusted operating income | $ | 3.48 | | | $ | 3.62 | | | $ | 9.98 | | | $ | 9.40 | |

| Weighted average number of outstanding common shares - basic | 356.9 | | | 362.6 | | | 358.3 | | | 364.6 | |

| Weighted average number of outstanding common shares - diluted | 358.7 | | | 363.8 | | | 359.9 | | | 365.8 | |

| For earnings per share of Common Stock calculation: | | | | | | | |

| Net income (loss) attributable to Prudential Financial, Inc. | $ | 448 | | | $ | (802) | | | $ | 2,784 | | | $ | 1,171 | |

| Less: Earnings allocated to participating unvested share-based payment awards | 5 | | | 5 | | | 33 | | | 17 | |

| Net income (loss) attributable to Prudential Financial, Inc. for earnings per share of Common Stock calculation | $ | 443 | | | $ | (807) | | | $ | 2,751 | | | $ | 1,154 | |

| After-tax adjusted operating income (1) | $ | 1,260 | | | $ | 1,332 | | | $ | 3,635 | | | $ | 3,478 | |

| Less: Earnings allocated to participating unvested share-based payment awards | 13 | | | 15 | | | 42 | | | 40 | |

| After-tax adjusted operating income for earnings per share of Common Stock calculation (1) | $ | 1,247 | | | $ | 1,317 | | | $ | 3,593 | | | $ | 3,438 | |

| Prudential Financial, Inc. Equity (as of end of period): | | | | | | | |

| GAAP book value (total PFI equity) at end of period | $ | 30,416 | | | $ | 25,814 | | | | | |

| Less: Accumulated other comprehensive income (AOCI) | (4,844) | | | (7,831) | | | | | |

| GAAP book value excluding AOCI | 35,260 | | | 33,645 | | | | | |

| Less: Cumulative change in fair value of funds withheld embedded derivatives | (238) | | | — | | | | | |

| Less: Cumulative effect of foreign exchange rate remeasurement and currency translation adjustments corresponding to realized gains (losses) | (49) | | | (687) | | | | | |

| Adjusted book value | $ | 35,547 | | | $ | 34,332 | | | | | |

| End of period number of common shares - diluted | 360.1 | | | 364.5 | | | | | |

| GAAP book value per common share - diluted | 84.47 | | | 70.82 | | | | | |

| GAAP book value excluding AOCI per share - diluted | 97.92 | | | 92.30 | | | | | |

| Adjusted book value per common share - diluted | 98.71 | | | 94.19 | | | | | |

| | | | | | | |

| See footnotes on last page. | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | |

| (in millions, or as otherwise noted, unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| PGIM: | | | | | | | |

| PGIM: | | | | | | | |

| Assets Managed by PGIM (in billions, as of end of period): | | | | | | | |

| Institutional customers | $ | 630.4 | | | $ | 547.6 | | | | | |

| Retail customers | 361.9 | | | 312.5 | | | | | |

| General account | 407.6 | | | 358.5 | | | | | |

| Total PGIM | $ | 1,399.9 | | | $ | 1,218.6 | | | | | |

| Institutional Customers - Assets Under Management (in billions): | | | | | | | |

| Gross additions, excluding money market | $ | 15.7 | | | $ | 14.4 | | | $ | 77.8 | | | $ | 47.2 | |

| Net additions (withdrawals), excluding money market | $ | (4.5) | | | $ | (3.8) | | | $ | 12.7 | | | $ | (17.0) | |

| Retail Customers - Assets Under Management (in billions): | | | | | | | |

| Gross additions, excluding money market | $ | 16.4 | | | $ | 11.9 | | | $ | 46.6 | | | $ | 37.1 | |

| Net additions (withdrawals), excluding money market | $ | 1.3 | | | $ | (1.9) | | | $ | 1.2 | | | $ | (7.9) | |

| U.S. Businesses: | | | | | | | |

| Retirement Strategies: | | | | | | | |

| Institutional Retirement Strategies: | | | | | | | |

| Gross additions | $ | 11,081 | | | $ | 4,697 | | | $ | 26,082 | | | $ | 14,211 | |

| Net additions (withdrawals) | $ | 4,462 | | | $ | (3,084) | | | $ | 6,882 | | | $ | (4,909) | |

| Total account value at end of period, net | $ | 278,767 | | | $ | 245,660 | | | | | |

| Individual Retirement Strategies: | | | | | | | |

| Actively-Sold Protected Investment and Income Solutions and, Discontinued Traditional VA and Guaranteed Living Benefits: | | | | | | | |

| Gross sales (3) | $ | 3,618 | | | $ | 1,943 | | | $ | 10,402 | | | $ | 5,502 | |

| Sales, net of full surrenders and death benefits | $ | 763 | | | $ | 198 | | | $ | 2,209 | | | $ | 635 | |

| Total account value at end of period, net | $ | 128,825 | | | $ | 110,106 | | | | | |

| Group Insurance: | | | | | | | |

| Annualized New Business Premiums (4): | | | | | | | |

| Group life | $ | 35 | | | $ | 61 | | | $ | 251 | | | $ | 255 | |

| Group disability | 28 | | | 34 | | | 236 | | | 216 | |

| Total | $ | 63 | | | $ | 95 | | | $ | 487 | | | $ | 471 | |

| Individual Life: | | | | | | | |

| Annualized New Business Premiums (4): | | | | | | | |

| Term life | $ | 34 | | | $ | 33 | | | $ | 99 | | | $ | 87 | |

| Universal life | 19 | | | 17 | | | 61 | | | 54 | |

| Variable life | 157 | | | 136 | | | 420 | | | 391 | |

| Total | $ | 210 | | | $ | 186 | | | $ | 580 | | | $ | 532 | |

| International Businesses: | | | | | | | |

| International Businesses: | | | | | | | |

| Annualized New Business Premiums (4)(5): | | | | | | | |

| Actual exchange rate basis | $ | 588 | | | $ | 491 | | | $ | 1,624 | | | $ | 1,489 | |

| Constant exchange rate basis | $ | 600 | | | $ | 479 | | | $ | 1,652 | | | $ | 1,454 | |

