- Product revenue of $943.3 million in the fourth quarter,

representing 28% year-over-year growth

- Net revenue retention rate of 126%

- 580 customers with trailing 12-month product revenue greater

than $1 million

- 745 Forbes Global 2000 customers

- Remaining performance obligations of $6.9 billion, representing

33% year-over-year growth

Snowflake (NYSE: SNOW), the AI Data Cloud company, today

announced financial results for its fourth quarter and full-year of

fiscal 2025, ended January 31, 2025.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250226670487/en/

Snowflake Q4 and Full-Year FY25

Infographic (Graphic: Snowflake)

Revenue for the quarter was $986.8 million, representing 27%

year-over-year growth. Product revenue for the quarter was $943.3

million, representing 28% year-over-year growth. Net revenue

retention rate was 126% as of January 31, 2025. The company now has

580 customers with trailing 12-month product revenue greater than

$1 million and 745 Forbes Global 2000 customers, representing 27%

and 5% year-over-year growth, respectively. Remaining performance

obligations were $6.9 billion, representing 33% year-over-year

growth. See the section titled “Key Business Metrics” for

definitions of product revenue, net revenue retention rate,

customers with trailing 12-month product revenue greater than $1

million, Forbes Global 2000 customers, and remaining performance

obligations.

“We delivered another strong quarter, with product revenue of

$943 million, up a strong 28% year-over-year, and remaining

performance obligations totaling $6.9 billion,” said Sridhar

Ramaswamy, CEO of Snowflake. “Today, Snowflake is the most

consequential data and AI company in the world. More than 11,000

customers are already betting their business on our easy-to-use,

efficient, and trusted platform. We see tremendous opportunities

ahead to support our customers throughout their end-to-end data

lifecycle, and we are laser-focused on delivering on this

vision.”

Fourth Quarter Fiscal 2025 GAAP and Non-GAAP Results:

The following table summarizes our financial results for the

fourth quarter of fiscal 2025:

Fourth Quarter Fiscal

2025

GAAP Results

Fourth Quarter Fiscal

2025

Non-GAAP Results(1)

Amount

(millions)

Year/Year

Growth

Product revenue

$943.3

28%

Amount

(millions)

Margin

Amount

(millions)

Margin

Product gross profit

$670.1

71%

$715.3

76%

Operating income (loss)

($386.7)

(39%)

$92.8

9%

Net cash provided by operating

activities

$432.7

44%

(2)

Free cash flow

$415.4

42%

Adjusted free cash flow

$423.1

43%

(1) We report non-GAAP financial measures

in addition to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. See the

section titled “Statement Regarding Use of Non-GAAP Financial

Measures” for an explanation of non-GAAP financial measures, and

the table titled “GAAP to Non-GAAP Reconciliations” for a

reconciliation of GAAP to non-GAAP financial measures.

(2) Calculated as net cash provided by

operating activities as a percentage of revenue.

Note: Fiscal year ends January 31. Numbers

are rounded for presentation purposes.

Full-Year Fiscal 2025 GAAP and Non-GAAP Results:

The following table summarizes our financial results for the

full-year of fiscal 2025:

Full-Year Fiscal 2025

GAAP Results

Full-Year Fiscal 2025

Non-GAAP Results(1)

Amount

(millions)

Year/Year

Growth

Product revenue

$3,462.4

30%

Amount

(millions)

Margin

Amount

(millions)

Margin

Product gross profit

$2,470.4

71%

$2,643.3

76%

Operating income (loss)

($1,456.0)

(40%)

$231.7

6%

Net cash provided by operating

activities

$959.8

26%

(2)

Free cash flow

$884.1

24%

Adjusted free cash flow

$941.5

26%

(1) We report non-GAAP financial measures

in addition to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. See the

section titled “Statement Regarding Use of Non-GAAP Financial

Measures” for an explanation of non-GAAP financial measures, and

the table titled “GAAP to Non-GAAP Reconciliations” for a

reconciliation of GAAP to non-GAAP financial measures.

(2) Calculated as net cash provided by

operating activities as a percentage of revenue.

Note: Fiscal year ends January 31. Numbers

are rounded for presentation purposes.

Financial Outlook:

Our guidance includes GAAP and non-GAAP financial measures.

The following table summarizes our guidance for the first

quarter of fiscal 2026:

First Quarter Fiscal

2026

GAAP Guidance

First Quarter Fiscal

2026

Non-GAAP Guidance(1)

Amount

(millions)

Year/Year

Growth

Product revenue

$955 - $960

21 - 22%

Margin

Operating income

5%

Amount

(millions)

Weighted-average shares used in

computing net income per share attributable to Snowflake Inc.

common stockholders—diluted(2)

374

(1) We report non-GAAP financial measures

in addition to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. See the

section titled “Statement Regarding Use of Non-GAAP Financial

Measures” for an explanation of non-GAAP financial measures.

(2) The potential impact of future

repurchases under our stock repurchase program is not reflected in

our guidance for weighted-average shares used in computing net

income per share attributable to Snowflake Inc. common

stockholders—diluted due to the uncertainty regarding, and the

potential variability of, the timing and amount of repurchases.

Additionally, the dilutive effect of the shares issuable upon

conversion of our 0% convertible senior notes due 2027 and 0%

convertible senior notes due 2029 (the Notes) using the

if-converted method, estimated at approximately 13 million shares

for the first quarter of fiscal 2026 based on the current

conversion price and net of the potential antidilutive impact of

the capped call transactions entered into in connection with the

Notes (the Capped Calls), is reflected in our guidance for

weighted-average shares used in computing net income per share

attributable to Snowflake Inc. common stockholders—diluted. Upon

conversion of the Notes, we may choose to satisfy our conversion

obligations by paying or delivering, as the case may be, cash,

shares of our common stock, or a combination of both. The Capped

Calls will have an antidilutive impact when the average stock price

of our common stock in a given period is higher than their exercise

price. The estimated antidilutive impact of the Capped Calls

reflected in our guidance is based on the market price of our

common stock as of January 31, 2025, and is subject to change with

future stock price movements.

