Targa Resources Corp. (NYSE: TRGP) (“TRGP,” the “Company” or

“Targa”) today reported third quarter 2024 results.

Third quarter 2024 net income attributable to

Targa Resources Corp. was $387.4 million compared to $220.0 million

for the third quarter of 2023. The Company reported adjusted

earnings before interest, income taxes, depreciation and

amortization, and other non-cash items (“adjusted EBITDA”)(1) of

$1,069.7 million for the third quarter of 2024 compared to $840.2

million for the third quarter of 2023.

Highlights

- Record adjusted EBITDA for the third quarter of $1.07

billion

- Record Permian, NGL transportation, and fractionation volumes

during the third quarter

- Completed its Daytona NGL Pipeline expansion during the third

quarter

- Repurchased approximately $168 million of common stock during

the third quarter, and $647 million for the nine months ended

September 30, 2024 at a weighted average price of $121.50

- Estimate full year 2024 adjusted EBITDA to be above the top end

of $3.95 billion to $4.05 billion range

- In August and October, upgraded by Fitch to BBB and by Moody’s

to Baa2

- In October, commenced operations at its new 275 million cubic

feet per day (“MMcf/d”) Greenwood II plant in Permian Midland and

its new 120 thousand barrels per day (“MBbl/d”) Train 10

fractionator in Mont Belvieu

- Announced two new 275 MMcf/d gas plants in the Permian

- Expect to recommend to Targa’s Board of Directors an annual

common dividend per share of $4.00 in 2025, a 33% increase to

2024

On October 10, 2024, the Company declared a

quarterly cash dividend of $0.75 per common share, or $3.00 per

common share on an annualized basis, for the third quarter of 2024.

Total cash dividends of approximately $164 million will be paid on

November 15, 2024 on all outstanding shares of common stock to

holders of record as of the close of business on October 31,

2024.

Targa repurchased 1,150,107 shares of its common

stock during the third quarter of 2024 at a weighted average per

share price of $146.02 for a total net cost of $167.9 million. As

of September 30, 2024, there was $1.1 billion remaining under the

Company’s Share Repurchase Programs.

Third Quarter 2024 - Sequential Quarter

over Quarter Commentary

Targa reported record third quarter adjusted

EBITDA of $1,069.7 million, representing a 9 percent increase

compared to the second quarter of 2024. The sequential increase in

adjusted EBITDA was attributable to higher volumes across Targa’s

Gathering and Processing (“G&P”) and Logistics and

Transportation (“L&T”) systems. In the G&P segment, higher

sequential adjusted operating margin was attributable to record

Permian natural gas inlet volumes, higher Badlands crude volumes,

and higher fees. In the L&T segment, record NGL pipeline

transportation and fractionation volumes, higher marketing margin

and higher LPG export volumes drove the sequential increase in

segment adjusted operating margin. Increasing NGL pipeline

transportation and fractionation volumes were attributable to

higher supply volumes from Targa’s Permian G&P systems and the

start-up of Targa’s Daytona NGL Pipeline. Marketing margin

increased due to greater optimization opportunities and higher LPG

export volumes benefited from improved market conditions. Higher

segment operating expenses were attributable to higher system

volumes and expansions.

Capitalization and

Liquidity

The Company’s total consolidated debt as of

September 30, 2024 was $14,254.7 million, net of $91.6 million

of debt issuance costs and $29.7 million of unamortized discount,

with $12,534.4 million of outstanding senior notes, $951.0 million

outstanding under the Commercial Paper Program, $600.0 million

outstanding under the Securitization Facility, and $290.6 million

of finance lease liabilities.

Total consolidated liquidity as of

September 30, 2024 was approximately $1.9 billion, including

$1.8 billion available under the TRGP Revolver and $127.2 million

of cash.

Financing Update

In August 2024, Targa completed an underwritten

public offering of $1.0 billion aggregate principal amount of its

5.500% Senior Notes due 2035 (the “5.500% Notes”), resulting in net

proceeds of approximately $990.1 million. Targa used the net

proceeds from the issuance to repay borrowings under the Commercial

Paper Program, a portion of which were incurred to repay the

remaining balance under the Term Loan Facility, and for general

corporate purposes.

In August 2024, the Partnership amended its

$600.0 million accounts receivable securitization facility (the

“Securitization Facility”) to extend the termination date of the

Securitization Facility to August 29, 2025.

In August 2024, Fitch Ratings Inc. (“Fitch”)

upgraded the Company’s corporate investment grade credit rating to

‘BBB’ from ‘BBB-’. In October 2024, Moody’s Ratings (“Moody’s”)

upgraded the Company’s corporate investment grade credit rating to

‘Baa2’ from ‘Baa3’.

Growth Projects Update

In the third quarter of 2024, Targa commenced

operations on its Daytona NGL Pipeline ahead of schedule and

under-budget. In October 2024, Targa commenced operations at its

new 275 MMcf/d Greenwood II plant in Permian Midland and its new

120 MBbl/d Train 10 fractionator in Mont Belvieu. Targa expects to

complete the reactivation of Gulf Coast Fractionators (“GCF”) in

Mont Belvieu in November 2024. In its G&P segment, construction

continues on Targa’s 275 MMcf/d Pembrook II and East Pembrook

plants in Permian Midland and its 275 MMcf/d Bull Moose and Bull

Moose II plants in Permian Delaware. In its L&T segment,

construction continues on Targa’s 150 MBbl/d Train 11 fractionator

in Mont Belvieu. Targa now expects to complete its East Pembrook

plant ahead of schedule in the second quarter of 2026 and remains

on-track to complete its other expansions as previously

disclosed.

In November 2024, in response to increasing

production and to meet the infrastructure needs of its customers,

Targa announced the construction of a new 275 MMcf/d cryogenic

natural gas processing plant in Permian Delaware (the “Falcon II

plant”) and a new 275 MMcf/d cryogenic natural gas processing plant

in Permian Midland (the “East Driver plant”). Falcon II and East

Driver are expected to commence operations in the second and third

quarters of 2026.

2024 and 2025 Outlook

Targa’s adjusted EBITDA and growth capital

projections are trending higher than previously estimated from the

acceleration of spending on infrastructure to handle additional

volume growth. The Company is in the middle of its planning

process, and consistent with previous years, Targa plans to detail

its full year 2025 operational and financial outlook in February

2025 in conjunction with its fourth quarter 2024 earnings

announcement. For 2024, the Company estimates full year adjusted

EBITDA to be above the top end of its $3.95 billion to $4.05

billion range. Targa continues to anticipate a meaningful

inflection in 2025 adjusted free cash flow generation relative to

2024.

