OceanaGold Announces Filing of Final Prospectus For C$150 Million Bought Deal Offering of Common Shares

14 Octobre 2020 - 10:54PM

OceanaGold Corporation (

TSX: OGC)

(ASX: OGC) (the “Company”) announces that

it has today filed a final short form prospectus in connection with

its previously announced bought deal financing. The Company

previously entered into an agreement with a syndicate of

underwriters (the “Underwriters”), led by Scotiabank and BMO

Capital Markets, who have agreed to purchase, on a bought deal

basis, an aggregate of 73,000,000 common shares (the "Offered

Shares") of the Company at a price of C$2.06 per Offered Share (the

"Offering Price"), for aggregate gross proceeds of C$150 million

(the “Offering”).

The Company has also granted the Underwriters

the option, exercisable in whole or in part from time to time until

and including 30 days following the Closing Date, to purchase up to

an additional 10,950,000 common shares (representing an additional

15% of the Offered Shares) at the Offering Price and on the same

terms and conditions as the Offered Shares to cover

over-allotments, if any, and for market stabilization purposes.

The closing of the Offering is expected to occur

on October 19, 2020 (the "Closing Date"), or such other date as may

be agreed by the Underwriters and the Company, acting

reasonably.

The Toronto Stock Exchange has conditionally

approved the Offering and the listing of the Offered Shares,

subject to its customary conditions.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements thereunder.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

Amended Technical Reports

In addition, as a result of a review by staff of

the Ontario Securities Commission in connection with the Offering,

the Company is also today re-filing the NI 43-101 Technical Report

Macraes Gold Mine Otago, New Zealand originally dated September 25,

2020 and the Waihi District Study Preliminary Economic Assessment

NI 43-101 Technical Report originally dated August 30, 2020, in

order to amend Section 3 of each report relating to reliance on

certain experts. There are no changes to the mineral reserves,

mineral resources or any economic outcomes in either report.

– ENDS –

Authorised for release to market by Acting

Company Secretary, Chris Hansen.

For further information please contact:

|

Investor Relations |

Media Relations |

| Sam Pazuki Tel: +1 720 602

4880IR@oceanagold.com |

Melissa BowermanTel: +61 407 783 270info@oceanagold.com |

| |

|

www.oceanagold.com | Twitter: @OceanaGold

About OceanaGold

OceanaGold is a multinational gold producer

committed to the highest standards of technical, environmental and

social performance.

For 30 years, we have been contributing to

excellence in our industry by delivering sustainable environmental

and social outcomes for our communities, and strong returns for our

shareholders. Our global exploration, development, and operating

experience has created a significant pipeline of organic growth

opportunities and a portfolio of established operating assets

including Didipio Mine in the Philippines; Macraes and Waihi

operations in New Zealand; and Haile Gold Mine in the United States

of America.

OceanaGold (TSX:OGC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

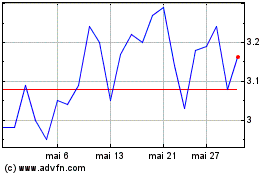

OceanaGold (TSX:OGC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024