Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”)

today announces surface exploration drilling results from the

Presqu’île Zone at the Company’s 100% owned Kiena Mine Complex in

Val d'Or, Quebec.

Since the completion of the PFS for the Kiena

Mine in 2021, both surface and underground drilling has been more

focused on exploration targets proximal to the Kiena Mine.

Initially this drilling has been completed along strike from the

Kiena Mine within the prospective Jacola Formation in order to

provide additional feed for the Kiena mill. Most recently surface

drilling has focused on the Presqu’île Zone located 2 kilometres

west of the Kiena Mine (Figure 1). Previous drilling at the

Presqu’île zones has defined a near surface mineral resource

(Inferred Mineral Resource of 353,000 tonnes grading 7.1 g/t au

totalling 80,600 oz of gold from 3 lenses [PR-1, PR-2, and PR-2A

zones], December 31, 2021 Mineral Resources).

Recent drilling has confirmed several narrow,

subparallel zones that are steeply east-plunging located proximal

to a sheared mafic-ultramafic contact. The zones are generally

hosted by a porphyritic basalt. The mineralization corresponds to

several quartz-carbonate-chlorite veins (<40cm) mineralized with

pyrite, chalcopyrite, sphalerite, galena and ±visible native gold.

Quartz veins are associated with a typical biotite alteration. The

drilling has confirmed the continuity of the mineralized zones. The

PR-2A Zone is interpreted to be open along strike eastward and down

dip and represents an excellent target for the exploration drilling

at depth.

Highlights of the recent drilling are listed

below and are summarized in Table 1.

- Hole PR-22-034: 24.3 g/t over 3.3 m core length (10.6 g/t Au

capped*, 3.0 true width) PR-1 Zone

- Hole PR-22-026: 30.0 g/t Au over 9.4 m core length (13.1 g/t Au

capped*, 9.2 m true width) PR-2A Zone

- Hole PR-22-024: 45.0 g/t Au over 3.8 m core length (18.5 g/t Au

capped*, 3.7 m true width) PR-2A Zone

- Hole PR-22-029: 27.6 g/t over 3.5 m core length (12.8 g/t Au

capped*, 3.3 m true width) PR-2 Zone

* All assays capped at 35 g/t. Au. True widths

are estimated based on 3D model construction.

Given the significant upside that the Presqu’île

zone could represent for Kiena, the Company is currently evaluating

options to fast-track an exploration ramp from surface. This

infrastructure would provide the ideal platform for exploration

activities to test the potential of the Presqu’île area. It could

also easily be connected to Kiena’s existing underground ramp

network, providing access to surface for the existing operation.

This could represent a significant milestone on the Company’s

journey to unlock the full potential of Kiena, as it would provide

a second access for conveyance of material and personnel, freeing

time for additional ore hoisting via the shaft. Other gains, such

as reduced ventilation costs and savings from added operational

flexibility are also expected.

Mr. Duncan Middlemiss, President and CEO

commented, “We are pleased with the recent surface exploration

results at Presqu’île which could potentially increase our resource

base in areas proximal to the mine. The Presqu’île Zone represents

an opportunity to establish an exploration ramp for further

exploration of the zone but also to provide access to the

underground workings via a ramp system that would greatly improve

efficiencies at the Kiena mine.

We are currently drilling with two drills on

barges and one surface drill to explore adjacent mineralization to

the Kiena mine within the Jacola Formation. Several of these areas

include the Dubuisson, Shawkey, Thompson, and recently discovered

Bourgo zone again having the potential to add to feed for the Kiena

mill. Drilling is ongoing and updates will be released within the

next several months. It is evident that as we continue to explore

and collect new geological information, we are able to discover

traps for gold mineralization, thereby demonstrating the

prospectivity of the property.

We are also pleased with the progress being made

at the construction of the paste back fill plant that is expected

to be completed in November. As part of this, the most critical

components of the paste fill plant, the motor control system (MCC)

have been received and being installed. Commissioning remains on

track for Q4 2022.”

