false000163411700016341172023-08-042023-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4, 2023

| | | | | | | | | | | | | | | | | |

| BARNES & NOBLE EDUCATION, INC. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware | | 1-37499 | | 46-0599018 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | |

120 Mountainview Blvd., Basking Ridge, NJ 07920 |

| (Address of principal executive offices)(Zip Code) |

| |

| Registrant’s telephone number, including area code: | | (908) 991-2665 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Class | | Trading Symbol | | Name of Exchange on which registered |

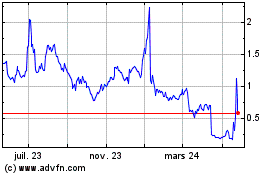

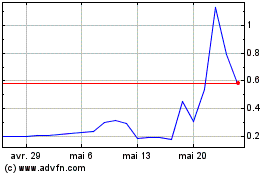

| Common Stock, $0.01 par value per share | | BNED | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. □

Item 2.02 Results of Operations and Financial Condition.

On August 4, 2023, Barnes & Noble Education, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal fourth quarter and full year ended April 29, 2023 (the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1.

The information in this Form 8-K and the Exhibit attached hereto pertaining to the Company’s financial results shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: August 4, 2023

BARNES & NOBLE EDUCATION, INC.

By: /s/ Michael P. Huseby

Name: Michael P. Huseby

Title: Chief Executive Officer and

Principal Financial Officer

BARNES & NOBLE EDUCATION, INC.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Exhibit 99.1

Barnes & Noble Education Reports Fourth Quarter and Fiscal Year 2023 Financial Results

Amends and Extends Maturity Date of its Credit Facility to Enhance Financial and Operating Flexibility

Fiscal Year 2023 Consolidated Revenue Increased 3.2% to $1,543 Million

Fiscal Year 2023 Retail Gross Comparable Store Sales Increased 3.2%

Fiscal Year 2023 General Merchandise Gross Comparable Store Sales Increased 8.6%

First Day® Complete Revenue Increased 88% to $198 Million in Fiscal Year 2023

157 Campus Stores Have Committed to Utilize BNC’s First Day Complete for the Fall 2023;

Total Enrollment of Nearly 800,000*

Basking Ridge, NJ - Barnes & Noble Education, Inc. (NYSE: BNED), a leading solutions provider for the education industry, today reported sales and earnings for the fourth quarter and fiscal year 2023, which ended on April 29, 2023.

During the fourth quarter of fiscal year 2023, the assets related to the Company’s Digital Student Solutions ("DSS") segment met the criteria for classification as Assets Held for Sale and Discontinued Operations. Results reported in this press release reflect results from Continuing Operations. On May 31, 2023, BNED completed the sale of its DSS segment for cash proceeds of $20 million, net of certain transaction fees, severance costs, escrow, and other considerations. During the first quarter of fiscal year 2024, the Company expects to record a Gain on Sale of Business in the range of $2.5 million to $4.5 million.

Fourth Quarter 2023 financial and operational highlights:

•Consolidated fourth quarter GAAP revenue of $241.8 million decreased by $9.3 million, or 3.7%, as compared to the prior year period.

•Consolidated fourth quarter GAAP gross profit of $58.3 million decreased by $13.9 million, or 19.2%, as compared to the prior year period.

•Consolidated fourth quarter selling and administrative expenses decreased by $3.4 million, or 4.3%, as compared to the prior year period.

•Consolidated fourth quarter GAAP net loss from continuing operations was $(41.9) million, as compared to a net loss of $(9.3) million in the prior year period. The increase in net loss from continuing operations was primarily due to lower gross profit of $13.9 million, and increases in restructuring and other charges of $7.5 million, interest expense of $4.7 million and income tax expense of $10.0 million, primarily due to a $9.6 million income tax benefit recorded in the fourth quarter of fiscal year 2022.

•Consolidated fourth quarter non-GAAP Adjusted EBITDA from Continuing Operations was $(18.2) million, as compared to $(7.7) million in the prior year period.

•Fourth quarter Total Retail gross comparable store sales increased by $2.1 million, or 0.9%, comprised of a 1.0% increase in course material sales, and a 0.9% increase in general merchandise sales. For comparable store sales reporting purposes, logo general merchandise sales fulfilled by Lids and Fanatics are included on a gross basis.

•BNC’s First Day® Complete revenue grew 60% to $24.4 million. 116 campus stores utilized BNC’s First Day® Complete courseware delivery program during the 2023 Spring Term, at institutions representing

approximately 580,000* in total enrollment; up from 76 campus stores and approximately 380,000* in total enrollment in the 2022 Spring Term.

Fiscal Year 2023 financial and operational highlights:

•Consolidated fiscal year 2023 GAAP revenue of $1,543.2 million increased by $47.5 million, or 3.2%, as compared to the prior year period.

•Consolidated fiscal year 2023 GAAP gross profit of $349.4 million increased by $6.6 million, or 1.9%, as compared to the prior year period.

•Consolidated fiscal year 2023 selling and administrative expenses increased by $3.6 million, or 1.0%, as compared to the prior year period.

•Consolidated fiscal year 2023 GAAP net loss from continuing operations was $(90.1) million, as compared to a net loss of $(61.6) million in the prior year period. The increase in net loss from continuing operations was primarily due to increases in restructuring and other charges of $9.2 million, interest expense of $12.6 million and income tax expense of $10.2 million, primarily due to a $9.2 million income tax benefit recorded in fiscal year 2022. These increases in expense were partially offset by higher gross profit of $6.6 million.

•Consolidated fiscal year 2023 non-GAAP Adjusted EBITDA from Continuing Operations was $(8.2) million, as compared to $(10.3) million in the prior year period.

•Total Retail segment gross comparable store sales increased by $48.0 million, or 3.2%, comprised of a 0.4% increase in course material sales, and an 8.6% increase in general merchandise sales. For comparable store sales reporting purposes, logo general merchandise sales fulfilled by Lids and Fanatics are included on a gross basis.

•Fiscal year 2023 First Day® Complete revenue grew by $93 million, or 88%, to $198 million, as compared to $105 million in the prior year period.

•157 campus stores are committed to utilize First Day® Complete in the Fall of 2023 representing enrollment of nearly 800,000 undergraduate and post graduate students*, an increase of approximately 46% compared to Fall of 2022.

•Achieved approximately $17 million of run-rate cost savings in fiscal year 2023. The Company expects to achieve a total of $30 million to $35 million in annualized run-rate cost savings in fiscal year 2024 based on actions implemented in fiscal 2023. Additionally, the Company has identified opportunities to further reduce expenses and gross capital expenditures in fiscal year 2024.

•Ended the year with 1,366 physical and virtual stores, a net decrease of 61 stores, as compared to the prior year period, as the Company focuses on closing unprofitable stores.

*As reported by National Center for Education Statistics (NCES)

“Fiscal 2023 proved to be a challenging year for BNED, as we continued to experience macro and market headwinds, particularly in our a la carte course material business. During the year we took significant and decisive actions to accelerate our strategy to unlock the value of BNED. We significantly reduced, and continue to reduce, our cost structure and streamlined our organization while taking steps to accelerate the adoption of our more predictable and profitable First Day® Complete equitable access model. We also divested our DSS segment to simplify our business and sharpen our focus on the large opportunities in our retail business,” said Michael P. Huseby, Chief Executive Officer, BNED. “We believe we are entering fiscal 2024 with a strong foundation and a substantial opportunity to further impact the higher education landscape. Our First Day® Complete equitable access model is gaining momentum. We are on track to achieve the previously announced $30 million to $35 million of cost reduction initiatives and we are executing on additional cost reduction opportunities that will impact Fiscal 2024. As a result, we expect to achieve sustainable, profitable growth in fiscal 2024 and beyond. Additionally, the amendment and extension of our credit facility and term loan earlier this week enhances our liquidity position and provides us with greater operational flexibility to execute on our key strategic initiatives to achieve BNED’s full potential.”

