CN (TSX: CNR) (NYSE: CNI) announced today that its Board of

Directors has approved the repurchase of its shares under a new

normal course issuer bid (Bid), as well as an 8% increase in the

2023 dividend on the Company's common shares outstanding.

The Bid, in the range of C$4 billion, permits CN

to purchase, for cancellation, over a 12-month period up to 32

million common shares, representing 4.8% of the 671,253,977 common

shares issued and outstanding of the Company on January 18,

2023.

“We are pleased to uphold our track record of

consistent dividend growth. Our share repurchase program reflects

our prudent approach in returning a significant amount of capital

to shareholders despite a softening economy. This is a testament to

our confidence in the strong cash flow generation capacity of CN

throughout business cycles.”- Ghislain Houle, Executive

Vice-President and Chief Financial Officer, CN

The Bid will be conducted between

February 1, 2023 and January 31, 2024 through a

combination of discretionary transactions and automatic repurchase

plans at market prices prevailing at the time of purchase, through

the facilities of the Toronto and New York stock exchanges, or

alternative trading systems in Canada and in the United States, if

eligible, and will conform to their regulations. Purchases may also

be conducted using derivative-based programs, accelerated share

repurchase transactions, or other methods of acquiring shares,

subject to any required regulatory approval and on such terms and

at such times as shall be permitted by applicable laws.

The decisions regarding the timing and size of

future purchases of common shares under the Bid are subject to

management’s discretion and are based on a variety of factors,

including market conditions. The new Bid was approved by the

Toronto Stock Exchange (TSX) today. TSX rules permit CN to purchase

daily, through TSX facilities, a maximum of 255,460 common shares

under the Bid.

CN believes that the repurchase of its shares

represents an appropriate and beneficial use of the Company's

funds.

CN's current normal course issuer bid announced

in January 2022 for the purchase of up to 42 million common shares

expires on January 31, 2023. As at the close of trading on January

18, 2023, CN had repurchased 30,839,917 common shares at a

weighted-average price of C$156.42 per share, excluding brokerage

fees, returning C$4,824 million to its shareholders. Purchases were

made through the facilities of the Toronto and New York stock

exchanges, or alternative trading systems in Canada and in the

United States.

CN's Board of Directors also approved a

first-quarter 2023 dividend on the Company's common shares

outstanding. A quarterly dividend of seventy-nine cents (C$0.7900)

per common share will be paid on March 31, 2023, to shareholders of

record at the close of business on March 10, 2023.

Forward-Looking

StatementsCertain statements included in this news release

constitute "forward-looking statements" within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

under Canadian securities laws, including statements based on

management’s assessment and assumptions and publicly available

information with respect to CN. By their nature, forward-looking

statements involve risks, uncertainties and assumptions. CN

cautions that its assumptions may not materialize and that current

economic conditions render such assumptions, although reasonable at

the time they were made, subject to greater uncertainty.

Forward-looking statements may be identified by the use of

terminology such as "believes", "expects", "anticipates",

"assumes", "outlook", "plans", "targets" or other similar

words.

Forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and other

factors which may cause actual results, performance or achievements

of CN to be materially different from the outlook or any future

results, performance or achievements implied by such statements.

Accordingly, readers are advised not to place undue reliance on

forward-looking statements. Important risk factors that could

affect the forward-looking statements include, but are not limited

to, general economic and business conditions, including factors

impacting global supply chains such as pandemics and geopolitical

conflicts and tensions; industry competition; inflation, currency

and interest rate fluctuations; changes in fuel prices; legislative

and/or regulatory developments; compliance with environmental laws

and regulations; actions by regulators; increases in maintenance

and operating costs; security threats; reliance on technology and

related cybersecurity risk; trade restrictions or other changes to

international trade arrangements; transportation of hazardous

materials; various events which could disrupt operations, including

illegal blockades of rail networks, and natural events such as

severe weather, droughts, fires, floods and earthquakes; climate

change; labor negotiations and disruptions; environmental claims;

uncertainties of investigations, proceedings or other types of

claims and litigation; risks and liabilities arising from

derailments; timing and completion of capital programs; and other

risks detailed from time to time in reports filed by CN with

securities regulators in Canada and the United States. Reference

should also be made to Management’s Discussion and Analysis

(MD&A) in CN’s annual and interim reports, Annual Information

Form and Form 40-F, filed with Canadian and U.S. securities

regulators and available on CN’s website, for a description of

major risk factors relating to CN.

Forward-looking statements reflect information

as of the date on which they are made. CN assumes no obligation to

update or revise forward-looking statements to reflect future

events, changes in circumstances, or changes in beliefs, unless

required by applicable securities laws. In the event CN does update

any forward-looking statement, no inference should be made that CN

will make additional updates with respect to that statement,

related matters, or any other forward-looking statement.

Information contained on, or accessible through, our website is not

a part of this news release.

About CNCN is a world-class

transportation leader and trade-enabler. Essential to the economy,

to the customers, and to the communities it serves, CN safely

transports more than 300 million tons of natural resources,

manufactured products, and finished goods throughout North America

every year. CN's network connects Canada’s Eastern and Western

coasts with the U.S. South through a 18,600-mile rail network. CN

and its affiliates have been contributing to community prosperity

and sustainable trade since 1919. CN is committed to programs

supporting social responsibility and environmental stewardship.

Contacts:

|

Media |

Investment Community |

| Jonathan Abecassis |

Paul Butcher |

| Senior Manager |

Vice-President |

| Media Relations |

Investor Relations |

| (438) 455-3692media@cn.ca |

(514)

399-0052investor.relations@cn.ca |

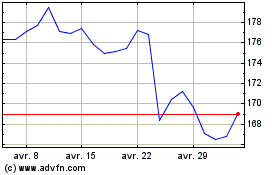

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024