Dominion Lending Centres Inc. (TSX:DLCG) (“DLCG” or the

“Corporation”) is pleased to report its financial results for the

three months and year ended December 31, 2021 (“Q4-2021” and

“annual”, respectively). For complete information, readers should

refer to the annual audited consolidated financial statements,

management discussion and analysis (“MD&A”) and annual

information form (“AIF”) which are available on SEDAR at

www.sedar.com and on the Corporation’s website at www.dlcg.ca. All

amounts are presented in Canadian dollars unless otherwise stated.

Reference herein to the Dominion Lending Centres

Group of Companies (the “DLC Group” or “Core Business Operations”)

includes the Corporation and its three main subsidiaries, MCC

Mortgage Centres Canada Inc. (“MCC”), MA Mortgage Architects Inc.

(“MA”), and Newton Connectivity Systems Inc. (“Newton), and

excludes the Non-Core Business Asset Management segment and their

corresponding historical financial and operating results. The

“Non-Core Business Asset Management” segment represents the

Corporation’s share of income in its equity-accounted investments

in Club16 Limited Partnership and Cape Communications International

Inc. (“Impact”) (collectively, the “Non-Core Assets”), the

expenses, assets and liabilities associated with managing the

Non-Core Assets, the non-core credit facility, and public company

costs.

Financial Highlights

- DLC Group achieved

strong funded volumes of $20.6 billion in Q4-2021 and record funded

volumes for the year ended December 31, 2021, of $78.5 billion,

representing a 17% and 52% increase compared to 2020,

respectively;

- DLC Group had

revenues of $21.3 million for Q4-2021 and record revenues of $78.8

million for the year ended December 31, 2021, representing a 22%

and 50% increase compared to 2020, respectively;

- DLC Group had

Adjusted EBITDA of $11.8 million for Q4-2021 and record Adjusted

EBITDA of $46.9 million for the year ended December 31, 2021, an

increase of 37% and 71% compared to 2020 respectively;

- Subsequent to the

year end, on January 11, 2022, DLC announced the final results of

its substantial issuer bid where the Corporation purchased

1,781,790 class “A” common shares that were validly tendered to the

bid for an aggregate cost of $6.7 million (which shares were

cancelled and returned to treasury);

- On February 3,

2022, the Corporation’s class “A” common shares were listed for

trading on the Toronto Stock Exchange (“TSX”); and

- On February 28,

2022, DLC acquired the remaining 30% of Newton that DLC did not

already own.

Gary Mauris, Executive Chairman and CEO,

commented, “We are pleased to announce annual funded volume growth

of over 50% year over year to $78.5 billion, which helped drive

record annual Adjusted EBITDA to $46.9 million. Our dedicated

mortgage professionals and management teams at Dominion Lending

Centres, MA, MCC and Newton demonstrated the DLC Group’s resilience

during a global pandemic. Further, we are proud of the various

corporate initiatives that have been recently achieved, including

refinancing our credit facilities with TD Bank, returning capital

to shareholders via the substantial issuer bid, graduation to the

Toronto Stock Exchange and the acquisition of the remaining 30% of

Newton.”

Selected Consolidated Financial

Highlights:Below are the financial results highlights for

the three months and year ended December 31, 2021. The results for

the comparative periods reflect the segregation of the Non-Core

Assets as discontinued operations (refer to the Discontinued

Operations section of this document). The current period results

for the three months and year ended December 31, 2021 include the

Non-Core Assets as equity accounted investments within the Non-Core

Business Asset Management segment. The discontinued operations are

only included in net (loss) income and diluted (loss) earnings per

Common Share.

