Melcor REIT (TSX: MR.UN) today announced results for the second

quarter ended June 30, 2022. Rental revenue was up 1% in the

quarter at $18.15 million and down 1% at $37.12 million

year-to-date. NOI was down 2% in the quarter at $11.39 million and

down 4% year-to-date at $23.25 million. ACFO for the quarter

was $4.51 million or $0.15 per unit, and $9.57 million or $0.33 per

unit year-to-date. Occupancy held steady over the first quarter and

year-end at 87% and we retained 86% of expiring leases

year-to-date. We continue to actively pursue new tenant

opportunities and have commenced 53,444 sf in new leases. Including

new leasing, renewals and holdovers, we have signed 273,154 sf to

date.

Second Quarter Highlights:

- Revenue was up 1%

at $18.15 million compared to Q2-2021;

- Net operating

income (NOI) was down 2% to $11.39 million compared to

Q2-2021;

- Funds from

operations (FFO) was down 7% to $6.11 million or $0.21 per unit

compared to Q2-2021;

- Adjusted cash flow

from operations (ACFO) was down 9% at $4.51 million or $0.15 per

unit compared to Q2-2021;

- Occupancy remained

stable at 87%;

- Distributions of

$0.04 per unit were paid in Q2-2022 for a quarterly ACFO payout

ratio of 77%.

Year-to-Date Highlights:

|

Results: |

Results, excluding Early Termination

event1: |

|

• Revenue was down 1% at $37.12 million. |

• Revenue was up 2%. |

|

• Net operating income (NOI) was down 4% to

$23.25 million. |

• NOI was stable. |

|

• Funds from operation (FFO) was down 8% to $12.64 million or

$0.43 per unit. |

• FFO was stable. |

|

• Adjusted cash from operations (ACFO) was down 11% at $9.57

million or $0.33 per unit. |

• ACFO was down 1%. |

|

• Distributions of $0.04 per unit were paid in January through

June for a year-to-date ACFO payout ratio of 73%. |

1. Early Termination event: In Q1-2021, we received $1.00 million

for the early lease termination of a fast food chain which was

included in other revenue, and impacts the comparative results |

Andrew Melton, CEO of Melcor REIT commented: "The

second quarter of 2022 presented similar results to what we saw in

the first quarter. We are pleased with stability in a market that

continues to see challenges. Our leasing team has worked diligently

to renew expiring leases and source new tenants, resulting in a

healthy retention rate of 86% and 273,154 sf of new and renewed

leasing. Future leasing remains a priority and we have commitment

on an additional 110,966 sf of future renewals and over 78,000 sf

in new deals.

Rising interest rates and inflation place even more

pressure on the market and we expect to further feel the effects of

this as our mortgages come up for renewal. Our weighted average

interest rate rose to 3.71% over year-end. (December 31, 2021

- 3.62%).

Our distributions remained stable over Q1-2022 at

$0.04 per unit, an increase of 14% over Q2-2021. Subsequent to

quarter-end, the Board of Trustees declared distributions for July

2022, unchanged from previous months."

HIGHLIGHTS:Our portfolio

performance remained stable in the second quarter and year-to-date.

Year-to-date NOI and net rental income was down 4% due to $1

million in early termination fees paid in Q1-2021. Excluding these

payments, year-to-date NOI was stable and net rental income was up

1%. In the quarter, both NOI and net rental income were down 2% due

to the timing of operating expenses.

We continue to proactively renew existing tenants

which has resulted in a strong retention rate of 86% year-to-date.

We are actively pursuing new tenant opportunities and have

commenced 53,444 sf in new leases. Occupancy remained stable over

the first quarter and year-end at 87% (Q1-2022 - 87%, Q4-2021 -

87%). On average, WABR has decreased slightly from year-end, down

1%, due to ongoing challenges within the office class. Following

the lifting of work-from-home orders, demand for office space

continues to fluctuate while supply increases. WABR on our retail

properties increased 1% over Q1-2022.

The factors that contributed most significantly to

results in 2022 compared to 2021 are as follows:

- Early

Termination event: In Q1-2021, we received $1.00 million

for the early lease termination of a fast food chain which was

included in other revenue, and impacts the comparative

results.

