Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”)

today announces second quarter (“Q2 2021”) financial results. All

figures are stated in Canadian dollars unless otherwise noted.

Mr. Duncan Middlemiss, President and CEO commented, “Strong gold

production in the second quarter of 30,375 ounces drove significant

improvement in cost performance. Cash costs of $814 per ounce

(US$663) and AISC of $1,240 (US$1,009), a decrease of 24% and 17%

respectively over Q1 2021. H1 2021 production of 52,939 ounces, and

cash costs of US$745 per ounce and AISC of US$1,085 per ounce has

us well positioned to deliver on both our production and cost

guidance for the year at Eagle River Mine Complex (92,000 – 105,000

ounces at cash costs of US$680 – 770 and AISC of US$980 – 1,090).

Cash margins also improved quarter on quarter with $40.1 million

earned in Q2 compared to $21.8 million in Q1. Cash position

increased to $67.8 million compared to $63.9 million in the

previous quarter.

During Q2, there were some one-time non-cash items which

impacted net income. After announcing a restart of operations at

Kiena on May 26, we recorded an impairment reversal charge of $58.6

million pre-tax ($36.3 million after-tax), as well, we had an

after-tax gain on the disposal of the Moss Lake mineral properties

of $34.5 million. Consequently, net income was $87.8 million, or

$0.63 per share. Net income adjusted for these one-off items was

$17.0 million, or $0.12 per share.

As a result of the above items and also due to a higher capital

spending rate at Kiena, free cash outflow for the quarter was $9.1

million. A total of $24.1M was spent at Kiena in Q2 in preparation

for the production restart that was approved by the Board of

Directors of the Company late in May. This decision was based on

the positive outcome of the independent Pre-Feasibility Study

published earlier this year. The investment includes $13.7 of mine

development and restart costs, $7.2M on mobile and fixed equipment

purchases, including headframe bin repairs and hoist system

upgrades. As a result of the preparatory work the mill was

restarted on July 12, and has been successfully processing S50 ore

since then. As well, work is underway to prepare the A Zone for its

first production stope starting in August, slightly ahead of

schedule. In addition, $3.2M was spent in surface and underground

exploration, which has confirmed the discovery of the new footwall

zone in the Kiena Deep.”

Key operating and financial highlights of the Q2 2021

results include:

- Gold production of 30,375 ounces

from the Eagle River Complex, a 21% increase over the same period

in the previous year (Q2 2020: 25,142 ounces):

- Eagle River Underground 63,057

tonnes at a head grade of 15.1 grams per tonne for 29,836 ounces

produced, 24% increase over the previous year (Q2 2020: 24,117

ounces).

- Mishi Open Pit 9,347 tonnes at a

head grade of 2.4 g/t Au for 539 ounces produced (Q2 2020: 1,026

ounces).

- Revenue of $63.9 million, a 17%

increase over the previous year (Q2 2020: $54.8 million).

- Ounces sold were 28,500 at an

average sales price of $2,239/oz (Q2 2020: 23,140 ounces at an

average price of $2,365/oz).

- Cash margin1 of $40.6 million, a

18.0% increase over Q2 2020 (Q2 2020 - $34.3 million).

- Operating cash flow of $26.9 million

or $0.19 per share1 as compared to $30.3 million or $0.22 per share

for the same period in 2020.

- Free cash outflow of $9.1 million,

net of an investment of $24.1 million in Kiena, or ($0.07) per

share1 (Q2 2020: free cash flow of $17.8 million or $0.13 per

share).

- Net income of $87.8 million or $0.63

per share (Q2 2020: $16.1 million or $0.12 per share) and Net

income (adjusted)1 of $17.0 million or $0.12 per share (Q2 2020:

$16.1 million or $0.12 per share).

- Cash position increased to $67.8

million compared to $63.9 million in the previous quarter.

- Cash costs1 of $814/oz or US$663/oz,

an 8% decrease over the same period in 2020 (Q2 2020: $882/oz or

US$637/oz).

- All-in sustaining costs (“AISC”) 1

of $1,240/oz or US$1,009/oz, a 2% increase over the same period in

2020 (Q2 2020: $1,218/oz or US$879/oz), due to higher sustaining

capital, corporate and general expenses and lease payments, which

was partially offset by a 23% increase in ounces sold.

