- Record quarterly adjusted EPS1 of $0.80;

basic EPS at $0.22

- Record adjusted EBITDA1 per share of $1.30;

EBITDA per share of $0.71

- Record total assets of $320.4 billion, an

increase of $126.0 billion or 65% year over year

- Asset management net sales of $821 million

at highest level since Q2-2015

- Acquired two U.S. private wealth firms,

Portola Partners and Radnor Financial Advisors, adding $10.1

billion and increasing U.S. assets to $97.0 billion

- Following quarter-end, completed

acquisition of Budros, Ruhlin & Roe and agreed to acquire

McCutchen Group, R.H. Bluestein, Gofen and Glossberg, and GLAS

Funds, boosting U.S. assets to $122.3 billion (US$98.7

billion)

- Continued asset management modernization by

launching new products focused on high-growth sectors

- Repurchased 4.1 million shares for $99.7

million

- Paid quarterly dividend of $0.18 a share,

totalling $36.2 million

All financial

amounts in Canadian dollars as at September 30, 2021, unless stated

otherwise.

CI Financial Corp. (“CI”) (TSX: CIX, NYSE: CIXX) today released

record financial results for the quarter ended September 30,

2021.

“It was another record financial quarter for CI and included a

new all-time high for asset levels and the best net flows in our

asset management business in over six years – reflecting the

successful ongoing transformation of our company,” said Kurt

MacAlpine, CI Chief Executive Officer. “CI is $126 billion larger,

much more diversified by business line, geography, and product

category and more competitive than it was just one year ago.

“In U.S. wealth management, we are seeing many of the country’s

largest and most successful registered investment advisors choosing

to join CI, attracted by the exceptional businesses we have in

place and our vision for a national platform. These include firms

dedicated to serving high-net-worth and ultra-high-net-worth

individuals and families across the U.S. Including all recently

announced transactions, our U.S. wealth business will exceed US$98

billion, up from zero at the start of 2020.

“In asset management, our flows continue to strengthen, with net

sales of $821 million representing a major turnaround from a year

earlier,” Mr. MacAlpine said. “We believe this success stems from

the execution of our strategy to modernize this business, which has

included integrating our boutique portfolio management teams into a

single global investment platform, hiring our first-ever head of

investment management, Marc-André Lewis, to lead that team, and the

reorganization of our sales and marketing function supported by the

adoption of advanced analytics.

“Additionally, we have launched a series of timely new products

that have resonated with advisors and investors and attracted

considerable assets. In the third quarter, we were very active in

product development, building out our lineup with new ETFs, liquid

alternative funds, and ESG mandates.”

Financial highlights

As at and for the quarters

ended

[millions of dollars, except share

amounts]

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Sep. 30, 2020

Core assets under management (Canada and

Australia)2

139,380

138,187

132,626

129,591

123,605

U.S. assets under management

7,203

6,564

5,916

5,461

4,707

Total assets under management

146,583

144,751

138,541

135,052

128,312

Core average assets under management

(Canada and Australia)

141,095

135,921

131,569

126,233

124,626

Total average assets under management

148,012

141,880

137,142

131,246

129,021

Canadian wealth management

76,859

75,521

71,066

67,257

51,189

U.S. wealth management

96,974

83,764

31,013

29,230

14,937

Total wealth management assets

173,833

159,284

102,078

96,487

66,127

Total assets

320,416

304,036

240,620

231,539

194,438

Total asset management net flows

821

356

(883)

(2,140)

(2,010)

Net income attributable to

shareholders

43.8

117.6

124.2

105.0

130.6

Adjusted net income1

159.2

153.0

151.6

148.7

133.3

Basic earnings per share

0.22

0.58

0.60

0.50

0.62

Diluted earnings per share

0.22

0.57

0.59

0.50

0.61

Adjusted earnings per share1

0.80

0.75

0.73

0.71

0.63

Adjusted EBITDA1

258.1

242.3

236.3

226.0

204.3

Adjusted EBITDA per share1

$1.30

$1.19

$1.14

$1.08

$0.97

Free cash flow1

180.9

164.1

155.6

145.6

144.3

Share repurchases

99.1

132.0

112.7

29.8

77.7

Dividends paid per share

0.18

0.18

0.18

0.18

0.18

Average basic shares outstanding

199,321,002

203,039,536

207,476,125

209,347,760

211,347,613

Average diluted shares outstanding

202,279,662

205,495,538

209,345,181

211,105,613

212,996,056

Long term debt (including current

portion)

3,408

3,350

2,201

2,456

1,962

Net debt1

2,655

2,461

1,856

1,872

1,669

Net debt to adjusted EBITDA1

2.59

2.53

1.94

2.08

2.05

- Free cash flow, net debt, adjusted net income, adjusted

earnings per share and adjusted EBITDA are not standardized

earnings measures prescribed by IFRS. For further information, see

“Non-IFRS Measures” note below.