| | | | | | | |

| See footnotes on last page. | | | | | | | |

| | | | | | | | | | | | |

| Financial Highlights | | | | |

| (in billions, as of end of period, unaudited) | | | | |

| | | | |

| | | | |

| September 30, | |

| 2024 | | 2023 | |

| Assets and Assets Under Management and Administration: | | | | |

| Total assets | $ | 760.3 | | | $ | 681.3 | | |

| Assets under management (at fair market value): | | | | |

| PGIM | $ | 1,399.9 | | | $ | 1,218.6 | | |

| U.S. Businesses | 128.6 | | | 116.5 | | |

| International Businesses | 18.1 | | | 16.4 | | |

| Corporate and Other | 11.3 | | | 9.8 | | |

| Total assets under management | 1,557.9 | | | 1,361.3 | | |

| Assets under administration | 189.8 | | | 164.7 | | |

| Total assets under management and administration | $ | 1,747.7 | | | $ | 1,526.0 | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Adjusted operating income is a non-GAAP measure of performance. See NON-GAAP MEASURES within the earnings release for additional information. Adjusted operating income, when presented at the segment level, is also a segment performance measure. This segment performance measure, while not a traditional U.S. GAAP measure, is required to be disclosed by U.S. GAAP in accordance with FASB Accounting Standard Codification (ASC) 280 – Segment Reporting. When presented by segment, we have prepared the reconciliation of adjusted operating income to the corresponding consolidated U.S. GAAP total in accordance with the disclosure requirements as articulated in ASC 280. |

| | | | | | |

| (2) | Represents adjustments not included in the above reconciling items, including certain components of consideration for business acquisitions, which are recognized as compensation expense over the requisite service periods. |

| | | | | | |

| (3) | Includes Prudential FlexGuard and FlexGuard Income, Prudential Premier Investment, MyRock, Private Placement Variable Annuity and all fixed annuity products. Excludes discontinued traditional variable annuities and guaranteed living benefits. |

| | | | | | |

| (4) | Premiums from new sales are expected to be collected over a one-year period. Group insurance annualized new business premiums exclude new premiums resulting from rate changes on existing policies, from additional coverage issued under our Servicemembers’ Group Life Insurance contract, and from excess premiums on group universal life insurance that build cash value but do not purchase face amounts. Group insurance annualized new business premiums include premiums from the takeover of claim liabilities. Excess (unscheduled) and single premium business for the Company’s domestic individual life and international operations are included in annualized new business premiums based on a 10% credit. |

| | | | | | |

| (5) | Actual amounts reflect the impact of currency fluctuations. Constant amounts reflect foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods presented, including Japanese yen 129 per U.S. dollar. U.S. dollar-denominated activity is included based on the amounts as transacted in U.S. dollars. |

Exhibit 99.2

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | Prudential Financial, Inc. (PRU) | | |

| | | | |

| | | | |

| | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | Quarterly Financial Supplement | | |

| | | | |

| | Third Quarter 2024 | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | Reference is made to Prudential Financial, Inc.'s (PFI) filings with the Securities and Exchange Commission for general information and consolidated financial information. All financial information in this document is unaudited. | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | |

| Prudential Financial, Inc. | |

| Quarterly Financial Supplement |

| Third Quarter 2024 |

| | |

| | TABLE OF CONTENTS |

| | | | | |

| | | | | |

| | | | Page | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | Individual Retirement Strategies Sales Results and Account Values | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prudential Financial, Inc. | | | | | | | | | | | | | | | | | |

| Quarterly Financial Supplement | | | | | | | | | | | | | | | | |

| Third Quarter 2024 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL METRICS SUMMARY | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share and return on equity data) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2023 | | 2024 | | | | Year-to-date |

| | | | | 3Q | | | 4Q | | 1Q | | 2Q | | | 3Q | | | | 2023 | | 2024 | | % change |

| | | | | | | | | | | | | | | | | | | | | | | |

| Earnings | | | | | | | | | | | | | | | | | | | | |

| | Adjusted operating income (loss) before income taxes: | | | | | | | | | | | | | | | | | | | | |

| | | PGIM | | 211 | | | | 172 | | | 169 | | | 206 | | | | 241 | | | | | 541 | | | 616 | | | 14% |

| | | U.S. Businesses | | 1,088 | | | | 988 | | | 839 | | | 1,070 | | | | 1,108 | | | | | 2,804 | | | 3,017 | | | 8% |

| | | International Businesses | | 811 | | | | 748 | | | 896 | | | 702 | | | | 766 | | | | | 2,435 | | | 2,364 | | | -3% |

| | | Corporate and Other | | (438) | | | | (653) | | | (435) | | | (371) | | | | (487) | | | | | (1,381) | | | (1,293) | | | 6% |

| | Total adjusted operating income before income taxes | | 1,672 | | | | 1,255 | | | 1,469 | | | 1,607 | | | | 1,628 | | | | | 4,399 | | | 4,704 | | | 7% |

| | Income taxes, applicable to adjusted operating income | | 340 | | | | 309 | | | 328 | | | 373 | | | | 368 | | | | | 921 | | | 1,069 | | | 16% |

| | After-tax adjusted operating income | | 1,332 | | | | 946 | | | 1,141 | | | 1,234 | | | | 1,260 | | | | | 3,478 | | | 3,635 | | | 5% |

| | Income (loss) attributable to Prudential Financial, Inc. | | (802) | | | | 1,317 | | | 1,138 | | | 1,198 | | | | 448 | | | | | 1,171 | | | 2,784 | | | 138% |

| Return on Equity | | | | | | | | | | | | | | | | | | | | |

| | Operating Return on Average Equity (based on adjusted operating income) (1) | | 15.2 | % | | | 10.9 | % | | 13.0 | % | | 13.9 | % | | | 14.2 | % | | | | 13.2 | % | | 13.7 | % | | |

| | Return on Average Equity (based on net income (loss)) | | -11.8 | % | | | 19.6 | % | | 16.5 | % | | 17.4 | % | | | 6.1 | % | | | | 5.4 | % | | 13.1 | % | | |

| Distributions to Shareholders | | | | | | | | | | | | | | | | | | | | |

| | Dividends paid | | 461 | | | | 458 | | | 476 | | | 475 | | | | 471 | | | | | 1,392 | | | 1,422 | | | 2% |

| | Share repurchases | | 250 | | | | 250 | | | 250 | | | 250 | | | | 250 | | | | | 750 | | | 750 | | | —% |

