UPS Reports Surprise Revenue Drop -- 2nd Update

27 Octobre 2015 - 4:32PM

Dow Jones News

By Chelsey Dulaney

United Parcel Service Inc. on Tuesday reported a surprise drop

in revenue, though growth in its international division helped

drive profit higher.

Shares of UPS fell 3.2% to $102.75 a share in early trading. The

company backed its outlook for the year.

For the quarter ended Sept. 30, UPS posted earnings of $1.26

billion, or $1.39 a share, up from $1.21 billion, or $1.32 a share,

a year earlier.

Revenue ticked down to $14.24 billion from $14.29 billion a year

earlier, hurt by lower fuel surcharge rates and currency impacts.

Excluding currency impacts, revenue would have risen 1.8%.

Analysts had expected earnings of $1.37 a share on revenue of

$14.43 billion, according to Thomson Reuters.

Total company shipments grew 1.9% to 1.1 billion packages, led

by U.S. air products and European transborder shipments.

In the domestic segment, profit fell 1.6% to $1.26 billion,

dragged by lower fuel-surcharge revenue. But daily shipments ticked

up 0.6%, helped by growth in air products.

Profit in the international segment grew 10% to $507 million,

helped by network improvements and a 1.2% increase in daily export

shipments.

In the supply chain and freight segment, operating profit

increased 1.9% to $219 million. The company's acquisition of Coyote

Logistics, which closed during the quarter, helped offset lower

forwarding revenue and a drop in less-than-truckload tonnage.

The results come as UPS heads into the holiday peak season, and

the company is working to keep its expenses in check.

UPS said it expects to deliver more than 630 million packages

this holiday season, an increase of more than 10% from last year.

The season, which spans from Black Friday to New Year's Eve, will

include an additional shipping day before Christmas.

UPS has spent about $200 million more than it expected the last

two years, first as its network was swamped with unexpected

packages in 2013, and then as packages spiked around Thanksgiving

and Christmas last year and left the network underused in

between.

UPS said it expects up to 60% of its package deliveries during

the holiday season to go to residential addresses, compared with an

average of 45% during the full year.

UPS has raised its fuel surcharge and its oversize-package fee,

effective Nov. 2, in the latest attempt by the delivery giant to

ensure what it feels is proper compensation as shipments

increasingly head to residential addresses thanks to

e-commerce.

Write to Chelsey Dulaney at chelsey.dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 27, 2015 11:17 ET (15:17 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

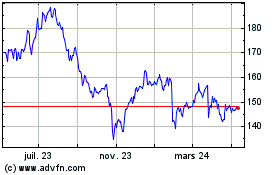

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

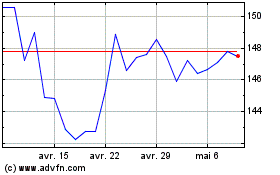

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024