0001176309

false

0001176309

2023-08-04

2023-08-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 4, 2023

ORAMED PHARMACEUTICALS INC.

(Exact name of registrant

as specified in its charter)

| delaware |

|

001-35813 |

|

98-0376008 |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

| 1185 Avenue of the Americas, Third Floor, New York, New York |

|

10036 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

844-967-2633

(Registrant’s telephone number, including

area code)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.012 |

|

ORMP |

|

The

Nasdaq Capital Market,

Tel

Aviv Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

Share Purchase Term Sheet

On August 4, 2023, Oramed

Pharmaceuticals Inc., a Delaware corporation (the “Company”), entered into a non-binding term sheet (the “Term Sheet”)

with Sorrento Therapeutics, Inc., a Delaware corporation (the “Seller”), which contemplates that, subject to the terms and

conditions set forth in the Term Sheet, the Company would acquire certain securities of Scilex Holding Company (“Scilex”)

owned by the Seller, including (A) 59,726,737 shares of common stock of Scilex; provided, that the Seller will provide the Company an

option to purchase up to 2,259,058 additional shares of common stock of Scilex, which the Seller is currently holding in abeyance on behalf

of certain warrantholders of the Seller (the “Option Shares”), at an exercise price of $1.13 per Option Share, at such time(s)

as such Option Shares become transferable; (B) 29,057,096 shares of Series A preferred stock of Scilex, which shares constitute one fewer

than all of the issued and outstanding Series A preferred stock of the Scilex; and (C) warrants exercisable for 1,386,617 shares of common

stock of Scilex in respect of public warrants, and warrants exercisable for 3,104,000 shares of common stock of Scilex in respect of private

placement warrants (collectively, the “Purchased Securities”) (such acquisition of the Purchased Securities, the “Transaction”)

for a total purchase price of $105,000,000 (excluding any additional amounts paid by the Company in the future in respect of Option Shares).

The consideration for the Transaction shall consist of a credit bid by the Company on a dollar-for-dollar basis of the full amount of

outstanding obligations as of the closing date under the Replacement DIP Facility (as defined below, and which is between the Company

and the Seller and its affiliated debtor), with the remaining balance of the purchase price to be paid in cash by the Company to the Seller.

The Term Sheet further provides

that the Company and the Seller will use reasonable best efforts to negotiate in good faith and execute the Definitive Documentation (as

defined below) by August 8, 2023 containing terms consistent with the terms of the Term Sheet and other customary terms and conditions

for transactions of this nature. The Definitive Documentation shall provide for, among other things, as conditions to closing, the amendment

of Scilex’s governance documents, the grant of an irrevocable proxy and call option (with an exercise price of $1) with respect

to the remaining shares of Scilex Series A preferred stock retained by the Seller (or Seller shall have deposited such remaining preferred

share in a voting trust and named the Company as the trustee of such trust), and the grant of all of the Seller’s rights (pursuant

to a certain stockholder agreement) with respect to the Series A preferred stock of Scilex to the Company. The Term Sheet is non-binding

and consummation of the Transaction is subject to a number of contingencies including, among other things, the negotiation, execution

and consummation of final definitive documentation (the “Definitive Documentation”).

The Seller and its wholly-owned

direct subsidiary, Scintilla Pharmaceuticals, Inc. (together with the Seller, the “Debtors”) are Debtors in Chapter 11 bankruptcy

proceedings pending before the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”)

which commenced on February 13, 2023. Subject to the approval of the Bankruptcy Court, the Term Sheet provides for the Company to be designated

as the “stalking horse” bidder, providing the Company with rights to a break-up fee in the amount of $3,412,500 and expense

reimbursement of certain costs and expenses up to $1,000,000 for outside counsel if certain conditions are met (to the extent such costs

and expenses are not paid under the Replacement DIP Facility). The Transaction will be conducted through a Bankruptcy Court-supervised

process pursuant to Bankruptcy Court-approved bidding procedures and is subject to the receipt of higher or otherwise better offers from

competing bidders at an auction (at which the Company may increase the total purchase price for the Transaction), approval of the sale

by the Bankruptcy Court, and the satisfaction of certain closing conditions. Accordingly, the Company can give no assurances of the outcome

of the Transaction and whether the Company will be successful in acquiring the Purchased Securities pursuant to the Term Sheet.

