Postal Service Is on Track to Gain Larger Share of Holiday Deliveries

23 Décembre 2015 - 2:24AM

Dow Jones News

By Laura Stevens

This holiday season, the letter carriers for the U.S. Postal

Service have been busier than an army of elves, operating

practically 24/7 to try to take a significant share of a

record-breaking online shopping season.

So far, USPS is on track to scale a new high in holiday

deliveries, as its volume is up more than 15% compared with a year

ago and is forecast to reach more than 600 million packages between

Black Friday and New Year's Eve.

Based on that number, the agency's market share of holiday

deliveries this year will increase to 40% from last year's 35%, as

it continues to elbow its way into an e-commerce market long

dominated by United Parcel Service Inc. and FedEx Corp.

"We're putting more pressure on the organization to grow the

business and to look at opportunities to continue to grow," said

Postmaster General Megan Brennan. "And I think given the pace of

innovation and what we've demonstrated in terms of our capability,

we're well positioned."

The Postal Service also has taken several steps to prepare for

this peak holiday season, including deploying additional

package-sorting equipment. Carriers and post offices are equipped

with more than 200,000 blue, package-scanning devices to improve

tracking data.

It has hired seasonal workers--about 30,000 this year--along

with its own employees to increase the number of delivery shifts in

some areas to three a day from one.

And it is running the equivalent of about 25,000 routes on

Sunday, up from 4,000 on a nonpeak Sunday. Both UPS and FedEx

typically don't deliver on Sundays.

"That ability to deliver on Sundays takes tremendous pressure

off the week," Ms. Brennan said. "That has certainly been a game

changer in our ability to keep the network fluid."

The Postal Service's ambitious holiday plans are just the latest

in a series of efforts to compete with UPS and FedEx in the battle

for online shipping. But the efforts have been costly since its

aging network was built for letters, not packages. Compensation

expenses increased 2.3% in fiscal 2015 to $35.9 billion, in part

due to growth in packages, the agency said.

In September, the USPS requested permission to raise prices on

its lightweight category, last-mile packages by 23.5%, because it

was only making about a penny per package on those deliveries.

Ms. Brennan acknowledged that it is a challenge to balance the

workload associated with packages with the costs. She said the

agency is working to manage overall expenses and expects to present

good numbers for the quarter.

"As a general rule, anytime the Post Office takes on more

business, especially during peak with all those extra costs, the

profitability goes way down," says Keith Byrd, a partner at

shipping consultancy Transportation Impact.

A typical mail truck can hold an average of about 70 packages,

compared with about 200 for a FedEx or UPS truck, according to

Satish Jindel, president of ShipMatrix Inc. Despite some scattered

reports of hiccups, so far its last-mile delivery service is coming

in at about 99% on-time, higher than the national networks of

rivals UPS and FedEx.

The Postal Service pays for its own way: it doesn't receive

taxpayer dollars to cover operating costs, although it is

compensated for certain services and receives a $15 billion credit

line with the U.S. Department of the Treasury. In November, the

agency reported a $5.1 billion loss for fiscal 2015. Stripping out

certain items including mandated retiree benefits, it would have

earned $1.2 billion.

The Postal Service in recent years has started competing more

aggressively for parcel business as its lucrative business--First

Class mail--has declined in the digital age.

It lowered prices last year on some of its Priority Mail

packages, and most recently has been testing out same-day

deliveries of groceries, water and fish.

It also has become a more attractive option for both lightweight

and bulky packages, after both UPS and FedEx started charging by

the size and weight of packages this year to encourage shippers to

use smaller boxes.

"I think the Postal Service is positioning itself for the

future," said Gordon Glazer, a shipping consultant with Shipware

LLC. "It's important to be seen as a viable carrier."

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

December 22, 2015 20:09 ET (01:09 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

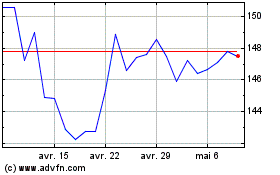

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2024 à Août 2024

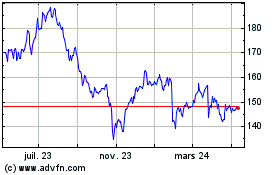

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Août 2023 à Août 2024