Dundee Corporation (TSX: DC.A) (the “Corporation”

or “Dundee”) today announced its financial results for the three

months ended March 31, 2022. All currency amounts in this press

release are in Canadian dollars except as otherwise indicated.

FIRST QUARTER 2022 RESULTS

- Reported net income from

investments of $46.6 million (2021 – loss of $10.9 million).

- Reported net earnings attributable

to owners of the Corporation of $31.1 million (2021 – loss of $19.7

million), or earnings of $0.34 per share before the effect of any

dilutive securities (2021 – loss of $0.23 per share). Including the

effect of dilutive securities, the Corporation reported earnings of

$0.33 per share for the current year.

- Reduced total corporate G&A

costs by 9% compared to the first quarter of 2021, excluding the

impact of stock-based compensation (1% including the impact of

stock-based compensation).

- On a consolidated basis, the

Corporation reported cash of $76.2 million as at March 31, 2022

(December 31, 2021 – $93.9 million).

Jonathan Goodman, President and Chief Executive

Officer of Dundee Corporation, commented:

“Dundee is pleased to show positive investment

results in the first quarter of 2022, as we continue to make

progress against all three of our strategic pillars: doing more

mining deals, rationalizing our legacy portfolio of non-core

assets, and streamlining our cost structure. During the period,

Dundee was rewarded for its focus on deep-dive due-diligence, with

its portfolio investments delivering a solid performance against a

backdrop of global financial weakness.”

“I am pleased with the way our entire Dundee

investment team remained active in identifying, de-risking and

investing in mining companies with solid value propositions. During

the first quarter, we increased positions in high-quality, well-run

mining companies such as Reunion Gold, Centaurus Metals, and

Ausgold among others. Subsequent to quarter end, Dundee was

extremely pleased to announce a strategic partnership with Aura

Minerals to develop and participate in future cash flows from the

Borborema Gold Project.”

“With recent geopolitical events and a global

pandemic exposing the fragility of global supply chains and

financial systems, we hold to our strong conviction that the need

for high quality and sustainably sourced mining assets has never

been greater. We remain focused on investing in the long-term and

working with our investee companies as advisors and partners to

maximize asset value and realize their full potential.”

Mr. Goodman continued, “We continued to make

progress in reducing our corporate G&A run rate in the first

quarter of 2022. We see a clear path to additional G&A

improvements in leasehold costs, IT costs, insurance costs and

other items. We remain laser-focused on reducing run-rate G&A

as well as funding to subsidiaries.”

Mr. Goodman concluded, “The entire team at

Dundee continues to work hard to execute on all aspects of our

transformation strategy. I am encouraged by our ability to sustain

and grow our momentum in the first quarter of 2022. Our team

remains committed to growing the core business and setting Dundee

up to deliver long-term, sustainable value for our stakeholders,

shareholders and partners. I would like to thank the entire team

for their efforts in managing through a period of incredible

change.”

FINANCIAL RESULTS

Operating results during the first quarter of

2022 reflect a $44.8 million market appreciation (2021 – $11.5

million market depreciation) in certain of the Corporation’s

investments that are carried in the consolidated financial

statements at fair value through profit or loss. In addition, net

income from investments during the first quarter of 2022 includes

$1.8 million (2021 – $0.7 million) dividend and interest income

distributed from its portfolio investments. Additionally, during

the first quarter of 2022, the Corporation recognized a loss from

its equity accounted investments, excluding real estate joint

ventures, of $0.6 million (2021 – earnings of $0.6 million).

OPERATING SUBSIDIARIES’

PERFORMANCE

Goodman & Company, Investment Counsel Inc.

(“GCIC”)

GCIC’s AUM increased from $57.9 million at the

end of December 2021 to $64.0 million at the end of March 2022.

During the first three months of 2022, GCIC raised capital of $13.2

million from launching a new tax-assisted limited partnership, CMP

2022 Resource Limited Partnership. Redemptions of AUM during the

same period of 2022 were $7.2 million. During the three months

ended March 31, 2022, this segment incurred a pre-tax loss of $0.3

million (2021 – earnings of $0.2 million).

During the three months ended March 31, 2022,

GCIC recognized financial services revenue of $1.1 million (2021 –

$0.7 million) from the services provided by Dundee Goodman Merchant

Partners, a division of GCIC.

Dundee Sustainable Technologies Inc. (“Dundee

Technologies”)

Dundee Technologies incurred a pre-tax loss of

$0.7 million (2021 – $0.8 million) during the three months ended

March 31, 2022. Revenue during the same period was $1.1 million

(2021 – $0.7 million). On March 1, 2022, Dundee Technologies

announced the closing of a private placement for total

consideration of $0.6 million.