DIP Financing

The Term Sheet also contemplates

that the Company will provide a non-amortizing super-priority debtor-in-possession term loan financing facility in an aggregate principal

amount of $100 million (the “Replacement DIP Facility”), which shall be subject to definitive documentation. The Replacement

DIP Facility proceeds will be used (i) to refinance and pay in full the approximately $82 million of obligations outstanding under the

Seller’s Senior Secured, Super-Priority Debtor-in-Possession Loan and Security Agreement (the “Existing DIP Facility”),

approved by the Bankruptcy Court pursuant to its Final Order (I) Authorizing the Debtors to (A) Obtain Senior Secured Superpriority Postpetition

Financing and (B) Use Cash Collateral, (II) Granting Liens and Providing Claims with Superpriority Administrative Expense Status, (III)

Modifying the Automatic Stay, and (IV) Granting Related Relief, dated March 30, 2023, and (ii) for working capital and other general corporate

purposes of the Debtors (subject to the budgets contemplated in connection with the Replacement DIP Facility), and the payment of certain

fees, expenses, and other amounts payable under the Replacement DIP Facility. The Replacement DIP Facility is expected to be provided

on substantially the same terms and conditions as those of the Existing DIP Facility, subject to, among other things, (a) mutually agreed-upon

permitted asset sales from the DIP Collateral (as defined in the Existing DIP Facility), the proceeds of such asset sales to be included

in the Replacement DIP Facility collateral package; (b) agreed-upon “stalking horse” bidder protections mentioned above; (c)

agreed-upon milestones and other deadlines for, among other things, the auction, the sale hearing and the outside date for consummation

of the Transaction; (d) agreed-upon documentation for the Replacement DIP Facility; (e) an acceptable DIP budget; and (f) entry of an

order (in form and substance acceptable to the Company) of the Bankruptcy Court approving the Replacement DIP Facility and “stalking

horse” bidder protections, which order shall provide, among other things, the Company with the unqualified right to credit bid the

obligations under the Replacement DIP Facility. On August 4, 2023, the Seller filed a motion (the “DIP Motion”) with the Bankruptcy

Court, seeking, among other things, approval of the Replacement DIP Facility, entry into the Definitive Documentation, and the “stalking

horse” bidder protections. The Bankruptcy Court is expected to consider the DIP Motion at a hearing scheduled on August 7, 2023.

H.C. Wainwright & Co., LLC is acting as exclusive financial advisor to Oramed in connection with the Transaction.

Exit Financing

In addition, the Term Sheet

contemplates that the Company shall engage an advisor to structure and arrange financing for the Seller’s post-emergence business

in the form of senior secured convertible debt and/or additional securities in the principal amount of approximately $115 million (the

“Exit Financing”). The Term Sheet further provides that the Seller, Scilex and the Company will consent to the roll over by

Seller of Scilex’s junior secured super-priority post-petition financing to the Seller in connection with the Exit Financing (subject

to any fiduciary duty or other limitations under applicable law).