Fourth Quarter 2023 and Year to Date Results

During the fourth quarter of fiscal year 2023, assets related to the Company’s DSS Segment met the criteria for classification as Assets Held for Sale and Discontinued Operations and is no longer a reportable segment. The Company has two reportable segments: Retail and Wholesale. Additionally, unallocated shared-service costs, which include various corporate level expenses and other governance functions, continue to be presented as “Corporate Services.” All material intercompany accounts and transactions have been eliminated in consolidation.

Retail Segment Results

Fourth quarter Retail sales of $235.4 million decreased by $10.2 million or 4.1%, as compared to the prior year period due to decreases in a la carte course material and supply product sales.

Total Retail Gross Comparable Store Sales increased by $2.1 million, or 0.9%, for the quarter. Course Material Comparable Store Sales increased by $0.9 million, or 1.0%, due to increased revenue from the Company’s BNC First Day models, offset by declines in the Company’s a la carte course material business. Gross Comparable Store Sales for general merchandise increased by $1.2 million, or 0.9%, due to increased revenue from logo and emblematic products, offset by a decline in supply products, particularly computing and other electronic devices.

Fiscal year 2023 Retail sales of $1,491.7 increased by $52.1million, or 3.6%, as compared to the prior year period due to increases in the Company’s BNC First Day models and general merchandise sales.

Total Retail Gross Comparable Store Sales increased by $48.0 million, or 3.2%, for the fiscal year. Fiscal year 2023 Course Material Comparable Store Sales increased by $4.1 million, or 0.4%, due to increased revenue from the Company’s BNC First Day models, offset by declines in the Company’s a la carte course material business. Gross Comparable Store Sales for general merchandise increased by $43.9 million, or 8.6%, due to growth in logo products and café and convenience offset by declines in supply products and dorm furnishings.

Fourth quarter Retail non-GAAP Adjusted EBITDA was $(10.0) million, as compared to $4.2 million in the prior year period. Retail Non-GAAP Adjusted EBITDA declined due to lower fourth quarter revenue and lower fourth quarter gross profits, which included a shift in the mix of buying patterns from physical textbooks to lower-margin digital course materials within the Company’s a la carte course material model. Fourth quarter Retail selling and administrative expenses decreased by $3.8 million, or 5.2%, as compared to the prior year period due to the Company’s initiatives to drive efficiencies, simplify organizational structure, and reduce non-essential costs, and lower incentive compensation expense.

Fiscal year 2023 Retail non-GAAP Adjusted EBITDA increased by $2.0 million to $10.6 million, primarily due to increased sales.

Wholesale Segment Results (Before Intercompany Eliminations)

Wholesale fourth quarter sales of $9.2 million increased by $0.2 million, as compared to the prior year period. The fourth quarter is the lowest sales period for the Wholesale Segment as they primarily receive inventory returns and buybacks in preparation for the upcoming Fall term.

Fiscal year 2023 Wholesale sales of $106.4 million decreased by $5.9 million, or 5.2%, over the prior year period. The decrease is primarily due to lower gross sales impacted by supply constraints resulting from the lack of textbook purchasing opportunities and a decrease in customer demand resulting from a shift in buying patterns from physical textbooks to digital products. In the third and fourth quarter of fiscal year 2023, an easing of supply constraints relative to the prior year periods resulted in more textbook purchasing opportunities, which enabled the Company to fill increasing demand at its Retail Segment bookstores.

Wholesale non-GAAP Adjusted EBITDA for the quarter of $(4.2) million increased $3.8 million, as compared to $(8.0) million in the prior year.

Wholesale non-GAAP Adjusted EBITDA for fiscal year 2023 was $3.2 million, as compared to $3.8 million in the prior year period. The decrease was primarily due to lower sales and margin offset by a decrease in sales and administrative costs.

Balance Sheet and Cash Flow

As of April 29, 2023, the Company’s cash and cash equivalents was $14.2 million and total outstanding debt was $184.2 million, as compared to cash and cash equivalents of $8.8 million and total outstanding debt of $225.7 million in the prior year period.

On July 28, 2023, the Company announced that it has entered into an agreement with its financial stakeholders and strategic partners on the terms of a refinancing that would immediately strengthen the Company’s liquidity and overall financial positions by extending the maturity of its debt facilities, amending certain credit facility covenants and modifying certain other agreements. With this agreement, the Company is well-positioned to continue supporting academic institutions and customers nationwide through the upcoming Fall Rush and the 2023 and 2024 academic years.

Fiscal Year 2024 Outlook

For fiscal year 2024, the Company expects consolidated non-GAAP Adjusted EBITDA from Continuing Operations to be approximately $40 million. The year-over-year increase in non-GAAP Adjusted EBITDA from Continuing Operations will be driven by growth in the Company’s Retail Segment and the impact of cost reductions executed in fiscal year 2023, and other cost reductions executed in, or planned for execution in, fiscal year 2024.

Conference Call

A conference call with Barnes & Noble Education, Inc. senior management will be webcast at 8:30 a.m. Eastern Time on Friday, August 4, 2023 and can be accessed at the Barnes & Noble Education corporate website at investor.bned.com or www.bned.com.

Barnes & Noble Education, Inc. expects to report fiscal year 2024 first quarter earnings in early September.

EXPLANATORY NOTE

During the fourth quarter of fiscal 2023, assets related to our Digital Student Solutions ("DSS") Segment met the criteria for classification as Assets Held for Sale and Discontinued Operations and is no longer a reportable segment. Certain assets and liabilities associated with the DSS Segment are presented in our consolidated balance sheets as "Assets Held for Sale" and "Liabilities Held for Sale". The results of operations related to the DSS Segment are included in the consolidated statements of operations as "Loss from discontinued operations, net of tax." The cash flows of the DSS Segment are also presented separately in our consolidated statements of cash flows.

On May 31, 2023, subsequent to the end of fiscal 2023, we completed the sale of these assets related to our DSS Segment for cash proceeds of $20 million, net of certain transaction fees, severance costs, escrow, and other considerations. During the first quarter of fiscal 2024, we expect to record a Gain on Sale of Business in the range of $2.5 million to $4.5 million. Net cash proceeds from the sale was used for debt repayment and provided additional funds for working capital needs under our Credit Facility.

We have two reportable segments: Retail and Wholesale as follows:

•The Retail Segment operates 1,366 college, university, and K-12 school bookstores, comprised of 774 physical bookstores and 592 virtual bookstores. Our bookstores typically operate under agreements with the college, university, or K-12 schools to be the official bookstore and the exclusive seller of course materials and supplies, including physical and digital products. The majority of the physical campus bookstores have school-branded e-commerce websites which we operate independently or along with our merchant partners, and which offer students access to affordable course materials and affinity products, including emblematic apparel and gifts. The Retail Segment also offers equitable and inclusive access programs, in which course materials are offered at a reduced price through a fee charged by the institution or included in tuition, and delivered to students on or before the first day of class. Additionally, the Retail Segment offers a suite of digital content and services to colleges and universities, including a variety of open educational resource-based courseware.

•The Wholesale Segment is comprised of our wholesale textbook business and is one of the largest textbook wholesalers in the country. The Wholesale Segment centrally sources, sells, and distributes new and used textbooks to approximately 3,000 physical bookstores (including our Retail Segment's 774 physical bookstores) and sources and distributes new and used textbooks to our 592 virtual bookstores. Additionally, the Wholesale Segment sells hardware and a software suite of applications that provides inventory management and point-of-sale solutions to approximately 340 college bookstores.

Corporate Services represents unallocated shared-service costs which include corporate level expenses and other governance functions, including executive functions, such as accounting, legal, treasury, information technology, and human resources.

All material intercompany accounts and transactions have been eliminated in consolidation.