Capital Allocation Update

For the first quarter of 2025, Management

intends to recommend to Targa’s Board of Directors an increase to

its common dividend to $1.00 per common share or $4.00 per common

share annualized. The recommended common dividend per share

increase, if approved, would be effective for the first quarter of

2025 and payable in May 2025. Beyond 2025, Targa expects to be in

position to continue to provide meaningful annual increases to its

common dividend. For the nine months ended September 30, 2024,

Targa has repurchased 5,322,367 shares of common stock at a

weighted average per share price of $121.50 for a total net cost of

$646.7 million. Targa expects to continue to be in position to

opportunistically repurchase its stock going forward with

approximately $1.1 billion remaining under its common Share

Repurchase Programs.

An earnings supplement presentation and updated

investor presentation are available under Events and Presentations

in the Investors section of the Company’s website at

www.targaresources.com/investors/events.

Conference Call

The Company will host a conference call for the

investment community at 11:00 a.m. Eastern time (10:00 a.m. Central

time) on November 5, 2024 to discuss its third quarter results. The

conference call can be accessed via webcast under Events and

Presentations in the Investors section of the Company’s website at

www.targaresources.com/investors/events, or by going directly to

https://edge.media-server.com/mmc/p/yf8cw4hf/. A webcast replay

will be available at the link above approximately two hours after

the conclusion of the event.

(1) Adjusted EBITDA is a non-GAAP financial

measure and is discussed under “Non-GAAP Financial Measures.”

Targa Resources Corp. – Consolidated

Financial Results of Operations

| |

| |

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

|

|

|

| |

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

| |

(In millions) |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales of commodities |

$ |

3,217.0 |

|

|

$ |

3,374.3 |

|

|

$ |

(157.3 |

) |

|

|

(5 |

%) |

|

$ |

10,126.2 |

|

|

$ |

10,314.0 |

|

|

$ |

(187.8 |

) |

|

(2 |

%) |

|

Fees from midstream services |

|

634.8 |

|

|

|

522.3 |

|

|

|

112.5 |

|

|

|

22 |

% |

|

|

1,850.0 |

|

|

|

1,506.8 |

|

|

|

343.2 |

|

|

23 |

% |

|

Total revenues |

|

3,851.8 |

|

|

|

3,896.6 |

|

|

|

(44.8 |

) |

|

|

(1 |

%) |

|

|

11,976.2 |

|

|

|

11,820.8 |

|

|

|

155.4 |

|

|

1 |

% |

| Product purchases and

fuel |

|

2,365.0 |

|

|

|

2,690.0 |

|

|

|

(325.0 |

) |

|

|

(12 |

%) |

|

|

7,780.4 |

|

|

|

7,777.9 |

|

|

|

2.5 |

|

|

— |

|

| Operating expenses |

|

301.0 |

|

|

|

277.7 |

|

|

|

23.3 |

|

|

|

8 |

% |

|

|

869.7 |

|

|

|

808.4 |

|

|

|

61.3 |

|

|

8 |

% |

| Depreciation and amortization

expense |

|

355.4 |

|

|

|

331.3 |

|

|

|

24.1 |

|

|

|

7 |

% |

|

|

1,044.5 |

|

|

|

988.2 |

|

|

|

56.3 |

|

|

6 |

% |

| General and administrative

expense |

|

102.6 |

|

|

|

90.0 |

|

|

|

12.6 |

|

|

|

14 |

% |

|

|

287.4 |

|

|

|

253.4 |

|

|

|

34.0 |

|

|

13 |

% |

| Other operating (income)

expense |

|

(0.4 |

) |

|

|

2.5 |

|

|

|

(2.9 |

) |

|

|

(116 |

%) |

|

|

(0.7 |

) |

|

|

2.0 |

|

|

|

(2.7 |

) |

|

(135 |

%) |

| Income (loss) from

operations |

|

728.2 |

|

|

|

505.1 |

|

|

|

223.1 |

|

|

|

44 |

% |

|

|

1,994.9 |

|

|

|

1,990.9 |

|

|

|

4.0 |

|

|

— |

|

| Interest expense, net |

|

(184.9 |

) |

|

|

(175.1 |

) |

|

|

(9.8 |

) |

|

|

6 |

% |

|

|

(589.5 |

) |

|

|

(509.8 |

) |

|

|

(79.7 |

) |

|

16 |

% |

| Equity earnings (loss) |

|

2.2 |

|

|

|

3.0 |

|

|

|

(0.8 |

) |

|

|

(27 |

%) |

|

|

7.9 |

|

|

|

6.2 |

|

|

|

1.7 |

|

|

27 |

% |

| Gain (loss) from financing

activities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.8 |

) |

|

|

— |

|

|

|

(0.8 |

) |

|

(100 |

%) |

| Other, net |

|

(0.4 |

) |

|

|

(0.1 |

) |

|

|

(0.3 |

) |

|

NM |

|

|

|

1.1 |

|

|

|

(4.9 |

) |

|

|

6.0 |

|

|

122 |

% |

| Income tax (expense)

benefit |

|

(97.0 |

) |

|

|

(53.9 |

) |

|

|

(43.1 |

) |

|

|

80 |

% |

|

|

(274.1 |

) |

|

|

(260.7 |

) |

|

|

(13.4 |

) |

|

5 |

% |

| Net income (loss) |

|

448.1 |

|

|

|

279.0 |

|

|

|

169.1 |

|

|

|

61 |

% |

|

|

1,139.5 |

|

|

|

1,221.7 |

|

|

|

(82.2 |

) |

|

(7 |

%) |

| Less: Net income (loss)

attributable to noncontrolling interests |

|

60.7 |

|

|

|

59.0 |

|

|

|

1.7 |

|

|

|

3 |

% |

|

|

178.5 |

|

|

|

175.4 |

|

|

|

3.1 |

|

|

2 |

% |

| Net income (loss) attributable

to Targa Resources Corp. |

|

387.4 |

|

|

|

220.0 |

|

|

|

167.4 |

|

|

|

76 |

% |

|

|

961.0 |

|

|

|

1,046.3 |

|

|

|

(85.3 |

) |

|

(8 |

%) |

| Premium on repurchase of

noncontrolling interests, net of tax |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