The following table summarizes our guidance for the full-year of

fiscal 2026:

Full-Year Fiscal 2026

GAAP Guidance

Full-Year Fiscal 2026

Non-GAAP Guidance(1)

Amount

(millions)

Year/Year

Growth

Product revenue

$4,280

24%

Margin

Product gross profit

75%

Operating income

8%

Adjusted free cash flow

25%

Amount

(millions)

Weighted-average shares used in

computing net income per share attributable to Snowflake Inc.

common stockholders—diluted(2)

374

(1) We report non-GAAP financial measures

in addition to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. See the

section titled “Statement Regarding Use of Non-GAAP Financial

Measures” for an explanation of non-GAAP financial measures.

(2) The potential impact of future

repurchases under our stock repurchase program is not reflected in

our guidance for weighted-average shares used in computing net

income per share attributable to Snowflake Inc. common

stockholders—diluted due to the uncertainty regarding, and the

potential variability of, the timing and amount of repurchases.

Additionally, the dilutive effect of the shares issuable upon

conversion of the Notes using the if-converted method, estimated at

approximately 13 million shares for the full-year of fiscal 2026

based on the current conversion price and net of the potential

antidilutive impact of the Capped Calls, is reflected in our

guidance for weighted-average shares used in computing net income

per share attributable to Snowflake Inc. common

stockholders—diluted. Upon conversion of the Notes, we may choose

to satisfy our conversion obligations by paying or delivering, as

the case may be, cash, shares of our common stock or a combination

of both. The Capped Calls will have an antidilutive impact when the

average stock price of our common stock in a given period is higher

than their exercise price. The estimated antidilutive impact of the

Capped Calls reflected in our guidance is based on the market price

of our common stock as of January 31, 2025, and is subject to

change with future stock price movements.

A reconciliation of non-GAAP guidance measures to corresponding

GAAP guidance measures is not available on a forward-looking basis

without unreasonable effort due to the uncertainty regarding, and

the potential variability of, expenses that may be incurred in the

future. Stock-based compensation-related charges, including

employer payroll tax-related items on employee stock transactions,

are impacted by the timing of employee stock transactions, the

future fair market value of our common stock, and our future hiring

and retention needs, all of which are difficult to predict and

subject to constant change. These factors could be material to our

results computed in accordance with GAAP. We have provided a

reconciliation of GAAP to non-GAAP financial measures in the

financial statement tables for our historical non-GAAP financial

results included in this release. Our fiscal year ends January 31,

and numbers are rounded for presentation purposes.

Conference Call Details

The conference call will begin at 3 p.m. Mountain Time on

February 26, 2025. Investors and participants may attend the call

by dialing (833) 470-1428 (Access code: 180858). For investors and

participants outside the United States, see global dial-in numbers

at https://www.netroadshow.com/events/global-numbers?confId=73127

(Access code: 180858).

The call will also be webcast live on the Snowflake Investor

Relations website at https://investors.snowflake.com.

An audio replay of the conference call and webcast will be

available two hours after its completion and will be accessible for

30 days on the Snowflake Investor Relations website.

Investor Presentation Details

An investor presentation providing additional information and

analysis can be found at https://investors.snowflake.com.

Statement Regarding Use of Non‑GAAP Financial

Measures

We report the following non-GAAP financial measures, which have

not been prepared in accordance with generally accepted accounting

principles in the United States (GAAP), in addition to, and not as

a substitute for, or superior to, financial measures calculated in

accordance with GAAP.

- Non-GAAP Product gross profit, Operating income, Net income,

Net income attributable to Snowflake Inc., and Net income per share

attributable to Snowflake Inc. common stockholders—basic and

diluted. Non-GAAP product gross profit, operating income, net

income, and net income attributable to Snowflake Inc. are each

defined as the respective GAAP measure, excluding, as applicable,

the effect of (i) stock-based compensation-related charges,

including employer payroll tax-related items on employee stock

transactions, (ii) amortization of acquired intangibles, (iii)

expenses associated with acquisitions and strategic investments,

(iv) amortization of debt issuance costs, (v) restructuring

charges, (vi) asset impairment related to office facility exit,

(vii) adjustments attributable to noncontrolling interest, and

(viii) the related income tax effect of these adjustments as well

as the non-recurring income tax expense or benefit associated with

acquisitions. Non-GAAP product gross margin is calculated as

non-GAAP product gross profit as a percentage of product revenue.

Non-GAAP operating margin is calculated as non-GAAP operating

income as a percentage of revenue. Our non-GAAP net income per

share attributable to Snowflake Inc. common stockholders—basic is

calculated by dividing non-GAAP net income attributable to

Snowflake Inc. by the weighted-average number of shares of common

stock outstanding during the period. Our non-GAAP net income per

share attributable to Snowflake Inc. common stockholders—diluted is

calculated by dividing non-GAAP net income attributable to

Snowflake Inc. by the non-GAAP weighted-average number of diluted

shares outstanding, which includes (a) the effect of all

potentially dilutive common stock equivalents (stock options,

restricted stock units, employee stock purchase rights under our

2020 Employee Stock Purchase Plan), (b) the potential dilutive

effect of the shares issuable upon conversion of the Notes using

the if-converted method, and (c) the antidilutive impact, if any,

of the Capped Calls entered into in connection with the Notes. The

Capped Calls are expected to reduce the potential dilution to our

common stock upon any conversion of the Notes under certain

circumstances. Under GAAP, the antidilutive impact of the Capped

Calls is not reflected in diluted shares outstanding until

exercised. For the historical periods presented, there was no

material antidilutive impact of the Capped Calls. The potential

dilutive effect of outstanding restricted stock units with

performance conditions not yet satisfied is included in the

non-GAAP weighted-average number of diluted shares at forecasted

attainment levels to the extent we believe it is probable that the

performance conditions will be met. Amounts attributable to

noncontrolling interest were not material for all periods

presented. We believe the presentation of operating results that

exclude these items that are (i) non-cash items, (ii) non-recurring

items, or (iii) items that have highly variable amounts due to

factors beyond our control and are unrelated to our core operations

such that management does not consider them in evaluating the

business performance or making operating plans, provides useful

supplemental information to investors and facilitates the analysis

of our operating results and comparison of operating results across

reporting periods.

