WSP Global Inc. (TSX:WSP) (“WSP” or the “Corporation”) is

pleased to announce that it has completed today its previously

announced bought deal public offering (the "Offering") of common

shares ("Common Shares") of the Corporation (the "Offering Common

Shares") and private placement (the "Concurrent Private Placement")

of Common Shares (the "Private Placement Common Shares") for

aggregate gross proceeds of approximately $920 million.

The Corporation issued from treasury 3,031,400

Offering Common Shares, including 395,400 Offering Common Shares

issued as a result of the exercise of the over-allotment option

granted to the syndicate of underwriters (the "Underwriters")

co-led by CIBC Capital Markets, National Bank Financial Inc. and

RBC Capital Markets at a price of $151.75 per Offering Common Share

for aggregate gross proceeds of approximately $460 million.

In addition, the Corporation issued 3,032,550

Private Placement Common Shares at a price of $151.75 per Private

Placement Common Share by way of a Concurrent Private Placement

with GIC Pte. Ltd. ("GIC"), Caisse de dépôt et placement du Québec

("CDPQ") and a subsidiary of Canada Pension Plan Investment Board

("CPP Investments") for aggregate gross proceeds to the Corporation

of approximately $460 million, which includes 395,550 Private

Placement Common Shares issued pursuant to the exercise in full of

the additional subscription options. CDPQ now beneficially owns, or

exercises control or direction over, directly or indirectly, an

aggregate of 22,483,722 Common Shares, representing 18.1% of the

issued and outstanding Common Shares, and CPP Investments now

beneficially owns, or exercises control or direction over, directly

or indirectly, an aggregate of 18,217,889 Common Shares,

representing 14.7% of the issued and outstanding Common Shares.

GIC, CDPQ and CPP Investments have undertaken to have all of their

Private Placement Common Shares enrolled in the Corporation’s

dividend reinvestment plan for all dividends for which the record

date is on or before September 30, 2023.

WSP intends to use the net proceeds from the

Offering and the Concurrent Private Placement to fund in part the

purchase price payable in respect of its previously announced

acquisition of RPS Group plc (and related costs and expenses) as a

means of re-balancing the Corporation’s capital structure and

accordingly reduce amounts to be advanced, or repay amounts

advanced, under the credit facilities entered into by the

Corporation to fund the purchase price for such acquisition.

No securities regulatory authority has either

approved or disapproved the contents of this press release. The

Offering Common Shares have not been, and will not be, registered

under the U.S. Securities Act, or any state securities laws.

Accordingly, the Offering Common Shares may not be offered or sold

within the United States unless registered under the U.S.

Securities Act of 1933 (as amended, the "U.S. Securities Act") and

applicable state securities laws or pursuant to exemptions from the

registration requirements of the U.S. Securities Act and applicable

state securities laws. This press release shall not constitute an

offer to sell or the solicitation of an offer to buy, nor shall

there be any sale of the Offering Common Shares in any jurisdiction

in which such offer, solicitation or sale would be unlawful.

ABOUT WSPAs one of the world’s

leading professional services firms, WSP exists to future-proof our

cities and environment. We provide strategic advisory, engineering,

and design services to clients in the transportation,

infrastructure, environment, building, power, energy, water,

mining, and resources sectors. Our 57,500 trusted professionals are

united by the common purpose of creating positive, long-lasting

impacts on the communities we serve through a culture of

innovation, integrity, and inclusion. Sustainability and science

permeate our work. WSP derived about half of its $10.3B (CAD) 2021

revenues from clean sources. The Corporation’s shares are listed on

the Toronto Stock Exchange (TSX: WSP). To find out more, visit

wsp.com

ABOUT GICGIC is a leading

global investment firm established in 1981 to secure Singapore’s

financial future. As the manager of Singapore’s foreign reserves,

GIC takes a long-term, disciplined approach to investing and is

uniquely positioned across a wide range of asset classes and active

strategies globally. These include equities, fixed income, real

estate, private equity, venture capital and infrastructure. Its

long-term approach, multi-asset capabilities and global

connectivity enable it to be an investor of choice. GIC seeks to

add meaningful value to its investments. Headquartered in

Singapore, GIC has a global talent force of over 1,900 people in 11

key financial cities and has investments in over 40 countries. For

more information on GIC, please visit www.gic.com.sg.

ABOUT CDPQCDPQ invests

constructively to generate sustainable returns over the long term.

As a global investment group managing funds for public retirement

and insurance plans, CDPQ works alongside its partners to build

enterprises that drive performance and progress. CDPQ is active in

the major financial markets, private equity, infrastructure, real

estate and private debt. As at December 31, 2021, CDPQ’s net assets

totalled CAD 419.8 billion. For more information, visit cdpq.com,

follow CDPQ on Twitter or consult CDPQ’s Facebook or LinkedIn

pages. CDPQ is a registered trademark owned by Caisse de dépôt et

placement du Québec and licensed for use by its subsidiaries.

ABOUT CPP INVESTMENTSCanada

Pension Plan Investment Board (CPP Investments™) is a professional

investment management organization that manages the Fund in the

best interest of the 21 million contributors and beneficiaries of

the Canada Pension Plan. In order to build diversified portfolios

of assets, investments are made around the world in public

equities, private equities, real estate, infrastructure and fixed

income. Headquartered in Toronto, with offices in Hong Kong,

London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo

and Sydney, CPP Investments is governed and managed independently

of the Canada Pension Plan and at arm’s length from governments. At

June 30, 2022, the Fund totalled $523 billion. For more

information, please visit www.cppinvestments.com or follow CPP

Investments on LinkedIn, Facebook or Twitter.

FORWARD-LOOKING STATEMENTSThis

press release contains information or statements that are or may be

“forward-looking statements” within the meaning of applicable

Canadian securities laws. When used in this press release, the

words “may”, “will”, “should”, “expect”, “plan”, “anticipate”,

“believe”, “estimate”, “predict”, “forecast”, “project”, “intend”,

“target”, “potential”, “continue” or the negative of these terms or

terminology of a similar nature as they relate to the Corporation

are intended to identify forward-looking statements.

Forward-looking statements in this press release include, without

limitation, those information and statements related to the

intended use of proceeds of the Offering and the Concurrent Private

Placement. Although the Corporation believes that the expectations

and assumptions on which such forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements since no assurance can be given that

they will prove to be correct. These statements are subject to

certain risks and uncertainties and may be based on assumptions

that could cause actual results to differ materially from those

anticipated or implied in the forward-looking statements. These

risks and uncertainties are described in in the “Risk Factors”

section of WSP’s Management’s Discussion and Analysis for the year

ended December 31, 2021, and WSP's Management’s Discussion and

Analysis for the six-month period ended July 2, 2022, which are

available under WSP’s profile on SEDAR at www.sedar.com.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. The forward-looking information contained herein is made

as of the date of this press release, and the Corporation

undertakes no obligation to publicly update such forward-looking

information to reflect new information, subsequent or otherwise,

unless required by applicable securities laws.

Not for distribution to U.S. Newswire services

or for dissemination in the United States

FOR ADDITIONAL INFORMATION, PLEASE CONTACT:

Alain Michaud

Chief Financial OfficerWSP Global Inc.alain.michaud@wsp.com

Phone: 438-843-7317

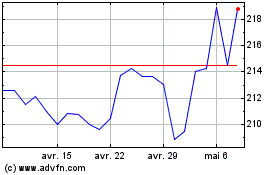

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024