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Consolidated Statements of Operations (Unaudited)

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended | | 52 weeks ended |

| April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Sales: | | | | | | | |

| Product sales and other | $ | 201,849 | | | $ | 205,580 | | | $ | 1,406,655 | | | $ | 1,362,380 | |

| Rental income | 39,998 | | | 45,597 | | | 136,553 | | | 133,354 | |

| Total sales | 241,847 | | | 251,177 | | | 1,543,208 | | | 1,495,734 | |

| Cost of sales (exclusive of depreciation and amortization expense): | | | | | | | |

| Product and other cost of sales | 161,694 | | | 155,463 | | | 1,119,482 | | | 1,076,243 | |

| Rental cost of sales | 21,871 | | | 23,563 | | | 74,287 | | | 76,659 | |

| Total cost of sales | 183,565 | | | 179,026 | | | 1,193,769 | | | 1,152,902 | |

| Gross profit | 58,282 | | | 72,151 | | | 349,439 | | | 342,832 | |

| Selling and administrative expenses | 76,475 | | | 79,898 | | | 357,611 | | | 353,968 | |

| Depreciation and amortization expense | 10,899 | | | 10,996 | | | 42,163 | | | 42,124 | |

Impairment loss (non-cash) (a) | — | | | — | | | 6,008 | | | 6,411 | |

Restructuring and other charges (a) | 5,341 | | | (2,123) | | | 10,103 | | | 944 | |

| Operating loss | (34,433) | | | (16,620) | | | (66,446) | | | (60,615) | |

| Interest expense, net | 7,011 | | | 2,287 | | | 22,683 | | | 10,096 | |

| Loss from continuing operations before income taxes | (41,444) | | | (18,907) | | | (89,129) | | | (70,711) | |

| Income tax expense (benefit) | 408 | | | (9,608) | | | 1,011 | | | (9,152) | |

| Loss from continuing operations | (41,852) | | | (9,299) | | | (90,140) | | | (61,559) | |

| Loss from discontinued operations, net of tax of $101, $142, $398, and $497, respectively | (4,398) | | | (1,657) | | | (11,722) | | | (7,298) | |

| Net loss | $ | (46,250) | | | $ | (10,956) | | | $ | (101,862) | | | $ | (68,857) | |

| | | | | | | |

| Loss per common share: | | | | | | | |

| Basic and Diluted | | | | | | | |

| Continuing operations | $ | (0.80) | | | $ | (0.18) | | | $ | (1.72) | | | $ | (1.19) | |

| Discontinued operations | $ | (0.08) | | | $ | (0.03) | | | $ | (0.22) | | | $ | (0.14) | |

| Total Basic and Diluted Earnings per share | $ | (0.88) | | | $ | (0.21) | | | $ | (1.94) | | | $ | (1.33) | |

| Weighted average common shares outstanding - Basic and Diluted: | 52,604 | | | 52,046 | | | 52,454 | | | 51,797 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

|

(a) For additional information, see the Notes in the Non-GAAP disclosure information of this Press Release.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended | | 52 weeks ended | | | | |

| April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 | | | | |

| Percentage of sales: | | | | | | | | | | | |

| Sales: | | | | | | | | | | | |

| Product sales and other | 83.5 | % | | 81.8 | % | | 91.2 | % | | 91.1 | % | | | | |

| Rental income | 16.5 | % | | 18.2 | % | | 8.8 | % | | 8.9 | % | | | | |

| Total sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Cost of sales (exclusive of depreciation and amortization expense): | | | | | | | | | | | |

Product and other cost of sales (a) | 80.1 | % | | 75.6 | % | | 79.6 | % | | 79.0 | % | | | | |

Rental cost of sales (a) | 54.7 | % | | 51.7 | % | | 54.4 | % | | 57.5 | % | | | | |

| Total cost of sales | 75.9 | % | | 71.3 | % | | 77.4 | % | | 77.1 | % | | | | |

| Gross profit | 24.1 | % | | 28.7 | % | | 22.6 | % | | 22.9 | % | | | | |

| Selling and administrative expenses | 31.6 | % | | 31.8 | % | | 23.2 | % | | 23.7 | % | | | | |

| Depreciation and amortization | 4.5 | % | | 4.4 | % | | 2.7 | % | | 2.8 | % | | | | |

| Impairment loss (non-cash) | — | % | | — | % | | 0.4 | % | | 0.4 | % | | | | |

| Restructuring and other charges | 2.2 | % | | (0.8) | % | | 0.7 | % | | 0.1 | % | | | | |

| Operating loss | (14.2) | % | | (6.6) | % | | (4.3) | % | | (4.1) | % | | | | |

| Interest expense, net | 2.9 | % | | 0.9 | % | | 1.5 | % | | 0.7 | % | | | | |

| Loss from continuing operations before income taxes | (17.1) | % | | (7.5) | % | | (5.8) | % | | (4.7) | % | | | | |

| Income tax expense (benefit) | 0.2 | % | | (3.8) | % | | 0.1 | % | | (0.6) | % | | | | |

| Loss from continuing operations | (17.3) | % | | (3.7) | % | | (5.8) | % | | (4.1) | % | | | | |

| | | | | | | | | | | |

(a) Represents the percentage these costs bear to the related sales, instead of total sales.

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Consolidated Balance Sheets (Unaudited) (In thousands, except per share data)

| | | | | | | | | | | |

| April 29, 2023 | | April 30, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 14,219 | | | $ | 8,795 | |

| Receivables, net | 92,512 | | | 136,001 | |

| Merchandise inventories, net | 322,979 | | | 293,854 | |

| Textbook rental inventories | 30,349 | | | 29,612 | |

| Prepaid expenses and other current assets | 49,512 | | | 59,899 | |

| Assets held for sale, current | 27,430 | | | 3,544 | |

| Total current assets | 537,001 | | | 531,705 | |

| Property and equipment, net | 68,153 | | | 73,584 | |

| Operating lease right-of-use assets | 246,972 | | | 286,584 | |

| Intangible assets, net | 110,632 | | | 126,993 | |

| | | |

| Deferred tax assets, net | 132 | | | — | |

| Other noncurrent assets | 17,889 | | | 24,547 | |

| Assets held for sale, noncurrent | — | | | 28,140 | |

| Total assets | $ | 980,779 | | | $ | 1,071,553 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 267,923 | | | $ | 182,617 | |

| Accrued liabilities | 85,759 | | | 88,540 | |

| Current operating lease liabilities | 99,980 | | | 97,143 | |

| Short-term borrowings | — | | | 40,000 | |

| Liabilities held for sale | 8,423 | | | 7,102 | |

| Total current liabilities | 462,085 | | | 415,402 | |

| Long-term deferred taxes, net | 1,970 | | | 1,430 | |

| Long-term operating lease liabilities | 184,754 | | | 219,594 | |

| Other long-term liabilities | 19,068 | | | 21,053 | |

| Long-term borrowings | 182,151 | | | 185,700 | |

| Total liabilities | 850,028 | | | 843,179 | |

| Commitments and contingencies | — | | | — | |

| Stockholders' equity: | | | |

Preferred stock, $0.01 par value; authorized, 5,000 shares; issued and outstanding, none | — | | | — | |

| Common stock, $0.01 par value; authorized, 200,000 shares; issued, 55,140 and 54,234 shares, respectively; outstanding, 52,604 and 52,046 shares, respectively | 551 | | | 542 | |

| Additional paid-in-capital | 745,932 | | | 740,838 | |

| Accumulated deficit | (593,356) | | | (491,494) | |

| Treasury stock, at cost | (22,376) | | | (21,512) | |

| Total stockholders' equity | 130,751 | | | 228,374 | |

| Total liabilities and stockholders' equity | $ | 980,779 | | | $ | 1,071,553 | |

| | | |

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flow (Unaudited)

