SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For August, 2024

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

TABLE OF CONTENTS

1. Introduction |

2 |

2. References |

2 |

3. Definitions |

2 |

4. Purpose |

3 |

5. Guidelines |

3 |

6. Disclosure |

6 |

| 1.1 | This Profit Allocation and Dividend Distribution Policy (“Policy”)

establishes the rules to conduct the dividend distribution process of Companhia de Saneamento Básico do Estado de São Paulo

(“Company”). |

·

Sabesp’s Bylaws;

·

Federal Law 6,404/1976;

·

Federal Law 9,249/1995;

·

CVM Resolution 81/2022; and

·

CVM Resolution 143/22.

| 3.1. | The following terms used in this Policy have the meanings outlined below: |

3.1.1. Financial

Leverage:

Index

obtained by dividing the Company’s Net Debt by Adjusted EBITDA on December 31 of the respective fiscal year, based on the Company’s

consolidated audited financial statements for the respective year.

3.1.2. Concession

Agreement:

Concession

Agreement 1/2024, for the provision of public water supply and sewage services, executed on May 24, 2024, between the Company and the

Regional Unit for Drinking Water Supply and Sewage Services 1 – Southeastern (“URAE-1”).

3.1.3. Financial

Expenses:

Regarding

the 12 (twelve) months before the date of calculation of the Financial Leverage index, the sum of interest payments and financial expenses

incurred on financial indebtedness should not include expenses from exchange rate changes (currency differences).

3.1.4. Net

Debt:

Total

short-and long-term loans and financings of the Company less (i) accrued interest and financial charges; (ii) cash and cash equivalents;

(iii) the balance of financial investments; and (iv) the net value of mark-to-market of hedge operations on foreign currency debt, to

be informed by the Company.

3.1.5. Minimum

Mandatory Dividend

It

corresponds to 25% (twenty-five percent) of Adjusted Net Income

3.1.6. Adjusted

EBITDA:

Sum of (i) earnings before taxes on income;

(ii) depreciation and amortization expenses incurred in the period; (iii) Financial Expenses less financial revenue; and (iv) other operating

income and expenses.

3.1.7. U Factor

Universalization Factor, under the Concession

Agreement, related to the fiscal year of the dividend distribution calculation, according to the terms of this Policy.

3.1.8. Adjusted Net Income

Net income for the fiscal year after

deductions required or permitted by law, including the legal reserve.

| 4.1 | This Policy aims to define the practices to be adopted by the Company regarding

shareholder compensation to provide transparency to the market and investors, offering them earnings predictability and seeking to meet

the best standards of corporate governance, without prejudice to the universalization of basic sanitation services in the area operated

by the Company in the São Paulo State and the execution of its capital expenditure plan. |

| 5.1 | The Company’s fiscal year comprises the 12 (twelve) months started

on January 01 and ended on December 31. |

| 5.2 | Of the net income for the year, 5% (five percent) is used, before any other

allocation, for the creation of the legal reserve, which shall not exceed 20% (twenty percent) of the Company’s capital stock, under

Article 193 of Federal Law 6,404/1976. |

| 5.3 | Under paragraph 1 of Article

202 of Federal Law 6,404/1976 and Article 49 of the Bylaws, common shares will have the right to a minimum mandatory dividend corresponding

to 25% (twenty-five percent) of Adjusted Net Income (“Minimum Mandatory Dividend”). |

| 5.3.1 | Common shares will be entitled to the Minimum Mandatory Dividend for the

fiscal years ended on December 31, 2024 and December 31, 2025. |

| 5.4 | Under the conditions provided for in item 5.5 and the assumptions of item

5.6 of this Policy, common shares may be entitled to the following total dividends: |

| (i) | of up to 50% (fifty percent) of the Adjusted Net Income for the fiscal years ended on December 31, 2026

and December 31, 2027; |

| (ii) | of up to 75% (seventy-five percent) of the Adjusted Net Income for the fiscal years ended on December

31, 2028 and December 31, 2029; and |

| (iii) | of up to 100% (one hundred percent) of the Adjusted Net Income for the fiscal years ended as of December

31, 2030. |

5.4.1.

If the U Factor is equal to a 0 (zero), dividend distribution will be authorized up to the limits provided for in the subitems of item

5.4.

5.4.2.

