Brookfield Infrastructure Partners L.P. (Brookfield Infrastructure,

BIP, or the Partnership) (NYSE: BIP; TSX: BIP.UN) today announced

its results for the third quarter ended September 30, 2024.

"Brookfield Infrastructure continues to deliver

solid results while achieving its strategic objectives, including

successfully reaching our $2 billion capital recycling target for

the year,” said Sam Pollock, Chief Executive Officer of Brookfield

Infrastructure Partners. “With interest rates coming down, we are

in a new market environment with increased deal flow, creating a

significant investment pipeline that is also benefiting from growth

in sectors related to AI and associated energy demands.”

| |

For the three months ended September 30 |

|

For the nine months ended September 30 |

|

US$ millions (except per unit amounts), unaudited1 |

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

|

|

2023 |

|

Net (loss) income2 |

$ |

(52 |

) |

|

$ |

104 |

|

$ |

126 |

|

|

$ |

505 |

|

– per unit3 |

$ |

(0.18 |

) |

|

$ |

0.03 |

|

$ |

(0.18 |

) |

|

$ |

0.34 |

| FFO4 |

$ |

599 |

|

|

$ |

560 |

|

$ |

1,822 |

|

|

$ |

1,666 |

|

– per unit5 |

$ |

0.76 |

|

|

$ |

0.73 |

|

$ |

2.31 |

|

|

$ |

2.16 |

Brookfield Infrastructure reported a net loss of

$52 million for the three-month period ended September 30, 2024

compared to net income of $104 million in the prior year. Strong

growth within our businesses was more than offset by mark to market

losses on our corporate hedging activities and commodities

contracts, both of which contributed gains in the prior period.

Funds from operations (FFO) for the third

quarter was $599 million, which is 7% above the comparable period.

On a per unit basis, FFO was $0.76, which represents a 4% increase

after considering the increased share count associated with the

privatization of the global intermodal logistics operation last

September. We experienced strong contributions from the new

investments completed last year, as well as the initial

contribution from three accretive tuck-in acquisitions that closed

this year. Results also benefited from organic growth at the

midpoint of our target range, capturing annual rate increases from

inflation indexation, stronger transportation volumes and the

commissioning of over $1 billion from our capital backlog. This

result was partially offset by the impact of higher borrowing costs

and foreign exchange, most notably the depreciation of the

Brazilian real. When normalizing only for the impacts of foreign

exchange, FFO per unit growth was 10%, which is in-line with our

target and better reflects the current operational performance of

our businesses.

Segment Performance

The following table presents FFO by segment:

| |

For the three months ended September 30 |

|

For the nine months ended September 30 |

|

US$ millions, unaudited1 |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

FFO by segment |

|

|

|

|

|

|

|

|

Utilities |

$ |

188 |

|

|

$ |

229 |

|

|

$ |

558 |

|

|

$ |

661 |

|

|

Transport |

|

308 |

|

|

|

205 |

|

|

|

929 |

|

|

|

596 |

|

|

Midstream |

|

147 |

|

|

|

163 |

|

|

|

460 |

|

|

|

522 |

|

|

Data |

|

85 |

|

|

|

66 |

|

|

|

231 |

|

|

|

208 |

|

|

Corporate |

|

(129 |

) |

|

|

(103 |

) |

|

|

(356 |

) |

|

|

(321 |

) |

|

FFO4 |

$ |

599 |

|

|

$ |

560 |

|

|

$ |

1,822 |

|

|

$ |

1,666 |

|

The utilities segment generated FFO of $188

million, an increase of 9% on a comparable basis. In total, the

amount was higher last year as we sold our interest in an

Australian regulated utility business and completed a

recapitalization at our Brazilian regulated gas transmission

business in the first quarter. Organic growth for the segment was

driven by the continued benefit of inflation indexation and the

commissioning of over $450 million of capital into the rate base

over the last twelve months.

FFO for the transport segment was $308 million,

which represented a 50% increase over the same period in the prior

year. The increase is primarily attributable to the acquisition of

our global intermodal logistics operation that closed at the end of

the third quarter last year and an incremental 10% stake in our

Brazilian integrated rail and logistics operation that was

completed this year. The remaining businesses performed well, with

strong volumes across our networks and average rate increases of 7%

across our rail networks and 5% across our toll road portfolio.

Our midstream segment generated FFO of $147

million, compared to $163 million in the same period last year. The

decline is primarily attributable to capital recycling activities

completed last year at our U.S. gas pipeline and higher interest

costs across the portfolio from new financing initiatives. The

underlying businesses are performing well in the current

environment following continued demand for long-term services

supported by robust customer activity levels across our critical

midstream assets, particularly at our North American gas storage

business.

FFO from the data segment was $85 million,

representing a 29% increase over the same period last year. The

step change is attributable to strong underlying performance and

several new investments completed over the last twelve months. The

most impactful was the tuck-in acquisition of a portfolio of retail

colocation data centers completed in the first quarter. Our global

data center platform continues to execute its development plans to

drive growth, with an additional 70 MW commissioned during the

quarter bringing our total installed data center capacity to over

900 MW.

Update on Strategic Initiatives

On September 12th we closed the tuck-in

acquisition of 76,000 telecom tower sites in India. We are now the

largest telecom tower operator in India and second largest

globally, with over 250,000 tower sites. This acquisition is highly

complementary to our existing operations, increasing and

diversifying our tenancies from the country’s second and third

largest mobile network operators, while offering significant

operating synergies. The scale and benefits of the combined

platform were all achieved at a value-based entry point below 6x

EBITDA. Our total equity commitment was $140 million, and we expect

the business to generate a strong going-in FFO yield. Concurrent

with the acquisition we completed a rebranding of the business, to

Altius, which brings together the three acquisitions we have made

in the Indian telecommunications space.

