Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

23 Mai 2024 - 8:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

| ¨ |

Preliminary Proxy

Statement |

| ¨ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy

Statement |

| x |

Definitive Additional

Materials |

| ¨ |

Soliciting Material

under §240.14a-12 |

Tesla, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ |

Fee paid previously

with preliminary materials |

| ¨ |

Fee computed on

table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On May 23, 2024, Tesla, Inc. (“Tesla”) posted

the following presentation (the “Presentation”) to its website, www.VoteTesla.com, and provided the Presentation

to Institutional Shareholder Services and Glass, Lewis & Co. Copies of the Presentation and the updated website materials, other than those previously filed, are below.

| May 2024 |

| © 2024 Tesla, Inc.

PROPOSAL 3

Approve the redomestication of Tesla from

Delaware to Texas by conversion

Texas is Tesla’s home and future, and the Board believes

unifying operations and incorporation is in stockholders’ best

interests

Texas law aligns with Tesla’s mission

Stockholders have substantially equivalent rights under

Delaware and Texas law

No reduction in economic, governance, or litigation rights vis-à-vis Delaware

PROPOSAL 4

Ratify the 100% performance-based option

award to Elon that was approved by Tesla’s

stockholders in 2018

Avoids uncertainty about Elon’s motivation by honoring the

Company's contract and compensating Elon as we promised for

delivering extraordinary value, which he did

73% of disinterested stockholder votes were cast FOR the 2018

CEO Performance Award ("2018 Award")

Thousands of stockholders asked Tesla to let them vote again

now

Tesla needs stockholder support to ensure it fulfills its mission and continues to grow stockholder value

The Tesla Board of Directors Is Asking Stockholders to Vote FOR Proposals Three and Four

2 1. Source: FactSet. Based on change in market value from March 21, 2018 to December 31, 2023.

Tesla has been one of the most successful enterprises of our time

Tesla is leading the sustainability movement and has become the world’s leading automotive brand

In just the last six years, Tesla stockholders have seen more than $735 billion1 of market value creation

Our future depends on the continued execution against an ambitious agenda of innovation |

| © 2024 Tesla, Inc.

Leading the way in accelerating the world’s transition to sustainable energy

The Tesla Ecosystem: More Than an Automotive Company

3 |

| © 2024 Tesla, Inc.

With intense and dedicated focus, Tesla has pursued its mission, grown tremendously and created extraordinary value for stockholders

The Past Six Years: Transformative Growth, Extraordinary Value Creation

4

1. Refers to 2017 full-year revenue. 2. Refers to 2017 net loss, as disclosed on Form 10-K. 3. International Energy Agency report on electric vehicles (https://www.iea.org/energy-system/transport/electric-vehicles). 4.

Refers to 2023 full-year revenue and increase from 2017 full-year revenue. 5. Refers to 2023 net income, as reported on Form 10-K. 2023 net income includes a one-time non-cash tax benefit of $5.93 billion for the

release of valuation allowance on certain deferred tax assets. 6. As of YE2023. 7. Source: FactSet. Based on change in market value from March 21, 2018 to December 31, 2023. 8. Total stockholder return as

measured from March 2018 through year-end 2023.

Six Years Ago Present Day

Revenues $11.8 billion1

$2.2 billion loss2

Loss-making, ambitious company with

significant hurdles and challenges

to overcome

EVs not mainstream or popular – only

1.2 million sold by all automakers in 20173

Delivered 103,184 vehicles in 2017

Popularized EVs; Tesla Model Y best-selling vehicle in the world with over

1.2 million deliveries in 2023 alone6

7x increase of revenues to $96.8 billion4

Industry-leading developer of

autonomous driving and first vertically

integrated sustainable energy company

More than $735 billion7 of value creation and ~1,100% TSR8

Delivered 1.8 million vehicles in 2023

$15.0 billion profit5 |

| © 2024 Tesla, Inc. 5

Embarking on our next phase of growth to generate significant additional

value for stockholders

Our Next Growth Vector Is Equally Ambitious

Putting the auto in automotive

1.3 billion miles driven2 – so far – on Tesla’s Supervised Self-Driving

technology software

Extending our lead in EVs through product and financing

Developing differentiated models, including more affordable options, paired

with attractive financing packages

Establishing autonomous ride-hailing network

Purpose-built robotaxi expected to be demo’ed this year

Optimus, the humanoid robot

Leading AI capabilities and designed for volume production

Increasing AI compute capabilities

Grew AI training compute by more than 130% in Q1 20241

1. Q1 2024 earnings presentation. 2. As of April 21, 2024.

Fulfilling our mission and advancing our

business depends on significant levels

of innovation |

| The Special Committee and

Its Independent, Rigorous Process |

| © 2024 Tesla, Inc. 7

History of the Special Committee & Its Thoughtful, Rigorous and Independent Process