- Free cash flow. Free cash flow is defined as net cash

provided by operating activities reduced by purchases of property

and equipment and capitalized internal-use software development

costs. Cash outflows for employee payroll tax items related to the

net share settlement of equity awards are included in cash flow for

financing activities and, as a result, do not have an effect on the

calculation of free cash flow. Free cash flow margin is calculated

as free cash flow as a percentage of revenue. We believe these

measures provide useful supplemental information to investors

because they are indicators of the strength and performance of our

core business operations.

- Adjusted free cash flow. Adjusted free cash flow is

defined as free cash flow plus (minus) net cash paid (received) on

employer and employee payroll tax-related items on employee stock

transactions. Employee payroll tax-related items on employee stock

transactions are generally pass-through transactions that are

expected to have a net zero impact on free cash flow over time, but

that may impact free cash flow in any given fiscal quarter due to

differences between the time that we receive funds from our

employees and the time we remit those funds to applicable tax

authorities. We believe that excluding the effects of these payroll

tax-related items will enhance stockholders' ability to evaluate

our free cash flow performance, including on a quarter-over-quarter

basis. Adjusted free cash flow margin is calculated as adjusted

free cash flow as a percentage of revenue. We believe these

measures provide useful supplemental information to investors

because they are indicators of the strength and performance of our

core business operations.

We use these non-GAAP financial measures internally for

financial and operational decision-making purposes and as a means

to evaluate period-to-period comparisons. Non-GAAP financial

measures are not meant to be considered in isolation or as a

substitute for comparable GAAP financial measures and should be

read only in conjunction with our condensed consolidated financial

statements prepared in accordance with GAAP. Our presentation of

non-GAAP financial measures may not be comparable to similar

measures used by other companies. We encourage investors to

carefully consider our results under GAAP, as well as our

supplemental non-GAAP information and the reconciliation between

these presentations, to more fully understand our business. Please

see the tables included at the end of this release for the

reconciliation of GAAP to non-GAAP results.

Key Business Metrics

We monitor our key business metrics, including (i) free cash

flow and (ii) the other metrics set forth below to help us evaluate

our business and growth trends, establish budgets, measure the

effectiveness of our sales and marketing efforts, and assess

operational efficiencies. See the section titled “Statement

Regarding Use of Non-GAAP Financial Measures” for the definition of

free cash flow. The calculation of our key business metrics may

differ from other similarly titled metrics used by other companies,

securities analysts, or investors.

- Product Revenue. Product revenue is a key metric

for us because we recognize revenue based on platform consumption,

which is inherently variable at our customers’ discretion, and not

based on the amount and duration of contract terms. Product revenue

is primarily derived from the consumption of compute, storage, and

data transfer resources by customers on our platform. Customers

have the flexibility to consume more than their contracted capacity

during the contract term and may have the ability to roll over

unused capacity to future periods, generally upon the purchase of

additional capacity at renewal. Our consumption-based business

model distinguishes us from subscription-based software companies

that generally recognize revenue ratably over the contract term and

may not permit rollover. Because customers have flexibility in the

timing of their consumption, which can exceed their contracted

capacity or extend beyond the original contract term in many cases,

the amount of product revenue recognized in a given period is an

important indicator of customer satisfaction and the value derived

from our platform. While customer use of our platform in any period

is not necessarily indicative of future use, we estimate future

revenue using predictive models based on customers’ historical

usage to plan and determine financial forecasts. Product revenue

excludes our professional services and other revenue.

- Net Revenue Retention Rate. To calculate net

revenue retention rate, we first specify a measurement period

consisting of the trailing two years from our current period end.

Next, we define as our measurement cohort the population of

customers under capacity contracts that used our platform at any

point in the first month of the first year of the measurement

period. The cohorts used to calculate net revenue retention rate

include end-customers under a reseller arrangement. We then

calculate our net revenue retention rate as the quotient obtained

by dividing our product revenue from this cohort in the second year

of the measurement period by our product revenue from this cohort

in the first year of the measurement period. Any customer in the

cohort that did not use our platform in the second year remains in

the calculation and contributes zero product revenue in the second

year. Our net revenue retention rate is subject to adjustments for

acquisitions, consolidations, spin-offs, and other market activity,

and we present our net revenue retention rate for historical

periods reflecting these adjustments. Since we will continue to

attribute the historical product revenue to the consolidated

contract, consolidation of capacity contracts within a customer’s

organization typically will not impact our net revenue retention

rate unless one of those customers was not a customer at any point

in the first month of the first year of the measurement

period.

- Customers with Trailing 12-Month Product Revenue Greater

than $1 Million. To calculate the number of customers

with trailing 12-month product revenue greater than $1 million, we

count the number of customers under capacity arrangements that

contributed more than $1 million in product revenue in the trailing

12 months. For purposes of determining our customer count, we treat

each customer account, including accounts for end-customers under a

reseller arrangement, that has at least one corresponding capacity

contract as a unique customer, and a single organization with

multiple divisions, segments, or subsidiaries may be counted as

multiple customers. We do not include customers that consume our

platform only under on-demand arrangements for purposes of

determining our customer count. Our customer count is subject to

adjustments for acquisitions, consolidations, spin-offs, and other

market activity, and we present our customer count for historical

periods reflecting these adjustments.

