Westport Fuel Systems Inc. (“

WFS”) (TSX:WPRT /

Nasdaq:WPRT) today reported financial results for the fourth

quarter and year ended December 31, 2021, and provided an update on

operations. All figures are in U.S. dollars unless otherwise

stated.

FOURTH QUARTER 2021 HIGHLIGHTS

- Revenue of $82.7 million, a decrease of 1% over the same period

last year, reflecting manufacturing delays caused by the shortage

of semiconductors in our heavy and light-duty businesses

- Net income of $5.3 million or $0.03 per share; Adjusted EBITDA1

was $10.0 million, or a $1.9 million improvement

year-over-year

- Completed refinancing of $20 million Term Loan from Export

Development Canada

FULL-YEAR 2021 HIGHLIGHTS

- Revenue of $312.4 million, up 24% vs. 2020 due to the

continued recovery of sales volumes in our Original Equipment

Manufacturer ("OEM") and Independent Aftermarket (" IAM")

businesses

- Net income of $13.7 million, or $0.09 per share, compared

to a net loss of $7.4 million in the prior year and Adjusted

EBITDA1 of $17.5 million, compared to $14.7 million in the prior

year

- Announced a project with truck and bus manufacturer, Scania to

apply HPDI 2.0™ with hydrogen to the latest Scania commercial

vehicle engine

- Announced a collaboration with Tupy and AVL to develop a

highly efficient hydrogen internal combustion engine using HPDI 2.0

for commercial vehicle applications

- Completed the acquisition of Stako s.p. z.o.o ("Stako"), a

world-leading manufacturer of Liquified Petroleum Gas Fuel Storage

for a total purchase price of $7.1 million

- Awarded a tender issued by NAFTAL for the supply of 60,000

liquefied petroleum gas systems

- Completed an over-subscribed equity offering for net proceeds

of $120.7 million, further strengthening the company's balance

sheet

- Completed the refinancing of a $20.0 million Term Loan from

Export Development Canada

- Attributable Cummins Westport Inc. ("CWI") net income of

$33.0 million. On February 7, 2022, we agreed to sell 100% of

our shares in CWI to Cummins Inc. for proceeds of approximately

$22.2 million, along with our interest in the joint venture's

intellectual property for an additional $20.0 million. We

received proceeds of $31.4 million, net of a

$10.8 million holdback, after the closing date.

1Adjusted EBITDA is a non-GAAP financial

measures. Refer to section 'GAAP and Non-GAAP Financial Measures'

for the reconciliation.

|

Consolidated Results |

|

($ in millions, except per share amounts) |

4Q21 |

4Q20 |

Over / (Under)% |

FY21 |

|

FY20 |

|

Over / (Under)% |

|

|

|

|

Revenues |

$ |

82.7 |

|

$ |

83.9 |

|

(1 |

)% |

$ |

312.4 |

|

$ |

252.5 |

|

24 |

% |

|

Gross Margin(2) |

|

9.3 |

|

|

13.0 |

|

(29 |

)% |

|

48.2 |

|

|

39.5 |

|

22 |

% |

|

Gross Margin %(2) |

|

11 |

% |

|

15 |

% |

— |

|

|

15 |

% |

|

16 |

% |

— |

|

| Operating Expenses |

|

19.3 |

|

|

13.8 |

|

40 |

% |

|

78.8 |

|

|

61.5 |

|

28 |

% |

| Income from Investments

Accounted for by the Equity Method(1) |

|

15.0 |

|

|

9.9 |

|

51 |

% |

|

33.7 |

|

|

24.0 |

|

40 |

% |

| Net Income (Loss) |

|

5.3 |

|

|

4.1 |

|

30 |

% |

|

13.7 |

|

|

(7.4 |

) |

(286 |

)% |

| Net Income (Loss) per

Share |

|

0.03 |

|

|

0.03 |

|

— |

% |

|

0.09 |

|

|

(0.05 |

) |

(280 |

)% |

|

EBITDA(2) |

|

8.4 |

|

|

13.1 |

|

(36 |

)% |

|

23.0 |

|

|

16.1 |

|

43 |

% |

|

Adjusted EBITDA(2) |

|

10.0 |

|

|

8.1 |

|

23 |

% |

|

17.5 |

|

|

14.7 |

|

19 |

% |

(1) This includes income primarily from our

Cummins Westport Inc. ("CWI"), Minda Westport and Westport Weichai

Inc. joint ventures.(2) These financial measures and ratios are

non-GAAP measures. Please refer to GAAP and NON-GAAP FINANCIAL

MEASURES for the reconciliation.

4Q21 AND FULL-YEAR 2021 OPERATIONS

We generated revenues of $82.7 million and

$312.4 million in 4Q21 and FY 2021, compared to $83.9 million and

$252.5 million for 4Q20 and FY 2020, respectively. Revenues for the

full year 2021 increased 24% due to the continued recovery of sales

volumes in our OEM and IAM businesses and the addition of

$13.8 million in revenue from our recently acquired fuel

storage business.