During the quarter we secured approximately $600

million of capital recycling proceeds, for a total of approximately

$2 billion for the year, successfully achieving our capital

recycling target. We agreed on terms to sell our Mexican regulated

natural gas transmission business for net proceeds of approximately

$500 million ($125 million net to BIP), crystallizing an IRR of 22%

and a multiple of capital of 2.2x. The business is mature and

derisked, having achieved its value creation plan, most recently

securing an average regulatory tariff increase of over 25% that was

effective June 1, 2023. The sale is expected to close in the first

quarter of 2025, subject to satisfying customary closing

conditions.

We also completed the recapitalization of our

North American gas storage platform, raising $1.25 billion that

enabled a $770 million distribution ($305 million net to BIP) in

advance of a sale process. This financing alone returned more

capital than we had initially invested and increased the

investment’s realized multiple of capital to 2.5x. This is an

extremely attractive result, given we still own a business that

generates approximately $330 million in annual EBITDA. The

remaining sale proceeds secured during the quarter were generated

from the sale of several financial assets. We remain on track to

close the sale of our fiber platform within our French Telecom

Infrastructure business in the fourth quarter, generating $100

million in proceeds and an IRR of 17%.

Distribution and Dividend Declaration

The Board of Directors of BIP declared a

quarterly distribution in the amount of $0.405 per unit, payable on

December 31, 2024 to unitholders of record as at the close of

business on November 29, 2024. This distribution represents a 6%

increase compared to the prior year. The regular quarterly

dividends on the Cumulative Class A Preferred Limited Partnership

Units, Series 1, Series 3, Series 9, Series 11, Series 13 and

Series 14 have also been declared, as well as the capital gains

dividend for BIP Investment Corporation Senior Preferred Shares,

Series 1, which will also be payable on December 31, 2024, subject

to the results of the special meeting of holders on November 27,

2024. In conjunction with the Partnership’s distribution

declaration, the Board of Directors of BIPC has declared an

equivalent quarterly dividend of $0.405 per share, also payable on

December 31, 2024 to shareholders of record as at the close of

business on November 29, 2024.

Conference Call and Quarterly Earnings

Details

Investors, analysts and other interested parties

can access Brookfield Infrastructure’s Third Quarter 2024 Results,

as well as Letter to Unitholders and Supplemental Information,

under the Investor Relations section at

https://bip.brookfield.com.

To participate in the Conference Call today at

9:00am EST, please pre-register at

https://register.vevent.com/register/BId0571f9a865e44d2bbf9e77964270a30.

Upon registering, you will be emailed a dial-in number and unique

PIN. The Conference Call will also be Webcast live at

https://edge.media-server.com/mmc/p/qgby5rtc.

Additional Information

The Board has reviewed and approved this news

release, including the summarized unaudited financial information

contained herein.

About Brookfield

Infrastructure

Brookfield Infrastructure is a leading global

infrastructure company that owns and operates high-quality,

long-life assets in the utilities, transport, midstream and data

sectors across the Americas, Asia Pacific and Europe. We are

focused on assets that have contracted and regulated revenues that

generate predictable and stable cash flows. Investors can access

its portfolio either through Brookfield Infrastructure Partners

L.P. (NYSE: BIP; TSX: BIP.UN), a Bermuda-based limited partnership,

or Brookfield Infrastructure Corporation (NYSE, TSX: BIPC), a

Canadian corporation. Further information is available at

https://bip.brookfield.com.

Brookfield Infrastructure is the flagship listed

infrastructure company of Brookfield Asset Management, a global

alternative asset manager with over $1 trillion of assets

under management. For more information, go to

https://www.brookfield.com.

Contact Information

| Media: |

Investors: |

| Simon Maine |

Stephen Fukuda |

| Managing Director |

Senior Vice President |

| Corporate Communications |

Corporate Development &

Investor Relations |

| Tel: +44 739 890 9278 |

Tel: +1 416 956 5129 |

| Email:

simon.maine@brookfield.com |

Email:

stephen.fukuda@brookfield.com |

Cautionary Statement Regarding

Forward-looking Statements

This news release may contain forward-looking

information within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of

applicable securities laws. The words “will”, “target”, “future”,

“growth”, “expect”, “believe”, “may”, derivatives thereof and other

expressions which are predictions of or indicate future events,

trends or prospects and which do not relate to historical matters,

identify the above mentioned and other forward-looking statements.

Forward-looking statements in this news release may include

statements regarding expansion of Brookfield Infrastructure’s

business, the likelihood and timing of successfully completing the

transactions referred to in this news release, statements with

respect to our assets tending to appreciate in value over time, the

future performance of acquired businesses and growth initiatives,

the commissioning of our capital backlog, the pursuit of projects

in our pipeline, the level of distribution growth over the next

several years and our expectations regarding returns to our

unitholders as a result of such growth. Although Brookfield

Infrastructure believes that these forward-looking statements and

information are based upon reasonable assumptions and expectations,

the reader should not place undue reliance on them, or any other

forward-looking statements or information in this news release. The

future performance and prospects of Brookfield Infrastructure are

subject to a number of known and unknown risks and uncertainties.

