UPS Rides a Surge in Overnight Air Shipments -- Update

24 Juillet 2019 - 4:28PM

Dow Jones News

By Paul Ziobro

United Parcel Service Inc. posted a 30% quarterly surge in

next-day air shipping volumes, as online shippers used the delivery

giant's planes to get packages to homes faster.

The sharp increase in fast air shipments boosted UPS's second

quarter revenue nearly 8% in its domestic unit and 3.4% overall to

$18 billion. Profit rose 13.5% from last year, beating Wall Street

expectations.

UPS shares climbed 4% in early trading Wednesday.

Online retailers from Amazon.com Inc. to Walmart Inc. have reset

customer expectations for orders to reach doorsteps faster,

boosting demand for next-day delivery options.

UPS Chief Executive David Abney said changes the company is

making to speed up its network, add air capacity and process

packages with automated facilities are winning over shippers from

competitors' two-day air service.

"This structural change is creating opportunities for UPS," Mr.

Abney said on Wednesday's earnings call.

UPS's air-shipment growth comes as its main rival, FedEx Corp.,

ended a major air shipping contract in the U.S. with Amazon at the

end of June. That leaves more of the online retailer's packages up

for grabs, with analysts expecting many to move to UPS as a

result.

UPS is taking other steps to woo customers, speed up shipping

and lower costs. It is moving to seven-day-a-week service next

year, adding up to 12,000 new retail locations with CVS Health

Corp., Advance Auto Parts Inc. and Michaels Cos., and it also is

offering a later pickup time for orders.

Such changes match some of the plans outlined by FedEx in recent

months, setting up a showdown as the two rivals fight for a larger

slice of the online delivery market. FedEx expects the volume of

e-commerce packages to double over the next few years.

"We are always encouraged when we see others following our

actions," a FedEx spokeswoman said.

Growth in the U.S. comes as UPS encounters a more-muted

environment overseas amid weakness in Europe and trade disputes

causing uncertainty in trade patterns. Mr. Abney said that while he

is encouraged by talks between U.S. and China trade

representatives, "we need to see more measurable progress toward a

comprehensive agreement."

UPS's international-package revenue for the quarter ended June

30 declined to $3.51 billion from $3.6 billion. Domestic-package

revenue climbed to $11.15 billion from $10.35 billion a year

earlier.

For the quarter, UPS reported a profit of $1.69 billion.

Per-share earnings rose to $1.94 from $1.71 last year. Analysts

polled by FactSet were expecting $1.93 a share.

The company backed its outlook for adjusted earnings per share

for the year of $7.45 to $7.75.

--Dave Sebastian contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

July 24, 2019 10:13 ET (14:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

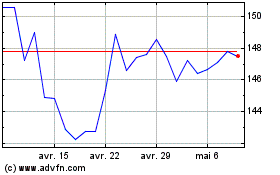

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

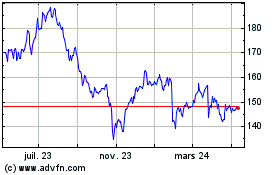

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024