Consolidated net income for 4Q21 was $5.3

million, resulting in earnings of $0.03 per share, compared to net

income of $4.1 million, or $0.03 per share, for the same period in

2020.

We reported net income of $13.7 million for

the year ended December 31, 2021, compared to net loss of

$7.4 million for the prior year. The improvement in net income

was driven primarily by increases in gross margin of

$8.7 million from higher sales volumes, an income tax recovery

of $8.1 million compared to an income tax expense of

$1.4 million in the prior year and a bargain purchase gain of

$5.9 million from the acquisition of Stako.

We reported $17.5 million Adjusted Earnings

Before Interest, Taxes, Depreciation and Amortization ("Adjusted

EBITDA"), see "Non-GAAP Measures" section in the MD&A) during

the year ended December 31, 2021, compared to $14.7 million in

the prior year.

“Westport delivered record annual revenue in

2021 despite customer demand constrained by the effects of

lingering COVID restrictions, supply chain shortages and other

disruptions that our global industry faces. Our acquisition of

Stako contributed strongly to our 2021 performance, and

importantly, expanded our product portfolio and manufacturing

capabilities. Balance sheet and organizational improvements

completed during the year position us well to achieve our mid-and

long-term goals. The gross margin pressure we faced in 2021 will be

addressed by the economies of scale that will result from continued

and accelerating growth. Increasing demand will lead to

higher production and sales that drive profitability improvement.

This is our decade. The world needs and demands

clean affordable transportation. Westport Fuel Systems’ solutions

are available now. I’m confident that our committed global

team will drive our growth and profitability in the years

ahead”.

David M. Johnson, Chief Executive Officer

SEGMENT INFORMATION

Original Equipment Manufacturer Segment

Original Equipment Manufacturer ("OEM") revenue

for the three months and year ended December 31, 2021, was

$57.4 million and $195.5 million, respectively, compared

with $58.8 million and $149.6 million for the three

months and year ended December 31, 2020. OEM revenue decreased by

$1.4 million in the current quarter reflecting the

manufacturing delays caused by the shortage of semiconductors in

our heavy and light-duty businesses, and the effect of

year-over-year price decreases in components sold to our initial

OEM launch partner. Revenue for the OEM business segment increased

by $45.9 million for the year. The increase in the year was

mainly due to the higher light-duty OEM sales volumes, particularly

sales to Indian and Russian OEMs, and $13.8 million of

additional revenue from the fuel storage business.

Independent Aftermarket Segment

Revenue for the three months and year ended

December 31, 2021, was $25.3 million and $116.9 million,

respectively, compared with $25.1 million and

$102.9 million for the three months and year ended December

31, 2020. Revenue for the three months and year ended December 31,

2021, for the IAM business segment increased by $0.2 million

and $14.0 million, respectively, primarily due to growth in

the African and South American markets, consistent year-over-year

sales in western Europe was offset by softness in demand from the

Russian and Turkish markets due to the rapid increase in LPG

prices. We expect to see continued improvement in revenues from the

IAM business segment for the full year of 2022, but temper

expectations in the near term due to the elevated LPG prices in our

key markets.

|

SEGMENT RESULTS |

4Q21 |

|

|

Revenue |

|

Operating income (loss) |

|

Depreciation & amortization |

|

Equity income |

|

OEM |

$ |

57.4 |

|

$ |

(5.0 |

) |

|

$ |

2.1 |

|

$ |

0.2 |

| IAM |

|

25.3 |

|

|

(1.3 |

) |

|

|

1.4 |

|

|

— |

|

Corporate |

|

— |

|

|

(3.7 |

) |

|

|

0.1 |

|

|

14.7 |

|

Total consolidated |

$ |

82.7 |

|

$ |

(10.0 |

) |

|

$ |

3.6 |

|

$ |

15.0 |

|

SEGMENT RESULTS |

4Q20 |

|

|

Revenue |

|

Operating income (loss) |

|

Depreciation & amortization |

|

Equity income |

|

OEM |

$ |

58.8 |

|

$ |

(3.0 |

) |

|

$ |

2.2 |

|

$ |

0.5 |

| IAM |

|

25.1 |

|

|

1.3 |

|

|

|

1.6 |

|

|

— |

|

Corporate |

|

— |

|

|

0.9 |

|

|

|

— |

|

|

9.4 |

|

Total consolidated |

$ |

83.9 |

|

$ |

(0.8 |

) |

|

$ |

3.8 |

|

$ |

9.9 |

CUMMINS WESTPORT INC.

Revenue for 4Q21 increased by $15.7 million to

$111.7 million, or 16% over the same period last year. Unit sales

were higher for Q4 2021 compared to the prior year due to the

timing of sales from the slowdown in Q3 2021 due to supply chain

issues. Gross margin for 4Q21 increased by $10.7 million to $39.2

million, or 35% of revenue from $28.5 million or 30% of revenue in

the prior-year quarter. The increase in gross margin percentage

from 30 to 35% of revenue was largely driven by increases in sales

volume of high-margin parts revenue.