(In thousands, except per share data)

| | | | | | | | | | | | | | |

| | 52 weeks ended |

| | April 29, 2023 | | April 30, 2022 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (101,862) | | | $ | (68,857) | |

| Less: Loss from discontinued operations, net of tax | | (11,722) | | | (7,298) | |

| Loss from continuing operations | | (90,140) | | | (61,559) | |

| Adjustments to reconcile net loss from continuing operations to net cash flows from operating activities from continuing operations: | | | | |

| Depreciation and amortization expense | | 42,163 | | | 42,124 | |

| Content amortization expense | | 26 | | | 386 | |

| Amortization of deferred financing costs | | 3,129 | | | 1,472 | |

Impairment loss (non-cash) (a) | | 6,008 | | | 6,411 | |

Merchandise inventory loss (a) | | — | | | 434 | |

| Deferred taxes | | 409 | | | (17,838) | |

| Stock-based compensation expense | | 4,715 | | | 5,726 | |

| Changes in operating lease right-of-use assets and liabilities | | 5,912 | | | (8,475) | |

| Changes in other long-term assets and liabilities and other, net | | 2,711 | | | (3,291) | |

| Changes in other operating assets and liabilities, net: | | | | |

| Receivables, net | | 43,489 | | | (15,532) | |

| Merchandise inventories | | (29,125) | | | (13,176) | |

| Textbook rental inventories | | (737) | | | (920) | |

| Prepaid expenses and other current assets | | 19,610 | | | 2,100 | |

| Accounts payable and accrued liabilities | | 82,343 | | | 45,943 | |

| Changes in other operating assets and liabilities, net | | 115,580 | | | 18,415 | |

| Net cash flows provided by (used in) operating activities from continuing operations | | 90,513 | | | (16,195) | |

| Net cash flows provided by operating activities from discontinued operations | | 1,157 | | | 17,356 | |

| Net cash flows provided by operating activities | | $ | 91,670 | | | $ | 1,161 | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment | | $ | (25,092) | | | $ | (33,607) | |

| Changes in other noncurrent assets and other | | 591 | | | 872 | |

| Net cash flows used in investing activities from continuing operations | | (24,501) | | | (32,735) | |

| Net cash flows used in investing activities from discontinued operations | | (6,542) | | | (9,926) | |

| Net cash flows used in investing activities | | $ | (31,043) | | | $ | (42,661) | |

| Cash flows from financing activities: | | | | |

| Proceeds from borrowings | | $ | 590,303 | | | $ | 632,220 | |

| Repayments of borrowings | | (631,849) | | | (584,120) | |

| Payment of deferred financing costs | | (7,265) | | | (265) | |

| | | | |

| Purchase of treasury shares | | (864) | | | (2,370) | |

| Proceeds from the exercise of stock options, net | | — | | | 256 | |

| Net cash flows (used in) provided by financing activities from continuing operations | | (49,675) | | | 45,721 | |

| Net cash flows provided by financing activities from discontinued operations | | — | | | — | |

| Net cash flows (used in) provided by financing activities | | $ | (49,675) | | | $ | 45,721 | |

| Net increase in cash, cash equivalents, and restricted cash | | $ | 10,952 | | | $ | 4,221 | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 21,036 | | | 16,815 | |

| Cash, cash equivalents, and restricted cash at end of period | | 31,988 | | | 21,036 | |

| Less: Cash and cash equivalents of discontinued operations at end of period | | (1,057) | | | (696) | |

| Cash, cash equivalents, and restricted cash of continuing operations at end of period | | $ | 30,931 | | | $ | 20,340 | |

| | | | |

| Supplemental cash flow information: | | | | |

| Cash paid during the period for: | | | | |

| Interest paid | | $ | 19,024 | | | $ | 8,166 | |

| Income taxes paid (net of refunds) | | $ | (15,216) | | | $ | (8,007) | |

(a) For additional information, see the Notes in the Non-GAAP disclosure information of this Press Release.

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Segment Information - Continuing Operations (Unaudited)

(In thousands, except percentages)

| | | | | | | | | | | | | | | | | | | | | | | |

Segment Information (a) - Continuing Operations | 13 weeks ended | | 52 weeks ended |

| April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Sales | | | | | | | |

Retail (b) | $ | 235,350 | | | $ | 245,503 | | | $ | 1,491,726 | | | $ | 1,439,664 | |

| Wholesale | 9,205 | | | 9,054 | | | 106,366 | | | 112,246 | |

| | | | | | | |

| Eliminations | (2,708) | | | (3,380) | | | (54,884) | | | (56,176) | |

| Total Sales | $ | 241,847 | | | $ | 251,177 | | | $ | 1,543,208 | | | $ | 1,495,734 | |

| | | | | | | |

| Gross Profit | | | | | | | |

Retail (c) | $ | 58,923 | | | $ | 76,890 | | | $ | 331,370 | | | $ | 323,803 | |

| Wholesale | (747) | | | (4,347) | | | 18,275 | | | 19,782 | |

| | | | | | | |

| Eliminations | 106 | | | (356) | | | (180) | | | 67 | |

| Total Gross Profit | $ | 58,282 | | | $ | 72,187 | | | $ | 349,465 | | | $ | 343,652 | |

| | | | | | | |

| Selling and Administrative Expenses | | | | | | | |

| Retail | $ | 68,887 | | | $ | 72,647 | | | $ | 320,730 | | | $ | 315,124 | |

| Wholesale | 3,475 | | | 3,681 | | | 15,036 | | | 16,000 | |

| | | | | | | |

| Corporate Services | 4,139 | | | 3,595 | | | 22,000 | | | 23,002 | |

| Eliminations | (26) | | | (25) | | | (155) | | | (158) | |

| Total Selling and Administrative Expenses | $ | 76,475 | | | $ | 79,898 | | | $ | 357,611 | | | $ | 353,968 | |

| | | | | | | |

Segment Adjusted EBITDA (Non-GAAP) (d) | | | | | | | |

| Retail | $ | (9,964) | | | $ | 4,243 | | | $ | 10,640 | | | $ | 8,679 | |

| Wholesale | (4,222) | | | (8,028) | | | 3,239 | | | 3,782 | |

| | | | | | | |

| Corporate Services | (4,139) | | | (3,595) | | | (22,000) | | | (23,002) | |

| Eliminations | 132 | | | (331) | | | (25) | | | 225 | |

| Total Segment Adjusted EBITDA (Non-GAAP) | $ | (18,193) | | | $ | (7,711) | | | $ | (8,146) | | | $ | (10,316) | |

| | | | | | | |

| Percentage of Segment Sales | | | | | | | |

| Gross Profit | | | | | | | |

Retail (c) | 25.0 | % | | 31.3 | % | | 22.2 | % | | 22.5 | % |

| Wholesale | (8.1) | % | | (48.0) | % | | 17.2 | % | | 17.6 | % |

| | | | | | | |

| | | | | | | |

| Total Gross Profit | 24.1 | % | | 28.7 | % | | 22.6 | % | | 23.0 | % |

| | | | | | | |

| Selling and Administrative Expenses | | | | | | | |

| Retail | 29.3 | % | | 29.6 | % | | 21.5 | % | | 21.9 | % |

| Wholesale | 37.8 | % | | 40.7 | % | | 14.1 | % | | 14.3 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total Selling and Administrative Expenses | 31.6 | % | | 31.8 | % | | 23.2 | % | | 23.7 | % |

| | | | | | | |

(a) See Explanatory Note in this Press Release for Segment descriptions.

