FedEx Corp. said Tuesday it had been informed that it won't be

challenged by European regulators in its acquisition of Dutch

parcel firm TNT Express NV, clearing one of the biggest hurdles in

the nearly $5 billion deal.

While the companies still must receive approvals from regulators

in other countries, the news was an unexpectedly easy pass from

Europe's antitrust cops, which blocked a similar deal between rival

United Parcel Service Inc. and TNT in 2013.

EU regulators opened a full-blown investigation into the deal in

July, warning that the merged company could face "insufficient

competitive constraints" in a number of European markets. They also

said they were examining how the merger could affect delivery

routes out of Europe.

"FedEx and TNT have been informed by the European Commission

that no statement of objections will be issued," the companies said

in a release. The transaction is still expected to close in the

first half of next year.

While executives at both companies have maintained the deal is

substantially different than Atlanta-based UPS's attempt because

FedEx's current operations in Europe are much smaller than UPS's

were, analysts and people close to the deal had largely expected EU

regulators to take a tougher stance—at least for appearance'

sake.

While it is surprising the regulators didn't put up more of a

fight, European approval was the first hurdle, and remaining

regulatory approvals should now follow, said David Vernon, a

transportation analyst with Sanford C. Bernstein & Co.

"The fact that the deal will get done is in line with our

expectations and we think most investors in FedEx were expecting

approval," Mr. Vernon said. He said that increasing the company's

business in Europe should eventually help make the company's

Express business more stable and less susceptible to cyclical

changes.

A FedEx spokeswoman said the Memphis-based company is making

timely progress on the necessary regulatory steps around the

world.

TNT stock closed up 10% at €7.55 ($8.55) after languishing about

15% under FedEx's offer price of €8 per share in recent weeks as

investors worried about a potential EU rebuttal. FedEx closed up 1%

at $154.

The deal, announced in April, would allow FedEx to acquire an

extensive ground network in Europe, making it a bigger player in

the burgeoning e-commerce market with an established door-to-door

road network in the region that connects more than 40 countries.

The acquisition would bring FedEx about 58,000 employees, 19 road

hubs and 550 depots to its portfolio. It would become the

third-largest player in Europe's international express-delivery

market, behind DHL and UPS.

"I think it is great for FedEx and TNT, great for European

shippers, and the EU got it right," said Rob Martinez, chief

executive of shipping consultant Shipware LLC, in an email. "The

acquisition makes strategic sense for FedEx to immediately grow its

European capabilities, distribution footprint and market

share."

Until now, FedEx has largely had only limited options for

shipping within Europe, instead focusing its energy on

international delivery services, analysts say. Combining the two

networks will make it a major competitor overnight, with very

little overlap in operations.

"Even when you put FedEx and TNT together, it is still a pretty

competitive market, and it makes a stronger competitor," said Ivan

Hofmann, principal at ETC & Associates and former executive

vice president and chief operating officer at FedEx Ground.

EU regulators care strongly about jobs, he said. UPS and TNT had

significantly more overlap and would have cost too many. "Right now

they're probably breaking out the champagne in Memphis, and in

Atlanta they're probably disappointed," he added.

A UPS spokesman said in a statement that the company is awaiting

the commission's official ruling "and looks forward to reviewing

the official decision once it is made public by competition

authorities."

The delivery giant has previously said it would accelerate its

growth strategy to invest more than $2 billion in Europe over five

years.

"UPS customers will be able to rely upon the same high levels of

service across our global network even as we continue to expand and

upgrade our capabilities," the spokesman added.

UPS's acquisition attempt was derailed in part by its inability

to find a large enough purchaser for assets the European Commission

mandated it shed. At the time, UPS revised its €5.2 billion

proposal, then valued at nearly $7 billion, three times but failed

to satisfy the EU's concerns. UPS is appealing that decision, with

a court hearing expected by year's end. If UPS were to win, it

could bid again if the FedEx deal has yet to go through, although

analysts say this scenario is highly unlikely.

Separately Tuesday, FedEx received additional good news as it

found out that its pilots voted in favor of a new six-year contract

agreement. Following years of negotiations, the Air Line Pilots

Association said the new agreement includes higher hourly wages,

new-hire compensation, a "significant" signing bonus, retirement

plan enhancements and work-rule improvements.

The agreement comes before the all-important peak holiday season

arrives for the delivery company

Tom Fairless in Brussels contributed to this article

Write to Laura Stevens at laura.stevens@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 20, 2015 18:25 ET (22:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

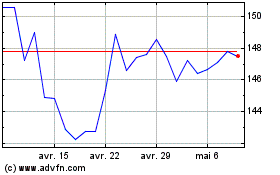

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

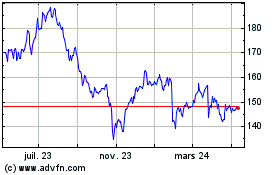

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024