The following tables sets forth a summary of the

financial results of CWI for the years ended December 31, 2021, and

2020, and three months ended December 31, 2021, and 2020.

|

CUMMINS WESTPORT HIGHLIGHTS |

|

|

|

|

|

|

|

|

|

|

Over / (Under)% |

|

|

Over / (Under)% |

|

($ in millions, except unit amounts) |

4Q21 |

4Q20 |

FY21 |

FY20 |

|

Units |

|

2,648 |

|

|

2,288 |

|

16 |

% |

|

8,290 |

|

|

7,065 |

|

17 |

% |

|

Revenue |

$ |

111.7 |

|

$ |

96.0 |

|

16 |

% |

$ |

367.5 |

|

$ |

323.5 |

|

14 |

% |

|

Gross Margin |

|

39.2 |

|

|

28.5 |

|

38 |

% |

|

99.1 |

|

|

87.3 |

|

14 |

% |

|

Gross Margin % |

|

35 |

% |

|

30 |

% |

— |

|

|

27 |

% |

|

27 |

% |

— |

|

| Operating

Expenses |

|

6.0 |

|

|

4.2 |

|

41 |

% |

|

20.7 |

|

|

26.4 |

|

(21 |

)% |

| Operating

Income |

|

33.1 |

|

|

24.3 |

|

36 |

% |

|

78.3 |

|

|

60.9 |

|

29 |

% |

|

Net Income |

|

29.5 |

|

|

18.7 |

|

58 |

% |

|

65.9 |

|

|

47.5 |

|

39 |

% |

|

WFS 50% Interest |

|

14.8 |

|

|

9.4 |

|

59 |

% |

|

33.0 |

|

|

23.8 |

|

39 |

% |

Outlook

StrategyThe market dynamics and

global trends impacting the continued adoption of alternative fuel

systems and components for transportation applications have shaped

our corporate strategy to realize the opportunities ahead for

Westport Fuel Systems. The foundation of our strategic pillars is

based on the continued strengthening of our organizational

capability and a focus on operational excellence. Our people are at

the heart of what we do. We leverage technology to turn data into

insights, driving smart decisions and accelerating sustainable,

principled growth. We strive to deliver valuable, impactful

products and services to customers around the world, enabling a

collective contribution to a decarbonized transportation

sector.

Our strategy to leverage innovation and

technology to grow our business as the leading Tier 1 supplier

towards sustainable profitability is based on the following

pillars:

1.

Principled Growth Realized through a Diverse Portfolio of

Technology, Products, and Services

Our diverse portfolio of technology, products,

and services are sold today under a wide range of established

brands. They provide the foundation for sustainable growth in

existing markets and guide our expansion into new and emerging

markets around the world.

- Responsibly achieve sustainable profitability in businesses

focused on growth in key markets – Europe, India, North America and

China – to satisfy the demand for clean, low emissions

transportation with our diverse portfolio of technology solutions

for low carbon gaseous fuels

- Complement our growth and scale efficiencies through strategic

merger and acquisition ("M&A") and corporate development

activities

2.

Quality and Reliability will drive our reputation as a

Leading Tier I Supplier

We strive for operational excellence in our

approach to manufacturing and supply chain management. The goal to

achieve greater profitability is also predicated on our ability to

enhance quality, production efficiency, and reliability that

fosters strong long-term partnerships with OEMs, distributors, and

customers. This is accomplished in line with our focus on our ESG

goals.

- Aim to reduce GHG emissions throughout the value chain while

embedding these efforts in our day-to-day business

- Adherence to the WFS Quality Management System across all

global operations, validated by requisite ISO certifications

- Improving our business processes and interactions within our

ESG framework to guide our actions and improvements

3.

Deliver clean, affordable transportation solutions through

our innovation & technology that power a cleaner

future

Investing in innovation and delivering new

technology to the market is a critical aspect to our future growth

and building opportunities in our business that address global

trends impacting the evolution and diversification of sustainable

transportation fuel alternatives. This includes, but is not limited

to, advancing our HPDI™ fuel system, including Westport's HPDI 3.0™

fuel system and hydrogen-fuelled H2 HPDI™ fuel system and

advancements in our direct injection aftermarket technologies.

- Provide customers with the ability to preserve investments in

capital and manufacturing infrastructure while achieving the goal

of reducing their carbon footprint with Westport's H2 HPDI fuel

system, and seamlessly integrated engineering services

- Strengthen our product portfolio by identifying and addressing

strategic opportunities for growth that complements our business

and our technology

Capital Markets DayIn the fall

of 2022, we plan to provide an update on our strategy and strategic

initiatives. Details on the timing and venue will be provided at a

future date.

2022The

long-term growth potential of our HPDI technology in Heavy-Duty

commercial vehicles and our diversified portfolio of gaseous fuel

systems and components is poised to capture a share of the global

transition to cleaner transportation, especially in promising

markets like India.