- Non-cash

fair value adjustments: Non-cash fair value adjustments on

Class B LP Units and investment properties often cause dramatic

swings in results. Class B Units are valued at market value, thus a

change in unit price has a counter-intuitive impact on net income,

as an increase in unit value decreases net income. These

revaluations have had a material impact to net income in both the

current and prior periods, making comparison less meaningful.

Management considers FFO and ACFO better measures of our

performance as these non-cash items are removed from those

metrics.

-

Distribution Increase: Our monthly distribution

increased by 14% to $0.04 per unit compared to Q2-2021.

FINANCIAL HIGHLIGHTSFinancial

highlights of our performance in the second quarter and

year-to-date include:

- Revenue was up 1% at $18.15 million in

Q2-2022 and down 1% at $37.12 million year-to-date. Excluding the

Early Termination event, year-to-date revenue was up 2%.

- NOI was down 2% at $23.25 million

in Q2-2022 due to the timing of operating expenses. NOI was down 4%

year-to-date. Excluding the Early Termination event, year-to-date

NOI was stable.

- FFO was down 7% to $6.11 million or

$0.21 per unit in the quarter (Q2-2021: $6.57 million or $0.23 per

unit). Year-to-date, FFO was down 8% to $12.64 million or $0.43 per

unit (2021: $13.67 million or $0.47 per unit). Excluding the Early

Termination event, year-to-date FFO was stable. Management believes

FFO best reflects our true operating performance.

- ACFO was down 9% at $4.51 million or

$0.15 per unit in Q2-2022 (Q2-2021: $4.96 million or $0.17 per

unit). Year-to-date ACFO is down 11% at $9.57 million (2021: $10.71

million). Excluding the Early Termination event, year-to-date ACFO

was down 1%. Management believes that ACFO best reflects our cash

flow and therefore our ability to pay distributions. The second

quarter payout ratio was 77% based on ACFO, and 73% year-to-date

(Q2-2021 - 62% and year-to-date 2021 - 57%).

- Net income in the current and

comparative period is significantly impacted by the non-cash fair

value adjustments described above and thus not a meaningful metric

to assess financial performance.

- Year-to-date we have completed

financing renewals on 3 properties, for net proceeds of $1.44

million.

- As at June 30,

2022 we had $4.55 million in cash and $32.00 million in undrawn

liquidity under our revolving credit facility.

DISTRIBUTIONSOur monthly

distributions remained stable over year-end at $0.04 and increased

14% over Q2-2021. The quarterly payout ratio was 77% based on ACFO

and 57% based on FFO (Q2-2021: distribution of $0.035 per month;

62% ACFO and 47% FFO). Year-to-date the payout ratio was 73% based

on ACFO and 55% based on FFO (2021: distributions of $0.035 per

month; 57% based on ACFO and 45% based on FFO)

SUBSEQUENT EVENTSubsequent to the

quarter, we declared the following distribution:

|

Month |

Record Date |

Distribution Date |

Distribution Amount |

|

July 2022 |

July 29, 2022 |

August 15, 2022 |

$0.04 per Unit |

FINANCIAL HIGHLIGHTS & KEY PERFORMANCE

INDICATORS (KPI)

