Manitou Gold Intersects Visible Gold; Drills 3.3 g/t Au over 3.0m at Goudreau Project, Wawa, Ontario

28 Septembre 2021 - 1:00PM

Manitou Gold Inc. (TSX-V: MTU) (the “Company” or “Manitou”) is

pleased announce that it has identified a new gold zone, the Bald

Eagle Gold Zone (the “BEGZ”) on its Goudreau project in

northeastern Ontario. The BEGZ has been intersected with six drill

holes over a strike length of 150 meters.

Highlights:

- Visible gold

observed in the BEGZ hole MTU-21-43 with assays pending

- New gold zone

identified in the northeastern portion of the project area

with wide drill intersections of gold mineralization

- Intersection highlights

of:

- 3.3 g/t Au over 3.0

m, including 5.2 g/t Au over 1.5 m within

a wider gold mineralized interval of 20.6 m at 0.8 g/t Au in hole

MTU-21-41; and

- 1.4 g/t Au over 9.0 m and

2.8 g/t Au over 1.4 m within a wider gold mineralized

interval of 22.8 m at 0.9 g/t Au in hole MTU-21-39

- Currently drilling high priority

targets on the west side of the Baltimore Deformation Zone (the

“BDZ”)

Surface work in late Summer of 2021 identified

the BEGZ as a new gold zone in the northeastern portion of the

Goudreau project, containing high-grade gold mineralization ranging

from below detection limit up to 74.7 g/t Au, based on grab

samples. The BEGZ has been identified as being part of a

large-scale orogenic system within the boundaries of the Goudreau

project (see Figure 2).

Approximately 67% of Canadian gold production is

found within this type of geologic setting, with examples including

the nearby Island Gold Mine operated by Alamos Gold

(TSX:AGI; NYSE:AGI) and many deposits located in regions

within the Canadian shield, including Timmins (>70 Moz),

Kirkland Lake (>40 Moz) and Val d’Or/Noranda (>69 Moz).

Six holes totaling 1,800 metres were drilled at

the BEGZ, with results for four holes having been received to date

(see Table 1). All four holes intersected significant gold

mineralization, with highlights including 3.3 g/t Au over

3.0 m, including 5.2 g/t Au over 1.5 m

within a wider gold mineralized interval of 20.6 m at 0.8 g/t Au in

hole MTU-21-41 and 1.4 g/t Au over 9.0 m and 2.8 g/t Au

over 1.4 m within a wider gold mineralized interval of

22.8 m grading 0.9 g/t Au in hole MTU-21-39.

Visible gold was encountered in the fifth hole

(MTU-21-43) at the BEGZ and assay results will be released as they

are received.

Gold mineralization at the BEGZ occurs within a

highly strained sericite-pyrite schist and is open along strike and

at depth. Detailed ground geophysical and geochemical surveys are

underway and further step-out and step-down drilling is planned

once results for the ongoing surveys have been received.

Table 1: Highlight Drill

Intersections

|

Hole ID |

|

From |

To |

Core

Length(1)(m) |

Au (g/t) |

Zone |

|

MTU-21-39 |

|

48.0 |

49.5 |

1.5 |

2.8 |

Bald Eagle Gold Zone |

|

|

181.9 |

183.0 |

1.1 |

1.6 |

Bald Eagle Gold Zone |

| |

216.0 |

238.8 |

22.8 |

0.9 |

Bald Eagle Gold Zone |

| incl. |

217.0 |

226.0 |

9.0 |

1.4 |

Bald Eagle Gold Zone |

|

incl. |

224.5 |

226.0 |

1.5 |

2.8 |

Bald Eagle Gold Zone |

|

MTU-21-40 |

|

75.5 |

77.0 |

1.5 |

1.1 |

Bald Eagle Gold Zone |

| |

116.9 |

121.5 |

4.6 |

0.9 |

Bald Eagle Gold Zone |

| incl. |

120.0 |

121.5 |

1.5 |

1.3 |

Bald Eagle Gold Zone |

| |

177.0 |

179.0 |

2.0 |

1.7 |

Bald Eagle Gold Zone |

|

|

198.0 |

202.5 |

4.5 |

0.8 |

Bald Eagle Gold Zone |

| |

208.5 |

227.0 |

18.5 |

0.5 |

Bald Eagle Gold Zone |

|

incl. |

210.0 |

211.5 |

1.5 |

1.3 |

Bald Eagle Gold Zone |

|

MTU-21-41 |

|

46.5 |

49.5 |

3.0 |

1.0 |

Bald Eagle Gold Zone |

| incl. |

46.5 |

48.0 |

1.5 |

1.5 |

Bald Eagle Gold Zone |

| |

122.0 |

123.0 |

1.0 |

2.5 |

Bald Eagle Gold Zone |

|

|

126.2 |

127.0 |

0.8 |

1.8 |

Bald Eagle Gold Zone |

| |

197.5 |

218.1 |

20.6 |

0.8 |

Bald Eagle Gold Zone |

| incl. |

209.5 |

212.5 |

3.0 |

3.3 |

Bald Eagle Gold Zone |

|

incl. |

209.5 |

211.0 |

1.5 |

5.1 |

Bald Eagle Gold Zone |

|

MTU-21-42 |

|

78.7 |

80.0 |

1.3 |

2.4 |

Bald Eagle Gold Zone |

| |

144.0 |

145.5 |

1.5 |

1.8 |

Bald Eagle Gold Zone |

|

|

155.5 |

156.5 |

1.0 |

1.4 |

Bald Eagle Gold Zone |

(1)Lengths are reported as core lengths. True

thickness is estimated at 85% of reported intervals based on

observed core angles.