The foregoing summary of the

Term Sheet is not complete and is qualified in its entirety by reference to the full text of the Term Sheet, a copy of which is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking

Statements

This Current Report on Form

8-K may contain forward-looking statements, which may generally be identified by the use of the words “anticipates,” “expects,”

“intends,” “plans,” “should,” “could,” “would,” “may,” “will,”

“believes,” “estimates,” “potential,” “target,” or “continue” and variations

or similar expressions. These statements are based upon the current expectations and beliefs of management and are subject to certain

risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These

risks and uncertainties include, but are not limited to, risks and uncertainties discussed in the Company’s most recent annual or

quarterly report and detailed from time to time in the Company’s other filings with the Securities and Exchange Commission, which

factors are incorporated herein by reference and the following factors: the occurrence of any event, change or other circumstances that

could give rise to the termination of the Term Sheet by either the Company or the Seller; the possibility that the Company and the Seller

are not able to agree on terms with respect to the Definitive Documentation; the outcome and timing of the Seller’s Chapter 11 process

and approval of the Transaction and the Replacement DIP Facility by the Bankruptcy Court; the possibility that the anticipated benefits

of the Transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the Company’s

purchase of the Purchased Securities; the possibility that the Transaction may be more expensive to complete than anticipated; diversion

of management’s attention from ongoing business operations and opportunities; and exposure to potential litigation. In addition,

certain material factors and assumptions have been applied in making these forward-looking statements, including that the risks and uncertainties

outlined above will not cause actual results or events to differ materially from those described in these forward-looking statements.

The Company believes that the material factors and assumptions reflected in these forward-looking statements are reasonable, but readers

are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of

the date hereof. The Company undertakes no obligation to update any of these forward-looking statements to reflect events or circumstances

after the date hereof or to reflect actual outcomes, unless required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ORAMED PHARMACEUTICALS INC. |

| |

|

| |

By: |

/s/ Nadav Kidron |

| |

Name: |

Nadav Kidron |

| |

Title: |

President and CEO |

August 7, 2023

3

Exhibit 99.1

Execution Version

Stalking

Horse Stock Purchase Term Sheet

|

This

term sheet (this “Stalking Horse Term Sheet”) sets forth the principal terms of a proposed equity sale transaction

(the “Sale”) between the parties described herein. Consummation of the Sale is subject to (i) final definitive documentation

to be negotiated in good faith between the parties, (ii) the satisfaction or waiver of the Closing Conditions set forth below, and (iii)

authorization and approval by the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”).

This Stalking Horse Term Sheet is solely for discussion purposes and does not purport to summarize all of the terms, conditions, covenants,

representations, warranties and other provisions which would be contained in the definitive documentation for the transactions described

herein.

|

| Seller |

Sorrento

Therapeutics, Inc. (“Seller”)

|

| Purchaser

|

Oramed

Pharmaceuticals Inc. (“Purchaser”)

|

Company

|

Scilex

Holding Company (together with its subsidiaries, the “Company”)

|

| Transaction

Form |

The

Sale will be structured through a section 363 sale in Seller’s chapter 11 bankruptcy proceedings (the “Chapter 11

Case”) commenced by the Seller under chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”)

in the Bankruptcy Court.

|

| DIP

Financing; Purchase Price |

Subject

to the entry of the Stalking Horse Protections Order, Purchaser will provide debtor-in-possession financing to facilitate the Sale

and to refinance the Senior Secured Superpriority Postpetition Financing of $82 million original principal amount (the “Existing

DIP Facility”), on terms substantially similar to the Existing DIP Facility approved pursuant to the order at ECF No. 324,

in the principal amount of up to $100 million (the “Replacement DIP Facility”).

The

consideration for the Purchased Securities shall be $105 million (the “Purchase Price”), which shall consist of

(i) a credit bid on a dollar-for-dollar basis in respect of the full amount of outstanding obligations as of the Closing Date (to

be defined in the Stalking Horse SPA) under the Replacement DIP Facility, and (ii) the remaining balance to be paid in cash to the

Seller.

|

| Purchased

Securities |

The

“Purchased Securities” shall consist of: (i) 59,726,737 shares of common stock of the Company; (ii) 29,057,096

shares of Series A preferred stock of the Company, which shares of Series A preferred stock of the Company constitute one fewer than

all of the issued and outstanding preferred stock of the Company; and (iii) warrants exercisable for 1,386,617 shares of common stock

of the Company in respect of Public Warrants, and warrants exercisable for 3,104,000 shares of common stock of the Company in respect

of Private Placement Warrants (each as defined in the latest publicly filed Annual Report on Form 10-K of the Company)).