| | Total capital returned | | 711 | | | | 708 | | | 726 | | | 725 | | | | 721 | | | | | 2,142 | | | 2,172 | | | 1% |

| Per Share Data | | | | | | | | | | | | | | | | | | | | |

| | Net income (loss) - diluted (2) | | (2.23) | | | | 3.61 | | | 3.12 | | | 3.28 | | | | 1.24 | | | | | 3.15 | | | 7.64 | | | 143% |

| | Adjusted Operating Income - diluted | | 3.62 | | | | 2.59 | | | 3.12 | | | 3.39 | | | | 3.48 | | | | | 9.40 | | | 9.98 | | | 6% |

| | Shareholder dividends | | 1.25 | | | | 1.25 | | | 1.30 | | | 1.30 | | | | 1.30 | | | | | 3.75 | | | 3.90 | | | 4% |

| | GAAP book value - diluted | | 70.82 | | | | 76.77 | | | 75.00 | | | 77.51 | | | | 84.47 | | | | | | | | | |

| | Adjusted book value - diluted (3) | | 94.19 | | | | 96.64 | | | 97.03 | | | 98.42 | | | | 98.71 | | | | | | | | | |

| Shares Outstanding | | | | | | | | | | | | | | | | | | | | |

| | Weighted average number of common shares - basic | | 362.6 | | | | 360.3 | | | 359.0 | | | 358.8 | | | | 356.9 | | | | | 364.6 | | | 358.3 | | | -2% |

| | Weighted average number of common shares - diluted | | 363.8 | | | | 361.0 | | | 360.5 | | | 360.5 | | | | 358.7 | | | | | 365.8 | | | 359.9 | | | -2% |

| | End of period common shares - basic | | 361.3 | | | | 359.2 | | | 359.1 | | | 357.7 | | | | 355.9 | | | | | | | | | |

| | End of period common shares - diluted | | 364.5 | | | | 362.4 | | | 362.8 | | | 361.4 | | | | 360.1 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| __________ | | | | | | | | | | | | | | | | | | | | |

| (1) Operating Return on Average Equity (based on adjusted operating income) is a non-GAAP measure and represents adjusted operating income after-tax, annualized for interim periods, divided by average Prudential Financial, Inc. equity excluding accumulated other comprehensive income, adjusted to remove amounts included for foreign currency exchange rate remeasurement and the cumulative change in fair value of funds withheld embedded derivatives as described on page 3. |

| (2) For the three months ended September 30, 2023 weighted average shares for basic earnings per share is used for calculating diluted earnings per share because dilutive shares and dilutive earnings per share are not applicable when a net loss is reported. As a result of the net loss attributable to Prudential Financial available to holders of Common Stock for the three months ended September 30, 2023 all potential stock options and compensation programs were considered antidilutive. |

| (3) Adjusted book value is calculated as total equity (GAAP book value) excluding accumulated other comprehensive income (loss), the cumulative effect of foreign currency exchange rate remeasurements and currency translation adjustments corresponding to realized investment gains and losses, and the cumulative change in fair value of funds withheld and modified coinsurance embedded derivatives as described on page 3. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prudential Financial, Inc. | | | | | | | | | | | | | | |

| Quarterly Financial Supplement | | | | | | | | | | | | | |

| Third Quarter 2024 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | 2023 | | 2024 | | | | Year-to-date |

| | | | 3Q | | | 4Q | | 1Q | | 2Q | | | 3Q | | | | 2023 | | 2024 |

| | | | | | | | | | | | | | | | | | | | |

| Earnings per share of Common Stock (diluted): | | | | | | | | | | | | | | | | | | | |

| After-tax adjusted operating income | | | 3.62 | | | | 2.59 | | | 3.12 | | | 3.39 | | | | 3.48 | | | | | 9.40 | | | 9.98 | |

| Reconciling items: | | | | | | | | | | | | | | | | | | | |

| Realized investment gains (losses), net, and related charges and adjustments | | | (6.85) | | | | 0.87 | | | (0.27) | | | 0.36 | | | | (2.24) | | | | | (7.87) | | | (2.15) | |

| Change in value of market risk benefits, net of related hedging gains (losses) | | | (0.69) | | | | 0.60 | | | 0.34 | | | (0.82) | | | | (0.41) | | | | | (0.44) | | | (0.89) | |

| Market experience updates | | | 0.39 | | | | (0.22) | | | (0.09) | | | 0.13 | | | | (0.35) | | | | | 0.51 | | | (0.31) | |

| Divested and Run-off Businesses: | | | | | | | | | | | | | | | | | | | |

| Closed Block division | | | 0.01 | | | | (0.14) | | | (0.01) | | | (0.17) | | | | 0.01 | | | | | (0.14) | | | (0.17) | |

| Other Divested and Run-off Businesses | | | (0.31) | | | | 0.12 | | | (0.10) | | | 0.11 | | | | 0.13 | | | | | (0.06) | | | 0.14 | |

| Difference in earnings allocated to participating unvested share-based payment awards | | | 0.03 | | | | (0.01) | | | — | | | — | | | | 0.02 | | | | | 0.06 | | | 0.03 | |

| Other adjustments (1) | | | (0.02) | | | | (0.03) | | | (0.02) | | | (0.01) | | | | (0.01) | | | | | (0.07) | | | (0.04) | |

| Total reconciling items, before income taxes | | | (7.44) | | | | 1.19 | | | (0.15) | | | (0.40) | | | | (2.85) | | | | | (8.01) | | | (3.39) | |

| Income taxes, not applicable to adjusted operating income | | | (1.59) | | | | 0.17 | | | (0.15) | | | (0.29) | | | | (0.61) | | | | | (1.76) | | | (1.05) | |

| Total reconciling items, after income taxes | | | (5.85) | | | | 1.02 | | | — | | | (0.11) | | | | (2.24) | | | | | (6.25) | | | (2.34) | |

| Net income (loss) attributable to Prudential Financial, Inc. | | | (2.23) | | | | 3.61 | | | 3.12 | | | 3.28 | | | | 1.24 | | | | | 3.15 | | | 7.64 | |

| Weighted average number of outstanding common shares - basic | | | 362.6 | | | | 360.3 | | | 359.0 | | | 358.8 | | | | 356.9 | | | | | 364.6 | | | 358.3 | |

