Capgemini delivers a solid Q3 performance with growth of +2.3% at

constant exchange rates

Media relations:Victoire

GruxTel.: +33 6 04 52 16 55victoire.grux@capgemini.com

Investor relations:Vincent

BiraudTel.: +33 1 47 54 50 87vincent.biraud@capgemini.com

Capgemini delivers a solid Q3

performance with growth of +2.3% at constant

exchange rates

-

Revenues of €5,480 million in Q3 2023, up +2.3% at constant

exchange rates*

- Revenues of €16,906 million

in the first nine months, up +6.0% at constant exchange

rates

Paris, November 7, 2023

– The Capgemini Group reported consolidated

revenues of €5,480 million in Q3 2023, down -1.3% at current

exchange rates and up +2.3% at constant exchange rates*

year-on-year.

Aiman Ezzat, Chief Executive Officer of the

Capgemini Group, commented: “The Group delivered a solid

performance in the third quarter in a challenging economic

environment.

The dual transition to a digital and sustainable

economy continues to be at the top of our clients’ strategic

agendas. Their appetite for technology has never been greater,

fueled by constant innovation such as generative AI and the

proliferation of its use cases to drive growth, deliver new

services and optimize operations. Demand for generative AI

accelerated in the third quarter with over 100 projects signed and

a strong pipeline. As part of our 2 billion euros investment plan

announced in July, we launched our Gen AI campus to scale up

training for all our employees.

We have become a major business and technology

partner to our clients across their entire value chains playing a

significant role from product innovation to customer interactions

and services. Our portfolio of industry-specific innovative

offerings meets client demand for value-creating solutions and

contributes to our sustained operating margin improvement.

Thanks to this third-quarter performance, we

confirm all our full-year objectives.”

| |

(in millions of euros) |

|

Change |

|

Revenues |

2022 |

2023 |

|

At currentexchange rates |

At constantexchange

rates* |

|

Q3 |

5,553 |

5,480 |

|

-1.3% |

+2.3% |

|

9 months |

16,241 |

16,906 |

|

+4.1% |

+6.0% |

Capgemini’s performance in Q3 2023 was a

prolongation of the trends observed since the start of the year,

extending as expected the gradual slowdown seen in previous

quarters. The Group posted revenues of €5,480 million in Q3, up

+2.3% at constant exchange rates. Organic growth* i.e., excluding

the impacts of currency fluctuations and changes in Group scope, is

+2.0% for the quarter. For the first nine months of the year,

growth stands at +4.1% on a reported basis and +6.0% at constant

exchange rates, while organic growth reaches +5.5%.

In a macroeconomic context that remains

challenging, clients are holding onto their digital transformation

ambitions. They are increasingly focusing on projects with faster

payback, such as those boosting operational efficiency, which in

turn fuels steady growth of the Group’s innovative offers. The

Group’s activities involving Data and Artificial Intelligence and

those in Intelligent Industry were the fastest growing in Q3.

OPERATIONS BY REGION

Overall, the contrast in growth rates between

regions is unchanged since the beginning of the year.

The United Kingdom and Ireland

region (12% of Group revenues in Q3 2023) continued its solid

momentum, growing +5.0% at constant exchange rates. This

performance was primarily driven by the strong growth in the Public

Sector and the Consumer Goods & Retail Sector, while the

Financial Services and TMT (Telecoms, Media and Technology) sectors

were down.

The Rest of Europe region (30%

of Group revenues) also performed well with growth of +5.4% at

constant exchange rates, primarily fueled by the Public Sector and

the Manufacturing, Energy and Utilities sectors.

France revenues (19% of Group

revenues) were up by +3.7% at constant exchange rates. The momentum

recorded in the Public Sector and the solid performance delivered

by the Consumer Goods & Retail and Manufacturing sectors

contrasted with the decline in TMT.

Revenues in the North America

region (29% of Group revenues) were down by -4.0% at constant

exchange rates. Manufacturing sector growth remained solid during

the quarter, whereas TMT sector further contracted and Financial

Services growth turned negative.

The Asia-Pacific and Latin

America region (10% of Group revenues) boosted its growth

with a +7.6% increase in revenues at constant exchange rates. This

improvement was primarily driven by the Asia-Pacific region, with

solid growth in the Public Sector and Consumer Goods & Retail

and Manufacturing sectors.

OPERATIONS BY

BUSINESS

Strategy & Transformation

services (8% of total Group revenues* in Q3 2023) maintained robust

growth, with a +5.1% increase in total revenues at constant

exchange rates compared to Q3 2022.

Applications & Technology

services (63% of Group revenues and Capgemini’s core business)

reported growth in total revenues of +2.8% at constant exchange

rates.

Finally, Operations &

Engineering total revenues (29% of Group revenues) grew

+0.9% at constant exchange rates.