Prior to 2024

Moved HQ to Texas in

2021; redomestication

considered by

management and

independent directors

January 30, 2024

Tornetta ruling

invalidated Elon's 2018

CEO Performance

Award

February 10, 2024

Board created a Special Committee, which

chose its own independent legal and

financial advisors, to consider

redomestication, recognizing that such a

matter is a Board decision, not a CEO one

March 5, 2024

Expanded mandate to

consider ratification of

2018 Award at the

Committee’s request

January 31, 2024

Elon posted on X: ”Tesla will

move immediately to hold a

shareholder vote to transfer

state of incorporation to

Texas"

The Special Committee's Process

Robust process over 8 weeks, including

16 meetings for more than 26 hours, with

thousands of hours of analysis by outside,

independent advisors

Elon and Kimbal Musk recused themselves –

did not participate in Board meetings or

influence process

Committee fully empowered to decide on both

redomestication and ratification – including to

reject both redomestication and ratification

outright

Committee interviewed directors and executives

Prepared and delivered comprehensive public

report explaining process, considerations and

deliberated decisions

Committee filed its detailed report in

Tesla’s proxy to provide full transparency to

stockholders to inform their vote, including

supporting report from corporate governance

expert from University of Chicago Law School |

| © 2024 Tesla, Inc. 8

The Special Committee’s Extensive Analysis to Determine

What Is in the Best Interests of Tesla Stockholders

Redomestication to Texas

Started with all 50 states and even outside U.S.

Examined options based on their legal systems and stockholder rights

Committee’s financial advisor examined market practices and conducted

quantitative analysis to determine if there was any observable Delaware

premium

Committee reviewed precedent redomestications from Delaware to Texas

Considered TripAdvisor decision regarding non-ratable benefits to

directors from Nevada redomestication; evaluated and found no non-ratable benefits for Texas redomestication

Ratification of the 2018 Award

Analyzed potential alternatives to ratification, including not ratifying

Received and considered substantial input from institutional and retail

stockholders, making note of “powerful and persuasive” feedback from

stockholders

Concluded ratification would avoid prolonged uncertainty about Elon’s

compensation and motivation to devote his time and energy to Tesla

Process and proxy designed to address the issues raised by the

Delaware court and disclose detailed information to allow stockholders to

make fully informed decisions

Determined costs associated with any new replacement package would

substantially exceed costs of ratification

Determined, based on all relevant considerations, redomestication in Texas and

ratification of the 2018 Award are both in the best interests of all stockholders |

| PROPOSAL 3

Redomestication in Texas |

| © 2024 Tesla, Inc.

Redomestication in Texas is the logical evolution for Tesla as it marries its operational footprint and its values with its state of incorporation

Texas Is Tesla’s Home

10

July 2020

Announced

Gigafactory Texas

October 2021

Moved corporate

headquarters to Texas

and launched auto

insurance in Texas

January 2023

Announced Gigafactory

Texas expansion

December 2021

Began production at

Gigafactory Texas

April 2022

Gigafactory Texas

officially opens

June 2022

Gigafactory Texas

reaches a run rate of

1,000 units per week

December 2022

Gigafactory Texas

reaches a run rate of

3,000 units per week

March 2023

Hosted first Investor

Day, held at our

Texas headquarters

Thousands of manufacturing, operations

and engineering employees, as well as

our executives, are based in Texas

Our Gigafactory Texas is one of the

largest factories in the U.S., covering

2,500 acres along the Colorado River,

and is the manufacturing hub for our

most innovative vehicles, including the

Cybertruck and Model Y

Texas is already our business home; our

headquarters – and our future – are in

Texas |

| © 2024 Tesla, Inc.