490.7 |

|

|

|

(490.7 |

) |

|

(100 |

%) |

| Net income (loss) attributable

to common shareholders |

$ |

387.4 |

|

|

$ |

220.0 |

|

|

$ |

167.4 |

|

|

|

76 |

% |

|

$ |

961.0 |

|

|

$ |

555.6 |

|

|

$ |

405.4 |

|

|

73 |

% |

| Financial

data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (1) |

$ |

1,069.7 |

|

|

$ |

840.2 |

|

|

$ |

229.5 |

|

|

|

27 |

% |

|

$ |

3,020.3 |

|

|

$ |

2,570.1 |

|

|

$ |

450.2 |

|

|

18 |

% |

| Adjusted cash flow from

operations (1) |

|

884.6 |

|

|

|

667.2 |

|

|

|

217.4 |

|

|

|

33 |

% |

|

|

2,431.7 |

|

|

|

2,060.6 |

|

|

|

371.1 |

|

|

18 |

% |

| Adjusted free cash flow

(1) |

|

124.2 |

|

|

|

8.6 |

|

|

|

115.6 |

|

|

NM |

|

|

|

84.2 |

|

|

|

319.1 |

|

|

|

(234.9 |

) |

|

(74 |

%) |

| _________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Adjusted EBITDA, adjusted cash flow from operations and

adjusted free cash flow are non-GAAP financial measures and are

discussed under “Non-GAAP Financial Measures.” |

| NM

Due to a low denominator, the noted percentage change is

disproportionately high and as a result, considered not

meaningful. |

| |

Three Months Ended September 30, 2024 Compared to Three

Months Ended September 30, 2023

The decrease in commodity sales reflects lower

natural gas and NGL prices ($504.7 million) and the unfavorable

impact of hedges ($49.2 million), partially offset by higher NGL

volumes ($400.0 million).

The increase in fees from midstream services is

primarily due to higher gas gathering and processing fees, higher

transportation fees and higher export volumes, partially offset by

lower fractionation fees.

The decrease in product purchases and fuel

reflects lower natural gas and NGL prices, partially offset by

higher NGL volumes.

The increase in operating expenses is primarily

due to higher labor and maintenance costs as a result of increased

activity and system expansions, partially offset by lower

taxes.

See “—Review of Segment Performance” for

additional information on a segment basis.

The increase in depreciation and amortization

expense is primarily due to the impact of system expansions on the

Company’s asset base that have been placed in service since

September 30, 2023.

The increase in general and administrative

expense is primarily due to higher compensation and benefits.

The increase in interest expense, net, is due to

higher borrowings, partially offset by an increase in capitalized

interest.

The increase in income tax expense is primarily

due to an increase in pre-tax book income.

Nine Months Ended September 30, 2024 Compared to Nine

Months Ended September 30, 2023

Commodity sales are relatively flat reflecting

lower natural gas prices ($1,051.9 million) and the unfavorable

impact of hedges ($559.2 million), offset by higher NGL, natural

gas and condensate volumes ($1,369.1 million), and higher NGL and

condensate prices ($53.9 million).

The increase in fees from midstream services is

primarily due to higher gas gathering and processing fees, higher

transportation fees and higher export volumes.

Product purchases and fuel are relatively flat

reflecting higher NGL and natural gas volumes, offset by lower

natural gas prices.

The increase in operating expenses is primarily

due to higher labor and rental costs as a result of increased

activity and system expansions.

See “—Review of Segment Performance” for

additional information on a segment basis.

The increase in depreciation and amortization

expense is primarily due to the impact of system expansions on the

Company’s asset base that have been placed in service since

September 30, 2023, partially offset by the shortening of

depreciable lives of certain assets that were idled in the second

quarter of 2023 and subsequently shut down in the third quarter of

2023.

The increase in general and administrative

expense is primarily due to higher compensation and benefits.

The increase in interest expense, net, is due to

recognition of cumulative interest on a 2024 legal ruling

associated with the Splitter Agreement and higher borrowings,

partially offset by an increase in capitalized interest.

The increase in income tax expense is primarily

due to the release of state valuation allowance in 2023, partially

offset by a decrease in pre-tax book income.

The premium on repurchase of noncontrolling

interests, net of tax is due to the acquisition of Blackstone

Energy Partners’ 25% interest in the Grand Prix Joint Venture in

2023.

Review of Segment

Performance

The following discussion of segment performance

includes inter-segment activities. The Company views segment

operating margin and adjusted operating margin as important

performance measures of the core profitability of its operations.

These measures are key components of internal financial reporting

and are reviewed for consistency and trend analysis. For a

discussion of adjusted operating margin, see “Non-GAAP Financial

Measures ― Adjusted Operating Margin.” Segment operating financial

results and operating statistics include the effects of

intersegment transactions. These intersegment transactions have

been eliminated from the consolidated presentation.

The Company operates in two primary segments:

(i) Gathering and Processing; and (ii) Logistics and

Transportation.

Gathering and Processing

Segment

The Gathering and Processing segment includes

assets used in the gathering and/or purchase and sale of natural

gas produced from oil and gas wells, removing impurities and

processing this raw natural gas into merchantable natural gas by

extracting NGLs; and assets used for the gathering and terminaling

and/or purchase and sale of crude oil. The Gathering and Processing

segment’s assets are located in the Permian Basin of West Texas and

Southeast New Mexico (including the Midland, Central and Delaware

Basins); the Eagle Ford Shale in South Texas; the Barnett Shale in

North Texas; the Anadarko, Ardmore, and Arkoma Basins in Oklahoma

(including the SCOOP and STACK) and South Central Kansas; the

Williston Basin in North Dakota (including the Bakken and Three

Forks plays); and the onshore and near offshore regions of the

Louisiana Gulf Coast.

The following table provides summary data

regarding results of operations of this segment for the periods

indicated:

| |

| |

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

|

|

|

|

|

| |

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

| |

|

(In millions, except operating statistics and price

amounts) |

|

|

Operating margin |

$ |

|

584.3 |

|

|

$ |

|

505.0 |

|

|

$ |

|

79.3 |

|

|

|

16 |

% |

|

$ |

|

1,713.4 |

|

|

$ |

|

1,545.9 |

|

|

$ |

|

167.5 |

|

|

|

11 |

% |

| Operating expenses |

|

|

203.7 |

|

|

|

|

189.6 |

|

|

|

|

14.1 |

|

|

|

7 |

% |

|

|

|

597.2 |

|

|

|

|

560.8 |

|

|

|

|

36.4 |

|

|

|

6 |

% |

| Adjusted operating margin |

$ |

|

788.0 |

|

|

$ |

|

694.6 |

|

|

$ |

|

93.4 |

|

|

|

13 |

% |

|

$ |

|

2,310.6 |

|

|

$ |

|

2,106.7 |

|

|

$ |

|

203.9 |

|

|

|

10 |

% |

| Operating statistics

(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Plant natural gas inlet,

MMcf/d (2) (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permian Midland (4) |