The

59,726,737 shares of common stock of the Company referred to above and the Option Shares (as defined below) constitute all the shares

of common stock of the Company owned by Seller.

Notwithstanding

anything to the contrary in this Stalking Horse Term Sheet, the amount of Purchased Securities, Option Shares and dollar amounts

per share shall be appropriately adjusted in the event of any stock split, dividend, stock combination, reclassification or similar

transaction occurring prior to the Closing Date.

|

| Option

Securities |

In

the Stalking Horse SPA (as defined below) Seller will grant to the Purchaser a call option to purchase all or part of the 2,259,058

shares of common stock of the Company which Seller is currently holding in abeyance on behalf of certain warrantholders of Seller

(the “Option Shares”). Such option will be exercisable for a period of 30 days after Seller notifies Purchaser

that Seller no longer holds all or part of such Option Shares in abeyance and can freely transfer such Option Shares to Purchaser.

The exercise price per Option Share payable by Purchaser in connection with the exercise of such option shall be $1.13 per Option

Share.

|

| Exit

Financing |

Purchaser

has engaged H.C. Wainwright & Co. as financial and capital markets advisor to advise the Purchaser in the Sale and to assist

in structuring and arranging financing for Seller’s post-emergence business, on a best efforts basis, in the form of senior

secured convertible debt and/or additional securities in the amount of approximately $115 million (the “Exit Financing”). Seller,

Company and Purchaser will consent to the roll over by the Company of its Junior Secured Superpriority Postpetition Financing to

Seller in connection with the Exit Financing (subject to any fiduciary duty or other limitations under applicable law). |

| Closing Conditions | The closing of the Sale shall be subject to the following conditions (the “Closing Conditions”) that shall be set forth in the Stock Purchase Agreement to be finalized between the parties (the “Stalking Horse SPA”): |

| |

(i) |

the

representations and warranties of Seller and Purchaser contained in the Stalking Horse SPA (disregarding for these purposes any exception

in such representations and warranties relating to materiality or a Material Adverse Effect) shall be true and correct in all material

respects as of the date of the Stalking Horse SPA and on and as of the Closing Date as though such representations and warranties

were made at and as of the Closing Date (except for those representations and warranties which address matters only as of an earlier

date in which case such representation or warranty shall have been true and correct as of such earlier date); |

| |

|

|

| |

(ii) |

Seller

and Purchaser shall have performed and complied in all material respects with all agreements and covenants contained in the Stalking

Horse SPA which are required to be performed or complied with prior to or on the Closing Date; |

| |

|

|

| |

(iii) |

Seller

and Purchaser shall have each furnished a certificate signed by an authorized representative, in his or her capacity as such and

not in his or her individual capacity, and dated as of the Closing Date, to the effect that the conditions set forth in clauses

(i) and (ii) above have been satisfied in respect of such party; |

| |

|

|

| |

(iv) |

Seller

shall have delivered a stock transfer power of attorney duly executed by Seller and any other instruments of transfer necessary to

effect the Sale; |

| |

|

|

| |

(v) |

no

temporary restraining order, preliminary or permanent injunction or other order issued by any governmental authority preventing consummation

of the Sale shall be in effect; |

| |

|

|

| |

(vi) |

no

law shall be in effect which prohibits the transactions contemplated by the Sale; |

| |

|

|

| |

(vii) |

no

Event of Default shall have occurred under the Replacement DIP Facility or the order of the Bankruptcy Court approving the Replacement