Texas' Legal Regime Permits Tesla to Innovate and Pursue Its World-Changing Mission

11

Texas’ legal regime allows Tesla

to promote its strong mission

Express statutory provision that would allow

directors to consider the company’s mission – a

mission that is fundamental to Tesla’s culture

and critical to recruitment, motivation and

retention from the factory floor to the boardroom

Tesla stockholders care about

advancing our mission

Tesla stockholders believe fundamentally in our

mission

The company received letters from thousands of

Tesla stockholders – large and small –

supporting a move home to Texas, recognizing

it’s where we belong

Tesla’s identity is intertwined with

its Texas headquarters

Many of the most successful companies in the

U.S. are incorporated in the state where they are

headquartered – i.e., their home state (e.g.,

MSFT, AAPL)

There is value in business disputes being heard

where Tesla is headquartered – the community

is directly impacted by court decisions affecting

our company

Redomesticating in Texas builds on Tesla’s

relationships with state and local communities,

including government actors, employees and

other stakeholders, which are critical to Tesla,

and reinforces our commitment to the state |

| © 2024 Tesla, Inc. 12

Texas stockholders have

substantially equivalent rights as in

Delaware

Texas has substantially equivalent governance

rights, with ability to call a special meeting added

to Texas charter

Texas law also affords stockholders substantially

equivalent economic and litigation rights as in

Delaware

Governance experts have opined that

stockholder rights are not negatively impacted by

a reincorporation from Delaware to Texas1

No “Delaware premium”

Redomestication in Texas is not expected to

affect Tesla's market value

Financial advisors to the Special Committee

concluded, based on analysis, there is no

financial premium to being incorporated in

Delaware

Texas would provide potential cost savings,

including no franchise taxes

Texas is expected to provide more

certainty for innovative, big-ticket

business decisions

Texas is expected to provide stability and

certainty through a highly defined corporate code

Delaware case law is fact-specific and

indeterminate, with Chancery Court wielding

significant influence and ability to change

corporate law

Delaware courts are increasingly “second

guessing” boards’ and stockholders' reasoned

decisions and limiting their freedom to act

decisively to create extraordinary stockholder

value

Texas Is the Best Place for Tesla and Its Stockholders

1. Since 2014, ISS has recommended FOR 100% of public-company redomestications to Texas (i.e., 7 out of 7, of which 5 were from Delaware to Texas). In 2022 (Alset) and 2019 (Legacy Housing), ISS wrote, “reincorporation

from Delaware to Texas would appear to have a neutral impact on shareholders’ rights.” Since 2014, Glass Lewis has recommended FOR 80% of public-company redomestications to Texas (i.e., 4 out of 5, of which 3 were from

Delaware to Texas). In 2019 (Legacy Housing), Glass Lewis wrote, “in most respects, the corporate statues in Delaware and Texas are comparable.” For the one redomestication from Delaware to Texas that Glass Lewis

recommended against, it cited changes to the corporate charter that made it harder to call a stockholder meeting. |

| PROPOSAL 4

Ratification of the 2018 Award |

| © 2024 Tesla, Inc.

Elon’s only opportunity to receive any compensation at all for his work and leadership would come from delivering

transformative growth and extraordinary value to stockholders in 10 years' time. He did it in 5 years.

In 2018, Tesla's Compensation Committee Designed a CEO

Performance Award 100% Aligned with Stockholder Interests

14

The 2018 Award was 100% performance-based and at risk The 2018 Award was aligned with

stockholders’ interests

Because Elon is required to hold shares

for five years after exercising options, he

remains incentivized to drive value for

stockholders

The 2018 Award was comprised of

options, not RSUs – meaning Elon’s

compensation was driven by him creating

value for stockholders

If Elon hits ambitious targets,

creating extraordinary value

for stockholders

If Elon fails to achieve the

ambitious growth targets

Elon receives stock

options commensurate

with that achievement

Elon receives ZERO

compensation

Board approved 2018 Award

after lengthy design process

led by outside directors on

Compensation Committee |

| © 2024 Tesla, Inc.

