Mandalay Resources Corporation ("Mandalay" or the "Company") (TSX:

MND, OTCQB: MNDJF) is pleased to announce its financial results for

the quarter ended June 30, 2021.

The Company’s condensed and consolidated interim

financial results for the quarter ended June 30, 2021, together

with its Management’s Discussion and Analysis (“MD&A”) for the

corresponding period, can be accessed under the Company’s profile

on www.sedar.com and on the Company’s website at

www.mandalayresources.com. All currency references in this press

release are in U.S. dollars except as otherwise indicated.

Second Quarter 2021

Highlights:

- Quarterly revenue of $51.4 million – second highest since Q2

2016;

- Adjusted EBITDA of $23.1 million;

- $12.7 million free cash flow and $26.6 million in net cash flow

from operating activities;

- Adjusted net income of $11.5 million ($0.13 or C$0.15 per

share);

- Consolidated net income of $4.8 million ($0.05 or C$0.06 per

share); and

- Quarter ending cash balance of $39.1 million.

Dominic Duffy, President and CEO of Mandalay,

commented:

“Mandalay Resources is pleased to deliver strong

financial results for the second quarter of 2021, as the Company

continues to execute against our operational strategy and is on

track to attain our 2021 production and cost guidance.

During the second quarter, the Company generated

$12.7 million in free cash flow and ended the quarter with a cash

balance of $39.1 million. As the Company continues to generate

strong free cash flow, the emerging strength of our balance sheet

significantly improves our abilities to fund near-term growth

opportunities. During this quarter, the Company also repaid $3.8

million towards our Syndicated Facility leaving $51.4 million

owing.”

Mr. Duffy continued, “During the quarter the

Company generated $51.4 million in consolidated revenue and $23.1

million in adjusted EBITDA, resulting in an EBITDA margin of 45%,

and a year to date adjusted EBITDA of $49.2 million. Mandalay

earned $11.5 million ($0.13 or C$0.15 per share) in adjusted net

income during the second quarter, marking our sixth consecutive

quarter of profitability.”

Mr. Duffy added, “Our consolidated cash and

all-in sustaining costs per saleable gold equivalent ounce during

the second quarter of 2021 were $960 and $1,342, respectively, an

increase as compared to the $851 and $1,230 during the same period

last year. The main reasons for this were due to foreign exchange

movements, with local currencies strengthening against the U.S.

dollar, a decrease in gold production at Björkdal for the quarter

due to lower grade stoping and increased infill exploration spend

at both sites.”

Mr. Duffy added, “Costerfield posted $23.4

million in revenue and $15.8 million in adjusted EBITDA at a cash

cost and all-in sustaining cost of $652 and $1,009 per oz gold

equivalent produced, respectively.

Exploration so far this year has been a huge

success for Mandalay due to the outstanding results at our newly

discovered high-grade Shepherd structure, which lies beneath our

Youle mine at Costerfield. With $4.3 million spent on exploration

year to date, we expect to exceed our 2021 guidance amount for

exploration spending. The additional capital invested aligns with

our growth strategy as the Company seeks to deliver further value

at Costerfield by extending its life of mine.”

Mr. Duffy continued, “Björkdal generated stable

production and sales resulting in $22.5 million and $6.5 million of

revenue and adjusted EBITDA, respectively, during the second

quarter of 2021. The underground mined tonnage ramp up continued as

we mined approximately 540,000 tonnes during the first half of

2021, an approximate 11% increase as compared to the same period

last year. We are on track to achieve our goal of 1.1 million

tonnes production from the underground.

Grade performance during this quarter was lower

than previous quarters mainly due to the amount of stope production

performed in lower grade areas of the mine. This, along with

negative exchange rate impacts, resulted in higher cash and all-in

sustaining costs of $1,338 and $1,766, respectively, for the

quarter. We expect to see a decrease to these higher unit costs in

the coming quarters as we ramp up production in the lower, higher

grade levels of Aurora.”

Mr. Duffy concluded, “For the rest of 2021, we

expect to improve on this level of operational and financial

performance, while building on our successful exploration

campaigns. At Costerfield, the program will continue with infill

drilling at Shepherd and progressing with deeper drilling at

Cuffley, Augusta and Shepherd. At Björkdal, we will be focused on

the Main, Central and Lake zones to the north east at depth and

extensions of the Aurora zone. At current metal prices and exchange

rates the Company is on schedule to be net debt free by year end

2021.”

Second Quarter 2021 Financial Summary

The following table summarizes the Company’s

financial results for the three months and six months ended June

30, 2021, and 2020:

|

|

Three monthsendedJune

30,2021 |

Three monthsendedJune

30,2020 |

Six monthsendedJune

30,2021 |

Six monthsendedJune

30,2020 |

|

$’000 |

$’000 |

$’000 |

$’000 |

|

Revenue |

51,352 |

42,335 |

103,925 |

83,901 |

|

Cost of sales |

27,135 |

19,734 |

52,549 |

38,566 |

|

Adjusted EBITDA (1) |

23,135 |

21,271 |

49,197 |

42,174 |

|

Income from mine ops before depreciation, depletion |

24,217 |

22,601 |

51,376 |

45,335 |

|

Adjusted net income (1) |

11,475 |

7,632 |

17,121 |

12,818 |

|

Consolidated net income (loss) |

4,790 |

(2,439) |

30,290 |

(6,047) |

|

Capital expenditure |

13,578 |

10,566 |

25,604 |

20,603 |

|

Total assets |

310,841 |

260,298 |

310,841 |

260,298 |

|

Total liabilities |

151,852 |

155,024 |

151,852 |

155,024 |

|

Adjusted net income per share (1) |

0.13 |

0.08 |

0.19 |

0.14 |

|

Consolidated net income (loss) per share |

0.05 |

(0.03) |

0.33 |

(0.07) |

- Adjusted EBITDA, adjusted net

income (loss) and adjusted net income (loss) per share are non-IFRS

measures, defined at the end of this press release “Non-IFRS

Measures”.

In the second quarter of 2021, Mandalay

generated consolidated revenue of $51.4 million, 21% higher than in

the second quarter of 2021. This increase is attributable to

Mandalay selling 3,199 more gold equivalent ounces combined with

higher realized prices in the second quarter of 2021 compared to

the second quarter of 2020. The Company’s realized gold price in

the second quarter of 2021 increased by 5% compared to the second

quarter of 2020, and the realized price of antimony increased by

120%. Consolidated cash cost per ounce of $960

increased by 13% in the second quarter of 2021 compared to the

second quarter of 2020, mainly due to higher costs of production.

Cost of sales during the second quarter of 2021 versus the second

quarter of 2020 were almost same at Costerfield and $3.7 million

higher at Björkdal. Consolidated general and administrative costs

were $0.2 million lower as compared to the prior year quarter.

Mandalay generated adjusted EBITDA of $23.1

million in the second quarter of 2021, 9% higher compared to the

Company’s adjusted EBITDA of $21.3 million in the year ago quarter.

Adjusted net income was $11.5 million in the second quarter of

2021, which excludes the $6.3 million fair value loss related to

the gold hedges associated with the Syndicated Facility and $0.4

million fair value loss related to mark to market adjustment,

compared to an adjusted net income of $7.6 million in the second

quarter of 2020. Consolidated net income was $4.8 million for the

second quarter of 2021, versus a net loss of $2.4 million in the

second quarter of 2020. Mandalay ended the second quarter of 2021

with $39.1 million in cash and cash equivalents.

Second Quarter 2021 Operational Summary

The table below summarizes the Company’s

operations, capital expenditures and operational unit costs for the

three months and six months ended June 30, 2021 and 2020:

|

|

Three monthsended June

30, 2021 |

Three monthsended June 30,

2020 |

Six monthsended June 30,

2021 |

Six monthsended June 30,

2020 |

|

$’000 |

$’000 |

$’000 |

$’000 |

|

Costerfield |

|

Gold produced (oz) |

9,959 |

10,353 |

21,041 |

20,973 |

|

Antimony produced (t) |

858 |

946 |

1,690 |

2,054 |

|

Gold equivalent produced (oz) |

14,818 |

13,502 |

30,276 |

28,429 |

|

Cash cost (1) per oz gold eq. produced ($) |

652 |

662 |

646 |

604 |

|

All-in sustaining cost (1) per oz gold eq. produced ($) |

1,009 |

1,025 |

972 |

935 |

|

Capital development |

3,108 |

3,481 |

6,086 |

6,677 |

|

Property, plant and equipment purchases |

1,029 |

716 |

1,930 |

1,497 |

|

Capitalized exploration |

1,583 |

1,335 |

2,807 |

2,067 |

|

Björkdal |

|

Gold produced (oz) |

10,941 |

11,250 |

22,796 |

22,000 |

|

Cash cost (1) per oz gold produced ($) |

1,338 |

1,078 |

1,259 |

1,065 |

|

All-in sustaining cost (1) per oz gold produced ($) |

1,766 |

1,352 |

1,647 |

1,383 |

|

Capital development |

2,727 |

2,268 |

5,120 |

4,479 |

|

Property, plant and equipment purchases |

4,277 |

2,452 |

8,122 |

4,779 |

|

Capitalized exploration |

601 |

338 |

1,058 |

984 |

|

Cerro Bayo |

|

Gold produced (oz) |

1,807 |

- |

2,531 |

- |

|

Silver produced (oz) |

87,062 |

- |

130,761 |

- |

|

Gold equivalent produced (oz) |

3,084 |

- |

4,447 |

- |

|

Cash cost (1) per oz gold eq. produced ($) |

1,097 |

- |

1,066 |

- |

|

All-in sustaining cost (1) per oz gold eq. produced ($) |

1,110 |

- |

1,075 |

- |

|

Consolidated |

|

Gold equivalent produced (oz) |

28,843 |

24,752 |

57,519 |

50,429 |

|

Cash cost* per oz gold eq. produced ($) |

960 |

851 |

922 |

805 |

|

All-in sustaining cost (1) per oz gold eq. produced ($) |

1,342 |

1,230 |

1,284 |

1,244 |

|

Capital development |

5,835 |

5,749 |

11,206 |

11,156 |

|

Property, plant and equipment purchases |

5,306 |

3,168 |

10,052 |

6,276 |

|

Capitalized exploration (2) |

2,437 |

1,649 |

4,346 |

3,171 |

- Cash cost and all-in sustaining

cost are non-IFRS measures. See “Non-IFRS Measures” at the end of

this press release.

- Includes capitalized exploration

relating to other non-core assets.

Costerfield gold-antimony mine, Victoria, Australia

Costerfield produced 9,959 ounces of gold and

858 tonnes of antimony for 14,818 gold equivalent ounces in the

second quarter of 2021. Cash and all-in sustaining costs at

Costerfield of $652/oz and $1,009/oz, respectively, compared to

cash and all-in sustaining costs of $662/oz and $1,025/oz,

respectively, in the second quarter of 2020.

Björkdal gold mine, Skellefteå, Sweden

Björkdal produced 10,941 ounces of gold in the

second quarter of 2021 with cash and all-in sustaining costs of

$1,338/oz and $1,766/oz, respectively, compared to cash and all-in

sustaining costs of $1,078/oz and $1,352/oz, respectively, in the

second quarter of 2020.

Cerro Bayo silver-gold mine, Patagonia,

Chile

In the second quarter of 2021, the Company spent

nil on care and maintenance expenses at Cerro Bayo, compared to

$0.5 million in the second quarter of 2020. Cerro Bayo is currently

subject to a binding option agreement between the Company and Equus

Mining (“Equus”) pursuant to which Equus has an option to acquire

Cerro Bayo. For further information see the Company’s October 8,

2019, press release.

During the second quarter of 2021, Cerro Bayo

produced 1,807 ounces of gold and 87,062 ounces of silver for 3,084

gold equivalent ounces in the second quarter of 2021 at a cash cost

of $1,097/oz.

Lupin, Nunavut, Canada

Care and maintenance spending at Lupin was less

than $0.1 million during the second quarter of 2021, which was the

same as in the second quarter of 2020. Reclamation spending at

Lupin was $0.8 million during the second quarter of 2021 compared

to $5.1 million during the second quarter of 2020. The full closure

of Lupin will continue in the 2021 season funded by ongoing

progressive security reductions held by CIRNA.

Challacollo, Chile

On April 19, 2021, Aftermath Silver Ltd.

(“Aftermath Silver”) paid C$1.5 million in cash and issued

2,054,794 common shares at fair value of C$0.73 per share to the

Company on May 05, 2021, in satisfaction of a purchase price

instalment. As at June 30, 2021, the Company is holding this asset

as held for sale. Further information regarding the definitive

agreement signed with Aftermath Silver for the sale of Challacollo

can be found in the Company’s November 12, 2019, press release.

La Quebrada, Chile

No work was carried out on the La Quebrada

development property during Q2 2021.

COVID-19

The coronavirus (“COVID-19”) pandemic is present

in all countries in which the Company operates, with cases being

reported in Canada, Australia, Sweden and Chile. At this time, the

Company has activated business continuity practices across all

sites. Management will continue to monitor developments across all

jurisdictions and will adjust its planning as necessary.

The Company is not able to estimate the duration

of the pandemic and potential impact on its business if disruptions

or delays in our operations occur or our ability to transfer our

products to market. In addition, a severe prolonged economic

downturn could result in a variety of risks to the business,

including a decreased ability to raise additional capital when

needed on acceptable terms, if at all. As the situation continues

to evolve, the Company will continue to closely monitor operating

conditions in the countries we operate and respond accordingly.

More details are included in the press release dated March 20,

2020, and on the Company’s website.

Conference Call

Mandalay’s management will be hosting a

conference call for investors and analysts on August 12, 2021, at

8:00 AM (Toronto time).

Analysts and interested investors are invited to

participate using the following dial-in numbers:

|

Participant Number (Toll free): |

(877) 407-8289 |

| Participant Number: |

(201) 689-8341 |

| Conference ID: |

13722369 |

A replay of the conference call will be

available until 11:59 PM (Toronto time), August 26,

2021, and can be accessed using the following dial-in

number:

|

Encore Toll Free Dial-in Number: |

(877) 660-6853 |

| Encore ID: |

13722369 |

About Mandalay Resources Corporation:

Mandalay Resources is a Canadian-based natural

resource company with producing assets in Australia (Costerfield

gold-antimony mine), Sweden (Björkdal gold mine) and Chile (Cerro

Bayo gold-silver mine). The Company is focused on growing its

production and reducing costs to generate significant positive

cashflow.

Mandalay’s mission is to create shareholder value through the

profitable operation of both its Costerfield and Björkdal mines.

Currently, the Company’s main objective is to continue mining the

high-grade Youle vein at Costerfield, which continues to supply

high-grade ore, and to extend Youle’s Mineral Reserves at depth and

to the south, as well as continuing the regional exploration

program. At Björkdal, the Company will aim to increase production

from the Aurora zone and other higher-grade areas in the coming

years, in order to maximize profit margins from the mine and

continue exploration in near mine and regional.

Forward-Looking Statements

This news release contains "forward-looking

statements" within the meaning of applicable securities laws,

including statements regarding the Company’s anticipated

performance in 2021. Readers are cautioned not to place undue

reliance on forward-looking statements. Actual results and

developments may differ materially from those contemplated by these

statements depending on, among other things, changes in commodity

prices and general market and economic conditions. The factors

identified above are not intended to represent a complete list of

the factors that could affect Mandalay. A description of additional

risks that could result in actual results and developments

differing from those contemplated by forward-looking statements in

this news release can be found under the heading “Risk Factors” in

Mandalay’s annual information form dated March 31, 2021, a copy of

which is available under Mandalay’s profile at www.sedar.com. In

addition, there can be no assurance that any inferred resources

that are discovered as a result of additional drilling will ever be

upgraded to proven or probable reserves. Although Mandalay has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements.

Non-IFRS Measures

This news release may contain references to

adjusted EBITDA, adjusted net income, free cash flow, cash cost per

saleable ounce of gold equivalent produced and all-in sustaining

cost all of which are non-IFRS measures and do not have

standardized meanings under IFRS. Therefore, these measures may not

be comparable to similar measures presented by other issuers.

Management uses adjusted EBITDA and free cash

flow as measures of operating performance to assist in assessing

the Company’s ability to generate liquidity through operating cash

flow to fund future working capital needs and to fund future

capital expenditures, as well as to assist in comparing financial

performance from period to period on a consistent basis. Management

uses adjusted net income in order to facilitate an understanding of

the Company’s financial performance prior to the impact of

non-recurring or special items. The Company believes that these

measures are used by and are useful to investors and other users of

the Company’s financial statements in evaluating the Company’s

operating and cash performance because they allow for analysis of

its financial results without regard to special, non-cash and other

non-core items, which can vary substantially from company to

company and over different periods.

The Company defines adjusted EBITDA as income

from mine operations, net of administration costs, and before

interest, taxes, non-cash charges/(income), intercompany charges

and finance costs. The Company defines adjusted net income as net

income before special items. Special items are items of income and

expense that are presented separately due to their nature and, in

some cases, expected infrequency of the events giving rise to them.

A reconciliation between adjusted EBITDA and adjusted net income,

on the one hand, and consolidated net income, on the other hand, is

included in the MD&A.

The Company defines free cash flow as a measure

of the Corporation’s ability to generate and manage liquidity. It

is calculated starting with the net cash flows from operating

activities (as per IFRS) and then subtracting capital expenditures

and lease payments. Refer to Section 1.2 of MD&A for a

reconciliation between free cash flow and net cash flows from

operating activities.

For Costerfield, saleable equivalent gold ounces

produced is calculated by adding to saleable gold ounces produced,

the saleable antimony tonnes produced times the average antimony

price in the period divided by the average gold price in the

period. The total cash operating cost associated with the

production of these saleable equivalent ounces produced in the

period is then divided by the saleable equivalent gold ounces

produced to yield the cash cost per saleable equivalent ounce

produced. The cash cost excludes royalty expenses. Site all-in

sustaining costs include total cash operating costs, sustaining

mining capital, royalty expense, accretion and depletion.

Sustaining capital reflects the capital required to maintain each

site’s current level of operations. The site’s all-in sustaining

cost per ounce of saleable gold equivalent in a period equals the

all-in sustaining cost divided by the saleable equivalent gold

ounces produced in the period.

For Cerro Bayo, saleable equivalent gold ounces

produced is calculated by adding to saleable gold ounces produced,

the saleable silver ounces produced times the average silver price

in the period divided by the average gold price in the period. The

total cash operating cost associated with the production of these

saleable equivalent ounces produced in the period is then divided

by the saleable equivalent gold ounces produced to yield the cash

cost per saleable equivalent ounce produced. The cash cost excludes

royalty expenses. Site all-in sustaining costs include total cash

operating costs, sustaining mining capital, royalty expense,

accretion and depletion. Sustaining capital reflects the capital

required to maintain each site’s current level of operations. The

site’s all-in sustaining cost per ounce of saleable gold equivalent

in a period equals the all-in sustaining cost divided by the

saleable equivalent gold ounces produced in the period.

For Björkdal, the total cash operating cost

associated with the production of saleable gold ounces produced in

the period is then divided by the saleable gold ounces produced to

yield the cash cost per saleable gold ounce produced. The cash cost

excludes royalty expenses. Site all-in costs include total cash

operating costs, royalty expense, accretion, depletion,

depreciation and amortization. Site all-in sustaining costs include

total cash operating costs, sustaining mining capital, royalty

expense, accretion and depletion. Sustaining capital reflects the

capital required to maintain each site’s current level of

operations. The site’s all-in sustaining cost per ounce of saleable

gold equivalent in a period equals the all-in sustaining cost

divided by the saleable equivalent gold ounces produced in the

period.

For the Company as a whole, cash cost per

saleable gold equivalent ounce is calculated by summing the gold

equivalent ounces produced by each site and dividing the total by

the sum of cash operating costs at the sites. Consolidated cash

cost excludes royalty and corporate level general and

administrative expenses. This definition was updated in the third

quarter of 2020 to exclude corporate general and administrative

expenses to better align with industry standard. All-in sustaining

cost per saleable ounce gold equivalent in the period equals the

sum of cash costs associated with the production of gold equivalent

ounces at all operating sites in the period plus corporate overhead

expense in the period plus sustaining mining capital, royalty

expense, accretion, depletion, depreciation and amortization,

divided by the total saleable gold equivalent ounces produced in

the period. A reconciliation between cost of sales and cash costs,

and also cash cost to all-in sustaining costs are included in the

MD&A.

For Further Information:

Dominic Duffy President and Chief Executive

OfficerEdison NguyenManager, Analytics and Investor

RelationsContact: (647) 260-1566 ext. 1

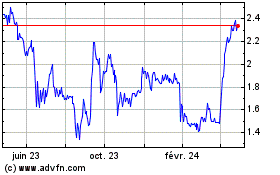

Mandalay Resources (TSX:MND)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Mandalay Resources (TSX:MND)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024