Maxim Power Corp. ("MAXIM" or the "Corporation") (TSX: MXG)

announced today the release of financial and operating results for

the first quarter ended March 31, 2022. The unaudited condensed

consolidated interim financial statements, accompanying notes and

Management’s Discussion and Analysis (“MD&A”) will be available

on SEDAR and on MAXIM's website on May 10, 2022. All figures

reported herein are Canadian dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

|

|

Three Months EndedMarch 31, |

|

($ in thousands except per share amounts) |

2022 |

2021 |

| Revenue |

36,147 |

30,030 |

| Net

income |

16,868 |

26,426 |

| Earnings per share –

basic |

0.34 |

0.53 |

| Earnings per share –

diluted |

0.28 |

0.43 |

| Adjusted

EBITDA(1) |

15,893 |

9,423 |

| Total generation –

(MWh) |

393,591 |

324,490 |

| Total fuel consumption

– (GJ) |

4,179,531 |

3,597,341 |

| Average Alberta market

power price ($ per MWh) |

89.80 |

95.45 |

| Average realized power

price ($ per MWh) |

91.84 |

92.54 |

| Total net

debt(1) |

41,236 |

37,242 |

| Total

assets |

364,569 |

262,384 |

|

(1) |

Select financial information was derived from the consolidated

financial statements and is prepared in accordance with GAAP,

except adjusted Earnings before Interest, Income Taxes,

Depreciation and Amortization (“Adjusted EBITDA”). Adjusted EBITDA

is provided to assist management and investors in determining the

Corporation's approximate operating cash flows before interest,

income taxes, and depreciation and amortization and certain other

non-recurring income and expenses. Total net debt was derived from

the consolidated financial statements to include: loans and

borrowings (including the convertible loan facility), current

liabilities, other long-term liability, less total current

assets. |

OPERATING RESULTS

During the first quarter of 2022, revenues and

Adjusted EBITDA increased as compared to 2021 primarily due to

higher generation, realized gains on power and natural gas

commodity swaps and increased availability of Milner 2 (“M2”).

These favourable variances were partially offset by higher fuel

costs due to higher generation volumes and higher per unit natural

gas costs in 2022 as compared to the same period in 2021.

Net income decreased in 2022 as compared to

2021, with a significant portion due to the recognition of the

second payment from the Line loss Proceedings in 2021, partially

offset by unrealized gains from natural gas swaps in 2022 and the

same factors impacting Adjusted EBITDA.

M2 CCGT PROJECT UPDATE

In 2022, MAXIM continued progress on the

engineering and construction of the Combined Cycle Gas Turbine

(“CCGT”) expansion of M2 and is pleased to report that the project

remains on schedule to commission in December 2022. Recent

milestones include 45% of expected construction labour hours

expended and significant advancement of piping and welding of the

heat recovery steam generator components, near completion of

natural gas pipeline construction and associated balance of plant.

Additional milestones during the first quarter of 2022 included

near completion of the main stack. The estimated project cost is

currently $142 million as of the date of this MD&A. Estimated

costs have increased from the $136 million previously reported due

to increased expenditures related to the natural gas pipeline,

construction support, procurement and control systems integration.

As of March 31, 2022, MAXIM has incurred $104 million of capital

investment in relation to the CCGT expansion of M2 and has funded

this spending with existing cash on hand, cash flow from operating

activities and debt.

MAXIM will commence the commissioning process in

the third quarter of 2022 and anticipates that the plant will

commence commercial operations late in the fourth quarter of 2022.

MAXIM believes strongly that this asset will be a top performing

facility in the Alberta market.

At this time, MAXIM forecasts it has sufficient

liquidity to complete the CCGT expansion of M2 and will fund the

project using cash on hand, cash flow from operating revenues and

available funds through the existing senior and subordinated credit

facilities, as required.

Completion of the CCGT expansion of M2 will

allow capture of waste heat that would otherwise exhaust into the

atmosphere and turn it into useful low carbon electricity for the

Alberta power grid. The CCGT expansion of M2 will reduce the

intensity of carbon emissions by more than 60% compared to the

legacy coal-fired H.R. Milner facility.

NORMAL COURSE ISSUER BID

MAXIM continues its fourth normal course issuer

bid ("NCIB") program for August 25, 2021 to August 24, 2022 period.

Under this NCIB, the Corporation may purchase for cancellation up

to 2,400,000 common shares of the Corporation. Collectively under

this program the Corporation has repurchased and cancelled 277,285

common shares for $1.1 million, of which 259,965 common shares were

repurchased and cancelled in 2022 for $1.0 million.

MAXIM’s NCIB program is limited to $1.0 million

per calendar year under the senior credit facility and as of the

date of this press release, MAXIM has reached this limit. Any

excess purchases under the NCIB program are subject to approval

from the lenders under the senior credit facility.

FORKED RIVER LAND SALE

On April 5, 2022, the Corporation closed the

sale of the 31 acre Forked River land parcel for US$3 million net

of customary closing costs.

About MAXIM

Based in Calgary, Alberta, MAXIM is one of

Canada’s largest truly independent power producers. MAXIM is now

focused entirely on power projects in Alberta. Its core asset – the

204 MW H.R. Milner Plant, M2, in Grande Cache, AB – is a

state-of-the-art natural gas-fired power plant that commissioned in

Q2, 2020. MAXIM is currently increasing the capacity of M2 to

approximately 300 MW and concurrently will realize an improvement

in the efficiency of the plant by investing in heat recovery

combined cycle technology. In addition, MAXIM continues to explore

additional development options in Alberta including its currently

permitted gas-fired generation projects and the permitting of its

wind power generation project. MAXIM trades on the TSX under the

symbol “MXG”. For more information about MAXIM, visit our website

at www.maximpowercorp.com. For further information please

contact:

Bob Emmott, President and COO, (403)

263-3021

Kyle Mitton, CFO and Vice President, Corporate

Development, (403) 263-3021

This press release contains forward-looking

statements and forward-looking information (collectively "forward

looking information") within the meaning of applicable securities

laws relating to MAXIM's plans and other aspects of MAXIM's

anticipated future operations, management focus, objectives,

strategies, financial, operating and production results.

Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", "may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement. Specifically, this press release contains

forward-looking information concerning, among other things, the

expected completion date of the CCGT expansion of M2, emissions

intensity, the current cost estimates for the CCGT expansion of M2

and MAXIM’s financing plans with respect to the CCGT expansion.

Management has included the forward-looking

statements above and a summary of assumptions and risks related to

forward-looking statements provided in this press release in order

to provide readers with a more complete perspective on MAXIM's

future plans and operations and such information may not be

appropriate for other purposes.

MAXIM's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that MAXIM will derive there from.

Readers are cautioned that the foregoing lists of factors are not

exhaustive. These forward-looking statements are made as of the

date of this press release and MAXIM disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

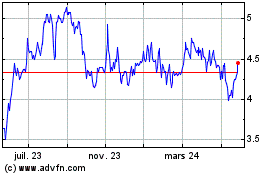

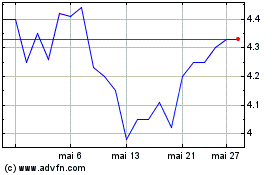

Maxim Power (TSX:MXG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Maxim Power (TSX:MXG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024