Valeant Posts a Loss, Says It Will Retool

09 Août 2016 - 1:20PM

Dow Jones News

Valeant Pharmaceuticals International Inc. posted a wider loss

in its latest quarter, and the company said it would reorganize,

continuing a push to remake itself as a normal pharmaceutical

firm.

The company also affirmed its yearly guidance after a string of

cuts, easing fears of triggering a debt-covenant breach. Shares in

the company added 7% premarket to $24.

It has been just over a full year since Valeant shares hit an

all-time closing high. Since that peak last August at $262.52, the

stock has erased more than 90% of its value amid a slate of

concerns, including drug-price hikes, accounting problems, a brush

with a potential debt default, and investigations by Congress and

federal regulators.

Investors have been watching for signs of what kind of

profitability Valeant can deliver as it distances itself from big

acquisitions and severe price increases for its drugs, the method

it used to build its business.

Chief Executive Joseph Papa, who took the helm from Michael

Pearson in May, said the company would be going in a "new strategic

direction" that involves reorganizing the company and its reporting

segments. The company didn't further outline the plan Tuesday

morning. Mr. Papa said the new direction for Valeant "has a mission

to improve patients' lives."

For the quarter ended in June, Valeant posted a loss of $302.3

million, or 88 cents a share, wider than its loss of $53 million,

or 15 cents a share, a year earlier.

On an adjusted basis that strips out some costs and uses a new

tax-reporting method, earnings fell to $1.40 a share from $2.14.

Revenue slid 11% to $2.42 billion. Analysts were looking for

adjusted earnings of $1.48 a share on $2.46 billion in revenue,

according to Thomson Reuters.

Valeant backed its guidance for the year—which it had cut

sharply at the end of the previous quarter—for earnings of $6.60 to

$7 a share and revenue between $9.9 billion and $10.1 billion. By

backing its guidance, Valeant essentially endorsed that it thinks

it can earn enough to keep its ratios high enough to stay in

compliance with its debt covenants.

Valeant also said it agreed to sell all North American

commercialization rights to Ruconest to Pharming Group NV for $60

million upfront and additional sales-based milestone payments of up

to $65 million.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

August 09, 2016 07:05 ET (11:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

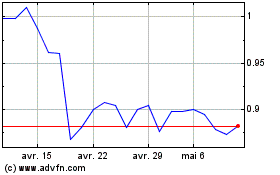

Pharming Group NV (EU:PHARM)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

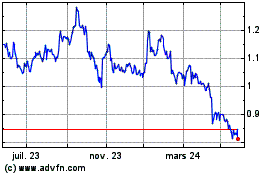

Pharming Group NV (EU:PHARM)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024