UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

INTERCEPT PHARMACEUTICALS, INC.

(Name of Subject Company (Issuer))

INTERSTELLAR ACQUISITION INC.

a wholly owned subsidiary of

ALFASIGMA S.P.A.

(Names of Filing Persons (Offerors))

Common Stock, par value $0.001 per share

(Title of Class of Securities)

45845P108

(CUSIP Number of Class of Securities)

Michele A. Cera

Corporate General Counsel

Alfasigma S.p.A.

Via Ragazzi del ‘99, 5

40133 Bologna, Italy

+39 051 648 9521

(Name, address and telephone number of person authorized to receive notices and

communications on behalf of the filing person)

Copies to:

Matthew G. Hurd

Oderisio de Vito Piscicelli

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☒

third-party tender offer subject to Rule 14d-1.

☐

issuer tender offer subject to Rule 13e-4.

☐

going-private transaction subject to Rule 13e-3.

☐

amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐ If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐

Rule 14d-1(d) (Cross-Border Third Party Tender Offer)

This Tender Offer Statement on Schedule TO (the “Schedule TO”) relates to the offer by Interstellar Acquisition Inc. (the “Purchaser”), a Delaware corporation and a wholly owned subsidiary of Alfasigma S.p.A., an Italian società per azioni (joint stock company) (“Alfasigma”), for all of the outstanding shares of common stock, par value $0.001 per share (the “Shares”), of Intercept Pharmaceuticals, Inc., a Delaware corporation (“Intercept”), at a price of $19.00 per Share, net to the seller in cash, without interest and subject to any applicable withholding taxes, upon the terms and subject to the conditions described in the offer to purchase, dated October 11, 2023 (the “Offer to Purchase”), and in the related letter of transmittal (the “Letter of Transmittal”), copies of which are attached hereto as Exhibits (a)(1)(i) and (a)(1)(ii), respectively, which Offer to Purchase and Letter of Transmittal collectively constitute the “Offer.”

The information contained in the Offer to Purchase, including all schedules and annexes to the Offer to Purchase, is hereby expressly incorporated by reference in responses to Items 1 through 11 of this Schedule TO and is supplemented by the information specifically provided for in this Schedule TO.

Item 1. Summary Term Sheet.

Regulation M-A Item 1001

The information set forth in the section of the Offer to Purchase entitled “Summary Term Sheet” is incorporated herein by reference.

Item 2. Subject Company Information.

Regulation M-A Item 1002(a) through (c)

(a)

The name of the subject company and the issuer of the securities to which this Schedule TO relates is Intercept Pharmaceuticals, Inc., a Delaware corporation. Intercept Pharmaceuticals’ executive offices are located at 305 Madison Avenue, Morristown, New Jersey, NJ 07960. Intercept Pharmaceuticals’ telephone number at such address is (646) 747-1000.

(b)

The information set forth in the Introduction to the Offer to Purchase is incorporated herein by reference.

(c)

The information set forth in Section 6 — “Price Range of Shares; Dividends” of the Offer to Purchase is incorporated herein by reference.

Item 3. Identity and Background of Filing Person.

Regulation M-A Item 1003(a) through (c)

(a) – (c) This Schedule TO is filed by Alfasigma and the Purchaser. The information set forth in Section 8 — “Certain Information Concerning Alfasigma, TURYTES and the Purchaser” in the Offer to Purchase and in Annex A to the Offer to Purchase is incorporated herein by reference.

Item 4. Terms of the Transaction.

Regulation M-A Item 1004(a)

For purposes of subsection (a)(1)(i)-(viii), (x) and (xii), the information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

Introduction

Section 1 — “Terms of the Offer”

Section 2 — “Acceptance for Payment and Payment for Shares”

Section 3 — “Procedures for Accepting the Offer and Tendering Shares”

Section 4 — “Withdrawal Rights”

Section 5 — “U.S. Federal Income Tax Considerations of the Offer and Merger”

Section 11 — “The Merger Agreement; Other Agreements”

Section 13 — “Certain Effects of the Offer”

Section 15 — “Conditions to the Offer”

Section 16 — “Adjustments to Prevent Dilution”

Subsections (a)(1)(ix) and (xi) are not applicable.

For purposes of subsections (a)(2)(i)-(v) and (vii), the information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

Introduction

Section 1 — “Terms of the Offer”

Section 5 — “U.S. Federal Income Tax Considerations of the Offer and Merger”

Section 10 — “Background of the Offer, Past Contacts, Transactions, Negotiations and Agreements Intercept”

Section 11 — “The Merger Agreement; Other Agreements”

Section 12 — “Purpose of the Offer; Plans for Intercept”

Section 13 — “Certain Effects of the Offer”

Section 16 — “Adjustments to Prevent Dilution”

Subsection (a)(2)(vi) is not applicable.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

Regulation M-A Item 1005(a) and (b)

The information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

Introduction

Section 8 — “Certain Information Concerning Alfasigma, TURYTES and the Purchaser”

Section 10 — “Background of the Offer, Past Contacts, Transactions, Negotiations and Agreements with Alfasigma”

Section 11 — “The Merger Agreement; Other Agreements”

Section 12 — “Purpose of the Offer; Plans for Alfasigma”

Item 6. Purposes of the Transaction and Plans or Proposals.

Regulation M-A Item 1006(a) and (c)(1) through (7)

For purposes of subsections (a), (c)(1) though (7), the information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

Introduction

Summary Term Sheet

Section 6 — “Price Range of Shares; Dividends”

Section 11 — “The Merger Agreement; Other Agreements”

Section 12 — “Purpose of the Offer; Plans for Intercept”

Section 13 — “Certain Effects of the Offer”

Section 14 — “Dividends and Distributions”

Item 7. Source and Amount of Funds or Other Consideration.

Regulation M-A Item 1007(a), (b) and (d)

The information set forth in Section 9 — “Source and Amount of Funds” of the Offer to Purchase is incorporated herein by reference.

Item 8. Interests in Securities of the Subject Company.

Regulation M-A Item 1008

The information set forth in Section 8 — “Certain Information Concerning Alfasigma, TURYTES and the Purchaser” of the Offer to Purchase is incorporated herein by reference.

Item 9. Persons/Assets Retained, Employed, Compensated or Used.

Regulation M-A Item 1009(a)

The information set forth in Section 18 — “Fees and Expenses” of the Offer to Purchase is incorporated herein by reference.

Item 10. Financial Statements.

Regulation M-A Item 1010(a) and (b)

Not applicable.

Item 11. Additional Information.

Regulation M-A Item 1011(a) and (c)

For purposes of subsection (a), the information set forth in the Offer to Purchase under the following captions is incorporated herein by reference:

Section 1 — “Terms of the Offer”

Section 8 — “Certain Information Concerning Alfasigma, TURYTES and the Purchaser”

Section 10 — “Background of the Offer, Past Contacts, Transactions, Negotiations and Agreements with Intercept”

Section 11 — “The Merger Agreement; Other Agreements”

Section 12 — “Purpose of the Offer; Plans for Intercept”

Section 13 — “Certain Effects of the Offer”

Section 15 — “Condition to the Offer”

Section 17 — “Certain Legal Matters; Regulatory Approvals”

Section 19 — “Miscellaneous”

For purposes of subsection (c) the information set forth in the Offer to Purchase and Letter of Transmittal is incorporated herein by reference.

Item 12. Exhibits.

The Exhibit Index attached to this Schedule TO is incorporated herein by reference.

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: October 11, 2023

ALFASIGMA S.P.A.

By:

/s/ Francesco Balestrieri

Name: Francesco Balestrieri

Title: Chief Executive Officer

INTERSTELLAR ACQUISITION INC.