AgriMarine Holdings Inc. (“AgriMarine”)

During the three months ended March 31, 2022,

AgriMarine reported a pre-tax loss of $1.1 million (2021 – $0.9

million) with sales revenue of $1.3 million (2021 – $1.5 million).

While depressed and unpredictable market conditions associated with

COVID-19 are abating, a reduction in harvest volumes resulted in

lower sales revenues compared to the same period in 2021.

SHAREHOLDERS’ EQUITY ON A PER SHARE BASIS

|

|

|

Carrying Value as at |

|

|

|

|

Mar 31, 2022 |

|

|

Dec 31, 2021 |

|

|

Operating subsidiaries |

$ |

43,818 |

|

$ |

45,844 |

|

|

Equity accounted investments |

|

24,014 |

|

|

24,250 |

|

|

Investments carried at fair value through profit or loss |

|

243,588 |

|

|

185,297 |

|

|

Other net corporate account balances |

|

55,385 |

|

|

79,899 |

|

|

Total shareholders' equity |

|

366,805 |

|

|

335,290 |

|

|

|

|

|

|

|

Less: |

Shareholders' equity attributable to holders of: |

|

|

|

|

Preference Shares, series

2 |

|

(27,667 |

) |

|

(27,667 |

) |

|

|

Preference Shares, series

3 |

|

(50,423 |

) |

|

(50,423 |

) |

|

|

|

|

|

|

|

|

|

|

Shareholders' equity attributable to holders of Class A |

|

|

|

Subordinate Voting Shares and Class B Shares of the

Corporation |

$ |

288,715 |

|

$ |

257,200 |

|

|

|

|

|

|

|

|

|

|

|

Number of Class A Subordinate Voting Shares and Class B Shares of

the Corporation issued and outstanding |

|

|

Class A Subordinate Voting Shares |

|

84,697,363 |

|

|

84,697,363 |

|

|

Class B Shares |

|

3,114,491 |

|

|

3,114,491 |

|

|

|

|

|

87,811,854 |

|

|

87,811,854 |

|

|

|

|

|

|

|

|

Shareholders' Equity on a Per Share Basis |

$ |

3.29 |

|

$ |

2.93 |

|

FIRST QUARTER 2022 CONFERENCE CALL AND WEBCAST

DETAILS

Dundee’s management will be hosting a conference

call to discuss our quarterly results on Thursday, May 12, 2022 at

10:00 am ET. Analysts and investors are invited to participate

using the following dial-in numbers or webcast link:

Participant Number (Local):

416-764-8659Participant number (Toll-free):

1-888-664-6392Conference ID:

84524620Audience URL:

https://produceredition.webcasts.com/starthere.jsp?ei=1547286&tp_key=1c7b70d4db

A replay of the conference call will be

available until 11:59 pm (ET) May 26, 2022, and can be accessed

using the following dial-in numbers:

Encore (Local):

416-764-8677Encore (Toll-free):

1-888-390-0541Encore ID: 524620#

The Corporation’s unaudited interim consolidated

financial statements as at and for the three months ended March 31,

2022 and 2021, along with the accompanying management’s discussion

and analysis have been filed on the System for Electronic Document

Analysis and Retrieval (“SEDAR”) and may be viewed by interested

parties under the Corporation’s profile at www.sedar.com or the

Corporation’s website at www.dundeecorporation.com

ABOUT DUNDEE CORPORATION:

Dundee Corporation is a public Canadian

independent holding company, listed on the Toronto Stock Exchange

under the symbol “DC.A”. Through its operating subsidiaries, Dundee

Corporation is an active investor focused on delivering

long-term, sustainable value as a trusted partner in the mining

sector with more than 30 years of experience making accretive

mining investments.

FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, which reflects Dundee Corporation’s current

expectations regarding future events including but not limited to,

the strategic partnership with Aura Minerals and the future

development of the Borborema Gold Project. Forward-looking

information is based on a number of assumptions and is subject to a

number of risks and uncertainties, many of which are beyond Dundee

Corporation’s control, which could cause actual results and events

to differ materially from those that are disclosed in or implied by

such forward-looking information. Such risks and uncertainties

include, but are not limited to, the factors discussed under “Risk

Factors” in the Annual Information Form of Dundee Corporation and

subsequent filings made with securities commissions in Canada.

Dundee Corporation does not undertake any obligation to update such

forward-looking information, whether as a result of new

information, future events or otherwise, except as expressly

required by applicable law.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Investor and Media RelationsT: (416) 864-3584E:

ir@dundeecorporation.com

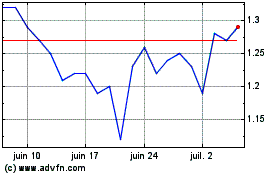

Dundee (TSX:DC.A)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Dundee (TSX:DC.A)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024