If the U Factor is greater than 0 (zero) but lower than or equal to 1% (one percent), the dividend distribution limit will be 80%

(eighty percent) of the limits provided for in the subitems of item 5.4.

| 5.4.3. | If the U Factor is greater than 1% (one percent) but lower than or equal to 2% (two percent), the dividend

distribution limit will be 60% (sixty percent) of the limits provided for in the subitems of item 5.4. |

| 5.4.4. | If the U Factor is greater than 2% (two percent), dividend distribution will be limited to the payment

of the Minimum Mandatory Dividend. |

5.5

The declaration of dividends greater than the Minimum Mandatory Dividend provided for in item

5.4 will be subject to the following conditions:

| (i) | compliance with the provisions of items 5.4.1 to 5.4.4; and |

| (ii) | the Company’s Financial Leverage ratio for December 31 of the respective

fiscal year shall be equal to or lower than 3.25 (three point twenty-five hundredths). |

5.6

The dividend distribution proposal under this Policy must consider:

| (i) | investment requirements to achieve the basic sanitation universalization

goals, as outlined in the Concession Agreement; |

| (ii) | achievement of the Company’s corporate purpose defined in its Bylaws; |

| (iii) | cash generation and requirements; and |

| (iv) | the Company’s economic-financial sustainability. |

5.7

The Company may also remunerate shareholders as interest on equity, calculated under Article

9 of Federal Law 9,249/1995, provided that only the net amount of income tax withheld by the Company may be imputed to the Minimum Mandatory

Dividend.

| 5.7.1. | If the Company decides to distribute dividends exceeding the Minimum Mandatory

Dividend and the payment is made as interest on equity, the portion corresponding to the income tax withheld by the Company may be imputed

as an additional dividend to the Minimum Mandatory Dividend. |

5.8

The Board of Directors is responsible for resolving on the declaration of interest on equity

and/or distribution of interim dividends, without prejudice to subsequent ratification by the General Meeting.

5.9

The Board of Directors may propose to the General Meeting that the remaining balance of the

profit for the fiscal year be allocated to the creation of an investment reserve, under the Bylaws and current legislation.

5.10

The Management proposal for the allocation of the net income for the year, including dividend

distribution, will be submitted to the Annual Shareholders' Meeting, held every year, within the first four months following the end of

the fiscal year.

| 5.10.1 | Under paragraph 4 of Article

202 of Federal Law 6,404/1976, the Minimum Mandatory Dividend may, exceptionally, fail to be paid in the year in which the Company’s

Management informs the Annual Shareholders' Meeting that it is not compatible with the Company’s financial standing. In this case,

undistributed profit, if not absorbed by losses in subsequent years, must be paid as soon as the Company’s financial standing allows

so. |

5.11

The Fiscal Council is responsible for providing an opinion on the Management proposal related

to dividend distribution to be submitted to the General Meeting.

5.12

Under Article 205 of Federal Law 6,404/1976, the Company will pay dividends on registered shares

to the person who, on the date of dividend declaration, is registered as a holder or usufructuary of the share.

5.13

The dividend must be paid, unless otherwise decided by the Annual Shareholders' Meeting or Board

of Directors, as applicable, within 60 (sixty) days of the date on which it is declared and, in any event, within the fiscal year.

5.14

The dividend will be credited to the shareholders’ checking account, the depository financial

institution, or by any other means provided for in law.

5.15

Approved dividends do not accrue interest, and those not claimed within 3 (three) years from

the payment date established by the Annual Shareholders' Meeting or Board of Directors, as applicable, will mature in favor of the Company.

5.16

This Policy shall become effective on the settlement date of the public offering for distribution

of shares issued by the Company addressed to by State Law 17,853/2023, and shall remain effective for an indefinite time.

5.17

This Policy shall be revised at least every 5 (five) years or whenever necessary to keep its

content updated, whether to ensure the continuous improvement of corporate governance practices or due to statutory, legislative, or

regulatory amendments, and shall be reviewed, approved, and recorded in the minutes of the Board of Directors’ meetings.

5.18

This Policy can only be changed by a decision of the Company’s Board of Directors. Omissions

shall be decided by the Company’s Board of Directors.

a) Electronic

Documentation Manager;

b) Sabesp’s

IR website.

| Anexos Referenciados (Base de Anexos) |

Documentos Referenciados |

Informações de Registros |

| --- |

--- |

--- |

| Arquivos Anexados (Arquivos Complementares do Instrumento Organizacional) |

| --- |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: August 13, 2024

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Catia Cristina Teixeira Pereira

|

|

| |

Name: Catia Cristina Teixeira Pereira

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

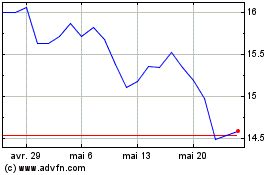

Companhia Sanea (NYSE:SBS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Companhia Sanea (NYSE:SBS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024