- Includes $34.7 billion of assets managed by CI and held by

clients of advisors with Assante, CIPC and Aligned Capital as at

September 30, 2021 ($35.4 billion at August 31, 2021 and $28.9

billion at September 30, 2020).

Financial results

Net Income, Adjusted Net Income

For the quarters ended

[millions of dollars, except per share

amounts]

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Sep. 30, 2020

Management Fees

460.9

441.1

425.1

415.9

410.4

Administration Fees

243.0

193.7

167.5

125.6

86.8

Other Revenues

(42.6)

27.6

47.8

26.8

12.3

Total Revenues

661.3

662.4

640.4

568.3

509.5

SG&A

192.5

165.6

140.2

116.7

108.8

Trailer Fees

142.0

136.4

130.8

129.4

128.0

Advisor & Dealer Fees

110.9

99.3

101.5

87.0

60.3

Deferred Sales Commissions

1.4

1.3

1.9

1.4

1.4

Interest and Lease Finance

31.6

24.2

21.3

17.8

17.3

Amortization and Depreciation

26.8

21.4

19.6

13.9

11.0

Other Expenses

73.7

47.6

62.9

59.9

6.4

Total Expenses

578.9

495.9

478.3

426.1

333.2

Income Before Income Taxes

82.4

166.6

162.1

142.2

176.3

Income Taxes

37.0

48.2

37.4

36.6

46.1

Non-Controlling Interest

1.6

0.8

0.6

0.6

(0.4)

Net Income Attributable to

Shareholders

43.8

117.6

124.2

105.0

130.6

Adjusted Net Income:

Reported Net Income

45.4

118.4

124.8

105.7

130.2

Amortization of Acquisition Related

Intangibles

16.8

12.0

9.9

5.2

3.3

FX (Gains) and Losses

50.3

(8.2)

(20.2)

(2.2)

(0.4)

Change in Fair Value of Acquisition

Liabilities

61.4

22.4

22.2

--

--

Legal and Restructuring Charges

3.9

17.5

0.8

52.1

--

Write-down in Assets

--

--

7.1

1.8

--

Bond Redemption Costs

--

0.2

24.7

1.9

--

Gain on Equity Investment

--

(1.4)

--

--

--

Contingent consideration recorded as

compensation

4.2

0.9

--

--

--

Total Adjustments (pre-tax)

136.6

43.6

44.5

58.8

2.9

Tax Effect (recovery)

(21.2)

(8.2)

(17.0)

(14.9)

(0.3)

Non-Controlling Interest

1.6

0.8

0.7

0.8

(0.5)

Adjusted Net Income

159.2

153.0

151.6

148.7

133.3

Adjusted Net Income Per Share

0.80

0.75

0.73

0.71

0.63

Capital allocation

In the third quarter of 2021, CI repurchased 4.1 million shares

at a cost of $99.7 million, for an average cost of $24.29 per

share, and paid $36.2 million in dividends at a rate of $0.18 a

share.

The Board of Directors declared a quarterly dividend of $0.18

per share, payable on April 14, 2022 to shareholders of record on

March 31, 2022. The annual dividend rate of $0.72 per share

represented a yield of 2.4% on CI’s closing share price of $29.93

on November 10, 2021.

Third quarter business highlights

- CI completed the acquisitions of registered investment advisors

(“RIAs”) Radnor Financial Advisors, LLC, a firm based in Wayne,

Pennsylvania with $3.4 billion in assets, and Portola Partners

Group LLC of Menlo Park, California. Portola manages $6.7 billion

on behalf of ultra-high-net-worth individuals and families.

- CI agreed to acquire Budros, Ruhlin & Roe, Inc., a wealth

management firm with $4.4 billion in assets based in Columbus,

Ohio. The transaction was completed on October 1, 2021.

- CI announced that it would establish its U.S. headquarters in

Miami to support its fast-growing U.S. business.

- As part of CI’s drive to modernize its asset management

business, CI Global Asset Management (“CI GAM”) launched a series

of mandates focused on high-growth areas of the market, including

liquid alternatives, ETFs and environmental, social and governance

(ESG). The new mandates included:

- In the area of ESG, the CI Mosaic ESG ETF Portfolios, a

fund-of-ETFs product, and CI Climate Leaders Fund, which is

available in both mutual fund and ETF series.