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000's) |

2022 |

2021 |

Δ% |

2022 |

2021 |

Δ% |

|

Non-standard KPIs |

|

|

|

|

|

|

|

NOI1 |

11,391 |

11,582 |

(2) |

23,246 |

24,209 |

(4) |

|

Same-asset NOI1 |

11,391 |

11,582 |

(2) |

23,246 |

24,209 |

(4) |

|

FFO1 |

6,108 |

6,570 |

(7) |

12,638 |

13,671 |

(8) |

|

AFFO1 |

4,352 |

4,811 |

(10) |

9,263 |

10,415 |

(11) |

|

ACFO1 |

4,506 |

4,956 |

(9) |

9,571 |

10,705 |

(11) |

|

Rental revenue |

18,154 |

17,977 |

1 |

37,119 |

37,463 |

(1) |

|

Income before fair value adjustments1 |

3,267 |

3,941 |

(17) |

6,961 |

8,434 |

(17) |

|

Fair value adjustment on investment properties2 |

(5,540) |

531 |

nm |

(9,202) |

130 |

nm |

|

Cash flows from operations |

2,430 |

1,999 |

22 |

6,723 |

7,792 |

(14) |

|

Distributions to unitholders |

1,556 |

1,362 |

14 |

3,112 |

2,731 |

14 |

|

Distributions3 |

$0.12 |

$0.11 |

9 |

$0.24 |

$0.21 |

14 |

- Non-GAAP financial measure. Refer to

the Non-GAAP and Non-Standard Measures section for further

information.

- The abbreviation nm is shorthand for

not meaningful and is used through this MD&A where

appropriate.

- Distributions have

been paid out at $0.04 per unit per month from January to June

2022. Distributions in the comparative period were paid out at

$0.035 per unit per month from January to June 2021.

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

|

2022 |

2021 |

Δ% |

2022 |

2021 |

Δ% |

|

Per Unit Metrics |

|

|

|

|

|

|

|

Net income (loss) |

|

|

|

|

|

|

|

Basic |

$1.39 |

($0.36) |

|

$0.89 |

($2.23) |

|

|

Diluted |

$0.11 |

($0.36) |

|

$0.20 |

($2.23) |

|

|

Weighted average number of units for net income (loss)

(000s):1 |

|

|

|

|

|

|

|

Basic |

12,963 |

12,975 |

— |

12,964 |

13,010 |

— |

|

Diluted |

29,088 |

12,975 |

124 |

29,089 |

13,010 |

124 |

|

FFO |

|

|

|

|

|

|

|

Basic2 |

$0.21 |

$0.23 |

|

$0.43 |

$0.47 |

|

|

Diluted2 |

$0.20 |

$0.21 |

|

$0.42 |

$0.44 |

|

|

Payout ratio2 |

57% |

47% |

|

55% |

45% |

|

|

AFFO |

|

|

|

|

|

|

|

Basic2 |

$0.15 |

$0.17 |

|

$0.32 |

$0.36 |

|

|

Payout ratio2 |

80% |

64% |

|

75% |

59% |

|

|

ACFO |

|

|

|

|

|

|

|

Basic2 |

$0.15 |

$0.17 |

|

$0.33 |

$0.37 |

|

|

Payout ratio2 |

77% |

62% |

|

73% |

57% |

|

|

Weighted average number of units for FFO, AFFO and ACFO

(000s):3 |

|

|

|

|

|

Basic |

29,088 |

29,100 |

— |

29,089 |

29,135 |

— |

|

Diluted |

36,255 |

36,268 |

— |

36,255 |

36,304 |

— |

- For the purposes of

calculating per unit net income the basic weighted average number

of units includes Trust Units and the diluted weighted average

number of units includes Class B LP Units and convertible

debentures, to the extent that their impact is dilutive.

- Non-GAAP ratio. Refer to the Non-GAAP

and Non-Standard Measures section for further information.

- For the purposes of calculating per

unit FFO, AFFO and ACFO the basic weighted average number of units

includes Trust Units and Class B LP Units.

|

|

June 30, 2022 |

December 31, 2021 |

Δ% |

|

Total assets ($000s) |

730,290 |

735,668 |

(1) |

|

Equity at historical cost ($000s)1 |

288,196 |

288,234 |

— |

|

Indebtedness ($000s)2 |

441,396 |

446,769 |

(1) |

|

Weighted average interest rate on debt |

3.71% |

3.62% |

2 |

|

Debt to GBV, excluding convertible debentures (maximum threshold -

60%)3 |

49% |

49% |

— |

|

Debt to GBV (maximum threshold - 65%)3 |

58% |

58% |

— |

|

Finance costs coverage ratio4 |

2.38 |

2.45 |

(3) |

|

Debt service coverage ratio5 |

1.68 |

2.06 |

(18) |

- Calculated as the sum of trust units

and Class B LP Units at their historical cost value. In accordance

with IFRS the Class B LP Units are presented as a financial

liability in the consolidated financial statements. Please refer to

page 11 for calculation of Equity at historical cost.

