Forget Fear, Embrace Greed? Bitcoin Soars As Sentiment Turns Red Hot

28 Mai 2024 - 3:00PM

NEWSBTC

Bitcoin (BTC) continues its captivating dance near its all-time

high, leaving investors to ponder whether it’s a victory lap or a

prelude to a potential tumble. While the price sits stubbornly

around $68,000, new data reveals a market brimming with “extreme

greed,” according to the Crypto Fear and Greed Index. This suggests

investors are piling on, fueled by the belief that the digital gold

is on an unstoppable ascent. However, beneath the surface of this

bullish fervor lurk shadows of potential setbacks. Let’s dissect

the forces shaping Bitcoin’s trajectory. Related Reading: Floki

Floats 22% On Marketing Blitz, Aims For ‘World’s Most Used Crypto’

Title Greed For Bitcoin Up The Fear and Greed Index at 74 paints a

picture of a market intoxicated by optimism. Investors are chomping

at the bit, accumulating more BTC in anticipation of a price surge.

This bullish sentiment might very well be a self-fulfilling

prophecy, but a note of caution is necessary. Historically, periods

of extreme greed have often ended with sharp corrections. Profit

Taking: The Looming Sell-Off? With BTC brushing shoulders with its

all-time high, the allure of profit-taking becomes irresistible for

some investors. The temptation to cash out and lock in gains could

trigger a wave of selling, applying downward pressure on the price.

This dynamic highlights the double-edged sword of profitability.

While it bolsters sentiment, it can also ignite a sell-off if not

managed strategically. Short-Term Holders: A Recipe For Volatility?

The analysis also reveals a rise in short-term holders (STHs).

These investors, unlike their long-term counterparts, are more

likely to react impulsively to market fluctuations. A sudden dip in

price could trigger panic selling from these STHs, leading to

short-term volatility for Bitcoin. Related Reading: Polkadot (DOT)

Price Prediction: Analyst Sparks Bullish Frenzy With $10 Target

Greed: Bullish Sentiment The bullish sentiment fueled by the Fear

and Greed Index is a positive force. However, the risks of

profit-taking, short-term holder behavior, and potential future

miner capitulation cannot be ignored. The coming days will be

crucial in determining whether Bitcoin can overcome these hurdles

and propel itself to new heights or succumb to a correction.

Miners: A Force To Be Reckoned With Meanwhile, miners – the

lifeblood of the Bitcoin network – play a crucial role in price

stability. When miner revenue dips, they’re forced to sell their

BTC holdings to cover operational costs. This selling pressure can

significantly impact the price. However, the good news is that

miner revenue has been on an upswing recently, alleviating some

concerns about a miner-induced sell-off. Featured image from Getty

Images, chart from TradingView

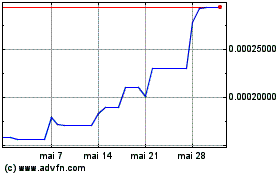

FLOKI (COIN:FLOKIUSD)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

FLOKI (COIN:FLOKIUSD)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024