(b) In December 2020, we entered into merchandising partnership with Fanatics Retail Group Fulfillment, LLC, Inc. (“Fanatics”) and Fanatics Lids College, Inc. D/B/A "Lids" (“Lids”) (collectively referred to herein as the “F/L Partnership”). Effective in April 2021, as contemplated by the F/L Partnership's merchandising agreement and e-commerce agreement, we began to transition the fulfillment of our logo general merchandise sales to Lids and Fanatics. The transition to Lids for campus stores was effective in April 2021, and the e-commerce websites transitioned to Fanatics throughout fiscal 2022. As the logo general merchandise sales are fulfilled by Lids and Fanatics, we recognize commission revenue earned for these sales on a net basis in our consolidated financial statements, as compared to the recognition of logo general merchandise sales on a gross basis in the periods prior to the transition. For Retail Gross Comparable Store Sales details, see the Sales Information disclosure of this Press Release.

(c) For the 13 and 52 weeks ended April 29, 2023, the Retail Segment gross margin excludes $0 and $26 respectively, of amortization expense (non-cash) related to content development costs. For the 13 and 52 weeks ended April 30, 2022, the Retail Segment gross margin excludes $36 and $386 respectively, of amortization expense (non-cash) related to content development costs. Additionally, for the 52 weeks ended April 30, 2022, gross margin excludes a merchandise inventory loss of $434 in the Retail Segment related to the sale of our logo general merchandise inventory below cost to Lids.

(d) For additional information, including a reconciliation to the most comparable financial measures presented in accordance with GAAP, see "Non-GAAP Information" and "Use of Non-GAAP Financial Information" in the Non-GAAP disclosure information of this Press Release.

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Segment Information - Discontinued Operations (Unaudited)

(In thousands, except percentages)

During the fourth quarter of fiscal 2023, assets related to our Digital Student Solutions ("DSS") Segment met the criteria for classification as Assets Held for Sale and Discontinued Operations and is no longer a reportable segment. Certain assets and liabilities associated with the DSS Segment are presented in our consolidated balance sheets as "Assets Held for Sale" and "Liabilities Held for Sale". The results of operations related to the DSS Segment are included in the consolidated statements of operations as "Loss from discontinued operations, net of tax." The cash flows of the DSS Segment are also presented separately in our consolidated statements of cash flows.

On May 31, 2023, subsequent to the end of fiscal 2023, we completed the sale of these assets related to our DSS Segment for cash proceeds of $20 million, net of certain transaction fees, severance costs, escrow, and other considerations. During the first quarter of fiscal 2024, we expect to record a Gain on Sale of Business in the range of $2.5 million to $4.5 million. Net cash proceeds from the sale were used for debt repayment and to provide additional funds for working capital needs under our Credit Facility.

The following table summarizes the operating results of the discontinued operations for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

Segment Information - Discontinued Operations | 13 weeks ended | | 52 weeks ended |

| April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Total sales | $ | 8,694 | | | $ | 9,654 | | | $ | 35,353 | | | $ | 35,666 | |

Cost of sales (a) | 1,873 | | | 1,594 | | | 7,156 | | | 5,738 | |

Gross profit (a) | 6,821 | | | 8,060 | | | 28,197 | | | 29,928 | |

| Selling and administrative expenses | 10,228 | | | 7,945 | | | 34,137 | | | 29,472 | |

| Depreciation and amortization | 509 | | | 1,630 | | | 3,155 | | | 7,257 | |

Restructuring costs (b) | — | | | — | | | 1,848 | | | — | |

Transaction costs (c) | 381 | | | — | | | 381 | | | — | |

| Operating loss | (4,297) | | | (1,515) | | | (11,324) | | | (6,801) | |

| Income tax expense | 101 | | | 142 | | | 398 | | | 497 | |

| Loss from discontinued operations | $ | (4,398) | | | $ | (1,657) | | | $ | (11,722) | | | $ | (7,298) | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended | | 52 weeks ended |

| Adjusted EBITDA (non-GAAP) - Discontinued Operations | April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Loss from discontinued operations | $ | (4,398) | | | $ | (1,657) | | | $ | (11,722) | | | $ | (7,298) | |

| Add: | | | | | | | |

| Depreciation and amortization expense | 509 | | | 1,630 | | | 3,155 | | | 7,257 | |

| Income tax expense (benefit) | 101 | | | 142 | | | 398 | | | 497 | |

| Content amortization (non-cash) | 1,739 | | | 1,434 | | | 6,594 | | | 5,068 | |

| Restructuring and other charges | — | | | — | | | 1,848 | | | — | |

| Transaction costs | 381 | | | — | | | 381 | | | — | |

| Adjusted EBITDA (Non-GAAP) - Total | $ | (1,668) | | | $ | 1,549 | | | $ | 654 | | | $ | 5,524 | |

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Sales Information

(Unaudited)

Total Sales - Continuing Operations

The components of the sales variances for the 13 and 52 week periods are as follows:

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Dollars in millions | | 13 weeks ended | | | | 52 weeks ended | | |

| Retail Sales | | April 29, 2023 | | | | April 29, 2023 | | |

New stores (a) | | $ | 4.7 | | | | | $ | 78.3 | | | |

Closed stores (a) | | (5.4) | | | | | (46.4) | | | |

Comparable stores (b) | | (3.6) | | | | | 25.7 | | | |

| Textbook rental deferral | | (5.6) | | | | | 0.9 | | | |

Service revenue (c) | | (0.4) | | | | | (3.8) | | | |

Other (d) | | 0.1 | | | | | (2.6) | | | |

| Retail Sales subtotal: | | $ | (10.2) | | | | | $ | 52.1 | | | |

| Wholesale Sales | | $ | 0.2 | | | | | $ | (5.9) | | | |

| | | | | | | | |

Eliminations (e) | | $ | 0.7 | | | | | $ | 1.3 | | | |

| Total sales variance | | $ | (9.3) | | | | | $ | 47.5 | | | |

(a) The following is a store count summary for physical stores and virtual stores:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended | | 52 weeks ended |

| April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Number of Stores: | Physical | | Virtual | | Total | | Physical | | Virtual | | Total | | Physical | | Virtual | | Total | | Physical | | Virtual | | Total |

| Beginning of period | 785 | | | 603 | | | 1,388 | | | 799 | | | 642 | | | 1,441 | | | 805 | | | 622 | | | 1,427 | | | 769 | | | 648 | | | 1,417 | |

| Stores opened | 2 | | | 2 | | | 4 | | | 10 | | | — | | | 10 | | | 36 | | | 30 | | | 66 | | | 57 | | | 35 | | | 92 | |

| Stores closed | 13 | | | 13 | | | 26 | | | 4 | | | 20 | | | 24 | | | 67 | | | 60 | | | 127 | | | 21 | | | 61 | | | 82 | |

| End of period | 774 | | | 592 | | | 1,366 | | | 805 | | | 622 | | | 1,427 | | | 774 | | | 592 | | | 1,366 | | | 805 | | | 622 | | | 1,427 | |

| | | | | | | | | | | | | | | | | | | | | | | |

(b) In December 2020, we entered into merchandising partnership with Fanatics Retail Group Fulfillment, LLC, Inc. (“Fanatics”) and Fanatics Lids College, Inc. D/B/A "Lids" (“Lids”) (collectively referred to herein as the “F/L Partnership”). Effective in April 2021, as contemplated by the F/L Partnership's merchandising agreement and e-commerce agreement, we began to transition the fulfillment of our logo general merchandise sales to Lids and Fanatics. The transition to Lids for campus stores was effective in April 2021, and the e-commerce websites transitioned to Fanatics throughout fiscal 2022. As the logo general merchandise sales are fulfilled by Lids and Fanatics, we recognize commission revenue earned for these sales on a net basis in our consolidated financial statements, as compared to the recognition of logo general merchandise sales on a gross basis in the periods prior to the transition. For Retail Gross Comparable Store Sales details, see below.

(c) Service revenue includes brand partnerships, shipping and handling, and revenue from other programs.

(d) Other includes inventory liquidation sales to third parties, marketplace sales and certain accounting adjusting items related to return reserves, and other deferred items.

(e) Eliminates Wholesale sales and service fees to Retail and Retail commissions earned from Wholesale.

