- Strong growth in business

- €933 million in sales

- Up 19.5% as reported

- Up 8.1% like-for-like

- Sharp 34% improvement in

contributive operating income before non-recurring items lifted by

strong business momentum, the disciplined management of operating

expenses and the positive currency effect

- Sustained successful performance by

FilmArray®

- 510(k) FDA clearance of

VIDAS® 3

- Execution of the industrial

investment plan

- Confirmation of the 2015 financial

objectives

Alexandre Mérieux, Chief Executive Officer, said: "bioMérieux

delivered a solid performance in the first half of 2015, attesting

to its effective positioning as a specialist in the in vitro

diagnosis of infectious diseases. The strong dynamic observed

during the past 6 months reflects our broad geographic footprint

and our diversified portfolio of solutions, which was recently

enhanced with the acquisition of BioFire in molecular biology.

Against this backdrop, and despite the economic instability, we are

confident in our ability to reach our 2015 objectives."

Regulatory News:

The Board of Directors of bioMérieux (Paris:BIM), a world leader

in the field of in vitro diagnostics, met on August 28 under

the chairmanship of Jean-Luc Belingard and approved the

consolidated financial statements for the six months ended

June 30, 2015. The Statutory Auditors had performed a review

of the financial statements.

Audited

consolidated data

In € millions

H12015

H12014(1)

% changeas reported

Sales 933 781 +19.5%

Contributive operating income before non-recurring items(2)

122 91 +34.3% Operating income

103 78 +33.1%

Net

income of consolidated companies 59 51

+16.9% Earnings per share (in €)

1.51

1.28 +16.9%

(1) Adjusted for the application of IFRIC 21 – Levies, as shown

in appendix 1.(2) Contributive operating income before

non-recurring items corresponds to operating income before

non-recurring BioFire acquisition and integration costs and before

accounting entries relating to BioFire purchase price allocation.

Operating income before non-recurring items corresponds to

operating income before material, extraordinary and non-recurring

items, which are included in “other non-recurring income and

expenses from operations”.

FINANCIAL RESULTS

Sales1

Consolidated sales amounted to €933 million in the first half of

2015, up from €781 million in the year-earlier period. This

represented growth of 8.1% like-for-like with FilmArray® confirming

its role as a faster growth driver for the Group, adding

approximately 300 basis points to the gains generated by the other

bioMérieux lines. After changes in the scope of consolidation

related to the BioFire and CEERAM acquisitions, growth reached 9.1%

at constant exchange rates. Reported growth stood at 19.5%, lifted

by the €81 million (10.4%) positive effect of the increase in the

US dollar and other currencies against the euro over the

period.

Analysis of Sales

In € millions

Sales - 6 months ended June 30, 2014

781 Currency effect +81 +10.4% Organic growth (at constant

exchange rates and scope of consolidation) +63 +8.1%

}+9.1%

Change in scope of consolidation(1) +8 +1.0%

Sales - 6 months

ended June 30, 2015 933 +19.5%

(1) BioFire: sales from January 1 to January 15, 2015 excluded

from the organic growth calculation (acquisition date:

January 16, 2014)CEERAM: first-time consolidation of

sales from this technological start-up acquired in late December

2014.

Consolidated income statement

Lifted by a €35-million gain from favorable currency movements,

reported gross profit stood at €474 million in first-half 2015,

compared with €385 million in the prior-year period and

representing a gross margin of 50.8% of sales. At constant exchange

rates and scope of consolidation, gross margin came to an estimated

51.4%, up 210 basis points from first-half 2014. The improvement

was led by the robust 8.1% organic growth in sales, which raised

coverage of fixed costs, and by a more favorable product mix, both

of which were partly offset by the impact of provisions on

licensing agreements. Expenses committed by the Durham, NC site in

response to observations made by the US Food and Drug

Administration (FDA) declined gradually during the period, to

€12 million from €15 million a year earlier.

- Contributive operating income before

non-recurring items

Contributive operating income before non-recurring items ended

the first six months at €122 million or 13.1% of sales, versus

€91 million and 11.6% a year earlier. The growth reflected the

improvement in gross profit, a €6-million positive currency effect

and operating cost discipline at a time when the Company is

investing to maintain the success of FilmArray®.

- Selling, general and administrative

expenses totaled €254 million, or 27.3% of sales, compared

with €215 million and 27.6% in first-half 2014. The around

€19-million increase at constant exchange rates primarily reflected

the investment in the commercial development of the FilmArray®

line.