$53.7

$100.0

$650.0

March 2018 2018 Award

Lowest

Milestone

2018 Award

Highest

Milestone

$0.6

$1.5

$14.0

FY 2017

Actual

2018 Award

Lowest

Milestone

2018 Award

Highest

Milestone

$11.8

$20.0

$175.0

FY 2017

Actual

2018 Award

Lowest

Milestone

2018 Award

Highest

Milestone

Compensation was contingent on Elon leading Tesla to hit exceptionally ambitious targets

The 2018 Award Set Bold and Ambitious Targets...

15

Revenue ($B)1 Adjusted EBITDA ($B)1 Market Value ($B)2

15x

22x

1. Source: FactSet and Company filings. 2. Source: FactSet and Company filings. Market value as of March 21, 2018, the day the 2018 Award was approved by stockholders.

12x |

| © 2024 Tesla, Inc.

Mr. Musk’s new targets are even more

ambitious than the 10-year goals from 2012

that he blew through years early. The

potential value of share grants totaling 12

percent of the company is vast, but at least

the Tesla board has done much more than

the usual lip service in setting a serious

challenge.”

Antony Currie, Reuters Breakingviews

(January 23, 2018)

In the context of history, the financial targets

Tesla has set are lofty, if not extraordinary.

We note that CEO's Musk incentive targets

call for Tesla's revenue to grow at a 32%

compounded rate for the next 10 years, and

its market cap to grow at 28% per year over

the next 10 years – there are only two

companies in history that have grown

revenue from ~$11B to $100B in less than

10 years (Apple and Amazon).”

Toni Sacconaghi, Bernstein

(February 7, 2018)

It’s breathtaking both in size and in terms of

performance required to earn it…Like

everything Musk is involved in, whether it’s

building a company from scratch or

launching satellites into space, this is

beyond expectation.”

Anders Melin, Brandon Kochkodin, Dana

Hull, Bloomberg (January 23, 2018)

Elon Musk will remain at Tesla under a 10-

year, all-or-nothing pay package that

demands massive growth. The

agreement…requires that Tesla grow in $50

billion leaps, to a staggering $650 billion

market capitalization. Tesla must also hit a

series of escalating revenue and adjusted

profit targets, only after which Musk would

vest stock options worth 1 percent of

company shares.”

Jamie Cook, CFA, Credit Suisse

(January 26, 2018)

…Targets That Most Thought Were Impossible for Tesla to Achieve

16

Mr. Musk’s new compensation plan… is perhaps the most radical

in corporate history: Mr. Musk will be paid only if he reaches a

series of jaw-dropping milestones based on the company’s market

value and operations. Otherwise, he will be paid nothing… As

executive compensation plans go, Tesla’s is about as friendly to

shareholders as they come.”

Andrew Ross Sorkin,

The New York Times (January 23, 2018)

Even compared with the bullish financial modelling that has

propelled Tesla to its current valuation, its new executive pay

targets outlined last week look pretty ambitious… [O]nly three

companies had a market value of more than $650bn at the end of

2017: Apple, Microsoft and Alphabet (Google’s parent). GM’s

market capitalisation is $61.5bn and Ford is worth $41bn.”

Karl West, The Guardian (January 26, 2018)

The unusual package is based entirely on performance,

guaranteeing no salary and no bonus, and requires Musk to reach

aggressive market capitalization and financial goals in order to be

paid. He would also have to hold onto his shares for five years

after he receives them before selling, a rare stipulation that’s

viewed as particularly shareholder-friendly…Yet compensation

experts said the biggest message Musk’s new pay plan may be

designed to send is not just that Tesla intends to take an

unusually performance-driven approach to paying its CEO. It’s

that the company has galaxy-size ambitions for its growth and

aims to rival the planet’s largest tech companies over the next

decade.”

Jena McGregor, Washington Post (January 23, 2018) |

| © 2024 Tesla, Inc.