- Refer to the Company’s 2021 Second

Quarter Management Discussion and Analysis, section entitled

“Non-IFRS Performance Measures” for the reconciliation of these

non-IFRS measurements to the financial statements.

|

Production and Exploration Highlights |

Achievements |

|

Eagle River |

- The Eagle

River underground ore production increased to 693 tpd in Q2 2021

due to the ventilation system upgrade that occurred in the previous

quarter, which included the development of the 640 m ramp to

provide a connection with the main ramp, a new ventilation raise

underground, and the installation of a second fan on surface.

Operational efficiencies have also contributed positively.

-

Definition drilling and initial sill development continues at the

Falcon Zone, which will provide an opportunity to assess the gold

mineralization of the Falcon Zone in the volcanic rocks. The

Company is continuing to develop and explore the 311 West Zone

along the western margin of the mine diorite. The zone has

transitioned from the diorite into the adjacent mafic volcanics,

again highlighting the potential of the volcanic rocks to host gold

mineralization, similar to that observed at the neighbouring Falcon

7 zone.

- Surface

drilling is ongoing both east and west of the mine to follow up on

anomalous values returned from regional drilling program in

2020.

|

|

Kiena |

- The

Preliminary Feasibility Study (“PFS”) was completed in Q2 2021 and

based on the positive results the operations will restart in H2

2021. Mineral reserves are over 1.5M tonnes at a head grade of

11.89 g/t for a total of 602,000 ounces. Remaining mineral

resources (exclusive of mineral reserves) for the Kiena Complex

total 0.6M tonnes grading 7.6 g/t Au totaling 156,500 ounces of

gold and remaining inferred resources totaling 3.4 million tonnes

grading 5.9 g/t Au for 649, 200 ounces.

- The

reconciliation of the A zone bulk sample that was processed in Q4

2020 recovered 6% more gold than the MRE with a feed grade of 15.7

g/t Au versus model grade of 14.7 g/t Au. Total gold produced from

the 7,032 tonnes milled was 3,479 ounces with gold recovery in the

Kiena mill of 98.2%

- The new Footwall Zone was initially

announced in March of this year. To date, the Footwall Zone is

defined by new intersections of gold mineralization located within

a 50 metre (‘m’) wide corridor adjacent to the footwall of A2 Zone.

The Footwall Zone corridor remains open laterally and down plunge.

The location of new gold intercepts in recent holes suggest that

the Footwall Zone extends over 300 m along plunge. The deepest hole

returned 41.2 g/t Au (uncapped) over 51.2 m core length.

- The discovery of the high-grade

Footwall Zone could have significant positive impacts on the

resources, the ounces per vertical metre, and the overall project

economics. This drilling highlights the potential to add ounces not

only in this area but illustrates the untested potential of the

entire gold system around the Kiena mine. This footwall zone will

be one of the zones of focus for the continuing drilling.

- Ongoing drilling also continues to

better define and expand the Kiena Deep A Zone predominantly along

the lateral extensions of the zone. The high grades intersected

will be included in future resource updates. Hole 6750 returned

122.1 g/t Au over 7.5 m core length (26.7 g/t Au capped, 4.7 m true

width).

- Surface

drilling is ongoing with a 42,000 m drilling program. These initial

targets are located along the Marbenite Fault (within 1.5 km from

Kiena Mine Complex).

- Wesdome

purchased the Tarmac Gold Property from Globex Mining Enterprises.

The Property consists of 6 claims covering 94 hectares located

entirely within Wesdome’s Kiena Mine Complex and less than 2

kilometers northeast of the Kiena underground mine, all located

beneath Lac De Montigny.

|

Technical Disclosure

The technical content of this release has been

compiled, reviewed and approved by Marc-Andre Pelletier, P. Eng,

Chief Operating Officer, and Michael Michaud, P.Geo., Vice

President, Exploration of the Company and each a "Qualified Person"

as defined in National Instrument 43-101 -Standards of Disclosure

for Mineral Projects.