DIP Facility (the “DIP Order”); |

| |

|

|

| |

(viii) |

no

“change in control” provision or other adverse effect shall have been triggered under any material contracts of the Company

filed by the Company pursuant to Exhibit 10, as specified in Regulation S-K Item 601(b)(10), with its annual report on Form 10-K

for the fiscal year ended December 31, 2022, or any subsequent current report on Form 8-K or any quarterly report on Form 10-Q filed

prior to the date hereof, with the SEC, to which the Company is a party (a “Material Contract”) as a result of

the Sale or the transactions contemplated hereby, other than in respect of the Yorkville convertible debenture or any publicly filed

equity plans of the Company; |

| |

(ix) |

no

Material Adverse Effect (to be defined in the Stalking Horse SPA) or Trigger Event (as defined in the Restated Certificate of Incorporation

of the Company) shall have occurred; |

| |

|

|

| |

(x) |

the

Bankruptcy Court shall have entered the Sale Order, which shall be a final order reasonably satisfactory to Seller and Purchaser; |

| |

|

|

| |

(xi) |

all

HSR filing and waiting periods applicable to the Sale shall have expired or been terminated; |

| |

|

|

| |

(xii) |

all

other governmental and regulatory approvals, if any, shall have been obtained; |

| |

|

|

| |

(xiii) |

the

Purchaser and the Company shall have entered into a new Registration Rights Agreement that provides to Purchaser the same piggyback

and demand registration rights as those currently provided to Seller by the Company pursuant to that certain Amended and Restated

Registration Rights Agreement dated as of November 10, 2022, among the Company, Seller and others; |

| |

|

|

| |

(xiv) |

prior

to the occurrence of a Trigger Event, the Company’s board of directors shall have approved, declared advisable and submitted

to Seller, in its capacity as a stockholder of the Company, for adoption thereby, an amended and restated certificate of incorporation

(the “Revised COI”) and shall have approved, subject to the effectiveness of the Revised COI, amended and restated

bylaws of the Company (the “Revised By-Laws”), which Revised COI and Revised By-laws shall make all substantive

changes as are necessary to change all references to Seller to references to Purchaser; |

| |

|

|

| |

(xv) |

prior

to the occurrence of a Trigger Event, the Seller shall have adopted the Revised COI in its capacity as stockholder of the Company,

it being understood that the filing and effectiveness thereof will be subject only to expiry of the period set forth in 17 CFR 240.14c-2(b); |

| |

|

|

| |

(xvi) |

Seller

shall have granted Purchaser an irrevocable proxy and call option (with an exercise price of $1) over the Remaining Preferred Share

(or shall have deposited the Remaining Preferred Share in a voting trust and named Purchaser as the trustee of such trust), and all

the rights of the Seller and/or the Remaining Preferred Share under that certain Stockholder Agreement, dated as of September 12,

2022 (the “Stockholder Agreement”), between the Company and Seller, shall be assigned to and vested in the Purchaser,

in form and substance reasonably acceptable to Purchaser; |

| |

(xvii) |

the

Board of Directors of the Company shall have approved the Sale and shall have taken all action necessary to render inapplicable to

Purchaser any “business combination,” “control share acquisition,” “fair price,” “moratorium”

or other takeover or anti-takeover statute or similar law, rule or regulation, or any similar anti-takeover provision under the Company’s

organizational documents; |

| |

|

|

| |

(xviii) |

the

Company shall not have a rights plan, “poison pill” or other comparable agreement that has the effect of preventing the

Sale or preventing or materially interfering with Purchaser’s ability to exercise any of its rights provided for in the Stockholder

Agreement, the Revised Charter or the Revised By-Laws; and |

| |

|

|

| |

(xix) |

the

Purchased Securities shall represent at least a majority in voting power of the outstanding shares of capital stock of the Company

entitled to vote generally in an election of directors (not including any shares of capital stock issuable upon exercise of any options,

warrants or other rights to purchase stock or upon the conversion or exchange of any securities convertible into stock). |

| Representations

& Warranties |

Seller

will provide customary representations and warranties in the context of a section 363 sale of equity of a non-wholly owned, publicly

traded U.S. corporation in which a seller has the right to appoint all the directors of such publicly traded U.S. corporation to

be set forth in the Stalking Horse SPA (including certain representations and warranties relating to the business and operations

of the Company), it being understood that such representations and warranties shall not survive the Closing Date. Those representations

and warranties that relate to the business and operations of the Company shall be either (a) limited to the actual knowledge of Seller’s