Retail Gross Comparable Store Sales

Retail Gross Comparable Store Sales variances by category are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollars in millions | | 13 weeks ended | | 52 weeks ended |

| | April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Textbooks (Course Materials) | | $ | 0.9 | | | 1.0% | | $ | 3.5 | | | 4.0% | | $ | 4.1 | | | 0.4 | % | | $ | 21.2 | | | 2.3 | % |

| General Merchandise | | 1.2 | | | 0.9% | | 51.8 | | | 63.3% | | 43.9 | | | 8.6 | % | | 219.5 | | | 75.6 | % |

| | | | | | | | | | | | | | | | |

| Total Retail Gross Comparable Store Sales | | $ | 2.1 | | | 0.9% | | $ | 55.3 | | | 32.6% | | $ | 48.0 | | | 3.2 | % | | $ | 240.7 | | | 19.6 | % |

| | | | | | | | | | | | | | | | |

To supplement the Total Sales table presented above, the Company uses Retail Gross Comparable Store Sales as a key performance indicator. Retail Gross Comparable Store Sales includes sales from physical and virtual stores that have been open for an entire fiscal year period and does not include sales from permanently closed stores for all periods presented. For Retail Gross Comparable Store Sales, sales for logo general merchandise fulfilled by Lids, Fanatics and digital agency sales are included on a gross basis for consistent year-over-year comparison.

Effective in April 2021, as contemplated by the F/L Partnership's merchandising agreement and e-commerce agreement, we began to transition the fulfillment of our logo general merchandise sales to Lids and Fanatics. The transition to Lids for campus stores was effective in April 2021, and the e-commerce websites transitioned to Fanatics throughout fiscal 2022. As the logo general merchandise sales are fulfilled by Lids and Fanatics, we recognize commission revenue earned for these sales on a net basis in our consolidated financial statements, as compared to the recognition of logo general merchandise sales on a gross basis in the periods prior to the transition.

We believe the current Retail Gross Comparable Store Sales calculation method reflects management’s view that such comparable store sales are an important measure of the growth in sales when evaluating how established stores have performed over time. We present this metric as additional useful information about the Company’s operational and financial performance and to allow greater transparency with respect to important metrics used by management for operating and financial decision-making. Retail Gross Comparable Store Sales are also referred to as "same-store" sales by others within the retail industry and the method of calculating comparable store sales varies across the retail industry. As a result, our calculation of comparable store sales is not necessarily comparable to similarly titled measures reported by other companies and is intended only as supplemental information and is not a substitute for net sales presented in accordance with GAAP.

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Non-GAAP Information (a) (Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

Consolidated Adjusted Earnings (non-GAAP) (a) - Continuing Operations | 13 weeks ended | | 52 weeks ended |

| April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Net loss from continuing operations | $ | (41,852) | | | $ | (9,299) | | | $ | (90,140) | | | $ | (61,559) | |

| Reconciling items, after-tax (below) | 5,341 | | | (2,087) | | | 16,137 | | | 8,175 | |

| Adjusted Earnings (Non-GAAP) | $ | (36,511) | | | $ | (11,386) | | | $ | (74,003) | | | $ | (53,384) | |

| | | | | | | |

| Reconciling items, pre-tax | | | | | | | |

Impairment loss (non-cash) (b) | $ | — | | | $ | — | | | $ | 6,008 | | | $ | 6,411 | |

Merchandise inventory loss (c) | — | | | — | | | — | | | 434 | |

Content amortization (non-cash) (d) | — | | | 36 | | | 26 | | | 386 | |

Restructuring and other charges (e) | 5,341 | | | (2,123) | | | 10,103 | | | 944 | |

| | | | | | | |

| Reconciling items, pre-tax | 5,341 | | | (2,087) | | | 16,137 | | | 8,175 | |

Less: Pro forma income tax impact (f) | — | | | — | | | — | | | — | |

| Reconciling items, after-tax | $ | 5,341 | | | $ | (2,087) | | | $ | 16,137 | | | $ | 8,175 | |

| | | | | | | |

| | | | | | | |

Consolidated Adjusted EBITDA (non-GAAP) (a) | 13 weeks ended | | 52 weeks ended |

| April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Net loss from continuing operations | $ | (41,852) | | | $ | (9,299) | | | $ | (90,140) | | | $ | (61,559) | |

| Add: | | | | | | | |

| Depreciation and amortization expense | 10,899 | | | 10,996 | | | 42,163 | | | 42,124 | |

| Interest expense, net | 7,011 | | | 2,287 | | | 22,683 | | | 10,096 | |

| Income tax expense (benefit) | 408 | | | (9,608) | | | 1,011 | | | (9,152) | |

Impairment loss (non-cash) (b) | — | | | — | | | 6,008 | | | 6,411 | |

Merchandise inventory loss (c) | — | | | — | | | — | | | 434 | |

Content amortization (non-cash) (d) | — | | | 36 | | | 26 | | | 386 | |

Restructuring and other charges (e) | 5,341 | | | (2,123) | | | 10,103 | | | 944 | |

| | | | | | | |

| Adjusted EBITDA (Non-GAAP) - Continuing Operations | $ | (18,193) | | | $ | (7,711) | | | $ | (8,146) | | | $ | (10,316) | |

Adjusted EBITDA (Non-GAAP) - Discontinued Operations (g) | $ | (1,668) | | | $ | 1,549 | | | $ | 654 | | | $ | 5,524 | |

| Adjusted EBITDA (Non-GAAP) - Total | $ | (19,861) | | | $ | (6,162) | | | $ | (7,492) | | | $ | (4,792) | |

Adjusted EBITDA by Segment (non-GAAP) (a) - Continuing Operations

The following is Adjusted EBITDA by Segment for Continuing Operations for the 13 and 52 week periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13 weeks ended April 29, 2023 |

| | Retail | | Wholesale | | | | Corporate Services (h) | | Eliminations | | Total |

| Net (loss) income from continuing operations | | $ | (21,066) | | | $ | (5,504) | | | | | $ | (15,414) | | | $ | 132 | | | $ | (41,852) | |

| Add: | | | | | | | | | | | | |

| Depreciation and amortization expense | | 9,590 | | | 1,297 | | | | | 12 | | | — | | | 10,899 | |

| Interest expense, net | | — | | | — | | | | | 7,011 | | | — | | | 7,011 | |

| Income tax expense | | — | | | — | | | | | 408 | | | — | | | 408 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Restructuring and other charges (e) | | 1,512 | | | (15) | | | | | 3,844 | | | — | | | 5,341 | |

| Adjusted EBITDA (non-GAAP) | | $ | (9,964) | | | $ | (4,222) | | | | | $ | (4,139) | | | $ | 132 | | | $ | (18,193) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13 weeks ended April 30, 2022 |

| | Retail | | Wholesale | | | | Corporate Services (h) | | Eliminations | | Total |

| Net (loss) income from continuing operations | | $ | (5,418) | | | $ | (7,255) | | | | | $ | 3,705 | | | $ | (331) | | | $ | (9,299) | |

| Add: | | | | | | | | | | | | |

| Depreciation and amortization expense | | 9,620 | | | 1,358 | | | | | 18 | | | — | | | 10,996 | |

| Interest expense, net | | — | | | — | | | | | 2,287 | | | — | | | 2,287 | |

| Income tax benefit | | — | | | — | | | | | (9,608) | | | — | | | (9,608) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Content amortization (non-cash) (d) | | 36 | | | — | | | | | — | | | — | | | 36 | |