Cautionary Note to United States

Investors Concerning Estimates of Reserves and

Resources

The mineral reserve and resource estimates

reported in this news release were prepared in accordance with

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”) as required by Canadian

securities regulatory authorities. The United States Securities and

Exchange Commission (the “SEC”) applies different

standards in order to classify and report mineralization. This news

release uses the terms “measured”, “indicated” and “inferred”

mineral resources, as required by NI 43-101. Readers are advised

that although such terms are recognized and required by Canadian

securities regulations, the SEC does not recognize such terms.

Canadian standards differ significantly from the requirements of

the SEC. Readers are cautioned not to assume that any part or all

of the mineral deposits in these categories constitute or will ever

be converted into mineral reserves. In addition, “inferred” mineral

resources have a great amount of uncertainty as to their existence

and great uncertainty as to their economic and legal feasibility.

It cannot be assumed that all or any part of an inferred mineral

resource exists, is economically or legally mineable or will ever

be upgraded to a higher category of mineral resource.

Wesdome Gold Mines 2021 Second Quarter

Financial Results Conference Call

North American Toll Free: + 1

(844) 202-7109International Dial-In Number:

+1 (703) 639-1272Conference ID:

9491665 Webcast link:

https://edge.media-server.com/mmc/p/xxgwkhekThe

webcast can also be accessed under the News and Events section of

the Company’s website (www.wesdome.com)

Webcast can also be accessed under the News and Events section

of the Company’s website (www.wesdome.com)

ABOUT WESDOMEWesdome is

Canadian focused with a pipeline of projects in various stages of

development. The Company’s strategy is to build Canada’s next

intermediate gold producer, producing 200,000+ ounces from two

mines in Ontario and Québec. The Eagle River Underground Mine in

Wawa, Ontario is currently producing gold at a rate of 92,000 –

105,000 ounces per year. Wesdome is actively exploring its

brownfields asset, the Kiena Complex in Val d’Or, Québec. The Kiena

Complex is a fully permitted former mine with a 930-metre shaft and

2,000 tonne-per-day mill, and a restart of operations was announced

on May 26, 2021. The Company has completed a PFS in support of the

production restart decision. The Company also retains meaningful

exposure to the Moss Lake gold deposit, located 100 kilometres west

of Thunder Bay, Ontario through its equity position in Goldshore

Resources Inc. The Company has approximately 140.0 million shares

issued and outstanding and trades on the Toronto Stock Exchange

under the symbol “WDO”.

| For further information, please

contact: |

| |

|

|

| Duncan Middlemiss |

or |

Lindsay Carpenter Dunlop |

| President and CEO |

|

VP Investor Relations |

| 416-360-3743 ext. 2029 |

|

416-360-3743 ext. 2025 |

| duncan.middlemiss@wesdome.com |

|

lindsay.dunlop@wesdome.com |

| |

|

|

| 220 Bay St, Suite 1200 |

| Toronto, ON, M5J 2W4 |

| Toll Free: 1-866-4-WDO-TSX |

| Phone: 416-360-3743, Fax: 416-360-7620 |

| Website: www.wesdome.com |

This news release contains “forward-looking

information” which may include, but is not limited to, statements

with respect to the future financial or operating performance of

the Company and its projects. Often, but not always,

forward-looking statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or variations (including negative variations) of such words and

phrases, or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

Forward-looking statements contained herein are made as of the date

of this press release and the Company disclaims any obligation to

update any forward-looking statements, whether as a result of new

information, future events or results or otherwise. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The Company

undertakes no obligation to update forward-looking statements if

circumstances, management’s estimates or opinions should change,

except as required by securities legislation. Accordingly, the

reader is cautioned not to place undue reliance on forward-looking

statements. The Company has included in this news release certain

non-IFRS performance measures, including, but not limited to, mine

operating profit, mining and processing costs and cash costs. Cash

costs per ounce reflect actual mine operating costs incurred during

the fiscal period divided by the number of ounces produced. These

measures are not defined under IFRS and therefore should not be

considered in isolation or as an alternative to or more meaningful

than, net income (loss) or cash flow from operating activities as

determined in accordance with IFRS as an indicator of our financial

performance or liquidity. The Company believes that, in addition to

conventional measures prepared in accordance with IFRS, certain

investors use this information to evaluate the Company's

performance and ability to generate cash flow.