However, against the current backdrop of supply

chain disruptions that continue to challenge the automotive

industry and the recent volatility in fuel prices, we are not

providing quantitative guidance on revenues or profitability for

2022. Since the fourth quarter of 2021, we have observed softness

in demand caused by the continued uncertainty of the elevated

prices of gaseous fuels relative to diesel and gasoline. At this

time, we are uncertain as to the duration of the price fluctuations

and their impact on sales volumes but remain cautiously optimistic

that price differentials will return to historically normal ranges

in the long term.

The Russia-Ukraine ConflictWe

conduct a substantial portion (10 to 15%) of our LD OEM and IAM

businesses in Russia by selling our products to numerous OEMs and

other IAM customers. This Russian business has been a growing and

important market for gaseous fuel systems and components. Due to

the Russian invasion of Ukraine in late February 2022, the United

States, European Union, Canada and other Western countries and

organizations have announced and enacted numerous sanctions against

Russia to impose severe economic pressure on the Russian economy

and government. Potential consequences of the sanctions that could

impact our business in Russia include but are not limited to: (1)

limiting and/or banning the use of the SWIFT financial and payment

system by Russian entities to buy and pay for our products; (2)

devaluation of the Ruble and the related impact on applicable

exchange rates to negatively impact the competitiveness of our

products; (3) government-owned entities (or partially owned

entities) being potentially limited by sanctions from purchasing

our products; and (4) a general deterioration of the Russian

economy which may limit the ability for end customers to purchase

our products. The full impact of the commercial and economic

consequences of the conflict are uncertain at this time, and we

cannot provide assurance that future developments in the

Russian-Ukraine conflict would not have an adverse impact on the

ongoing operations and financial condition of our business in

Russia.

FINANCIAL STATEMENTS & MANAGEMENT'S DISCUSSION AND

ANALYSIS

To view WFS full financials for the fourth

quarter and year ended December 31, 2021, please visit

https://investors.wfsinc.com/financials/

CONFERENCE CALL PRESENTATION

WFS is providing a conference call presentation

as a guide to its financial information in a quick reference format

and it should be read in conjunction with WFS full financials for

the year ended December 31, 2021.

LIVE CONFERENCE CALL & WEBCAST

WFS has scheduled a conference call for Tuesday,

March 15, 2022, at 7:00 am Pacific Time (10:00 am Eastern Time) to

discuss these results. To access the conference call by telephone,

please dial 1-800-319-4610 (Canada & USA toll-free) or

604-638-5340. The live webcast of the conference call can be

accessed through the WFS website at

https://investors.wfsinc.com/

REPLAY CONFERENCE CALL & WEBCAST

To access the conference call replay, please

dial 1-800-319-6413 (Canada & USA toll-free) or 1-604-638-9010

using the passcode 8348. The telephone replay will be available

until March 22, 2022. Shortly after the conference call, the

webcast will be archived on the Westport Fuel Systems website and

replay will be available in streaming audio and a downloadable MP3

file.

2022 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

Westport Fuel Systems will host its Annual

General and Special Meeting of shareholders (the

“Meeting”) virtually on Wednesday, May 5, 2022, at

10:00 a.m. Pacific Time. In order to streamline the virtual meeting

process, Westport Fuel Systems encourages shareholders to vote in

advance of the Meeting using the voting instruction form or the

form of proxy which will be emailed or mailed to them with the

Meeting materials at the end of March. Further instructions on

voting and accessing the meeting will be contained in the

Management Information Circular under “Section 1: Voting” – upon

receipt, please review these materials carefully.

Guest Access:

Dial-In +1-800-319-4610

(Canada / USA) or +1-604-638-5340 (International)Webcast

https://services.choruscall.ca/links/westportasgm20220505.html

Registered Shareholders or Duly

Appointed Proxyholders Access:

Shareholder or Duly Appointed Proxyholders

access to the virtual Meeting requires early registration at the

following link – https://tinyurl.com/wfsagsm2022. Please register

at your earliest convenience as registration will close May 3,

2022, at 10:00 a.m. Pacific Time (48 hours prior to the meeting).

Before the Meeting, shareholders of record at the close of business

on March 25, 2022, may vote by completing the form of proxy or

voting instruction form in accordance with the instructions

provided herein.

Non-registered shareholders should carefully

follow all instructions provided by their intermediaries to ensure

that their Westport Fuel Systems voting shares are voted at the

Meeting. Please refer to “Section 1: Voting” of Westport Fuel

Systems Management Information Circular dated March 14, 2022, in

respect of the Meeting for additional details on how to vote by

proxy before the Meeting and the matters to be voted upon.

Votes placed prior to the Meeting must be

received by our transfer agent, Computershare Investor Services

Inc. by May 3, 2022, at 10:00 a.m. Pacific Time.

