WELL Health Technologies Corp. (TSX: WELL) (“

WELL”

or the “

Company”) is pleased to announce that it

has entered into an agreement pursuant to which Eight Capital and

Stifel GMP as joint bookrunners and co-lead underwriters, together

with a syndicate of underwriters (collectively, the

“

Underwriters”), will purchase, on a bought deal

basis, 8,109,000 common shares in the capital of the Company (the

“

Shares”), subject to all regulatory approvals, at

a price of $3.70 per Share (the “

Issue Price”) for

gross proceeds of $30,003,300 (the “

Offering”).

The Company has agreed to grant the Underwriters

an over-allotment option to purchase up to an additional 15% of the

Shares at the Issue Price, exercisable in whole or in part, at any

time on or prior to the date that is 30 days following the closing

of the Offering. If this option is exercised in full, approximately

$4,500,000 additional proceeds will be raised pursuant to the

Offering and the aggregate proceeds of the Offering will be

approximately $34,500,000.

The Company has received indications of interest

for lead orders in connection with the Offering from a large

International Sovereign Wealth Fund and Hong Kong businessman and

investor Mr. Li Ka-shing.

The Company intends to use the net proceeds of

the Offering to fund growth initiatives, including potential future

acquisitions in the areas of physician acquisition, higher margin

speciality clinics and executive health opportunities, and for

working capital and general corporate purposes.

“WELL’s earnings and cash flow continues to

grow, and our business continues to mature as we complete the

optimization and integration of businesses acquired in 2021. The

proceeds from this financing will allow us to remain opportunistic

through the remainder of the year and continue allocating capital

in a highly accretive manner particularly as attractive

opportunities present themselves in weaker market conditions,” said

Hamed Shahbazi, Chairman and CEO of WELL, “We are deeply

appreciative to Mr. Li Ka-shing and one of the world’s leading

sovereign wealth funds for their support of this financing

initiative.”

The closing date of the Offering is scheduled to

be on or about May 19, 2022, and is subject to certain conditions

including, but not limited to, the receipt of all necessary

approvals, including the approval of the Toronto Stock Exchange and

the applicable securities regulatory authorities.

The Offering will be completed by way of a

prospectus supplement (the “Supplement”) to the

short form base shelf prospectus of the Company dated September 22,

2021 (the “Base Prospectus”), which Supplement is

expected to be filed with the securities commissions and other

similar regulatory authorities in each of the provinces of Canada,

on or prior to May 13, 2022. The Base Prospectus and, once filed,

the Supplement can be found on SEDAR at www.sedar.com, and contain

important detailed information about the Offering.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in any state in which such offer,

solicitation or sale would be unlawful. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and may not

be offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the

United States Securities Act of 1933, as amended, and

applicable state securities laws.

WELL HEALTH TECHNOLOGIES

CORP.Per: “Hamed Shahbazi”

Hamed

ShahbaziChief Executive Officer, Chairman and Director

About WELL Health Technologies

Corp.

WELL is a practitioner focused digital

healthcare company whose overarching objective is to positively

impact health outcomes to empower and support healthcare

practitioners and their patients. WELL has built an innovative

practitioner enablement platform that includes comprehensive end to

end practice management tools inclusive of virtual care and digital

patient engagement capabilities as well as Electronic Medical

Records (EMR), Revenue Cycle Management (RCM) and data protection

services. WELL uses this platform to power healthcare practitioners

both inside and outside of WELL's own omni-channel patient services

offerings. As such, WELL owns and operates Canada's largest network

of outpatient medical clinics serving primary and specialized

healthcare services and is the provider of a leading

multi-national, multi-disciplinary telehealth offering. WELL is

publicly traded on the Toronto Stock Exchange under the symbol

"WELL" and is part of the TSX Composite Index. To learn more about

the Company, please visit: www.well.company.

Notice Regarding Forward Looking

Information

Certain information in this news release related

to the Company is forward-looking information and is prospective in

nature. Forward-looking information is not based on historical

facts, but rather on current expectations and projections about

future events, and is therefore subject to risks and uncertainties

which could cause actual results to differ materially from the

future results expressed or implied by the forward-looking

information. The information generally can be identified by the use

of forward-looking words such as “may”, “should”, “could”,

“intend”, “estimate”, “plan”, “anticipate”, “expect”, “believe” or

“continue”, or the negative thereof or similar variations.

Forward-looking information in this news release include

information regarding the prospective lead order and the intended

use of proceeds of the Offering. There are numerous risks and

uncertainties that could cause actual results and WELL’s plans and

objectives to differ materially from those expressed in the

forward-looking information, including: (i) adverse market

conditions; (ii) risks inherent in the primary healthcare sector in

general; (iii) that the proceeds of the Offering may need to be

used other than as set out in this news release and other factors

beyond the control of the Company. Actual results and future events

could differ materially from those anticipated in such information.

These and all subsequent written and oral forward-looking

information are based on estimates and opinions of management on

the dates they are made and are expressly qualified in their

entirety by this notice. Except as required by law, the Company

does not intend to update this forward-looking information.

Neither the Toronto Stock Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the Toronto Stock Exchange) accepts responsibility for the

adequacy or accuracy of this release.

For further information Tyler

BabaInvestor Relations Managerinvestor@well.company604-628-7266

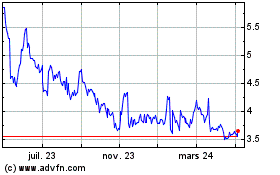

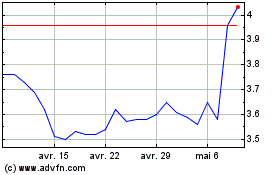

WELL Health Technologies (TSX:WELL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

WELL Health Technologies (TSX:WELL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024