Restructuring and other charges (e) | | 5 | | | (2,131) | | | | | 3 | | | — | | | (2,123) | |

| Adjusted EBITDA (non-GAAP) | | $ | 4,243 | | | $ | (8,028) | | | | | $ | (3,595) | | | $ | (331) | | | $ | (7,711) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 52 weeks ended April 29, 2023 |

| | Retail | | Wholesale | | | | Corporate Services (h) | | Eliminations | | Total |

| Net loss from continuing operations | | $ | (35,095) | | | $ | (3,050) | | | | | $ | (51,970) | | | $ | (25) | | | $ | (90,140) | |

| Add: | | | | | | | | | | | | |

| Depreciation and amortization expense | | 36,737 | | | 5,373 | | | | | 53 | | | — | | | 42,163 | |

| Interest expense, net | | — | | | — | | | | | 22,683 | | | — | | | 22,683 | |

| Income tax expense | | — | | | — | | | | | 1,011 | | | — | | | 1,011 | |

Impairment loss (non-cash) (b) | | 6,008 | | | — | | | | | — | | | — | | | 6,008 | |

| | | | | | | | | | | | |

Content amortization (non-cash) (d) | | 26 | | | — | | | | | — | | | — | | | 26 | |

Restructuring and other charges (e) | | 2,964 | | | 916 | | | | | 6,223 | | | — | | | 10,103 | |

| Adjusted EBITDA (non-GAAP) | | $ | 10,640 | | | $ | 3,239 | | | | | $ | (22,000) | | | $ | (25) | | | $ | (8,146) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 52 weeks ended April 30, 2022 |

| | Retail | | Wholesale | | | | Corporate Services (h) | | Eliminations | | Total |

| Net (loss) income from continuing operations | | $ | (37,305) | | | $ | 495 | | | | | $ | (24,974) | | | $ | 225 | | | $ | (61,559) | |

| Add: | | | | | | | | | | | | |

| Depreciation and amortization expense | | 36,635 | | | 5,418 | | | | | 71 | | | — | | | 42,124 | |

| Interest expense, net | | — | | | — | | | | | 10,096 | | | — | | | 10,096 | |

| Income tax benefit | | — | | | — | | | | | (9,152) | | | — | | | (9,152) | |

Impairment loss (non-cash) (b) | | 6,411 | | | — | | | | | — | | | — | | | 6,411 | |

Merchandise inventory loss (c) | | 434 | | | — | | | | | — | | | — | | | 434 | |

Content amortization (non-cash) (d) | | 386 | | | — | | | | | — | | | — | | | 386 | |

Restructuring and other charges (e) | | 2,118 | | | (2,131) | | | | | 957 | | | — | | | 944 | |

| Adjusted EBITDA (non-GAAP) | | $ | 8,679 | | | $ | 3,782 | | | | | $ | (23,002) | | | $ | 225 | | | $ | (10,316) | |

(a) For additional information, see "Use of Non-GAAP Financial Information" in the Non-GAAP disclosure information of this Press Release.

(b) During the 52 weeks ended April 29, 2023, we evaluated certain of our store-level long-lived assets in the Retail segment for impairment. Based on the results of the impairment tests, we recognized an impairment loss (non-cash) of $6,008 (both pre-tax and after-tax) comprised of $708, $1,697, $3,599 and $4 of property and equipment, operating lease right-of-use assets, amortizable intangibles, and other noncurrent assets, respectively.

During the 52 weeks ended April 30, 2022, we evaluated certain of our store-level long-lived assets in the Retail segment for impairment. Based on the results of the impairment tests, we recognized an impairment loss (non-cash) of $6,411 (both pre-tax and after-tax) comprised of $739, $1,793, $3,668 and $211 of property and equipment, operating lease right-of-use assets, amortizable intangibles, and other noncurrent assets, respectively.

(c) As contemplated by the F/L Partnership's merchandising agreement, we sold our logo general merchandise inventory to Lids and received proceeds of $41,773, and recognized a merchandise inventory loss on the sale of $10,262 in cost of goods sold during the 52 weeks ended May 1, 2021 for the Retail Segment. The final inventory sale price was determined during the first quarter of fiscal 2022, at which time, we received additional proceeds of $1,906, and recognized a merchandise inventory loss on the sale of $434 in cost of goods sold for the Retail Segment.

(d) Represents amortization of content development costs (non-cash) recorded in cost of goods sold in the consolidated financial statements.

(e) During the 52 weeks ended April 29, 2023 and April 30, 2022, we recognized restructuring and other charges totaling $10,103 and $944, respectively, comprised primarily of severance and other employee termination and benefit costs associated with the elimination of various positions as part of cost reduction objectives, professional service costs for restructuring, process improvements, costs related to development and integration associated with the F/L Partnership, and an actuarial gains related to a frozen retirement benefit plan (non-cash).

(f) There is no pro forma income effect of the non-GAAP items.

(g) For additional information, see "Segment Information - Discontinued Operations" of this Press Release.

(h) Interest expense is reflected in Corporate Services as it is primarily related to our Credit Agreement which funds our operating and financing needs across the organization. Income taxes are reflected in Corporate Services as we record our income tax provision on a consolidated basis.

Free Cash Flow (non-GAAP) (a) - Continuing Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| 13 weeks ended | | 52 weeks ended |

| April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Net cash flows provided by (used in) operating activities from continuing operations | $ | 111,762 | | | $ | (18,255) | | | $ | 90,513 | | | $ | (16,195) | |

| Less: | | | | | | | |

Capital expenditures (b) | 3,391 | | | 7,413 | | | 25,092 | | | 33,607 | |

| Cash interest paid | 5,618 | | | 2,184 | | | 19,024 | | | 8,166 | |

| Cash taxes refund | (63) | | | (264) | | | (16,005) | | | (8,088) | |

| Free Cash Flow (non-GAAP) | $ | 102,816 | | | $ | (27,588) | | | $ | 62,402 | | | $ | (49,880) | |

| | | | | | | |

(a) For additional information, see "Use of Non-GAAP Financial Information" in the Non-GAAP disclosure information of this Press Release.

(b) Purchases of property and equipment are also referred to as capital expenditures. Our investing activities consist principally of capital expenditures for contractual capital investments associated with renewing existing contracts, new store construction, and enhancements to internal systems and our website. The following table provides the components of total purchases of property and equipment:

| | | | | | | | | | | | | | | | | | | | | | | |

| Capital Expenditures | 13 weeks ended | | 52 weeks ended |

| - Continuing Operations | April 29, 2023 | | April 30, 2022 | | April 29, 2023 | | April 30, 2022 |

| Physical store capital expenditures | $ | 820 | | | $ | 3,645 | | | $ | 13,068 | | | $ | 16,206 | |

| Product and system development | 2,163 | | | 3,439 | | | 10,030 | | | 14,867 | |

| | | | | | | |

| Other | 408 | | | 329 | | | 1,994 | | | 2,534 | |

| Total Capital Expenditures | $ | 3,391 | | | $ | 7,413 | | | $ | 25,092 | | | $ | 33,607 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Use of Non-GAAP Financial Information - Adjusted Earnings, Adjusted EBITDA, Adjusted EBITDA by Segment, and Free Cash Flow | |

| | | | | | | | | | | |

To supplement the Company’s consolidated financial statements presented in accordance with generally accepted accounting principles (“GAAP”), in the Press Release attached hereto as Exhibit 99.1, the Company uses the financial measures of Adjusted Earnings, Adjusted EBITDA, Adjusted EBITDA by Segment and Free Cash Flow, which are non-GAAP financial measures under Securities and Exchange Commission (the "SEC") regulations. We define Adjusted Earnings as net income (loss) from continuing operations adjusted for certain reconciling items that are subtracted from or added to net income (loss) from continuing operations. We define Adjusted EBITDA as net income (loss) from continuing operations plus (1) depreciation and amortization; (2) interest expense and (3) income taxes, (4) as adjusted for items that are subtracted from or added to net income (loss) from continuing operations. We define Free Cash Flow as Cash Flows from Operating Activities from continuing operations less capital expenditures, cash interest and cash taxes. | |