HEADCOUNT

At September 30, 2023, the Group’s total

headcount stood at 342,700, down by 4% year-on-year. Onshore

workforce was virtually stable at 146,700 employees, while the

offshore workforce is down 7% to 196,000 employees, i.e. 57% of the

total headcount.

BOOKINGS

Bookings totaled €5,275 million in Q3 2023, a

+1% increase at constant exchange rates year-on-year. This

translates into a book-to-bill ratio of 0.96, which is a strong

performance given the usual seasonality of bookings.

OUTLOOK

The Group’s financial targets for 2023 are:

- Revenue growth of +4% to +7% at

constant currency;

- Operating margin of 13.0% to

13.2%;

- Organic free cash flow of around

€1.8 billion.

The inorganic contribution to growth should be

0.5 points at the lower end of the target range and 1.0 point at

the upper end.

CONFERENCE CALL

Aiman Ezzat, Chief Executive Officer,

accompanied by Carole Ferrand, Chief Financial Officer, and Olivier

Sevillia, Chief Operating Officer, will present this press release

during a conference call in English to be held today at

8.00 a.m. Paris time (CET). You can follow this conference

call live via webcast at the following link. A replay will also be

available for a period of one year.

All documents relating to this publication will

be posted on the Capgemini investor website at

https://investors.capgemini.com/en/.

PROVISIONAL CALENDAR

February 14,

2024 FY

2023 resultsApril 30,

2024 Q1

2024 revenuesMay 16,

2024 Shareholders’

Meeting

The full and always up-to-date calendar is

available at https://investors.capgemini.com/en/calendar/.

DISCLAIMER

This press release may contain forward-looking

statements. Such statements may include projections, estimates,

assumptions, statements regarding plans, objectives, intentions

and/or expectations with respect to future financial results,

events, operations and services and product development, as well as

statements, regarding future performance or events. Forward-looking

statements are generally identified by the words “expects”,

“anticipates”, “believes”, “intends”, “estimates”, “plans”,

“projects”, “may”, “would”, “should” or the negatives of these

terms and similar expressions. Although Capgemini’s management

currently believes that the expectations reflected in such

forward-looking statements are reasonable, investors are cautioned

that forward-looking statements are subject to various risks and

uncertainties (including, without limitation, risks identified in

Capgemini’s Universal Registration Document available on

Capgemini’s website), because they relate to future events and

depend on future circumstances that may or may not occur and may be

different from those anticipated, many of which are difficult to

predict and generally beyond the control of Capgemini. Actual

results and developments may differ materially from those expressed

in, implied by or projected by forward-looking statements.

Forward-looking statements are not intended to and do not give any

assurances or comfort as to future events or results. Other than as

required by applicable law, Capgemini does not undertake any

obligation to update or revise any forward-looking statement.

This press release does not contain or

constitute an offer of securities for sale or an invitation or

inducement to invest in securities in France, the United States or

any other jurisdiction.

ABOUT CAPGEMINI

Capgemini is a global leader in partnering with

companies to transform and manage their business by harnessing the

power of technology. The Group is guided everyday by its purpose of

unleashing human energy through technology for an inclusive and

sustainable future. It is a responsible and diverse organization of

nearly 350,000 team members in more than 50 countries. With its

strong 55-year heritage and deep industry expertise, Capgemini is

trusted by its clients to address the entire breadth of their

business needs, from strategy and design to operations, fueled by

the fast evolving and innovative world of cloud, data, AI,

connectivity, software, digital engineering and platforms. The

Group reported 2022 global revenues of €22 billion.Get the Future

You Want | www.capgemini.com

* *

*

APPENDICES1

BUSINESS CLASSIFICATION

- Strategy &

Transformation includes all strategy, innovation and

transformation consulting services.

- Applications &

Technology brings together “Application Services” and

related activities and notably local technology services.

- Operations &

Engineering encompasses all other Group businesses. These

comprise Business Services (including Business Process Outsourcing

and transaction services), all Infrastructure and Cloud services,

and R&D and Engineering services.

DEFINITIONS

Organic growth or like-for-like

growth in revenues is the growth rate calculated at

constant Group scope and exchange rates. The Group scope

and exchange rates used are those for the reported period. Exchange

rates for the reported period are also used to calculate

growth at constant exchange rates.

|

Reconciliation of growth rates |

Q1 2023 |

Q2 2023 |

Q3 2023 |

9 months2023 |

|

Organic growth |

+10.1% |

+4.7% |

+2.0% |

+5.5% |

|

Changes in Group scope |

+0.6 pts |

+0.5 pts |

+0.3 pts |

+0.5 pts |

|

Growth at constant exchange rates |

+10.7% |

+5.2% |

+2.3% |

+6.0% |

|

Exchange rate fluctuations |

+0.2 pts |

-2.0 pts |

-3.6 pts |

-1.9 pts |

|

Reported growth |

+10.9% |

+3.2% |

-1.3% |

+4.1% |

When determining activity trends by business and

in accordance with internal operating performance measures, growth

at constant exchange rates is calculated based on total

revenues, i.e. before elimination of inter-business

billing. The Group considers this to be more representative of

activity levels by business. As its businesses change, an

increasing number of contracts require a range of business

expertise for delivery, leading to a rise in inter-business

flows.