And subsequent say-on-pay proposals and the election of members of the Compensation Committee have all received strong support from stockholders

The 2018 Award Was Overwhelmingly Approved by Stockholders

Our two say-on-pay proposals following the 2018 Award

received strong support from stockholders

Each of the members of the Compensation Committee

who has stood for election after the 2018 Award has

received strong support

Support for Tesla’s Say-on-Pay Proposals1 Support for Compensation Committee

Members at Next Annual Meeting1

73%

of disinterested

stockholders voted to approve

Support for 2018 CEO Performance Award

2018 2020 & 2023 2018, 2019 & 2020

85%

91%

2020 2023

1. Source: Company filings. Vote refers to votes “For” divided by votes “For” plus votes “Against,” inclusive of votes cast by insiders. 17

89%

85%

81%

Antonio Gracias

(2018)

Ira Ehrenpreis

(2019)

Robyn Denholm

(2020) |

| © 2024 Tesla, Inc.

2017-2023

Revenue Growth1

2017-2023

Adjusted EBITDA Growth1

2018-2023

Total Stockholder Return2

Motivated by the 2018 Award, Elon has led Tesla to significant growth that has surpassed that of other leading technology companies

The 2018 Award Did What It Was Supposed to Do

1 Source: Bloomberg and Company filings. Data is calendarized. NVIDIA data is calendarized by multiplying the totals from the beginning and ending January quarters by 1/3 and 2/3,

respectively (to represent the number of months in each quarter that fell within the calendar year), and adding those totals to the other three quarters within each calendar year. Adjusted

EBITDA refers to EBITDA plus stock-based compensation. 2. Source: Bloomberg. Data measures total stockholder return from March 21, 2018 to December 31, 2023.

1078%

TSLA NVDA AAPL MSFT GOOGL META AMZN

2482%

TSLA NVDA AMZN GOOGL MSFT META AAPL

723%

TSLA NVDA META AMZN GOOGL MSFT AAPL

18 |

| © 2024 Tesla, Inc.

In January 2024, Delaware Court overturned the will of Tesla stockholders

Ratification of the 2018 Award Protects Stockholder Democracy...

19

Ratification ensures stockholders’ voices are heard on this critical matter

As Tesla shareholders, we want our shareholder votes

to count (not be rescinded years later); we want Tesla

CEO Elon Musk to be compensated for his Past Work

(that is keep ALL stock options previously awarded for

meeting the 2018 Musk Incentive Comp Plan

milestones)… [We] [w]ould like the Board to explore

options to affirm the shareholder vote in support of

keeping […] Tesla’s 2018 CEO Compensation Plan

active and in place.”

Letter to Tesla's Board of Directors on

Behalf of 5,821 Stockholders

The requirements of the 2018 package

were extraordinarily ambitious — and they were

delivered. It is not reasonable for investors to expect to

re-absorb the canceled options and consider all

that value creation to have been delivered to us for

no consideration. Therefore, if it is legally advisable,

we suggest simply subjecting the original 2018

package to a new shareholder vote, accompanied

by expansive disclosure as to the process

undertaken and the potential conflicts of interest that

were considered at the time.”

T. Rowe Price

Shareholders voted overwhelmingly in favour of

the CEO’s compensation package in 2018. I

subsequently bought stock with full awareness and

understanding of the implications and nature of Elon’s

compensation structure. Contrary to the assumption of

ignorance or misinformation, my investment was made

after careful consideration and analysis of the

proposed incentives and their alignment with the

company’s long-term goals, as well as my own

aspirations for gains.”

Letter to the Delaware Court from a Tesla

stockholder

The Court sided with a stockholder plaintiff who owned just nine Tesla

shares when he sued, and who now seeks a fee of more than $5 billion

from Tesla (and its stockholders)

The Court’s decision overturned the will of stockholders – 73% of

disinterested stockholders voted to approve the 2018 Award |

| © 2024 Tesla, Inc. 20

Less costly option to compensate for past work and to incentivize Elon for the future

…While Ensuring We Compensate Our CEO As Promised

New Compensation

Award Would Be Costly

A functionally equivalent1 grant of

new options could result in an

accounting charge of more than

$25 billion, compared to the $2.3

billion granted in 2018

Per the Special Committee, Elon

Confirmed That the 2018 Award

Would Incentivize and Motivate

Him For the Future

Under Elon’s leadership, Tesla is well-positioned to lead in large and rapidly

growing markets, with an evolving and

vast ecosystem of transformative

technologies

Ratification Compensates Elon

for Value Created

Elon told the Committee he wants to

be treated fairly and with respect. He

performed, against all odds, in

accordance with the terms of the

deal, delivering extraordinary value

for Tesla stockholders

A deal should be a deal: stockholders approved the plan.

