Amended Current Report Filing (8-k/a)

18 Mai 2023 - 10:16PM

Edgar (US Regulatory)

true000139603300013960332023-05-102023-05-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 10, 2023 |

LL Flooring Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-33767 |

27-1310817 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4901 Bakers Mill Lane |

|

Richmond, Virginia |

|

23230 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 804 463-2000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

LL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On May 11, 2023, LL Flooring Holdings, Inc. filed a Current Report on Form 8-K (the “Original Current Report”) with the Securities and Exchange Commission relating to the voting results of its Annual Meeting of Stockholders held on May 10, 2023. Subsequent to filing the Original Current Report, the Company discovered the voting standard used to determine whether Proposal 4 (Declassification of the Board) had been approved was incorrect. Approval of Proposal 4 required the affirmative vote of a majority of the Company’s outstanding shares of common stock. The purpose of this amendment is to correct the final outcome of the voting result for Proposal 4, which did not pass.

|

|

|

|

Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

At the Annual Meeting of Stockholders of LL Flooring Holdings, Inc. (the “Company”) held on May 10, 2023 (the “2023 Annual Meeting”), stockholders approved the LL Flooring Holdings, Inc. 2023 Equity Compensation Plan (the “2023 Plan”). The 2023 Plan, which became effective upon stockholder approval, permits the granting of stock options (both incentive and non-qualified options), other stock-based awards, and cash incentive awards. The maximum number of shares of the Company’s common stock that may be issued under the 2023 Plan is 1,750,000. In addition, the number of shares remaining available for issuance under the Company’s Amended and Restated 2011 Equity Compensation Plan (the “Prior Plan”) that are not the subject of outstanding awards as of the effective date for issuance, as well as any outstanding awards under the Prior Plan that are forfeited, canceled or otherwise terminated, other than by exercise, will be added to the shares of common stock available for issuance under the 2023 Plan. As a result of the approval of the 2023 Plan, the Company will no longer grant any awards under the Prior Plan.

The full text, along with a summary, of the 2023 Plan is set forth in the Company’s proxy statement for the 2023 Annual Meeting filed with the Securities and Exchange Commission on April 3, 2023 (the “Proxy Statement”), with the 2023 Plan and its Summary being incorporated herein by reference.

Grants under the 2023 Plan may be evidenced by entry into an Employee Performance-Based Stock Unit Award Agreement, Employee Restricted Stock Award Agreement, Non-Employee Director Restricted Stock Award Agreement, or Non-Employee Director Restricted Stock Unit Award Agreement, forms of which are filed as Exhibits 10.1, 10.2, 10.3, and 10.4 hereto and incorporated herein by reference.

|

|

|

|

Item 5.07 |

Submission of Matters to a Vote of Security Holders. |

At the 2023 Annual Meeting, the stockholders of the Company (i) elected the three Class II directors for three (3)-year terms, each to hold office until the 2026 Annual Meeting of Stockholders, and until their successors are elected and qualified, (ii) approved a non-binding advisory resolution approving the compensation of the Company’s named executive officers, (iii) set the frequency of future advisory votes on executive compensation at every one year, (iv) did not approve an amendment and restatement of the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors, (v) approved the LL Flooring Holdings, Inc. 2023 Equity Compensation Plan and (vi) ratified the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. A quorum of the Company’s common stock was present for the 2023 Annual Meeting. The following are the results of the matters voted on at the 2023 Annual Meeting:

(1)In the election of three (3) Class II directors for three (3)-year terms to hold office until the 2026 Annual Meeting of Stockholders and until their successors are elected and qualified, each Class II director nominee was elected by a vote of the stockholders as follows:

|

|

|

|

|

|

|

Director |

|

For |

|

Withheld |

|

Broker Non-Votes |

David A. Levin |

|

14,062,834 |

|

603,874 |

|

6,718,569 |

Martin F. Roper |

|

13,295,661 |

|

1,371,047 |

|

6,718,569 |

Charles E. Tyson |

|

14,013,462 |

|

653,246 |

|

6,718,569 |

(2)The proposal to approve a non-binding advisory resolution approving the compensation of the Company’s named executive officers as disclosed in the Proxy Statement was approved by the stockholders as follows:

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

12,884,163 |

|

1,736,015 |

|

46,530 |

|

6,718,569 |

(3)The proposal to approve a non-binding advisory resolution on the frequency of future advisory votes on executive compensation (“say-on-pay votes”) as disclosed in the Proxy Statement was approved by the stockholders as follows:

|

|

|

|

|

|

|

|

|

One Year |

|

Two Years |

|

Three Years |

|

Abstain |

|

Broker Non-Votes |

13,830,584 |

|

33,312 |

|

723,314 |

|

79,498 |

|

6,718,569 |

The Company has considered the outcome of this advisory vote and has determined that the Company will hold future say-on-pay votes on an annual basis until the occurrence of the next advisory vote on the frequency of say-on-pay votes. The next advisory vote regarding the frequency of say-on-pay votes is required to occur no later than the Company's 2029 Annual Meeting of Stockholders.

(4)The proposal to approve an amendment and restatement of the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors as disclosed in the Proxy Statement was not approved by the stockholders as follows:

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

14,340,473 |

|

253,912 |

|

72,323 |

|

6,718,569 |

(5)The proposal to approve the LL Flooring Holdings, Inc. 2023 Equity Compensation Plan as disclosed in the Proxy Statement was approved by the stockholders as follows:

|

|

|

|

|

|

|

For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

13,467,496 |

|

1,154,714 |

|

44,498 |

|

6,718,569 |

(6)The proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 was approved by stockholders as follows:

|

|

|

|

|

For |

|

Against |

|

Abstain |

21,127,220 |

|

220,259 |

|

37,798 |

|

|

|

|

Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

LL FLOORING HOLDINGS, INC. |

|

|

|

|

Date: |

May 18, 2023 |

By: |

/s/ Alice G. Givens |

|

|

|

Alice G. Givens

Chief Legal, Ethics and Compliance Officer and Corporate Secretary |

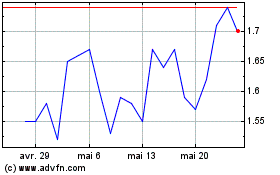

LL Flooring (NYSE:LL)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

LL Flooring (NYSE:LL)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024