| Weighted average number of outstanding common shares - diluted | | | 363.8 | | | | 361.0 | | | 360.5 | | | 360.5 | | | | 358.7 | | | | | 365.8 | | | 359.9 | |

| For earnings per share of Common Stock calculation: | | | | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to Prudential Financial, Inc. | | | (802) | | | | 1,317 | | | 1,138 | | | 1,198 | | | | 448 | | | | | 1,171 | | | 2,784 | |

| Less: Earnings allocated to participating unvested share-based payment awards | | | 5 | | | | 14 | | | 15 | | | 14 | | | | 5 | | | | | 17 | | | 33 | |

| Net income (loss) attributable to Prudential Financial, Inc. for earnings per share of Common Stock calculation | | | (807) | | | | 1,303 | | | 1,123 | | | 1,184 | | | | 443 | | | | | 1,154 | | | 2,751 | |

| After-tax adjusted operating income | | | 1,332 | | | | 946 | | | 1,141 | | | 1,234 | | | | 1,260 | | | | | 3,478 | | | 3,635 | |

| Less: Earnings allocated to participating unvested share-based payment awards | | | 15 | | | | 11 | | | 16 | | | 13 | | | | 13 | | | | | 40 | | | 42 | |

| After-tax adjusted operating income for earnings per share of Common Stock calculation | | | 1,317 | | | | 935 | | | 1,125 | | | 1,221 | | | | 1,247 | | | | | 3,438 | | | 3,593 | |

| | | | | | | | | | | | | | | | | | | | |

| ___________ | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (1) Represents adjustments not included in the above reconciling items, including certain components of consideration for business acquisitions, which are recognized as compensation expense over the requisite service periods. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prudential Financial, Inc. | | | | | | | | |

| Quarterly Financial Supplement | | | | | | | |

| Third Quarter 2024 | | | | | | | |

| | | | | | | | | | | | | | |

| OTHER FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | |

| (in millions, except per share data) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | 2023 | | 2024 | |

| | | 3Q | | | 4Q | | 1Q | | 2Q | | | 3Q | |

| | | | | | | | | | | | | | |

| Capitalization Data (1): | | | | | | | | | | | | | |

| Senior debt: | | | | | | | | | | | | | |

| Short-term debt | | 615 | | | | 618 | | | 585 | | | 588 | | | | 950 | | |

| Long-term debt | | 10,787 | | | | 10,788 | | | 10,786 | | | 10,771 | | | | 10,487 | | |

| Junior subordinated long-term debt | | 8,090 | | | | 8,094 | | | 8,582 | | | 8,582 | | | | 8,589 | | |

| Prudential Financial, Inc. Equity: | | | | | | | | | | | | | |

| GAAP book value (total PFI equity) at end of period | | 25,814 | | | | 27,820 | | | 27,209 | | | 28,013 | | | | 30,416 | | |

| Less: Accumulated other comprehensive income (AOCI) | | (7,831) | | | | (6,504) | | | (7,661) | | | (7,444) | | | | (4,844) | | |

| GAAP book value excluding AOCI (2) | | 33,645 | | | | 34,324 | | | 34,870 | | | 35,457 | | | | 35,260 | | |

| Less: Cumulative change in fair value of funds withheld embedded derivatives (3) | | — | | | | (181) | | | 14 | | | 178 | | | | (238) | | |

| Less: Cumulative effect of foreign exchange rate remeasurement and currency translation adjustments corresponding to realized gains (losses) (4) | | (687) | | | | (518) | | | (345) | | | (291) | | | | (49) | | |

| Adjusted book value | | 34,332 | | | | 35,023 | | | 35,201 | | | 35,570 | | | | 35,547 | | |

| Book Value per Share of Common Stock: | | | | | | | | | | | | | |

| GAAP book value per common share - diluted | | 70.82 | | | | 76.77 | | | 75.00 | | | 77.51 | | | | 84.47 | | |

| GAAP book value excluding AOCI per share - diluted (2) | | 92.30 | | | | 94.71 | | | 96.11 | | | 98.11 | | | | 97.92 | | |

| Adjusted book value per common share - diluted | | 94.19 | | | | 96.64 | | | 97.03 | | | 98.42 | | | | 98.71 | | |

| End of period number of common shares - diluted | | 364.5 | | | | 362.4 | | | 362.8 | | | 361.4 | | | | 360.1 | | |

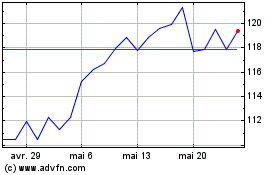

| Common Stock Price Range (based on closing price): | | | | | | | | | | | | | |

| High | | 99.14 | | | | 105.21 | | | 117.40 | | | 121.31 | | | | 127.32 | | |

| Low | | 88.66 | | | | 88.61 | | | 101.84 | | | 107.35 | | | | 105.53 | | |

| Close | | 94.89 | | | | 103.71 | | | 117.40 | | | 117.19 | | | | 121.10 | | |

| Common Stock market capitalization (1) | | 34,284 | | | | 37,253 | | | 42,158 | | | 41,919 | | | | 43,099 | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| __________ | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| (1) As of end of period. | |

| (2) Foreign currency translation adjustments and the cumulative impact of foreign currency exchange rate remeasurement, except for those items remeasured through net income (loss), are a component of accumulated other comprehensive income. | |

| (3) Amount represents the cumulative change in fair value of funds withheld embedded derivatives related to unrealized gains and losses on available-for-sale securities and certain derivatives associated with customer liabilities reinsured under coinsurance with funds withheld and modified coinsurance arrangements. | |

| (4) Includes the cumulative impact of net gains and losses resulting from foreign currency exchange rate remeasurement and associated realized investment gains and losses included in net income (loss) and currency translation adjustments corresponding to realized investment gains and losses. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prudential Financial, Inc. | | | | | | | | | |

| Quarterly Financial Supplement | | | | | | | | |

| Third Quarter 2024 | | | | | | | | |

| | | | | | | | | | | | | | |

| OPERATIONS HIGHLIGHTS | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | 2023 | | 2024 | |

| | | 3Q | | | 4Q | | 1Q | | 2Q | | | 3Q | |

| | | | | | | | | | | | | | |

| Assets Under Management and Administration (in billions) (1)(2): | | | | | | | | | | | | | |