|

Three months ended December 31, |

|

Year ended December 31, |

|

(in thousands, except per share) |

|

2021 |

|

|

2020 |

|

Change |

|

2021 |

|

|

2020 |

Change |

|

Revenues |

$ |

21,266 |

|

$ |

17,477 |

|

22% |

$ |

78,816 |

|

$ |

52,413 |

50% |

|

Income from operations |

|

9,127 |

|

|

5,152 |

|

77% |

|

37,387 |

|

|

18,248 |

105% |

|

Adjusted EBITDA (1) |

|

10,538 |

|

|

7,917 |

|

33% |

|

43,882 |

|

|

25,214 |

74% |

|

Free cash flow attributable to common shareholders (1) |

|

3,528 |

|

|

2,401 |

|

47% |

|

17,137 |

|

|

4,929 |

248% |

|

Net (loss) income |

|

(5,463) |

|

|

22,643 |

|

NMF (2) |

|

(3,943) |

|

|

25,559 |

NMF (2) |

|

Net (loss) income from continuing operations |

|

(5,463) |

|

|

18,690 |

|

NMF (2) |

|

(3,943) |

|

|

23,871 |

NMF (2) |

|

Net income from discontinued operations |

|

- |

|

|

3,953 |

|

NMF (2) |

|

- |

|

|

1,688 |

NMF (2) |

|

Net (loss) income attributable to: |

|

|

|

|

|

|

|

|

|

|

|

Common shareholders |

|

(5,721) |

|

|

20,851 |

|

NMF (2) |

|

(5,508) |

|

|

20,037 |

NMF (2) |

|

Non-controlling interests |

|

258 |

|

|

1,792 |

|

(86%) |

|

1,565 |

|

|

5,522 |

(72%) |

|

Adjusted net income (1) |

|

1,771 |

|

|

2,034 |

|

(13%) |

|

9,973 |

|

|

7,544 |

32% |

|

Diluted (loss) earnings per Common Share |

|

(0.12) |

|

|

0.54 |

|

NMF (2) |

|

(0.12) |

|

|

0.53 |

NMF (2) |

|

Adjusted earnings (loss) per Common Share (1) |

$ |

0.03 |

|

$ |

(0.01 |

) |

NMF (2) |

$ |

0.18 |

|

$ |

0.01 |

NMF (2) |

(1) Please see the Non-IFRS

Financial Performance Measures section of this document for

additional information.

(2) The percentage change is

Not a Meaningful Figure (“NMF”).

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

(in thousands) |

|

2021 |

|

|

2020 |

|

Change |

|

|

2021 |

|

|

2020 |

|

Change |

|

Adjusted EBITDA(1) |

|

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

$ |

11,823 |

|

$ |

8,653 |

|

37% |

|

$ |

46,868 |

|

$ |

27,376 |

|

71% |

|

Non-Core Business Asset Management |

|

(1,285) |

|

|

(736) |

|

(75%) |

|

|

(2,986) |

|

|

(2,162) |

|

(38%) |

|

Total Adjusted EBITDA(1) |

$ |

10,538 |

|

$ |

7,917 |

|

33% |

|

$ |

43,882 |

|

$ |

25,214 |

|

74% |

(1) Please see the Non-IFRS

Financial Performance Measures section of this document for

additional information.

Q4-2021 Highlights

The Corporation had a net loss for the three

months and year ended December 31, 2021, compared to net income in

the same periods in the previous year, primarily due to finance

expense on the Preferred Share liability and an increased net loss

in the Non-Core Business Asset Management segment due to the

recognition of the deferred tax asset during 2020, partly offset by

higher DLC Group revenues from an increase in funded mortgage

volumes. The Corporation did not have discontinued operations

during the year ended December 31, 2021, compared to income from

discontinued operations during the year ended December 31,

2020.

Adjusted net income decreased during the three

months ended December 31, 2021 compared to the same period in the

prior year, primarily from higher general administrative expenses

and higher direct costs, partly offset by increased DLC Group

revenues from higher funded mortgage volumes. During the year ended

December 31, 2021, adjusted net income increased compared to the

previous year, primarily from increased DLC Group revenues from

higher funded mortgage volumes.

Adjusted EBITDA increased for the three months

and year ended December 31, 2021 from increased revenues from

higher funded mortgage volumes. The increase in adjusted EBITDA

contributed to increased free cash flow attributable to common

shareholders during the three months and year ended December 31,

2021, when compared to 2020.