By:

/s/ Francesco Balestrieri

Name: Francesco Balestrieri

Title: President

Exhibit Index

Exhibit

Number

|

|

|

Exhibit Description

|

|

|

(a)(1)(i)

|

|

|

|

|

|

(a)(1)(ii)

|

|

|

|

|

|

(a)(1)(iii)

|

|

|

|

|

|

(a)(1)(iv)

|

|

|

|

|

|

(a)(1)(v)

|

|

|

|

|

|

(a)(1)(vi)

|

|

|

|

|

|

(a)(5)(i)

|

|

|

|

|

|

(a)(5)(ii)

|

|

|

Communication to Intercept Employees, dated October 9, 2023 (incorporated by reference to Exhibit 99.1 to the Schedule TO-C filed by Alfasigma S.p.A. with the SEC on October 10, 2023).

|

|

|

(a)(5)(iii)

|

|

|

|

|

|

(b)(1)

|

|

|

Medium to Long-Term Loan Agreement, dated February 28, 2022, by and among Alfasigma S.p.A. and Banca Nazionale del Lavoro S.p.A. (English translation)

|

|

|

(b)(2)

|

|

|

Financing Agreement, dated July 28, 2023, by and among Alfasigma S.p.A. and BPER Banca S.p.A. (English translation)

|

|

|

(b)(3)

|

|

|

Loan Agreement, dated November 16, 2022, by and among Alfasigma S.p.A. and Unicredit S.p.A. (English translation)

|

|

|

(b)(4)

|

|

|

Loan Agreement, dated January 28, 2022, by and among Alfasigma S.p.A. and Intesa Sanpaolo S.p.A. (English translation)

|

|

|

(b)(5)

|

|

|

Loan Agreement, dated December 20, 2022, by and among Alfasigma S.p.A. and Banco BPM S.p.A. (English translation)

|

|

|

(b)(6)

|

|

|

Financing Agreement, dated September 15, 2023, by and among Alfasigma S.p.A. and Banco BPM S.p.A. (English translation)

|

|

|

(d)(1)

|

|

|

Agreement and Plan of Merger, dated September 26, 2023, among Intercept Pharmaceuticals, Inc., Alfasigma S.p.A. and Interstellar Acquisition Inc. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by Intercept Pharmaceuticals, Inc. with the SEC on September 26, 2023).

|

|

|

(d)(2)

|

|

|

|

|

|

(g)

|

|

|

Not applicable.

|

|

|

(h)

|

|

|

Not applicable.

|

|

|

107

|

|

|

|

|

Exhibit (a)(1)(i)

Offer to Purchase for Cash

All Outstanding Shares of Common Stock

of

INTERCEPT PHARMACEUTICALS, INC.

at

$19.00 Net Per Share

by

INTERSTELLAR ACQUISITION INC.

a wholly owned subsidiary of

ALFASIGMA S.P.A.

| |

|

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT ONE MINUTE AFTER 11:59 P.M. EASTERN TIME ON NOVEMBER 7, 2023, UNLESS THE OFFER IS EXTENDED

OR EARLIER TERMINATED.

|

|

|

The Offer (as defined below) is being made pursuant to the Agreement and Plan of Merger, dated as of September 26, 2023 by and among Alfasigma S.p.A., an Italian società per azioni (joint stock company) (“Alfasigma”), Interstellar Acquisition Inc., a Delaware corporation and a wholly owned subsidiary of Alfasigma (the “Purchaser”), and Intercept Pharmaceuticals, Inc., a Delaware corporation (“Intercept”) (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Merger Agreement”).

The Purchaser is offering to purchase all of the outstanding shares of common stock, par value $0.001 per share, of Intercept (the “Shares”), other than Shares held by Alfasigma, the Purchaser or any of their direct or indirect wholly owned subsidiaries (including, for the avoidance of doubt, any Shares acquired by the Purchaser in the Offer) or by Intercept (the “Excluded Shares”), for $19.00 per share, net to the seller in cash, without interest (the “Offer Price”), subject to any applicable withholding taxes (the “Offer”).

The obligation of the Purchaser to accept for payment and pay for Shares validly tendered (and not validly withdrawn) pursuant to the Offer is subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, including (i) there shall have been validly tendered (and not validly withdrawn) Shares that, considered together with all other Shares (if any) beneficially owned by Alfasigma and its affiliates, represent one (1) more Share than 50% of the total number of Shares outstanding at the time of the expiration of the Offer (excluding Shares tendered in the Offer pursuant to guaranteed delivery procedures that have not yet been received in settlement or satisfaction of such guarantee) (the “Minimum Condition”); (ii) the Merger Agreement shall not have been validly terminated in accordance with its terms (the “Termination Condition”); (iii) the expiration or termination of any waiting period applicable to the Offer under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”); (iv) the receipt of correspondence from the FDA acknowledging that Intercept’s proposed revised milestone for certain postmarketing requirements will be December 2023, which correspondence has been received; and (v) those certain other conditions set forth in the Merger Agreement (collectively, the “Offer Conditions”).

As soon as practicable (and in any event within one (1) business day) following the acceptance for payment of the Shares tendered and not properly withdrawn pursuant to the Offer representing at least such number of Shares as shall satisfy the Minimum Condition in accordance with the terms of the Offer and the Merger Agreement (such time of acceptance, the “Acceptance Time”), and subject to the satisfaction or waiver of certain conditions set forth in the Merger Agreement, the Purchaser will merge with and into Intercept (the “Merger”), with Intercept continuing as the surviving corporation and as a wholly owned subsidiary of Alfasigma (the “Surviving Corporation”), pursuant to the provisions of Section 251(h) of the Delaware General Corporation Law, as amended (the “DGCL”), with no stockholder approval required to consummate the Merger. The closing of the Merger will occur as soon as practicable and, in any event, no

later than the first business day after the conditions set forth in the Merger Agreement are satisfied or waived, unless another date is agreed to by the parties.

Each Share issued and outstanding immediately prior to the effective time of the Merger (the “Effective Time”), other than (i) the “Excluded Shares” or (ii) any Shares in respect of which appraisal rights were perfected in accordance with Section 262 of the DGCL (the “Dissenting Shares”), will be automatically converted into the right to receive an amount in cash equal to the Offer Price, subject to any applicable withholding taxes. See Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights.”

Under no circumstances will interest be paid either with respect to the purchase of Shares pursuant to the Offer or upon conversion of Shares into the right to receive an amount of cash equal to the Offer Price in the Merger (which, in either case, may be reduced by any applicable withholding taxes), regardless of any extension of the Offer or any delay in making payment for Shares or consummating the Offer or the Merger.

| |

|

THE BOARD OF DIRECTORS OF INTERCEPT RECOMMENDS THAT YOU TENDER

ALL OF YOUR SHARES INTO THE OFFER.

|

|

|

THE BOARD OF DIRECTORS OF INTERCEPT HAS (1) DETERMINED THAT THE MERGER AGREEMENT AND THE TRANSACTIONS CONTEMPLATED THEREBY, INCLUDING THE OFFER AND THE MERGER, ARE FAIR TO, AND IN THE BEST INTERESTS OF, INTERCEPT AND ITS STOCKHOLDERS; (2) DECLARED IT ADVISABLE TO ENTER INTO THE MERGER AGREEMENT; (3) APPROVED THE EXECUTION, DELIVERY AND PERFORMANCE BY INTERCEPT OF THE MERGER AGREEMENT AND THE CONSUMMATION OF THE TRANSACTIONS CONTEMPLATED THEREBY, INCLUDING THE OFFER AND THE MERGER; (4) AGREED THAT THE MERGER SHALL BE EFFECTED UNDER SECTION 251(H) OF THE DGCL; AND (5) AGREED TO RECOMMEND THAT INTERCEPT’S STOCKHOLDERS ACCEPT THE OFFER AND TENDER THEIR SHARES PURSUANT TO THE OFFER.