Wesdome Gold Mines

Ltd.Summarized Operating and Financial

Data(Unaudited, expressed in thousands of Canadian

dollars, except per share and per unit amounts and otherwise

indicated)

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months

Ended |

Six Months

Ended |

|

| |

|

June 30, |

|

June 30, |

|

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Operating data |

|

|

|

|

|

|

|

|

|

|

|

Milling (tonnes) |

|

|

|

|

|

|

|

|

|

|

| Eagle

River |

|

63,057 |

|

|

42,349 |

|

|

116,596 |

|

|

98,223 |

|

| Mishi |

|

9,347 |

|

|

13,721 |

|

|

26,567 |

|

|

24,768 |

|

| Throughput

2 |

|

72,404 |

|

|

56,070 |

|

|

143,163 |

|

|

122,991 |

|

| Head

grades (g/t) |

|

|

|

|

|

|

|

|

|

|

| Eagle

River |

|

15.1 |

|

|

18.1 |

|

|

14.1 |

|

|

15.8 |

|

| Mishi |

|

2.4 |

|

|

2.9 |

|

|

2.4 |

|

|

2.7 |

|

|

Recovery (%) |

|

|

|

|

|

|

|

|

|

|

| Eagle

River |

|

97.4 |

|

|

97.9 |

|

|

97.3 |

|

|

97.6 |

|

| Mishi |

|

76.1 |

|

|

79.8 |

|

|

81.9 |

|

|

77.8 |

|

|

Production (ounces) |

|

|

|

|

|

|

|

|

|

|

| Eagle

River |

|

29,836 |

|

|

24,117 |

|

|

51,232 |

|

|

48,574 |

|

| Mishi |

|

539 |

|

|

1,026 |

|

|

1,707 |

|

|

1,690 |

|

|

Total gold produced 2 |

|

30,375 |

|

|

25,142 |

|

|

52,939 |

|

|

50,264 |

|

|

Total gold sales (ounces) |

|

28,500 |

|

|

23,140 |

|

|

50,957 |

|

|

49,640 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Eagle River Complex (per ounce of gold sold)