Elon hit the targets. We should hold up our end of the deal.

1. Refer to Special Committee report. |

| © 2024 Tesla, Inc.

Concern Raised… … What Actually Happened

Award locked in high-pay opportunities for years and

diminished Compensation Committee’s ability to adjust

pay levels to reflect shifts in performance or strategy.

No adjustment of pay levels was necessary. Within five years – half the time of

the 2018 award period – Elon met all performance metrics and transformed

the company’s financial profile.

Alternate operational goals provide for significant vesting

regardless of sustained profitability. Several tranches

could be earned based on either revenue or adjusted

EBITDA targets.

Other than two tranches, which were met based on revenue, every other

tranche was met based on hitting high EBITDA performance hurdles. Elon

successfully turned profit from a $2.2 billion loss to a $15.0 billion net income.1

Adjusted EBITDA targets excluded stock

compensation expense.

Elon delivered positive earnings beyond the amount returned as

compensation. Removing impact of all stock-based compensation expenses,

Tesla still hit each EBITDA target (unadjusted for stock-based

compensation) in short order.

Achieving targets would lead to high compensation level

for Elon without commensurate compounded revenue

growth and compounded share price growth (only slightly

outpacing S&P 500).

Elon delivered all tranches in five years, which translates to an astonishing

compound share price growth of 45%2 and a compound revenue growth of

47%.3 The actual stock price growth delivered was more than 9 times the

S&P 500 over the same period.4

Magnitude of the award was not discussed transparently

with investors.

The magnitude of the award was clearly outlined in the 2018 proxy statement,

including the value that would be realized upon achievement of the targets.

There is a lack of clear prohibitions against

repricing the grant. The options were not repriced and cannot be without stockholder approval.

1. Refers to 2017 and 2023 net loss / net income, as reported on Form 10-K, respectively. 2023 net income included a one-time non-cash tax benefit of $5.93 billion for the release of valuation

allowance on certain deferred tax assets. 2. Based on the period from March 21, 2018 to December 31, 2022. 3. Based on revenue growth from the last twelve months ended March 31, 2018 and

March 31, 2023, respectively. 4. Source: Bloomberg: Based on the period from March 21, 2018 to December 31, 2022.

∂

∂

∂

∂

∂

∂

Concerns Raised in 2018 Around the Award Did Not Materialize

21 |

| © 2024 Tesla, Inc.

PROPOSAL 3

Approve the redomestication of Tesla from

Delaware to Texas by conversion

Texas is Tesla’s home and future, and the Board believes

unifying operations and incorporation is in stockholders’ best

interests

Texas law aligns with Tesla’s mission

Stockholders have substantially equivalent rights under

Delaware and Texas law

No reduction in economic, governance, or litigation rights vis-à-vis Delaware

PROPOSAL 4

Ratify the 100% performance-based option

award to Elon that was approved by Tesla’s

stockholders in 2018

Avoids uncertainty about Elon’s motivation by honoring the

Company's contract and compensating Elon as we promised for

delivering extraordinary value, which he did

73% of disinterested stockholder votes were cast FOR the 2018

Award

Thousands of stockholders asked Tesla to let them vote again

now

Tesla needs stockholder support to ensure it fulfills its mission and continues to grow stockholder value

The Tesla Board of Directors Is Asking Stockholders to Vote FOR Proposals Three and Four

22 1. Source: FactSet. Based on change in market value from March 21, 2018 to December 31, 2023.

Tesla has been one of the most successful enterprises of our time

Tesla is leading the sustainability movement and has become the world’s leading automotive brand

In just the last six years, Tesla stockholders have seen more than $735 billion1 of market value creation

Our future depends on the continued execution against an ambitious agenda of innovation |

| Appendix |

| © 2024 Tesla, Inc.