The Offer is not subject to any financing condition. The Offer is conditioned upon (i) the Minimum Condition, (ii) the Termination Condition, (iii) the expiration or termination of the applicable waiting period under the HSR Act, and (iv) the satisfaction or waiver by the Purchaser of the other Offer Conditions described in Section 15 — “Conditions to the Offer.” See Section 15 — “Conditions to the Offer” and Section 17 — “Certain Legal Matters; Regulatory Approvals.”

A summary of the principal terms of the Offer appears on pages 1 through 8. You should read both this entire Offer to Purchase, the Letter of Transmittal (as defined herein) and the other documents to which this Offer to Purchase refers carefully before deciding whether to tender your Shares into the Offer.

The Information Agent for the Offer is:

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Shareholders, Banks and Brokers

Call Toll Free: 888-293-6812

Email: ICPTOffer@Georgeson.com

October 11, 2023

IMPORTANT

If you desire to tender all or any portion of your Shares to the Purchaser pursuant to the Offer, prior to the expiration date of the Offer:

•

If you are a holder (i.e., you have a stock certificate or you hold Shares directly in your name in book-entry form in an account with Intercept’s transfer agent, VStock Transfer, LLC), you must complete and sign the enclosed Letter of Transmittal in accordance with the instructions contained in the Letter of Transmittal and send it, together with any original certificate representing your Shares and any other required documents, to Computershare Trust Company, N.A., in its capacity as depositary for the Offer (the “Depositary”). These materials must reach the Depositary before the Expiration Date (as defined below). See Section 3 — “Procedures for Accepting the Offer and Tendering Shares” for further details.

•

If you hold your Shares through a broker, dealer, commercial bank, trust company or other nominee, you must contact your broker, dealer, commercial bank, trust company or other nominee and give instructions that your Shares be tendered to the Purchaser pursuant to the Offer.

If you desire to tender your Shares pursuant to the Offer and the certificates representing your Shares are not immediately available, or you cannot comply in a timely manner with the procedures for tendering your Shares by book-entry transfer or you cannot deliver all required documents to the Depositary prior to the Expiration Date, you may tender your Shares to the Purchaser pursuant to the Offer by following the procedures for guaranteed delivery described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Guaranteed Delivery.”

Beneficial owners of Shares holding their Shares through nominees should be aware that their broker, dealer, commercial bank, trust company or other nominee may establish its own earlier deadline for participation in the Offer. Accordingly, beneficial owners holding Shares through a broker, dealer, commercial bank, trust company or other nominee and who wish to participate in the Offer should contact such nominee as soon as possible in order to determine the times by which such owner must take action in order to participate in the Offer.

*****

Questions and requests for assistance may be directed to Georgeson LLC (the “Information Agent”) at its address and telephone number set forth on the back cover of this Offer to Purchase. Additional copies of this Offer to Purchase, the Letter of Transmittal, the notice of guaranteed delivery and other related materials may also be obtained from the Information Agent. Stockholders may also contact their broker, dealer, commercial bank, trust company or other nominee for copies of these documents. Copies of these materials may also be found at the website maintained by the United States Securities and Exchange Commission at www.sec.gov. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Offer. Brokers, dealers, commercial banks, trust companies or other nominees will, upon request, be reimbursed by the Purchaser for customary mailing and handling expenses incurred by them in forwarding the tender offer materials to their customers.

This Offer to Purchase and the Letter of Transmittal contain important information, and you should read both carefully and in their entirety before making a decision with respect to the Offer.

The Information Agent for the Offer is:

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Shareholders, Banks and Brokers

Call Toll Free: 888-293-6812

Email: ICPTOffer@Georgeson.com

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

47 |

|

|

|

|

|

|

|

|

48 |

|

|

|

|

|

|

|

|

49 |

|

|

|

|

|

|

|

|

49 |

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

54 |

|

|

|

|

|

|

|

|

54 |

|

|

|

|

|

|

|

|

A-1

|

|

|

SUMMARY TERM SHEET

The following are some questions that you, as a stockholder of Intercept, may have and answers to those questions. This summary term sheet highlights selected information from this offer to purchase (this “Offer to Purchase”). It may not contain all of the information that is important to you and is qualified in its entirety by the more detailed descriptions and explanations contained in this Offer to Purchase and the related letter of transmittal (as it may be amended or supplemented from time to time, the “Letter of Transmittal”). This Offer to Purchase and the Letter of Transmittal collectively constitute the “Offer.”

To better understand the Offer and for a complete description of the terms of the Offer, you should read this Offer to Purchase, the Letter of Transmittal and the other documents to which we refer carefully and in their entirety. Questions or requests for assistance may be directed to Georgeson LLC, our information agent (the “Information Agent”), at its address and telephone number set forth on the back cover of this Offer to Purchase. Unless otherwise indicated in this Offer to Purchase or the context otherwise requires, all references in this Offer to Purchase to “we,” “our” or “us” refer to the Purchaser and, where appropriate, Alfasigma.

| |

Securities Sought:

|

|

|

All of the outstanding shares of common stock, par value $0.001 per share (the “Shares”), of Intercept Pharmaceuticals, Inc., a Delaware corporation (“Intercept”).

|

|

| |

Price Offered Per Share:

|

|

|

$19.00 per Share, net to the seller in cash, without interest (the “Offer Price”), subject to any applicable withholding taxes.

|

|

| |

Scheduled Expiration Time:

|

|

|

The Offer and withdrawal rights will expire at one (1) minute after 11:59 p.m. Eastern Time on November 7, 2023, unless the Offer is extended or terminated. See Section 1 — “Terms of the Offer.”

|

|

| |

The Purchaser:

|

|

|

Interstellar Acquisition Inc., a Delaware corporation (the “Purchaser”) and a wholly owned subsidiary of Alfasigma S.p.A., an Italian società per azioni (joint stock company) (“Alfasigma”). Alfasigma is 84% controlled by TURYTES S.p.A, an Italian società per azioni (joint stock company) (“TURYTES”).

|

|

| |

Intercept Board of Directors Recommendation:

|

|

|

The Board of Directors of Intercept has resolved to recommend that Intercept’s stockholders accept the Offer and tender their Shares pursuant to the Offer.

|

|

Who is offering to buy my Shares?

Our name is Interstellar Acquisition Inc. We are a wholly owned subsidiary of Alfasigma S.p.A., an Italian società per azioni (joint stock company). Alfasigma S.p.A. is 84% controlled by TURYTES S.p.A., an Italian società per azioni (joint stock company). We are a Delaware corporation formed for the purpose of making the Offer and thereafter, pursuant to the Agreement and Plan of Merger, dated September 26, 2023, by and among Alfasigma, Intercept and us (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Merger Agreement”), for the purpose of merging with and into Intercept (the “Merger”), with Intercept continuing as the surviving corporation and as a wholly owned subsidiary of Alfasigma as a result of the Merger (the “Surviving Corporation”). To date, we have not carried on any activities other than those related to our formation and the Merger Agreement, and the transactions contemplated thereby, including making this Offer. See the “Introduction” and Section 8 — “Certain Information Concerning Alfasigma, TURYTES and the Purchaser.”

How many Shares are you offering to purchase in the Offer?

We are making the Offer to purchase all outstanding Shares, other than Excluded Shares, on the terms and subject to the conditions set forth in this Offer to Purchase and the Letter of Transmittal. See the “Introduction” and Section 1 — “Terms of the Offer.”

Why are you making the Offer?

We are making the Offer pursuant to the Merger Agreement in order for Alfasigma to acquire control of, and following the Merger, the entire equity interest in, Intercept. As soon as practicable (and in no event later than one business day) following the acquisition of Shares in accordance with the Offer and in accordance with Section 251(h) of the DGCL, the Purchaser will be merged with and into Intercept, with Intercept continuing as the Surviving Corporation, on the terms and subject to the conditions set forth in the Merger Agreement. Each Share issued and outstanding immediately prior to the effective time of the Merger (the “Effective Time”) (other than any Shares held by us, Alfasigma or any of our direct or indirect wholly owned subsidiaries (including, for the avoidance of doubt, any Shares acquired by us in the Offer) or by Intercept (the “Excluded Shares”) and any Shares in respect of which appraisal rights were perfected in accordance with Section 262 of the DGCL (the “Dissenting Shares”)), will be automatically converted into the right to receive an amount in cash equal to the Offer Price, subject to any applicable withholding taxes. See Section 12 — “Purpose of the Offer; Plans for Intercept.”

