OceanaGold Announces C$150 Million Bought Deal Offering of Common Shares

29 Septembre 2020 - 10:22PM

OceanaGold Corporation

(TSX: OGC) (ASX: OGC) (the

“Company”) announces that it has entered into an agreement with a

syndicate of underwriters (the “Underwriters”), led by Scotiabank

and BMO Capital Markets, who have agreed to purchase, on a bought

deal basis, an aggregate of 73,000,000 common shares (the "Offered

Shares") of the Company at a price of C$2.06 per Offered Share (the

"Offering Price"), for aggregate gross proceeds of C$150 million

(the “Offering”).

The Company has also granted the Underwriters

the option, exercisable in whole or in part from time to time until

and including 30 days following the Closing Date, to purchase up to

an additional 10,950,000 common shares (representing an additional

15% of the Offered Shares) at the Offering Price and on the same

terms and conditions as the Offered Shares to cover

over-allotments, if any, and for market stabilization purposes.

The Company intends to use the net proceeds of

the Offering to fund organic growth projects including the Haile

underground development, ongoing exploration and development of the

Company's mineral properties in New Zealand, as well as for working

capital and for general corporate purposes.

The Offered Shares will be offered by way of a

short form prospectus in all provinces of Canada (except Québec),

on a private placement basis in the United States, and

internationally as permitted by the Company and the regulatory

requirements in those jurisdictions.

The closing of the Offering is expected to occur

on October 19th, 2020 (the "Closing Date"), or such other date as

may be agreed by the Underwriters and the Company, acting

reasonably. The closing is subject to certain other conditions

including, but not limited to, the approval of the Toronto Stock

Exchange and the receipt of all necessary regulatory approvals.

The securities offered have not been

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration

requirements thereunder. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

Authorised for release to market by Acting

Company Secretary, Chris Hansen, on behalf of Liang Tang (currently

on Maternity Leave)

For further information please contact:

| Investor

Relations |

Media

Relations |

| Sam Pazuki Tel: +1 720 602

4880IR@oceanagold.com |

Melissa Bowerman

Tel:

+61 407 783 270info@oceanagold.com |

| |

|

www.oceanagold.com | Twitter: @OceanaGold

About

OceanaGold

OceanaGold Corporation is a mid-tier,

high-margin, multinational gold producer with assets located in the

Philippines, New Zealand and the United States. On the North Island

of New Zealand, the Company operates the high-grade Waihi Gold Mine

while on the South Island of New Zealand, the Company operates the

largest gold mine in the country at the Macraes Goldfield which is

made up of a series of open pit mines and the Frasers underground

mine. In the United States, the Company operates the Haile Gold

Mine, a top-tier, long-life, high-margin asset located in South

Carolina. The Company’s assets also encompass the Didipio

Gold-Copper Mine located on the island of Luzon in the Philippines.

OceanaGold also has a significant pipeline of organic growth and

exploration opportunities in the Americas and Asia-Pacific

regions.

OceanaGold has operated sustainably since 1990

with a proven track-record for environmental management and

community and social engagement. The Company has a strong social

license to operate and works collaboratively with its valued

stakeholders to identify and invest in social programs that are

designed to build capacity and not dependency.

Cautionary Statement for Public

Release

Certain information contained in this public

release may be deemed “forward-looking” within the meaning of

applicable securities laws. Forward-looking statements and

information in this press release include statements and

information related to the completion of the Offering. Any

statements that express or involve discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives,

assumptions or future events or performance (often, but not always,

using words or phrases such as "expects" or "does not expect", "is

expected", "anticipates" or "does not anticipate", "plans",

"estimates" or "intends", or stating that certain actions, events

or results "may", "could", "would", "might" or "will" be taken,

occur or be achieved) are not statements of historical fact and may

be forward-looking statements. Forward-looking statements are

subject to a variety of risks and uncertainties which could cause

actual events or results to differ materially from those expressed

in the forward-looking statements and information. They include,

among others, the receipt of regulatory and stock exchange

approvals, the outbreak of an infectious disease, the accuracy of

mineral reserve and resource estimates and related assumptions,

inherent operating risks and those risk factors identified in the

Company’s most recent Annual Information Form prepared and filed

with securities regulators which is available on SEDAR at

www.sedar.com under the Company’s name.

There are no assurances the Company can fulfil

forward-looking statements and information. Such forward-looking

statements and information are only predictions based on current

information available to management as of the date that such

predictions are made; actual events or results may differ

materially as a result of risks facing the Company, some of which

are beyond the Company's control. Although the Company believes

that any forward-looking statements and information contained in

this press release is based on reasonable assumptions, readers

cannot be assured that actual outcomes or results will be

consistent with such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and

information.

The Company expressly disclaims any intention or

obligation to update or revise any forward-looking statements and

information, whether as a result of new information, events or

otherwise, except as required by applicable securities laws. The

information contained in this release is not investment or

financial product advice.

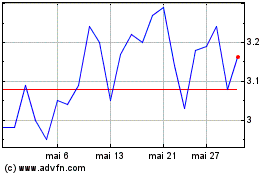

OceanaGold (TSX:OGC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

OceanaGold (TSX:OGC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024