- Liquid alternatives CI Alternative North American Opportunities

Fund and CI Alternative Diversified Opportunities Fund, launched as

both ETFs and mutual funds. CI continued to lead the Canadian

marketplace for liquid alternative funds with $4.3 billion in

assets under management.

- CI Beta ETFs, a suite of five passively managed ETFs to

complement CI GAM’s lineup of smart beta and actively managed

ETFs.

- Two actively managed ETFs focusing on emerging markets, and

technology and innovation.

Following quarter-end:

- In addition to completing the acquisition of BRR, CI agreed to

acquire:

- McCutchen Group LLC, a Seattle-based multi-family office

overseeing $4.3 billion

- A majority interest in R.H. Bluestein& Co., which manages

$5.2 billion from offices in Birmingham, Michigan and New York

City.

- Gofen and Glossberg, LLC, a Chicago-based RIA managing $9.3

billion in assets.

- A strategic interest in GLAS Funds, LLC, of Cleveland, which

offers a streamlined platform for advisors and their clients to

access alternative investments. It oversees approximately $1.4

billion.

- CI affiliate RGT Wealth Advisors, LLC acquired Odyssey Wealth

Management, LLC, an RIA with over $250 million in assets. Both

firms are based in the Dallas region.

- CI Galaxy Ethereum ETF (TSX: ETHX) exceeded $1 billion in

assets under management in October, with total assets in CI’s suite

of bitcoin and Ethereum funds exceeding $2 billion in early

November.

Analysts’ conference call

CI will hold a conference call with analysts today at 10:00 a.m.

Eastern Time, led by Mr. MacAlpine and Chief Financial Officer Amit

Muni. A live webcast of the call and slide presentation can be

accessed here, or through the Investor Relations section of CI’s

website. Alternatively, investors may listen to the discussion

through the following numbers (passcode: 676295):

- Canada toll-free: 1-833-950-0062

- United States: 1-844-200-6205

- United States (New York local): 1-646-904-5544

- All other locations: +1 929-526-1599.

About CI Financial

CI Financial Corp. is an independent company offering global

asset management and wealth management advisory services. CI’s

primary asset management businesses are CI Global Asset Management

(CI Investments Inc.) and GSFM Pty Ltd., and it operates in

Canadian wealth management through Assante Wealth Management

(Canada) Ltd., CI Private Counsel LP, Aligned Capital Partners

Inc., CI Direct Investing (WealthBar Financial Services Inc.), and

CI Investment Services Inc.

CI’s U.S. wealth management businesses consist of Barrett Asset

Management, LLC, BDF LLC, Budros, Ruhlin & Roe, Inc., Bowling

Portfolio Management LLC, Brightworth, LLC, The Cabana Group, LLC,

Congress Wealth Management, LLC, Dowling & Yahnke, LLC, Doyle

Wealth Management, LLC, One Capital Management, LLC, Portola

Partners Group LLC, Radnor Financial Advisors, LLC, The Roosevelt

Investment Group, LLC, RGT Wealth Advisors, LLC, Segall, Bryant

& Hamill, LLC, Stavis & Cohen Private Wealth, LLC, and

Surevest LLC.

CI is listed on the Toronto Stock Exchange under CIX and on the

New York Stock Exchange under CIXX. Further information is

available at www.cifinancial.com.

Non-IFRS Measures

CI reports certain financial information using non-IFRS measures

as CI believes these financial measures provide information that is

useful to investors in understanding CI’s performance and

facilitate a comparison of quarterly and full-year results from

period to period. Reconciliations to the nearest IFRS measures,

where necessary, are included in the “Non-IFRS Measures” section of

Management’s Discussion and Analysis dated November 11, 2021

available on SEDAR at www.sedar.com or at www.cifinancial.com.

EBITDA, Adjusted EBITDA

For the quarters

ended,

[millions of dollars, except per share

amounts]

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Sep. 30, 2020

Net Income

45.4

118.4

124.8

105.7

130.2

Add:

Interest & lease finance

31.6

24.2

21.3

17.8

17.3

Provision for income taxes

37.0

48.2

37.4

36.6

46.1

Amortization and depreciation

27.3

21.8

20.0

14.2

11.5

EBITDA

141.3

212.6

203.5

174.2

205.1

EBITDA per share

0.71

1.05

0.98

0.83

0.97

Adjustments:

FX (gains) and losses

50.3

(8.2)

(20.2)

(2.2)

(0.4)

Change in fair value of acquisition

liabilities

61.4

22.4

22.2

--

--

Legal & restructuring provision

3.9

17.5

0.8

52.1

--

Write-downs (gains) in assets and

investments

--

(1.4)

