Logistics Hiring Remained Strong Heading Into Holiday Shipping Season

07 Décembre 2018 - 8:36PM

Dow Jones News

By Jennifer Smith

Logistics operators defied weaker national hiring trends in

November, as parcel and warehouse firms added 16,100 jobs in a

sprint into the holiday peak shipping season.

Courier and messenger firms added 9,900 jobs in November, the

strongest increase since December 2016, according to preliminary

figures the Labor Department released Friday, in a strong sign that

growing e-commerce delivery demands are driving more hiring in

transportation and logistics. Consumers logged more than $26.61

billion in online purchases between Nov. 21 and Nov. 26, according

to Adobe Systems Inc.

United Parcel Service Inc. and FedEx Corp. are bringing on tens

of thousands of seasonal workers and investing heavily in

automation to handle the crush of online volume.

Storage and warehousing companies added 6,200 jobs last month

and have boosted payrolls by nearly 50,000 workers in the past 12

months.

This year, "we saw an increase in the number of employees we had

to hire by 10% to 12%" for the seasonal peak, said Steve Sensing,

president of Ryder System Inc.'s global supply chain division,

which operates more than 300 warehouses across North America.

Warehouse operators are also raising pay in a tight labor

market. Average starting wages were up 6.2% in November, to $13.59

an hour, from the same month a year ago, according to ProLogistix,

a logistics staffing firm. More increases are expected this month

as businesses offer bonuses, overtime and incentive pay aimed at

holding on to workers during the peak weeks leading up to

Christmas.

"This year I'm expecting it to peak out at $14.25 an hour" on

average, said Brian Devine, senior vice president of ProLogistix.

Wages could edge even higher, he said, in high-cost areas such as

San Francisco.

Overall U.S. job growth slowed last month, as employers added

155,000 jobs, while unemployment held steady at 3.7%, matching the

lowest rate in nearly 49 years. Wages grew 3.1%, matching the

strongest pace in nearly a decade.

Sectors that feed goods into logistics and shipping networks

signaled confidence in growth expectations with strong hiring.

Retailers added a net 18,200 jobs in November, including 39,300

at general merchandise stores such as department stores and

warehouse clubs. But the retail sector lost 14,100 positions at

clothing and accessories stores, where merchants are struggling to

adjust to the growth of online shopping.

Manufacturing payrolls grew by 27,000 last month, when factory

activity was stronger than expected as companies pushed out orders

ahead of expected tariff increases.

Trucking companies added 4,500 jobs, meanwhile, rebounding from

October's revised figure of 200 job losses. Overall, fleets added

36,300 jobs in the 12 months ending in November, the biggest

12-month gain since 2015, even as companies report difficulty

recruiting and retaining drivers.

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

December 07, 2018 14:21 ET (19:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

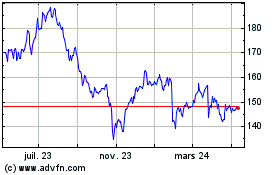

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

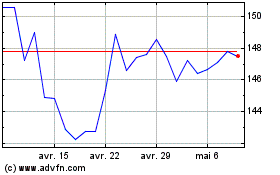

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024