Maxim Power Corp. ("MAXIM" or the "Corporation") (TSX: MXG)

announced today the release of financial and operating results for

the fourth quarter ended December 31, 2019. The audited

consolidated financial statements, accompanying notes and

Management’s Discussion and Analysis (“MD&A”) will be available

on SEDAR and on MAXIM's website on March 19, 2020. All figures

reported herein are Canadian dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

| |

|

Three Months EndedDecember 31, |

Twelve Months EndedDecember 31, |

|

($ in thousands except per share amounts) |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| Revenue |

|

$ |

4,972 |

|

$ |

9,755 |

|

$ |

28,335 |

|

$ |

19,744 |

|

| Net income

(loss) |

|

(2,173 |

) |

|

8,833 |

|

|

(5,850 |

) |

|

4,377 |

|

| Net income (loss) per

share – basic and diluted |

|

$ |

(0.04 |

) |

$ |

0.17 |

|

$ |

(0.11 |

) |

$ |

0.08 |

|

| Total

debt |

|

$ |

49,001 |

|

$ |

- |

|

$ |

49,001 |

|

$ |

- |

|

| Total

assets |

|

$ |

225,274 |

|

$ |

172,188 |

|

$ |

225,274 |

|

$ |

172,188 |

|

OPERATING RESULTS

Revenue in fourth quarter of 2019 decreased

primarily due to decreased generation volumes. Milner generated

74,181 MWh of electricity in the fourth quarter of 2019, as

compared to 146,550 MWh in 2018. Net loss increased in the fourth

quarter of 2019 when compared to the same period in 2018. This

variance is primarily due to recognizing deferred tax assets in

2018 and the same factor impacting revenue.

Revenue in 2019 increased primarily due to

increased generation volumes as a result of a full year of

operations at Milner versus seven months of operations in 2018 due

to unfavorable power market conditions. Milner also benefited from

increased generation capacity under natural gas-only operation and

improved reliability. Milner generated 442,916 MWh of electricity

in 2019, as compared to 304,711 MWh in 2018. Net loss increased in

2019 when compared to income in 2018. The change in this financial

measure was primarily due to the recognition of deferred tax assets

in 2018, partially offset by realized gains on commodity risk

management activities, increased revenue from a full year of

operations at Milner and lower depreciation in 2019.

MILNER 2 ("M2") DEVELOPMENT

PROJECT

During 2019 MAXIM made significant progress on

the construction of its 204 MW natural gas-fired power plant at its

H.R. Milner site ("M2"). Construction of M2 is approximately 93%

complete as of the date of this press release. MAXIM believes

strongly that this asset will be a top performing facility in its

class in the Alberta market. MAXIM currently estimates that total

capital expenditures to construct M2, excluding borrowing costs,

will be $147 million and currently anticipates that M2 will

commence commercial operations late in the second quarter of 2020.

MAXIM is closely monitoring the potential effects of recent

disruptions caused by the novel coronavirus (COVID-19) on M2,

including as it relates to access to products, services and labour

and other relevant market and economic conditions, which may affect

M2, including construction costs and timing of commercial

operations thereof. MAXIM has the option in the future to increase

the capacity of the facility to approximately 300 MW, in

conjunction with increasing the efficiency of the facility, by

investing capital to expand M2 to operate with combined cycle

technology.

FINANCING

On December 19, 2019, MAXIM announced that it

entered into a credit agreement with ATB Financial (“ATB”) for a

thirty-five month term that provides for senior debt financing of

up to $44 million to support financing requirements of M2, plus a

cash collateralized letter of credit facility of $8 million to

replace MAXIM's current outstanding letters of credit for equal

amounts. The loan provides for the financing of M2 under three

credit facilities. The Corporation is able to borrow up to $30

million under a construction loan that has a term of thirty-five

months with an amortization requirement of ten years commencing

when construction of M2 is complete. The Corporation is also able

to borrow up to $10 million under a revolving credit facility for

the construction of M2. Upon completion of construction of M2, this

revolving facility will become available for general corporate

purposes and the Corporation will be able to access a second

revolving credit facility to finance certain short-term working

capital requirements up to $4 million.

During 2019, MAXIM announced that it entered

into, amended and subordinated credit agreements with two related

parties, Alpine Capital Corp. and Prairie Merchant Corporation,

that collectively provide for up to $75 million to fully fund the

construction and development of M2. Alpine Capital Corp. is a

company majority owned by M. Bruce Chernoff, a director, Chairman

and significant shareholder of the Corporation and Prairie Merchant

Corporation is a company owned and controlled by W. Brett Wilson, a

director and significant shareholder of MAXIM. The loan is

convertible at $2.25 per share and bears interest at 12% per annum.

It is a revolving, secured, credit facility that is subordinated to

the ATB credit facilities. The term of the convertible loan ends

upon repayment of the ATB credit facilities.

OTHER DEVELOPMENT PROJECTS

MAXIM has permits to construct and operate

electric power projects totalling 536 MW of generating capacity in

Alberta, which are in addition to M2. Of this amount, 346 MW of

generation capacity is at the Milner site and the remaining 190 MW

of generation capacity is for the peaking station at Deerland.