- Research and development outlays

amounted to €116 million and represented 12.4% of sales,

versus €100 million and 12.8% in the prior-year period. The

like-for-like increase primarily reflects the stepped-up R&D

commitment to FilmArray® and tight control over spending on the

other lines.

- Research tax credits amounted to €11

million, versus €14 million in first-half 2014, when they were

lifted by favorable adjustments in relation to prior years.

- "Other operating income", which mainly

comprises royalty income, was unchanged for the period, at €7.4

million.

1 Sales growth by region and by application is presented in

Appendix 2. The full first-half 2015 business review may be found

at www.biomerieux-finance.com.

- Operating income before

non-recurring items

BioFire acquisition expenses primarily include the depreciation

and amortization charged against identifiable assets acquired,

whose fair value was estimated as part of the purchase price

allocation process, as well as the impact of the retention plan

adopted in connection with the acquisition, representing a total of

€18 million for the period, versus €15 million in first-half 2014.

As a result, operating income before non-recurring items stood at

€104 million, compared with €76 million a year

earlier.

Operating income ended the first half at €103 million or

11.0% of sales, versus €77 million and 9.8% in the prior-year

period.

- Financial income and taxes

Cost of debt stood at €12 million, up €10 million from €2

million in first-half 2014, primarily due to the additional debt

contracted to acquire BioFire.

In first-half 2015, the interest expense on this financing

amounted to €8 million and the fair value of the hedging

instruments recognized in the income statement declined by €2

million. On the other hand, in first-half 2014, when euro interest

rates were declining, the finance cost was zero on a net basis, as

the €6 million in interest expense was offset by the unrealized

fair value gains on the hedging instruments.

The effective tax rate came to 34.1% at June 30, 2015, higher

than the first-half 2014 figure of 30.7%, which was restated for

the impact of IFRIC 21 and reduced by the favorable adjustments in

relation to prior years.

Given these conditions, net income rose to €59 million or 6.3%

of sales, from €51 million in first-half 2014.

Cash management and finance

EBITDA2 amounted to €179 million in the first half of 2015,

compared with €141 million in the prior-year period,

reflecting the solid growth of contributive operating income before

non-recurring items.

While stable in first-half 2014, operating working capital

requirement rose in first-half 2015, by €62 million, under the

combined impact of:

- Movements of around €33 million in

trade receivables, down €2 million from the movements recorded in

first-half 2014 when €13 million in past-due Spanish receivables

were paid.

- A rise in the value of inventories that

was almost €20-million higher than the increase recorded in

first-half 2014, in particular at the Durham, NC site, due to the

return to satisfactory production conditions in the blood culture

bottle unit, and the Salt Lake City, UT facility, where FilmArray®

inventory is being rebuilt after the winter flu epidemic.

- Trade payables were down to

€37 million at June 30, 2015, compared with a €9-million

increase a year earlier, due to slight differences in payment

schedules from one month to the next, which had no impact on days

sales outstanding.

As expected, capital expenditure outlays rose steeply over the

period, to €86 million including €67 million in

industrial capital expenditure versus €56 million and €42

million respectively in first-half 2014. The outlays were primarily

committed to installing a new BacT/ALERT® blood-culture bottle line

at the Durham, NC site, building the new BioFire facility in Salt

Lake City, UT and extending the Marcy l’Etoile, France site with a

new VIDAS® strip packaging line.

In light of the above, free cash flow3 amounted to

€24 million for the period versus €62 million in first-half

2014.

2 EBITDA corresponds to the aggregate of contributive operating

income before non-recurring items, depreciation and amortization.3

Free cash flow corresponds to cash generated from operations, net

of cash used in investing activities.

Against a backdrop of significant operational and industrial

investment, net debt amounted to €274 million at June 30,

2015, versus €249 million at December 31, 2014. Dividends

totaling €39.5 million were paid in June 2015, an amount virtually

unchanged from 2014.

The Company has €300 million in seven-year bonds, placed with

institutional investors in October 2013. It also has an undrawn

€350-million syndicated line of credit expiring on May 20,

2019. Lastly, on March 31, 2015, it signed a 12-year, €45-million

lease financing agreement to fund the extension of the Marcy

l'Etoile, France site.