TECHNICAL DISCLOSURE

The technical and geoscientific content of this release has been

compiled and reviewed by Denys Vermette, P. Geo., (OGQ #564)

Consultant Geologist for IOS Services Géoscientifiques from

Chicoutimi, Qc), and approved by Bruno Turcotte, P.Geo., (OGQ #453)

Chief Geologist – Underground Exploration of the Company, both

"Qualified Persons" as defined in National Instrument 43-101

-Standards of Disclosure for Mineral Projects.

Analytical work was performed by ALS Minerals of

Val-d’Or (Quebec), a certified commercial laboratory (Accredited

Lab #689). Sample preparation was completed at ALS Minerals in

Lachine (Quebec). Assaying comprised fire assay methods with an

atomic absorption finish. Any sample assaying >3 g/t Au was

rerun by fire assay method with gravimetric finish, and any sample

assaying >10 g/t Au was rerun with the metallic sieve method. In

addition to laboratory internal duplicates, standards, and blanks,

the geology department inserts blind duplicates, standards, and

blanks into the sample stream at a frequency of one in twenty to

monitor quality control.

COVID-19

The health and safety of our employees,

contractors, vendors, and consultants is the Company’s top

priority. In response to the COVID-19 outbreak, Wesdome has adopted

all public health guidelines regarding safety measures and

protocols at all of its mine operations and corporate office. These

protocols are still in place at all sites despite the loosening of

some provincial public health guidelines. In addition, our internal

COVID-19 Taskforce continues to monitor developments and implement

policies and programs intended to protect those who are engaged in

business with the Company.

Through care and planning, to date the Company

has successfully maintained operations; however, there can be no

assurance that this will continue despite the Company’s best

efforts, with the emergence of new, highly contagious variants such

as Omicron. To date, the Company has been impacted by this most

recent variant outbreak, with employees at both operations and

corporate office becoming infected, which may negatively impact our

ability to maintain projected timelines and objectives.

Consequently, the Company’s actual future production and production

guidance is subject to higher levels of risk than usual. The

Company is continuing to monitor the situation closely and will

provide updates as they become available.

ABOUT WESDOMEWesdome is a

Canadian focused gold producer with two high grade underground

assets, the Eagle River mine in Ontario and the recently re-started

Kiena mine in Quebec. The Company also retains meaningful

exposure to the Moss Lake gold deposit in Ontario through its

equity position in Goldshore Resources Inc. The Company’s primary

goal is to responsibly leverage this operating platform and

high-quality brownfield and greenfield exploration pipeline to

build Canada’s next intermediate gold producer. Wesdome trades

on the Toronto Stock Exchange under the symbol “WDO,” with a

secondary listing on the OTCQX under the symbol “WDOFF.”

For further information, please

contact:

| Duncan

Middlemiss President and

CEO 416-360-3743 ext.

2029

duncan.middlemiss@wesdome.com |

or |

Lindsay

Carpenter DunlopVP Investor Relations416-360-3743 ext.

2025lindsay.dunlop@wesdome.com |

220 Bay St, Suite 1200 Toronto, ON, M5J 2W4 Toll Free:

1-866-4-WDO-TSX Phone: 416-360-3743, Fax: 416-360-7620 Website:

www.wesdome.com

This news release contains “forward-looking

information” which may include, but is not limited to, statements

with respect to the future financial or operating performance of

the Company and its projects. Often, but not always,

forward-looking statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or variations (including negative variations) of such words and

phrases, or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

Forward-looking statements contained herein are made as of the date

of this press release and the Company disclaims any obligation to

update any forward-looking statements, whether as a result of new

information, future events or results or otherwise. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The Company