Factors that could cause actual results of Brookfield

Infrastructure to differ materially from those contemplated or

implied by the statements in this news release include general

economic conditions in the jurisdictions in which we operate and

elsewhere which may impact the markets for our products and

services, the ability to achieve growth within Brookfield

Infrastructure’s businesses and in particular completion on time

and on budget of various large capital projects, which themselves

depend on access to capital and continuing favorable commodity

prices, and our ability to achieve the milestones necessary to

deliver the targeted returns to our unitholders, the impact of

market conditions on our businesses, the fact that success of

Brookfield Infrastructure is dependent on market demand for an

infrastructure company, which is unknown, the availability of

equity and debt financing for Brookfield Infrastructure, the impact

of health pandemics on our business and operations, the ability to

effectively complete transactions in the competitive infrastructure

space (including the ability to complete announced and potential

transactions that may be subject to conditions precedent, and the

inability to reach final agreement with counterparties to

transactions referred to in this press release as being currently

pursued, given that there can be no assurance that any such

transaction will be agreed to or completed) and to integrate

acquisitions into existing operations, the future performance of

these acquisitions, changes in technology which have the potential

to disrupt the business and industries in which we invest, the

market conditions of key commodities, the price, supply or demand

for which can have a significant impact upon the financial and

operating performance of our business and other risks and factors

described in the documents filed by Brookfield Infrastructure with

the securities regulators in Canada and the United States including

under “Risk Factors” in Brookfield Infrastructure’s most recent

Annual Report on Form 20-F and other risks and factors that are

described therein. Except as required by law, Brookfield

Infrastructure undertakes no obligation to publicly update or

revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise. References

to Brookfield Infrastructure are to the Partnership together with

its subsidiaries and operating entities. Brookfield

Infrastructure’s results include limited partnership units held by

public unitholders, redeemable partnership units, general

partnership units, Exchange LP units, BIPC exchangeable LP units

and BIPC exchangeable shares.

Any statements contained herein with respect to

tax consequences are of a general nature only and are not intended

to be, nor should they be construed to be, legal or tax advice to

any person, and no representation with respect to tax consequences

is made. Unitholders and shareholders are urged to consult their

tax advisors with respect to their particular circumstances.

References to Brookfield Infrastructure are to

the Partnership together with its subsidiaries and operating

entities. Brookfield Infrastructure’s results include limited

partnership units held by public unitholders, redeemable

partnership units, general partnership units, Exchange LP units,

BIPC exchangeable LP units and BIPC exchangeable shares.

References to the Partnership are to Brookfield

Infrastructure Partners L.P.

- Please

refer to page 11 for results of Brookfield Infrastructure

Corporation.

-

Includes net income attributable to limited partners, the general

partner, and non-controlling interests ‒ Redeemable Partnership

Units held by Brookfield, Exchange LP units, BIPC exchangeable LP

units and BIPC exchangeable shares.

-

Average number of limited partnership units outstanding on a time

weighted average basis for the three and nine-month periods ended

September 30, 2024 was 461.7 million and

461.5 million, respectively (2023: 458.8 million and

458.6 million).

-

We define FFO as net income excluding the impact of depreciation

and amortization, deferred income taxes, mark-to-market gains

(losses) and other income (expenses) that are not related to the

revenue earning activities and are not normal, recurring cash

operating expenses necessary for business operations. FFO includes

balances attributable to the Partnership generated by investments

in associates and joint ventures accounted for using the equity

method and excludes amounts attributable to non-controlling

interests based on the economic interests held by non-controlling

interests in consolidated subsidiaries. We believe that FFO, when

viewed in conjunction with our IFRS results, provides a more

complete understanding of factors and trends affecting our

underlying operations. FFO is a measure of operating performance

that is not calculated in accordance with, and does not have any

standardized meaning prescribed by IFRS as issued by the

International Accounting Standards Board. FFO is therefore unlikely

to be comparable to similar measures presented by other issuers. A

reconciliation of net income to FFO is available on page 9 of this

release. Readers are encouraged to consider both measures in

assessing our company’s results.

-

Average number of partnership units outstanding on a fully diluted

time weighted average basis for the three and nine-month periods

ended September 30, 2024 was 792.2 million and

792.1 million, respectively (2023: 772.1 million and

771.7 million).