7.1

1.8

--

Bond redemption costs

--

0.2

24.7

1.9

--

Contingent consideration recorded as

compensation

4.2

0.9

--

--

--

Less: Non-controlling interest

3.0

1.9

1.8

1.8

0.3

Adjusted EBITDA

258.1

242.3

236.3

226.0

204.3

Adjusted EBTIDA per share

1.30

1.19

1.14

1.08

0.97

Free Cash Flow

For the quarters

ended,

[millions of dollars, except per share

amounts]

Sep. 30, 2021

Jun. 30, 2021

Mar. 31, 2021

Dec. 31, 2020

Sep. 30, 2020

Cash provided by operating activities

182.5

130.1

189.7

77.3

140.1

Net change in operating assets and

liabilities

(47.3)

28.0

(11.9)

31.7

4.2

Operating Cash Flow

135.2

158.1

177.8

108.9

144.4

Adjustments:

FX (gains) and losses

50.3

(8.2)

(20.2)

(2.2)

(0.4)

Legal & restructuring charges

3.9

17.5

0.8

52.1

--

Write-down (gain) in assets and

investments

--

--

7.1

1.8

--

Sub-total

54.2

9.4

(12.3)

51.7

(0.4)

Tax effect (recovery) of adjustments

(5.9)

(1.4)

(8.3)

(13.5)

0.6

Less: Non-controlling interest

2.6

1.9

1.7

1.6

0.2

Free Cash Flow

180.9

164.1

155.6

145.6

144.3

Commissions, trailing commissions, management fees and expenses

all may be associated with an investment in mutual funds and

exchange-traded funds (ETFs). Please read the prospectus before

investing. Important information about mutual funds and ETFs is

contained in their respective prospectus. Mutual funds and ETFs are

not guaranteed; their values change frequently, and past

performance may not be repeated. You will usually pay brokerage

fees to your dealer if you purchase or sell units of an ETF on

recognized Canadian exchanges. If the units are purchased or sold

on these Canadian exchanges, investors may pay more than the

current net asset value when buying units of the ETF and may

receive less than the current net asset value when selling

them.

This press release contains forward-looking statements

concerning anticipated future events, results, circumstances,

performance or expectations with respect to CI Financial Corp.

(“CI”) and its products and services, including its business

operations, strategy and financial performance and condition.

Forward-looking statements are typically identified by words such

as “believe”, “expect”, “foresee”, “forecast”, “anticipate”,

“intend”, “estimate”, “goal”, “plan” and “project” and similar

references to future periods, or conditional verbs such as “will”,

“may”, “should”, “could” or “would”. These statements are not

historical facts but instead represent management beliefs regarding

future events, many of which by their nature are inherently

uncertain and beyond management’s control. Although management

believes that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, such statements

involve risks and uncertainties. The material factors and

assumptions applied in reaching the conclusions contained in these

forward-looking statements include that the acquisitions of

McCutchen Group, R.H. Bluestein, Gofen and Glossberg, and GLAS

Funds will be completed and their asset levels will remain stable,

that the investment fund industry will remain stable and that

interest rates will remain relatively stable. Factors that could

cause actual results to differ materially from expectations

include, among other things, general economic and market

conditions, including interest and foreign exchange rates, global

financial markets, changes in government regulations or in tax

laws, industry competition, technological developments and other

factors described or discussed in CI’s disclosure materials filed

with applicable securities regulatory authorities from time to

time. The foregoing list is not exhaustive and the reader is

cautioned to consider these and other factors carefully and not to

place undue reliance on forward- looking statements. Other than as

specifically required by applicable law, CI undertakes no

obligation to update or alter any forward-looking statement after

the date on which it is made, whether to reflect new information,

future events or otherwise.

CI Global Asset Management is a registered business name of CI

Investments Inc.

This communication is provided as a general source of

information and should not be considered personal, legal,

accounting, tax or investment advice, or construed as an

endorsement or recommendation of any entity or security discussed.

Individuals should seek the advice of professionals, as

appropriate, regarding any particular investment. Investors should

consult their professional advisors prior to implementing any

changes to their investment strategies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211111005535/en/

Investor Relations Jason Weyeneth, CFA Vice-President,

Investor Relations & Strategy 416-681-8779 jweyeneth@ci.com

Media Canada Murray Oxby Vice-President, Communications

416-681-3254 moxby@ci.com

United States Trevor Davis, Gregory FCA for CI Financial

443-248-0359 cifinancial@gregoryfca.com

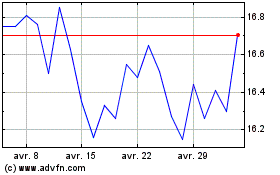

CI Financial (TSX:CIX)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

CI Financial (TSX:CIX)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024