|

|

3,082.0 |

|

|

|

|

2,566.9 |

|

|

|

|

515.1 |

|

|

|

20 |

% |

|

|

|

2,898.8 |

|

|

|

|

2,474.1 |

|

|

|

|

424.7 |

|

|

|

17 |

% |

|

Permian Delaware |

|

|

2,900.2 |

|

|

|

|

2,485.4 |

|

|

|

|

414.8 |

|

|

|

17 |

% |

|

|

|

2,785.2 |

|

|

|

|

2,513.7 |

|

|

|

|

271.5 |

|

|

|

11 |

% |

|

Total Permian |

|

|

5,982.2 |

|

|

|

|

5,052.3 |

|

|

|

|

929.9 |

|

|

|

18 |

% |

|

|

|

5,684.0 |

|

|

|

|

4,987.8 |

|

|

|

|

696.2 |

|

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SouthTX (5) |

|

|

329.9 |

|

|

|

|

394.4 |

|

|

|

|

(64.5 |

) |

|

|

(16 |

%) |

|

|

|

324.8 |

|

|

|

|

373.9 |

|

|

|

|

(49.1 |

) |

|

|

(13 |

%) |

|

North Texas |

|

|

184.2 |

|

|

|

|

212.0 |

|

|

|

|

(27.8 |

) |

|

|

(13 |

%) |

|

|

|

186.8 |

|

|

|

|

205.2 |

|

|

|

|

(18.4 |

) |

|

|

(9 |

%) |

|

SouthOK (5) |

|

|

348.5 |

|

|

|

|

394.6 |

|

|

|

|

(46.1 |

) |

|

|

(12 |

%) |

|

|

|

355.7 |

|

|

|

|

391.2 |

|

|

|

|

(35.5 |

) |

|

|

(9 |

%) |

|

WestOK |

|

|

215.5 |

|

|

|

|

206.2 |

|

|

|

|

9.3 |

|

|

|

5 |

% |

|

|

|

213.6 |

|

|

|

|

207.1 |

|

|

|

|

6.5 |

|

|

|

3 |

% |

|

Total Central |

|

|

1,078.1 |

|

|

|

|

1,207.2 |

|

|

|

|

(129.1 |

) |

|

|

(11 |

%) |

|

|

|

1,080.9 |

|

|

|

|

1,177.4 |

|

|

|

|

(96.5 |

) |

|

|

(8 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Badlands (5) (6) |

|

|

145.4 |

|

|

|

|

128.3 |

|

|

|

|

17.1 |

|

|

|

13 |

% |

|

|

|

138.8 |

|

|

|

|

129.6 |

|

|

|

|

9.2 |

|

|

|

7 |

% |

|

Total Field |

|

|

7,205.7 |

|

|

|

|

6,387.8 |

|

|

|

|

817.9 |

|

|

|

13 |

% |

|

|

|

6,903.7 |

|

|

|

|

6,294.8 |

|

|

|

|

608.9 |

|

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coastal |

|

|

402.1 |

|

|

|

|

535.6 |

|

|

|

|

(133.5 |

) |

|

|

(25 |

%) |

|

|

|

464.3 |

|

|

|

|

532.4 |

|

|

|

|

(68.1 |

) |

|

|

(13 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

7,607.8 |

|

|

|

|

6,923.4 |

|

|

|

|

684.4 |

|

|

|

10 |

% |

|

|

|

7,368.0 |

|

|

|

|

6,827.2 |

|

|

|

|

540.8 |

|

|

|

8 |

% |

| NGL production, MBbl/d

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permian Midland (4) |

|

|

450.6 |

|

|

|

|

373.1 |

|

|

|

|

77.5 |

|

|

|

21 |

% |

|

|

|

422.6 |

|

|

|

|

357.4 |

|

|

|

|

65.2 |

|

|

|

18 |

% |

|

Permian Delaware |

|

|

377.4 |

|

|

|

|

322.5 |

|

|

|

|

54.9 |

|

|

|

17 |

% |

|

|

|

349.7 |

|

|

|

|

325.3 |

|

|

|

|

24.4 |

|

|

|

8 |

% |

|

Total Permian |

|

|

828.0 |

|

|

|

|

695.6 |

|

|

|

|

132.4 |

|

|

|

19 |

% |

|

|

|

772.3 |

|

|

|

|

682.7 |

|

|

|

|

89.6 |

|

|

|

13 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SouthTX (5) |

|

|

30.6 |

|

|

|

|

42.3 |

|

|

|

|

(11.7 |

) |

|

|

(28 |

%) |

|

|

|

33.9 |

|

|

|

|

42.1 |

|

|

|

|

(8.2 |

) |

|

|

(19 |

%) |

|

North Texas |

|

|

22.0 |

|

|

|

|

24.2 |

|

|

|

|

(2.2 |

) |

|

|

(9 |

%) |

|

|

|

22.5 |

|

|

|

|

23.8 |

|

|

|

|

(1.3 |

) |

|

|

(5 |

%) |

|

SouthOK (5) |

|

|

28.4 |

|

|

|

|

46.4 |

|

|

|

|

(18.0 |

) |

|

|

(39 |

%) |

|

|

|

33.3 |

|

|

|

|

44.2 |

|

|

|

|

(10.9 |

) |

|

|

(25 |

%) |

|

WestOK |

|

|

17.0 |

|

|

|

|

12.3 |

|

|

|

|

4.7 |

|

|

|

38 |

% |

|

|

|

14.7 |

|

|

|

|

12.6 |

|

|

|

|

2.1 |

|

|

|

17 |

% |

|

Total Central |

|

|

98.0 |

|

|

|

|

125.2 |

|

|

|

|

(27.2 |

) |

|

|

(22 |

%) |

|

|

|

104.4 |

|

|

|

|

122.7 |

|

|

|

|

(18.3 |

) |

|

|

(15 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Badlands (5) |

|

|

18.3 |

|

|

|

|

15.5 |

|

|

|

|

2.8 |

|

|

|

18 |

% |

|

|

|

17.0 |

|

|

|

|

15.5 |

|

|

|

|

1.5 |

|

|

|

10 |

% |

|

Total Field |

|

|

944.3 |

|

|

|

|

836.3 |

|

|

|

|

108.0 |

|

|

|

13 |

% |

|

|

|

893.7 |

|

|

|

|

820.9 |

|

|

|

|

72.8 |

|

|

|

9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coastal |

|

|

33.9 |

|

|

|

|

40.6 |

|

|

|

|

(6.7 |

) |

|

|

(17 |

%) |

|

|

|

35.8 |

|

|

|

|

37.9 |

|

|

|

|

(2.1 |

) |

|

|

(6 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

978.2 |

|

|

|

|

876.9 |

|

|

|

|

101.3 |

|

|

|

12 |

% |

|

|

|

929.5 |

|

|

|

|

858.8 |

|

|

|

|

70.7 |

|

|

|

8 |

% |

| Crude oil, Badlands,

MBbl/d |

|

|

122.4 |

|

|

|

|

101.6 |

|

|

|

|

20.8 |

|

|

|

20 |

% |

|

|

|

105.4 |

|

|

|

|

105.6 |

|

|

|

|

(0.2 |

) |

|

|

— |

|

| Crude oil, Permian,

MBbl/d |

|

|

26.7 |

|

|

|

|

27.2 |

|

|

|

|

(0.5 |

) |

|

|

(2 |

%) |

|

|

|

27.4 |

|

|

|

|

27.4 |

|

|

|

|

— |

|

|

|

— |

|

| Natural gas sales, BBtu/d

(3) |

|

|

2,842.9 |

|

|

|

|

2,758.2 |

|

|

|

|

84.7 |

|

|

|

3 |

% |

|

|

|

2,779.2 |

|

|

|

|

2,668.4 |

|

|

|

|

110.8 |

|

|

|