| PGIM: | | | | | | | | | | | | | |

| Institutional customers | | 547.6 | | | | 582.6 | | | 616.6 | | | 604.4 | | | | 630.4 | | |

| Retail customers | | 312.5 | | | | 330.3 | | | 345.4 | | | 349.9 | | | | 361.9 | | |

| General account | | 358.5 | | | | 385.2 | | | 379.4 | | | 373.8 | | | | 407.6 | | |

| Total PGIM | | 1,218.6 | | | | 1,298.1 | | | 1,341.4 | | | 1,328.1 | | | | 1,399.9 | | |

| U.S. Businesses | | 116.5 | | | | 123.9 | | | 126.3 | | | 124.6 | | | | 128.6 | | |

| International Businesses | | 16.4 | | | | 17.9 | | | 18.2 | | | 17.9 | | | | 18.1 | | |

| Corporate and Other | | 9.8 | | | | 9.7 | | | 10.4 | | | 11.4 | | | | 11.3 | | |

| Total assets under management | | 1,361.3 | | | | 1,449.6 | | | 1,496.3 | | | 1,482.0 | | | | 1,557.9 | | |

| Assets under administration | | 164.7 | | | | 181.5 | | | 182.6 | | | 183.9 | | | | 189.8 | | |

| Total assets under management and administration | | 1,526.0 | | | | 1,631.1 | | | 1,678.9 | | | 1,665.9 | | | | 1,747.7 | | |

| Distribution Representatives (1): | | | | | | | | | | | | | |

| Prudential Advisors | | 2,681 | | | | 2,660 | | | 2,752 | | | 2,821 | | | | 2,877 | | |

| International Life Planners | | 5,917 | | | | 5,856 | | | 5,855 | | | 5,836 | | | | 5,900 | | |

| Gibraltar Life Consultants | | 6,736 | | | | 6,808 | | | 6,792 | | | 6,724 | | | | 6,861 | | |

| | | | | | | | | | | | | | |

| __________ | | | | | | | | | | | | | |

| (1) As of end of period. | |

| (2) At fair market value. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prudential Financial, Inc. | | | | | | | | | | | | | | | | |

| Quarterly Financial Supplement | | | | | | | | | | | | | | | |

| Third Quarter 2024 | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| COMBINED STATEMENTS OF OPERATIONS | | | | | | | | | | | | | | | | | | | |

| (in millions) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2023 | | 2024 | | | Year-to-date |

| | | 3Q | | | 4Q | | 1Q | | 2Q | | | 3Q | | | 2023 | | 2024 | | % change |

| | | | | | | | | | | | | | | | | | | | |

| Revenues (1): | | | | | | | | | | | | | | | | | | | |

| Premiums | | 3,659 | | | | 6,364 | | | 15,006 | | | 7,277 | | | | 12,527 | | | | 18,860 | | | 34,810 | | | 85% |

| Policy charges and fee income | | 1,060 | | | | 1,059 | | | 1,056 | | | 1,061 | | | | 1,098 | | | | 3,165 | | | 3,215 | | | 2% |

| Net investment income | | 3,892 | | | | 3,918 | | | 4,120 | | | 4,218 | | | | 4,436 | | | | 11,375 | | | 12,774 | | | 12% |

| Asset management fees, commissions and other income | | 1,433 | | | | 1,525 | | | 1,517 | | | 1,285 | | | | 1,420 | | | | 4,209 | | | 4,222 | | | —% |

| Total revenues | | 10,044 | | | | 12,866 | | | 21,699 | | | 13,841 | | | | 19,481 | | | | 37,609 | | | 55,021 | | | 46% |

| Benefits and expenses (1): | | | | | | | | | | | | | | | | | | | |

| Insurance and annuity benefits | | 4,348 | | | | 7,130 | | | 15,774 | | | 8,137 | | | | 13,321 | | | | 20,867 | | | 37,232 | | | 78% |

| Change in estimates of liability for future policy benefits | | 49 | | | | 20 | | | 15 | | | (29) | | | | 66 | | | | 230 | | | 52 | | | -77% |

| Interest credited to policyholders' account balances | | 804 | | | | 836 | | | 861 | | | 897 | | | | 962 | | | | 2,340 | | | 2,720 | | | 16% |

| Interest expense | | 419 | | | | 439 | | | 529 | | | 480 | | | | 485 | | | | 1,315 | | | 1,494 | | | 14% |

| Deferral of acquisition costs | | (576) | | | | (637) | | | (647) | | | (614) | | | | (636) | | | | (1,691) | | | (1,897) | | | -12% |

| Amortization of acquisition costs | | 351 | | | | 356 | | | 362 | | | 363 | | | | 356 | | | | 1,061 | | | 1,081 | | | 2% |

| General and administrative expenses | | 2,977 | | | | 3,467 | | | 3,336 | | | 3,000 | | | | 3,299 | | | | 9,088 | | | 9,635 | | | 6% |

| Total benefits and expenses | | 8,372 | | | | 11,611 | | | 20,230 | | | 12,234 | | | | 17,853 | | | | 33,210 | | | 50,317 | | | 52% |

| Adjusted operating income before income taxes | | 1,672 | | | | 1,255 | | | 1,469 | | | 1,607 | | | | 1,628 | | | | 4,399 | | | 4,704 | | | 7% |

| Income taxes, applicable to adjusted operating income | | 340 | | | | 309 | | | 328 | | | 373 | | | | 368 | | | | 921 | | | 1,069 | | | 16% |

| After-tax adjusted operating income | | 1,332 | | | | 946 | | | 1,141 | | | 1,234 | | | | 1,260 | | | | 3,478 | | | 3,635 | | | 5% |

| Reconciling items: | | | | | | | | | | | | | | | | | | | |

| Realized investment gains (losses), net, and related charges and adjustments | | (2,491) | | | | 314 | | | (97) | | | 128 | | | | (805) | | | | (2,879) | | | (774) | | | 73% |

| Change in value of market risk benefits, net of related hedging gains (losses) | | (251) | | | | 216 | | | 123 | | | (297) | | | | (146) | | | | (160) | | | (320) | | | -100% |

| Market experience updates | | 143 | | | | (78) | | | (32) | | | 47 | | | | (127) | | | | 188 | | | (112) | | | -160% |

