Air Transport Agrees To Provide Air Freight Services For Amazon--Update

09 Mars 2016 - 5:52PM

Dow Jones News

By Joshua Jamerson

Air cargo carrier Air Transport Services Group Inc. struck a

deal with Amazon.com Inc. to operate a freight operation for the

online retailer, crowning an effort by Amazon to reduce its

reliance on traditional carriers.

The deal, between Air Transport Services and Amazon Fulfillment

Services Inc., an Amazon affiliate, includes the leasing of 20

Boeing 767 freighter aircraft.

Dave Clark, Amazon senior vice president of world-wide

operations and customer service, said Wednesday that the new air

cargo network would supplement its existing delivery network by

boosting its air cargo capacity to support one- and two-day

delivery for customers in the U.S.

Amazon has sought to reduce its reliance on traditional carriers

by trying to lease airplanes and establish its own freight

operations, The Wall Street Journal has reported.

Under the deal's terms, Air Transport Services would lease the

freighters for five to seven years, and operate the network for

five years. Air Transport Services said it also agreed to grant

Amazon warrants to acquire up to 19.9% of its common shares at

$9.73 per share over a five-year period.

Shares of Air Transport Services rose 19% to $13.97 in morning

trading in New York. The stock earlier hit an all-time high of

$14.90.

Air Transport Services is the largest operator of widebody 767

freighters, with 47 of the jets. The aircraft-leasing firm started

domestic flights with two aircraft that were widely believed to be

for Amazon in September and added three more aircraft in

November.

The announcement is further confirmation of steps Amazon is

taking to establish pieces of its own delivery and logistics

network, something that has weighed on shares of both United Parcel

Service Inc. and FedEx Corp. in recent months as investors fear the

e-commerce giant may turn into a disruptive competitor.

While it would likely take years for Amazon to establish its own

delivery network, the e-commerce giant is currently a major

customer for both UPS and FedEx, helping drive volume growth at the

delivery giants. Nonetheless, investors also fear Amazon might have

ambitions to someday become a competitor in the market, poaching

customers from the delivery giants.

There is a broad desire at Amazon to take greater control over

its shipping and package delivery operations amid rising transport

costs, despite the drop in fuel prices. In some cases, the company

is using its own trucks, drivers and a fleet of couriers for

so-called last mile delivery, the final and most-expensive leg of

an order's trip.

FedEx shares fell 1.7% to $140.15, while UPS shares declined

1.4% to $99.19.

--Laura Stevens contributed to this article.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

March 09, 2016 11:37 ET (16:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

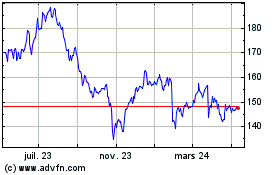

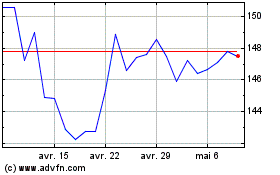

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024