DIRTT Environmental Solutions Ltd. (“DIRTT” or the “Company”)

(Nasdaq: DRTT, TSX: DRT), a global leader in industrialized

construction that empowers organizations, together with

construction and design leaders, to build high-performing,

adaptable, interior environments, today announced its financial

results for the three months ended March 31, 2022. All financial

information in this news release is presented in U.S. dollars,

unless otherwise stated.

First Quarter 2022

- Revenue of $38.3 million

- Gross profit margin of 8.6%

- Adjusted Gross Profit Margin1 of 17.7%

- Net loss of $23.0 million

- Net loss margin of (60.2%)

- Adjusted EBITDA1 of ($12.0) million

- Adjusted EBITDA Margin1 of (31.2%)

- Unrestricted cash balance of $38.9 million

Note: (1) See “Non-GAAP Financial Measures”

Management Commentary

“First quarter revenue was at the low end of our estimates but

was an increase of 30% over the same period in 2021 and we believe

mark a shift in activity levels as the pandemic moves to endemic

with the easing of health restrictions across North America,” said

Geoff Krause, CFO and co-interim CEO. “While the beginning of the

year temporarily sent many employees back to their home offices and

delayed return dates, we experienced a strong uptick in activity

that began to translate into orders in March. Approximately 46% of

our first quarter revenues were generated in March and we have seen

improved sales activity continue into the second quarter. March

marked the highest revenue month since October of 2020 and the

second highest revenue month since the beginning of the pandemic.

Our twelve-month forward pipeline, including leads, increased by 5%

to $318 million from $302 million at January 1, 2022.”

“In early April, we completed our final shift at the Phoenix

Facility and commenced decommissioning activities,” said Jeffrey

Calkins, COO and co-interim CEO. “While this closure temporarily

impacted labor capacity in April as a result of hiring challenges

in Savannah, we are actively focused on increasing staff levels at

Savannah and Calgary required to expand aluminum manufacturing at

those facilities to support the activity levels that we are seeing

build and to meet our delivery timeline commitments.”

“We expected high cash usage in the first quarter,” added Mr.

Krause, “driven by the slow start to the quarter which resulted in

working capital build combined with one-time restructuring costs

and professional fees associated with the contested director

elections. Full year revenue guidance is consistent with

improvements in cash usage as 2022 progresses as a result of

sequential improvements in revenues and a lower fixed cost base,

approaching monthly cashflow breakeven in the third or fourth

quarter of 2022.”

Mr. Krause concluded, “As an organization, we are relieved to

have the proxy fight behind us and enthusiastically welcome our new

board of directors. It is with the unwavering belief in the

opportunity for DIRTT, in our employees who have repeatedly

demonstrated extraordinary resilience and loyalty for our company

and in our partners with whom we are grateful to work with every

day, that Jeff Calkins and I assumed the role of co-CEO during this

interim period. We are also pleased to announce the appointment of

Jeffrey Metcalf to interim CFO, effective May 9th, 2022, to enable

me to better focus on my new responsibilities working alongside

Jeff Calkins.”

Ken Sanders commented, “We have been humbled by the support from

the employees and partners during the early stages of the

transition to the new board of directors. The board of directors is

grateful for the commitment and leadership of Geoff Krause and Jeff

Calkins who stepped up to the role of co-interim CEO and, along

with the rest of our very talented leadership team are providing

strategic insight and strong guidance for developing the path

forward for the organization. The CEO search process has been

immediately prioritized and we have picked up and accelerated the

Company’s search process already underway. We anticipate being able

to welcome a new CEO by mid-year.”

“In our early observations, we strongly believe that together

with our leadership, our re-energized employees and our partners,

we can unlock meaningful value for shareholders, customers and

other stakeholders under the stewardship of the new board. We have

confidence in the financial guidance provided previously by the

organization and believe the second quarter revenue range between

$43M - $47M and full year revenue range between $175M - $185M are

achievable” Mr. Sanders continued. “On behalf of the board of

directors, we are enthusiastically looking forward to leveraging

our industry experience to be of service to DIRTT in promoting its

growth and financial performance as a public company.”

First Quarter Financial Review

Revenues for the quarter ended March 31, 2022 were $38.3

million, an increase of $8.8 million or 30% from $29.5 million for

the period ended March 31, 2021. While the resurgence of COVID-19

infections due to the Omicron variant at the beginning of the year

temporarily sent many employees back to their home offices and

delayed return dates, DIRTT and its partners experienced an uptick

in planning activity and opportunities growth which began to

translate into orders in March 2022.

Gross profit for the quarter ended March 31, 2022 was $3.3

million or 8.6% of revenue, a decrease of $0.1 million or 2% from

$3.4 million or 11.4% of revenue for the quarter ended March 31,

2021. The decrease in gross profit margin largely reflects

significant inflationary increases in the realized cost of

materials, transportation and packaging partially offset by

improved labor utilization and fixed cost leverage on higher

revenues. Gross profit for the quarter ended March 31, 2022 also

included $1.1 million of accelerated depreciation and amortization

arising from a change in useful life of assets.

Adjusted Gross Profit and Adjusted Gross Profit Margin (see

“Non-GAAP Financial Measures”) for the quarter ended March 31, 2022

was $6.8 million or 17.7%, respectively, a decrease from $7.2

million or 24.3%, respectively, for the quarter ended March 31,

2021, due to the reasons described above.

Sales and marketing expenses increased by $0.6 million to $7.2

million for the three months ended March 31, 2022 from $6.7 million

for the three months ended March 31, 2021. The increases were

largely related to an increase of $0.4 million in travel, meals and

entertainment expenses as business activity has increased and

restrictions on travel have eased, a $0.3 million increase in

commissions due to higher sales volumes and increased facilities

costs related to the Dallas DXC which opened in the third quarter

of 2021, offset by a decrease in salaries and benefits costs.

General and administrative expenses increased $0.8 million to

$8.0 million for the three months ended March 31, 2022 from $7.2

million for the three months ended March 31, 2021. The increase

reflects $1.5 million of incremental professional fees associated

with the contested director elections offset by a $0.7 million

decrease in salaries and benefits costs.

Operations support expenses increased by $0.2 million from $2.3

million for the three months ended March 31, 2021 to $2.5 million

for the three months ended March 31, 2022. The increase was due to

lower costs capitalized to internal projects with the completion of

the Rock Hill manufacturing facility and Dallas DXC.

Technology and development expenses increased by $0.2 million to

$2.1 million for the three months ended March 31, 2022, compared to

$1.9 million for the three months ended March 31, 2021, primarily

related to a decrease in capitalized software development

costs.

During the quarter we incurred $3.7 million in reorganization

costs associated with salaried workforce reductions and initial

costs associated with the closure of the Phoenix Facility. Overall

one-time costs were initially estimated to be $5 million, we now

anticipate a further $4.4 million of reorganization costs in the

second quarter, as the Company incurred a $3.1 million charge for

incremental insurance on change of control of the board on April

26, 2022.

Net loss for the three months ended March 31, 2022 was $23.0

million compared to $12.5 million for the three months ended March

31, 2021. The higher net loss is primarily the result of a $0.1

million decrease in gross profit, a $5.6 million increase in

operating expenses including $3.7 million of reorganization

expenses and $1.5 million of incremental professional fees as

described previously, a $0.8 million increase in interest expense,

a $0.6 million increase in foreign exchange loss and a $3.5 million

decrease in government subsidies.

Adjusted EBITDA (see “Non-GAAP Financial Measures”) for the

quarter ended March 31, 2022 was a $12.0 million loss or (31.2)%, a

decline of $0.6 million from a $11.4 million loss or (38.6)% for

the quarter ended March 31, 2021 for the above noted reasons.

Conference Call and Webcast Details

A conference call and webcast for the investment community is

scheduled for Thursday, May 5th, 2022 at 8:00 a.m. MDT (10:00 a.m.

EDT). The call and webcast will be hosted by Ken Sanders, board

chair, Geoff Krause, chief financial officer and interim co-chief

executive officer, Jeff Calkins, chief operating officer and

interim co-chief executive officer, and Kim MacEachern, director of

investor relations.

The conference call will be broadcast live in listen-only mode

available through the company website at dirtt.com/investors.

Alternatively, click here to listen to the live webcast.

To join by telephone, dial +1-800-319-4610 (toll-free in North

America) or +1-604-638-5340 (international). Please dial in a

minimum of 15 minutes prior to the start time to ensure a timely

connection to the call.

Investors are invited to submit questions to ir@dirtt.com before

the call. Supplemental information slides will be available within

the webcast and at dirtt.com/investors prior to the call start.

A replay of the webcast will be available online and on DIRTT’s

website.

Statement of Operations

(Unaudited – Stated in thousands of U.S. dollars)

|

|

For the Three Months Ended March 31, |

|

|

|

2022 |

|

|

2021 |

|

|

Product revenue |

37,451 |

|

|

28,542 |

|

| Service revenue |

835 |

|

|

923 |

|

| Total

revenue |

38,286 |

|

|

29,465 |

|

| Product cost of sales |

34,607 |

|

|

23,551 |

|

| Costs of under-utilized

capacity |

- |

|

|

1,756 |

|

| Service cost of sales |

392 |

|

|

788 |

|

| Total cost of

sales |

34,999 |

|

|

26,095 |

|

| Gross

profit |

3,287 |

|

|

3,370 |

|

| Expenses |

|

|

|

|

|

| Sales and marketing |

7,228 |

|

|

6,670 |

|

| General and

administrative |

7,993 |

|

|

7,241 |

|

| Operations support |

2,498 |

|

|

2,297 |

|

| Technology and

development |

2,140 |

|

|

1,935 |

|

| Stock-based compensation |

1,302 |

|

|

1,094 |

|

| Reorganization |

3,692 |

|

|

- |

|

| Total operating

expenses |

24,853 |

|

|

19,237 |

|

| Operating

loss |

(21,566 |

) |

|

(15,867 |

) |

| Government subsidies |

575 |

|

|

4,068 |

|

| Foreign exchange loss |

(732 |

) |

|

(180 |

) |

| Interest income |

11 |

|

|

19 |

|

| Interest expense |

(1,330 |

) |

|

(500 |

) |

| |

(1,476 |

) |

|

3,407 |

|

| Loss before

tax |

(23,042 |

) |

|

(12,460 |

) |

| Income

taxes |

|

|

|

|

|

| Deferred tax expense |

- |

|

|

39 |

|

| |

- |

|

|

39 |

|

| Net loss |

(23,042 |

) |

|

(12,499 |

) |

| Loss per

share |

|

|

|

|

|

| Basic and diluted loss per

share |

(0.27 |

) |

|

(0.15 |

) |

| Weighted average

number of shares outstanding (in thousands) |

|

|

|

|

|

| Basic and Diluted |

85,451 |

|

|

84,681 |

|

Non-GAAP Financial Measures

Our condensed consolidated interim financial statements are

prepared in accordance with GAAP. These GAAP financial statements

include non-cash charges and other charges and benefits that we

believe are unusual or infrequent in nature or that we believe may

make comparisons to our prior or future performance difficult.

As a result, we also provide financial information in this news

release that is not prepared in accordance with GAAP and should not

be considered as an alternative to the information prepared in

accordance with GAAP. Management uses these non-GAAP financial

measures in its review and evaluation of the financial performance

of the Company. We believe that these non-GAAP financial measures

also provide additional insight to investors and securities

analysts as supplemental information to our GAAP results and as a

basis to compare our financial performance period over period and

to compare our financial performance with that of other companies.

We believe that these non-GAAP financial measures facilitate

comparisons of our core operating results from period to period and

to other companies by removing the effects of our capital structure

(net interest income on cash deposits, interest expense on

outstanding debt and debt facilities, or foreign exchange

movements), asset base (depreciation and amortization), the impact

of under-utilized capacity on gross profit, tax consequences,

reorganization expense and stock-based compensation. We remove the

impact of all foreign exchange from Adjusted EBITDA. Foreign

exchange gains and losses can vary significantly period-to-period

due to the impact of changes in the U.S. and Canadian dollar

exchange rates on foreign currency denominated monetary items on

the balance sheet and are not reflective of the underlying

operations of the Company. We remove the impact of under-utilized

capacity from gross profit, and fixed production overheads are

allocated to inventory on the basis of normal capacity of the

production facilities. In periods where production levels are

abnormally low, unallocated overheads are recognized as an expense

in the period in which they are incurred. In addition, management

bases certain forward-looking estimates and budgets on non-GAAP

financial measures, primarily Adjusted EBITDA.

Government subsidies, depreciation and amortization, stock-based

compensation expense, reorganization expenses and foreign exchange

gains and losses and impairment expenses are excluded from our

non-GAAP financial measures because management considers them to be

outside of the Company’s core operating results, even though some

of those receipts and expenses may recur, and because management

believes that each of these items can distort the trends associated

with the Company’s ongoing performance. We believe that excluding

these receipts and expenses provides investors and management with

greater visibility to the underlying performance of the business

operations, enhances consistency and comparativeness with results

in prior periods that do not, or future periods that may not,

include such items, and facilitates comparison with the results of

other companies in our industry.

The following non-GAAP financial measures are presented in this

news release, and a description of the calculation for each measure

is included.

|

Adjusted Gross Profit |

Gross profit before deductions for costs of under-utilized

capacity, depreciation, and amortization |

| |

|

| Adjusted Gross Profit

Margin |

Adjusted Gross Profit divided by

revenue |

| |

|

| EBITDA |

Net income before interest,

taxes, depreciation, and amortization |

| |

|

| Adjusted

EBITDA |

EBITDA adjusted to remove foreign

exchange gains or losses; impairment expenses; reorganization

expenses; stock-based compensation expense; government subsidies;

and any other non-core gains or losses |

| |

|

| Adjusted EBITDA

Margin |

Adjusted EBITDA divided by

revenue |

You should carefully evaluate these non-GAAP financial measures,

the adjustments included in them, and the reasons we consider them

appropriate for analysis supplemental to our GAAP information. Each

of these non-GAAP financial measures has important limitations as

an analytical tool due to exclusion of some but not all items that

affect the most directly comparable GAAP financial measures. You

should not consider any of these non-GAAP financial measures in

isolation or as substitutes for an analysis of our results as

reported under GAAP. You should also be aware that we may recognize

income or incur expenses in the future that are the same as, or

similar to some of the adjustments in these non-GAAP financial

measures. Because these non-GAAP financial measures may be defined

differently by other companies in our industry, our definitions of

these non-GAAP financial measures may not be comparable to

similarly titled measures of other companies, thereby diminishing

their utility.

The following table presents a reconciliation for the three

months ended March 31, 2022, and 2021 of EBITDA and Adjusted EBITDA

to our net loss, which is the most directly comparable GAAP measure

for the periods presented:

(Unaudited Stated in thousands of U.S. dollars)

| |

For the Three Months Ended March 31, |

|

|

|

2022 |

|

|

2021 |

|

| |

($ in thousands) |

|

| Net loss for the

period |

(23,042 |

) |

|

(12,499 |

) |

| Add back (deduct): |

|

|

|

|

|

| Interest Expense |

1,330 |

|

|

500 |

|

| Interest Income |

(11 |

) |

|

(19 |

) |

| Income Tax Expense |

- |

|

|

39 |

|

| Depreciation and

Amortization |

4,622 |

|

|

3,402 |

|

| EBITDA |

(17,101 |

) |

|

(8,577 |

) |

| Foreign Exchange Losses |

732 |

|

|

180 |

|

| Stock-Based Compensation |

1,302 |

|

|

1,094 |

|

| Government Subsidies |

(575 |

) |

|

(4,068 |

) |

| Reorganization Expense |

3,692 |

|

|

- |

|

| Adjusted

EBITDA |

(11,950 |

) |

|

(11,371 |

) |

| Net Loss

Margin(1) |

(60.2 |

)% |

|

(42.4 |

)% |

| Adjusted EBITDA

Margin |

(31.2 |

)% |

|

(38.6 |

)% |

(1) Net loss divided by revenue.

The following table presents a reconciliation for the three

months ended March 31, 2022, and 2021 of Adjusted Gross Profit to

our gross profit, which is the most directly comparable GAAP

measure for the periods presented:

(Unaudited Stated in thousands of U.S. dollars)

|

|

For the Three Months Ended March 31, |

|

|

|

2022 |

|

|

2021 |

|

|

|

($ in thousands) |

|

| Gross

profit |

3,287 |

|

|

3,370 |

|

| Gross profit

margin |

8.6 |

% |

|

11.4 |

% |

| Add: Depreciation and

amortization expense |

3,472 |

|

|

2,029 |

|

| Add: Costs of under-utilized

capacity |

- |

|

|

1,756 |

|

| Adjusted Gross

Profit |

6,759 |

|

|

7,155 |

|

| Adjusted Gross Profit

Margin |

17.7 |

% |

|

24.3 |

% |

Special Note Regarding Forward-Looking

Statements

Certain statements contained in this news release are

“forward-looking statements” within the meaning of “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995 and Section 21E of the Securities Exchange Act

of 1934 and “forward-looking information” within the meaning of

applicable Canadian securities laws. All statements, other than

statements of historical fact included in this news release,

regarding our strategy, future operations, financial position,

estimated revenues and losses, projected costs, prospects, plans

and objectives of management are forward-looking statements. When

used in this news release, the words “anticipate,” “believe,”

“expect,” “estimate,” “intend,” “plan,” “project,” “outlook,”

“may,” “will,” “should,” “would,” “could,” “can,” the negatives

thereof, variations thereon and other similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain such identifying words. In

particular and without limitation, this news release contains

forward-looking information pertaining to our expectations

regarding second quarter 2022 and full year 2022 revenues; our

beliefs about our twelve-month forward sales pipeline; our belief

that the COVID pandemic is entering an endemic stage; our beliefs

about future activity levels; our beliefs about the impact of

future revenue on cash flow, and the timing thereof; and our

beliefs about the timing of being able to hire a permanent CEO.

Forward-looking statements are based on certain estimates,

beliefs, expectations, and assumptions made in light of

management’s experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors that may be appropriate.

Forward-looking statements necessarily involve unknown risks and

uncertainties, which could cause actual results or outcomes to

differ materially from those expressed or implied in such

statements. Due to the risks, uncertainties, and assumptions

inherent in forward-looking information, you should not place undue

reliance on forward-looking statements. Factors that could have a

material adverse effect on our business, financial condition,

results of operations and growth prospects include, but are not

limited to, the severity and duration of the COVID-19 pandemic and

related economic repercussions and other risks described under the

section titled “Risk Factors” in our Annual Report on Form 10-K for

the year ended December 31, 2021, filed with the U.S. Securities

and Exchange Commission (the “SEC”) and applicable securities

commissions or similar regulatory authorities in Canada on February

23, 2022, and as supplemented by our Quarterly Report on Form 10-Q

for the quarter ended March 31, 2022 filed with the SEC and

applicable securities commissions or similar regulatory authorities

in Canada on May 4, 2022.

Our past results of operations are not necessarily indicative of

our future results. You should not rely on any forward-looking

statements, which represent our beliefs, assumptions and estimates

only as of the dates on which they were made, as predictions of

future events. We undertake no obligation to update these

forward-looking statements, even though circumstances may change in

the future, except as required under applicable securities laws. We

qualify all of our forward-looking statements by these cautionary

statements.

About DIRTT Environmental Solutions

DIRTT is a global leader in industrialized construction. Its

system of physical products and digital tools empowers

organizations, together with construction and design leaders, to

build high-performing, adaptable, interior environments. Operating

in the commercial, healthcare, education, and public sector

markets, DIRTT’s system provides total design freedom, and greater

certainty in cost, schedule and outcomes.

Headquartered in the US and Canada, DIRTT trades on Nasdaq under

the symbol “DRTT” and on the Toronto Stock Exchange under the

symbol “DRT”.

FOR FURTHER INFORMATION PLEASE CONTACT

Kim MacEachern

Investor Relations, DIRTT

403-618-4539

kmaceachern@dirtt.com

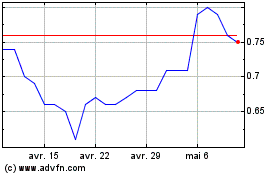

DIRTT Environmental Solu... (TSX:DRT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

DIRTT Environmental Solu... (TSX:DRT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024