| Divested and Run-off Businesses: | | | | | | | | | | | | | | | | | | | |

| Closed Block division | | 2 | | | | (50) | | | (3) | | | (60) | | | | 2 | | | | (50) | | | (61) | | | -22% |

| Other Divested and Run-off Businesses | | (113) | | | | 43 | | | (35) | | | 38 | | | | 47 | | | | (22) | | | 50 | | | 327% |

| Equity in earnings of joint ventures and other operating entities, and earnings attributable to noncontrolling interests | | (11) | | | | (26) | | | (27) | | | (43) | | | | (43) | | | | (42) | | | (113) | | | -169% |

| Other adjustments (2) | | (9) | | | | (12) | | | (8) | | | (5) | | | | (3) | | | | (24) | | | (16) | | | 33% |

| Total reconciling items, before income taxes | | (2,730) | | | | 407 | | | (79) | | | (192) | | | | (1,075) | | | | (2,989) | | | (1,346) | | | 55% |

| Income taxes, not applicable to adjusted operating income | | (591) | | | | 50 | | | (39) | | | (109) | | | | (228) | | | | (667) | | | (376) | | | 44% |

| Total reconciling items, after income taxes | | (2,139) | | | | 357 | | | (40) | | | (83) | | | | (847) | | | | (2,322) | | | (970) | | | 58% |

| Income (loss) before income taxes and equity in earnings of joint ventures and other operating entities | | (1,058) | | | | 1,662 | | | 1,390 | | | 1,415 | | | | 553 | | | | 1,410 | | | 3,358 | | | 138% |

| Income tax expense (benefit) | | (251) | | | | 359 | | | 289 | | | 264 | | | | 140 | | | | 254 | | | 693 | | | 173% |

| Income (loss) before equity in earnings of joint ventures and other operating entities | | (807) | | | | 1,303 | | | 1,101 | | | 1,151 | | | | 413 | | | | 1,156 | | | 2,665 | | | 131% |

| Equity in earnings of joint ventures and other operating entities, net of taxes and earnings attributable to noncontrolling interests | | 5 | | | | 14 | | | 37 | | | 47 | | | | 35 | | | | 15 | | | 119 | | | 693% |

| Income (loss) attributable to Prudential Financial, Inc. | | (802) | | | | 1,317 | | | 1,138 | | | 1,198 | | | | 448 | | | | 1,171 | | | 2,784 | | | 138% |

| Earnings attributable to noncontrolling interests | | 11 | | | | 9 | | | 13 | | | (27) | | | | 3 | | | | 11 | | | (11) | | | -200% |

| Net income (loss) | | (791) | | | | 1,326 | | | 1,151 | | | 1,171 | | | | 451 | | | | 1,182 | | | 2,773 | | | 135% |

| Less: Income (loss) attributable to noncontrolling interests | | 11 | | | | 9 | | | 13 | | | (27) | | | | 3 | | | | 11 | | | (11) | | | -200% |

| Net income (loss) attributable to Prudential Financial, Inc. | | (802) | | | | 1,317 | | | 1,138 | | | 1,198 | | | | 448 | | | | 1,171 | | | 2,784 | | | 138% |

| __________ | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (1) Revenues exclude realized investment gains, net of losses and related charges and adjustments; investment gains, net of losses, on assets supporting experience-rated contractholder liabilities, change in value of market risk benefits, net of related hedging gains (losses), revenues of Divested and Run-off Businesses, and include revenues representing equity in earnings of joint ventures and other operating entities other than those classified as Divested and Run-off Businesses. Benefits and expenses exclude charges related to realized investment gains, net of losses; change in experience-rated contractholder liabilities due to asset value changes, benefits and expenses of Divested and Run-off Businesses, and certain components of acquisitions, including the Assurance IQ acquisition which are recognized as compensation expense over the requisite service periods and include charges for income attributable to noncontrolling interests. Revenues and Benefits and expenses exclude market experience updates. See pages 35-38 for reconciliation. |

| (2) Represents adjustments not included in the above reconciling items, including certain components of consideration for business acquisitions, which are recognized as compensation expense over the requisite service periods. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prudential Financial, Inc. | | | | | | | | | |

| Quarterly Financial Supplement | | | | | | | | |

| Third Quarter 2024 | | | | | | | | |

| | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEETS | | | | | | | | | | | | | |

| (in millions) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | 09/30/2023 | | | 12/31/2023 | | 03/31/2024 | | 06/30/2024 | | | 09/30/2024 | |

| | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | |

| Fixed maturities, available-for-sale, at fair value | | 295,318 | | | | 316,321 | | | 318,510 | | | 311,092 | | | | 340,730 | | |

| Fixed maturities, held-to-maturity, at amortized cost, net of allowance for credit losses | | — | | | | — | | | — | | | — | | | | — | | |

| Fixed maturities, trading, at fair value | | 7,129 | | | | 9,790 | | | 10,288 | | | 10,250 | | | | 12,065 | | |

| Assets supporting experience-rated contractholder liabilities, at fair value | | 2,943 | | | | 3,168 | | | 3,359 | | | 3,351 | | | | 3,654 | | |

| Equity securities, at fair value | | 7,039 | | | | 8,242 | | | 7,224 | | | 7,098 | | | | 6,771 | | |

| Commercial mortgage and other loans | | 57,908 | | | | 59,305 | | | 58,781 | | | 60,243 | | | | 62,573 | | |

| Policy loans | | 9,959 | | | | 10,047 | | | 9,907 | | | 9,739 | | | | 9,947 | | |

| Other invested assets | | 21,868 | | | | 22,855 | | | 24,227 | | | 24,634 | | | | 25,367 | | |

| Short-term investments | | 5,072 | | | | 5,005 | | | 5,953 | | | 6,241 | | | | 8,010 | | |

| Total investments | | 407,236 | | | | 434,733 | | | 438,249 | | | 432,648 | | | | 469,117 | | |

| Cash and cash equivalents | | 16,892 | | | | 19,419 | | | 18,735 | | | 17,111 | | | | 20,198 | | |

| Accrued investment income | | 3,191 | | | | 3,287 | | | 3,361 | | | 3,434 | | | | 3,566 | | |

| Deferred policy acquisition costs | | 20,394 | | | | 20,856 | | | 20,613 | | | 20,564 | | | | 21,182 | | |