OTHER INFORMATION

The installed base at June 30, 2015 stood at

approximately 81,200 instruments, including 1,867 FilmArray®

instruments. This represented an increase of around 1,700 new

instruments over the period, of which 266 FilmArray® units.

The Company had a total of 9,258 full-time-equivalent

employees and temporary staff as of June 30, 2015,

compared with 8,935 at December 31, 2014.

SIGNIFICANT EVENTS OF FIRST-HALF 2015

During the first quarter, the new generation FilmArray®

system, FilmArray® 2.0, was cleared by the FDA and

CE-marked. The main feature of this compact instrument is its

higher throughput, which allows laboratories to process up to 175

samples in a day. The solution accommodates up to eight

FilmArray® 2.0 units operated by a single computer and is

capable of connecting to Laboratory Information Systems (LIS).

In addition, bioMérieux broadened its offering in molecular

biology, with the introduction of a new version of the

NucliSENtral® middleware, and in immunoassays, with

the launch of the bioNexia® Legionella

rapid diagnostic test that detects the presence of Legionella

pneumophila serogroup 1, the most commonly identified pathogen in

Legionnaires' disease.

- De novo application submitted

for the FilmArray® Meningitis/Encephalitis

Panel

In April 2015, BioFire submitted a de novo classification

request to the US Food and Drug Administration (FDA) for the

FilmArray® Meningitis/Encephalitis (ME) panel.

The pioneering FilmArray® ME panel addresses a critical, unmet need

for quickly identifying central nervous system infections by

utilizing a comprehensive panel to test cerebrospinal fluid (CSF)

for the most common bacteria, viruses and fungi responsible for

community-acquired meningitis or encephalitis. A one-hour or so

turnaround time has the potential to reduce mortality and morbidity

from these devastating diseases and to positively impact patient

management. FilmArray® ME will only be available for sale once the

FDA has completed its process. Subject to FDA clearance, the panel

will be the fourth clinical diagnostic test to run on the

FilmArray® system, making its syndromic menu the largest

commercially available for a multiplexing platform.

- Production and quality

system

In February 2015, France's ANSM drug regulatory agency issued an

injunction letter requesting that bioMérieux complete, within 12

months, the work required to bring into compliance certain

production units at the site in Craponne, France. Based on

discussions with the ANSM, an action plan was defined in April to

address this request and is now being deployed.

In June 2015, the FDA re-inspected the site in St. Louis,

Missouri and reviewed all of the corrective actions implemented in

response to the October 2014 Warning Letter. It determined that

there were no repeat observations as regards the Letter. Following

the inspection, the FDA issued two new observations, which

bioMérieux is already addressing with a corrective action plan.

Also in the United States, the Durham, NC site continued to

deploy the action plans defined with the FDA to address its

observations and prepare for the coming re-inspections.

To refocus its commercial offering, bioMérieux has initiated a

plan to dispose of its microplate immunoassay product line,

which it deems to be non-strategic for the Company. After talks

with potential buyers proved inconclusive, the production and sale

of certain product lines will be terminated as of year-end 2015. As

a result, €8 million in assets previously recorded under "Assets

held for sale" have been reclassified under their initial headings

as of June 30, 2015

The search for a partner to step up bioTheranostics's

growth was still underway at period-end.

SUBSEQUENT EVENTS

- VIDAS® 3 cleared by

the FDA

On July 9, bioMérieux received 510(k) clearance from the FDA to

market VIDAS® 3, the new generation of VIDAS® that further enhances

the range of automated VIDAS® and mini VIDAS® immunoassay

instruments in the United States. VIDAS® 3 reinforces the ease of

use that has made the VIDAS® range so popular. Thanks to its

design, tests can be performed on demand, individually or in

series, 24 hours a day and seven days a week. As a result, it is

perfectly suited to centralized as well as satellite laboratories,

bringing both versatility and reliability to healthcare

professionals who are able to optimize their workflows and

guarantee the quality of biological testing.

- Non-exclusive license agreement

signed with LBT Innovations Ltd

On August 27, 2015, a non-exclusive license agreement was

signed with LBT Innovations for the MicroStreak® technology used in

the PREVI® Isola automated culture-plate streaking system. The

agreement terminates the exclusive license initially granted in

2007 and leaves each company free to independently pursue its own

developments in the field of microbiology lab automation.

bioMérieux will retain the right to maintain the installed base of

PREVI® Isola systems, including the supply of patented inoculation

applicators, but will no longer market new PREVI® Isola systems

after August 2016.