About Westport Fuel Systems

Westport Fuel Systems is driving innovation to

power a cleaner tomorrow. The Company is a leading supplier of

advanced fuel delivery components and systems for clean, low-carbon

fuels such as natural gas, renewable natural gas, propane, and

hydrogen to the global automotive industry. Westport Fuel Systems’

technology delivers the performance and fuel efficiency required by

transportation applications and the environmental benefits that

address climate change and urban air quality challenges.

Headquartered in Vancouver, Canada, with operations in Europe,

Asia, North America and South America, the Company serves customers

in more than 70 countries with leading global transportation

brands. For more information, visit www.wfsinc.com.

Cautionary Note Regarding Forward Looking Statements

This press release contains forward-looking

statements, including statements regarding revenue and cash usage

expectations, future strategic initiatives and future growth,

future of our development programs (including those relating to

HPDI and Hydrogen), the impact of COVID-19 on our business, the

demand for our products, the future success of our business and

technology strategies, intentions of partners and potential

customers, the performance and competitiveness of Westport Fuel

Systems' products and expansion of product coverage, future market

opportunities, speed of adoption of natural gas for transportation

and terms and timing of future agreements as well as Westport Fuel

Systems management's response to any of the aforementioned factors.

These statements are neither promises nor guarantees, but involve

known and unknown risks and uncertainties and are based on both the

views of management and assumptions that may cause our actual

results, levels of activity, performance or achievements to be

materially different from any future results, levels of activities,

performance or achievements expressed in or implied by these

forward looking statements. These risks, uncertainties and

assumptions include those related to our revenue growth, operating

results, industry and products, the general economy, conditions of

and access to the capital and debt markets, solvency, governmental

policies and regulation, technology innovations, fluctuations in

foreign exchange rates, operating expenses, continued reduction in

expenses, ability to successfully commercialize new products, the

performance of our joint ventures, the availability and price of

natural gas, global government stimulus packages and new

environmental regulations, the acceptance of and shift to natural

gas vehicles, the relaxation or waiver of fuel emission standards,

the inability of fleets to access capital or government funding to

purchase natural gas vehicles, the development of competing

technologies, our ability to adequately develop and deploy our

technology, the actions and determinations of our joint venture and

development partners, the effects and duration of COVID-19 as well

as other risk factors and assumptions that may affect our actual

results, performance or achievements or financial position

discussed in our most recent Annual Information Form and other

filings with securities regulators. Readers should not place undue

reliance on any such forward-looking statements, which speak only

as of the date they were made. We disclaim any obligation to

publicly update or revise such statements to reflect any change in

our expectations or in events, conditions or circumstances on which

any such statements may be based, or that may affect the likelihood

that actual results will differ from those set forth in these

forward looking statements except as required by National

Instrument 51-102. The contents of any website, RSS feed or twitter

account referenced in this press release are not incorporated by

reference herein.

Contact Information

Christian TweedyInvestor

RelationsWestport Fuel SystemsT: +1

604-718-2046invest@wfsinc.com

GAAP and NON-GAAP FINANCIAL MEASURES

Our financial statements are prepared in

accordance with U.S. generally accepted accounting principles

("U.S. GAAP"). These U.S. GAAP financial

statements include non-cash charges and other charges and benefits

that may be unusual or infrequent in nature or that we believe may

make comparisons to our prior or future performance difficult. In

addition to conventional measures prepared in accordance with U.S.

GAAP, WFS and certain investors use EBITDA and Adjusted EBITDA as

an indicator of our ability to generate liquidity by producing

operating cash flow to fund working capital needs, service debt

obligations and fund capital expenditures. Management also uses

these non-GAAP measures in its review and evaluation of the

financial performance of WFS. EBITDA is also frequently used by

investors and analysts for valuation purposes whereby EBITDA is

multiplied by a factor or "EBITDA multiple" that is based on an

observed or inferred relationship between EBITDA and market values

to determine the approximate total enterprise value of a company.

We believe that these non-GAAP financial measures also provide

additional insight to investors and securities analysts as

supplemental information to our U.S. GAAP results and as a basis to

compare our financial performance period-over-period and to compare

our financial performance with that of other companies. We believe

that these non-GAAP financial measures facilitate comparisons of

our core operating results from period to period and to other

companies by, in the case of EBITDA, removing the effects of our

capital structure (net interest income on cash deposits, interest

expense on outstanding debt and debt facilities), asset base

(depreciation and amortization) and tax consequences. Adjusted

EBITDA provides this same indicator of WFS' EBITDA from continuing

operations and removing such effects of our capital structure,

asset base and tax consequences, but additionally excludes any

unrealized foreign exchange gains or losses, stock-based

compensation charges and other one-time impairments and costs which

are not expected to be repeated in order to provide greater insight

into the cash flow being produced from our operating business,

without the influence of extraneous events.

EBITDA and Adjusted EBITDA are intended to

provide additional information to investors and analysts and do not

have any standardized definition under U.S. GAAP, and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with U.S. GAAP. EBITDA and

Adjusted EBITDA exclude the impact of cash costs of financing

activities and taxes, and the effects of changes in operating

working capital balances, and therefore are not necessarily

indicative of operating profit or cash flow from operations as

determined under U.S. GAAP. Other companies may calculate EBITDA

and Adjusted EBITDA differently.