Selected Segmented Financial

Highlights:Our reportable segment results reconciled to

our consolidated results are presented in the table below. The

segmented information for the comparative three months and year

ended December 31, 2020 exclude discontinued operations results

from the Non-Core Assets. The current period results for the three

months and year ended December 31, 2021 include the Non-Core Assets

as an equity accounted investment within the Non-Core Business

Asset Management segment.

|

Three months ended December 31, |

|

Year ended December 31, |

|

(in thousands) |

|

2021 |

|

|

2020 |

|

Change |

|

2021 |

|

|

2020 |

|

Change |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

$ |

21,266 |

|

$ |

17,477 |

|

22% |

$ |

78,816 |

|

$ |

52,413 |

|

50% |

|

Consolidated revenues |

|

21,266 |

|

|

17,477 |

|

22% |

|

78,816 |

|

|

52,413 |

|

50% |

|

Operating expenses(1) |

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

|

10,862 |

|

|

10,397 |

|

4% |

|

37,940 |

|

|

30,418 |

|

25% |

|

Non-Core Business Asset Management |

|

1,277 |

|

|

1,928 |

|

(34%) |

|

3,489 |

|

|

3,747 |

|

(7%) |

|

Consolidated operating expenses |

|

12,139 |

|

|

12,325 |

|

(2%) |

|

41,429 |

|

|

34,165 |

|

21% |

|

Income (loss) from operations |

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

|

10,404 |

|

|

7,080 |

|

47% |

|

40,876 |

|

|

21,995 |

|

86% |

|

Non-Core Business Asset Management |

|

(1,277) |

|

|

(1,928) |

|

34% |

|

(3,489) |

|

|

(3,747) |

|

7% |

|

Consolidated income from operations |

|

9,127 |

|

|

5,152 |

|

77% |

|

37,387 |

|

|

18,248 |

|

105% |

|

Adjusted EBITDA(2) |

|

|

|

|

|

|

|

|

|

|

|

Core Business Operations |

|

11,823 |

|

|

8,653 |

|

37% |

|

46,868 |

|

|

27,376 |

|

71% |

|

Non-Core Business Asset Management |

|

(1,285) |

|

|

(736) |

|

(75%) |

|

(2,986) |

|

|

(2,162) |

|

(38%) |

|

Consolidated Adjusted EBITDA(2) |

|

10,538 |

|

|

7,917 |

|

33% |

|

43,882 |

|

|

25,214 |

|

74% |

(1) Operating expenses comprise of

direct costs, general and administrative expenses, share-based

payments, and depreciation and amortization expense.

(2) Please see the Non-IFRS Financial

Performance Measures section of this document for additional

information.

Non-IFRS Financial Performance

Measures

Management presents certain non-IFRS financial

performance measures which we use as supplemental indicators of our

operating performance. These non-IFRS measures do not have any

standardized meaning, and therefore are unlikely to be comparable

to the calculation of similar measures used by other companies and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS. Non-IFRS

measures are defined and reconciled to the most directly comparable

IFRS measure. Non-IFRS financial performance measures include

Adjusted EBITDA, Adjusted net income, Adjusted earnings per share,

and free cash flow. Please see the Non-IFRS Financial Performance

Measures section of the Corporation’s MD&A dated March 29,

2022, for the three months and year ended December 31, 2021, for

further information on these measures. The Corporation's MD&A

is available on SEDAR at www.sedar.com.

The following table reconciles adjusted EBITDA

from (loss) income before income tax, for continuing operations

which is the most directly comparable measure calculated in

accordance with IFRS:

|

|

Three months ended December 31, |

|

Year ended December 31, |

|

(in thousands) |

2021 |

|

2020 |

|

|

2021 |

|

|

2020 |

|

(Loss) income before income tax |

$ |

(3,672) |

|

$ |

4,238 |

|

$ |

4,845 |

|

$ |

13,062 |

|

Add back: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

979 |

|

|

1,062 |

|

|

4,130 |

|

|

4,312 |

|

Finance expense |

|

2,999 |

|

|

1,299 |

|

|

6,808 |

|

|

5,700 |

|

Finance expense on the Preferred Share liability |

|

9,675 |

|

|

- |

|

|

26,543 |

|

|

- |

|

|

|

9,981 |

|

|

6,599 |

|

|

42,326 |

|

|

23,074 |

|

Adjustments to remove: |

|

|

|

|

|

|

|

|

|

Share-based payments |

|

526 |

|

|

1,256 |

|

|

1,107 |

|

|

1,655 |

|

Foreign exchange gain |

|

(210) |

|

|

(246) |

|

|

(247) |

|

|

(59) |

|

Loss (gain) on contract settlement |

|

28 |

|

|

(119) |

|

|

559 |

|

|

137 |

|

Other expense (income)(1) |

|

109 |

|

|

367 |

|

|

(135) |

|

|

75 |

|

Acquisition, integration and restructuring costs(2) |

|

104 |

|

|

60 |

|

|

272 |

|

|

332 |

|

Adjusted EBITDA(3) |

$ |

10,538 |

|

$ |

7,917 |

|

$ |

43,882 |

|

$ |

25,214 |

(1) Other income in the year

ended December 31, 2021 relates to the derecognition of sales tax

receivables and payables on initial acquisition of the Core

Business Operations in 2016 and litigation settlements in the Core

Business Operations, partly offset by a loss on disposal of

intangible assets. Other expense in the year ended December 31,

2020 primarily related to the write down of the Non-Core Business

Asset Management segment’s non-equity-accounted investment, partly

offset by litigation settlements in the Core Business

Operations.

(2) Acquisition, integration

and restructuring costs for the years ended December 31, 2021 and

2020 relate to the restructuring and amalgamation of the

Corporation from Founders Advantage Capital Corp. to Dominion

Lending Centres Inc. Also included in the year ended December 31,

2021 are restructuring costs related to the Corporation’s

graduation to the TSX, the SIB, and debt restructuring.

(3) The amortization of

franchise rights and relationships within the Core Business

Operations of $0.7 million and $2.7 million for the three months

and year ended December 31, 2021, respectively, (December 31, 2020

- $0.6 million and $2.0 million) are classified as a charge against

revenue, and have not been added back for adjusted EBITDA.

The following table reconciles free cash flow

from cash flow from operating activities, which is the most

directly comparable measure calculated in accordance with IFRS:

|

|

Three months ended December 31, |

|

Year Ended December 31, |

|

(in thousands) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Cash flow from operating activities |

$ |

9,468 |

|

$ |

8,921 |

|

$ |

39,061 |

|

$ |

33,190 |

|

|

Discontinued Operations – cash flows from operating activities |

|

- |

|

|

(1,815) |

|

|

- |

|

|

(9,992) |

|

|

Continuing Operations – changes in non-cash working capital and

other non-cash items |

|

(1,992) |

|

|

(2,231) |

|

|

(4,745) |

|

|

(8,235) |

|

|

Cash provided from continuing operations excluding changes

in non-cash working capital and other non-cash items |

|

7,476 |

|

|

4,875 |

|

|

34,316 |

|

|

14,963 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Distributions from equity accounted investees (1) |

|

420 |

|

|

120 |

|

|

1,449 |

|

|

360 |

|

|

Maintenance CAPEX (1) (2) |

|

(181) |

|

|

524 |

|

|

(1,523) |

|

|

(1,026) |

|

|

NCI portion of cash provided from continuing operations |

|

(228) |

|

|

(2,979) |

|

|

(1,530) |

|

|

(9,242) |

|

|

Lease payments (1) |

|

(135) |

|

|

(109) |

|

|

(544) |

|

|

(408) |

|

|

Acquisition, integration and restructuring costs (1) |

|

104 |

|

|

42 |

|

|

272 |

|

|

314 |

|

|

Loss (gain) on contract settlement (1) |

|

28 |

|

|

(72) |

|

|

559 |

|

|

82 |

|

|

Other items (1) |

|

109 |

|

|

- |

|

|

(135) |

|

|

(114) |

|

|

|

|

7,593 |

|

|

2,401 |

|

|

32,864 |

|

|

4,929 |

|

|

Free cash flow attributable to Preferred Shareholders |

|

(4,065) |

|

|

- |

|

|

(15,727) |

|

|

- |

|

|

Free cash flow attributable to common

shareholders |

$ |

3,528 |

|

$ |

2,401 |

|

$ |

17,137 |

|

$ |

4,929 |

|

(1) Amounts presented reflect

the Corporation’s common shareholders’ proportion and have excluded

amounts attributed to NCI holders.