|

Brookfield Infrastructure Partners

L.P.Consolidated Statements of Financial

Position |

| |

As of |

| US$

millions, unaudited |

Sept. 30, 2024 |

|

Dec. 31, 2023 |

|

|

|

|

|

| Assets |

|

|

|

|

Cash and cash equivalents |

$ |

1,602 |

|

$ |

1,857 |

| Financial assets |

|

280 |

|

|

787 |

| Property, plant and equipment

and investment properties |

|

58,035 |

|

|

52,879 |

| Intangible assets and

goodwill |

|

29,426 |

|

|

30,333 |

| Investments in associates and

joint ventures |

|

5,642 |

|

|

5,402 |

|

Deferred income taxes and other |

|

10,259 |

|

|

9,526 |

|

Total assets |

$ |

105,244 |

|

$ |

100,784 |

|

|

|

|

|

| Liabilities and

partnership capital |

|

|

|

| Corporate borrowings |

$ |

5,156 |

|

$ |

4,911 |

| Non-recourse borrowings |

|

47,622 |

|

|

40,904 |

| Financial liabilities |

|

3,237 |

|

|

2,875 |

| Deferred income taxes and

other |

|

19,722 |

|

|

18,078 |

| |

|

|

|

| Partnership

capital |

|

|

|

| Limited partners |

|

4,641 |

|

|

5,321 |

| General partner |

|

26 |

|

|

28 |

| Non-controlling interest

attributable to: |

|

|

|

|

Redeemable partnership units held by Brookfield |

|

1,903 |

|

|

2,190 |

|

Exchangeable units/shares1 |

|

1,400 |

|

|

1,605 |

|

Perpetual subordinated notes |

|

293 |

|

|

293 |

|

Interest of others in operating subsidiaries |

|

20,326 |

|

|

23,661 |

|

Preferred unitholders |

|

918 |

|

|

918 |

|

Total partnership capital |

|

29,507 |

|

|

34,016 |

|

Total liabilities and partnership capital |

$ |

105,244 |

|

$ |

100,784 |

- Includes

non-controlling interest attributable to BIPC exchangeable shares,

BIPC exchangeable LP units and Exchange LP units.

|

Brookfield Infrastructure Partners L.P.Consolidated

Statements of Operating Results |

| |

For the three monthsended September 30 |

|

For the nine monthsended September 30 |

|

US$ millions, except per unit information, unaudited |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

5,270 |

|

|

$ |

4,487 |

|

|

$ |

15,595 |

|

|

$ |

12,961 |

|

| Direct operating costs |

|

(3,897 |

) |

|

|

(3,384 |

) |

|

|

(11,685 |

) |

|

|

(9,893 |

) |

| General

and administrative expense |

|

(113 |

) |

|

|

(100 |

) |

|

|

(302 |

) |

|

|

(312 |

) |

|

|

|

1,260 |

|

|

|

1,003 |

|

|

|

3,608 |

|

|

|

2,756 |

|

| Interest expense |

|

(873 |

) |

|

|

(640 |

) |

|

|

(2,493 |

) |

|

|

(1,775 |

) |

| Share of earnings from

associates and joint ventures |

|

56 |

|

|

|

96 |

|

|

|

192 |

|

|

|

472 |

|

| Mark-to-market (losses)

gains |

|

(23 |

) |

|

|

34 |

|

|

|

(61 |

) |

|

|

27 |

|

| Other

(expense) income |

|

(107 |

) |

|

|

(99 |

) |

|

|

158 |

|

|

|

101 |

|

|

Income before income tax |

|

313 |

|

|

|

394 |

|

|

|

1,404 |

|

|

|

1,581 |

|

| Income tax (expense)

recovery |

|

|

|

|

|

|

|

|

Current |

|

(135 |

) |

|

|

(142 |

) |

|

|

(429 |

) |

|

|

(418 |

) |

|

Deferred |

|

56 |

|

|

|

4 |

|

|

|

257 |

|

|

|

9 |

|

|

Net income |

|

234 |

|

|

|

256 |

|

|

|

1,232 |

|

|

$ |

1,172 |

|

|

Non-controlling interest of others in operating subsidiaries |

|

(286 |

) |

|

|

(152 |

) |

|

|

(1,106 |

) |

|

|

(667 |

) |

|

Net (loss) income attributable to partnership |

$ |

(52 |

) |

|

$ |

104 |

|

|

$ |

126 |

|

|

$ |

505 |

|

|

|

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

Limited partners |

$ |

(73 |

) |

|

$ |

23 |

|

|

$ |

(55 |

) |

|

$ |

184 |

|

|

General partner |

|

73 |

|

|

|

66 |

|

|

|

220 |

|

|

|

198 |

|

|

Non-controlling interest |

|

|

|

|

|

|

|

|

Redeemable partnership units held by Brookfield |

|

(30 |

) |

|

|

10 |

|

|

|

(23 |

) |

|

|

76 |

|

|

Exchangeable units/shares1 |

|

(22 |

) |

|

|

5 |

|

|

|

(16 |

) |

|

|

47 |

|

|

Basic and diluted (losses) gains per unit attributable to: |

|

|

|

|

|

|

|

|

Limited partners2 |

$ |

(0.18 |

) |

|

$ |

0.03 |

|

|

$ |

(0.18 |

) |

|

$ |

0.34 |

|

- Includes

non-controlling interest attributable to BIPC exchangeable shares,

BIPC exchangeable LP units and Exchange LP units.

- Average number of

limited partnership units outstanding on a time weighted average

basis for the three and nine-month periods ended September 30,

2024 was 461.7 million and 461.5 million, respectively (2023:

458.8 million and 458.6 million).