| Value of business acquired | | 514 | | | | 530 | | | 484 | | | 446 | | | | 488 | | |

| Market risk benefit assets | | 2,200 | | | | 1,981 | | | 2,225 | | | 2,233 | | | | 2,134 | | |

| Reinsurance recoverables and deposit receivables | | 25,941 | | | | 27,311 | | | 27,929 | | | 27,746 | | | | 29,633 | | |

| Income tax assets | | 1,108 | | | | 939 | | | 958 | | | 856 | | | | 479 | | |

| Other assets | | 13,136 | | | | 13,179 | | | 13,205 | | | 13,299 | | | | 12,947 | | |

| Separate account assets | | 190,642 | | | | 198,888 | | | 200,064 | | | 196,859 | | | | 200,550 | | |

| Total assets | | 681,254 | | | | 721,123 | | | 725,823 | | | 715,196 | | | | 760,294 | | |

| Liabilities: | | | | | | | | | | | | | |

| Future policy benefits | | 253,551 | | | | 273,281 | | | 272,790 | | | 262,330 | | | | 285,474 | | |

| Policyholders' account balances | | 140,788 | | | | 147,018 | | | 151,810 | | | 154,991 | | | | 164,088 | | |

| Market risk benefit liabilities | | 4,660 | | | | 5,467 | | | 4,624 | | | 4,592 | | | | 5,178 | | |

| Reinsurance and funds withheld payables | | 14,199 | | | | 15,729 | | | 15,746 | | | 15,604 | | | | 17,443 | | |

| Securities sold under agreements to repurchase | | 5,547 | | | | 6,056 | | | 6,563 | | | 6,929 | | | | 7,455 | | |

| Cash collateral for loaned securities | | 6,067 | | | | 6,477 | | | 6,978 | | | 7,050 | | | | 8,471 | | |

| Income tax liabilities | | — | | | | — | | | — | | | — | | | | — | | |

| Short-term debt | | 615 | | | | 618 | | | 585 | | | 588 | | | | 950 | | |

| Long-term debt | | 18,877 | | | | 18,882 | | | 19,368 | | | 19,353 | | | | 19,076 | | |

| Other liabilities | | 18,155 | | | | 17,546 | | | 16,749 | | | 15,621 | | | | 17,578 | | |

| Notes issued by consolidated variable interest entities | | 791 | | | | 1,374 | | | 1,132 | | | 1,174 | | | | 1,456 | | |

| Separate account liabilities | | 190,642 | | | | 198,888 | | | 200,064 | | | 196,859 | | | | 200,550 | | |

| Total liabilities | | 653,892 | | | | 691,336 | | | 696,409 | | | 685,091 | | | | 727,719 | | |

| Mezzanine Equity: | | | | | | | | | | | | | |

| Redeemable noncontrolling interests | | 414 | | | | 524 | | | 544 | | | 545 | | | | 560 | | |

| Total mezzanine equity | | 414 | | | | 524 | | | 544 | | | 545 | | | | 560 | | |

| Equity: | | | | | | | | | | | | | |

| Accumulated other comprehensive loss | | (7,831) | | | | (6,504) | | | (7,661) | | | (7,444) | | | | (4,844) | | |

| Other equity (1) | | 33,645 | | | | 34,324 | | | 34,870 | | | 35,457 | | | | 35,260 | | |

| Total Prudential Financial, Inc. equity | | 25,814 | | | | 27,820 | | | 27,209 | | | 28,013 | | | | 30,416 | | |

| Noncontrolling interests | | 1,133 | | | | 1,443 | | | 1,661 | | | 1,547 | | | | 1,599 | | |

| Total equity | | 26,947 | | | | 29,263 | | | 28,870 | | | 29,560 | | | | 32,015 | | |

| Total liabilities, mezzanine equity and equity | | 681,253 | | | | 721,123 | | | 725,823 | | | 715,196 | | | | 760,294 | | |

| | | | | | | | | | | | | | |

| ____________ | | | | | | | | | | | | | |

| (1) Includes $(238) million, $178 million, $(14) million and $181 million of cumulative change in fair value of funds withheld and modified coinsurance embedded derivatives as described on page 3, as of September 30, 2024, June 30, 2024, March 31, 2024 and December 31, 2023, respectively. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prudential Financial, Inc. | | | | | | | | | | | | | |

| Quarterly Financial Supplement | | | | | | | | | | | | |

| Third Quarter 2024 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| COMBINING BALANCE SHEETS | | | | | | | | | | | | |

| (in millions) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | As of September 30, 2024 |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Consolidated PFI | | Closed Block Division | | | PFI Excluding Closed Block Division | | | PGIM | | U.S. Businesses | | International Businesses | | Corporate and Other |

| Assets: | | | | | | | | | | | | | | | |

| Total investments | 469,117 | | | 49,519 | | | | 419,598 | | | | 3,833 | | | 213,476 | | | 171,025 | | | 31,264 | |

| Deferred policy acquisition costs | 21,182 | | | 159 | | | | 21,023 | | | | — | | | 12,016 | | | 9,558 | | | (551) | |

| Other assets | 69,445 | | | 1,246 | | | | 68,199 | | | | 4,714 | | | 46,213 | | | 12,713 | | | 4,559 | |

| Separate account assets | 200,550 | | | — | | | | 200,550 | | | | 29,331 | | | 174,779 | | | — | | | (3,560) | |

| Total assets | 760,294 | | | 50,924 | | | | 709,370 | | | | 37,878 | | | 446,484 | | | 193,296 | | | 31,712 | |

| Liabilities: | | | | | | | | | | | | | | | |

| Future policy benefits | 285,474 | | | 42,683 | | | | 242,791 | | | | — | | | 123,199 | | | 110,175 | | | 9,417 | |

| Policyholders' account balances | 164,088 | | | 4,391 | | | | 159,697 | | | | — | | | 99,599 | | | 55,841 | | | 4,257 | |

| Debt | 20,026 | | | — | | | | 20,026 | | | | 1,565 | | | 7,206 | | | 106 | | | 11,149 | |

| Other liabilities | 57,581 | | | 5,412 | | | | 52,169 | | | | 3,565 | | | 26,182 | | | 8,494 | | | 13,928 | |

