Team, Inc. Announces Commitment for Refinancing of Capital Structure

25 Mai 2023 - 12:00PM

Team, Inc. (NYSE: TISI) (“TEAM” or the “Company”),

a global, leading provider of specialty industrial services

offering clients access to a full suite of conventional,

specialized, and proprietary mechanical, heat-treating, and

inspection services, today announced that it has secured committed

financing from two of its largest current stakeholders for a series

of transactions that, once completed, are expected to significantly

improve its capital structure and extend maturities.

TEAM entered into a commitment letter (the

“Corre Commitment Letter”) with Corre Management Partners, LLC

(“Corre”) for a new $57.5 million, 12% senior secured first lien

term loan maturing in December 2026 and comprised of a $37.5

million term loan tranche and a $20 million delayed draw term loan

tranche (the “Corre Secured Term Loan”), subject to certain closing

conditions. The Corre Commitment Letter also provides that Corre’s

existing subordinated term loan will become secured on a pari passu

basis to the Corre Secured Term Loan. TEAM expects to use the

proceeds from the Corre Secured Term Loan to repay in full TEAM’s

remaining $41 million of Convertible Notes due August 2023 and for

general corporate purposes.

TEAM also entered into a commitment letter with

Eclipse Business Capital LLC (the “Eclipse Commitment Letter”) for

a new $27.4 million term loan secured by certain real estate and

machinery and equipment of the Company (the “Eclipse Term Loan”),

subject to certain closing conditions, and with a maturity date

coterminous with the Company’s existing revolving credit facility.

The Eclipse Commitment Letter also provides for an amendment to the

existing revolving credit facility to extend the maturity date of

the revolving credit facility (and therefore the proposed Eclipse

Term Loan) to August 2025, and to increase availability under the

revolving credit facility by an additional $2.5 million. TEAM

expects to use the proceeds from the Eclipse Term Loan, together

with advances under the Company’s revolving credit facility to

repay in full the Company’s existing senior secured term loan with

Atlantic Park Strategic Capital Fund, L.P.

The closing of the term loan facilities and

related amendments to existing credit facilities is expected to

occur in the second quarter of 2023 and is subject to the

negotiation of definitive documentation and the satisfaction of

customary conditions prior to closing.

“Addressing our capital structure has been one

of our top priorities in our ongoing program to improve liquidity

and strengthen TEAM’s balance sheet,” said Keith D. Tucker, TEAM’s

Chief Executive Officer. “A key step in that process was securing a

refinancing solution for our $41 million of convertible notes

maturing in August of 2023. We are very pleased to announce

committed financing that provides $87.4 million in funding,

allowing for the payoff of our convertible notes and our existing

$36 million senior secured term loan, while also extending our next

debt maturity to August 2025. Once completed, we believe these

transactions should remediate the conditions that led to the going

concern disclosure in our 2022 fiscal year end annual report and

our most recent quarterly report and provide the runway to continue

successfully implementing our turnaround plan designed to further

lower our cost structure and improve profitability and cash

flow.”

Kirkland & Ellis LLP and Evercore

Partners Inc. are advising TEAM in connection with these

transactions.

About Team, Inc.

Headquartered in Sugar Land, Texas, Team, Inc.

(NYSE: TISI) is a global, leading provider of specialty industrial

services offering clients access to a full suite of conventional,

specialized, and proprietary mechanical, heat-treating, and

inspection services. We deploy conventional to highly specialized

inspection, condition assessment, maintenance, and repair services

that result in greater safety, reliability, and operational

efficiency for our client’s most critical assets. Through locations

in more than 20 countries, we unite the delivery of technological

innovation with over a century of progressive, yet proven integrity

and reliability management expertise to fuel a better tomorrow. For

more information, please visit www.teaminc.com.

Forward Looking Statements

Certain forward-looking information contained

herein is being provided in accordance with the provisions of the

Private Securities Litigation Reform Act of 1995. We have made

reasonable efforts to ensure that the information, assumptions, and

beliefs upon which this forward-looking information is based are

current, reasonable, and complete. However, such forward-looking

statements involve estimates, assumptions, judgments, and

uncertainties. They include but are not limited to statements

regarding the Company’s financial prospects, the implementation of

cost saving measures and the Company’s ability to remediate the

conditions that led to the going concern disclosure in the

Company’s recent public filings. There are known and unknown

factors that could cause actual results or outcomes to differ

materially from those addressed in the forward-looking information.

Although it is not possible to identify all of these factors, they

include, among others, the duration and magnitude of accidents,

extreme weather, natural disasters, and pandemics (such as

COVID-19) and related economic effects, the Company’s liquidity and

ability to obtain additional financing (including the ability to

complete the transactions contemplated by the Corre Commitment

Letter and the Eclipse Commitment Letter), the Company’s ability to

continue as a going concern, the Company’s ability to execute on

its cost management actions, the impact of new or changes to

existing governmental laws and regulations and their application,

including tariffs; the outcome of tax examinations, changes in tax

laws, and other tax matters; foreign currency exchange rate and

interest rate fluctuations; the Company’s ability to successfully

divest assets on terms that are favorable to the Company; our

ability to repay, refinance or restructure our debt and the debt of

certain of our subsidiaries; anticipated or expected purchases or

sales of assets; the Company’s continued listing on the New York

Stock Exchange, and such known factors as are detailed in the

Company’s Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K, each as filed with the

Securities and Exchange Commission, and in other reports filed by

the Company with the Securities and Exchange Commission from time

to time. Accordingly, there can be no assurance that the

forward-looking information contained herein, including statement

regarding the Company’s financial prospects and the implementation

of cost saving measures, will occur or that objectives will be

achieved. We assume no obligation to publicly update or revise any

forward-looking statements made today or any other forward-looking

statements made by the Company, whether as a result of new

information, future events or otherwise, except as may be required

by law.

Contact:Nelson M. HaightExecutive Vice

President, Chief Financial Officer(281) 388-5521

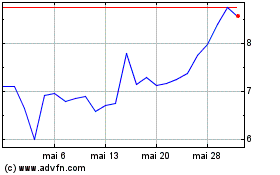

Team (NYSE:TISI)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Team (NYSE:TISI)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024