|

Brookfield Infrastructure Partners L.P. Consolidated

Statements of Cash Flows |

| |

For the three monthsended September 30 |

|

For the nine monthsended September 30 |

|

US$ millions, unaudited |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

|

|

| Net income |

$ |

234 |

|

|

$ |

256 |

|

|

$ |

1,232 |

|

|

$ |

1,172 |

|

| Adjusted for the following

items: |

|

|

|

|

|

|

|

|

Earnings from investments in associates and joint ventures, net of

distributions received |

|

22 |

|

|

|

30 |

|

|

|

24 |

|

|

|

191 |

|

|

Depreciation and amortization expense |

|

854 |

|

|

|

669 |

|

|

|

2,672 |

|

|

|

1,946 |

|

|

Mark-to-market, provisions and other |

|

92 |

|

|

|

156 |

|

|

|

(192 |

) |

|

|

48 |

|

|

Deferred income tax recovery |

|

(56 |

) |

|

|

(4 |

) |

|

|

(257 |

) |

|

|

(9 |

) |

| Change

in non-cash working capital, net |

|

48 |

|

|

|

(7 |

) |

|

|

(387 |

) |

|

|

(761 |

) |

|

Cash from operating activities |

|

1,194 |

|

|

|

1,100 |

|

|

|

3,092 |

|

|

|

2,587 |

|

|

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

| Net (investments in)

proceeds from: |

|

|

|

|

|

|

|

|

Operating assets |

|

(1,673 |

) |

|

|

(5,970 |

) |

|

|

(2,304 |

) |

|

|

(10,145 |

) |

|

Associates |

|

— |

|

|

|

435 |

|

|

|

(350 |

) |

|

|

405 |

|

|

Long-lived assets |

|

(865 |

) |

|

|

(616 |

) |

|

|

(3,210 |

) |

|

|

(1,612 |

) |

|

Financial assets |

|

246 |

|

|

|

69 |

|

|

|

363 |

|

|

|

245 |

|

| Net settlements of foreign

exchange contracts |

|

(13 |

) |

|

|

2 |

|

|

|

(22 |

) |

|

|

2 |

|

| Other

investing activities |

|

(4 |

) |

|

|

(54 |

) |

|

|

(132 |

) |

|

|

(722 |

) |

|

Cash used by investing activities |

|

(2,309 |

) |

|

|

(6,134 |

) |

|

|

(5,655 |

) |

|

|

(11,827 |

) |

|

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

| Distributions to limited and

general partners |

|

(411 |

) |

|

|

(377 |

) |

|

|

(1,233 |

) |

|

|

(1,130 |

) |

| Net borrowings: |

|

|

|

|

|

|

|

|

Corporate |

|

37 |

|

|

|

652 |

|

|

|

299 |

|

|

|

1,610 |

|

|

Subsidiary |

|

2,251 |

|

|

|

777 |

|

|

|

7,209 |

|

|

|

3,323 |

|

| Partnership units issued |

|

3 |

|

|

|

2 |

|

|

|

9 |

|

|

|

10 |

|

| Net capital provided (to) by

non-controlling interest |

|

(141 |

) |

|

|

4,514 |

|

|

|

(2,915 |

) |

|

|

6,758 |

|

| Lease

liability repaid and other |

|

(369 |

) |

|

|

(545 |

) |

|

|

(1,018 |

) |

|

|

(1,326 |

) |

|

Cash from financing activities |

|

1,370 |

|

|

|

5,023 |

|

|

|

2,351 |

|

|

|

9,245 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

|

|

|

|

|

|

Change during the period |

$ |

255 |

|

|

$ |

(11 |

) |

|

$ |

(212 |

) |

|

$ |

5 |

|

|

Cash reclassified as held for sale |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6 |

) |

|

Impact of foreign exchange and other on cash |

|

21 |

|

|

|

(62 |

) |

|

|

(43 |

) |

|

|

29 |

|

|

Balance, beginning of period |

|

1,326 |

|

|

|

1,380 |

|

|

|

1,857 |

|

|

|

1,279 |

|

|

Balance, end of period |

$ |

1,602 |

|

|

$ |

1,307 |

|

|

$ |

1,602 |

|

|

$ |

1,307 |

|

|

Brookfield Infrastructure Partners

L.P.Reconciliation of Net Income to Funds from

Operations |

| |

For the three monthsended September 30 |

|

For the nine monthsended September 30 |

|

US$ millions, unaudited |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

234 |

|

|

$ |

256 |

|

|

$ |

1,232 |

|

|

$ |

1,172 |

|

|

Add back or deduct the following: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

854 |

|

|

|

669 |

|

|

|

2,672 |

|

|

|

1,946 |

|

|

Share of earnings from investments in associates and joint

ventures |

|

(56 |

) |

|

|

(96 |

) |

|

|

(192 |

) |

|

|

(472 |

) |

|

FFO contribution from investments in associates and joint

ventures1 |

|

238 |

|

|

|

225 |

|

|

|

708 |

|

|

|

709 |

|

|

Deferred tax recovery |

|

(56 |

) |

|

|

(4 |

) |

|

|

(257 |

) |

|

|

(9 |

) |

|

Mark-to-market losses (gains) |

|

23 |

|

|

|

(34 |

) |

|

|

61 |

|

|

|

(27 |

) |

|

Other expense2 |

|

200 |

|

|

|

194 |

|

|

|

100 |

|

|

|

142 |

|

|

Consolidated Funds from Operations |

$ |

1,437 |

|

|

$ |

1,210 |

|

|

$ |

4,324 |

|

|

$ |

3,461 |

|

|

FFO attributable to non-controlling interests3 |

|

(838 |

) |

|

|

(650 |

) |

|

|

(2,502 |

) |

|

|

(1,795 |

) |

|

FFO |

$ |

599 |

|

|

$ |

560 |

|

|

$ |

1,822 |

|

|

$ |

1,666 |

|

- FFO

contribution from investments in associates and joint ventures

correspond to the FFO attributable to the partnership that are

generated by its investments in associates and joint ventures

accounted for using the equity method.

