Maurel & Prom - Activity and sales 2018: US$440m (+10%)

Paris, 7 February

2019 No. 03-19

Activity and sales 2018: US$440m

(+10%)

- Group sales up 10% to US$440m for 2018

- The average sale price of oil was US$68.8/bbl in 2018, up 30%

compared with 2017

- M&P total working interest production of 22,934

boepd for 2018, down 4% compared with 2017

- Oil production in Gabon was 20,342 bopd for operated interest

(16,273 bopd for M&P working interest), down 19% on the

previous year due to reduced evacuation capacity from May to

end-November. Since December 2018, production has been evacuated

without incident and has started rising again to reach 25,013 bopd

for operated interest.

- Gas production in Tanzania was 83.2 MMcf/d for operated

interest (40 MMcf/d for M&P working interest), up 69% compared

with the previous year.

- Group reserves at 31 December 2018 – M&P working

interest:

- Gross P1+P2 reserves: 190 MMboe

- These reserves do not include those of two new projects:

Venezuela and Angola.

2018 Sales

| |

|

|

|

|

|

|

|

|

|

| |

Q1 2018 |

Q2 2018 |

Q3 2018 |

Q4 2018 |

|

12 months 2018 |

|

12 months 2017 |

Chg. 18/17 |

| |

|

|

|

|

|

|

|

|

|

|

Total production sold over the period, M&P working

interest |

|

|

|

|

|

|

|

|

|

|

million barrels of oil |

1.7 |

1.4 |

1.2 |

1.4 |

|

5.7 |

|

6.8 |

-16 |

% |

|

MMBTU |

3.4 |

3.7 |

3.9 |

3.9 |

|

14.9 |

|

8.8 |

69 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Average sale price |

|

|

|

|

|

|

|

|

|

|

OIL, in US$/bbl |

66.3 |

73.0 |

74.3 |

62.7 |

|

68.8 |

|

53.0 |

30 |

% |

|

GAS, in US$/MMBTU |

3.18 |

3.17 |

3.17 |

3.17 |

|

3.17 |

|

3.15 |

1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

EUR/USD exchange rate |

1.23 |

1.19 |

1.16 |

1.14 |

|

1.18 |

|

1.13 |

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

SALES (in US$m) |

|

|

|

|

|

|

|

|

|

|

Oil production |

124 |

107 |

102 |

95 |

|

428 |

|

384 |

11 |

% |

|

Gabon |

115 |

98 |

92 |

84 |

|

389 |

|

361 |

|

|

Tanzania |

9 |

9 |

10 |

11 |

|

39 |

|

23 |

|

|

Drilling operations |

4 |

2 |

3 |

3 |

|

12 |

|

16 |

-25 |

% |

|

Consolidated sales (in million US$ ) |

128 |

109 |

105 |

98 |

|

440 |

|

400 |

10 |

% |

|

Consolidated sales (in million €) |

104 |

92 |

90 |

87 |

|

373 |

|

354 |

5 |

% |

| |

|

|

|

|

|

|

|

|

|

The Group’s consolidated sales for 2018 amounted

to US$440 million (€373 million), up by 10% on 2017.

The sharp rise in oil prices in 2018 more than

compensated for the drop in oil production in Gabon which was

caused by technical constraints with the evacuation process. This

led to an overall increase in sales.

The average sale price of oil in fiscal year

2018 rose by 30% to US$68.8/bbl versus US$53/bbl in 2017.

The higher demand for gas in Tanzania meant that gas production

increased significantly in 2018.

Total average production for the year stood at

83.2 MMcf/d, up 69% on 2017. In the second half of 2018, average

production was 87.0 MMcf/d.

2018 Activity

Breakdown of hydrocarbon production in

2018

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2018 |

Q2 2018 |

Q3 2018 |

Q4 2018 |

|

12 months 2018 |

|

12 months 2017 |

Chg.18/17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Production operated by Maurel & Prom

(100%) |

|

|

|

|

|

|

|

|

|

|

|

Oil |

bopd |

23,975 |

19,173 |

17,409 |

20,876 |

|

20,342 |

|

24,963 |

-19 |

% |

|

Gas |

MMcf/d |

77.0 |

81.6 |

86.7 |

87.2 |

|

83.2 |

|

49.1 |

69 |

% |

|

TOTAL |

boepd |

36,804 |

32,778 |

31,853 |

35,411 |

|

34,201 |

|

33,145 |

3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Maurel & Promshare of

production |

|

|

|

|

|

|

|

|

|

|

|

Oil |

bopd |

19,180 |

15,338 |

13,928 |

16,701 |

|

16,273 |

|

19,970 |

-19 |

% |

|

Gas |

MMcf/d |

37.0 |

39.2 |

41.7 |

41.9 |

|

40.0 |

|

23.6 |

69 |

% |

|

TOTAL |

boepd |

25,346 |

21,877 |

20,869 |

23,686 |

|

22,934 |

|

23,903 |

-4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

In Gabon, operated oil production in 2018 stood

at 20,342 bopd (16,273 bopd for M&P working interest), down 19%

on 2017. This was due to the restriction on the volumes evacuated

by the pipeline connecting the Ezanga facilities to the Cap Lopez

export terminal. These issues began in mid-May 2018 and continued

intermittently until the end of November.

- Monthly operated production in Gabon in 2018

(Mbbl/d)

Production figures in January 2019 reflect the

results of the evacuation measures already taken, and take

production from new wells into account.

Exports returned to normal at the beginning of

December 2018. Measures to improve evacuation capacity in

2019 were discussed with the pipeline

operator. Drilling

activities on the Ezanga permit, which had been halted for almost

three years, resumed in 2018 to support the production profile and

counteract the fields’ natural depletion. Drilling began in the

first half of 2018 and accelerated in August when a second unit

went into operation. In total, 9 wells were drilled in 2018. The

programme will continue in 2019 with the drilling of high potential

wells.