How much are you offering to pay and what is the form of payment? Will I have to pay any fees or commissions?

We are offering to pay $19.00 per Share, net to the seller in cash, without interest and subject to any applicable withholding taxes.

If you are the record owner of your Shares and you tender your Shares to us in the Offer, you will not have to pay brokerage fees, commissions or similar expenses. If you own your Shares through a broker, dealer, commercial bank, trust company or other nominee and such nominee tenders your Shares on your behalf, they may charge you a fee for doing so. You should consult with your broker, dealer, commercial bank, trust company or other nominee to determine whether any charges will apply. See “Introduction,” Section 1 — “Terms of the Offer” and Section 2 — “Acceptance for Payment and Payment for Shares.”

What does the Board of Directors of Intercept think about the Offer?

We are making the Offer pursuant to the Merger Agreement, which has been approved by the Board of Directors of Intercept. The Board of Directors of Intercept has:

•

determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are fair to, and in the best interests of, Intercept and its stockholders;

•

declared it advisable for Intercept to enter into the Merger Agreement;

•

approved the execution, delivery and performance by Intercept of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Offer and the Merger;

•

agreed that the Merger shall be effected under Section 251(h) of the DGCL; and

•

agreed to recommend that Intercept’s stockholders accept the Offer and tender their Shares to the Purchaser pursuant to the Offer.

A more complete description of the reasons of the Board of Directors of Intercept for authorizing and approving the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, is set forth in the Schedule 14D-9 that is being filed by Intercept with the United States Securities and Exchange Commission (the “SEC”) and mailed to Intercept’s stockholders with this Offer to Purchase. Stockholders should carefully read the information set forth in the Schedule 14D-9 in its entirety. See the “Introduction” and Section 12 — “Purpose of the Offer; Plans for Intercept.”

What are the most significant conditions to the Offer?

The Offer is subject to the satisfaction of the following conditions (collectively, the “Offer Conditions”):

•

there shall have been validly tendered (and not validly withdrawn) Shares that, considered together with all other Shares (if any) beneficially owned by Alfasigma or its affiliates, represent one (1) more Share than 50% of the total number of Shares outstanding at the time of the expiration of the Offer (excluding Shares tendered in the Offer pursuant to guaranteed delivery procedures that have not yet been received in settlement or satisfaction of such guarantee) (the “Minimum Condition”);

•

the Merger Agreement shall not have been validly terminated in accordance with its terms (the “Termination Condition”);

•

any waiting period (or any extension thereof) applicable to the Offer under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”) shall have expired or been terminated;

•

no governmental body of competent jurisdiction in a jurisdiction where either Alfasigma or Intercept operates their respective business or owns any material assets shall have issued, promulgated, enacted or deemed applicable to the Merger or the Offer any order, injunction, decree, ruling or other legal requirement (whether temporary, preliminary or permanent) or taken any other action, in each case restraining, enjoining, making illegal or otherwise prohibiting the consummation of the Merger or the Offer, which order, injunction, decree, ruling, or other legal requirement or action remains in effect;

•

the receipt of correspondence from the FDA acknowledging that Intercept’s proposed revised milestone for certain postmarketing requirements will be December 2023, which correspondence has been received; and

•

the satisfaction or waiver by the Purchaser of the other conditions and requirements of the Offer set forth in the Merger Agreement and described in Section 15 — “Conditions to the Offer.” See Section 15 — “Conditions to the Offer” and Section 17 — “Certain Legal Matters; Regulatory Approvals.”

The foregoing conditions are for the sole benefit of Alfasigma and the Purchaser and (except for the Minimum Condition, the Termination Condition, and conditions related to the HSR Act and actions by government bodies) may be waived by Alfasigma and the Purchaser, in whole or in part at any time and from time to time, in the sole discretion of Alfasigma and the Purchaser, to the extent permitted under applicable legal requirements.

Is the Offer subject to any financing condition?

No. The Offer is not subject to any financing condition.

Is there an agreement governing the Offer?

Yes. We, Alfasigma and Intercept have entered into the Merger Agreement referred to above in “Who is offering to buy my Shares?”. The Merger Agreement provides, among other things, for the terms and conditions of the Offer and, following the Acceptance Time, the merger of the Purchaser with and into Intercept. See Section 11 — “The Merger Agreement; Other Agreements.”

Do you have the financial resources to pay for all Shares?

Yes. We estimate that we will need approximately $795 million in cash to purchase all Shares pursuant to the Offer, to pay the consideration in respect of all Shares that are not tendered and that will each be converted in the Merger into the right to receive the Offer Price (except as provided in the Merger Agreement with respect to Excluded Shares and Dissenting Shares) and to pay related fees and expenses. Alfasigma, our parent company, will provide us with sufficient funds to make such payments. Alfasigma expects to fund such payments from a combination of available cash and borrowings from existing committed corporate lines of credits, each of which is described below. No alternative financing arrangements or alternative financing plans have been made. The Offer is not subject to any financing condition. See Section 9 — “Source and Amount of Funds.”

Is your financial condition relevant to my decision to tender into the Offer?

No. We do not think that our financial condition is relevant to your decision whether to tender Shares and accept the Offer because:

•

the consummation of the Offer is not subject to any financing condition;

•

the Offer is being made for all Shares solely for cash;

•

if the Offer is consummated, we will acquire all remaining Shares in the Merger for the same cash price as was paid in the Offer (i.e., the Offer Price, subject to any applicable withholding taxes); and

•

we have all of the financial resources, including committed corporate credit lines and cash on hand, to purchase all Shares validly tendered and not properly withdrawn pursuant to the Offer and to provide funding for the Merger and related fees and expenses.

See Section 9 — “Source and Amount of Funds” and Section 11 — “The Merger Agreement; Other Agreements.”

How long do I have to decide whether to tender into the Offer?

You will be able to tender your Shares into the Offer until one (1) minute after 11:59 p.m. Eastern Time on November 7, 2023 (such date and time, the “Expiration Date”), unless (i) we extend the period during which the Offer is open pursuant to and in accordance with the terms of the Merger Agreement, in which case the term “Expiration Date” will mean the latest date and time at which the Offer, as so extended by us, will expire, or (ii) the Merger Agreement has been earlier terminated. If we extend the Offer, we will inform Computershare Trust Company, N.A., our depositary for the Offer (the “Depositary”) of that fact and will make a public announcement of the extension no later than 9:00 a.m., Eastern Time, on the next business day after the previously scheduled Expiration Date.

If you hold Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you should be aware that such institutions may establish their own earlier deadline for tendering Shares in the Offer. Accordingly, if you hold Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you should contact such institution as soon as possible in order to determine the times by which you must take action in order to tender Shares in the Offer.

If you cannot deliver everything that is required in order to make a valid tender in accordance with the terms of the Offer by the Expiration Date, you may be able to use a guaranteed delivery procedure by which a broker, a bank or any other fiduciary that is an Eligible Institution (as defined in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Signature Guarantees”) may guarantee that the missing items will be received by the Depositary within two (2) trading days of the Nasdaq Stock Market (“Nasdaq”). Please give your broker, dealer, commercial bank, trust company or other nominee instructions sufficient time to permit such nominee to tender your Shares by the Expiration Date. See Section 1 — “Terms of the Offer” and Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

Can the Offer be extended and, if so, under what circumstances can or will the Offer be extended?

