Brookfield, DigitalBridge to Buy Stake in Deutsche Telekom's Tower Business for $17.60 Billion

14 Juillet 2022 - 8:07AM

Dow Jones News

By Mauro Orru

A consortium of Brookfield Infrastructure Partners LP and

DigitalBridge Group Inc. agreed to buy a stake in Deutsche Telekom

AG's tower business for 17.5 billion euros ($17.60 billion)

including debt, raising their bet on a telecommunications sector

that has seen a flurry of deal making in recent years.

Germany's Deutsche Telekom on Thursday said it had agreed to

sell the consortium a 51% stake in GD Towers, its tower business in

Germany and Austria, after a yearlong effort to sell part of the

business.

GD Towers operates more than 40,000 sites across Germany and

Austria, and will hand the consortium some 800 employees.

"This represents a great opportunity to invest in a highly

attractive tower portfolio, with highly contracted cash flows and

strong upside potential," Sam Pollock, managing partner at

Brookfield, said.

For Deutsche Telekom, the sale will give it more leeway to trim

a net debt pile that stood at EUR135.95 billion at the end of

March. The company said it expects a reduction in net debt

including leases of EUR6.5 billion. Closing of the deal is expected

toward end of the year.

News of the deal with the consortium comes after Spain's Cellnex

Telecom SA pulled out of the race, putting an end to speculation

that the Spanish company had made concessions to secure a share of

the business.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

July 14, 2022 01:52 ET (05:52 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

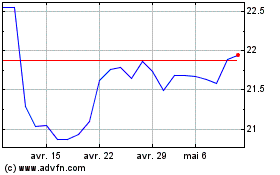

Deutsche Telekom (TG:DTE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Deutsche Telekom (TG:DTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024