- Calculated as the sum of total amount

drawn on revolving credit facility, mortgages payable, Class C LP

Units and convertible debentures, excluding unamortized discount

and transaction costs. Please refer to page 11 for calculation of

Indebtedness.

- Debt to GBV is a Non-GAAP ratio. Refer

to the Non-GAAP and Non-Standard Measures section for further

information.

- Non-GAAP financial ratio. Calculated

as the sum of FFO and finance costs; divided by finance costs,

excluding distributions on Class B LP Units and fair value

adjustment on derivative instruments. This metric is not calculated

for purposes of covenant compliance on any of our debt facilities.

Please refer to Non-GAAP and Non-Standard Measures section for

further information.

- Non-GAAP financial

ratio. Calculated as FFO; divided by sum of contractual principal

repayments on mortgages payable and distributions of Class C LP

Units, excluding amortization of fair value adjustment on Class C

LP Units. This metric is not calculated for purposes of covenant

compliance on any of our debt facilities. Please refer to Non-GAAP

and Non-Standard Measures section for further information.

|

Operational Highlights |

June 30, 2022 |

December 31, 2021 |

Δ% |

|

Number of properties |

39 |

39 |

— |

|

GLA (sf) |

3,216,141 |

3,216,175 |

— |

|

Occupancy (weighted by GLA) |

86.6% |

87.1% |

(1) |

|

Retention (weighted by GLA) |

85.5% |

81.7% |

5 |

|

Weighted average remaining lease term (years) |

3.81 |

3.86 |

(1) |

|

Weighted average base rent (per sf) |

$16.58 |

$16.73 |

(1) |

MD&A and Financial

StatementsInformation included in this press release is a

summary of results. This press release should be read in

conjunction with the REIT's Q2-2022 quarterly report to

unitholders. The REIT’s consolidated financial statements and

management’s discussion and analysis for the three-months ended

June 30, 2022 can be found on the REIT’s website at

www.MelcorREIT.ca or on SEDAR (www.sedar.com).

Conference Call &

WebcastUnitholders and interested parties are invited to

join management on a conference call to be held July 27, 2022 at

11:00 AM ET (9:00 AM MT). Call 416-915-3239 in the Toronto area;

1-800-319-4610 toll free.

The call will also be webcast (listen only) at

https://www.gowebcasting.com/11855. A replay of the call will be

available at the same URL shortly after the call is concluded.

About Melcor REITMelcor REIT is an

unincorporated, open-ended real estate investment trust. Melcor

REIT owns, acquires, manages and leases quality retail, office and

industrial income-generating properties in western Canadian

markets. Its portfolio is currently made up of interests in 39

properties representing approximately 3.22 million square feet of

gross leasable area located across Alberta and in Regina,

Saskatchewan; and Kelowna, British Columbia. For more information,

please visit www.MelcorREIT.ca.

Non-standard MeasuresNOI, FFO,

AFFO and ACFO are key measures of performance used by real estate

operating companies; however, they are not defined by International

Financial Reporting Standards (IFRS), do not have standard meanings

and may not be comparable with other industries or income trusts.

These non-IFRS measures are defined and discussed in the REIT’s

MD&A for the quarter ended June 30, 2022, which is

available on SEDAR at www.sedar.com.

Finance costs coverage ratio:

Finance costs coverage ratio is a non-GAAP ratio and is calculated

as FFO plus finance costs for the period divided by finance costs

expensed during the period excluding distributions on Class B LP

Units and fair value adjustment on derivative instruments.

Debt service coverage ratio: Debt

service coverage ratio is a non-GAAP ratio and is calculated as FFO

for the period divided by principal repayments on mortgages payable

and Class C LP Units made during the period.

Debt to Gross Book Value: Debt to

GBV is a non-GAAP ratio and is calculated as the sum of total

amount drawn on revolving credit facility, mortgages payable, Class

C LP Units, excluding unamortized fair value adjustment on Class C

LP Units, liability held for sale (as applicable) and convertible

debenture, excluding unamortized discount and transaction costs

divided by GBV. GBV is calculated as the total assets acquired in

the Initial Properties, subsequent asset purchases and development

costs less dispositions.