MAXIM also has a wind power development project, Buffalo Atlee,

which has the development potential of up to 200 MW of wind

generation capacity. As at the date of this press release, no

definitive commitments have been made on these projects.

AUC LOSS FACTOR DECISION

As previously reported, MAXIM, through its

wholly-owned subsidiary, Milner Power Inc., has an outstanding

complaint relating to the Alberta Electric System Operator ("AESO")

Line Loss Rule for the period of January 1, 2006 to December 31,

2016. MAXIM anticipates cash proceeds to be approximately $40

million, based on calculations established using information

currently available on the final public record, before accounting

for the time value of money. The Corporation anticipates, based on

the AESO’s current published timelines that the collection of these

prior overpayments and the time value of money component at the

Bank of Canada Bank Rate plus 1.5%, will occur in the middle of

2021. On December 3, 2019, the AESO made application to the AUC

seeking a Review and Variance of an AUC decision that, if approved,

would enable the AESO to pursue year-by-year settlement of the

historic period with first payments issued as early as the third

quarter of 2020. MAXIM does not anticipate the AUC to rule on the

Review and Variance application until the end of the second quarter

of 2020.

About MAXIM

Based in Calgary, Alberta, MAXIM is an Alberta

focused independent power producer which currently owns and

operates a 150 MW power plant near Grande Cache, Alberta. Milner is

nearing the end of its life under federal climate change

regulations and is being replaced by M2 with anticipated nameplate

capacity of 204 MW in simple cycle mode. MAXIM has the option in

the future to increase the capacity of M2, in conjunction with

increasing the overall efficiency of the facility, by upgrading M2

into a combined cycle plant. In addition, MAXIM continues to

explore development options for its remaining permitted gas-fired

generation capacity in Alberta and permitting of its wind power

generation project. MAXIM trades on the TSX under the symbol “MXG”.

For more information about MAXIM, visit our website at

www.maximpowercorp.com.

For further information please contact:

Michael R. Mayder, President and CFO, (403)

263-3021.

This press release contains forward-looking

statements and forward-looking information (collectively "forward

looking information") within the meaning of applicable securities

laws relating to MAXIM's plans and other aspects of MAXIM's

anticipated future operations, management focus, objectives,

strategies, financial, operating and production results.

Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", "may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement. Specifically, this press release contains

forward-looking statements relating to: anticipated profitable

earnings from development of generation capacity at the Milner

site, the anticipated time periods of continued generation of

electricity from Milner, the initial generation capacity of the

Corporation's new facility at its Milner site, current development

cost estimates to complete the same and anticipated completion

dates, the Corporation's current estimate of the proceeds payable

to the Corporation from the outstanding compliant relating to the

AESO Line Loss Rule and the timeline to potentially receive any

proceeds therefrom.

Forward-looking statements regarding MAXIM are

based on certain key expectations and assumptions of MAXIM

concerning, among other things, construction timelines and costs,

regulatory decisions (including with respect to the AESO Line

Loss), the ability of MAXIM to reliably generate electricity from

its projects in the timelines and manners currently contemplated,

current and future commodity and electricity prices, the price of

MAXIM's common shares, regulatory developments, tax laws, future

operating costs, the performance of existing and new facilities,

the sufficiency and timing of budgeted capital expenditures in

carrying out planned activities, the availability and cost of labor

and services, the impact of increasing competition, conditions in

general economic and financial markets, effects of regulation by

governmental agencies, the ability to obtain financing on

acceptable terms which are subject to change based on commodity

prices, market conditions, and potential timing delays.

These forward-looking statements are subject to

numerous risks and uncertainties, certain of which are beyond

MAXIM's control. Such risks and uncertainties include, without

limitation: construction delays, cost overruns, adverse regulatory

decisions, the impact of general economic conditions; volatility in

market prices electricity and other commodities such as natural

gas; industry conditions; currency fluctuations; environmental

risks; incorrect assessments of the value of acquisitions;

competition from other producers; the lack of availability of

qualified personnel, changes in income tax laws, environmental laws

or changes programs relating to the electricity industry in

Alberta; hazards such as fire, explosion, and ability to access

sufficient capital from internal and external sources.

Management has included the forward-looking

statements above and a summary of assumptions and risks related to

forward-looking statements provided in this press release in order

to provide readers with a more complete perspective on MAXIM's

future plans and operations and such information may not be

appropriate for other purposes.

MAXIM's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that MAXIM will derive there from.

Readers are cautioned that the foregoing lists of factors are not

exhaustive. These forward looking statements are made as of the

date of this press release and MAXIM disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

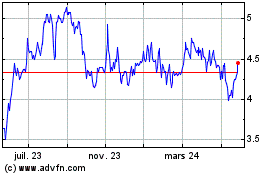

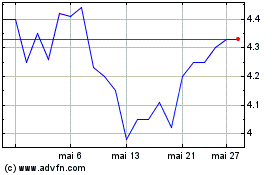

Maxim Power (TSX:MXG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Maxim Power (TSX:MXG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024