undertakes no obligation to update forward-looking statements if

circumstances, management’s estimates or opinions should change,

except as required by securities legislation. Accordingly, the

reader is cautioned not to place undue reliance on forward-looking

statements. The Company has included in this news release certain

non-IFRS performance measures, including, but not limited to, mine

operating profit, mining and processing costs and cash costs. Cash

costs per ounce reflect actual mine operating costs incurred during

the fiscal period divided by the number of ounces produced. These

measures are not defined under IFRS and therefore should not be

considered in isolation or as an alternative to or more meaningful

than, net income (loss) or cash flow from operating activities as

determined in accordance with IFRS as an indicator of our financial

performance or liquidity. The Company believes that, in addition to

conventional measures prepared in accordance with IFRS, certain

investors use this information to evaluate the Company's

performance and ability to generate cash flow

Table 1: Kiena Complex Surface Drilling Assay and

Composite Results

Composites

|

Hole No. |

From (m) |

To (m) |

Core Length (m) |

Estimated True width (m) |

Grade (g/t Au) |

Cut Grade (35 g/t Au) |

Zone Name |

|

PR-21-014 |

391.5 |

394.5 |

3.0 |

2.9 |

5.49 |

5.49 |

PR-2A |

|

PR-21-019 |

94.0 |

98.0 |

4.0 |

2.8 |

42.30 |

13.30 |

PR-3 |

|

PR-21-020 |

172.5 |

176.0 |

3.5 |

3.4 |

10.04 |

10.01 |

PR-2A |

|

PR-22-023 |

229.5 |

234.9 |

5.4 |

4.1 |

4.64 |

4.64 |

PR-2 |

|

PR-22-024 |

185.2 |

189.0 |

3.8 |

3.7 |

44.99 |

18.45 |

PR-2A |

|

PR-22-026 |

196.2 |

205.6 |

9.4 |

9.2 |

29.98 |

13.12 |

PR-2A |

|

PR-22-027 |

189.9 |

194.1 |

4.2 |

3.9 |

9.41 |

9.41 |

PR-1 |

|

PR-22-028 |

284.0 |

288.0 |

4.0 |

3.1 |

12.09 |

12.09 |

PR-2 |

|

PR-22-029 |

234.5 |

238.0 |

3.5 |

3.3 |

27.62 |

12.74 |

PR-2 |

|

PR-22-031 |

183.5 |

186.5 |

3.0 |

3.0 |

4.06 |

4.06 |

PR-2A |

|

PR-22-032 |

172.0 |

175.0 |

3.0 |

2.9 |

6.54 |

6.54 |

PR-1 |

|

PR-22-034 |

234.0 |

237.3 |

3.3 |

3.0 |

24.25 |

10.63 |

PR-1 |

|

PR-22-035 |

240.5 |

243.5 |

3.0 |

2.9 |

3.04 |

3.04 |

PR-2A |

|

PR-22-036 |

288.5 |

291.5 |

3.0 |

2.9 |

8.77 |

8.77 |

PR-2A |

|

PR-22-037 |

339.0 |

342.0 |

3.0 |

2.8 |

14.91 |

14.91 |

PR-2 |

|

PR-22-042 |