- FilmArray® BioThreat-E

for the detection of the Ebola virus receives WHO Emergency Use

Assessment and Listing

In view of the unprecedented outbreak of Ebola virus raging in

West and Central Africa since summer 2014, the World Health

Organization (WHO) introduced an emergency mechanism to assess in

vitro diagnostics that will be used to diagnose Ebola virus

disease. As a result, the FilmArray® BioThreat-E test for the

detection of the Ebola virus was accepted for UN procurement in

August 2015. The FilmArray® BioThreat-E test enables a simple,

rapid and reliable diagnosis of the Zaire Ebola virus involved in

the current epidemic.

2015 OBJECTIVES

Based on the current business outlook, the Company maintains its

objective of reporting between 4.5% and 6.5% organic

growth in sales in 2015, at constant exchange rates and scope

of consolidation. It is also maintaining its contributive

operating income before non-recurring items target of between

€240 million and €265 million for the year. In an

unstable economic environment, bioMérieux remains confident about

the strength of the performance expected for 2015 in relation to

the objectives set.

Jean-Luc Belingard, Chairman, concluded: "The market we

serve continues to expand. In particular, the fight against

microbial resistance is now considered a global public health

priority, supported by a wide range of government initiatives in

which we are actively participating. As a result, backed by its

extensive international presence and broader business portfolio,

bioMérieux will continue to assertively deploy its strategy and its

operational action plan, the validity of which is confirmed by the

solid results announced today."

INVESTOR CALENDAR

Third-quarter sales: October 22, 2015, before start of

trading

The above forward-looking statements are based, entirely or

partially, on assessments or judgments that may change or be

modified, due to uncertainties and risks related to the Company's

economic, financial, regulatory and competitive environment,

notably those described in the 2014 Registration Document.

Accordingly, the Company cannot give any assurance nor make any

representation as to whether the objectives will be met. The

Company does not undertake to update or otherwise revise any

forecasts or objectives presented herein, except in compliance with

the disclosure obligations applicable to companies whose shares are

listed on a stock exchange.

ABOUT BIOMÉRIEUX

Pioneering Diagnostics

A world leader in the field of in vitro diagnostics for 50

years, bioMérieux is present in more than 150 countries

through 42 subsidiaries and a large network of distributors. In

2014, revenues reached €1,698 million with 88% of sales

outside of France.

bioMérieux provides diagnostic solutions (reagents, instruments,

software) which determine the source of disease and contamination

to improve patient health and ensure consumer safety. Its products

are used for diagnosing infectious diseases and providing high

medical value results for cancer screening and monitoring and

cardiovascular emergencies. They are also used for detecting

microorganisms in agri-food, pharmaceutical and cosmetic

products.

bioMérieux is listed on the NYSE Euronext Paris stock market

(Symbol: BIM – ISIN: FR0010096479).

Corporate website: www.biomerieux.com

Investor website: www.biomerieux-finance.com

Appendix 1: Adjustments Following Application of

IFRIC 21

Key factors impacted 06/30/2014

12/31/2014 in millions of euros

Published

IFRIC 21 Restated Published

IFRIC 21 Restated

Total equity of the Group

at January 1st

1,267.3 0.8 1,268.1 1,267.3 0.8

1,268.1 Total other comprehensive income

(expense)

-7.0 -7.0 24.0 24.0 Net income for the year 52.5 -1.9 50.6 135.5

135.5 Total comprehensive income 45.5 -1.9 43.6 159.4 159.4 Other

movements -39.6 -39.6 -38.1 -38.1

Total equity of the Group

at closing

1,273.2 -1.1 1,272.2 1,388.6 0.8

1,389.4

Total balance

sheet at closing 2,327.5 -0.5 2,327.0 2,580.5 -0.5 2,580.0 Other

operating payables 235.0 1.9 236.9 251.3 -1.3 250.0 Deferred tax

assets 58.0 -0.5 57.5 86.0 -0.5 85.5 Current tax 14.2 -1.2 13.0

15.4 15.4 Earnings per share 1.32 -0.04 1.28

3.42 3.42

Appendix 2: Sales by Region and Application

Sales by Region

In € millions

H12015 H12014 % changeas

reported

% changeat constant exchange rates and scope

of consolidation Europe(1)

414.9 402.5

+3.1%

+1.8% Americas

358.4 249.7 +43.5%

+18.9% North America

291.8 190.7 +53.0%

+21.8%

Latin America

66.6 59.0 +12.8%

+9.3% Asia-Pacific

148.8 120.3 +23.6%

+6.6%

Total sales from the regions 922.1

772.6 +19.4%

+8.0% bioTheranostics

8.9 4.7 +90.0%

+54.8%

R&D-related revenues

2.2 3.4

TOTAL 933.2 780.7

+19.5%

+8.1%

(1) Including the Middle East and Africa.