Yes, the Offer can be extended. In some cases, we may be required to extend the Offer beyond the initial Expiration Date, but in no event will we (i) be required to extend the Offer beyond the earlier to occur of (x) the termination of the Merger Agreement pursuant to the terms thereof, and (y) midnight Eastern Time, on January 26, 2024 (such earlier occurrence, the “Extension Deadline”); or (ii) be permitted to extend the Offer beyond the Extension Deadline without the prior written consent of Intercept. Subject to the parties’ respective termination rights under the Merger Agreement, we will not terminate the Offer, or permit the Offer to expire, prior to the Extension Deadline without the prior written consent of Intercept.

Pursuant to the Merger Agreement, we will extend the Offer:

•

on one or more occasions, in our discretion (and without the consent of Intercept or any other person), for successive periods of up to ten (10) business days each, if, as of the then-scheduled Expiration Date, any Offer Condition is not satisfied and has not been waived by us or Alfasigma (to the extent waivable by us or Alfasigma), in order to permit the satisfaction of such Offer Condition;

•

on one or more occasions, at the request of Intercept, for successive periods of up to ten (10) business days each, if, as of the then-scheduled Expiration Date, any Offer Condition (other than the Minimum Condition) is not satisfied and has not been waived (if permitted thereunder), in order to permit the satisfaction of such Offer Condition;

•

for any period required by any legal requirement, any interpretation or position of the SEC, the staff thereof or Nasdaq applicable to the Offer;

•

for periods of up to ten (10) business days per extension, until any waiting period (and any extension thereof) applicable to the consummation of the Offer under the HSR Act and any foreign antitrust laws shall have expired or been terminated; or

•

at the request of Intercept or in our own discretion, for successive periods of up to ten (10) business days each, if, as of the then-scheduled Expiration Date, all Offer Conditions have been satisfied or waived (if permitted thereunder, and other than any such conditions of the Offer that by their nature are to be satisfied at the expiration of the Offer (provided such conditions would be capable of being satisfied or validly waived were the expiration of the Offer to occur at such time)), except that the Minimum Condition has not been satisfied as of any then-scheduled expiration of the Offer, in order to permit the satisfaction of the Minimum Condition; provided, however, that we will not be required to extend the Offer pursuant to this paragraph on more than two (2) occasions, but we may, in our sole and absolute discretion elect to do so.

For purposes of the Offer, as provided under the Securities Exchange Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the “Exchange Act”), a “business day” means any day other than a Saturday, Sunday or a U.S. federal holiday and consists of the time period from 12:01 a.m. through 12:00 midnight, Eastern Time.

If we extend the Offer, such extension will extend the time that you will have to tender your Shares. See Section 1 — “Terms of the Offer.” Each of the time periods described above is calculated in accordance with Rule 14d-1(g)(3) and Rule 14e-1(a) under the Exchange Act.

How will I be notified if the time period during which I can tender my Shares into the Offer is extended?

If we extend the Offer, we will inform the Depositary of that fact and will make a public announcement of the extension no later than 9:00 a.m., Eastern Time, on the next business day after the previously scheduled Expiration Date.

How do I tender my Shares into the Offer?

If you wish to accept the Offer, this is what you must do:

•

If you are a registered holder (i.e., you have a stock certificate or you hold Shares directly in your name in book-entry form in an account with Intercept’s transfer agent, VStock Transfer, LLC), you must complete and sign the enclosed Letter of Transmittal, in accordance with the instructions contained in the Letter of Transmittal, and send it, together with any original certificates representing your Shares and any other required documents, to the Depositary. These materials must reach the Depositary before the Expiration Date. See Section 3 — “Procedures for Accepting the Offer and Tendering Shares” for further details.

•

If you hold your Shares through a broker, dealer, commercial bank, trust company or other nominee, you must contact your broker, dealer, commercial bank, trust company or other nominee and give instructions that your Shares be tendered to the Purchaser pursuant to the Offer.

•

If you are unable to deliver any required document or instrument to the Depositary prior to the Expiration Date, you may extend the time you have to deliver such items by having a broker, a bank or any other fiduciary that is an eligible guarantor institution guarantee that the missing items will be received by the Depositary by using the enclosed notice of guaranteed delivery (the “Notice of Guaranteed Delivery”). For the tender to be valid, however, the Depositary must receive the Notice of Guaranteed Delivery prior to the Expiration Date and must then receive the missing items within two (2) Nasdaq trading days after the date of execution of such Notice of Guaranteed Delivery. See Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Guaranteed Delivery.”

Until what time may I withdraw previously tendered Shares?

To withdraw your Shares, you must deliver a written notice of withdrawal with the required information to the Depositary while you still have the right to withdraw the Shares. See Section 4 — “Withdrawal Rights.”

How do I properly withdraw previously tendered Shares?

To properly withdraw any of your previously tendered Shares, you must deliver a written notice of withdrawal with the required information (as specified in this Offer to Purchase and in the Letter of Transmittal) to the Depositary while you still have the right to withdraw Shares. If you tendered your Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct such nominee to arrange for the proper withdrawal of your Shares. See Section 4 — “Withdrawal Rights.”

Upon the successful consummation of the Offer, will Shares continue to be publicly traded?

No. Following the purchase of Shares in the Offer, we expect to consummate the Merger as soon as practicable (and in no event later than one business day) following such purchase in accordance with Section 251(h) of the DGCL, and no stockholder vote to adopt the Merger Agreement or any other action by the stockholders of Intercept will be required in connection with the Merger. Following the consummation of the Merger, no Shares will be publicly owned. If the Merger is consummated, then stockholders who did not tender their Shares into the Offer will receive the same amount of cash per Share that they would have received had they tendered their Shares into the Offer (i.e., the Offer Price, subject to any applicable withholding taxes), except as provided in the Merger Agreement with respect to Excluded Shares and Dissenting Shares. See Section 13 — “Certain Effects of the Offer” and Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights.”

If I decide not to tender my Shares into the Offer, what will happen to my Shares?

If the Offer is consummated and certain other conditions are satisfied, the Purchaser will merge with and into Intercept. At the Effective Time, each Share then issued and outstanding immediately prior to the Effective Time will be converted into the right to receive an amount in cash equal to the Offer Price (the “Merger Consideration”), subject to any applicable withholding taxes, except as provided in the Merger Agreement with respect to Excluded Shares and Dissenting Shares. Dissenting Shares will not be converted into the right to receive the Merger Consideration and will instead be entitled to seek to have a Delaware court determine the “fair value” of such Shares in accordance with the DGCL, unless such holder fails to perfect, withdraws, waives or loses the right to appraisal. In each such case, such Shares will be treated as if they had been converted at the Effective Time into the right to receive the Merger Consideration. See Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights.”

If the Offer is not consummated, will you nevertheless consummate the Merger?

No. None of us, Alfasigma or Intercept are under any obligation to pursue or consummate the Merger if the time of acceptance for payment of all Shares validly tendered (and not validly withdrawn) in the Offer pursuant to and subject to the Offer Conditions (the “Acceptance Time”) has not occurred and the Offer has not been earlier consummated. This could happen for example if the Minimum Condition has not been satisfied, the Merger Agreement has been validly terminated in accordance with its terms or one of the other Offer Conditions has not been satisfied or waived.

Will there be a subsequent offering period?

No. Pursuant to Section 251(h) of the DGCL and the obligation of us and Intercept to take all necessary actions to cause the Merger to become effective as soon as practicable following the consummation of the Offer, we expect the consummation of the Merger to occur as soon as practicable (and in no event later than one business day) following the Acceptance Time. See Section 1 — “Terms of the Offer.”

If I object to the price being offered, will I have appraisal rights?