- Other expense

corresponds to amounts that are not related to the revenue earning

activities and are not normal, recurring cash operating expenses

necessary for business operations. Other income/expenses excluded

from FFO primarily includes gains on acquisitions and dispositions

of subsidiaries, associates and joint ventures, gains or losses

relating to foreign currency translation reclassified from

accumulated comprehensive income to other expense, acquisition

costs, gains/losses on remeasurement of borrowings, amortization of

deferred financing costs, fair value remeasurement gains/losses,

accretion expenses on deferred consideration or asset retirement

obligations, impairment losses, and gains or losses on debt

extinguishment.

- Amounts

attributable to non-controlling interests are calculated based on

the economic ownership interests held by non-controlling interests

in consolidated subsidiaries. By adjusting FFO attributable to

non-controlling interests, our partnership is able to remove the

portion of FFO earned at non-wholly owned subsidiaries that are not

attributable to our partnership.

|

Brookfield Infrastructure Partners L.P.Statements of Funds

from Operations per Unit |

| |

For the three monthsended September 30 |

|

For the nine monthsended September 30 |

|

US$, unaudited |

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

| (Losses) earnings per limited

partnership unit1 |

$ |

(0.18 |

) |

|

$ |

0.03 |

|

$ |

(0.18 |

) |

|

$ |

0.34 |

| Add back or deduct the

following: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

0.52 |

|

|

|

0.46 |

|

|

1.58 |

|

|

|

1.36 |

|

Deferred taxes and other items |

|

0.42 |

|

|

|

0.24 |

|

|

0.91 |

|

|

|

0.46 |

|

FFO per unit2 |

$ |

0.76 |

|

|

$ |

0.73 |

|

$ |

2.31 |

|

|

$ |

2.16 |

- Average

number of limited partnership units outstanding on a time weighted

average basis for the three and nine-month periods ended

September 30, 2024 was 461.7 million and 461.5 million,

respectively (2023: 458.8 million and

458.6 million).

- Average

number of partnership units outstanding on a fully diluted time

weighted average basis for the three and nine-month periods ended

September 30, 2024 was 792.2 million and

792.1 million, respectively (2023: 772.1 million and

771.7 million).

Notes:

The Statements of Funds from Operations per unit

above are prepared on a basis that is consistent with the

Partnership’s Supplemental Information and differs from net income

per limited partnership unit as presented in Brookfield

Infrastructure’s Consolidated Statements of Operating Results on

page 7 of this release, which is prepared in accordance with IFRS.

Management uses FFO per unit as a key measure to evaluate operating

performance. Readers are encouraged to consider both measures in

assessing Brookfield Infrastructure’s results.

Brookfield Infrastructure Corporation

Reports Third Quarter 2024 Results

The Board of Directors of Brookfield

Infrastructure Corporation (“BIPC” or our “company”) (NYSE, TSX:

BIPC) today declared a quarterly dividend in the amount of $0.405

per class A exchangeable subordinate voting share of BIPC (a

“Share”), payable on December 31, 2024 to shareholders of

record as at the close of business on November 29, 2024. This

dividend is identical in amount per Share and has identical record

and payment dates to the quarterly distribution announced today by

Brookfield Infrastructure Partners L.P. (“BIP” or the

“Partnership”) on its units.

The previously announced proposed reorganization

of BIPC, which is expected to be completed in December 2024, will

not impact the payment of this dividend on December 31, 2024 to

BIPC shareholders of record as at the close of business on November

29, 2024. After completion of the reorganization, it is expected

that quarterly dividends will be declared and paid on the new

shares held by BIPC shareholders at the same time as quarterly

distributions are declared and paid to unitholders.

The Shares of BIPC are structured with the

intention of being economically equivalent to the non-voting

limited partnership units of Brookfield Infrastructure Partnership

L.P. (“BIP” or the “Partnership”) (NYSE: BIP; TSX: BIP.UN). We

believe economic equivalence is achieved through identical

dividends and distributions on the Shares and BIP’s units and each

Share being exchangeable at the option of the holder for one BIP

unit at any time. Given the economic equivalence, we expect that

the market price of the Shares will be significantly impacted by

the market price of BIP’s units and the combined business

performance of our company and BIP as a whole. In addition to

carefully considering the disclosure made in this news release in

its entirety, shareholders are strongly encouraged to carefully

review BIP’s letter to unitholders, supplemental information and

its other continuous disclosure filings. BIP’s letter to

unitholders and supplemental information are available at

https://bip.brookfield.com. Copies of the Partnership’s continuous

disclosure filings are available electronically on EDGAR on the

SEC’s website at https://sec.gov or on SEDAR+ at

https://sedarplus.ca.

Results

The net income of BIPC is captured in the

Partnership’s financial statements and results.

BIPC reported a net loss of $808 million

for the three-month period ended September 30, 2024, compared

to net income of $1,009 million in the prior year. After

removing the impact of the revaluation on our own Shares that are

classified as liabilities under IFRS and the impact of foreign

exchange on loans with BIP denominated in Canadian dollars,

underlying earnings were 66% higher than the prior year. Current

period results benefited from the acquisition of our global

intermodal logistics operation, Triton, that closed at the end of

September in the prior year, and capital commissioned into rate

base at our U.K. regulated distribution business. These benefits

were partially offset by higher financing costs at our businesses,

as a result of incremental borrowings. Additionally, offsetting

results was an increase in dividends paid on our exchangeable

shares, which are classified as interest expense, due to the 6%

increase in our quarterly dividend compared to the prior year and

approximately 21 million exchangeable shares issued in connection

with our acquisition of Triton.