4 |

% |

| NGL sales, MBbl/d (3) |

|

|

581.5 |

|

|

|

|

508.8 |

|

|

|

|

72.7 |

|

|

|

14 |

% |

|

|

|

550.1 |

|

|

|

|

487.4 |

|

|

|

|

62.7 |

|

|

|

13 |

% |

| Condensate sales, MBbl/d |

|

|

17.3 |

|

|

|

|

17.0 |

|

|

|

|

0.3 |

|

|

|

2 |

% |

|

|

|

19.2 |

|

|

|

|

18.7 |

|

|

|

|

0.5 |

|

|

|

3 |

% |

| Average realized

prices (7): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Natural gas, $/MMBtu |

|

|

0.09 |

|

|

|

|

2.03 |

|

|

|

|

(1.94 |

) |

|

|

(96 |

%) |

|

|

|

0.54 |

|

|

|

|

1.97 |

|

|

|

|

(1.43 |

) |

|

|

(73 |

%) |

| NGL, $/gal |

|

|

0.44 |

|

|

|

|

0.46 |

|

|

|

|

(0.02 |

) |

|

|

(4 |

%) |

|

|

|

0.45 |

|

|

|

|

0.46 |

|

|

|

|

(0.01 |

) |

|

|

(2 |

%) |

| Condensate, $/Bbl |

|

|

77.20 |

|

|

|

|

70.07 |

|

|

|

|

7.13 |

|

|

|

10 |

% |

|

|

|

75.60 |

|

|

|

|

74.20 |

|

|

|

|

1.40 |

|

|

|

2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Segment

operating statistics include the effect of intersegment amounts,

which have been eliminated from the consolidated presentation. For

all volume statistics presented, the numerator is the total volume

sold during the period and the denominator is the number of

calendar days during the period. |

| (2) Plant natural

gas inlet represents the Company’s undivided interest in the volume

of natural gas passing through the meter located at the inlet of a

natural gas processing plant, other than Badlands. |

| (3) Plant natural

gas inlet volumes and gross NGL production volumes include producer

take-in-kind volumes, while natural gas sales and NGL sales exclude

producer take-in-kind volumes. |

| (4) Permian

Midland includes operations in WestTX, of which the Company owns a

72.8% undivided interest, and other plants that are owned 100% by

the Company. Operating results for the WestTX undivided interest

assets are presented on a pro-rata net basis in the Company’s

reported financials. |

| (5) Operations

include facilities that are not wholly owned by the Company. |

| (6) Badlands

natural gas inlet represents the total wellhead volume and includes

the Targa volumes processed at the Little Missouri 4 plant. |

| (7) Average

realized prices, net of fees, include the effect of realized

commodity hedge gain/loss attributable to the Company’s equity

volumes. The price is calculated using total commodity sales plus

the hedge gain/loss as the numerator and total sales volume as the

denominator, net of fees. |

| |

The following table presents the realized

commodity hedge gain (loss) attributable to the Company’s equity

volumes that are included in the adjusted operating margin of the

Gathering and Processing segment:

| |

|

Three Months Ended September 30, 2024 |

|

|

Three Months Ended September 30, 2023 |

|

| |

|

(In millions, except volumetric data and price

amounts) |

|

| |

|

Volume Settled |

|

|

Price Spread (1) |

|

|

Gain (Loss) |

|

|

Volume Settled |

|

|

Price Spread (1) |

|

|

Gain (Loss) |

|

|

Natural gas (BBtu) |

|

|

9.4 |

|

|

$ |

2.53 |

|

|

$ |

23.8 |

|

|

|

15.0 |

|

|

$ |

0.62 |

|

|

$ |

9.3 |

|

| NGL (MMgal) |

|

|

102.8 |

|

|

|

0.08 |

|

|

|

8.2 |

|

|

|

166.0 |

|

|

|

0.04 |

|

|

|

7.2 |

|

| Crude oil (MBbl) |

|

|

0.6 |

|

|

|

(0.67 |

) |

|

|

(0.4 |

) |

|

|

0.6 |

|

|

|

(13.17 |

) |

|

|

(7.9 |

) |

| |

|

|

|

|

|

|

|

$ |

31.6 |

|

|

|

|

|

|

|

|

$ |

8.6 |

|

| |

|

Nine Months Ended September 30, 2024 |

|

|

Nine Months Ended September 30, 2023 |

|

| |

|

(In millions, except volumetric data and price

amounts) |

|

| |

|

Volume Settled |

|

|

Price Spread (1) |

|

|

Gain (Loss) |

|

|

Volume Settled |

|

|

Price Spread (1) |

|

|

Gain (Loss) |

|

|

Natural gas (BBtu) |

|

|

35.6 |

|

|

$ |

1.94 |

|

|

$ |

69.2 |

|

|

|

50.0 |

|

|

$ |

1.24 |

|

|

$ |

62.2 |

|

| NGL (MMgal) |

|

|

348.9 |

|

|

|

0.04 |

|

|

|

14.9 |

|

|

|

515.0 |

|

|

|

0.07 |

|

|

|

34.4 |

|

| Crude oil (MBbl) |

|

|

1.4 |

|

|

|

(5.57 |

) |

|

|

(7.8 |

) |

|

|

1.8 |

|

|

|

(7.17 |

) |

|

|

(12.9 |

) |

| |

|

|

|

|

|

|

|

$ |

76.3 |

|

|

|

|

|

|

|

|

$ |

83.7 |

|

| _________________________ |

|

| (1) The price

spread is the differential between the contracted derivative

instrument pricing and the price of the corresponding settled

commodity transaction. |

| |

Three Months Ended September 30, 2024

Compared to Three Months Ended September 30, 2023

The increase in adjusted operating margin was

primarily due to higher natural gas inlet volumes and higher fees

in the Permian, partially offset by lower natural gas prices. The

increase in natural gas inlet volumes in the Permian was

attributable to the addition of the Greenwood I and Wildcat II

plants during the fourth quarter of 2023, the Roadrunner II plant

during the second quarter of 2024, and continued strong producer

activity. The increase in Badlands crude was due to higher

production.