The Special Committee Was Independent, Highly Qualified and Well Advised

24

Advised by Wholly Independent Advisors

Lead Counsel

Sidley Austin

Delaware Counsel

Abrams & Bayliss

Corporate Law and Governance Expert

University of Chicago Law School Professor

Financial Advisor

Houlihan Lokey

Kathleen Wilson-Thompson has been a member of the Tesla Board since December 2018. Ms. Wilson-Thompson

previously served as Executive Vice President and Global Chief Human Resources Officer of Walgreens Boots Alliance,

Inc., a global pharmacy and wellbeing company, from December 2014 to January 2021, and as Senior Vice President

and Chief Human Resources Officer from January 2010 to December 2014. Prior to Walgreens, Ms. Wilson-Thompson

held various legal and operational roles at The Kellogg Company, a food manufacturing company, from January 1991 to

December 2009, including most recently as its Senior Vice President, Global Human Resources. Ms. Wilson-Thompson

also serves on the boards of directors of Wolverine World Wide, Inc. and McKesson Corp. Ms. Wilson-Thompson holds

an A.B. in English Literature from the University of Michigan and a J.D. and L.L.M. (Corporate and Finance Law) from

Wayne State University.

Kathleen Wilson-Thompson

Independent Director

National reputation; prior C-Suite and other

director roles at Fortune 500 companies

Personally spent over 200 hours on

Committee’s process

No personal ties to Elon or other directors |

| © 2024 Tesla, Inc.

Reconciliation of GAAP to Non-GAAP Financial Information

(Unaudited)

25

In millions of USD 2017 2023

Net (loss) income attributable to common stockholders (GAAP) (1,962) 14,997

Interest expense 471 156

Provision for (benefits from) income taxes 32 (5,001)

Depreciation, amortization and impairment 1,636 4,667

Stock-based compensation expense 467 1,812

Adjusted EBITDA (non-GAAP) 644 16,631 |

| For questions, contact our proxy solicitor,

Innisfree M&A Incorporated

+1 (877) 800-5182 (U.S. and Canada)

+1 (412) 232-3651 (all other countries)

26 |

| © 2024 Tesla, Inc. 28

Additional Information and Where to Find It

Tesla, Inc. (“Tesla”) has filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A with respect to its solicitation of proxies for Tesla’s 2024

annual meeting (the “Definitive Proxy Statement”). The Definitive Proxy Statement contains important information about the matters to be voted on at the 2024 annual meeting. STOCKHOLDERS

OF TESLA ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT TESLA HAS

FILED OR WILL FILE WITH THE SEC BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT TESLA AND THE MATTERS TO BE VOTED ON AT THE 2024

ANNUAL MEETING. Stockholders are able to obtain free copies of these documents and other documents filed with the SEC by Tesla through the website maintained by the SEC at www.sec.gov.

In addition, stockholders are able to obtain free copies of these documents from Tesla by contacting Tesla’s Investor Relations by e-mail at ir@tesla.com, or by going to Tesla’s Investor Relations

page on its website at ir.tesla.com.

Participants in the Solicitation

The directors and executive officers of Tesla may be deemed to be participants in the solicitation of proxies from the stockholders of Tesla in connection with 2024 annual meeting. Information

regarding the interests of participants in the solicitation of proxies in respect of the 2024 annual meeting is included in the Definitive Proxy Statement.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 reflecting Tesla’s current expectations that involve risks and

uncertainties. These forward-looking statements include, but are not limited to, statements concerning its goals, commitments, strategies and mission, its plans and expectations regarding the

proposed redomestication of Tesla from Delaware to Texas (the “Texas Redomestication”) and the ratification of Tesla’s 2018 CEO pay package (the “Ratification”), expectations regarding the

future of litigation in Texas, including the expectations and timing related to the Texas business court, expectations regarding the continued CEO innovation and incentivization under the

Ratification, potential benefits, implications, risks or costs or tax effects, costs savings or other related implications associated with the Texas Redomestication or the Ratification, expectations about

stockholder intentions, views and reactions, the avoidance of uncertainty regarding CEO compensation through the Ratification, the ability to avoid future judicial or other criticism through the

Ratification, its future financial position, expected cost or charge reductions, its executive compensation program, expectations regarding demand and acceptance for its technologies, growth

opportunities and trends in the markets in which we operate, prospects and plans and objectives of management. The words “anticipates,” “believes,” “continues,” “could,” “design,” “drive,”