| Separate account liabilities | 200,550 | | | — | | | | 200,550 | | | | 29,331 | | | 174,779 | | | — | | | (3,560) | |

| Total liabilities | 727,719 | | | 52,486 | | | | 675,233 | | | | 34,461 | | | 430,965 | | | 174,616 | | | 35,191 | |

| Mezzanine Equity: | | | | | | | | | | | | | | | |

| Redeemable noncontrolling interests | 560 | | | — | | | | 560 | | | | 393 | | | — | | | — | | | 167 | |

| Total mezzanine equity | 560 | | | — | | | | 560 | | | | 393 | | | — | | | — | | | 167 | |

| Equity: | | | | | | | | | | | | | | | |

| Accumulated other comprehensive loss | (4,844) | | | (143) | | | | (4,701) | | | | (77) | | | (410) | | | (1,989) | | | (2,225) | |

| Other equity (1) | 35,260 | | | (1,430) | | | | 36,690 | | | | 2,844 | | | 15,849 | | | 20,639 | | | (2,642) | |

| Total Prudential Financial, Inc. equity | 30,416 | | | (1,573) | | | | 31,989 | | | | 2,767 | | | 15,439 | | | 18,650 | | | (4,867) | |

| Noncontrolling interests | 1,599 | | | 11 | | | | 1,588 | | | | 257 | | | 80 | | | 30 | | | 1,221 | |

| Total equity | 32,015 | | | (1,562) | | | | 33,577 | | | | 3,024 | | | 15,519 | | | 18,680 | | | (3,646) | |

| Total liabilities, mezzanine equity and equity | 760,294 | | | 50,924 | | | | 709,370 | | | | 37,878 | | | 446,484 | | | 193,296 | | | 31,712 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | As of December 31, 2023 |

| | | | | | | | | | | | | | | | |

| | Consolidated PFI | | Closed Block Division | | | PFI Excluding Closed Block Division | | | PGIM | | U.S. Businesses | | International Businesses | | Corporate and Other |

| Assets: | | | | | | | | | | | | | | | |

| Total investments | 434,733 | | | 49,336 | | | | 385,397 | | | | 4,906 | | | 184,264 | | | 169,531 | | | 26,696 | |

| Deferred policy acquisition costs | 20,856 | | | 168 | | | | 20,688 | | | | — | | | 11,757 | | | 9,351 | | | (420) | |

| Other assets | 66,646 | | | 1,584 | | | | 65,062 | | | | 4,511 | | | 41,498 | | | 12,342 | | | 6,711 | |

| Separate account assets | 198,888 | | | — | | | | 198,888 | | | | 32,647 | | | 169,386 | | | — | | | (3,145) | |

| Total assets | 721,123 | | | 51,088 | | | | 670,035 | | | | 42,064 | | | 406,905 | | | 191,224 | | | 29,842 | |

| Liabilities: | | | | | | | | | | | | | | | |

| Future policy benefits | 273,281 | | | 43,587 | | | | 229,694 | | | | — | | | 107,007 | | | 113,501 | | | 9,186 | |

| Policyholders' account balances | 147,018 | | | 4,500 | | | | 142,518 | | | | — | | | 85,983 | | | 51,941 | | | 4,594 | |

| Debt | 19,500 | | | — | | | | 19,500 | | | | 1,577 | | | 7,360 | | | 72 | | | 10,491 | |

| Other liabilities | 52,649 | | | 4,539 | | | | 48,110 | | | | 3,095 | | | 21,668 | | | 8,267 | | | 15,080 | |

| Separate account liabilities | 198,888 | | | — | | | | 198,888 | | | | 32,647 | | | 169,386 | | | — | | | (3,145) | |

| Total liabilities | 691,336 | | | 52,626 | | | | 638,710 | | | | 37,319 | | | 391,404 | | | 173,781 | | | 36,206 | |

| Mezzanine Equity: | | | | | | | | | | | | | | | |

| Redeemable noncontrolling interest | 524 | | | — | | | | 524 | | | | 524 | | | — | | | — | | | — | |

| Total mezzanine equity | 524 | | | — | | | | 524 | | | | 524 | | | — | | | — | | | — | |

| Equity: | | | | | | | | | | | | | | | |

| Accumulated other comprehensive loss | (6,504) | | | (144) | | | | (6,360) | | | | (86) | | | (1,862) | | | (1,922) | | | (2,490) | |

| Other equity (1) | 34,324 | | | (1,405) | | | | 35,729 | | | | 2,768 | | | 17,281 | | | 19,335 | | | (3,655) | |

| Total Prudential Financial, Inc. equity | 27,820 | | | (1,549) | | | | 29,369 | | | | 2,682 | | | 15,419 | | | 17,413 | | | (6,145) | |

| Noncontrolling interests | 1,443 | | | 11 | | | | 1,432 | | | | 1,539 | | | 82 | | | 30 | | | (219) | |

| Total equity | 29,263 | | | (1,538) | | | | 30,801 | | | | 4,221 | | | 15,501 | | | 17,443 | | | (6,364) | |

| Total liabilities, mezzanine equity and equity | 721,123 | | | 51,088 | | | | 670,035 | | | | 42,064 | | | 406,905 | | | 191,224 | | | 29,842 | |

| | | | | | | | | | | | | | | | |

| ____________ | | | | | | | | | | | | | | | |

| (1) Corporate and Other includes $(238) million and $181 million of cumulative change in fair value of funds withheld and modified coinsurance embedded derivatives as described on page 3, as of September 30, 2024 and December 31, 2023, respectively. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prudential Financial, Inc. | | | | | | | | | | | | | |

| Quarterly Financial Supplement | | | | | | | | | | | | |

| Third Quarter 2024 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| SHORT-TERM AND LONG-TERM DEBT - UNAFFILIATED | | | | | | | | | | |

| (in millions) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | As of September 30, 2024 | | As of December 31, 2023 |

| | | Senior Debt | | | | | | Senior Debt | | | | |

| | | Short-term Debt | | Long-term Debt | | Junior Subordinated Long-term Debt | | Total Debt | | Short-term Debt | | Long-term Debt | | Junior Subordinated Long-term Debt | | Total Debt |

| | | | | | | | | | | | | | | | | |

| Borrowings by use of proceeds: | | | | | | | | | | | | | | | | |