The increase in operating expenses was primarily

due to higher volumes in the Permian and the addition of the

Greenwood I, Wildcat II and Roadrunner II plants in the

Permian.

Nine Months Ended September 30, 2024

Compared to Nine Months Ended September 30, 2023

The increase in adjusted operating margin was

primarily due to higher natural gas inlet volumes and higher fees

in the Permian, partially offset by lower natural gas prices. The

increase in natural gas inlet volumes in the Permian was

attributable to the addition of the Legacy II plant during the

first quarter of 2023, the Midway plant during the second quarter

of 2023, the Greenwood I and Wildcat II plants during the fourth

quarter of 2023, the Roadrunner II plant during the second quarter

of 2024, and continued strong producer activity.

The increase in operating expenses was primarily

due to higher volumes in the Permian and the addition of the Legacy

II, Midway, Greenwood I, Wildcat II and Roadrunner II plants.

Logistics and Transportation

Segment

The Logistics and Transportation segment

includes the activities and assets necessary to convert mixed NGLs

into NGL products and also includes other assets and value-added

services such as transporting, storing, fractionating, terminaling,

and marketing of NGLs and NGL products, including services to LPG

exporters and certain natural gas supply and marketing activities

in support of the Company’s other businesses. The Logistics and

Transportation segment also includes Grand Prix NGL Pipeline, which

connects the Company’s gathering and processing positions in the

Permian Basin, Southern Oklahoma and North Texas with the Company’s

Downstream facilities in Mont Belvieu, Texas. The Company’s

Downstream facilities are located predominantly in Mont Belvieu and

Galena Park, Texas, and in Lake Charles, Louisiana.

The following table provides summary data

regarding results of operations of this segment for the periods

indicated:

| |

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

|

|

|

|

| |

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

| |

(In millions, except operating statistics) |

| Operating margin |

$ |

|

619.2 |

|

|

$ |

|

457.4 |

|

|

$ |

|

161.8 |

|

|

35 |

% |

|

$ |

|

1,699.0 |

|

|

$ |

|

1,394.4 |

|

|

$ |

|

304.6 |

|

|

22 |

% |

| Operating expenses |

|

|

98.1 |

|

|

|

|

88.8 |

|

|

|

|

9.3 |

|

|

10 |

% |

|

|

|

273.5 |

|

|

|

|

247.9 |

|

|

|

|

25.6 |

|

|

10 |

% |

| Adjusted operating margin |

$ |

|

717.3 |

|

|

$ |

|

546.2 |

|

|

$ |

|

171.1 |

|

|

31 |

% |

|

$ |

|

1,972.5 |

|

|

$ |

|

1,642.3 |

|

|

$ |

|

330.2 |

|

|

20 |

% |

| Operating statistics

MBbl/d (1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NGL pipeline transportation

volumes (2) |

|

|

829.2 |

|

|

|

|

660.2 |

|

|

|

|

169.0 |

|

|

26 |

% |

|

|

|

777.0 |

|

|

|

|

606.4 |

|

|

|

|

170.6 |

|

|

28 |

% |

| Fractionation volumes |

|

|

953.8 |

|

|

|

|

793.4 |

|

|

|

|

160.4 |

|

|

20 |

% |

|

|

|

884.7 |

|

|

|

|

782.3 |

|

|

|

|

102.4 |

|

|

13 |

% |

| Export volumes (3) |

|

|

403.9 |

|

|

|

|

349.3 |

|

|

|

|

54.6 |

|

|

16 |

% |

|

|

|

412.3 |

|

|

|

|

341.9 |

|

|

|

|

70.4 |

|

|

21 |

% |

| NGL sales |

|

|

1,162.0 |

|

|

|

|

997.9 |

|

|

|

|

164.1 |

|

|

16 |

% |

|

|

|

1,136.1 |

|

|

|

|

984.1 |

|

|

|

|

152.0 |

|

|

15 |

% |

| ________________________ |

|

| (1) Segment

operating statistics include intersegment amounts, which have been

eliminated from the consolidated presentation. For all volume

statistics presented, the numerator is the total volume sold during

the period and the denominator is the number of calendar days

during the period. |

| (2) Represents

the total quantity of mixed NGLs that earn a transportation

margin. |

| (3) Export

volumes represent the quantity of NGL products delivered to

third-party customers at the Company’s Galena Park Marine Terminal

that are destined for international markets. |

| |

Three Months Ended September 30, 2024

Compared to Three Months Ended September 30, 2023

The increase in adjusted operating margin was

due to higher pipeline transportation and fractionation margin,

higher marketing margin, and higher LPG export margin.

Pipeline transportation and fractionation volumes benefited from

higher supply volumes primarily from our Permian Gathering and

Processing systems and the addition of Train 9 during the second

quarter of 2024. Marketing margin increased due to greater

optimization opportunities. LPG export margin increased due

to higher volumes as the company benefited from the completion of

its export expansion during the third quarter of 2023 and the

Houston Ship Channel allowing night-time vessel transits, partially

offset by maintenance and required inspections.

The increase in operating expenses was due to

higher system volumes, higher compensation and benefits, higher

taxes and the addition of Train 9 during the second quarter of

2024.

Nine Months Ended September 30, 2024

Compared to Nine Months Ended September 30, 2023

The increase in adjusted operating margin was

due to higher pipeline transportation and fractionation margin,

higher marketing margin, and higher LPG export margin.

Pipeline transportation and fractionation volumes benefited from

higher supply volumes primarily from our Permian Gathering and

Processing systems and the addition of Train 9 during the second

quarter of 2024. Marketing margin increased due to greater

optimization opportunities. LPG export margin increased due to

higher volumes as the company benefited from the completion of its

export expansion during the third quarter of 2023 and the Houston

Ship Channel allowing night-time vessel transits, partially offset

by maintenance and required inspections.

The increase in operating expenses was due to

higher system volumes, higher compensation and benefits, higher

repairs and maintenance, higher taxes, and the addition of Train 9

during the second quarter of 2024.

Other

| |

|

Three Months Ended September 30, |

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 vs. 2023 |

|

| |

|

(In millions) |

|

|

Operating margin |

|

$ |

(17.7 |

) |

|

$ |

(33.5 |

) |

|

$ |

15.8 |

|

|

$ |

(86.3 |

) |

|

$ |

294.3 |

|

|

$ |

(380.6 |

) |

| Adjusted

operating margin |

|

$ |

(17.7 |

) |

|

$ |

(33.5 |

) |

|

$ |

15.8 |

|

|

$ |

(86.3 |

) |

|

$ |

294.3 |

|

|

$ |

(380.6 |

) |

| |

Other contains the results of commodity

derivative activity mark-to-market gains/losses related to

derivative contracts that were not designated as cash flow hedges.