(2) Includes amount paid to

maintain the current asset base and does not include amounts

considered as growth CAPEX.

The following table reconciles adjusted net

income from net (loss) income, which is the most directly

comparable measure calculated in accordance with IFRS:

|

Three months ended December 31, |

Year Ended December 31, |

|

(in thousands) |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

Net (loss) income |

$ |

(5,463) |

|

$ |

22,643 |

|

$ |

(3,943) |

|

$ |

25,559 |

|

|

Add back: |

|

|

|

|

|

|

|

|

|

Discontinued operations |

|

- |

|

|

(3,953) |

|

|

- |

|

|

(1,688) |

|

|

Interest penalty – Sagard credit facility repayment |

|

1,101 |

|

|

- |

|

|

1,101 |

|

|

- |

|

|

Recognition of non-capital losses |

|

- |

|

|

(16,718) |

|

|

- |

|

|

(16,718) |

|

|

Foreign exchange gain |

|

(210) |

|

|

(246) |

|

|

(247) |

|

|

(59) |

|

|

Finance expense on the Preferred Share liability |

|

9,675 |

|

|

- |

|

|

26,543 |

|

|

- |

|

|

Loss (gain) on contract settlement |

|

28 |

|

|

(119) |

|

|

559 |

|

|

137 |

|

|

Other expense (income) |

|

109 |

|

|

367 |

|

|

(135) |

|

|

75 |

|

|

Acquisition, integration and restructuring costs |

|

104 |

|

|

60 |

|

|

272 |

|

|

332 |

|

|

Income tax effects of adjusting items |

|

113 |

|

|

- |

|

|

42 |

|

|

(94) |

|

|

|

|

5,457 |

|

|

2,034 |

|

|

24,192 |

|

|

7,544 |

|

|

Core Business Operations’ adjusted net income attributable to

Preferred Shareholders |

|

(3,686) |

|

|

- |

|

|

(14,219) |

|

|

- |

|

|

Adjusted net income |

$ |

1,771 |

|

$ |

2,034 |

|

$ |

9,973 |

|

$ |

7,544 |

|

|

Adjusted net income (loss) attributable to common shareholders |

|

1,513 |

|

|

(290) |

|

|

8,408 |

|

|

520 |

|

|

Adjusted net income attributable to non-controlling interest |

|

258 |

|

|

2,324 |

|

|

1,565 |

|

|

7,024 |

|

|

Diluted adjusted earnings (loss) per Common Share |

$ |

0.03 |

|

$ |

(0.01) |

|

$ |

0.18 |

|

$ |

0.01 |

|

About Dominion Lending Centres

Inc.

The DLC Group is Canada’s leading network of

mortgage professionals. The DLC Group operates through Dominion

Lending Centres and its three main subsidiaries, MCC Mortgage

Centre Canada Inc., MA Mortgage Architects Inc. and Newton

Connectivity Systems Inc., and has operations across Canada. The

DLC Group’s extensive network includes ~7,750 agents and ~530

locations. Headquartered in British Columbia, the DLC Group was

founded in 2006 by Gary Mauris and Chris Kayat.

Contact information for the Corporation is as

follows:

|

James BellCo-President403-560-0821jbell@dlcg.ca |

Robin BurpeeCo-Chief Financial

Officer403-455-9670rburpee@dlcg.ca |

Amar LeekhaSr. Vice-President, Capital

Markets403-455-6671aleekha@dlcg.ca |

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

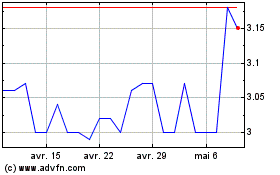

Dominion Lending Centres (TSX:DLCG)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Dominion Lending Centres (TSX:DLCG)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024