“estimates,” “expects,” “future,” “goals,” “intends,” “likely,” “may,” “plans,” “potential,” “seek,” “sets,” “shall,” “spearheads,” “spurring,” “should,” “will,” “would,” and similar expressions are intended to

identify forward-looking statements, although not all forward-looking statements contain these identifying words. Tesla may not actually achieve the plans, intentions or expectations disclosed in its

forward-looking statements and you should not place undue reliance on Tesla’s forward-looking statements. Actual results or events could differ materially from the plans, intentions and

expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause Tesla’s actual results to differ materially

from those in the forward-looking statements, including, without limitation, risks related to the Texas Redomestication and the Ratification and the risks set forth in Part I, Item 1A, “Risk Factors” of

the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and that are otherwise described or updated from time to time in Tesla’s other filings with the SEC. The discussion of

such risks is not an indication that any such risks have occurred at the time of this filing. Tesla disclaims any obligation to update any forward-looking statement contained in this document. |

On May 23, 2024, Elon Musk posted the following

on X.

Additional Information and Where to Find It

Tesla has filed with the Securities and Exchange

Commission (the “SEC”) a definitive proxy statement on Schedule 14A with respect

to its solicitation of proxies for Tesla’s 2024 annual meeting (the “Definitive Proxy Statement”). The

Definitive Proxy Statement contains important information about the matters to be voted on at the 2024 annual meeting. STOCKHOLDERS OF

TESLA ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT TESLA

HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT TESLA AND THE MATTERS TO BE VOTED

ON AT THE 2024 ANNUAL MEETING. Stockholders are able to obtain free copies of these documents and other documents filed with the SEC by

Tesla through the website maintained by the SEC at www.sec.gov. In addition, stockholders are able to obtain free copies of these documents

from Tesla by contacting Tesla’s Investor Relations by e-mail at ir@tesla.com, or by going to Tesla’s Investor Relations page

on its website at ir.tesla.com.

Participants in the Solicitation

The directors and executive officers of Tesla

may be deemed to be participants in the solicitation of proxies from the stockholders of Tesla in connection with 2024 annual meeting.

Information regarding the interests of participants in the solicitation of proxies in respect of the 2024 annual meeting is included in

the Definitive Proxy Statement.

Forward-Looking Statements

This communication contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995 reflecting Tesla’s current expectations that involve

risks and uncertainties. These forward-looking statements include, but are not limited to, statements concerning its goals, commitments,

strategies and mission, its plans and expectations regarding the proposed redomestication of Tesla from Delaware to Texas (the “Texas

Redomestication”) and the ratification of Tesla’s 2018 CEO pay package (the “Ratification”), expectations

regarding the future of litigation in Texas, including the expectations and timing related to the Texas business court, expectations regarding

the continued CEO innovation and incentivization under the Ratification, potential benefits, implications, risks or costs or tax effects,

costs savings or other related implications associated with the Texas Redomestication or the Ratification, expectations about stockholder

intentions, views and reactions, the avoidance of uncertainty regarding CEO compensation through the Ratification, the ability to avoid

future judicial or other criticism through the Ratification, its future financial position, expected cost or charge reductions, its executive

compensation program, expectations regarding demand and acceptance for its technologies, growth opportunities and trends in the markets

in which we operate, prospects and plans and objectives of management. The words “anticipates,” “believes,” “continues,”

“could,” “design,” “drive,” “estimates,” “expects,” “future,”

“goals,” “intends,” “likely,” “may,” “plans,” “potential,” “seek,”

“sets,” “shall,” “spearheads,” “spurring,” “should,” “will,” “would,”

and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these

identifying words. Tesla may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements and

you should not place undue reliance on Tesla’s forward-looking statements. Actual results or events could differ materially from

the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve

risks and uncertainties that could cause Tesla’s actual results to differ materially from those in the forward-looking statements,

including, without limitation, risks related to the Texas Redomestication and the Ratification and the risks set forth in Part I, Item

1A, “Risk Factors” of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and that are otherwise described

or updated from time to time in Tesla’s other filings with the SEC. The discussion of such risks is not an indication that any such

risks have occurred at the time of this filing. Tesla disclaims any obligation to update any forward-looking statement contained in this

document.

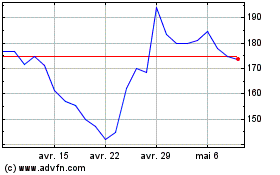

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024