The Company has entered into derivative instruments to hedge the

commodity price associated with a portion of the Company’s future

commodity purchases and sales and natural gas transportation basis

risk within the Company’s Logistics and Transportation segment.

About Targa Resources Corp.

Targa Resources Corp. is a leading provider of

midstream services and is one of the largest independent midstream

infrastructure companies in North America. The Company owns,

operates, acquires and develops a diversified portfolio of

complementary domestic midstream infrastructure assets and its

operations are critical to the efficient, safe and reliable

delivery of energy across the United States and increasingly to the

world. The Company’s assets connect natural gas and NGLs to

domestic and international markets with growing demand for cleaner

fuels and feedstocks. The Company is primarily engaged in the

business of: gathering, compressing, treating, processing,

transporting, and purchasing and selling natural gas; transporting,

storing, fractionating, treating, and purchasing and selling NGLs

and NGL products, including services to LPG exporters; and

gathering, storing, terminaling, and purchasing and selling crude

oil.

Targa is a FORTUNE 500 company and is included

in the S&P 500.

For more information, please visit the Company’s

website at www.targaresources.com.

Non-GAAP Financial Measures

This press release includes the Company’s

non-GAAP financial measures: adjusted EBITDA, adjusted cash flow

from operations, adjusted free cash flow and adjusted operating

margin (segment). The following tables provide reconciliations of

these non-GAAP financial measures to their most directly comparable

GAAP measures.

The Company utilizes non-GAAP measures to

analyze the Company’s performance. Adjusted EBITDA, adjusted cash

flow from operations, adjusted free cash flow and adjusted

operating margin (segment) are non-GAAP measures. The GAAP measures

most directly comparable to these non-GAAP measures are income

(loss) from operations, Net income (loss) attributable to Targa

Resources Corp. and segment operating margin. These non-GAAP

measures should not be considered as an alternative to GAAP

measures and have important limitations as analytical tools.

Investors should not consider these measures in isolation or as a

substitute for analysis of the Company’s results as reported under

GAAP. Additionally, because the Company’s non-GAAP measures exclude

some, but not all, items that affect income and segment operating

margin, and are defined differently by different companies within

the Company’s industry, the Company’s definitions may not be

comparable with similarly titled measures of other companies,

thereby diminishing their utility. Management compensates for the

limitations of the Company’s non-GAAP measures as analytical tools

by reviewing the comparable GAAP measures, understanding the

differences between the measures and incorporating these insights

into the Company’s decision-making processes.

Adjusted Operating Margin

The Company defines adjusted operating margin

for the Company’s segments as revenues less product purchases and

fuel. It is impacted by volumes and commodity prices as well as by

the Company’s contract mix and commodity hedging program.

Gathering and Processing adjusted operating

margin consists primarily of:

- service fees related to natural gas and crude oil gathering,

treating and processing; and

- revenues from the sale of natural gas, condensate, crude oil

and NGLs less producer settlements, fuel and transport and the

Company’s equity volume hedge settlements.

Logistics and Transportation adjusted operating

margin consists primarily of:

- service fees (including the pass-through of energy costs

included in certain fee rates);

- system product gains and losses; and

- NGL and natural gas sales, less NGL and natural gas purchases,

fuel, third-party transportation costs and the net inventory

change.

The adjusted operating margin impacts of

mark-to-market hedge unrealized changes in fair value are reported

in Other.

Adjusted operating margin for the Company’s

segments provides useful information to investors because it is

used as a supplemental financial measure by management and by

external users of the Company’s financial statements, including

investors and commercial banks, to assess:

- the financial performance of the Company’s assets without

regard to financing methods, capital structure or historical cost

basis;

- the Company’s operating performance and return on capital as

compared to other companies in the midstream energy sector, without

regard to financing or capital structure; and

- the viability of capital expenditure projects and acquisitions

and the overall rates of return on alternative investment

opportunities.

Management reviews adjusted operating margin and

operating margin for the Company’s segments monthly as a core

internal management process. The Company believes that investors

benefit from having access to the same financial measures that

management uses in evaluating the Company’s operating results. The

reconciliation of the Company’s adjusted operating margin to the

most directly comparable GAAP measure is presented under “Review of

Segment Performance.”

Adjusted EBITDA

The Company defines adjusted EBITDA as Net

income (loss) attributable to Targa Resources Corp. before

interest, income taxes, depreciation and amortization, and other

items that the Company believes should be adjusted consistent with

the Company’s core operating performance. The adjusting items are

detailed in the adjusted EBITDA reconciliation table and its

footnotes. Adjusted EBITDA is used as a supplemental financial

measure by the Company and by external users of the Company’s

financial statements such as investors, commercial banks and others

to measure the ability of the Company’s assets to generate cash

sufficient to pay interest costs, support the Company’s

indebtedness and pay dividends to the Company’s investors.

Adjusted Cash Flow from Operations and Adjusted Free

Cash Flow

The Company defines adjusted cash flow from

operations as adjusted EBITDA less cash interest expense on debt

obligations and cash tax (expense) benefit. The Company defines

adjusted free cash flow as adjusted cash flow from operations less

maintenance capital expenditures (net of any reimbursements of

project costs) and growth capital expenditures, net of

contributions from noncontrolling interest and contributions to

investments in unconsolidated affiliates. Adjusted cash flow from

operations and adjusted free cash flow are performance measures

used by the Company and by external users of the Company’s

financial statements, such as investors, commercial banks and

research analysts, to assess the Company’s ability to generate cash

earnings (after servicing the Company’s debt and funding capital

expenditures) to be used for corporate purposes, such as payment of

dividends, retirement of debt or redemption of other financing

arrangements.

The following table presents a reconciliation of

Net income (loss) attributable to Targa Resources Corp. to adjusted

EBITDA, adjusted cash flow from operations and adjusted free cash

flow for the periods indicated:

| |

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

(In millions) |

|

|

Reconciliation of Net income (loss) attributable to Targa

Resources Corp. to Adjusted EBITDA, Adjusted Cash Flow from

Operations and Adjusted Free Cash Flow |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Targa Resources Corp. |

