UPS Sees Growth Driven by Higher Pricing, E-commerce Demand

25 Juillet 2018 - 4:39PM

Dow Jones News

By Aisha Al-Muslim and Patrick Thomas

United Parcel Service Inc. reported higher revenues in its

latest quarter as the delivery company experienced strong growth

driven by higher base pricing and e-commerce demand in the U.S.,

but profits were stifled by increased expenses.

The Atlanta-based company reported $10.35 billion in revenue, up

6.3%, in its U.S. domestic package business. Overall for the

period, total revenue surged 9.6% to $17.46 billion, ahead of the

consensus forecast of $17.33 billion from analysts polled by

Thomson Reuters. The company said its average daily package volume

was 19.1 million, up 3% from a year earlier, while the average

revenue per piece was $11.26, up 4.6%.

UPS had a profit of $1.49 billion, or $1.71 a share, up from

$1.38 billion, or $1.58 a share, a year earlier. Adjusted earnings

were $1.94 a share, beating analysts' estimates of $1.93 a

share.

UPS operating profit fell 25.2% in its U.S. domestic package

segment during the quarter, while overall operating profit fell

13%. Operating profit was primarily reduced due to planned

increases in pension expense and costs for ongoing network

projects.

Profits in the U.S. package business were down in part due to

increased investments in the company's network. Chief Executive

David Abney said in the company's earnings call that it will open

its second-largest domestic ground hub in Atlanta over the next

couple weeks. He said the new facility "incorporates the latest

automated sortation and network control technologies."

"While operating profit is not currently where we wanted to be,

there are several initiatives under way to improve the bottom line

results, and clearly, the segment will also benefit as we advance

our transformation strategies," he said.

UPS has been upgrading technology systems as it faces heavy

competition from FedEx Corp. and Amazon.com Inc. as well as

ever-growing e-commerce shopping demands. The company still relies

on some outdated equipment and manual processes, but it is opening

new automated facilities and working on technology upgrades as part

of a $20 billion capital-spending plan.

Last week, The Wall Street Journal reported UPS is working on an

analytics and machine learning project to gather and consolidate

data from various applications within the company's logistics

network to better predict package flow, volume and delivery

status.

Separately, UPS started a pilot program in New York City for

deliveries to apartment building lobbies or package rooms in a

partnership with "smart access" company Latch. The system lets

people use smartphones to unlock doors, and angled cameras capture

footage that users can monitor from a mobile app.

The CEO also said the company hasn't yet been impacted by the

Trump administration's escalating disputes with major U.S. trading

partners, but warned of the dangers a trade war could bring.

"UPS has long supported the advancement of free-trade

principles. We are advocating for future trade discussions," Mr.

Abney said. "We're closely monitoring the changing trade landscape.

There will always be some exposure or risk of our business, but

that exposure is very much limited."

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

July 25, 2018 10:24 ET (14:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

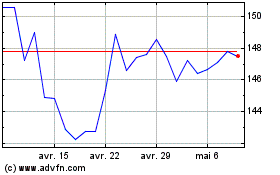

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

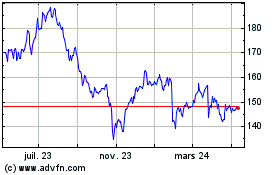

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024