- Forbes Global 2000 Customers. Our Forbes Global 2000

customer count is a subset of our customer count based on the 2024

Forbes Global 2000 list. Our Forbes Global 2000 customer count is

subject to adjustments for annual updates to the list by Forbes, as

well as acquisitions, consolidations, spin-offs, and other market

activity with respect to such customers, and we present our Forbes

Global 2000 customer count for historical periods reflecting these

adjustments.

- Remaining Performance Obligations. Remaining

performance obligations (RPO) represent the amount of contracted

future revenue that has not yet been recognized, including (i)

deferred revenue and (ii) non-cancelable contracted amounts that

will be invoiced and recognized as revenue in future periods. RPO

excludes performance obligations from on-demand arrangements and

certain time and materials contracts that are billed in arrears.

Portions of RPO that are not yet invoiced and are denominated in

foreign currencies are revalued into U.S. dollars each period based

on the applicable period-end exchange rates. RPO is not necessarily

indicative of future product revenue growth because it does not

account for the timing of customers’ consumption or their

consumption of more than their contracted capacity. Moreover, RPO

is influenced by a number of factors, including the timing and size

of renewals, the timing and size of purchases of additional

capacity, average contract terms, seasonality, changes in foreign

currency exchange rates, and the extent to which customers are

permitted to roll over unused capacity to future periods, generally

upon the purchase of additional capacity at renewal. Due to these

factors, it is important to review RPO in conjunction with product

revenue and other financial metrics disclosed elsewhere

herein.

Use of Forward-Looking Statements

This release and the accompanying oral presentation contain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, regarding our

performance, including but not limited to statements in the section

titled “Financial Outlook.” Words such as “guidance,” “outlook,”

“expect,” “anticipate,” “should,” “believe,” “hope,” “target,”

“project,” “plan,” “goals,” “estimate,” “potential,” “predict,”

“may,” “will,” “might,” “could,” “intend,” “shall,” and variations

of these terms or the negative of these terms and similar

expressions are intended to identify these forward-looking

statements. Other than statements of historical fact, all

statements contained in this release and accompanying oral

presentation are forward-looking statements, including statements

regarding (i) our future operating results, targets, or financial

position; (ii) our business strategy, plans, opportunities, or

priorities; (iii) the release, adoption, and use of our new or

enhanced products, services, and technology offerings, including

those that are under development or not generally available; (iv)

market size and growth, trends, and competitive considerations; (v)

our vision, strategy and expected benefits relating to artificial

intelligence, Snowpark, Snowflake Marketplace, the AI Data Cloud,

and AI Data Clouds for specific industries or product categories,

including the expected benefits and network effects of the AI Data

Cloud; and (vi) the integration, interoperability, and availability

of our products, services, and technology offerings with and on

third-party products and platforms, including public cloud

platforms.

The forward-looking statements contained in this release and the

accompanying oral presentation are subject to known and unknown

risks, uncertainties, assumptions, and other factors that may cause

actual results or outcomes to be materially different from any

future results or outcomes expressed or implied by the

forward-looking statements. These risks, uncertainties,

assumptions, and other factors include, but are not limited to,

those related to our business and financial performance; general

market and business conditions, downturns, or uncertainty,

including higher inflation, higher interest rates, fluctuations or

volatility in capital markets or foreign currency exchange rates,

and geopolitical instability; our ability to attract and retain

customers that use our platform to support their end-to-end data

lifecycle; the extent to which customers continue to optimize

consumption; the impact of new or optimized product features and

pricing strategies on consumption, including Iceberg tables and

tiered storage pricing; unforeseen technical, operational, or

business challenges impacting the timing, scope, or success of

strategic partnerships; the extent to which customers continue to

rationalize budgets and prioritize cash flow management, including

through shortened contract durations; our ability to develop new

products and services and enhance existing products and services;

the extent to which customer adoption of new product capabilities

results in durable consumption; the growth of successful native

applications on the Snowflake Marketplace; our ability to respond

rapidly to emerging technology trends, including the adoption and

use of artificial intelligence; our ability to execute on our

business strategy, including our strategy related to artificial

intelligence, the AI Data Cloud, Snowpark, and Snowflake

Marketplace; our ability to increase and predict customer

consumption of our platform, particularly in light of the impact of

holidays on customer consumption patterns; our ability to compete

effectively; our ability to increase our penetration into existing

markets and enter and grow new markets, including highly-regulated

markets such as financial services, healthcare, and the public

sector; the impact of cybersecurity threat activity directed at our

customers and any resulting reputational or financial damage; our

ability to manage growth; our ability to sublease or terminate

certain of our office facility commitments and the impact of

related asset impairment; the impact and timing of stock

repurchases under our stock repurchase program; and our ability to

meet the requirements of the Notes and the settlement timing and

method for the Notes and the Capped Calls.

Further information on these and additional risks,

uncertainties, and other factors that could cause actual outcomes

and results to differ materially from those included in or

contemplated by the forward-looking statements contained in this

release are included under the caption “Risk Factors” and elsewhere

in our Form 10-Q for the fiscal quarter ended October 31, 2024 and

other filings and reports we make with the Securities and Exchange

Commission from time to time, including our Form 10-K that will be

filed for the fiscal year ended January 31, 2025.