Chief Restructuring Officer, without the need for further inquiry, or (b) qualified by Material Adverse Effect. |

| |

|

| |

The representations

and warranties in the Stalking Horse SPA shall include, without limitation: (i) capitalization, (ii) title to Purchased Securities,

(iii) no Material Contracts or other arrangements relating to the Company’s business shall be subject to termination or adverse

change in the terms thereof as a result of the Sale, (iv) pending and threatened legal proceedings, (v) compliance with laws (including

SEC, Nasdaq, and other applicable regulations), (vi) absence of certain developments, (vii) financial statements, (viii) intellectual

property, (ix) data privacy, (x) benefit plans, (xi) health care regulatory matters, (xii) affiliated transactions, and (xiii) taxes.

|

|

Purchaser

will provide customary representations, including, without limitation, investment representations and a customary “big boy”

representation, it being understood that such representations and warranties shall not survive the Closing Date. |

| |

|

| Covenants |

Seller

will make customary and other negative and interim operating covenants regarding the Purchased Securities and the exercise of its

rights with respect thereto. Seller and Purchaser will make customary covenants in the context of transactions of this nature concerning:

(i) commercially reasonable efforts to provide Purchaser access to the Company’s financial and operating data, and access to

the personnel, facilities, books, contracts and records of the Company prior to the closing of the Sale; (ii) reasonable efforts

to obtain approval of the Sale Motion and other case management undertakings, (iii) commercially reasonable efforts to obtain the

necessary consents and authorizations to consummate the Sale transactions (including HSR approvals) and to prepare any necessary

SEC filings in respect thereof, (iv) notice of certain events impacting the parties’ ability to consummate the Sale, (v) restrictions

on Seller’s post-closing use of Company names or marks, (v) tax matters, and (vi) the continuation (as requested by Purchaser)

of certain services currently provided by Seller to the Company for a period following the Closing, not to exceed 90 days, on the

same terms and conditions (including cost) as is currently provided. Seller will be required to make covenants in respect of the

conduct of the Company’s business to the extent such conduct is within Seller’s control. |

| |

|

| |

In

addition, promptly after the execution of the Stalking Horse SPA, Seller shall use its reasonable best efforts to cause the Company

to take such actions as are reasonably necessary to cause satisfaction of the Closing Conditions. |

| Termination Rights |

The following termination rights will be set forth in the Stalking Horse SPA: |

| |

(i) |

by

the mutual written consent of Seller and Purchaser; |

| |

|

|

| |

(ii) |

by

Seller or Purchaser if the other party fails to comply in any material respect with any of its covenants or agreements, or breaches

its representations and warranties in any material respect, and such failure or breach is not capable of being cured or, if capable

of being cured, is not cured within ten (10) business days of the receipt of written notice of such failure or breach from the non-breaching

party; |

| |

|

|

| |

(iii) |

by

the Seller or the Purchaser if a court of competent jurisdiction or other governmental authority shall have issued a final, non-appealable

order, decree or ruling or taken any other action, which permanently restrains, enjoins or otherwise prohibits the Sale; |

| |

|

|

| |

(iv) |

by

the Purchaser if the Stalking Horse Protections Order (as defined below) has not been entered by the Bankruptcy Court by August 8,