1 |

|

|

|

|

|

|

|

|

| Average

realized price |

$ |

2,239 |

|

$ |

2,365 |

|

$ |

2,232 |

|

$ |

2,257 |

|

| Cash

costs |

|

814 |

|

|

882 |

|

|

930 |

|

|

1,009 |

|

| Cash

margin |

$ |

1,425 |

|

$ |

1,483 |

|

$ |

1,302 |

|

$ |

1,248 |

|

| All-in

Sustaining Costs 1 |

$ |

1,240 |

|

$ |

1,218 |

|

$ |

1,353 |

|

$ |

1,327 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Mine

operating costs/tonne milled 1 |

$ |

324 |

|

$ |

331 |

|

$ |

330 |

|

$ |

383 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Average 1

USD → CAD exchange rate |

|

1.2282 |

|

|

1.3853 |

|

|

1.247 |

|

|

1.3651 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Cash costs

per ounce of gold sold (US$) 1 |

$ |

663 |

|

$ |

637 |

|

$ |

745 |

|

$ |

739 |

|

| All-in

Sustaining Costs (US$) 1 |

$ |

1,009 |

|

$ |

879 |

|

$ |

1,085 |

|

$ |

972 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Financial Data |

|

|

|

|

|

|

|

|

|

|

| Cash margin

1 |

$ |

40,590 |

|

$ |

34,304 |

|

$ |

62,366 |

|

$ |

61,923 |

|

| Net

income |

$ |

87,807 |

|

$ |

16,097 |

|

$ |

94,910 |

|

$ |

27,610 |

|

| Net income

adjusted 1 |

$ |

17,028 |

|

$ |

16,097 |

|

$ |

24,131 |

|

$ |

27,610 |

|

| Earnings

before interest, taxes, depreciation and amortization 1 |

$ |

32,812 |

|

$ |

30,347 |

|

$ |

51,474 |

|

$ |

55,761 |

|

| Operating

cash flow |

$ |

26,875 |

|

$ |

30,348 |

|

$ |

48,908 |

|

$ |

63,839 |

|

| Free cash

flow |

$ |

(9,131 |

) |

$ |

17,793 |

|

$ |

(9,032 |

) |

$ |

34,527 |

|

| Per share

data |

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

0.63 |

|

$ |

0.12 |

|

$ |

0.68 |

|

$ |

0.20 |

|

|

Adjusted net income 1 |

$ |

0.12 |

|

$ |

0.12 |

|

$ |

0.17 |

|

$ |

0.20 |

|

|

Operating cash flow 1 |

$ |

0.19 |

|

$ |

0.22 |

|

$ |

0.35 |

|

$ |

0.46 |

|

|

Free cash flow 1 |

$ |

(0.07 |

) |

$ |

0.13 |

|

$ |

(0.06 |

) |

$ |

0.25 |

|

| |

|

|

|

|

|

|

|

|

|

|

- Refer to the Company’s 2021 Second

Quarter Management Discussion and Analysis, section entitled

“Non-IFRS Performance Measures” for the reconciliation of these

non-IFRS measurements to the financial statements.

- Totals for tonnage and gold ounces

information may not add due to rounding.

Wesdome Gold Mines

Ltd.Consolidated Statements of Financial

Position(Expressed in thousands of Canadian dollars)

| |

|

|

|

| |

As at June30, 2021 |

|

As at December31, 2020 |

|

Assets |

|

|

|

| Current |

|

|

|

|

Cash and cash equivalents |

$ |

67,799 |

|

$ |

63,480 |

|

Receivables and prepaids |

|

10,997 |

|

|

8,974 |

|

Share consideration receivable |

|

4,882 |

|

|

- |

|

Inventories |

|

16,761 |

|

|

12,451 |

| Total

current assets |

|

100,439 |

|

|

84,905 |

| |

|

|

|

| Restricted

cash |

|

657 |

|

|

657 |

| Deferred

financing costs |

|

938 |

|

|

827 |

| Mining

properties, plant and equipment |

|

193,641 |

|

|

128,670 |

| Mines under

development |

|

151,651 |

|

|

- |

| Exploration

properties |

|

15,202 |

|

|

143,524 |

| Share

consideration receivable |

|

13,265 |

|

|

- |

| Investment

in associate |

|

19,466 |

|

|

- |

| Total

assets |

$ |

495,259 |

|

$ |

358,583 |

| |

|

|

|

|

Liabilities |

|

|

|

| Current |

|

|

|

|

Payables and accruals |

$ |

23,088 |

|

$ |

21,123 |

|

Income and mining tax payable |

|

3,466 |

|

|

3,481 |

|

Current portion of lease liabilities |

|

6,744 |

|

|

5,901 |

| Total

current liabilities |

|

33,298 |

|

|

30,505 |

| |

|

|

|

| Lease

liabilities |

|

6,465 |

|

|

5,604 |

| Deferred

income and mining tax liabilities |

|

73,198 |

|

|

37,354 |

|

Decommissioning provisions |

|

21,794 |

|

|

22,270 |

| Total

liabilities |

|

134,755 |

|

|

95,733 |

| |

|

|

|

|

Equity |

|

|

|

| Equity

attributable to owners of the Company |

|

|

|

|

Capital stock |

|

182,144 |

|

|

179,540 |

|

Contributed surplus |

|

6,612 |

|

|

6,472 |

|

Retained earnings |

|

171,748 |

|

|

76,838 |

| Total equity

attributable to owners of the Company |

|

360,504 |

|

|

262,850 |

| |

$ |

495,259 |

|

$ |

358,583 |

| |

|

|

|

Wesdome Gold Mines

Ltd.Consolidated Statements of Income (loss) and

Comprehensive Income (loss)(Expressed in thousands of

Canadian dollars except for per share amounts)