Income before fair value adjustment and

taxes: Income before fair value adjustment and income

taxes is a non-GAAP financial measure and is calculated as net

income excluding fair value adjustments for Class B LP Units,

investment properties and derivative instruments.

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s) |

2022 |

2021 |

Δ% |

2022 |

2021 |

Δ% |

|

Net income (loss) for the period |

18,059 |

(4,619) |

|

11,521 |

(29,058) |

|

|

Fair value adjustment on Class B LP Units |

(16,770) |

6,612 |

|

(9,675) |

33,380 |

|

|

Fair value adjustment on investment properties |

5,540 |

(531) |

|

9,202 |

(130) |

|

|

Fair value adjustment on derivative instruments |

(3,562) |

2,479 |

|

(4,087) |

4,242 |

|

|

Income before fair value adjustment and taxes |

3,267 |

3,941 |

(17) |

6,961 |

8,434 |

(17) |

Fair value of investment

properties: Fair value of investment properties in the

Property Profile and Regional Analysis sections of the MD&A is

a supplementary financial measure and is calculated as the sum of

the balance sheet balances for investment properties and other

assets (TIs and SLR).

|

NOI Reconciliation |

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s) |

2022 |

2021 |

Δ% |

2022 |

2021 |

Δ% |

|

Net income (loss) for the period |

18,059 |

(4,619) |

|

11,521 |

(29,058) |

|

| Net

finance costs |

2,985 |

8,631 |

|

8,934 |

16,690 |

|

| Fair

value adjustment on Class B LP Units |

(16,770) |

6,612 |

|

(9,675) |

33,380 |

|

| Fair

value adjustment on investment properties |

5,540 |

(531) |

|

9,202 |

(130) |

|

| General

and administrative expenses |

810 |

695 |

|

1,598 |

1,498 |

|

|

Amortization of operating lease incentives |

906 |

936 |

|

1,807 |

1,851 |

|

|

Straight-line rent adjustment |

(139) |

(142) |

|

(141) |

(22) |

|

|

NOI |

11,391 |

11,582 |

(2) |

23,246 |

24,209 |

(4) |

1. Non-GAAP financial measure. Refer to the

Non-GAAP and Non-Standard Measures section for further

information.

|

Same-asset Reconciliation |

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s) |

2022 |

2021 |

Δ% |

2022 |

2021 |

Δ% |

|

Same-asset NOI1 |

11,391 |

11,582 |

(2) |

23,246 |

24,209 |

(4) |

|

NOI1 |

11,391 |

11,582 |

(2) |

23,246 |

24,209 |

(4) |

|

Amortization of tenant incentives |

(906) |

(936) |

|

(1,807) |

(1,851) |

|

|

SLR adjustment |

139 |

142 |

|

141 |

22 |

|

|

Net rental income |

10,624 |

10,788 |

(2) |

21,580 |

22,380 |

(4) |

1. Non-GAAP financial measure. Refer to the

Non-GAAP and Non-Standard Measures section for further

information.

|

FFO & AFFO Reconciliation |

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s, except per unit amounts) |