178.2 |

181.2 |

3.0 |

2.9 |

27.39 |

17.15 |

PR-2A |

Assays

|

Hole No. |

From (m) |

To (m) |

Core Length (m) |

Grade (g/t Au) |

Cut Grade (35 g/t Au) |

Name Zone |

|

PR-21-014 |

391.5 |

392.5 |

1.0 |

0.02 |

0.02 |

PR-2A |

|

PR-21-014 |

392.5 |

393.5 |

1.0 |

16.40 |

16.40 |

PR-2A |

|

PR-21-014 |

393.5 |

394.5 |

1.0 |

0.04 |

0.04 |

PR-2A |

|

|

|

|

|

|

|

|

|

PR-21-019 |

94.0 |

95.0 |

1.0 |

16.25 |

16.25 |

PR-3 |

|

PR-21-019 |

95.0 |

96.0 |

1.0 |

151.00 |

35.00 |

PR-3 |

|

PR-21-019 |

96.0 |

97.0 |

1.0 |

0.50 |

0.50 |

PR-3 |

|

PR-21-019 |

97.0 |

98.0 |

1.0 |

1.44 |

1.44 |

PR-3 |

|

|

|

|

|

|

|

|

|

PR-21-020 |

172.5 |

174.0 |

1.5 |

0.01 |

0.01 |

PR-2A |

|

PR-21-020 |

174.0 |

175.0 |

1.0 |

35.10 |

35.00 |

PR-2A |

|

PR-21-020 |

175.0 |

176.0 |

1.0 |

0.03 |

0.03 |

PR-2A |

|

|

|

|

|

|

|

|

|

PR-22-023 |

229.5 |

231.0 |

1.5 |

3.31 |

3.31 |

PR-2 |

|

PR-22-023 |

231.0 |

232.5 |

1.5 |

1.46 |

1.46 |

PR-2 |

|

PR-22-023 |

232.5 |

234.0 |

1.5 |

6.63 |

6.63 |

PR-2 |

|

PR-22-023 |

234.0 |

234.9 |

0.9 |

8.85 |

8.85 |

PR-2 |

|

|

|

|

|

|

|

|

|

PR-22-024 |

185.2 |

186.4 |

1.2 |

102.50 |

35.00 |

PR-2A |

|

PR-22-024 |

186.4 |

187.7 |

1.3 |

36.80 |

35.00 |

PR-2A |

|

PR-22-024 |

187.7 |

189.0 |

1.3 |

0.10 |

0.10 |

PR-2A |

|

|

|

|

|

|

|

|

|

PR-22-026 |

196.2 |

197.2 |

1.0 |

72.60 |

35.00 |

PR-2A |

|

PR-22-026 |

197.2 |

198.2 |

1.0 |

0.19 |

0.19 |

PR-2A |

|

PR-22-026 |

198.2 |

199.2 |

1.0 |

0.02 |

0.02 |

PR-2A |

|

PR-22-026 |

199.2 |

200.2 |

1.0 |

0.01 |

0.01 |

PR-2A |

|

PR-22-026 |

200.2 |

201.2 |

1.0 |

0.26 |

0.26 |

PR-2A |

|

PR-22-026 |

201.2 |

202.3 |

1.1 |

0.79 |

0.79 |

PR-2A |

|

PR-22-026 |

202.3 |

203.3 |

1.0 |

44.70 |

35.00 |

PR-2A |

|

PR-22-026 |

203.3 |

204.3 |

1.0 |

6.49 |

6.49 |

PR-2A |

|

PR-22-026 |

204.3 |

205.6 |

1.3 |

120.50 |

35.00 |

PR-2A |

|

|

|

|

|

|

|

|

|

PR-22-027 |

189.9 |

190.9 |

1.0 |

11.45 |

11.45 |

PR-1 |

|

PR-22-027 |

190.9 |

191.9 |

1.0 |

8.63 |

8.63 |

PR-1 |

|

PR-22-027 |

191.9 |

193.0 |

1.1 |

0.29 |

0.29 |

PR-1 |

|

PR-22-027 |

193.0 |

194.1 |

1.1 |

17.40 |

17.40 |

PR-1 |

|

|

|

|

|

|

|

|

|

PR-22-028 |

284.0 |

285.2 |

1.2 |

2.07 |

2.07 |

PR-2 |

|

PR-22-028 |

285.2 |

286.3 |

1.1 |

2.60 |

2.60 |