Moreover, we operate in a very competitive and rapidly changing

environment, and new risks may emerge from time to time. It is not

possible to predict all risks, nor can we assess the impact of all

factors on our business or the extent to which any factor(s) may

cause actual results or outcomes to differ materially from those

contained in any forward-looking statements we may make. As a

result of these risks, uncertainties, assumptions, and other

factors, you should not rely on any forward-looking statements as

predictions of future events. Forward-looking statements speak only

as of the date the statements are made and are based on information

available to us at the time those statements are made and/or

management's good faith belief as of that time with respect to

future events. Except as required by law, we undertake no

obligation, and do not intend, to update these forward-looking

statements, to review or confirm analysts’ expectations, or to

provide interim reports or updates on the progress of the current

financial quarter.

About Snowflake

Snowflake makes enterprise AI easy, efficient and trusted. More

than 11,000 companies around the globe, including hundreds of the

world’s largest, use Snowflake’s AI Data Cloud to share data, build

applications, and power their business with AI. The era of

enterprise AI is here. Learn more at snowflake.com (NYSE:

SNOW).

Source: Snowflake Inc.

Snowflake Inc.

Condensed Consolidated

Statements of Operations

(in thousands, except per

share data)

(unaudited)

Three Months Ended January

31,

Twelve Months Ended January

31,

2025

2024

2025

2024

Revenue

$

986,770

$

774,699

$

3,626,396

$

2,806,489

Cost of revenue

333,184

241,804

1,214,673

898,558

Gross profit

653,586

532,895

2,411,723

1,907,931

Operating expenses:

Sales and marketing

432,683

361,822

1,672,092

1,391,747

Research and development

492,490

364,476

1,783,379

1,287,949

General and administrative

115,091

82,102

412,262

323,008

Total operating expenses

1,040,264

808,400

3,867,733

3,002,704

Operating loss

(386,678

)

(275,505

)

(1,456,010

)

(1,094,773

)

Interest income

56,310

53,761

209,009

200,663

Interest expense

(2,070

)

—

(2,759

)

—

Other income (expense), net

2,383

47,533

(35,339

)

44,887

Loss before income taxes

(330,055

)

(174,211

)

(1,285,099

)

(849,223

)

Provision for (benefit from) income

taxes

(4,331

)

(4,299

)

4,113

(11,233

)

Net loss

(325,724

)

(169,912

)

(1,289,212

)

(837,990

)

Less: net income (loss) attributable to

noncontrolling interest

1,750

(560

)

(3,572

)

(1,893

)

Net loss attributable to Snowflake

Inc.

$

(327,474

)

$

(169,352

)

$

(1,285,640

)

$

(836,097

)

Net loss per share attributable to

Snowflake Inc. common stockholders—basic and diluted

$

(0.99

)

$

(0.51

)

$

(3.86

)

$

(2.55

)

Weighted-average shares used in computing

net loss per share attributable to Snowflake Inc. common

stockholders—basic and diluted

331,432

331,079

332,707

328,001

Snowflake Inc.

Condensed Consolidated Balance

Sheets

(in thousands)

(unaudited)

January 31, 2025

January 31, 2024

Assets

Current assets:

Cash and cash equivalents

$

2,628,798

$

1,762,749

Short-term investments

2,008,873

2,083,499

Accounts receivable, net

922,805

926,902

Deferred commissions, current

97,662

86,096

Prepaid expenses and other current

assets

211,234

180,018

Total current assets

5,869,372

5,039,264

Long-term investments

656,476

916,307

Property and equipment, net

296,393

247,464

Operating lease right-of-use assets

359,439

252,128

Goodwill

1,056,559

975,906

Intangible assets, net

278,028

331,411

Deferred commissions, non-current

183,967

187,093

Other assets

333,704

273,810

Total assets

$

9,033,938

$

8,223,383

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

169,767

$

51,721

Accrued expenses and other current

liabilities

515,454

446,860

Operating lease liabilities, current

35,923

33,944

Deferred revenue, current

2,580,039

2,198,705

Total current liabilities

3,301,183

2,731,230

Convertible senior notes, net

2,271,529

—

Operating lease liabilities,

non-current

377,818

254,037

Deferred revenue, non-current

15,501

14,402

Other liabilities

61,264

33,120

Snowflake Inc. stockholders’ equity

2,999,929

5,180,308

Noncontrolling interest

6,714

10,286

Total liabilities and stockholders’

equity

$

9,033,938

$

8,223,383

Snowflake Inc.

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(unaudited)

Three Months Ended January

31,

Twelve Months Ended January

31,

2025

2024

2025

2024

Cash flows from operating

activities:

Net loss

$

(325,724

)

$

(169,912

)

$

(1,289,212

)

$

(837,990

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

50,130

34,986

182,508

119,903

Non-cash operating lease costs

17,573

13,751

59,943

52,892

Amortization of deferred commissions

24,293

20,065

93,128

74,787

Stock-based compensation, net of amounts

capitalized

428,119

305,498

1,479,314

1,168,015

Net accretion of discounts on

investments

(9,565

)

(12,299

)

(43,434

)

(61,525

)

Net realized and unrealized losses (gains)

on strategic investments in equity securities

(4,394

)

(45,704

)

31,420

(46,809

)

Amortization of debt issuance costs

2,070

—

2,759

—

Deferred income tax

(7,139

)

(13,655

)

(7,671

)

(26,762

)

Other

2,541

609

7,420

14,895

Changes in operating assets and

liabilities, net of effects of business combinations:

Accounts receivable

(328,168

)

(417,221

)

536

(212,083

)

Deferred commissions

(38,784

)

(68,317

)

(101,569

)

(134,787

)

Prepaid expenses and other assets

(12,606

)

8,221

29,850

59,795

Accounts payable

6,131

(32,460

)

108,852

19,212

Accrued expenses and other liabilities

32,174

137,339

70,876

171,048

Operating lease liabilities

(13,367

)

(11,759

)

(47,711

)

(40,498

)