2023; |

| |

|

|

| |

(v) |

by

the Purchaser if (i) the auction has not commenced on or before August 14, 2023, or (ii) the Sale Order (as defined below) has not

been entered by the Bankruptcy Court by August 17, 2023; |

| |

|

|

| |

(vi) |

automatically

if the Seller agrees to, closes or consummates an Alternative Transaction (being a sale of any portion of the Purchased Securities

to a party other than Purchaser or its affiliate(s)); |

| |

|

|

| |

(vii) |

automatically

if the Seller (i) withdraws, or seeks to withdraw, the Sale Motion, or (ii) announces or files a chapter 11 plan or other transaction,

or seeks to file a chapter 11 plan or other transaction, contemplating reorganization or sale of the Purchased Securities that does

not comply with the terms and conditions of the Stalking Horse SPA; |

| |

|

|

| |

(viii) |

by

the Purchaser if, as a result of an Order of the Bankruptcy Court, the Chapter 11 Case is converted to chapter 7 and a chapter 7

trustee is appointed with respect to Seller; |

| |

|

|

| |

(ix) |

by

the Seller or the Purchaser if the Closing Date has not occurred by 5:00 p.m. ET on September 30, 2023, unless the party seeking

termination is in breach of any of its representations, warranties, covenants or agreements contained herein or in the Bid Procedures

Order, the Stalking Horse Protections Order, or the Sale Order; or |

| |

|

|

| |

(x) |

by

Purchaser, if for any reason Seller materially breaches the Replacement DIP Facility (subject to any applicable cure or grace periods

thereunder) or Purchaser is unable, pursuant to Bankruptcy Code section 363(k), to credit bid in payment of all or any portion of

the Replacement DIP Facility; |

| Tax Treatment |

Seller and Purchaser acknowledge that time is of the essence and agree to cooperate in good faith to explore a structure for the Sale that is tax efficient for both Seller and Purchaser. |

| Definitive

Documents |

The

Purchased Securities shall be sold and transferred to Purchaser free and clear of all liens, claims, interests, encumbrances and

liabilities in accordance with the terms of the Stalking Horse SPA (other than such liens, claims, interests, encumbrances and liabilities

that exist pursuant to applicable securities laws). The Stalking Horse SPA and such other definitive documents for the acquisition

of the Purchased Securities as the Seller and Purchaser mutually agree upon (collectively, the “Definitive Documents”)

shall memorialize this Stalking Horse Term Sheet and contain such representations, warranties, covenants, and other terms as set

forth herein and as otherwise acceptable to the Seller and Purchaser. |

| |

|

| |

The

signing of the Definitive Documents will be subject to, among other things, the negotiation by the Seller and Purchaser of acceptable

terms and conditions for the Definitive Documents. Seller and Purchaser shall use reasonable best efforts to negotiate in good faith

and execute the Definitive Documents in accordance with this Stalking Horse Term Sheet. In the event of any inconsistency between

this Stalking Horse Term Sheet and any Definitive Documents, the Definitive Documents shall govern. |

| |

|

| Sources

of Financing |

As

of the signing of the Definitive Documents and as of the Closing Date, Purchaser will be capitalized with sufficient debt and equity

capital to fund the cash portion of the Purchase Price. The proposed transaction will not be subject to a financing contingency. |

| |

|

| No

Assumption of Liabilities |

For

the avoidance of doubt, Purchaser will not assume any of the liabilities, accounts payable, notes payable, expenses or other obligations

of Seller or its affiliates. |

| |

(i) |

obtain an order (the “Stalking Horse Protections Order”) of the Bankruptcy Court approving the Stalking Horse Protections (as defined below) no later than August 8, 2023; |

| |

|

|

| |

(ii) |

negotiate with Purchaser to finalize the Stalking Horse SPA, to be executed by Purchaser not later than August 8, 2023; |

| |

|

|

| |

(iii) |

conduct an auction for the Purchased Securities which shall commence not later than August 14, 2023; |

| |

|

|

| |

(iv) |

obtain an order (the “Sale Order”) of the Bankruptcy Court, satisfactory to Purchaser, approving the sale of the Purchased Securities pursuant to the Stalking Horse SPA no later than August 17, 2023; and |

| |

|

|

| |

(v) |

consummate the sale of the Purchased Securities pursuant to the Stalking Horse SPA by or before September 15, 2023. |