PR-2 |

|

PR-22-028 |

286.3 |

286.8 |

0.5 |

84.50 |

35.00 |

PR-2 |

|

PR-22-028 |

286.8 |

288.0 |

1.2 |

0.64 |

0.64 |

PR-2 |

|

|

|

|

|

|

|

|

|

PR-22-029 |

234.5 |

235.8 |

1.3 |

0.33 |

0.33 |

PR-2 |

|

PR-22-029 |

235.8 |

237.0 |

1.2 |

78.40 |

35.00 |

PR-2 |

|

PR-22-029 |

237.0 |

238.0 |

1.0 |

2.16 |

2.16 |

PR-2 |

|

|

|

|

|

|

|

|

|

PR-22-031 |

183.5 |

184.5 |

1.0 |

10.25 |

10.25 |

PR-2A |

|

PR-22-031 |

184.5 |

185.5 |

1.0 |

1.86 |

1.86 |

PR-2A |

|

PR-22-031 |

185.5 |

186.5 |

1.0 |

0.06 |

0.06 |

PR-2A |

|

|

|

|

|

|

|

|

|

PR-22-032 |

172.0 |

173.0 |

1.0 |

0.01 |

0.01 |

PR-2A |

|

PR-22-032 |

173.0 |

174.0 |

1.0 |

19.60 |

19.60 |

PR-2A |

|

PR-22-032 |

174.0 |

175.0 |

1.0 |

0.02 |

0.02 |

PR-2A |

|

|

|

|

|

|

|

|

|

PR-22-034 |

234.0 |

235.3 |

1.3 |

0.03 |

0.03 |

PR-2A |

|

PR-22-034 |

235.3 |

236.6 |

1.3 |

61.50 |

35.00 |

PR-2A |

|

PR-22-034 |

236.6 |

237.3 |

0.7 |

0.05 |

0.05 |

PR-2A |

|

|

|

|

|

|

|

|

|

PR-22-035 |

240.5 |

241.5 |

1.0 |

0.65 |

0.65 |

PR-2A |

|

PR-22-035 |

241.5 |

242.5 |

1.0 |

0.13 |

0.13 |

PR-2A |

|

PR-22-035 |

242.5 |

243.5 |

1.0 |

8.33 |

8.33 |

PR-2A |

|

|

|

|

|

|

|

|

|

PR-22-036 |

288.5 |

289.5 |

1.0 |

0.05 |

0.05 |

PR-2A |

|

PR-22-036 |

289.5 |

290.5 |

1.0 |

26.20 |

26.20 |

PR-2A |

|

PR-22-036 |

290.5 |

291.5 |

1.0 |

0.07 |

0.07 |

PR-2A |

|

|

|

|

|

|

|

|

|

PR-22-037 |

339.0 |

340.0 |

1.0 |

14.00 |

14.00 |

PR-2 |

|

PR-22-037 |

340.0 |

341.0 |

1.0 |

30.60 |

30.60 |

PR-2 |

|

PR-22-037 |

341.0 |

342.0 |

1.0 |

0.14 |

0.14 |

PR-2 |

|

|

|

|

|

|

|

|

|

PR-22-042 |

178.2 |

179.2 |

1.0 |

0.66 |

0.66 |

PR-2 |

|

PR-22-042 |

179.2 |

180.2 |

1.0 |

65.70 |

35.00 |

PR-2 |

|

PR-22-042 |

180.2 |

181.2 |

1.0 |

15.80 |

15.80 |

PR-2 |

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/98b5595f-e28f-46ca-b442-020fb3fb8ce9

https://www.globenewswire.com/NewsRoom/AttachmentNg/3ff906b3-356c-4a8d-8270-f7434009c82e

PDF

available: http://ml.globenewswire.com/Resource/Download/45cf2b8b-8933-4128-9d7b-f81df4d046c3

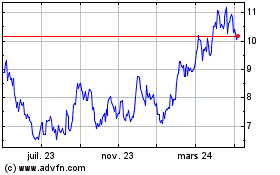

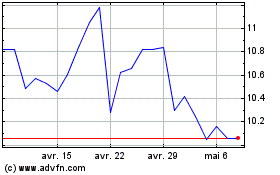

Wesdome Gold Mines (TSX:WDO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Wesdome Gold Mines (TSX:WDO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024