Cautionary Statement Regarding

Forward-looking Statements

This news release may contain forward-looking

information within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of Section

27A of the U.S. Securities Act of 1933, as amended, Section 21E of

the U.S. Securities Exchange Act of 1934, as amended, “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995 and in any applicable Canadian securities

regulations. The words “believe”, “expect”, “will” derivatives

thereof and other expressions which are predictions of or indicate

future events, trends or prospects and which do not relate to

historical matters, identify the above mentioned and other

forward-looking statements. Forward-looking statements in this news

release include statements regarding the impact of the market price

of BIP’s units and the combined business performance of our company

and BIP as a whole on the market price of the Shares. Although

Brookfield Infrastructure believes that these forward-looking

statements and information are based upon reasonable assumptions

and expectations, the reader should not place undue reliance on

them, or any other forward-looking statements or information in

this news release. The future performance and prospects of

Brookfield Infrastructure are subject to a number of known and

unknown risks and uncertainties. Factors that could cause actual

results of Brookfield Infrastructure to differ materially from

those contemplated or implied by the statements in this news

release include general economic conditions in the jurisdictions in

which we operate and elsewhere which may impact the markets for our

products and services, the ability to achieve growth within

Brookfield Infrastructure’s businesses and in particular completion

on time and on budget of various large capital projects, which

themselves depend on access to capital and continuing favorable

commodity prices, and our ability to achieve the milestones

necessary to deliver the targeted returns to our unitholders, the

impact of market conditions on our businesses, the fact that

success of Brookfield Infrastructure is dependent on market demand

for an infrastructure company, which is unknown, the availability

of equity and debt financing for Brookfield Infrastructure, the

impact of health pandemics on our business and operations, the

ability to effectively complete transactions in the competitive

infrastructure space (including the ability to complete announced

and potential transactions that may be subject to conditions

precedent, and the inability to reach final agreement with

counterparties to transactions being currently pursued, given that

there can be no assurance that any such transaction will be agreed

to or completed) and to integrate acquisitions into existing

operations, the future performance of these acquisitions, changes

in technology which have the potential to disrupt the business and

industries in which we invest, the market conditions of key

commodities, the price, supply or demand for which can have a

significant impact upon the financial and operating performance of

our business and other risks and factors described in the documents

filed by BIPC with the securities regulators in Canada and the

United States including “Risk Factors” in BIPC’s most recent Annual

Report on Form 20-F and other risks and factors that are described

therein. Except as required by law, Brookfield Infrastructure

Corporation undertakes no obligation to publicly update or revise

any forward-looking statements or information, whether as a result

of new information, future events or otherwise.