Deferred revenue

609,441

595,438

382,755

528,029

Net cash provided by operating

activities

432,725

344,580

959,764

848,122

Cash flows from investing

activities:

Purchases of property and equipment

(11,277

)

(13,072

)

(46,279

)

(35,086

)

Capitalized internal-use software

development costs

(6,005

)

(7,029

)

(29,433

)

(34,133

)

Cash paid for business combinations, net

of cash, cash equivalents, and restricted cash acquired

(13,180

)

3,828

(30,305

)

(275,706

)

Purchases of intangible assets

—

—

—

(28,744

)

Purchases of investments

(280,258

)

(380,877

)

(2,569,243

)

(2,476,206

)

Sales of investments

10,179

—

64,573

11,266

Maturities and redemptions of

investments

525,429

919,719

2,802,082

3,670,867

Settlement of cash flow hedges

—

—

(749

)

—

Net cash provided by investing

activities

224,888

522,569

190,646

832,258

Cash flows from financing

activities:

Proceeds from exercise of stock

options

9,674

18,340

44,886

57,194

Proceeds from issuance of common stock

under employee stock purchase plan

—

—

77,053

61,234

Taxes paid related to net share settlement

of equity awards

(129,542

)

(106,971

)

(489,149

)

(380,799

)

Repurchases of common stock

—

—

(1,932,333

)

(591,732

)

Payments of deferred purchase

consideration for business combinations

(250

)

—

(250

)

—

Gross proceeds from issuance of

convertible senior notes

—

—

2,300,000

—

Cash paid for issuance costs on

convertible senior notes

—

—

(31,230

)

—

Purchases of capped calls related to

convertible senior notes

—

—

(195,500

)

—

Net cash used in financing activities

(120,118

)

(88,631

)

(226,523

)

(854,103

)

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

(5,055

)

2,564

(6,186

)

(2,031

)

Net increase in cash, cash equivalents,

and restricted cash

532,440

781,082

917,701

824,246

Cash, cash equivalents, and restricted

cash—beginning of period

2,166,238

999,895

1,780,977

956,731

Cash, cash equivalents, and restricted

cash—end of period

$

2,698,678

$

1,780,977

$

2,698,678

$

1,780,977

Snowflake Inc.

GAAP to Non-GAAP

Reconciliations

(in thousands, except per

share data and percentages)

(unaudited)

Three Months Ended January

31,

Twelve Months Ended January

31,

2025

2024

2025

2024

Amount

Amount as a

% of Revenue

Amount

Amount as a

% of Revenue

Amount

Amount as a

% of Revenue

Amount

Amount as a

% of Revenue

Revenue:

Product revenue

$

943,303

96%

$

738,090

95%

$

3,462,422

95%

$

2,666,849

95%

Professional services and other

revenue

43,467

4%

36,609

5%

163,974

5%

139,640

5%

Revenue

$

986,770

100%

$

774,699

100%

$

3,626,396

100%

$

2,806,489

100%

Year-over-year growth

27

%

32

%

29

%

36

%

Cost of revenue:

GAAP cost of product revenue

$

273,208

$

192,776

$

992,069

$

701,200

Adjustments:

Stock-based compensation-related

charges

(33,541

)

(20,928

)

(122,794

)

(78,900

)

Amortization of acquired intangibles

(11,670

)

(9,760

)

(42,478

)

(31,403

)

Restructuring charges(1)

—

—

(7,678

)

—

Non-GAAP cost of product revenue

$

227,997

$

162,088

$

819,119

$

590,897

GAAP cost of professional services and

other revenue

$

59,976

$

49,028

$

222,604

$

197,358

Adjustments:

Stock-based compensation-related

charges

(15,753

)

(13,380

)

(57,424

)

(58,231

)

Amortization of acquired intangibles

(1,662

)

(1,663

)

(6,614

)

(6,434

)

Non-GAAP cost of professional services and

other revenue

$

42,561

$

33,985

$

158,566

$

132,693

GAAP cost of revenue

$

333,184

34%

$

241,804

31%

$

1,214,673

33%

$

898,558

32%

Adjustments:

Stock-based compensation-related

charges

(49,294

)

(34,308

)

(180,218

)

(137,131

)

Amortization of acquired intangibles

(13,332

)

(11,423

)

(49,092

)

(37,837

)

Restructuring charges(1)

—

—

(7,678

)

—

Non-GAAP cost of revenue

$

270,558

27%

$

196,073

25%

$

977,685

27%

$

723,590

26%

Gross profit (loss):

GAAP product gross profit

$

670,095

$

545,314

$

2,470,353

$

1,965,649

Adjustments:

Stock-based compensation-related

charges

33,541

20,928

122,794

78,900

Amortization of acquired intangibles

11,670

9,760

42,478

31,403

Restructuring charges(1)

—

—

7,678

—

Non-GAAP product gross profit

$

715,306

$

576,002

$

2,643,303

$

2,075,952

GAAP professional services and other

revenue gross loss

$

(16,509

)

$

(12,419

)

$

(58,630

)

$

(57,718

)

Adjustments:

Stock-based compensation-related

charges

15,753

13,380

57,424

58,231

Amortization of acquired intangibles

1,662

1,663

6,614

6,434

Non-GAAP professional services and other

revenue gross profit

$

906

$

2,624

$

5,408

$

6,947

GAAP gross profit

$

653,586

66%

$

532,895

69%

$

2,411,723

67%

$

1,907,931

68%

Adjustments:

Stock-based compensation-related

charges

49,294

34,308

180,218

137,131

Amortization of acquired intangibles

13,332

11,423

49,092

37,837

Restructuring charges(1)

—

—

7,678

—

Non-GAAP gross profit

$

716,212

73%

$

578,626

75%

$

2,648,711

73%

$

2,082,899

74%

Gross margin:

GAAP product gross margin

71

%

74

%

71

%

74

%

Adjustments:

Stock-based compensation-related charges

as a % of product revenue

4

%

3

%

4

%

3

%

Amortization of acquired intangibles as a

% of product revenue

1

%

1

%

1

%

1

%

Restructuring charges as a % of product

revenue

—

%

—

%

—

%

—

%

Non-GAAP product gross margin

76

%

78

%

76

%

78

%

GAAP professional services and other

revenue gross margin

(38

%)

(34

%)

(36

%)

(41

%)

Adjustments:

Stock-based compensation-related charges

as a % of professional services and other revenue

36

%

36

%

35

%

41

%

Amortization of acquired intangibles as a

% of professional services and other revenue

4

%

5

%

4

%

5

%

Non-GAAP professional services and other

revenue gross margin

2

%

7

%

3

%

5

%

GAAP gross margin

66

%

69

%

67

%

68

%

Adjustments:

Stock-based compensation-related charges

as a % of revenue

6

%

5

%

5

%

5

%

Amortization of acquired intangibles as a

% of revenue

1

%

1

%

1

%

1

%

Restructuring charges as a % of

revenue

—

%

—

%

—

%

—

%

Non-GAAP gross margin

73

%

75

%

73

%

74

%

Operating expenses:

GAAP sales and marketing expense

$

432,683

44%

$

361,822

47%

$

1,672,092

46%

$

1,391,747

50%

Adjustments:

Stock-based compensation-related

charges

(95,718

)

(77,121

)

(349,529

)

(319,979

)

Amortization of acquired intangibles

(8,021

)

(7,800

)

(31,358

)

(30,235

)

Non-GAAP sales and marketing expense

$

328,944

33%

$

276,901

36%

$

1,291,205

36%

$

1,041,533

37%

GAAP research and development expense

$

492,490

50%

$

364,476

47%

$

1,783,379

49%

$

1,287,949

46%

Adjustments:

Stock-based compensation-related

charges

(256,850

)

(181,059

)

(874,765

)

(663,471

)

Amortization of acquired intangibles

(3,679

)

(3,682

)

(14,638

)

(12,384

)

Restructuring charges(1)

(1,151

)

—

(11,014

)

—

Non-GAAP research and development

expense

$

230,810

24%

$

179,735

23%

$

882,962

24%

$

612,094

22%

GAAP general and administrative

expense

$

115,091

11%

$

82,102

11%

$

412,262

12%

$

323,008

11%

Adjustments:

Stock-based compensation-related

charges

(47,260

)

(27,816

)

(159,781

)

(108,942

)

Amortization of acquired intangibles

(451

)

(451

)

(1,794

)

(1,789

)

Expenses associated with acquisitions and

strategic investments

(3,006

)

(2,811

)

(7,105

)

(12,715

)

Restructuring charges(1)

(761

)

—

(761

)

—

Non-GAAP general and administrative

expense

$

63,613

7%

$

51,024

7%

$

242,821

7%

$

199,562

7%

GAAP total operating expenses

$

1,040,264

105%

$

808,400

105%

$

3,867,733

107%

$

3,002,704

107%

Adjustments:

Stock-based compensation-related

charges

(399,828

)

(285,996

)

(1,384,075

)

(1,092,392

)

Amortization of acquired intangibles

(12,151

)

(11,933

)

(47,790

)

(44,408

)

Expenses associated with acquisitions and

strategic investments

(3,006

)

(2,811

)

(7,105

)

(12,715

)

Restructuring charges(1)

(1,912

)

—

(11,775

)

—

Non-GAAP total operating expenses

$

623,367

64%

$

507,660

66%

$

2,416,988

67%

$

1,853,189

66%

Operating income (loss):

GAAP operating loss

$

(386,678

)

(39%)

$

(275,505

)

(36%)

$

(1,456,010

)

(40%)

$

(1,094,773

)

(39%)

Adjustments:

Stock-based compensation-related

charges(2)

449,122

320,304

1,564,293

1,229,523

Amortization of acquired intangibles

25,483

23,356

96,882

82,245

Expenses associated with acquisitions and

strategic investments

3,006

2,811

7,105

12,715

Restructuring charges(1)

1,912

—

19,453

—

Non-GAAP operating income

$

92,845

9%

$

70,966

9%

$

231,723

6%

$

229,710

8%

Operating margin:

GAAP operating margin

(39

%)

(36

%)

(40

%)

(39

%)

Adjustments:

Stock-based compensation-related charges

as a % of revenue

45

%

42

%

42

%

44

%

Amortization of acquired intangibles as a

% of revenue

3

%

3

%

3

%

3

%

Expenses associated with acquisitions and

strategic investments as a % of revenue

—

%

—

%

—

%

—

%

Restructuring charges as a % of

revenue

—

%

—

%

1

%

—

%

Non-GAAP operating margin

9

%

9

%

6

%

8

%

Net income (loss):

GAAP net loss

$

(325,724

)

(33%)

$

(169,912

)

(22%)

$

(1,289,212

)

(36%)

$

(837,990

)

(30%)

Adjustments:

Stock-based compensation-related

charges(2)

449,122

320,304

1,564,293

1,229,523

Amortization of acquired intangibles

25,483

23,356

96,882

82,245

Expenses associated with acquisitions and

strategic investments

3,006

2,811

7,105

12,715

Restructuring charges(1)

1,912

—

19,453

—

Amortization of debt issuance costs

2,070

—

2,759

—

Income tax effect related to the above

adjustments and acquisitions

(43,731

)

(49,087

)

(101,289

)

(134,801

)

Non-GAAP net income

$

112,138

11%

$

127,472

16%

$

299,991

8%

$

351,692

13%

Net income (loss) attributable to

Snowflake Inc.:

GAAP net loss attributable to Snowflake

Inc.

$

(327,474

)

(33%)

$

(169,352

)

(22%)

$

(1,285,640

)

(36%)

$

(836,097

)

(30%)

Adjustments:

Stock-based compensation-related

charges(2)

449,122

320,304

1,564,293

1,229,523

Amortization of acquired intangibles

25,483

23,356

96,882

82,245

Expenses associated with acquisitions and

strategic investments

3,006

2,811

7,105

12,715

Restructuring charges(1)

1,912

—

19,453

—

Amortization of debt issuance costs

2,070

—

2,759

—

Income tax effect related to the above

adjustments and acquisitions

(43,731

)

(49,087

)

(101,289

)

(134,801

)

Adjustments attributable to noncontrolling

interest, net of tax

1,727

(62

)

(2,222

)

(236

)

Non-GAAP net income attributable to

Snowflake Inc.

$

112,115

11%

$

127,970

17%

$

301,341

8%

$

353,349

13%

Net income (loss) per share

attributable to Snowflake Inc. common stockholders—basic and

diluted:

GAAP net loss per share attributable to

Snowflake Inc. common stockholders—basic and diluted

$

(0.99

)

$

(0.51

)

$

(3.86

)

$

(2.55

)

Weighted-average shares used in computing

GAAP net loss per share attributable to Snowflake Inc. common

stockholders—basic and diluted

331,432

331,079

332,707

328,001

Non-GAAP net income per share attributable

to Snowflake Inc. common stockholders—basic

$

0.34

$

0.39

$

0.90

$

1.08

Weighted-average shares used in computing

non-GAAP net income per share attributable to Snowflake Inc. common

stockholders—basic

331,432

331,079

332,707

328,001

Non-GAAP net income per share attributable

to Snowflake Inc. common stockholders—diluted

$

0.30

$

0.35

$

0.83

$

0.98

GAAP weighted-average shares used in

computing GAAP net loss per share attributable to Snowflake Inc.

common stockholders—basic and diluted

331,432

331,079

332,707

328,001

Add: Effect of potentially dilutive common

stock equivalents

24,819

32,678

25,600

34,063

Add: Effect of convertible senior notes,

net of antidilutive impact of capped call transactions

14,432

—

5,067

—

Non-GAAP weighted-average shares used in

computing non-GAAP net income per share attributable to Snowflake

Inc. common stockholders—diluted(3)

370,683

363,757

363,374

362,064

Free cash flow and adjusted free cash

flow:

GAAP net cash provided by operating

activities

$

432,725

44%

$

344,580

44%

$

959,764

26%

$

848,122

30%

Adjustments:

Purchases of property and equipment

(11,277

)

(13,072

)

(46,279

)

(35,086

)

Capitalized internal-use software

development costs

(6,005

)

(7,029

)

(29,433

)

(34,133

)

Non-GAAP free cash flow

415,443

42%

324,479

42%

884,052

24%

778,903

28%

Adjustments:

Net cash paid (received) on payroll

tax-related items on employee stock transactions(4)

7,644

(182

)

57,474

31,282

Non-GAAP adjusted free cash flow

$

423,087

43%

$

324,297

42%

$

941,526

26%

$

810,185

29%

Non-GAAP free cash flow margin

42

%

42

%

24

%

28

%

Non-GAAP adjusted free cash flow

margin

43

%

42

%

26

%

29

%

GAAP net cash provided by investing

activities

$

224,888

$

522,569

$

190,646

$

832,258

GAAP net cash used in financing

activities

$

(120,118

)

$

(88,631

)

$

(226,523

)

$

(854,103

)

(1) Restructuring charges relate

to certain costs incurred by us during the three and twelve months

ended January 31, 2025 in connection with a restructuring plan for

a majority-owned subsidiary.

(2) Stock-based

compensation-related charges included employer payroll tax-related

expenses on employee stock transactions of approximately $11.1

million and $51.9 million for the three and twelve months ended

January 31, 2025, respectively, and $11.0 million and $45.5 million

for the three and twelve months ended January 31, 2024,

respectively.

(3) For the periods in which we

had non-GAAP net income, the non-GAAP weighted-average shares used

in computing non-GAAP net income per share attributable to

Snowflake Inc. common stockholders—diluted included (a) the effect

of all potentially dilutive common stock equivalents (stock

options, restricted stock units, and employee stock purchase rights

under our 2020 Employee Stock Purchase Plan) and (b) the potential

dilutive effect of shares issuable upon conversion of the Notes

using the if-converted method, starting from the issuance date of

the Notes. The Capped Calls entered into in connection with the

Notes had no material antidilutive impact for any of the historical

periods presented. The potential dilutive effect of outstanding

restricted stock units with performance conditions not yet

satisfied is included in the non-GAAP weighted-average number of

diluted shares at forecasted attainment levels to the extent we

believe it is probable that the performance conditions will be

met.

(4) The amounts for the three and

twelve months ended January 31, 2025 do not include employee

payroll taxes of $129.5 million and $489.1 million, respectively,

and the amounts for the three and twelve months ended January 31,

2024 do not include employee payroll taxes of $107.0 million and

$380.8 million, respectively, related to net share settlement of

employee restricted stock units, which were reflected as cash

outflows for financing activities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226670487/en/

Investor Contact Jimmy Sexton IR@snowflake.com

Press Contact Eszter Szikora Press@snowflake.com

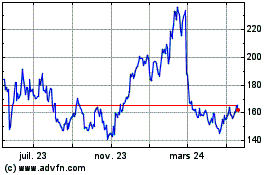

Snowflake (NYSE:SNOW)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

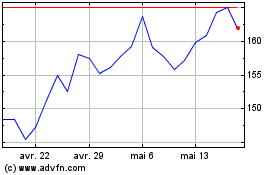

Snowflake (NYSE:SNOW)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025