| |

|

|

|

| |

Three Months

Ended |

|

Six Months

Ended |

| |

June

30, |

|

June

30, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

Revenues |

$ |

63,881 |

|

|

$ |

54,772 |

|

|

$ |

109,854 |

|

|

$ |

112,104 |

|

| Cost

of sales |

|

(29,774 |

) |

|

|

(26,826 |

) |

|

|

(60,038 |

) |

|

|

(64,416 |

) |

|

Gross profit |

|

34,107 |

|

|

|

27,946 |

|

|

|

49,816 |

|

|

|

47,688 |

|

| |

|

|

|

|

|

|

|

|

Other expenses |

|

|

|

|

|

|

|

| Corporate

and general |

|

2,841 |

|

|

|

1,805 |

|

|

|

5,232 |

|

|

|

3,776 |

|

| Stock-based

compensation |

|

1,203 |

|

|

|

1,340 |

|

|

|

1,513 |

|

|

|

1,744 |

|

| Reversal of

impairment charges |

|

(58,563 |

) |

|

|

- |

|

|

|

(58,563 |

) |

|

|

- |

|

| Write-down

of exploration properties |

|

3,113 |

|

|

|

- |

|

|

|

3,113 |

|

|

|

- |

|

| |

|

(51,406 |

) |

|

|

3,145 |

|

|

|

(48,705 |

) |

|

|

5,520 |

|

| |

|

|

|

|

|

|

|

|

Operating income |

|

85,513 |

|

|

|

24,801 |

|

|

|

98,521 |

|

|

|

42,168 |

|

| |

|

|

|

|

|

|

|

| Gain on sale

of Moss Lake exploration properties |

|

39,143 |

|

|

|

- |

|

|

|

39,143 |

|

|

|

- |

|

| Interest

expense |

|

(271 |

) |

|

|

(284 |

) |

|

|

(530 |

) |

|

|

(539 |

) |

| Accretion of

decommissioning provisions |

|

(124 |

) |

|

|

(52 |

) |

|

|

(234 |

) |

|

|

(177 |

) |

| Share of

loss of associate |

|

(89 |

) |

|

|

- |

|

|

|

(89 |

) |

|

|

- |

|

| Fair value

adjustment on share consideration receivable |

|

(8 |

) |

|

|

- |

|

|

|

(8 |

) |

|

|

- |

|

| Other income

(expenses) |

|

(400 |

) |

|

|

(204 |

) |

|

|

(703 |

) |

|

|

91 |

|

| Income

before income and mining taxes |

|

123,764 |

|

|

|

24,261 |

|

|

|

136,100 |

|

|

|

41,543 |

|

| |

|

|

|

|

|

|

|

|

Income and mining tax expense |

|

|

|

|

|

|

|

|

Current |

|

4,250 |

|

|

|

1,769 |

|

|

|

5,346 |

|

|

|

4,039 |

|

|

Deferred |

|

31,707 |

|

|

|

6,395 |

|

|

|

35,844 |

|

|

|

9,894 |

|

| |

|

35,957 |

|

|

|

8,164 |

|

|

|

41,190 |

|

|

|

13,933 |

|

| |

|

|

|

|

|

|

|

| Net

income and total |

|

|

|

|

|

|

|

|

comprehensive income |

$ |

87,807 |

|

|

$ |

16,097 |

|

|

$ |

94,910 |

|

|

$ |

27,610 |

|

| |

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.63 |

|

|

$ |

0.12 |

|

|

$ |

0.68 |

|

|

$ |

0.20 |

|

|

Diluted |

$ |

0.62 |

|

|

$ |

0.11 |

|

|

$ |

0.67 |

|

|

$ |

0.19 |

|

| |

|

|

|

|

|

|

|

|

Weighted average number of common |

|

|

|

|

|

|

|

|

shares (000s) |

|

|

|

|

|

|

|

|

Basic |

|

139,754 |

|

|

|

138,918 |

|

|

|

139,587 |

|

|

|

138,691 |

|

|

Diluted |

|

142,630 |

|

|

|

142,430 |

|

|

|

142,454 |

|

|

|

142,227 |

|

| |

|

|

|

|

|

|

|

Wesdome Gold Mines

Ltd.Consolidated Statements of Total

Equity(Expressed in thousands of Canadian dollars)

| |

|

|

|

|

|

|

|

|

|

| |

Capital |

|

|

Contributed |

|

Retained |

|

|

Total |

| |

Stock |

|

|

Surplus |

|

Earnings |

|

|

Equity |

| |

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2019 |

$ |

174,789 |

|

|

$ |

5,590 |

|

|

$ |

26,123 |

|

|

$ |

206,502 |

|

| Net income

for the period ended |

|

|

|

|

|

|

|

|

|

|

June 30, 2020 |

|

- |

|

|

|

- |

|

|

|

27,610 |

|

|

|

27,610 |

|

| Exercise of

options |

|

1,782 |

|

|

|

- |

|

|

|

- |

|

|

|

1,782 |

|

| Value

attributed to options exercised |

|

825 |

|

|

|

(825 |

) |

|

|

- |

|

|

|

- |

|

| Value

attributed to RSUs exercised |

|

577 |

|

|

|

(577 |

) |

|

|

- |

|

|

|

- |

|

| Stock-based

compensation |

|

- |

|

|

|

1,744 |

|

|

|

- |

|

|

|

1,744 |

|

| Balance,

June 30, 2020 |

$ |

177,973 |

|

|

$ |

5,932 |

|

|

$ |

53,733 |

|

|

$ |

237,638 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Balance,

December 31, 2020 |

$ |

179,540 |

|

|

$ |

6,472 |

|

|

$ |

76,838 |

|

|

$ |

262,850 |

|

| Net income

for the period ended |

|

|

|

|

|

|

|

|

|

|

June 30, 2021 |

|

- |

|

|

|

- |

|

|

|

94,910 |

|

|

|

94,910 |

|

| Exercise of

options |

|

1,231 |

|

|

|

- |

|

|

|

- |

|

|

|

1,231 |

|

| Value

attributed to options exercised |

|

587 |

|

|

|

(587 |

) |

|

|

- |

|

|

|

- |

|

| Value

attributed to RSUs exercised |

|

786 |

|

|

|

(786 |

) |

|

|

- |

|

|

|

- |

|

| Stock-based

compensation |

|

- |

|

|

|

1,513 |

|

|

|

- |

|

|

|

1,513 |

|

| Balance,

June 30, 2021 |

$ |

182,144 |

|

|

$ |

6,612 |

|

|

$ |

171,748 |

|

|

$ |

360,504 |

|

| |

|

|

|

|

|

|

|

|

|

Wesdome Gold Mines

Ltd.Consolidated Statements of Cash

Flows(Unaudited, expressed in thousands of Canadian

dollars)