Appraisal rights are not available to the holders of Shares in connection with the Offer. However, if the Merger is consummated, the holders of Shares immediately prior to the Effective Time who (i) did not tender their Shares in the Offer, (ii) follow the procedures set forth in Section 262 of the DGCL and (iii) do not thereafter withdraw their demand for appraisal of such Shares or otherwise lose their appraisal rights, in each case in accordance with the DGCL, will be entitled to have their Shares appraised by the Delaware Court

of Chancery and receive payment of the “fair value” of such Shares, exclusive of any element of value arising from the accomplishment or expectation of the Merger, together with a fair rate of interest, as determined by such court. The “fair value” could be higher or lower than, or the same as, the Offer Price or the consideration payable in the Merger (which is equivalent in amount to the Offer Price). See Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights.” Concurrently with the commencement of the Offer, Intercept is distributing the Schedule 14D-9, which contains important information regarding how a holder of Shares may exercise its appraisal rights.

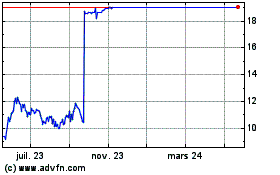

What was the market value of my Shares on recent dates and the “premium” I am receiving?

On September 25, 2023, the last full trading day prior to the day on which we announced that we entered into the Merger Agreement, the closing price of the Shares reported on Nasdaq was $10.44 per Share. The Offer Price of $19.00 per Share represents an approximate 82.0% premium to such closing price.

On October 10, 2023, the last Nasdaq trading day before we commenced the Offer, the closing price of the Shares reported on Nasdaq was $18.63 per Share.

We encourage you to obtain a recent quotation for Shares in deciding whether to tender your Shares. See Section 6 — “Price Range of Shares; Dividends.”

If I tender my Shares, when and how will I get paid?

If the conditions to the Offer described in Section 15 — “Conditions to the Offer” are satisfied or waived and we consummate the Offer and accept your Shares for payment, you will be entitled to receive promptly an amount equal to the number of Shares you tendered into the Offer multiplied by the Offer Price, subject to any applicable withholding taxes. We will pay for your validly tendered and not properly withdrawn Shares by depositing the aggregate Offer Price therefor with the Depositary, for the purpose of receiving payments from us and transmitting such payments to you. See Section 2 — “Acceptance for Payment and Payment for Shares.” In all cases, payment for tendered Shares will be made only after timely receipt by the Depositary of (i) any certificates representing such Shares, if applicable, (ii) a properly completed and duly executed Letter of Transmittal, together with any required signature guarantees or, in the case of book-entry transfer of Shares at The Depository Trust Company (“DTC”), an Agent’s Message (as defined below) in lieu of such Letter of Transmittal and delivery of Shares into the Depositary’s account at DTC, and (iii) any other required documents for such Shares, as described in Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

What will happen to my Intercept equity awards in the Offer?

Equity awards of Intercept are not sought in the Offer.

Except as otherwise agreed, at the Effective Time, each stock option to purchase Shares granted under Intercept’s equity plans (“Intercept Option”) that is outstanding and unexercised as of immediately prior to the Effective Time, whether or not vested, and which has a per Share exercise price that is less than the Merger Consideration (each, an “In the Money Option”), will be cancelled and converted into the right to receive a cash payment equal to (A) the excess of (x) the Merger Consideration over (y) the exercise price payable per Share of such In the Money Option, multiplied by (B) the total number of Shares subject to such In the Money Option immediately prior to the Effective Time, less applicable taxes required to be withheld with respect to such payment.

At the Effective Time, each Intercept Option other than an In the Money Option that is outstanding and unexercised as of immediately prior to the Effective Time, whether or not vested, shall be cancelled with no consideration payable in respect thereof.

At the Effective Time, each restricted stock unit with respect to Shares subject to performance vesting conditions granted under Intercept’s equity plans (each, an “Intercept PSU”) that is outstanding as of immediately prior to the Effective Time will be cancelled and the holder thereof will be entitled to receive a cash payment (without interest) equal to the product of the Merger Consideration and the number of Shares subject to such Intercept PSU as of immediately prior to the Effective Time based upon the actual level of

performance determined in accordance with the terms of the applicable Intercept PSU award agreement, less applicable taxes required to be withheld with respect to such payment.

At the Effective Time, each restricted stock unit with respect to Shares granted under Intercept’s equity plans, other than the Intercept PSUs, (each, an “Intercept RSU”) that is outstanding as of immediately prior to the Effective Time will be converted into the contingent right to receive a cash payment (without interest) equal to the product of the Merger Consideration and the number of Shares subject to such Intercept RSU as of immediately prior to the Effective Time, less applicable taxes required to be withheld with respect to such payment (“Intercept RSU Consideration”). Subject to the applicable holder’s continued service with Alfasigma or its affiliates after the consummation of the transaction, the Intercept RSU Consideration will vest and become payable in accordance with the vesting schedule (including any vesting acceleration provisions) that applied to the corresponding portion of the applicable Intercept RSUs immediately prior to the Effective Time. The Intercept RSU Consideration will otherwise remain subject to the same terms and conditions that are applicable to the underlying Intercept RSUs immediately prior to the Effective Time (except for terms rendered inoperative by reason of the transactions contemplated by the Merger Agreement).

See Section 11 — “The Merger Agreement; Other Agreements — The Merger Agreement — Intercept Equity Awards.”

What are the U.S. federal income tax considerations relevant to the Offer and the Merger?

The receipt of cash by you in exchange for your Shares pursuant to the Offer or the Merger will generally be a taxable transaction for U.S. federal income tax purposes. If you are a United States Holder (as defined in Section 5 — “Certain U.S. Federal Income Tax Considerations of the Offer and the Merger — United States Holders”), in general, you will recognize gain or loss in an amount equal to the difference, if any, between the amount of cash received for your Shares sold pursuant to the Offer or converted into the right to receive cash in the Merger (determined before deduction of any applicable withholding taxes) and your adjusted tax basis in such Shares. If you hold your Shares as a capital asset, the gain or loss that you recognize will be capital gain or loss and will be treated as long-term capital gain or loss if you have held such Shares for more than one (1) year. If you are a Non-United States Holder (as defined in Section 5 — “Certain U.S. Federal Income Tax Considerations of the Offer and the Merger — Non-United States Holders”), subject to the discussion in Section 3 — “Procedures for Accepting the Offer and Tendering Shares — U.S. Federal Backup Withholding” and the qualifications and limitations in Section 5 — “Certain U.S. Federal Income Tax Considerations of the Offer and the Merger,” you will generally not be subject to U.S. federal income tax on gain recognized on Shares you tender into the Offer or have converted into the right to receive cash in the Merger unless you have certain connections to the United States. You should consult your tax advisor about the particular tax considerations relevant to you of tendering your Shares into the Offer or having your Shares converted into the right to receive cash in the Merger. See Section 5 — “Certain U.S. Federal Income Tax Considerations of the Offer and the Merger” for a discussion of the U.S. federal income tax considerations relevant to tendering your Shares into the Offer or having your Shares converted into the right to receive cash in the Merger.

To whom should I talk if I have additional questions about the Offer?

You may call Georgeson LLC, the Information Agent, toll-free at 888-293-6812. See the back cover of this Offer to Purchase.

To the Holders of Shares of Common Stock of Intercept Pharmaceuticals, Inc.:

INTRODUCTION

We, Interstellar Acquisition Inc. , a Delaware corporation (the “Purchaser”) and a wholly owned subsidiary of Alfasigma S.p.A., an Italian società per azioni (joint stock company) ( “Alfasigma”), are offering to purchase all of the outstanding shares of common stock, par value $0.001 per share (the “Shares”), of Intercept Pharmaceuticals, Inc., a Delaware corporation (“Intercept”), at a price per Share of $19.00 net to the seller in cash, without interest (the “Offer Price”), subject to any applicable withholding taxes, upon the terms and subject to the conditions set forth in this offer to purchase (this “Offer to Purchase”) and the

related letter of transmittal (the “Letter of Transmittal”), which Offer to Purchase and Letter of Transmittal collectively constitute the “Offer.” We are making the Offer pursuant to an Agreement and Plan of Merger, dated as of September 26, 2023, by and among Alfasigma, the Purchaser and Intercept (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Merger Agreement”).

