Credit Agricole 3Q Net Profit Falls but Beats Expectations

08 Novembre 2017 - 8:03AM

Dow Jones News

By Pietro Lombardi

Credit Agricole SA (ACA.FR) said Wednesday that its

third-quarter net profit recorded a double-digit fall on year,

which had been expected because of a tough comparable during the

same period in 2016.

The French lender said net profit declined 43% to 1.07 billion

euros ($1.24 billion) compared with the same period a year earlier,

when it booked a gain of almost EUR1.3 billion after selling its

25% holding in the group's regional banks.

Analysts had expected the Paris-based lender, France's

second-largest listed bank by assets, to post a net profit of

EUR993 million for the quarter.

Underlying net profit, which strips out one-off items, was down

5.2% year-on-year, the lender said.

The bank said the fall is partly due to the "return to a more

normal effective tax rate, which rose from 16.6% in the third

quarter 2016 to 27.0% in the third quarter 2017." The underlying

tax charge rose 85.7% year-on-year to EUR364 million.

Revenue rose 22% to EUR4.58 billion. On an underlying base,

revenue grew by 3.5%.

Credit Agricole's core tier one ratio, a key measure of capital

strength, was 12% as of September.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

November 08, 2017 01:48 ET (06:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

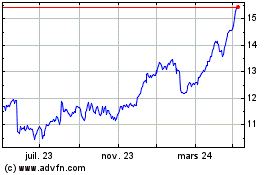

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

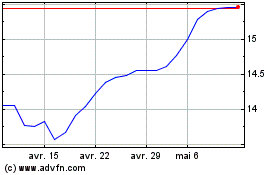

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024