| Break-Up Fee and Expense Reimbursement |

The Stalking Horse SPA shall provide for

payment of a break-up fee of 3.25% of the Purchase Price, plus reimbursement or payment of all reasonable and documented out-of-pocket

costs and expenses incurred by outside counsel to the Purchaser (which costs and expenses shall be subject to a cap of $1,000,000) in

connection with the negotiation, execution and delivery of this Stalking Horse Term Sheet, the Definitive Documents, the transactions

contemplated hereby and thereby and Purchaser’s representation in Seller’s bankruptcy case and which are not otherwise reimbursed

or paid pursuant to the terms of the Replacement DIP Facility, each of which shall be treated as an allowed superiority administrative

expense claim in the Seller’s bankruptcy case pursuant to Section 503(b)(1) and 507(a)(2) of the Bankruptcy Code, to be payable

to Purchaser within one business day following the closing of a sale of any of the Purchased Securities to a party other than Purchaser

or its affiliate(s) in one or more transactions (collectively, the “Stalking Horse Protections”). Upon entry of the

Stalking Horse Protections Order, the Stalking Horse Protections shall be binding upon and enforceable against Seller. |

| |

|

| |

Seller also shall provide, pursuant to the Bid Procedures Order, that the minimum overbid at the auction shall be no less than $1,000,000.00. |

| Costs |

Except with respect to the break-up fee, the expense reimbursement, and as otherwise provided in the Replacement DIP Facility, each as described above, Seller and Purchaser shall each bear their respective costs and expenses in connection with this Stalking Horse Term Sheet, the Replacement DIP Facility, the Definitive Documents and the transactions contemplated hereby and thereby. |

| |

|

| Governing Law |

The Definitive Documents will be governed by and construed in accordance with the laws of the State of New York applicable to contracts made and to be performed entirely within such State. All actions and proceedings arising out of or relating to the Definitive Documents and the transactions contemplated thereby will be heard and determined exclusively in the Bankruptcy Court, and Seller and Purchaser irrevocably submit to the exclusive jurisdiction of such court in any such action or proceeding and irrevocably waive the defense of an inconvenient forum to the maintenance of any such action or proceeding; provided, however, that, if the Chapter 11 Case is closed, any action, claim, suit or proceeding arising out of, based upon, or relating to the Definitive Documents or the transactions contemplated thereby will be heard and determined exclusively in any state or federal court location in the Southern District of New York. Each Party agrees that a final, non-appealable judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law. |

This Stalking Horse Term Sheet supersedes all other writings and oral statements in respect of the subject matter hereof.

This Stalking Horse Term Sheet does not constitute, and is not intended to constitute, an offer or a legally binding obligation of or promise by either Seller or Purchaser to enter into a transaction or negotiate the terms of any transaction, and no legally binding obligations will be created, implied or inferred by this document with the exception of this paragraph and the section above titled “Costs”.

[Signature Page Follows]

The

undersigned have executed and delivered this Stalking Horse Term Sheet as of August 4, 2023.

| |

Seller: |

| |

|

| |

SORRENTO THERAPEUTICS, INC. |

| |

|

| |

By: |

/s/ Mohsin Y. Meghii |

| |

|

Name: |

Mohsin Y. Meghji |

| |

|

Title: |

Chief Restructuring Officer |

| |

Purchaser: |

| |

|

| |

ORAMED PHARMACEUTICALS INC. |

| |

|

| |

By: |

/s/ Nadav Kidron |

| |

|

Name: |

Nadav Kidron |

| |

|

Title: |

Chief Executive Officer |

[Signature Page to Stalking Horse Term Sheet]

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

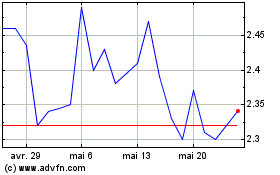

Oramed Pharmaceuticals (NASDAQ:ORMP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Oramed Pharmaceuticals (NASDAQ:ORMP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024