Sales by Application

In € millions

H12015 H12014 % changeas

reported

% changeat constant exchange rates and scope

of consolidation

Clinical Applications 740.5

615.5 +20.3%

+8.6% Microbiology

416.3 364.9 +14.1%

+5.0% Immunoassays(1)

210.2

185.0 +13.6%

+4.7% Molecular Biology(2)

107.9 57.7

+86.9%

+48.8% Others

6.1 7.9 -23.0%

-25.7%

Industrial Applications 172.8 152.6 +13.2%

+4.4% bioTheranostics

8.9 4.7 +90.0%

+54.8%

BioFire Defense

8.7 4.5 +95.1%

+52.3% R&D-related

revenue

2.2 3.4

TOTAL 933.2 780.7 +19.5%

+8.1%

(1) Including VIDAS®: up 7.4% like-for-like over the period(2)

Including €67 million in BioFire Diagnostics sales for the

period

Appendix 3: bioMérieux Consolidated Financial

Statements at June 30, 2015

bioMérieux

CONSOLIDATED INCOME STATEMENT

In millions of euros

06/30/2015

12/31/2014

(a)

06/30/2014

(a)

Net Sales 933.2

1,698.4 780.7 Cost of sales

-459.6 -853.9 -395.8

Gross profit 473.6 844.5

384.9 Other operating income (b)

18.7 41.1

21.5 Selling and marketing expenses -176.4 -311.3

-150.9 General and administrative expenses -77.9 -141.7 -64.9

Research and development expenses -115.9 -205.8 -99.8

Total

operating expenses -370.2

-658.8 -315.6 Contributive

operating income 122.1 226.8

90.9 Fees and amortization of the

BioFire purchase price (b) -18.2 -23.9 -14.6

Operating income

before non-recurring items 103.9

202.9 76.3 Other non-recurring

income (expenses) (b) -0.8 0.6 1.2

Operating income

103.1 203.6 77.5

Cost of net financial debt -12.1 -7.2 -1.7 Other financial

items -1.0 -8.9 -2.4 Income tax -30.7 -51.7 -22.5 Investments in

associates -0.2 -0.3 -0.2

Net income of consolidated

companies 59.1 135.5

50.6 Attributable to non-controlling interests

-0.4 0.6 0.2

Attributable to the parent company

59.6 134.9 50.4

Basic net income per share 1.51 € 3.42 € 1.28 €

Diluted net income per share 1.51 € 3.42 €

1.28 €

(a) Financial statements since January 1, 2014 have been

adjusted for the impact of applying IFRIC 21.(b) Given the scale of

the BioFire acquisition, the related fees have been broken out from

operating income before non-recurring items and shown on a separate

line, so as to give a better view of operating income.

bioMérieux

CONSOLIDATED BALANCE SHEET

ASSETS

(in millions of euros)

06/30/2015 12/31/2014

(a)

06/30/2014

(a)

Intangible assets 476.6 460.1 395.8 Goodwill

455.0 437.8 442.1 Property, plant and equipment 505.4 486.9 429.0

Financial assets 39.7 35.1 33.7 Investments in associates 0.3 0.5

0.2 Other non-current assets 21.7 21.9 21.9 Deferred tax assets

93.7 85.5 57.5

Non-current assets 1,592.3

1,527.8 1,380.2 Inventories and work in

progress 360.1 299.2 302.6 Accounts receivable 430.6 449.3 398.7

Other operating receivables 96.3 82.5 92.2 Tax receivable 12.2 21.0

3.8 Non-operating receivables 11.1 19.6 10.1 Cash and cash

equivalents 108.9 119.7 95.1

Current assets 1,019.3

991.4 902.5 Assets held for sale 62.5

60.8 44.3 TOTAL ASSETS 2,674.2

2,580.0 2,327.1

LIABILITIES AND SHAREHOLDERS' EQUITY

(in millions of euros)

06/30/2015 12/31/2014

(a)

06/30/2014

(a)