| |

|

|

|

| |

Three months

ended June 30, |

|

Six months

ended June 30, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

Operating Activities |

|

|

|

|

|

|

|

|

Net income |

$ |

87,807 |

|

|

$ |

16,097 |

|

|

$ |

94,910 |

|

|

$ |

27,610 |

|

|

Depreciation and depletion |

|

6,483 |

|

|

|

5,802 |

|

|

|

12,550 |

|

|

|

13,679 |

|

|

Stock-based compensation |

|

1,203 |

|

|

|

1,340 |

|

|

|

1,513 |

|

|

|

1,744 |

|

|

Accretion of decommissioning provisions |

|

124 |

|

|

|

52 |

|

|

|

234 |

|

|

|

177 |

|

|

Deferred income and mining tax expense |

|

31,707 |

|

|

|

6,395 |

|

|

|

35,844 |

|

|

|

9,894 |

|

|

Amortization of deferred financing cost |

|

119 |

|

|

|

102 |

|

|

|

224 |

|

|

|

164 |

|

|

Interest expense |

|

271 |

|

|

|

284 |

|

|

|

530 |

|

|

|

539 |

|

|

Reversal of impairment charges |

|

(58,563 |

) |

|

|

- |

|

|

|

(58,563 |

) |

|

|

- |

|

|

Gain on sale of Moss Lake exploration properties |

|

(39,143 |

) |

|

|

- |

|

|

|

(39,143 |

) |

|

|

- |

|

|

Write down of exploration properties |

|

3,113 |

|

|

|

- |

|

|

|

3,113 |

|

|

|

- |

|

|

Share of loss of associate |

|

89 |

|

|

|

- |

|

|

|

89 |

|

|

|

- |

|

|

Fair value adjustment on share consideration |

|

8 |

|

|

|

- |

|

|

|

8 |

|

|

|

- |

|

|

receivable |

|

|

|

|

|

|

|

|

Foreign exchange loss (gain) on lease financing |

|

(50 |

) |

|

|

(236 |

) |

|

|

(79 |

) |

|

|

184 |

|

| |

|

33,168 |

|

|

|

29,836 |

|

|

|

51,230 |

|

|

|

53,991 |

|

|

Net changes in non-cash working capital |

|

(1,131 |

) |

|

|

512 |

|

|

|

3,039 |

|

|

|

11,168 |

|

|

Mining and income tax paid |

|

(5,162 |

) |

|

|

- |

|

|

|

(5,361 |

) |

|

|

(1,320 |

) |

| Net

cash from operating activities |

|

26,875 |

|

|

|

30,348 |

|

|

|

48,908 |

|

|

|

63,839 |

|

| |

|

|

|

|

|

|

|

|

Financing Activities |

|

|

|

|

|

|

|

|

Exercise of options |

|

910 |

|

|

|

1,100 |

|

|

|

1,231 |

|

|

|

1,782 |

|

|

Deferred financing costs |

|

(95 |

) |

|

|

(99 |

) |

|

|

(334 |

) |

|

|

(198 |

) |

|

Repayment of borrowings |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3,636 |

) |

|

Repayment of lease liabilities |

|

(1,884 |

) |

|

|

(1,152 |

) |

|

|

(3,400 |

) |

|

|

(2,209 |

) |

|

Interest paid |

|

(271 |

) |

|

|

(284 |

) |

|

|

(530 |

) |

|

|

(539 |

) |

| Net

cash used in financing activities |

|

(1,340 |

) |

|

|

(435 |

) |

|

|

(3,033 |

) |

|

|

(4,800 |

) |

| |

|

|

|

|

|

|

|

|

Investing Activities |

|

|

|

|

|

|

|

|

Additions to mining properties |

|

(10,050 |

) |

|

|

(5,445 |

) |

|

|

(17,873 |

) |

|

|

(11,991 |

) |

|

Additions to mines under development |

|

(12,704 |

) |

|

|

- |

|

|

|

(13,400 |

) |

|

|

- |

|

|

Additions to exploration properties |

|

(11,368 |

) |

|

|

(5,958 |

) |

|

|

(23,267 |

) |

|

|

(15,112 |

) |

|

Cash proceeds on sale of Moss Lake, net |

|

11,762 |

|

|

|

- |

|

|

|

11,762 |

|

|

|

- |

|

|

of transaction costs |

|

|

|

|

|

|

|

|

Net changes in non-cash working capital |

|

740 |

|

|

|

(1,175 |

) |

|

|

1,222 |

|

|

|

(860 |

) |

| Net

cash used in investing activities |

|

(21,620 |

) |

|

|

(12,578 |

) |

|

|

(41,556 |

) |

|

|

(27,963 |

) |

| |

|

|

|

|

|

|

|

| Increase in

cash and cash equivalents |

|

3,915 |

|

|

|

17,335 |

|

|

|

4,319 |

|

|

|

31,076 |

|

| Cash and

cash equivalents - beginning of the period |

|

63,884 |

|

|

|

49,398 |

|

|

|

63,480 |

|

|

|

35,657 |

|

| Cash and

cash equivalents - end of the period |

$ |

67,799 |

|

|

$ |

66,733 |

|

|

$ |

67,799 |

|

|

$ |

66,733 |

|

| |

|

|

|

|

|

|

|

| Cash and

cash equivalents consist of: |

|

|

|

|

|

|

|

|

Cash |

$ |

67,799 |

|

|

$ |

66,733 |

|

|

$ |

67,799 |

|

|

$ |

66,733 |

|

| Term

deposits |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

$ |

67,799 |

|

|

$ |

66,733 |

|

|

$ |

67,799 |

|

|

$ |

66,733 |

|

PDF

available: http://ml.globenewswire.com/Resource/Download/f7a95385-47d1-4cea-b2ec-f21465ab70e0

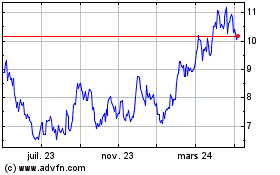

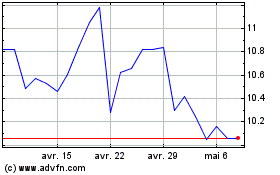

Wesdome Gold Mines (TSX:WDO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Wesdome Gold Mines (TSX:WDO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024