Drilling is currently testing new priority

targets, including coincident multi-line gold +/- copper soil

geochemistry anomalies with strike lengths of up to 350 m and

coincident IP anomalies in close proximity to prominent structural

intersections. These new targets are located along the BDZ, which

represents the interpreted fault offset continuation of the

Goudreau-Localsh Deformation Zone (the “GLDZ”). The GDLZ hosts

Alamos Gold’s (TSX:AGI; NYSE:AGI) Island gold

deposit and Argonaut Gold’s Magino deposit, in

addition to a number of smaller-scale past producing mines,

including the past-producing Cline and Edwards mines.

Figure 1: Goudreau Project

maphttps://www.globenewswire.com/NewsRoom/AttachmentNg/9c1b392a-de93-477f-8810-1bdefe0bb6ab

Figure 2: Showing structures along the Baltimore

Deformation

Zonehttps://www.globenewswire.com/NewsRoom/AttachmentNg/03159396-9568-48f0-b329-8b45d2a1a795

About the Goudreau Project

The Goudreau Project is located 50 kilometres

northeast of Wawa, Ontario and is underlain by Archean-aged rocks

of the Michipicoten Greenstone belt. The project area is traversed

by several broad-scale deformation corridors (such as the BDZ and

GLDZ), which host the majority of the important regional gold

deposits and showings in the region.

The BDS is an eastward trending fault

offset extension of the GLDZ, the later of which hosts two

multi-million ounce gold deposits

(1,2) and has seen over

1,000,000 metres of drilling for gold. As such, the BDZ is

extremely under-explored along its 18 kilometre-long trend, with

only 4,400 metres of historic gold drilling.

The Goudreau project covers approximately 350

square kilometres in this re-emerging gold camp that hosts several

multi-million ounce gold deposits (1,2).

Manitou’s key strategic shareholders

include Alamos Gold

Inc. (TSX:AGI; NYSE:AGI) at

19.9% and O3 Mining Inc. (TSX.V: OIII; OTCQX:

OIIIF) at 9.9%, each individually calculated on a

partially diluted basis.

- Azadbakht, Z. et al., 2021. Report of Activities, 2020 Resident

Geologist Program. Ontario Geological Survey Open File Report 6374,

43 p.

- Argonaut Gold Inc., (2021). Company website:

https://www.argonautgold.com/English/home/default.aspx, September

26, 2021

Sampling and Quality

Control

Samples were delivered to Activation

Laboratories (“Actlabs") in Thunder Bay, Ontario. At the

laboratory, samples were crushed up to 80% passing 2 mm, riffle

split (250 g) and then pulverized to 95% passing 105 microns. Gold

was analyzed by fire assay with an AA finish, using the 50 g

sub-sample. Over limit analysis was performed on all primary assay

results >3 g/t gold. All over limits were tested by fire assay

with gravimetric finish using a 50 g sub-sample. Actlabs is a

certified and ISO 17025 accredited laboratory. Standards and blanks

were routinely inserted into the stream of core and channel

samples. At least 20 percent of the core and channel samples

submitted to the laboratory comprise samples used for quality

control. Actlabs routinely inserts their own certified reference

materials for at least 20 percent quality control in each

batch.

Richard Murphy, P.Geo is the qualified person

responsible for the technical content contained in this release. He

has reviewed and approved the content contained herein.

For further information on Manitou Gold Inc. contact:

Richard Murphy, President and CEO

Telephone:

1 (705) 698-1962 Email: info@manitougold.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward Looking Statements – Certain information

set forth in this news release may contain forward-looking

statements that involve substantial known and unknown risks and

uncertainties, including regulatory risk related to the receipt of

final approval of the TSX Venture Exchange for the Offering. These

forward-looking statements are subject to numerous risks and

uncertainties, certain of which are beyond the control of Manitou,

including with respect to the prospective nature of the Stover and

Renabie-Easy Lake properties. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

forward-looking statements.

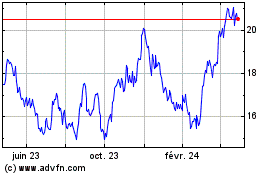

Alamos Gold (TSX:AGI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

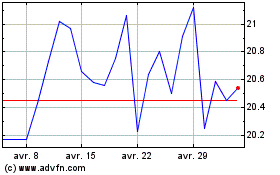

Alamos Gold (TSX:AGI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024