Share capital 12.0 12.0 12.0 Additional paid-in capital

& Reserves 1,362.1 1,234.8 1,203.2 Net income for the year 59.6

134.9 50.4

Shareholders' equity 1,433.7

1,381.7 1,265.5 Non-controlling

interests 7.9 7.8 6.6 Total equity

1,441.6 1,389.4 1,272.2 Net financial

debt - long-term 305.3 305.7 305.6 Deferred tax liabilities 156.6

145.1 124.5 Provisions 106.9 105.4 83.7

Non-current

liabilities 568.8 556.2 513.9 Net

financial debt - short-term 80.2 63.5 97.7 Provisions 17.5 11.1

11.8 Accounts payable 157.8 188.9 145.2 Other operating liabilities

269.2 250.0 236.9 Tax liabilities 26.4 15.4 13.0 Non-operating

liabilities 86.3 81.4 20.1

Current liabilities 637.4

610.2 524.6 Liabilities related to assets

held for sale 26.4 24.2 16.5 TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY 2,674.2

2,580.0 2,327.1

(a) Financial statements since January 1, 2014 have been

adjusted for the impact of applying IFRIC 21.

Balance sheet items do not include the corresponding assets and

liabilities of bioTheranostics, which have been reclassified as

either "Assets held for sale or "Liabilities related to assets held

for sale".

bioMérieux

CONSOLIDATED CASH FLOW

STATEMENT

In millions euros

06/30/2015 06/30/2014 Net income of

consolidated companies 59.1 52.5 - Investments in

associates 0.2 0.2 - Cost of net financial debt 12.1 1.7 - Other

financial items 1.0 2.4 - Current income tax expense 30.7 23.7 -

Operating depreciation and provisions on assets 56.7 46.9 -

Non-recurring items 19.0 13.4

EBITDA (before non-recurring

items) 178.8 140.9 Other non current operating

gains/losses

(w/o exceptionnal depreciations, assets

losses and capital gains/losses)

0.0 -9.9 Other financial items

(w/o accruals & disposal of financial

assets)

-1.0 -2.4 Operating provisions for risks and contingencies 2.9 1.6

Change in fair value of financial instruments -1.5 -4.4 Share-based

payments 0.4 0.4

Elimination of other gains and losses without

any impact on cash or operations 0.8 -14.7

Increase in inventories -45.4 -27.0 Change in trade receivable 32.7

35.2 Change in trade payable -37.0 8.5 Change in other operating

working capital -12.1 -16.2

Change in operating working

capital -61.8 0.5 Other non operating working

capital -4.6 -3.8 Change in non-current assets 1.9 2.7

Other

cashflows from operation -64.5 -0.6 Income tax

paid -5.5 -18.5 Net cash flow

from operations 109.6 107.1

Purchase of property, plant and equipment -86.1 -56.1 Proceeds on

fixed asset disposals 13.1 13.3 Purchase of financial assets /

Disposals of financial assets -6.1 -0.9 Impact of changes in the

scope of consolidation -0.5 -353.1

Net cash flow

from (used in) investment activities -79.6

-396.8 Increase in capital 0.0 0.0 Purchases and proceeds of

treasury stocks -0.8 -0.3 Dividends to shareholders -39.5 -39.5

Cost of net financial debt -12.1 -1.7 Change in confirmed financial

debt 15.2 -0.5

Net cash flow from (used in)

financing activities -37.2 -42.0

Net change in cash and cash equivalents -7.1

-331.7 Net cash and cash equivalents at the

beginning of the year 103.9 414.9

Impact of currency changes on net cash and cash equivalents

-2.0 -1.2

Net cash and cash equivalents at the end of the

year 94.8 82.0

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150830005018/en/

Investor RelationsbioMérieuxSylvain Morgeau, +33

(0)4 78 87 22 37investor.relations@biomerieux.comorMedia

RelationsbioMérieuxAurore Sergeant, +33 (0)4 78 87 54

75media@biomerieux.comorImage SeptLaurence Heilbronn, +33

(0)1 53 70 74 64lheilbronn@image7.frorClaire Doligez, +33 (0)1 53

70 74 48cdoligez@image7.fr

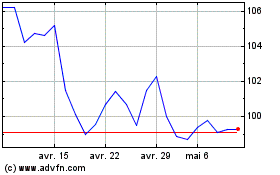

Biomerieux (EU:BIM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Biomerieux (EU:BIM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024