|

Brookfield Infrastructure

CorporationConsolidated Statements of Financial

Position |

| |

As of |

| US$

millions, unaudited |

Sept. 30, 2024 |

|

|

Dec. 31, 2023 |

|

|

|

|

|

|

| Assets |

|

|

|

|

Cash and cash equivalents |

$ |

245 |

|

|

$ |

539 |

|

| Due from Brookfield

Infrastructure |

|

1,766 |

|

|

|

1,288 |

|

| Property, plant and

equipment |

|

14,643 |

|

|

|

14,151 |

|

| Intangible assets |

|

3,306 |

|

|

|

3,699 |

|

| Goodwill |

|

1,670 |

|

|

|

1,726 |

|

|

Deferred tax asset and other |

|

2,501 |

|

|

|

2,506 |

|

|

Total assets |

$ |

24,131 |

|

|

$ |

23,909 |

|

|

|

|

|

|

| Liabilities and

equity |

|

|

|

| Accounts payable and

other |

$ |

1,182 |

|

|

$ |

1,099 |

|

| Loans payable to Brookfield

Infrastructure |

|

100 |

|

|

|

26 |

|

| Exchangeable and class B

shares |

|

4,626 |

|

|

|

4,153 |

|

| Non-recourse borrowings |

|

13,336 |

|

|

|

12,028 |

|

| Financial liabilities |

|

36 |

|

|

|

75 |

|

| Deferred tax liabilities and

other |

|

2,374 |

|

|

|

2,460 |

|

| |

|

|

|

| Equity |

|

|

|

| Equity in net assets

attributable to the Partnership |

|

(764 |

) |

|

|

(399 |

) |

|

Non-controlling interest |

|

3,241 |

|

|

|

4,467 |

|

|

Total equity |

|

2,477 |

|

|

|

4,068 |

|

|

Total liabilities and equity |

$ |

24,131 |

|

|

$ |

23,909 |

|

|

Brookfield Infrastructure CorporationConsolidated

Statements of Operating Results |

| |

For the three months ended September 30 |

|

For the nine months ended September 30 |

|

US$ millions, unaudited |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

912 |

|

|

$ |

551 |

|

|

$ |

2,722 |

|

|

$ |

1,586 |

|

| Direct operating costs |

|

(339 |

) |

|

|

(146 |

) |

|

|

(1,007 |

) |

|

|

(442 |

) |

| General

and administrative expenses |

|

(21 |

) |

|

|

(16 |

) |

|

|

(56 |

) |

|

|

(49 |

) |

|

|

|

552 |

|

|

|

389 |

|

|

|

1,659 |

|

|

|

1,095 |

|

| |

|

|

|

|

|

|

|

| Interest expense |

|

(269 |

) |

|

|

(162 |

) |

|

|

(767 |

) |

|

|

(476 |

) |

| Share of losses from

investments in associates |

|

— |

|

|

|

(24 |

) |

|

|

— |

|

|

|

(20 |

) |

| Remeasurement of exchangeable

and class B shares |

|

(1,003 |

) |

|

|

917 |

|

|

|

(468 |

) |

|

|

309 |

|

|

Mark-to-market and other |

|

(3 |

) |

|

|

(16 |

) |

|

|

(109 |

) |

|

|

22 |

|

|

(Loss) income before income tax |

|

(723 |

) |

|

|

1,104 |

|

|

|

315 |

|

|

|

930 |

|

| Income tax expense |

|

|

|

|

|

|

|

|

Current |

|

(80 |

) |

|

|

(93 |

) |

|

|

(275 |

) |

|

|

(262 |

) |

|

Deferred |

|

(5 |

) |

|

|

(2 |

) |

|

|

(8 |

) |

|

|

(8 |

) |

|

Net (loss) income |

$ |

(808 |

) |

|

$ |

1,009 |

|

|

$ |

32 |

|

|

$ |

660 |

|

|

|

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

Partnership |

$ |

(977 |

) |

|

$ |

913 |

|

|

$ |

(458 |

) |

|

$ |

338 |

|

|

Non-controlling interest |

|

169 |

|

|

|

96 |

|

|

|

490 |

|

|

|

322 |

|

|

Brookfield Infrastructure CorporationConsolidated

Statements of Cash Flows |

| |

For the three monthsended September 30 |

|

For the nine monthsended September 30 |

|

US$ millions, unaudited |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

|

|

| Net (loss) income |

$ |

(808 |

) |

|

$ |

1,009 |

|

|

$ |

32 |

|

|

$ |

660 |

|

| Adjusted for the following

items: |

|

|

|

|

|

|

|

|

Earnings from investments in associates, net of distributions

received |

|

— |

|

|

|

24 |

|

|

|

— |

|

|

|

23 |

|

|

Depreciation and amortization expense |

|

194 |

|

|

|

59 |

|

|

|

580 |

|

|

|

171 |

|

|

Mark-to-market and other |

|

14 |

|

|

|

37 |

|

|

|

93 |

|

|

|

32 |

|

|

Remeasurement of exchangeable and class B shares |

|

1,003 |

|

|

|

(917 |

) |

|

|

468 |

|

|

|

(309 |

) |

|

Deferred income tax expense |

|

5 |

|

|

|

2 |

|

|

|

8 |

|

|

|

8 |

|

| Change

in non-cash working capital, net |

|

56 |

|

|

|

(20 |

) |

|

|

72 |

|

|

|

(136 |

) |

|

Cash from operating activities |

|

464 |

|

|

|

194 |

|

|

|

1,253 |

|

|

|

449 |

|

|

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

| Disposal of associates |

|

— |

|

|

|

435 |

|

|

|

— |

|

|

|

435 |

|

| Purchase of long-lived assets,

net of disposals |

|

(354 |

) |

|

|

(122 |

) |

|

|

(755 |

) |

|

|

(381 |

) |

| Acquisition of

subsidiaries |

|

— |

|

|

|

(3,086 |

) |

|

|

— |

|

|

|

(3,086 |

) |

| Other

investing activities |

|

19 |

|

|

|

(53 |

) |

|

|

106 |

|

|

|

(57 |

) |

|

Cash used by investing activities |

|

(335 |

) |

|

|

(2,826 |

) |

|

|

(649 |

) |

|

|

(3,089 |

) |

|

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

| Net capital provided (to) by

non-controlling interest |

|

(281 |

) |

|

|

2,629 |

|

|

|

(1,821 |

) |

|

|

2,466 |

|

| Net (repayments)

borrowings |

|

(70 |

) |

|

|

(118 |

) |

|

|

946 |

|

|

|

(60 |

) |

| Other

financing activities |

|

— |

|

|

|

16 |

|

|

|

18 |

|

|

|

16 |

|

|

Cash (used by) from financing activities |

|

(351 |

) |

|

|

2,527 |

|

|

|

(857 |

) |

|

|

2,422 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

|

|

|

|

|

|

Change during the period |

$ |

(222 |

) |

|

$ |

(105 |

) |

|

$ |

(253 |

) |

|

$ |

(218 |

) |

|

Impact of foreign exchange on cash |

|

1 |

|

|

|

(10 |

) |

|

|

(41 |

) |

|

|

14 |

|

|

Balance, beginning of period |

|

466 |

|

|

|

356 |

|

|

|

539 |

|

|

|

445 |

|

|

Balance, end of period |

$ |

245 |

|

|

$ |

241 |

|

|

$ |

245 |

|

|

$ |

241 |

|

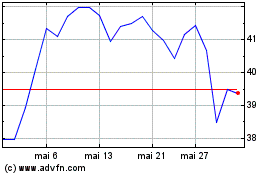

Brookfield Infrastructur... (TSX:BIP.UN)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Brookfield Infrastructur... (TSX:BIP.UN)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024