The Offer and withdrawal rights will expire at one (1) minute after 11:59 p.m., Eastern Time, on November 7, 2023 (such date and time, the “Expiration Date”), unless (i) we extend the period during which the Offer is open pursuant to and in accordance with the Merger Agreement, in which case the term “Expiration Date” means the latest date and time at which the Offer, as so extended by us, will expire (provided, however, our obligation to extend the Offer is limited as discussed in Section 1 — “Terms of the Offer” and Section 11 — “The Merger Agreement; Other Agreements — The Merger Agreement — Expiration and Extension of the Offer”) or (ii) the Merger Agreement has been earlier terminated. Under no circumstances will interest be paid with respect to the purchase of Shares pursuant to the Offer, regardless of any extension of the Offer or delay in making payment for Shares.

If you are an owner of Shares and you tender such Shares directly to Computershare Trust Company, N.A. (the “Depositary”) in accordance with the terms of this Offer, you will not be charged brokerage fees or commissions on the sale of Shares pursuant to the Offer.

Any tendering stockholder or other payee who fails to complete fully, sign and return to the Depositary the United States Internal Revenue Service (“IRS”) Form W-9 included with the Letter of Transmittal (or an applicable IRS Form W-8, if the tendering stockholder or other payee is a Non-United States Holder (as defined in Section 5 — “Certain U.S. Federal Income Tax Considerations of the Offer and the Merger — Non-United States Holders”)) may be subject to U.S. federal backup withholding on the gross proceeds paid to the stockholder or other payee pursuant to the Offer. See Section 3 — “Procedures for Accepting the Offer and Tendering Shares — U.S. Federal Backup Withholding.” Non-United States Holders are urged to consult their tax advisors regarding the application of U.S. federal backup withholding.

If you hold your Shares through a broker, dealer, commercial bank, trust company or other nominee, you should consult with such nominee to determine if you will be charged any service fees or commissions.

If you are unable to deliver any required document or instrument to the Depositary prior to the Expiration Date, you may gain some extra time by having a broker, a bank or any other fiduciary that is an eligible guarantor institution guarantee that the missing items will be received by the Depositary by using the enclosed notice of guaranteed delivery (the “Notice of Guaranteed Delivery”). For the tender to be valid, however, the Depositary must receive the Notice of Guaranteed Delivery prior to the Expiration Date and must then receive the missing items within two (2) Nasdaq Stock Market (“Nasdaq”) trading days after the date of execution of such Notice of Guaranteed Delivery. See Section 3 — “Procedures for Accepting the Offer and Tendering Shares — Guaranteed Delivery.”

We will pay all charges and expenses of the Depositary and Georgeson LLC (the “Information Agent”) incurred in connection with the Offer. See Section 18 — “Fees and Expenses.”

As soon as practicable (and in any event within one (1) business day) following the acceptance for payment of the Shares tendered and not properly withdrawn pursuant to the Offer representing at least such number of Shares as shall satisfy the Minimum Condition (as defined below) in accordance with the terms of the Offer and the Merger Agreement (such time of acceptance, the “Acceptance Time”), and subject to the satisfaction or waiver of certain conditions set forth in the Merger Agreement, the Purchaser will merge with and into Intercept (the “Merger”), with Intercept continuing as the surviving corporation and as a wholly owned subsidiary of Alfasigma (the “Surviving Corporation”), pursuant to the provisions of Section 251(h) of the Delaware General Corporation Law, as amended (the “DGCL”), with no stockholder approval required to consummate the Merger. The closing of the Merger will occur as soon as practicable and, in any event, no later than the first business day after the conditions set forth in the Merger Agreement are satisfied or waived, unless another date is agreed to by the parties.

Each Share issued and outstanding immediately prior to the effective time of the Merger (the “Effective Time”), except for Shares (i) held by Alfasigma, the Purchaser or any of their direct or indirect wholly owned subsidiaries (including, for the avoidance of doubt, any Shares acquired by the Purchaser in the Offer) or by Intercept (the “Excluded Shares”), or (ii) in respect of which appraisal rights were perfected in accordance

with Section 262 of the DGCL (the “Dissenting Shares”), will be automatically converted into the right to receive cash in an amount equal to the Offer Price (the “Merger Consideration”), subject to any applicable withholding taxes. See Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights.”

The Board of Directors of Intercept has:

•

determined that the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, are fair to, and in the best interests of, Intercept and its stockholders;

•

declared it advisable for Intercept to enter into the Merger Agreement;

•

approved the execution, delivery and performance by Intercept of the Merger Agreement and the consummation of the transactions contemplated thereby, including the Offer and the Merger;

•

agreed that the Merger shall be effected under Section 251(h) of the DGCL; and

•

agreed to recommend that Intercept’s stockholders accept the Offer and tender their Shares to the Purchaser pursuant to the Offer (collectively, the “Company Board Recommendation”).

A more complete description of the reasons of the Board of Directors of Intercept for authorizing and approving the Merger Agreement and the transactions contemplated thereby, including the Offer and the Merger, is set forth in the Schedule 14D-9 that is being filed by Intercept with the United States Securities and Exchange Commission (the “SEC”) and mailed to Intercept’s stockholders with this Offer to Purchase. Stockholders should carefully read the information set forth in the Schedule 14D-9 in its entirety.

The Offer is not subject to us or Alfasigma receiving financing or any other financing condition. The Offer is conditioned upon the following conditions (collectively, the “Offer Conditions”):

•

there shall have been validly tendered (and not validly withdrawn) Shares that, considered together with all other Shares (if any) beneficially owned by Alfasigma and its affiliates, represent one (1) more Share than 50% of the total number of Shares outstanding at the time of the expiration of the Offer (excluding Shares tendered in the Offer pursuant to guaranteed delivery procedures that have not yet been received in settlement or satisfaction of such guarantee) (the “Minimum Condition”);

•

the Merger Agreement shall not have been validly terminated in accordance with its terms (the “Termination Condition”);

•

any waiting period (or any extension thereof) applicable to the Offer under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”) shall have expired or been terminated;

•

no governmental body of competent jurisdiction in a jurisdiction where either Alfasigma or Intercept operates their respective business or owns any material assets shall have issued, promulgated, enacted or deemed applicable to the Merger or the Offer any order, injunction, decree, ruling or other legal requirement (whether temporary, preliminary or permanent) or taken any other action, in each case restraining, enjoining, making illegal or otherwise prohibiting the consummation of the Merger or the Offer, which order, injunction, decree, ruling, or other legal requirement or action remains in effect;

•

the receipt of correspondence from the FDA acknowledging that Intercept’s proposed revised milestone for certain postmarketing requirements will be December 2023, which correspondence has been received; and

•

the satisfaction or waiver by the Purchaser of the other conditions and requirements of the Offer set forth in the Merger Agreement and described in Section 15 — “Conditions to the Offer.” See Section 15 — “Conditions to the Offer” and Section 17 — “Certain Legal Matters; Regulatory Approvals.”

According to Intercept, as of the close of business on October 3, 2023: there were 41,814,336 Shares issued and outstanding.

No appraisal rights are available to the holders of Shares in connection with the Offer. However, if the Merger is consummated, the holders of Shares immediately prior to the Effective Time who (i) did not tender

their Shares in the Offer, (ii) follow the procedures set forth in Section 262 of the DGCL and (iii) do not thereafter withdraw their demand for appraisal of such Shares or otherwise lose their appraisal rights, in each case in accordance with the DGCL, will be entitled to have their Shares appraised by the Delaware Court of Chancery and receive payment of the “fair value” of such Shares, exclusive of any element of value arising from the accomplishment or expectation of the Merger, together with a fair rate of interest, as determined by such court. The “fair value” could be higher or lower than, or the same as, the Offer Price or the consideration payable in the Merger (which is equivalent in amount to the Offer Price). See Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights.”

