W. Brett Wilson Updates Early Warning Reporting in Respect of Maxim Power Corp.

12 Novembre 2021 - 12:33AM

Pursuant to the early warning requirements of applicable Canadian

securities laws, W. Brett Wilson announces that he has acquired

ownership and control of an aggregate of 750,000 common shares

("

Maxim Shares") of Maxim Power Corp.

("

Maxim"), representing approximately 1.5% of the

issued and outstanding Maxim Shares (based on 50,031,951 Maxim

Shares issued and outstanding), at a price of $3.20 per Maxim Share

for a total cash purchase price of $2,400,000. Mr. Wilson acquired

the Maxim Shares from one (1) third party (the

"

Seller") on November 11, 2021 pursuant to a

purchase and sale agreement (the "

PSA").

Before giving effect to the transaction, Mr.

Wilson owned or controlled an aggregate of 15,806,552 Maxim Shares

representing approximately 31.6% of the issued and outstanding

Maxim Shares (based on the number of issued and outstanding Maxim

Shares set forth above). After giving effect to the transaction,

Mr. Wilson owns or controls an aggregate of 16,556,552 Maxim Shares

representing approximately 33.1% of the issued and outstanding

Maxim Shares (based on the number of issued and outstanding Maxim

Shares set forth above).

The acquisition of the Maxim Shares was

completed pursuant to the private agreement exemption set forth in

section 4.2(1) of National Instrument 62-104 – Take-Over Bids and

Issuer Bids ("NI 62-104") in accordance with the

PSA between Mr. Wilson and the Seller. The value of the

consideration paid for the Maxim Shares was not greater than 115%

of the "market price" of the Maxim Shares determined in accordance

with section 1.11 of NI 62-104.

Furthermore, Mr. Wilson (indirectly through

Prairie Merchant Corporation ("Prairie Merchant")

a company owned and controlled by Mr. Wilson) has made a commitment

to fund up to 50% of the maximum principal amount of a $75 million

convertible loan provided to Maxim dated September 10, 2019, as

amended (the "Convertible Loan"), representing a

maximum aggregate commitment of $37.5 million. The Convertible Loan

was drawn as to $29.4 million as at September 30, 2021, or $14.7

million attributable to Prairie Merchant. Assuming the full $37.5

million principal amount of the Convertible Loan attributable to

Prairie Merchant is fully drawn and converted into Maxim Shares,

Prairie Merchant would acquire 16,666,667 Maxim Shares at a

conversion price of $2.25 per share.

If the 16,666,667 Maxim Shares issuable on

conversion of the full amount of the Convertible Loan attributable

to Prairie Merchant are issued, Mr. Wilson (including Prairie

Merchant) would have ownership and/or control over 33,223,219 Maxim

Shares, representing approximately 39.9% of the then issued and

outstanding Maxim Shares assuming the Convertible Loan is fully

drawn and converted into Common Shares, including the conversion of

any principal amounts attributable to the other lender (the

"Other Lender") thereunder (49.8% of the then

issued and outstanding Maxim Shares assuming the full conversion of

the Convertible Loan attributable to Prairie Merchant only and

excluding the conversion of any principal amounts attributable to

the Other Lender thereunder).

The acquisition of the Maxim Shares was made in

furtherance of Mr. Wilson’s investment objectives. Mr. Wilson may,

from time to time, as market opportunities exist or develop,

increase or decrease his ownership in Maxim Shares as permitted by

applicable securities laws.

FOR FURTHER INFORMATION OR TO OBTAIN A

COPY OF THE EARLY WARNING REPORT FILED IN CONJUNCTION WITH THIS

PRESS RELEASE, PLEASE CONTACT:

W. Brett Wilson Seventh Floor, 933 – 17th Avenue

SWCalgary, Alberta T2T 5R6Phone: (403) 705-7709

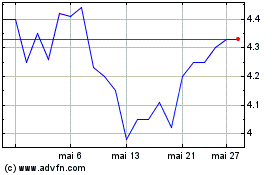

Maxim Power (TSX:MXG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

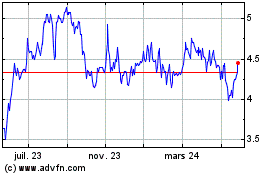

Maxim Power (TSX:MXG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024