$ |

387.4 |

|

|

$ |

220.0 |

|

|

$ |

961.0 |

|

|

$ |

1,046.3 |

|

|

Interest (income) expense, net |

|

184.9 |

|

|

|

175.1 |

|

|

|

589.5 |

|

|

|

509.8 |

|

|

Income tax expense (benefit) |

|

97.0 |

|

|

|

53.9 |

|

|

|

274.1 |

|

|

|

260.7 |

|

|

Depreciation and amortization expense |

|

355.4 |

|

|

|

331.3 |

|

|

|

1,044.5 |

|

|

|

988.2 |

|

|

(Gain) loss on sale or disposition of assets |

|

(1.0 |

) |

|

|

(0.9 |

) |

|

|

(2.7 |

) |

|

|

(3.9 |

) |

|

Write-down of assets |

|

2.7 |

|

|

|

3.4 |

|

|

|

4.0 |

|

|

|

6.0 |

|

|

(Gain) loss from financing activities |

|

— |

|

|

|

— |

|

|

|

0.8 |

|

|

|

— |

|

|

Equity (earnings) loss |

|

(2.2 |

) |

|

|

(3.0 |

) |

|

|

(7.9 |

) |

|

|

(6.2 |

) |

|

Distributions from unconsolidated affiliates |

|

4.4 |

|

|

|

5.3 |

|

|

|

16.6 |

|

|

|

14.1 |

|

|

Compensation on equity grants |

|

17.7 |

|

|

|

15.7 |

|

|

|

47.4 |

|

|

|

45.7 |

|

|

Risk management activities |

|

17.7 |

|

|

|

33.5 |

|

|

|

86.3 |

|

|

|

(294.3 |

) |

|

Noncontrolling interests adjustments (1) |

|

1.6 |

|

|

|

(1.0 |

) |

|

|

2.6 |

|

|

|

(3.2 |

) |

|

Litigation expense (2) |

|

4.1 |

|

|

|

6.9 |

|

|

|

4.1 |

|

|

|

6.9 |

|

| Adjusted

EBITDA |

$ |

1,069.7 |

|

|

$ |

840.2 |

|

|

$ |

3,020.3 |

|

|

$ |

2,570.1 |

|

|

Interest expense on debt obligations (3) |

|

(181.2 |

) |

|

|

(172.1 |

) |

|

|

(578.5 |

) |

|

|

(500.9 |

) |

|

Cash taxes |

|

(3.9 |

) |

|

|

(0.9 |

) |

|

|

(10.1 |

) |

|

|

(8.6 |

) |

| Adjusted Cash Flow

from Operations |

$ |

884.6 |

|

|

$ |

667.2 |

|

|

$ |

2,431.7 |

|

|

$ |

2,060.6 |

|

|

Maintenance capital expenditures, net (4) |

|

(62.0 |

) |

|

|

(65.0 |

) |

|

|

(167.1 |

) |

|

|

(153.0 |

) |

|

Growth capital expenditures, net (4) |

|

(698.4 |

) |

|

|

(593.6 |

) |

|

|

(2,180.4 |

) |

|

|

(1,588.5 |

) |

| Adjusted Free Cash

Flow |

$ |

124.2 |

|

|

$ |

8.6 |

|

|

$ |

84.2 |

|

|

$ |

319.1 |

|

|

_________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Noncontrolling interest portion of depreciation and amortization

expense. |

| (2) Litigation

expense includes charges related to litigation resulting from the

major winter storm in February 2021 that the Company considers

outside the ordinary course of its business and/or not reflective

of its ongoing core operations. The Company may incur such charges

from time to time, and the Company believes it is useful to exclude

such charges because it does not consider them reflective of its

ongoing core operations and because of the generally singular

nature of the claims underlying such litigation. |

| (3) Excludes

amortization of interest expense. The nine months ended

September 30, 2024 includes $55.8 million of interest expense

associated with the Splitter Agreement ruling. |

| (4) Represents

capital expenditures, net of contributions from noncontrolling

interests and includes contributions to investments in

unconsolidated affiliates |

| |

The following table presents a reconciliation of estimated net

income of the Company to estimated adjusted EBITDA for 2024:

| |

|

2024E |

|

| |

|

(In millions) |

|

| Reconciliation of

Estimated Net Income Attributable to Targa Resources Corp.

to |

|

|

|

| Estimated Adjusted

EBITDA |

|

|

|

|

Net income attributable to Targa Resources Corp. |

|

$ |

1,370.0 |

|

|

Interest expense, net (1) |

|

|

765.0 |

|

|

Income tax expense |

|

|

375.0 |

|

|

Depreciation and amortization expense |

|

|

1,370.0 |

|

|

Equity earnings |

|

|

(5.0 |

) |

|

Distributions from unconsolidated affiliates |

|

|

20.0 |

|

|

Compensation on equity grants |

|

|

65.0 |

|

|

Risk management and other |

|

|

90.0 |

|

|

Noncontrolling interests adjustments (2) |

|

|

— |

|

| Estimated Adjusted EBITDA |

|

$ |

4,050.0 |

|

|

_________________________ |

|

|

|

|

| (1) Includes $55.8

million of interest expense associated with the Splitter Agreement

ruling. |

| (2) Noncontrolling

interest portion of depreciation and amortization expense. |

| |

Regulation FD Disclosures

The Company uses any of the following to comply

with its disclosure obligations under Regulation FD: press

releases, SEC filings, public conference calls, or our website. The

Company routinely posts important information on its website at

www.targaresources.com, including information that may be deemed to

be material. The Company encourages investors and others interested

in the company to monitor these distribution channels for material

disclosures.

Forward-Looking Statements

Certain statements in this release are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements, other

than statements of historical facts, included in this release that

address activities, events or developments that the Company

expects, believes or anticipates will or may occur in the future,

are forward-looking statements, including statements regarding our

projected financial performance, capital spending and payment of

future dividends. These forward-looking statements rely on a number

of assumptions concerning future events and are subject to a number

of uncertainties, factors and risks, many of which are outside the

Company’s control, which could cause results to differ materially

from those expected by management of the Company. Such risks and

uncertainties include, but are not limited to, actions by the

Organization of the Petroleum Exporting Countries (“OPEC”) and

non-OPEC oil producing countries, weather, political, economic and

market conditions, including a decline in the price and market

demand for natural gas, natural gas liquids and crude oil, the

timing and success of our completion of capital projects and

business development efforts, the expected growth of volumes on our

systems, the impact of pandemics or any other public health crises,

commodity price volatility due to ongoing or new global conflicts,

the impact of disruptions in the bank and capital markets,

including those resulting from lack of access to liquidity for

banking and financial services firms, and other uncertainties.

These and other applicable uncertainties, factors and risks are

described more fully in the Company’s filings with the Securities

and Exchange Commission, including its most recent Annual Report on

Form 10-K, and any subsequently filed Quarterly Reports on Form

10-Q and Current Reports on Form 8-K. The Company does not

undertake an obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Targa Investor

RelationsInvestorRelations@targaresources.com(713) 584-1133

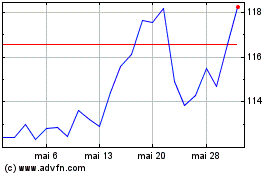

Targa Resources (NYSE:TRGP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Targa Resources (NYSE:TRGP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024