Operating margin is one of the

Group’s key performance indicators. It is defined as the difference

between revenues and operating costs. It is calculated before

“Other operating income and expense” which include amortization of

intangible assets recognized in business combinations, the charge

resulting from the deferred recognition of the fair value of shares

granted to employees (including social security contributions and

employer contributions), and non-recurring revenues and expenses,

notably impairment of goodwill, negative goodwill, capital gains or

losses on disposals of consolidated companies or businesses,

restructuring costs incurred under a detailed formal plan approved

by the Group’s management, the cost of acquiring and integrating

companies acquired by the Group, including earn-outs comprising

conditions of presence, and the effects of curtailments,

settlements and transfers of defined benefit pension plans.

Normalized net profit is equal to profit for the

year (Group share) adjusted for the impact of items recognized in

“Other operating income and expense”, net of tax calculated using

the effective tax rate. Normalized earnings per

share is computed like basic earnings per share, i.e.

excluding dilution.

Organic free cash flow is equal

to cash flow from operations less acquisitions of property, plant,

equipment and intangible assets (net of disposals) and repayments

of lease liabilities, adjusted for cash out relating to the net

interest cost.

Net debt (or net cash

and cash equivalents) comprises (i) cash and cash

equivalents, as presented in the Consolidated Statement of Cash

Flows (consisting of short-term investments and cash at bank) less

bank overdrafts, (ii) cash management assets (assets presented

separately in the Consolidated Statement of Financial Position due

to their characteristics), less (iii) short- and long-term

borrowings. Account is also taken of (iv) the impact of hedging

instruments when these relate to borrowings, inter-company loans

and own shares.

RESULTS BY REGION

| |

Revenues(in millions of euros) |

|

Change |

| |

Q3 2022 |

Q3 2023 |

|

Reported |

At constant exchange rates |

|

North America |

1,803 |

1,608 |

|

-10.8% |

-4.0% |

|

United Kingdom and Ireland |

646 |

676 |

|

+4.6% |

+5.0% |

|

France |

1,008 |

1,045 |

|

+3.7% |

+3.7% |

|

Rest of Europe |

1,574 |

1,633 |

|

+3.7% |

+5.4% |

|

Asia-Pacific and Latin America |

522 |

518 |

|

-0.8% |

+7.6% |

|

TOTAL |

5,553 |

5,480 |

|

-1.3% |

+2.3% |

| |

Revenues(in millions of euros) |

|

Change |

| |

9 months 2022 |

9 months 2023 |

|

Reported |

At constant exchange rates |

|

North America |

4,973 |

4,896 |

|

-1.5% |

+0.6% |

|

United Kingdom and Ireland |

1,933 |

2,062 |

|

+6.7% |

+9.6% |

|

France |

3,121 |

3,353 |

|

+7.4% |

+7.5% |

|

Rest of Europe |

4,735 |

5,105 |

|

+7.8% |

+9.4% |

|

Asia-Pacific and Latin America |

1,479 |

1,490 |

|

+0.7% |

+5.7% |

|

TOTAL |

16,241 |

16,906 |

|

+4.1% |

+6.0% |

RESULTS BY BUSINESS

| |

Total revenues*(% of Group revenues) |

Change at constant exchange rates in total revenues* of the

business |

| |

Q3 2023 |

|

Strategy & Transformation |

8% |

+5.1% |

|

Applications & Technology |

63% |

+2.8% |

|

Operations & Engineering |

29% |

+0.9% |

|

|

Total revenues*(% of Group revenues) |

Change at constant exchange rates in total revenues* of the

business |

| |

9 months 2023 |

|

Strategy & Transformation |

8% |

+9.9% |

|

Applications & Technology |

63% |

+6.3% |

|

Operations & Engineering |

29% |

+4.4% |

1 Note that in the appendix, certain totals may

not equal the sum of amounts due to rounding adjustments.

- Capgemini_-_2023-11-07_-_Q3_2023_Revenues

- Capgemini_Q3_2023_infographics_ENG

- Capgemini_YTD_2023_infographics_ENG

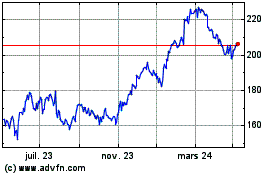

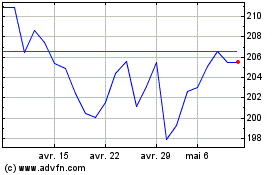

Capgemini (EU:CAP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Capgemini (EU:CAP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024