2022 |

2021 |

Δ% |

2022 |

2021 |

Δ% |

|

Net income (loss) for the period |

18,059 |

(4,619) |

|

11,521 |

(29,058) |

|

|

Add / (deduct) |

|

|

|

|

|

|

|

Fair value adjustment on investment properties |

5,540 |

(531) |

|

9,202 |

(130) |

|

|

Fair value adjustment on Class B LP Units |

(16,770) |

6,612 |

|

(9,675) |

33,380 |

|

|

Amortization of tenant incentives |

906 |

936 |

|

1,807 |

1,851 |

|

|

Distributions on Class B LP Units |

1,935 |

1,693 |

|

3,870 |

3,386 |

|

|

Fair value adjustment on derivative instruments |

(3,562) |

2,479 |

|

(4,087) |

4,242 |

|

|

FFO1 |

6,108 |

6,570 |

(7) |

12,638 |

13,671 |

(8) |

|

Deduct |

|

|

|

|

|

|

|

Straight-line rent adjustments |

(139) |

(142) |

|

(141) |

(22) |

|

|

Normalized capital expenditures |

(588) |

(587) |

|

(1,176) |

(1,174) |

|

|

Normalized tenant incentives and leasing commissions |

(1,029) |

(1,030) |

|

(2,058) |

(2,060) |

|

|

AFFO1 |

4,352 |

4,811 |

(10) |

9,263 |

10,415 |

(11) |

|

FFO/Unit2 |

$0.21 |

$0.23 |

|

$0.43 |

$0.47 |

|

|

AFFO/Unit2 |

$0.15 |

$0.17 |

|

$0.32 |

$0.36 |

|

|

Weighted average number of units (000s):3 |

29,088 |

29,100 |

— |

29,089 |

29,135 |

— |

- Non-GAAP financial

measure. Refer to the Non-GAAP and Non-Standard Measures section

for further information.

- Non-GAAP ratio. Refer to the Non-GAAP

and Non-Standard Measures section for further information.

- For the purposes of

calculating per unit FFO and AFFO, the basic weighted average

number of units includes Trust Units and Class B LP Units.

|

ACFO Reconciliation |

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s) |

2022 |

2021 |

Δ% |

2022 |

2021 |

Δ% |

|

Cash flows from operations |

2,430 |

1,999 |

22 |

6,723 |

7,792 |

(14) |

|

Distributions on Class B LP Units |

1,935 |

1,693 |

|

3,870 |

3,386 |

|

|

Actual payment of tenant incentives and direct leasing costs |

2,188 |

1,646 |

|

3,921 |

3,392 |

|

|

Changes in operating assets and liabilities |

(139) |

1,529 |

|

(1,067) |

(24) |

|

|

Amortization of deferred financing fees |

(291) |

(294) |

|

(642) |

(607) |

|

|

Normalized capital expenditures |

(588) |

(587) |

|

(1,176) |

(1,174) |

|

|

Normalized tenant incentives and leasing commissions |

(1,029) |

(1,030) |

|

(2,058) |

(2,060) |

|

|

ACFO1 |

4,506 |

4,956 |

(9) |

9,571 |

10,705 |

(11) |

|

|

|

|

|

|

|

|

|

ACFO/Unit2 |

$0.15 |

$0.17 |

|

$0.33 |

$0.37 |

|

|

|

|

|

|

|

|

|

|

Weighted average number of units (000s)3 |

29,088 |

29,100 |

— |

29,089 |

29,135 |

— |

- Non-GAAP financial

measure. Refer to the Non-GAAP and Non-Standard Measures section

for further information.

- Non-GAAP ratio. Refer to the Non-GAAP

and Non-Standard Measures section for further information.

- The diluted

weighted average number of units includes Trust Units, Class B LP

Units and convertible debentures.

Forward-looking Statements:

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, which reflects the REIT's current expectations

regarding future events. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond the REIT's control, that

could cause actual results and events to differ materially from

those that are disclosed in or implied by such forward-looking

information. Such risks and uncertainties include, but are not

limited to, general and local economic and business conditions; the

financial condition of tenants; the REIT’s ability to refinance

maturing debt; leasing risks, including those associated with the

ability to lease vacant space; and interest rate fluctuations. The

REIT’s objectives and forward-looking statements are based on

certain assumptions, including that the general economy remains

stable, interest rates remain stable, conditions within the real

estate market remain consistent, competition for acquisitions

remains consistent with the current climate and that the capital

markets continue to provide ready access to equity and/or debt. All

forward-looking information in this press release speaks as of the

date of this press release. The REIT does not undertake to update

any such forward-looking information whether as a result of new

information, future events or otherwise. Additional information

about these assumptions and risks and uncertainties is contained in

the REIT’s filings with securities regulators.

Contact Information:

Tel: 1.855.673.6931 x4707 Em: ir@melcorREIT.ca

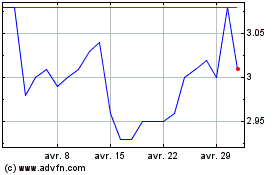

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024