UCASU acquires $3M cannabis property and aims at $1M gross profit for 2023

19 Janvier 2023 - 4:29PM

InvestorsHub NewsWire

January 19, 2023 --

InvestorsHub NewsWire -- In the very first month of 2023, UC

Asset LP (OTCQB:

UCASU) apprears very active, and have put forward a number of

press releases it put forward.

$1M Gross Profit

Based on these news

release, UC Asset closed a deal, with which UC Asset made $550,000

gross profit out of a $1.9 million sale. It was a cash deal, and UC

Asset claimed it had no debt financing on that deal. This means

that UC Asset should have about $1.9 million cash at its hands upon

closing the deal.

UC Asset sets a goal of $1

million gross profit for 2023. Now it had gone more than

halfway through to reach that goal in the very first month.

According to its news release, $1 million gross profit will be

about $0.20 per share.

According to its SEC

filings, UC Asset had been profitable in past years. It had

distributed cash dividend twice. The last cash distribution of

$0.10 per share was distributed in 2022.

$3M Cannabis Property

Acquisition

The company also announced

that it entered into a MOU to acquire a 10,000 square foot cannabis

cultivation property in the State of Oklahoma, through a non-cash

acquisition deal. Upon closing of the acquisition, UCASU will

invest $1 million to build extra 5,000 square feet of cannabis

cultivation facility at the same site.

After acquisition, the

current operator on the property, Fire Ranch Farm, will continue to

rent the property from UC Asset. UC Asset expects to receive

monthly rents representing a 14.4% cash on cash annual

return.

The non-cash acquisition

will be closed through the issuance of 2.5 million preferred shares

of UC Asset to the current property owner. Those preferred shares

will have a fixed conversion rate of 1:1. A fixed conversion

rate means that those preferred shares are NOT toxic, in the sense

that it won't flood the market with cheap shares. In fact, it

appears that those share will have a fixed cost of $1.20 per share,

which is 60% higher than the company's current PPS of

$0.75.

More, holder of the

preferred shares will receive no dividends from UC Asset, unless

those preferred shares are converted into common shares. But if the

holder converts the shares, UC Asset will start to charge more rent

on the property. The company claims that this is a

strong

protection for exist shareholders, because the increase of rent may outweigh the

additional dividend allocated to newly converted shares.

Cannabis Property

Investment

Cannabis property

investment was a hot topic last year, when shares of Innovative

Property (NYSE: IIPR) and Power REIT(NYSE: PW) soared roof top

high. It has had big adjustments since then. But overall, cannabis

properties still yield much higher ROI than other

properties.

UC Asset's claims that,

since it announced its intention to invest in cannabis property in

October 2021, their team have made hundreds of phone calls to

potential sellers, screened tens of opportunities, and conducted

research in 5 different states, including Colorado, California and

New York. And finally they chose to acquire this property in

Oklahoma.

UC Asset aims to become

one of the leading cannabis property investor in the State of

Oklahoma.

Links to these news

releases by UCASU

https://finance.yahoo.com/news/uc-asset-sold-farmland-550k-133300886.html

https://finance.yahoo.com/news/uc-asset-3m-cannabis-property-143400580.html

Disclaimer:

Money Chats

Group provides dissemination service that collects and

distributes investment related news and information that are

already in the public domain. Money Chats Group does NOT verify the

information it disseminates. The contents included in this

distribution do not construe any investment or other advice.

Nothing contained in this distribution constitutes a solicitation,

recommendation, endorsement, or offer by Money Chats Group of any

third parties to buy or sell any securities.

SOURCE: Money Chats

Group

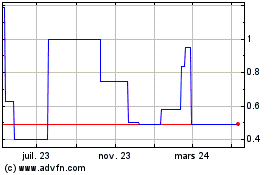

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024