Drilling of Kari and Nyanga Mayombé exploration

wells were delayed to 2019 due to a change in the mobilization

strategy of the rig to the well sites.

In Tanzania, total operated production averaged

83.2 MMcf/d in 2018, or 40 MMcf/d for M&P working interest

(48.06%), up 69% on 2017. Operated production in the fourth quarter

of 2018 exceeded 87 MMcf/d.

On the Mios permit, preparations were made to

drill the CDN-2 exploration well after 2018 saw the receipt of

administrative approvals. Drilling is expected to begin in February

2019.

Group reserves at 31 December 2018 –

M&P working interest

The Group's reserves correspond to the volumes

of recoverable hydrocarbons currently in production plus those

revealed by discovery and delineation wells that can be operated

commercially. These reserves were certified by DeGolyer and

MacNaughton in Gabon and RPS Energy in Tanzania as at 31 December

2018.

| Gross

reserves M&P working interest |

Oil (MMbbl) |

Gas (Bcf)(1) |

|

MMboe |

| |

Gabon |

Tanzania |

|

|

|

01/01/2018 |

171.3 |

|

265.4 |

|

|

215.5 |

|

|

production |

-5.9 |

|

-14.6 |

|

|

|

|

revision |

-14.2 |

|

-19.2 |

|

|

|

|

31/12/2018 |

151.1 |

|

231.6 |

|

|

189.7 |

|

|

o/w gross P1 reserves |

117.1 |

|

139.3 |

|

|

140.3 |

|

|

or |

77.5 |

% |

60.2 |

% |

|

74 |

% |

As at 31 December 2018, gross P1+P2 (2P)

reserves amounted to 190 MMboe, the equivalent of

172 MMboe in M&P share, net of royalties.

In Gabon, 2P reserves net of royalties and

restated for 2018 production amounted to 133 MMbbl as at 31

December 2018, with P1 reserves accounting for 77% of that total.

This revision of 2P reserves was due to an apparent faster decline

on the Onal field in 2018 which is expected to be offset by new

drilling in 2019.

As at 31 December 2018, the Group also had gas

reserves of 232 Bcf.

The significant increase in production in 2018

made it easier to assess the reservoir’s behaviour and led to a

more accurate reserve estimate.

New projects

In Angola, the period for possible pre-emptions

regarding the acquisition of the 20% stake held by AJOCO in the two

offshore blocks ended in December 2018. Finalisation of this

acquisition is now subject to receiving administrative approvals

from the Angolan Ministry of Petroleum and national concessionaire,

Sonangol EP.

In Venezuela, acquisition of Shell's 40% stake in Petroregional

del Lago Mixed Company was finalised on 20 December 2018. Due

regard is being taken to the initialization of activities within

the current events related to Venezuela.

|

French |

|

|

English |

|

pieds cubes |

pc |

cf |

cubic feet |

|

pieds cubes par jour |

pc/j |

cfpd |

cubic feet per

day |

|

milliers de pieds cubes |

kpc |

Mcf |

1,000 cubic

feet |

|

millions de pieds cubes |

Mpc |

MMcf |

1,000 Mcf =

million cubic feet |

|

milliards de pieds cubes |

Gpc |

Bcf |

billion cubic feet |

|

baril |

b |

bbl |

barrel |

|

barils d'huile par jour |

b/j |

bopd |

barrels of oil

per day |

|

milliers de barils |

kb |

Mbbl |

1,000

barrels |

|

millions de barils |

Mb |

MMbbl |

1,000 Mbbl = million barrels |

|

barils équivalent pétrole |

bep |

boe |

barrels of oil

equivalent |

|

barils équivalent pétrole par jour |

bep/j |

boepd |

barrels of oil

equivalent per day |

|

milliers de barils équivalent pétrole |

kbep |

Mboe |

1,000 barrels

of oil equivalent |

|

millions de barils équivalent pétrole |

Mbep |

MMboe |

1,000 Mbbl =

million barrels of oil equivalent |

For more information, visit

www.maureletprom.fr

Contacts

MAUREL & PROMPress,

shareholder and investor relations Tel: +33 (0)1 53 83 16

45

ir@maureletprom.fr

NewCapFinancial communications

and investor

relations

Julie Coulot/Louis-Victor Delouvrier Tel: +33 (0)1 44 71 98

53

maureletprom@newcap.eu

Media relationsNicolas MerigeauTel: +33 (0)1 44

71 94 98maureletprom@newcap.eu

This document may contain forward-looking

statements regarding the financial position, results, business and

industrial strategy of Maurel & Prom. By nature,

forward-looking statements contain risks and uncertainties to the

extent that they are based on events or circumstances that may or

may not happen in the future. These projections are based on

assumptions we believe to be reasonable, but which may prove to be

incorrect and which depend on a number of risk factors, such as

fluctuations in crude oil prices, changes in exchange rates,

uncertainties related to the valuation of our oil reserves, actual

rates of oil production and the related costs, operational

problems, political stability, legislative or regulatory reforms,

or even wars, terrorism and sabotage.

Maurel & Prom is listed for trading on

Euronext Paris CAC All-Share – CAC Oil & Gas – Next 150 -

PEA-PME and SRD eligibleIsin FR0000051070 /

Bloomberg MAU.FP / Reuters

MAUP.PA

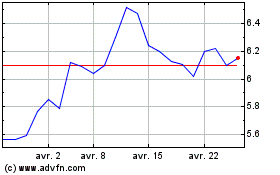

Maurel Et Prom (EU:MAU)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Maurel Et Prom (EU:MAU)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024