THIS OFFER TO PURCHASE AND THE RELATED LETTER OF TRANSMITTAL CONTAIN IMPORTANT INFORMATION, AND STOCKHOLDERS OF INTERCEPT SHOULD CAREFULLY READ BOTH IN THEIR ENTIRETY BEFORE MAKING ANY DECISION WITH RESPECT TO THE OFFER.

THE TENDER OFFER

1.

Terms of the Offer.

Upon the terms and subject to the conditions to the Offer, we will accept for payment and pay for all Shares validly tendered and not properly withdrawn prior to the Expiration Date in accordance with the procedures set forth in Section 4 — “Withdrawal Rights.”

The Offer is not subject to any financing condition. The Offer is conditioned upon the Minimum Condition, the Termination Condition and the other Offer Conditions described in Section 15 — “Conditions to the Offer.”

We expressly reserve the right, to the extent permitted by the applicable legal requirements, (i) to increase the Offer Price, (ii) waive any Offer Condition, and (iii) make any other changes in the terms and conditions of the Offer not inconsistent with the terms of the Merger Agreement; except that, unless previously approved by Intercept in writing, neither we nor Alfasigma will (A) decrease the Offer Price (other than for an adjustment pursuant to the Merger Agreement), (B) change the form of consideration payable in the Offer, (C) decrease the maximum number of Shares to be purchased in the Offer, (D) impose conditions or requirements to the Offer in addition to the Offer Conditions described in Section 15 — “Conditions to the Offer,” (E) amend, modify or waive the Minimum Condition, Termination Condition or the conditions set forth in the Merger Agreement relating to the expiry of the HSR waiting period and the absence of governmental action opposing the transaction, (F) otherwise amend or modify any of the other terms of the Offer in a manner that would adversely affect any holder of Shares in its capacity as such, (G) terminate the Offer or accelerate, extend or otherwise change the expiration date of the Offer, except as otherwise provided in the Merger Agreement, or (H) provide any “subsequent offering period” (or any extension thereof) within the meaning of Rule 14d-11 promulgated under the Exchange Act.

As soon as practicable (and in any event within one (1) business day) following the Acceptance Time, and subject to the satisfaction or waiver of certain conditions set forth in the Merger Agreement, the Purchaser will merge with and into Intercept, with Intercept continuing as the Surviving Corporation, pursuant to the provisions of Section 251(h) of the DGCL, with no stockholder approval required to consummate the Merger. The closing of the Merger will occur as soon as practicable and, in any event, no later than the first business day after the conditions set forth in the Merger Agreement are satisfied or waived, unless another date is agreed to by the parties. There will not be a subsequent offering period.

Each Share issued and outstanding immediately prior to the Effective Time, other than the Excluded Shares and the Dissenting Shares, will be automatically converted into the right to receive the Merger Consideration. See Section 17 — “Certain Legal Matters; Regulatory Approvals — Appraisal Rights.”

Pursuant to the Merger Agreement, we will extend the Offer (i) on one or more occasions, at our discretion (and without the consent of Intercept or any other person), for successive periods of up to ten (10) business days each, if, as of the then-scheduled Expiration Date, any Offer Condition is not satisfied and has not been waived by us or Alfasigma (to the extent waivable by us or Alfasigma), in order to permit the satisfaction of such Offer Condition; (ii) on one or more occasions, at the request of Intercept, for successive

periods of up to ten (10) business days each, if, as of the then-scheduled Expiration Date, any Offer Condition (other than the Minimum Condition) is not satisfied and has not been waived (if permitted thereunder), in order to permit the satisfaction of such Offer Condition; (iii) for any period required by any legal requirement, any interpretation or position of the SEC, the staff thereof or Nasdaq applicable to the Offer; (iv) for periods of up to ten (10) business days per extension, until any waiting period (and any extension thereof) applicable to the consummation of the Offer under the HSR Act and any foreign antitrust or competition-related legal requirement shall have expired or been terminated, and all necessary approvals shall have been obtained; and (v) at the request of Intercept or in our own discretion, for successive periods of ten (10) business days each, if, as of the then-scheduled Expiration Date, all conditions of the Offer have been satisfied or waived (if permitted thereunder, and other than any such conditions of the Offer that by their nature are to be satisfied at the expiration of the Offer (provided such conditions would be capable of being satisfied or validly waived were the expiration of the Offer to occur at such time)), except that the Minimum Condition has not been satisfied as of any then-scheduled Expiration Date, in order to permit the satisfaction of the Minimum Condition, it being understood and agreed that we will not be required to extend the Offer pursuant to this paragraph on more than two (2) occasions, but we may, in our sole and absolute discretion elect to do so. Our obligation to extend the Offer is further limited as set forth below in this Section 1 and in Section 11 — “The Merger Agreement; Other Agreements — The Merger Agreement — Expiration and Extension of the Offer.”

For purposes of the Offer, as provided under the Securities Exchange Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the “Exchange Act”), a “business day” means any day other than a Saturday, Sunday or a U.S. federal holiday and consists of the time period from 12:01 a.m. through 12:00 midnight, Eastern Time.

If we extend the Offer, delay our acceptance for payment of Shares, delay payment after the consummation of the Offer or are unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to our rights under the Offer, the Depositary may retain tendered Shares on our behalf, and such Shares may not be withdrawn except to the extent that tendering stockholders are entitled to withdrawal rights as described in this Offer to Purchase under Section 4 — “Withdrawal Rights.” However, our ability to delay the payment for Shares that we have accepted for payment is limited by Rule 14e-1(c) under the Exchange Act, which requires us to pay promptly the consideration offered or return the securities deposited by or on behalf of stockholders after the termination or withdrawal of the Offer.

If we make a material change in the terms of the Offer or the information concerning the Offer or if we waive a material condition of the Offer, we will disseminate additional tender offer materials and extend the Offer if and to the extent required by Rules 14d-4(d)(1), 14d-6(c) and 14e-1 under the Exchange Act and the interpretations thereunder. The minimum period during which an offer must remain open following material changes in the terms of an offer or information concerning an offer, other than a change in price or a change in percentage of securities sought, will depend upon the facts and circumstances, including the relative materiality of the terms or information changes and the appropriate manner of dissemination. The SEC has stated that, in its view, an offer should remain open for a minimum of five (5) business days from the date the material change is first published, sent or given to stockholders, and that if material changes are made with respect to information that approaches the significance of price and the percentage of securities sought, a minimum period of ten (10) business days may be required to allow for adequate dissemination to stockholders and investor response. In accordance with the foregoing view of the SEC and applicable law, if, prior to the Expiration Date, and subject to the limitations of the Merger Agreement, we change the number of Shares being sought or the consideration offered pursuant to the Offer, and if the Offer is scheduled to expire at any time earlier than the tenth (10th) business day from the date that notice of such change is first published, sent or given to stockholders, the Offer will be extended at least until the expiration of such tenth (10th) business day. Each of the time periods described in this paragraph is calculated in accordance with Rule 14d-1(g)(3) under the Exchange Act.

If, prior to the Expiration Date, we increase the consideration being paid for Shares, such altered consideration will be paid to all stockholders whose Shares are purchased in the Offer, whether or not such Shares were tendered before the announcement of such increase in consideration.

Any extension, delay, termination, waiver or amendment of the Offer will be followed as soon as practicable by public announcement thereof. In the case of an extension of the Offer, such announcement will be made no later than 9:00 a.m., Eastern Time, on the next business day after the previously scheduled Expiration Date. Subject to applicable law (including Rules 14d-4(d), 14d-6(c) and 14e-1 under the Exchange Act, which require that material changes be promptly disseminated to stockholders in a manner reasonably designed to inform them of such changes) and without limiting the manner in which we may choose to make any public announcement, we will have no obligation to publish, advertise or otherwise communicate any such public announcement other than by issuing a press release to a national news service.