NON-GAAP FINANCIAL MEASURES

RECONCILIATION

| Gross

Margin |

| |

|

Years ended December 31, |

|

|

|

|

2021 |

|

|

2020 |

| (expressed in

millions of U.S. dollars) |

| Revenue |

|

$ |

312.4 |

|

$ |

252.5 |

| Less: Cost of revenue |

|

$ |

264.2 |

|

$ |

213.0 |

| Gross

Margin |

|

$ |

48.2 |

|

$ |

39.5 |

| Gross

Margin as a percentage of Revenue |

| |

|

Years ended December 31, |

|

|

|

|

2021 |

|

|

|

2020 |

|

| (expressed in

millions of U.S. dollars) |

| Revenue |

|

$ |

312.4 |

|

|

$ |

252.5 |

|

| Gross Margin |

|

$ |

48.2 |

|

|

$ |

39.5 |

|

| Gross Margin as a

percentage of Revenue |

|

|

15 |

% |

|

|

16 |

% |

| EBITDA

and Adjusted EBITDA |

| Three months

ended |

|

31-Mar-20 |

|

30-Jun-20 |

|

30-Sep-20 |

|

31-Dec-20 |

|

31-Mar-21 |

|

30-Jun-21 |

|

30-Sep-21 |

|

31-Dec-21 |

|

Income (loss) before income taxes |

|

$ |

(16.0 |

) |

|

$ |

4.6 |

|

|

$ |

0.2 |

|

|

$ |

5.3 |

|

|

$ |

(2.8 |

) |

|

$ |

9.1 |

|

|

$ |

(5.4 |

) |

|

$ |

4.6 |

| Interest expense, net |

|

|

1.5 |

|

|

|

1.2 |

|

|

|

1.3 |

|

|

|

4.0 |

|

|

|

1.2 |

|

|

|

1.1 |

|

|

|

0.9 |

|

|

|

0.3 |

| Depreciation and

amortization |

|

|

3.4 |

|

|

|

3.4 |

|

|

|

3.4 |

|

|

|

3.8 |

|

|

|

3.5 |

|

|

|

3.7 |

|

|

|

3.3 |

|

|

|

3.5 |

| EBITDA |

|

$ |

(11.1 |

) |

|

$ |

9.2 |

|

|

$ |

4.9 |

|

|

$ |

13.1 |

|

|

$ |

1.9 |

|

|

$ |

13.9 |

|

|

$ |

(1.2 |

) |

|

$ |

8.4 |

| Stock based compensation |

|

$ |

0.6 |

|

|

$ |

0.6 |

|

|

$ |

0.9 |

|

|

$ |

0.3 |

|

|

$ |

0.1 |

|

|

$ |

0.5 |

|

|

$ |

0.7 |

|

|

$ |

0.6 |

| Unrealized foreign exchange

(gain) loss |

|

$ |

6.9 |

|

|

$ |

(3.6 |

) |

|

$ |

(2.3 |

) |

|

$ |

(5.3 |

) |

|

$ |

0.7 |

|

|

$ |

(2.3 |

) |

|

$ |

(0.9 |

) |

|

$ |

0.5 |

| Asset impairment |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.5 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.5 |

| Bargain purchase gain |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(5.9 |

) |

|

$ |

— |

|

|

$ |

— |

| Adjusted EBITDA |

|

$ |

(3.6 |

) |

|

$ |

6.2 |

|

|

$ |

4.0 |

|

|

$ |

8.1 |

|

|

$ |

2.7 |

|

|

$ |

6.2 |

|

|

$ |

(1.4 |

) |

|

$ |

10.0 |

| WESTPORT FUEL SYSTEMS

INC. |

| Consolidated Balance Sheets |

| (Expressed in thousands of United

States dollars, except share amounts) |

| December 31, 2021 and 2020 |

| |

|

December 31, 2021 |

|

December 31, 2020 |

| Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents (including restricted cash) |

|

$ |

124,892 |

|

|

$ |

64,262 |

|

|

Accounts receivable |

|

|

101,508 |

|

|

|

90,467 |

|

|

Inventories |

|

|

83,128 |

|

|

|

51,402 |

|

|

Prepaid expenses |

|

|

6,997 |

|

|

|

11,767 |

|

|

Current assets held for sale |

|

|

22,039 |

|

|

|

10,866 |

|

| Total current

assets |

|

|

338,564 |

|

|

|

228,764 |

|

|

Long-term investments |

|

|

3,824 |

|

|

|

3,088 |

|

|

Property, plant and equipment |

|

|

64,420 |

|

|

|

57,507 |

|

|

Operating lease right-of-use assets |

|

|

28,830 |

|

|

|

27,962 |

|

|

Intangible assets |

|

|

9,286 |

|

|

|

11,784 |

|

|

Deferred income tax assets |

|

|

11,653 |

|

|

|

2,140 |

|

|

Goodwill |

|

|

3,121 |

|

|

|

3,397 |

|

|

Other long-term assets |

|

|

11,615 |

|

|

|

11,621 |

|

| Total

assets |

|

$ |

471,313 |

|

|

$ |

346,263 |

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

99,238 |

|

|

$ |

84,599 |

|

|

Current portion of operating lease liabilities |

|

|

4,190 |

|

|

|

4,476 |

|

|

Short-term debt |

|

|

12,965 |

|

|

|

23,445 |

|

|

Current portion of long-term debt |

|

|

11,277 |

|

|

|

16,302 |

|

|

Current portion of long-term royalty payable |

|

|

5,200 |

|

|

|

7,451 |

|

|

Current portion of warranty liability |

|

|

13,577 |

|

|

|

10,749 |

|

| Total current

liabilities |

|

|

146,447 |

|

|

|

147,022 |

|

|

Long-term operating lease liabilities |

|

|

24,362 |

|

|

|

23,486 |

|

|

Long-term debt |

|

|

45,125 |

|

|

|

45,651 |

|

|

Long-term royalty payable |

|

|

4,747 |

|

|

|

8,591 |

|

|

Warranty liability |

|

|

5,214 |

|

|

|

8,187 |

|

|

Deferred income tax liabilities |

|

|

3,392 |

|

|

|

3,250 |

|

|

Other long-term liabilities |

|

|

5,607 |

|

|

|

6,017 |

|

| Total long-term

liabilities |

|

|

234,894 |

|

|

|

242,204 |

|

|

Shareholders’ equity: |

|

|

|

|

|

Share capital: |

|

|

|

|

|

Unlimited common and preferred shares, no par value |

|

|

|

|

|

170,799,325 (2020 - 144,069,972) common shares issued and

outstanding |

|

|

1,242,006 |

|

|

|

1,115,092 |

|

|

Other equity instruments |

|

|

8,412 |

|

|

|

7,671 |

|

|

Additional paid-in-capital |

|

|

11,516 |

|

|

|

11,516 |

|

|

Accumulated deficit |

|

|

(992,021 |

) |

|

|

(1,005,679 |

) |

|

Accumulated other comprehensive loss |

|

|

(33,494 |

) |

|

|

(24,541 |

) |

| Total shareholders'

equity |

|

|

236,419 |

|

|

|

104,059 |

|

| Total liabilities and

shareholders' equity |

|

$ |

471,313 |

|

|

$ |

346,263 |

|

| WESTPORT FUEL SYSTEMS

INC. |

|

| Consolidated Statements of

Operations and Comprehensive Income (Loss) |

|

| (Expressed in thousands of United

States dollars, except share and per share amounts) |

|

| Years ended December 31, 2021

and 2020 |

|

| |

|

Years ended December 31, |

|

|

|

|

2021 |

|

|

|

2020 |

|

| Revenue |

|

$ |

312,412 |

|

|

$ |

252,497 |

|

| Cost of revenue and

expenses: |

|

|

|

|

|

Cost of revenue |

|

|

264,260 |

|

|

|

212,953 |

|

|

Research and development |

|

|

25,194 |

|

|

|

20,976 |

|

|

General and administrative |

|

|

36,290 |

|

|

|

26,629 |

|

|

Sales and marketing |

|

|

13,495 |

|

|

|

11,510 |

|

|

Foreign exchange gain |

|

|

(1,984 |

) |

|

|

(4,300 |

) |

|

Depreciation and amortization |

|

|

5,390 |

|

|

|

6,239 |

|

|

Gain on sale of assets |

|

|

(146 |

) |

|

|

— |

|

|

Impairment on long lived assets, net |

|

|

459 |

|

|

|

479 |

|

| |

|

|

342,958 |

|

|

|

274,486 |

|

| Loss from operations |

|

|

(30,546 |

) |

|

|

(21,989 |

) |

| |

|

|

|

|

| Income from investments

accounted for by the equity method |

|

|

33,741 |

|

|

|

24,047 |

|

| Interest on long-term debt and

accretion on royalty payable |

|

|

(4,937 |

) |

|

|

(7,988 |

) |

| Bargain purchase gain from

acquisition |

|

|

5,856 |

|

|

|

— |

|

| Interest and other income |

|

|

1,413 |

|

|

|

2 |

|

| Income (loss) before income

taxes |

|

|

5,527 |

|

|

|

(5,928 |

) |

| Income tax expense

(recovery): |

|

|

|

|

|

Current |

|

|

2,172 |

|

|

|

2,438 |

|

|

Deferred |

|

|

(10,303 |

) |

|

|

(1,007 |

) |

| |

|

|

(8,131 |

) |

|

|

1,431 |

|

| Net income (loss) for the

year |

|

|

13,658 |

|

|

|

(7,359 |

) |

| Other comprehensive loss: |

|

|

|

|

| Cumulative translation

adjustment |

|

|

(8,953 |

) |

|

|

(651 |

) |

| Comprehensive loss |

|

$ |

4,705 |

|

|

$ |

(8,010 |

) |

| Income (loss) per share: |

|

|

|

|

| Net income (loss) per share -

basic |

|

$ |

0.09 |

|

|

$ |

(0.05 |

) |

| Net income (loss) per share -

diluted |

|

$ |

0.08 |

|

|

$ |

(0.05 |

) |

| Weighted average common shares

outstanding: |

|

|

|

|

| Basic |

|

|

160,232,742 |

|

|

|

137,092,854 |

|

| Diluted |

|

|

162,099,175 |

|

|

|

137,092,854 |

|

| WESTPORT FUEL SYSTEMS

INC. |

| Consolidated Statements of Cash

Flows |

| (Expressed in thousands of

United States dollars) |

| Years ended December 31, 2021

and 2020 |

| |

|

Years ended December 31, |

| |

|

|

2021 |

|

|

|

2020 |

|

| |

|

|

|

|

| Cash flows from (used in)

operating activities: |

|

|

|

|

| Net income (loss) for the

year |

|

$ |

13,658 |

|

|

$ |

(7,359 |

) |

|

Items not involving cash: |

|

|

|

|

|

Depreciation and amortization |

|

|

14,035 |

|

|

|

14,034 |

|

|

Stock-based compensation expense |

|

|

1,911 |

|

|

|

2,368 |

|

|

Unrealized foreign exchange gain |

|

|

(1,984 |

) |

|

|

(4,300 |

) |

|

Deferred income tax |

|

|

(10,303 |

) |

|

|

(1,007 |

) |

|

Income from investments accounted for by the equity method |

|

|

(33,741 |

) |

|

|

(24,047 |

) |

|

Interest on long-term debt and accretion of royalty payable |

|

|

4,937 |

|

|

|

7,988 |

|

|

Impairment on long lived assets, net |

|

|

459 |

|

|

|

479 |

|

|

Inventory write-downs to net realizable value |

|

|

914 |

|

|

|

507 |

|

|

Gain on sale of assets |

|

|

(146 |

) |

|

|

— |

|

|

Bargain purchase gain from acquisition |

|

|

(5,856 |

) |

|

|

— |

|

|

Change in bad debt expense |

|

|

(326 |

) |

|

|

299 |

|

| Net cash used before working

capital changes |

|

|

(16,442 |

) |

|

|

(11,038 |

) |

| |

|

|

|

|

| Changes in non-cash operating

working capital: |

|

|

|

|

|

Accounts receivable |

|

|

(11,117 |

) |

|

|

(22,721 |

) |

|

Inventories |

|

|

(31,744 |

) |

|

|

(3,225 |

) |

|

Prepaid expenses |

|

|

3,964 |

|

|

|

(8,685 |

) |

|

Accounts payable and accrued liabilities |

|

|

11,313 |

|

|

|

(420 |

) |

|

Warranty liability |

|

|

233 |

|

|

|

10,940 |

|

| Net cash used in operating

activities |

|

|

(43,793 |

) |

|

|

(35,149 |

) |

| Cash flows from (used in)

investing activities: |

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(14,158 |

) |

|

|

(7,123 |

) |

|

Acquisitions, net of acquired cash |

|

|

(5,948 |

) |

|

|

— |

|

|

Proceeds on sale of assets |

|

|

600 |

|

|

|

207 |

|

|

Dividends received from joint ventures |

|

|

21,796 |

|

|

|

20,758 |

|

| Net cash from investing

activities |

|

|

2,290 |

|

|

|

13,842 |

|

| Cash flows from (used in)

financing activities: |

|

|

|

|

|

Drawings on operating lines of credit and long-term facilities |

|

|

74,408 |

|

|

|

85,258 |

|

|

Repayment of operating lines of credit and long-term

facilities |

|

|

(82,958 |

) |

|

|

(53,523 |

) |

|

Proceeds from share issuance, net |

|

|

120,727 |

|

|

|

13,904 |

|

|

Repayment of royalty payable |

|

|

(7,451 |

) |

|

|

(5,948 |

) |

| Net cash from (used in)

financing activities |

|

|

104,726 |

|

|

|

39,691 |

|

| Effect of foreign exchange on

cash and cash equivalents |

|

|

(2,593 |

) |

|

|

(134 |

) |

| Increase (decrease) in cash

and cash equivalents |

|

|

60,630 |

|

|

|

18,250 |

|

| Cash and cash equivalents,

beginning of year (including restricted cash) |

|

|

64,262 |

|

|

|

46,012 |

|

| Cash and cash equivalents, end

of year (including restricted cash) |

|

|

124,892 |

|

|

|

64,262 |

|

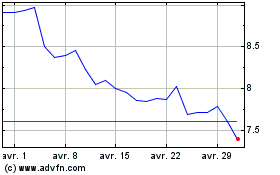

Westport Fuel Systems (TSX:WPRT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Westport Fuel Systems (TSX:WPRT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024