| | | | | | | | | | | |

The non-GAAP measures included in the Press Release have been reconciled to the most comparable financial measures presented in accordance with GAAP, attached hereto as Exhibit 99.1, as follows: the reconciliation of Adjusted Earnings to net income (loss) from continuing operations; the reconciliation of consolidated Adjusted EBITDA to consolidated net income (loss) from continuing operations; and the reconciliation of Adjusted EBITDA by Segment to net income (loss) from continuing operations by segment. All of the items included in the reconciliations are either (i) non-cash items or (ii) items that management does not consider in assessing our on-going operating performance. | | | | |

| | | | | | | | | | | |

| These non-GAAP financial measures are not intended as substitutes for and should not be considered superior to measures of financial performance prepared in accordance with GAAP. In addition, the Company's use of these non-GAAP financial measures may be different from similarly named measures used by other companies, limiting their usefulness for comparison purposes. | |

| | | | | | | | | | | |

We review these non-GAAP financial measures as internal measures to evaluate our performance at a consolidated level and at a segment level and manage our operations. We believe that these measures are useful performance measures which are used by us to facilitate a comparison of our on-going operating performance on a consistent basis from period-to-period. We believe that these non-GAAP financial measures provide for a more complete understanding of factors and trends affecting our business than measures under GAAP can provide alone, as they exclude certain items that management believes do not reflect the ordinary performance of our operations in a particular period. Our Board of Directors and management also use Adjusted EBITDA and Adjusted EBITDA by Segment, at a consolidated level and at a segment level, as one of the primary methods for planning and forecasting expected performance, for evaluating on a quarterly and annual basis actual results against such expectations, and as a measure for performance incentive plans. Management also uses Adjusted EBITDA by Segment to determine segment capital allocations. We believe that the inclusion of Adjusted Earnings, Adjusted EBITDA, and Adjusted EBITDA by Segment results provides investors useful and important information regarding our operating results, in a manner that is consistent with management’s evaluation of business performance. We believe that Free Cash Flow provides useful additional information concerning cash flow available to meet future debt service obligations and working capital requirements and assists investors in their understanding of our operating profitability and liquidity as we manage the business to maximize margin and cash flow. | |

| | | | | | | | | | | |

| The Company urges investors to carefully review the GAAP financial information included as part of the Company’s Form 10-K dated April 29, 2023 filed with the SEC on July 31, 2023, which includes consolidated financial statements for each of the three years for the period ended April 29, 2023, April 30, 2022, and May 1, 2021 (Fiscal 2023, Fiscal 2022, and Fiscal 2021, respectively) and the Company's Quarterly Reports on Form 10-Q for the period ended July 30, 2022 filed with the SEC on August 31, 2022, the Company's Quarterly Report on Form 10-Q for the period ended October 29, 2022 filed with the SEC on December 6, 2022, and the Company's Quarterly Report on Form 10-Q for the period ended January 28, 2023 filed with the SEC on March 9, 2023. | |

ABOUT BARNES & NOBLE EDUCATION, INC.

Barnes & Noble Education, Inc. (NYSE: BNED) is a leading solutions provider for the education industry, driving affordability, access and achievement at hundreds of academic institutions nationwide and ensuring millions of students are equipped for success in the classroom and beyond. Through its family of brands, BNED offers campus retail services and academic solutions, wholesale capabilities and more. BNED is a company serving all who work to elevate their lives through education, supporting students, faculty and institutions as they make tomorrow a better, more inclusive and smarter world. For more information, visit www.bned.com.

| | |

|

|

|

|

|

| Investor Contact: |

| Hunter Blankenbaker |

| Vice President, |

| Corporate Communications and Investor Relations |

| 908-991-2776 |

| hblankenbaker@bned.com |

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995 and information relating to us and our business that are based on the beliefs of our management as well as assumptions made by and information currently available to our management. When used in this communication, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “will,” “forecasts,” “projections,” and similar expressions, as they relate to us or our management, identify forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this press release may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Such statements reflect our current views with respect to future events, the outcome of which is subject to certain risks, including, among others: the amount of our indebtedness and ability to comply with covenants applicable to current and /or any future debt financing; our ability to satisfy future capital and liquidity requirements; our ability to access the credit and capital markets at the times and in the amounts needed and on acceptable terms; our ability to maintain adequate liquidity levels to support ongoing inventory purchases and related vendor payments in a timely manner; our ability to attract and retain employees; the pace of equitable access adoption in the marketplace is slower than anticipated and our ability to successfully convert the majority of our institutions to our BNC First Day® equitable and inclusive access course material models or successfully compete with third parties that provide similar equitable and inclusive access solutions; the strategic objectives, successful integration, anticipated synergies, and/or other expected potential benefits of various strategic and restructuring initiatives, may not be fully realized or may take longer than expected; dependency on strategic partnerships, such as with VitalSource Technologies, Inc. and the Fanatics Retail Group Fulfillment, LLC, Inc. (“Fanatics”) and Fanatics Lids College, Inc. D/B/A "Lids" (“Lids”) (collectively referred to herein as the “F/L Partnership”), and the potential for adverse operational and financial changes to these partnerships, may adversely impact our business; non-renewal of managed bookstore, physical and/or online store contracts and higher-than-anticipated store closings; decisions by colleges and universities to outsource their physical and/or online bookstore operations or change the operation of their bookstores; general competitive conditions, including actions our competitors and content providers may take to grow their businesses; the risk of changes in price or in formats of course materials by publishers, which could negatively impact revenues and margin; changes to purchase or rental terms, payment terms, return policies, the discount or margin on products or other terms with our suppliers; product shortages, including decreases in the used textbook inventory supply associated with the implementation of publishers’ digital offerings and direct to student textbook consignment rental programs; work stoppages or increases in labor costs; possible increases in shipping rates or interruptions in shipping services; a decline in college enrollment or decreased funding available for students; decreased consumer demand for our products, low growth or declining sales; the general economic environment and consumer spending patterns; trends

and challenges to our business and in the locations in which we have stores; risks associated with operation or performance of MBS Textbook Exchange, LLC’s point-of-sales systems that are sold to college bookstore customers; technological changes; risks associated with counterfeit and piracy of digital and print materials; risks associated with data privacy, information security and intellectual property; disruptions to our information technology systems, infrastructure, data, supplier systems, and customer ordering and payment systems due to computer malware, viruses, hacking and phishing attacks, resulting in harm to our business and results of operations; disruption of or interference with third party web service providers and our own proprietary technology; risks associated with the impact that public health crises, epidemics, and pandemics, such as the COVID-19 pandemic, have on the overall demand for BNED products and services, our operations, the operations of our suppliers and other business partners, and the effectiveness of our response to these risks; lingering impacts that public health crises may have on the ability of our suppliers to manufacture or source products, particularly from outside of the United States; changes in domestic and international laws or regulations, including U.S. tax reform, changes in tax rates, laws and regulations, as well as related guidance; enactment of laws or changes in enforcement practices which may restrict or prohibit our use of texts, emails, interest based online advertising, or similar marketing and sales activities; adverse results from litigation, governmental investigations, tax-related proceedings, or audits; changes in accounting standards; and the other risks and uncertainties detailed in the section titled “Risk Factors” in Part I - Item 1A in our Form 10-K for the year-ended April 29, 2023. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those described as anticipated, believed, estimated, expected, intended or planned. Subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements in this paragraph. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this press release.

v3.23.2

Cover

|

Aug. 04, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 04, 2023

|

| Entity Registrant Name |

BARNES & NOBLE EDUCATION, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-37499

|

| Entity Tax Identification Number |

46-0599018

|

| Entity Address, Address Line One |

120 Mountainview Blvd.,

|

| Entity Address, Address Line One |

NJ

|

| Entity Address, City or Town |

Basking Ridge,

|

| Entity Address, Postal Zip Code |

07920

|

| City Area Code |

(908)

|

| Local Phone Number |

991-2665

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

BNED

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001634117

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |