Statement Regarding RPS Group plc

26 Septembre 2022 - 8:00AM

WSP Global Inc. (“WSP” or the “Corporation”) notes the announcement

by Tetra Tech UK Holdings Limited (“Tetra Tech Holdings”), a wholly

owned subsidiary of Tetra Tech, Inc. (“Tetra Tech”), and RPS Group

plc ("

RPS") that they have reached agreement on

the terms of a recommended cash acquisition by Tetra Tech Holdings

(the “Tetra Tech Offer”) for the entire issued and to be issued

share capital of RPS.

The RPS directors have withdrawn their

recommendation of the proposed cash acquisition of the entire

issued and to be issued share capital of RPS by a wholly owned

subsidiary of WSP, announced on August 8, 2022, as set out in the

scheme document published and sent to RPS shareholders on September

1, 2022 (the “RPS Acquisition”), and will postpone the RPS

shareholder meeting to be convened in connection

therewith.

The Corporation is considering its options in

respect of the foregoing and a further announcement will be made by

WSP in due course.

ABOUT WSPAs one of the world’s

leading professional services firms, WSP exists to future-proof our

cities and environment. We provide strategic advisory, engineering,

and design services to clients in the transportation,

infrastructure, environment, building, power, energy, water,

mining, and resources sectors. Our 63,000 trusted professionals are

united by the common purpose of creating positive, long-lasting

impacts on the communities we serve through a culture of

innovation, integrity, and inclusion. Sustainability and science

permeate our work. WSP derived about half of its $10.3B (CAD) 2021

revenues from clean sources. The Corporation’s shares are listed on

the Toronto Stock Exchange (TSX: WSP). To find out more, please

visit www.wsp.com.

FORWARD-LOOKING STATEMENTSThis

press release contains information or statements that are or may be

“forward-looking statements” within the meaning of applicable

Canadian securities laws. When used in this press release, the

words “may”, “will”, “should”, “expect”, “plan”, “anticipate”,

“believe”, “estimate”, “predict”, “forecast”, “project”, “intend”,

“target”, “potential”, “continue” or the negative of these terms or

terminology of a similar nature as they relate to the Corporation,

an affiliate of the Corporation or the combined firm following the

RPS Acquisition, are intended to identify forward-looking

statements. Forward-looking statements in this press release

include, without limitation, those information and statements

related to the proposed RPS Acquisition and the Tetra Tech Offer.

Although the Corporation believes that the expectations and

assumptions on which such forward-looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements since no assurance can be given that

they will prove to be correct. These statements are subject to

certain risks and uncertainties and are based on assumptions that

could cause actual results to differ materially from those

anticipated or implied in the forward-looking statements, including

risks and uncertainties relating to the following: the possible

delay or failure to close the RPS Acquisition; interloper risk

(including the Tetra Tech Offer) and other impediments to the

completion of the RPS Acquisition on anticipated terms in a timely

manner, or at all, including obtaining required shareholder and

regulatory approvals and the satisfaction of other conditions to

the completion of the RPS Acquisition; the focus of management time

and attention on the RPS Acquisition and other disruptions arising

from the RPS Acquisition; the ability of management to accelerate

the execution of WSP’s key strategic priorities, including those in

connection with the RPS Acquisition; WSP’s inability to

successfully integrate RPS upon completion of the RPS Acquisition;

the potential failure to realize anticipated benefits from the RPS

Acquisition; the currency exchange risk and foreign currency

exposure related to the purchase price of the RPS Acquisition;

WSP’s reliance upon information provided by RPS in connection with

the acquisition and publicly available information; risks

associated with historical and pro forma financial information;

potential undisclosed costs or liabilities associated with the RPS

Acquisition; WSP or RPS being adversely impacted during the

pendency of the acquisition; and change of control and other

factors discussed or referred to in the “Risk Factors” section of

WSP’s Management’s Discussion and Analysis for the year ended

December 31, 2021, and WSP’s Management’s Discussion and Analysis

for the six-month period ended July 2, 2022 (together, the

“MD&As”), which are available under WSP’s profile on SEDAR at

www.sedar.com. The foregoing list is not exhaustive and other

unknown or unpredictable factors could also have a material adverse

effect on the performance or results of WSP or RPS.

WSP’s forward-looking statements are expressly

qualified in their entirety by this cautionary statement. For

additional information on this cautionary note regarding

forward-looking statements as well as a description of the relevant

assumptions and risk factors likely to affect WSP’s actual or

projected results, reference is made to the MD&As, which are

available on SEDAR at www.sedar.com. The forward-looking statements

contained in this press release are made as of the date hereof and

except as required under applicable securities laws, WSP does not

undertake to update or revise these forward-looking statements,

whether written or verbal, that may be made from time to time by

itself or on its behalf, whether as a result of new information,

future events or otherwise. The forward-looking statements

contained in this press release are expressly qualified by these

cautionary statements.

A number of statements were previously made by

WSP relating to the RPS Acquisition, including the attractiveness

of the RPS Acquisition from a financial perspective and expected

accretion in various financial metrics; expectations regarding

anticipated cost savings and synergies and certain expected

financial ratios; the strength, complementarity and compatibility

of the RPS’s business with WSP’s existing business and teams; other

anticipated benefits of the RPS Acquisition and its impact on the

Corporation’s delivery of its 2022-2024 Global Strategic Action

Plan and its long-term vision. These statements are subject to

certain risks and uncertainties and may be based on assumptions

that could cause actual results to differ materially from those

anticipated or implied in the forward-looking statements. The

uncertainty created by the Tetra Tech Offer has heightened these

risks. Given the impact of the changing circumstances surrounding

the Tetra Tech Offer and the related response from RPS, there is

inherently more uncertainty associated with WSP’s assumptions

regarding the satisfaction of closing conditions and completion of

the RPS Acquisition.

Not for distribution to U.S. Newswire services

or for dissemination in the United States

FOR ADDITIONAL INFORMATION, PLEASE CONTACT:

Alain MichaudChief Financial OfficerWSP Global

Inc.alain.michaud@wsp.com Phone: 438-843-7317

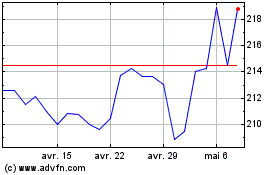

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

WSP Global (TSX:WSP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024